Summary

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「ロシア・CISと東欧のフリート管理 (第5版)」は、東欧、ロシア、CIS(旧ソ連諸国共同体)の2020年とそれ以降の商業車向けフリート管理システム (フリートマネジメントシステム)市場を調査している。急速に変化するテレマティックス業界の最新動向と発展について概説し、ベンダ、製品、市場に関する最新情報も記載している。

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「ロシア・CISと東欧のフリート管理 (第5版)」は、東欧、ロシア、CIS(旧ソ連諸国共同体)の2020年とそれ以降の商業車向けフリート管理システム (フリートマネジメントシステム)市場を調査している。急速に変化するテレマティックス業界の最新動向と発展について概説し、ベンダ、製品、市場に関する最新情報も記載している。

目次(抜粋)

-

ロシア・CISと東欧における商用車両フリート

-

フリート管理ソリューション

-

フリート管理インフラ

-

車両管理

-

運転者管理

-

運用管理

-

法令順守と報告

-

ビジネスモデル

-

市場予測と動向

-

市場分析

-

市場促進要因と阻害要因

-

バリューチェーン分析

-

今後の業界動向

-

OEM製品と戦略

-

国際的なアフターマーケットソリューション提供会社

-

東欧とCISのアフターマーケットソリューション提供会社

-

地域のアフターマーケットソリューション提供会社

Description

How will the market for fleet management systems for commercial vehicles in Eastern Europe, Russia and the CIS evolve in 2020 and beyond? This incredibly detailed 225 page report from Berg Insight covers the latest trends and developments in the dynamic telematics industry. Get up to date with the latest information about vendors, products and markets.

Fleet Management in Russia/CIS and Eastern Europe is the fifth strategy report from Berg Insight analysing the latest developments on the fleet management market in this region.

This strategic research report from Berg Insight provides you with 225 pages of unique business intelligence, including 5-year industry forecasts, expert commentary and real-life case studies on which to base your business decisions.

Highlights from this report:

-

Insights from 30 new executive interviews with market-leading companies.

-

New data on vehicle populations and commercial fleets in the CIS and Eastern Europe.

-

Comprehensive overview of the fleet management value chain and key applications.

-

In-depth analysis of market trends and key developments.

-

Profiles of 80 aftermarket fleet management solution providers.

-

Summary of OEM propositions from truck manufacturers.

-

Revised market forecasts lasting until 2023.

-

Fleet Management in Russia/CIS and Eastern Europe

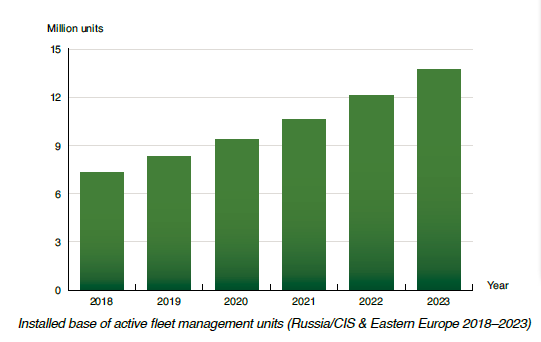

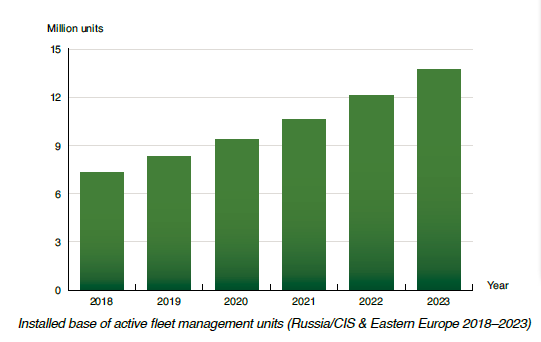

The installed base of fleet management systems in Eastern Europe and the CIS to reach 13.8 million units by 2023

