サマリー

このレポートは、プリンテッド/フレキシブルエレクトロニクスの11種の用途に注目し、現状や市場機会、売上および数量別の10年先の市場見通し、複数の事例検証ならびに商用化や技術的な成熟度を分析しています。

主な掲載内容(目次より抜粋)

-

全体概要

-

はじめに

-

電気自動車のパワートレインにおけるプリント/フレキシブルエレクトロニクス

-

自動車内装のプリント/フレキシブルエレクトロニクス

-

自動車外装用のプリント/フレキシブルエレクトロニクス

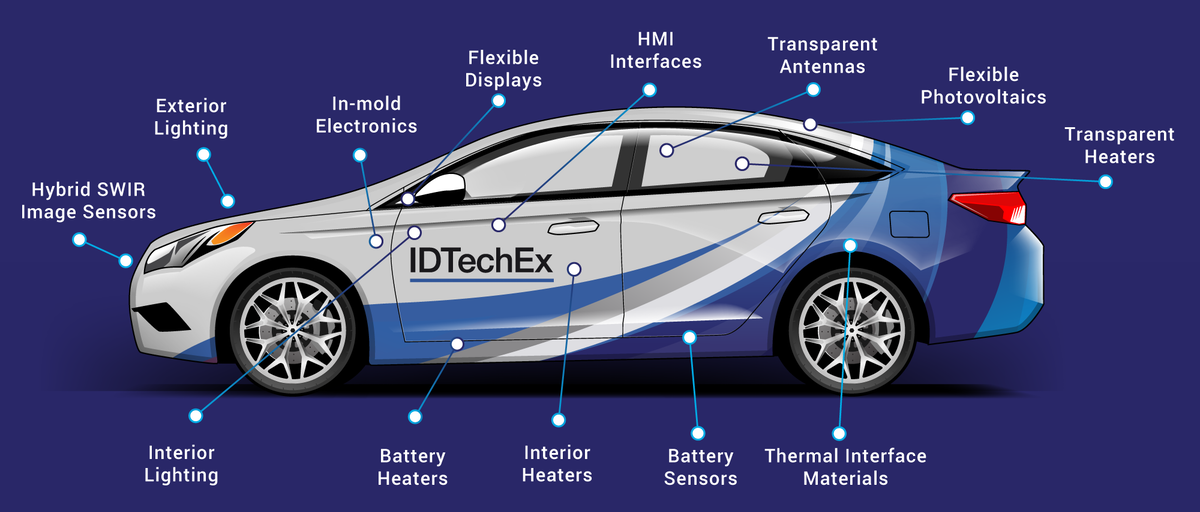

It is an exciting time for the automotive industry, with multiple technological transitions occurring simultaneously. This of course creates extensive opportunities for many new technologies, including printed/flexible electronics. For example, the ability to make electronics on thin flexible substrates enables weight to be reduced, a key consideration for electric vehicles. Furthermore, the conformality associated with flexible electronics is highly suited to emerging interior design trends with organic curves replacing flat surfaces.

The three key technological transitions we identify are:

-

Electric vehicles. The increased adoption of electric vehicles is well documented, with multiple countries announcing that sales of petrol/diesel fuelled new cars will become illegal at various points in the 2030s. This creates opportunities for printed electronics to be used in battery condition monitoring.

-

Increased levels of autonomy. Vehicles across the price range now contain sophisticated 'advanced driver assistance systems (ADAS)'. Over time the level of autonomy will increase, with full Level 5 autonomy expected in some vehicles within a decade. This creates opportunities for multiple sensor technologies and associated features such as transparent heaters and integrated antennas.

-

Differentiation shifts from powertrain to interior/cockpit. This transition is eloquently expressed in the quote from the president of a gauge cluster/cockpit manufacturer: "The cockpit is where the battleground has now shifted. It's no longer what is under the hood, but what's inside the cockpit." As such there are extensive opportunities for printed/flexible electronics to add additional functionality to the cockpit while facilitating efficient manufacturing.

Report Overview

This technical market research report from IDTechEx outlines the current status of printed/flexible electronics in all aspects of automotive design and manufacturing, along with the future opportunities created by these transitions.

The report is divided into three main sections, covering different aspects of the vehicle. Each section is then further segmented into the individual printed/flexible electronics technologies. Along with detailed technical discussion and application examples of the technologies outlined below, the report includes 10-year forecasts for each technology.

Printed/flexible electronics in electric vehicle powertrains.

Battery monitoring/heating for electric vehicles. Providing the maximum range possible for a given weight and price is a key requirement for electric vehicle manufacturers. This requires batteries to always work as efficiently as possible. However, battery capacity is strongly dependent on temperature. Furthermore, increases in temperature (and pressure) can indicate a malfunction and a possible safety concern. As such, there is an opportunity for printed arrays of temperature sensors to provide local monitoring, and for printed heaters to be integrated within the same functional film.

Thermal interface materials for electric vehicles. Although printed electronics are not well-suited to power electronics, they do require printed thermal interface materials for thermal management. Thermal greases are still the norm, but alternatives such as carbon nanotubes and phase change materials are likely to gain traction. As electric vehicles transition to ever higher charging rates, the need for thermal management becomes increasingly important.

Printed/flexible electronics in vehicle interiors.

Human machine interface (HMI) technologies. A major opportunity for printed/flexible electronics is in human machine interfaces (HMIs) for the interior. Already widely used in seat occupancy sensors, printed pressure sensors are likely to find their way into control panels to provide a wider range of inputs than purely capacitive touch sensors without the expense of mechanical switches. Furthermore, occupancy sensors are likely to evolve into multipoint sensors distributed throughout the seat fabric to monitor passenger comfort.

Printed/flexible interior heaters. The existing approach to heating car interiors by blowing hot air around is very inefficient, and highly detrimental to the range of electric vehicles. Printed/flexible electronics to incorporate heaters within touch points is far more efficient - this is approach is likely to extend beyond seats and steering wheels to encompass armrests and center consoles. Furthermore, the conformality of printed electronics enables heaters to be placed much closer to the surface, making heating more efficient and responsive. Transparent conductors take this idea a step further and can be applied directly to the surface of materials such as leather.

Emerging manufacturing methodologies for integrating electronics. In-mold electronics is a major trend in automotive manufacturing. By combining the electronics with the thermoformed plastic. It enables integrated systems such as center consoles and overhead control panels to be much lighter, simpler, and easier to manufacture. Indeed, IDTechEx forecast IME to be an approximately $1.3 bn market by 2031. Another emerging manufacturing methodology, albeit a few years further into the future than IME, is printing electronics and dielectric inks directly onto 3D surfaces. This should enable to enable wiring harnesses to be replaced, reducing weight and complexity.

Interior displays and lighting. Manufacturers are increasingly aiming to differentiate their vehicles by adding multiple displays. These go beyond the conventional center screen to include digital gauge clusters along with displays for mirrors and passenger entertainment. OLEDs are likely to be increasingly adopted, as the resolution and color gamut meet the expectations consumers transfer from their smartphones. Conformality should also enable a wider range of integration opportunities, such safety improving 'transparent' pillars. Distinctive interior lighting also offers differentiation, with LEDs mounted onto flexible substrates an emerging lightweight and conformal approach.

Printed/flexible electronics in vehicle exteriors.

Hybrid SWIR image sensors. ADAS systems and autonomous vehicles will require as much input information as possible to ensure safety. Imaging in the short-wave infra-red (SWIR) spectral region is especially promising since light scatters less at longer wavelengths, enabling objects to be identified at longer distances in fog or dust. The incumbent technology for SWIR image sensors is prohibitively expensive, so innovative technologies are required. Coating silicon read-out circuits with either organic semiconductors or quantum dots is a highly promising approach.

Integrated antennas. Vehicles become more connected every year, necessitating multiple antennas to cover multiple frequency bands. These need to be integrated into plastic body panels, opening opportunities for in-mold electronics and printing onto 3D surfaces. In the future, transparent antennas could also be installed on windows.

Exterior lighting. As the level of vehicle autonomy increases, vehicles will need to interact with pedestrians. Low-cost printed/flexible displays are ideally suited to this purpose, as low weight, durability and conformality (including in an accident) are all more important than resolution. Possible approaches include printed LEDs, and mounting LEDs on flexible substrates.