Fleet management (FM) is an ambiguous term used in reference to a wide range of solutions for different vehicle-related applications. Berg Insight’s definition of a fleet management solution is a vehiclebased system that incorporates data logging, satellite positioning and data communications to a backoffice application. The history of fleet management solutions goes back several decades. On-board vehicle computers first emerged in the 1980s and were soon connected to various satellite and terrestrial wireless networks. Today, mobile networks can provide ubiquitous online connectivity in many regions at a reasonable cost and mobile computing technology delivers very high performance, as well as excellent usability. All of these components combined enable the delivery of vehicle management, transport management, driver management and mobile workforce management applications linking vehicles and enterprise IT systems.

Commercial vehicle fleets play an essential role in the economy in the CIS and Eastern Europe, where several countries are part of important Pan-European transport corridors. The total of around 10 million heavy commercial vehicles in the region account for a major share of the inland transports. Motor vehicles are for example involved in about 70 percent of the total inland transportation in Russia. In Europe, medium and heavy trucks account for over 75 percent of all inland transports, forming a € 250 billion industry. Moreover, the greater part of the total 16 million light commercial vehicles in the CIS and Eastern Europe are used by mobile workers and for activities such as distribution of goods and parcels.

Berg Insight is of the opinion that the fleet management industry is in a long-term growth phase. Key drivers in Eastern Europe and the CIS include cost reductions related to fuel savings and regulatory developments such as ERA-GLONASS and the Platon electronic toll collection system which increase the awareness of telematics. The number of fleet management systems in active use in the region is forecasted to grow at a compound annual growth rate of 13.5 percent from 7.3 million units at the end of 2018 to 13.8 million by 2023. The penetration rate in the total population of non-privately owned commercial vehicles and passenger cars used in commercial and government fleets is estimated to increase from 17.5 percent in 2018 to 29.8 percent in 2023. The Russian market accounts for a significant share of the region’s total installed base and is forecasted to grow from 3.3 million active FM units at the end of 2018 to 5.6 million units by 2023.

The leading FM solution providers in terms of installed base in the CIS and Eastern Europe include diverse players from a number of countries. Belarus-based Gurtam is the leading FM software provider, having surpassed the milestone of 1 million vehicles under management in the region. Russia-based TechnoKom and Turkey-based Arvento Mobile Systems are the first and second runners-up, followed by Mobiliz from Turkey and the Russian players SCOUT, Navigator Group and NIS (MTS). Additional top-15 players with at least 100,000 active units in Russia/CIS and Eastern Europe include GeliosSoft, Fort Telecom, Omnicomm, SquareGPS, Live GPS Tracking (SkyNavis), Eurowag Telematics, Infotech and SpaceTeam. The major international solution providers based in Western Europe, North America or South Africa are yet to reach the top-15 list in this region.

The expectations for the future fleet management market in Eastern Europe and the CIS include a gradual convergence with the developments in Western Europe. Eastern Europe is already tracing the most developed European markets closely in terms of system functionality and service models. The major Russian solution providers have historically mainly served large corporations with standalone software systems which are paid upfront and hosted in-house, whereas subscription services traditionally mainly have been adopted by SMBs. Cloud services based on recurring service fees have however now become a greater focus also for major enterprise fleets on the Russian market and the domestic FM solution providers are increasingly pushing for a transition towards SaaS-based models. Another key trend on the European market is factory-fitment of OEM telematics, which is offered by most of the major truck manufacturers. The Russian vehicle manufacturers did not initially embrace the concept of OEM fleet telematics in the same way as its Western European counterparts, but the activities have increased in the last few years. GAZ became the first local manufacturer to offer factory installation of telematics units as standard in 2018. Kamaz and UAZ have also in 2018–2019 launched initiatives related to integration of telematics technology in collaboration with partners.

This report answers the following questions:

-

How do the FMS markets in the CIS and Eastern Europe compare with Western markets?

-

Will the FM industry consolidate further during 2020–2021?