Transparent heaters for exterior lighting/sensors/windows. Cameras and LIDAR in autonomous vehicles or ADAS systems will always require a clear view of the road. This means that ensuring that the transparent cover over the sensor is free of mist/frost is essential. Furthermore, thin metal lines could obscure the view of these safety critical components. As such, developing transparent heaters that use transparent conductors such as silver nanowires or CNTs is needed. Over time these technologies are likely to fall in price, enabling them to be applied to windows as well.

Printed/flexible photovoltaics. While photovoltaics will never be able to power a car continuously over a long journey, they do enable around 30 km of distance to be added each day. At present electric vehicles with solar panels use silicon photovoltaics, but thin film photovoltaics are a promising alternative due to their lightweight and conformality.

ページTOPに戻る

目次

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Printed/flexible/organic electronics market |

|

1.2. |

Printed/flexible electronics in automotive applications. |

|

1.3. |

Transitions in the automotive industry |

|

1.4. |

Advantages of roll-to-roll (R2R) manufacturing |

|

1.5. |

What is flexible hybrid electronics (FHE)? |

|

1.6. |

Automotive-relevant attributes of FHE |

|

1.7. |

Printed/flexible electronics in vehicle powertrains. |

|

1.8. |

Battery thermal management: Optimal temperature required |

|

1.9. |

Integrated pressure/temperature sensors and heaters for battery cells |

|

1.10. |

Technological/commercial readiness level of printed/flexible electronics in vehicle powertrains |

|

1.11. |

Vehicle interiors increasingly provide differentiation |

|

1.12. |

Printed/flexible electronics for vehicle interiors |

|

1.13. |

Printed/flexible electronics opportunities from car interior trends |

|

1.14. |

Printed/flexible electronics enables cost differentiation and/or cost reduction |

|

1.15. |

Integrated stretchable pressure sensors |

|

1.16. |

Innovative integration of capacitive touch screens |

|

1.17. |

Hybrid piezoresistive/capacitive sensors |

|

1.18. |

Metallization and materials for each 3D electronics methodology |

|

1.19. |

Motivation for 3D electronics |

|

1.20. |

In-mold electronics: Summary |

|

1.21. |

Printed/flexible electronics in automotive displays and lighting |

|

1.22. |

Technological/commercial readiness level of printed/flexible electronics in vehicle interiors |

|

1.23. |

Printed/flexible electronics for vehicle exteriors |

|

1.24. |

SWIR for autonomous mobility and ADAS |

|

1.25. |

Transparent electronics for ADAS radar |

|

1.26. |

Opportunities for printed/flexible electronics in exterior automotive lighting |

|

1.27. |

Transparent heaters for exterior lighting/sensors/windows |

|

1.28. |

Where are printed/flexible photovoltaics envisaged in cars? |

|

1.29. |

Technological/commercial readiness level of printed/flexible electronics in vehicle exteriors |

|

1.30. |

Global car market forecast by powertrain |

|

1.31. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) |

|

1.32. |

Overall forecast for printed/flexible electronics in automotive applications (volume) (data table) |

|

1.33. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) |

|

1.34. |

Overall forecast for printed/flexible electronics in automotive applications (revenue) (data table) |

|

1.35. |

Forecast revenue CAGR 2021-2031 |

|

2. |

INTRODUCTION |

|

2.1.1. |

Printed/flexible/organic electronics market |

|

2.1.2. |

Description and analysis of the main technology components of printed, flexible and organic electronics |