-

What is the geographical and ownership structure of commercial vehicle fleets in the CIS and Eastern Europe?

-

Which are the leading international, regional and local providers of aftermarket fleet management solutions in the CIS and Eastern Europe?

-

What offerings are available from truck OEMs?

-

How will the regulatory developments in this region affect the fleet management industry?

-

How will the commercial vehicle telematics industry evolve in the future?

ページTOPに戻る

Table of Contents

Executive Summary

1. Commercial vehicle fleets in the CIS and Eastern Europe

1.1 The commercial vehicle market in Russia and the CIS

1.1.1 Manufacturer market shares

1.1.2 Ownership structure

1.2 The commercial vehicle market in Eastern Europe

1.2.1 Manufacturer market shares

1.2.2 Ownership structure

2 Fleet management solutions

2.1 Fleet management infrastructure

2.1.1 Vehicle segment

2.1.2 GNSS segment

2.1.3 Network segment

2.1.4 Backoffice segment

2.2 Vehicle management

2.2.1 Vehicle diagnostics and maintenance planning

2.2.2 Security tracking

2.3 Driver management

2.3.1 Driving data registration and analysis

2.3.2 Video-based driver monitoring

2.3.3 Eco-driving schemes

2.3.4 Insurance risk management

2.4 Operations management

2.4.1 Routing and navigation

2.4.2 Transport management

2.4.3 Mobile workforce management

2.5 Regulatory compliance and reporting

2.5.1 Drivers’ working hours

2.5.2 Digital tachograph data download

2.5.3 Electronic toll collection

2.5.4 ERA-GLONASS and eCall

2.5.5 Other applications

2.6 Business models

3 Market forecasts and trends

3.1 Market analysis

3.1.1 Installed base and unit shipments – Eastern Europe and CIS including Russia

3.1.2 Installed base and unit shipments – Russia

3.1.3 Regional markets and players

3.1.4 Vendor market shares

3.2 Market drivers and barriers

3.2.1 Macroeconomic environment

3.2.2 Regulatory environment

3.2.3 Competitive environment

3.2.4 Technology environment

3.3 Value chain analysis

3.3.1 Telematics industry players

3.3.2 Automotive industry players

3.3.3 Telecom industry players

3.3.4 IT industry players

3.4 Future industry trends

4 OEM products and strategies

4.1 European truck manufacturers

4.1.1 DAF Trucks

4.1.2 Daimler Group

4.1.3 Iveco

4.1.4 MAN Truck & Bus

4.1.5 Scania

4.1.6 Volvo Group

4.2 Local truck manufacturers in the CIS

4.2.1 GAZ Group

4.2.2 Kamaz

4.2.3 UAZ

4.2.4 MAZ

5 International aftermarket solution providers

5.1 Astrata Europe

5.2 Fleet Complete

5.3 Garmin and partners

5.4 MiX Telematics

5.5 Transics

5.6 Viasat Group

5.7 Webfleet Solutions (Bridgestone)

6 Regional aftermarket solution providers

6.1 Arvento Mobile Systems

6.2 CVS Mobile

6.3 Fort Telecom

6.4 Frotcom International

6.5 Gurtam

6.6 Mobiliz

6.7 Omnicomm

6.8 Ruptela

6.9 TechnoKom

6.10 Teltonika

6.11 WebEye Telematics Group

7 Local aftermarket solution providers

7.1 Russia and the CIS

7.1.1 ANTOR

7.1.2 Arkan

7.1.3 Autoconnex and Vodafone Automotive

7.1.4 Autolocator (Megapage)

7.1.5 AutoTracker

7.1.6 BelTransSputnik

7.1.7 Benish GPS

7.1.8 Cesar Satellite

7.1.9 Galileosky

7.1.10 Garage GPS

7.1.11 GeliosSoft

7.1.12 GlobalSat

7.1.13 GLONASSSoft

7.1.14 Glosav

7.1.15 ITOB

7.1.16 Live GPS Tracking (SkyNavis)

7.1.17 Locarus