|

2.1.3. |

Market potential and profitability |

|

2.1.4. |

Printed/flexible electronics in automotive applications. |

|

2.1.5. |

Transitions in the automotive industry |

|

2.1.6. |

Trends in automotive powertrain adoption |

|

2.1.7. |

Trends in autonomous vehicle adoption |

|

2.1.8. |

What are the levels of automation in cars? |

|

2.1.9. |

Opportunities for printed/flexible electronics in automotive applications |

|

2.1.10. |

Advantages of roll-to-roll (R2R) manufacturing |

|

2.1.11. |

Flexible hybrid electronic (FHE) circuits for automotive applications |

|

2.1.12. |

What is flexible hybrid electronics (FHE)? |

|

2.1.13. |

What counts as FHE? |

|

2.1.14. |

FHE: The best of both worlds? |

|

2.1.15. |

Overcoming the flexibility/functionality compromise |

|

2.1.16. |

Commonality with other electronics methodologies |

|

2.1.17. |

Automotive-relevant attributes of FHE |

|

2.1.18. |

PCB replacement with FHE circuits |

|

2.2. |

Overall market forecasts |

|

2.2.1. |

Forecasting methodology |

|

2.2.2. |

Forecast: Global car market by powertrain |

|

2.2.3. |

Forecast: Global autonomous car market |

|

2.2.4. |

Forecast: Global autonomous car market (data table) |

|

2.2.5. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) |

|

2.2.6. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) (data table) |

|

2.2.7. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) |

|

2.2.8. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) (data table) |

|

2.2.9. |

Forecast revenue CAGR 2021-2031 |

|

2.2.10. |

Forecast: Flexible hybrid electronics (FHE) |

|

2.2.11. |

Forecast: Flexible hybrid electronics (data table) |

|

2.2.12. |

Forecast: Printed sensors and heaters for batteries |

|

2.2.13. |

Forecast: TIMs for electric vehicles |

|

2.2.14. |

Forecast: TIMs for electric vehicles (data table) |

|

2.2.15. |

Forecast: HMI technologies |

|

2.2.16. |

Forecast: HMI technologies (data table) |

|

2.2.17. |

Forecast: OLED displays |

|

2.2.18. |

Forecast: OLED displays (data table) |

|

2.2.19. |

Forecast: IME /FIM/Electronics on 3D surfaces |

|

2.2.20. |

Forecast: IME/FIM/Electronics on 3D surfaces (data table) |

|

2.2.21. |

Forecast: Printed heaters for seats and interior (data table) |

|

2.2.22. |

Forecast: Exterior applications of printed/flexible electronics |

|

3. |

PRINTED/FLEXIBLE ELECTRONICS IN ELECTRIC VEHICLE POWERTRAINS |

|

3.1.1. |

Printed/flexible electronics in electric vehicles |

|

3.2. |

Battery monitoring/heating for electric vehicles |

|

3.2.1. |

Introduction to thermal management for electric vehicles |

|

3.2.2. |

Battery thermal management: Optimal temperature required |

|

3.2.3. |

Integrated battery temperature sensing and heating: IEE |

|

3.2.4. |

Printed battery module heater: IEE |

|

3.2.5. |

Silicon nanoparticle ink for temperature sensing (PST Sensors) (II) |

|

3.2.6. |

Printed temperature sensors and heaters |

|

3.2.7. |

InnovationLab: Integrated pressure/temperature sensors and heaters for battery cells |

|

3.2.8. |

SWOT: Temperature control (sensing/heating) for battery systems |

|

3.2.9. |

Temperature control (sensing/heating) for battery systems |

|

3.3. |

Thermal interface materials for electric vehicle powertrains |

|

3.3.1. |

Thermal management materials (TIMs) in automotive applications |

|

3.3.2. |

Thermal management - pack and module overview |

|

3.3.3. |

Why use TIM in power modules? |

|

3.3.4. |

Automotive applications are a harsh environment |

|

3.3.5. |

Thermal greases are still the norm |

|

3.3.6. |

Thermal management of Electronic Control Units (ECUs) |

|

3.3.7. |

Alternatives TIMs: Carbon nanotubes (CNTs) |

|

3.3.8. |

ページTOPに戻る

Summary

このレポートは、プリンテッド/フレキシブルエレクトロニクスの11種の用途に注目し、現状や市場機会、売上および数量別の10年先の市場見通し、複数の事例検証ならびに商用化や技術的な成熟度を分析しています。

主な掲載内容(目次より抜粋)

-

全体概要

-

はじめに

-

電気自動車のパワートレインにおけるプリント/フレキシブルエレクトロニクス

-

自動車内装のプリント/フレキシブルエレクトロニクス

-

自動車外装用のプリント/フレキシブルエレクトロニクス

It is an exciting time for the automotive industry, with multiple technological transitions occurring simultaneously. This of course creates extensive opportunities for many new technologies, including printed/flexible electronics. For example, the ability to make electronics on thin flexible substrates enables weight to be reduced, a key consideration for electric vehicles. Furthermore, the conformality associated with flexible electronics is highly suited to emerging interior design trends with organic curves replacing flat surfaces.

The three key technological transitions we identify are:

-

Electric vehicles. The increased adoption of electric vehicles is well documented, with multiple countries announcing that sales of petrol/diesel fuelled new cars will become illegal at various points in the 2030s. This creates opportunities for printed electronics to be used in battery condition monitoring.