7.1.18 Matrix

7.1.19 Micro Line

7.1.20 Navigator Group (ENDS)

7.1.21 Navtelecom

7.1.22 NIS (MTS)

7.1.23 RCS

7.1.24 Ritm

7.1.25 SCOUT

7.1.26 SpaceTeam

7.1.27 SquareGPS

7.1.28 T-One Group

7.1.29 Vektor GPS

7.2 Eastern Europe

7.2.1 Aldobec Technologies (W.A.G. payment solutions)

7.2.2 AROBS Transilvania Software

7.2.3 Artronic

7.2.4 Auto3P (MultiFleet)

7.2.5 Business Lease Romania

7.2.6 CCS (Fleetcor)

7.2.7 EasyTRACK

7.2.8 ETA Automatizari Industriale (SafeFleet)

7.2.9 Eurowag Telematics (W.A.G. payment solutions)

7.2.10 Evotracking (Vodafone)

7.2.11 Framelogic (Vehco)

7.2.12 GPS Bulgaria

7.2.13 GPS-server.net

7.2.14 GSMvalve

7.2.15 GX Solutions

7.2.16 i-Cell

7.2.17 iData

7.2.18 Infocar

7.2.19 Infotech

7.2.20 iSYS Professional

7.2.21 Locator BG

7.2.22 Mapon

7.2.23 Mireo

7.2.24 Mobilisis

7.2.25 MOVYS

7.2.26 Satko

7.2.27 Seyir Mobil

7.2.28 SHERLOG Technology

7.2.29 Skyguard (Secret Control)

7.2.30 Sledenje

7.2.31 Tahograf

7.2.32 TrackNav

7.2.33 Webbase (Secret Control)

Glossary

Press Release

[プレスリリース原文]

2019-12-06

The installed base of fleet management systems in Russia/CIS and Eastern Europe will reach 13.8 million by 2023

According to a new report from the leading M2M/IoT market research provider Berg Insight, the number of active fleet management systems deployed in commercial vehicle fleets in Russia/CIS and Eastern Europe was 7.3 million in Q4-2018. Growing at a compound annual growth rate (CAGR) of 13.5 percent, this number is expected to reach 13.8 million by 2023. The Russian market alone accounts for a significant share of the region’s total installed base and is forecasted to grow from 3.3 million active units at the end of 2018 to 5.6 million units by 2023. The top-15 fleet management solution vendors across Russia, the rest of the CIS and Eastern Europe together have a combined installed base of close to 4.5 million active units in the region. The leading fleet management solution providers in terms of installed base in the CIS and Eastern Europe include diverse players from a number of countries.

“Belarus-based Gurtam is the leading fleet management software provider, having surpassed the milestone of 1 million vehicles under management in the region”, said Rickard Andersson, Principal Analyst, Berg Insight. He adds that Gurtam is focused on software, providing a hardware-agnostic tracking platform offering compatibility with more than 2,000 different device models from over 500 third-party hardware manufacturers.

“Russia-based TechnoKom and Turkey-based Arvento Mobile Systems are the first and second runners-up, followed by Mobiliz from Turkey and the Russian players SCOUT, Navigator Group and NIS”, continued Mr. Andersson. Additional top-15 players with at least 100,000 active units in Russia/CIS and Eastern Europe include GeliosSoft, Fort Telecom, Omnicomm, SquareGPS, Live GPS Tracking (SkyNavis), Eurowag Telematics, Infotech and SpaceTeam. “The major international solution providers based in Western Europe, North America or South Africa are yet to reach the top-15 list for this region”, concluded Mr. Andersson.

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「ロシア・CISと東欧のフリート管理 (第5版)」は、東欧、ロシア、CIS(

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「ロシア・CISと東欧のフリート管理 (第5版)」は、東欧、ロシア、CIS(