-

Increased levels of autonomy. Vehicles across the price range now contain sophisticated 'advanced driver assistance systems (ADAS)'. Over time the level of autonomy will increase, with full Level 5 autonomy expected in some vehicles within a decade. This creates opportunities for multiple sensor technologies and associated features such as transparent heaters and integrated antennas.

-

Differentiation shifts from powertrain to interior/cockpit. This transition is eloquently expressed in the quote from the president of a gauge cluster/cockpit manufacturer: "The cockpit is where the battleground has now shifted. It's no longer what is under the hood, but what's inside the cockpit." As such there are extensive opportunities for printed/flexible electronics to add additional functionality to the cockpit while facilitating efficient manufacturing.

Report Overview

This technical market research report from IDTechEx outlines the current status of printed/flexible electronics in all aspects of automotive design and manufacturing, along with the future opportunities created by these transitions.

The report is divided into three main sections, covering different aspects of the vehicle. Each section is then further segmented into the individual printed/flexible electronics technologies. Along with detailed technical discussion and application examples of the technologies outlined below, the report includes 10-year forecasts for each technology.

Printed/flexible electronics in electric vehicle powertrains.

Battery monitoring/heating for electric vehicles. Providing the maximum range possible for a given weight and price is a key requirement for electric vehicle manufacturers. This requires batteries to always work as efficiently as possible. However, battery capacity is strongly dependent on temperature. Furthermore, increases in temperature (and pressure) can indicate a malfunction and a possible safety concern. As such, there is an opportunity for printed arrays of temperature sensors to provide local monitoring, and for printed heaters to be integrated within the same functional film.

Thermal interface materials for electric vehicles. Although printed electronics are not well-suited to power electronics, they do require printed thermal interface materials for thermal management. Thermal greases are still the norm, but alternatives such as carbon nanotubes and phase change materials are likely to gain traction. As electric vehicles transition to ever higher charging rates, the need for thermal management becomes increasingly important.

Printed/flexible electronics in vehicle interiors.

Human machine interface (HMI) technologies. A major opportunity for printed/flexible electronics is in human machine interfaces (HMIs) for the interior. Already widely used in seat occupancy sensors, printed pressure sensors are likely to find their way into control panels to provide a wider range of inputs than purely capacitive touch sensors without the expense of mechanical switches. Furthermore, occupancy sensors are likely to evolve into multipoint sensors distributed throughout the seat fabric to monitor passenger comfort.

Printed/flexible interior heaters. The existing approach to heating car interiors by blowing hot air around is very inefficient, and highly detrimental to the range of electric vehicles. Printed/flexible electronics to incorporate heaters within touch points is far more efficient - this is approach is likely to extend beyond seats and steering wheels to encompass armrests and center consoles. Furthermore, the conformality of printed electronics enables heaters to be placed much closer to the surface, making heating more efficient and responsive. Transparent conductors take this idea a step further and can be applied directly to the surface of materials such as leather.

Emerging manufacturing methodologies for integrating electronics. In-mold electronics is a major trend in automotive manufacturing. By combining the electronics with the thermoformed plastic. It enables integrated systems such as center consoles and overhead control panels to be much lighter, simpler, and easier to manufacture. Indeed, IDTechEx forecast IME to be an approximately $1.3 bn market by 2031. Another emerging manufacturing methodology, albeit a few years further into the future than IME, is printing electronics and dielectric inks directly onto 3D surfaces. This should enable to enable wiring harnesses to be replaced, reducing weight and complexity.

Interior displays and lighting. Manufacturers are increasingly aiming to differentiate their vehicles by adding multiple displays. These go beyond the conventional center screen to include digital gauge clusters along with displays for mirrors and passenger entertainment. OLEDs are likely to be increasingly adopted, as the resolution and color gamut meet the expectations consumers transfer from their smartphones. Conformality should also enable a wider range of integration opportunities, such safety improving 'transparent' pillars. Distinctive interior lighting also offers differentiation, with LEDs mounted onto flexible substrates an emerging lightweight and conformal approach.

Printed/flexible electronics in vehicle exteriors.

Hybrid SWIR image sensors. ADAS systems and autonomous vehicles will require as much input information as possible to ensure safety. Imaging in the short-wave infra-red (SWIR) spectral region is especially promising since light scatters less at longer wavelengths, enabling objects to be identified at longer distances in fog or dust. The incumbent technology for SWIR image sensors is prohibitively expensive, so innovative technologies are required. Coating silicon read-out circuits with either organic semiconductors or quantum dots is a highly promising approach.

Integrated antennas. Vehicles become more connected every year, necessitating multiple antennas to cover multiple frequency bands. These need to be integrated into plastic body panels, opening opportunities for in-mold electronics and printing onto 3D surfaces. In the future, transparent antennas could also be installed on windows.

Exterior lighting. As the level of vehicle autonomy increases, vehicles will need to interact with pedestrians. Low-cost printed/flexible displays are ideally suited to this purpose, as low weight, durability and conformality (including in an accident) are all more important than resolution. Possible approaches include printed LEDs, and mounting LEDs on flexible substrates.

Transparent heaters for exterior lighting/sensors/windows. Cameras and LIDAR in autonomous vehicles or ADAS systems will always require a clear view of the road. This means that ensuring that the transparent cover over the sensor is free of mist/frost is essential. Furthermore, thin metal lines could obscure the view of these safety critical components. As such, developing transparent heaters that use transparent conductors such as silver nanowires or CNTs is needed. Over time these technologies are likely to fall in price, enabling them to be applied to windows as well.

Printed/flexible photovoltaics. While photovoltaics will never be able to power a car continuously over a long journey, they do enable around 30 km of distance to be added each day. At present electric vehicles with solar panels use silicon photovoltaics, but thin film photovoltaics are a promising alternative due to their lightweight and conformality.

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Printed/flexible/organic electronics market |

|

1.2. |

Printed/flexible electronics in automotive applications. |

|

1.3. |

Transitions in the automotive industry |

|

1.4. |

Advantages of roll-to-roll (R2R) manufacturing |

|

1.5. |

What is flexible hybrid electronics (FHE)? |

|

1.6. |

Automotive-relevant attributes of FHE |

|

1.7. |

Printed/flexible electronics in vehicle powertrains. |

|

1.8. |

Battery thermal management: Optimal temperature required |

|

1.9. |

Integrated pressure/temperature sensors and heaters for battery cells |

|

1.10. |

Technological/commercial readiness level of printed/flexible electronics in vehicle powertrains |

|

1.11. |

Vehicle interiors increasingly provide differentiation |

|

1.12. |

Printed/flexible electronics for vehicle interiors |

|

1.13. |

Printed/flexible electronics opportunities from car interior trends |

|

1.14. |

Printed/flexible electronics enables cost differentiation and/or cost reduction |

|

1.15. |

Integrated stretchable pressure sensors |

|

1.16. |

Innovative integration of capacitive touch screens |

|

1.17. |

Hybrid piezoresistive/capacitive sensors |

|

1.18. |

Metallization and materials for each 3D electronics methodology |

|

1.19. |

Motivation for 3D electronics |

|

1.20. |

In-mold electronics: Summary |

|

1.21. |

Printed/flexible electronics in automotive displays and lighting |

|

1.22. |

Technological/commercial readiness level of printed/flexible electronics in vehicle interiors |

|

1.23. |

Printed/flexible electronics for vehicle exteriors |

|

1.24. |

SWIR for autonomous mobility and ADAS |

|

1.25. |

Transparent electronics for ADAS radar |

|

1.26. |

Opportunities for printed/flexible electronics in exterior automotive lighting |

|

1.27. |

Transparent heaters for exterior lighting/sensors/windows |

|

1.28. |

Where are printed/flexible photovoltaics envisaged in cars? |

|

1.29. |

Technological/commercial readiness level of printed/flexible electronics in vehicle exteriors |

|

1.30. |

Global car market forecast by powertrain |

|

1.31. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) |

|

1.32. |

Overall forecast for printed/flexible electronics in automotive applications (volume) (data table) |

|

1.33. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) |

|

1.34. |

Overall forecast for printed/flexible electronics in automotive applications (revenue) (data table) |

|

1.35. |

Forecast revenue CAGR 2021-2031 |

|

2. |

INTRODUCTION |

|

2.1.1. |

Printed/flexible/organic electronics market |

|

2.1.2. |

Description and analysis of the main technology components of printed, flexible and organic electronics |

|

2.1.3. |

Market potential and profitability |

|

2.1.4. |

Printed/flexible electronics in automotive applications. |

|

2.1.5. |

Transitions in the automotive industry |

|

2.1.6. |

Trends in automotive powertrain adoption |

|

2.1.7. |

Trends in autonomous vehicle adoption |

|

2.1.8. |

What are the levels of automation in cars? |

|

2.1.9. |

Opportunities for printed/flexible electronics in automotive applications |

|

2.1.10. |

Advantages of roll-to-roll (R2R) manufacturing |

|

2.1.11. |

Flexible hybrid electronic (FHE) circuits for automotive applications |

|

2.1.12. |

What is flexible hybrid electronics (FHE)? |

|

2.1.13. |

What counts as FHE? |

|

2.1.14. |

FHE: The best of both worlds? |

|

2.1.15. |

Overcoming the flexibility/functionality compromise |

|

2.1.16. |

Commonality with other electronics methodologies |

|

2.1.17. |

Automotive-relevant attributes of FHE |

|

2.1.18. |

PCB replacement with FHE circuits |

|

2.2. |

Overall market forecasts |

|

2.2.1. |

Forecasting methodology |

|

2.2.2. |

Forecast: Global car market by powertrain |

|

2.2.3. |

Forecast: Global autonomous car market |

|

2.2.4. |

Forecast: Global autonomous car market (data table) |

|

2.2.5. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) |

|

2.2.6. |

Overall forecast: Printed/flexible electronics in automotive applications (volume) (data table) |

|

2.2.7. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) |

|

2.2.8. |

Overall forecast: Printed/flexible electronics in automotive applications (revenue) (data table) |

|

2.2.9. |

Forecast revenue CAGR 2021-2031 |

|

2.2.10. |

Forecast: Flexible hybrid electronics (FHE) |

|

2.2.11. |

Forecast: Flexible hybrid electronics (data table) |

|

2.2.12. |

Forecast: Printed sensors and heaters for batteries |

|

2.2.13. |

Forecast: TIMs for electric vehicles |

|

2.2.14. |

Forecast: TIMs for electric vehicles (data table) |

|

2.2.15. |

Forecast: HMI technologies |

|

2.2.16. |

Forecast: HMI technologies (data table) |

|

2.2.17. |

Forecast: OLED displays |

|

2.2.18. |

Forecast: OLED displays (data table) |

|

2.2.19. |

Forecast: IME /FIM/Electronics on 3D surfaces |

|

2.2.20. |

Forecast: IME/FIM/Electronics on 3D surfaces (data table) |

|

2.2.21. |

Forecast: Printed heaters for seats and interior (data table) |

|

2.2.22. |

Forecast: Exterior applications of printed/flexible electronics |

|

3. |

PRINTED/FLEXIBLE ELECTRONICS IN ELECTRIC VEHICLE POWERTRAINS |

|

3.1.1. |

Printed/flexible electronics in electric vehicles |

|

3.2. |

Battery monitoring/heating for electric vehicles |

|

3.2.1. |

Introduction to thermal management for electric vehicles |

|

3.2.2. |

Battery thermal management: Optimal temperature required |

|

3.2.3. |

Integrated battery temperature sensing and heating: IEE |

|

3.2.4. |

Printed battery module heater: IEE |

|

3.2.5. |

Silicon nanoparticle ink for temperature sensing (PST Sensors) (II) |

|

3.2.6. |

Printed temperature sensors and heaters |

|

3.2.7. |

InnovationLab: Integrated pressure/temperature sensors and heaters for battery cells |

|

3.2.8. |

SWOT: Temperature control (sensing/heating) for battery systems |

|

3.2.9. |

Temperature control (sensing/heating) for battery systems |

|

3.3. |

Thermal interface materials for electric vehicle powertrains |

|

3.3.1. |

Thermal management materials (TIMs) in automotive applications |

|

3.3.2. |

Thermal management - pack and module overview |

|

3.3.3. |

Why use TIM in power modules? |

|

3.3.4. |

Automotive applications are a harsh environment |

|

3.3.5. |

Thermal greases are still the norm |

|

3.3.6. |

Thermal management of Electronic Control Units (ECUs) |

|

3.3.7. |

Alternatives TIMs: Carbon nanotubes (CNTs) |

|

3.3.8. |

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

ページTOPに戻る