電気自動車用二次電池2025-2035年:市場、予測、プレーヤー、技術Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies 引退したEV用バッテリーの利用可能性が今後10年間で高まることから、IDTechExはEV用セカンドライフ・バッテリー市場が2035年までに42億米ドルになると予測している。 電気自動車(EV)バッテリ... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

サマリー

引退したEV用バッテリーの利用可能性が今後10年間で高まることから、IDTechExはEV用セカンドライフ・バッテリー市場が2035年までに42億米ドルになると予測している。

電気自動車(EV)バッテリーは、EVの性能要件を満たさなくなると、最終的には寿命が尽きて廃棄される。これらのリチウムイオンバッテリーをリサイクルすることで、貴重で重要な原材料を回収し、新しいEVバッテリーに再導入することができる。しかし、リサイクルする前に、これらのバッテリーを第二の用途に再利用することで、EVバッテリーの価値を最大化し、寿命を延ばし、バッテリーの循環経済に貢献することができる。場合によっては、電池パックのモジュールやセルを交換し、EV用途での寿命を延ばすこともできる。しかし、再利用された二次電池は、定置用蓄電池や低出力のエレクトロモビリティ・アプリケーションに使用される。

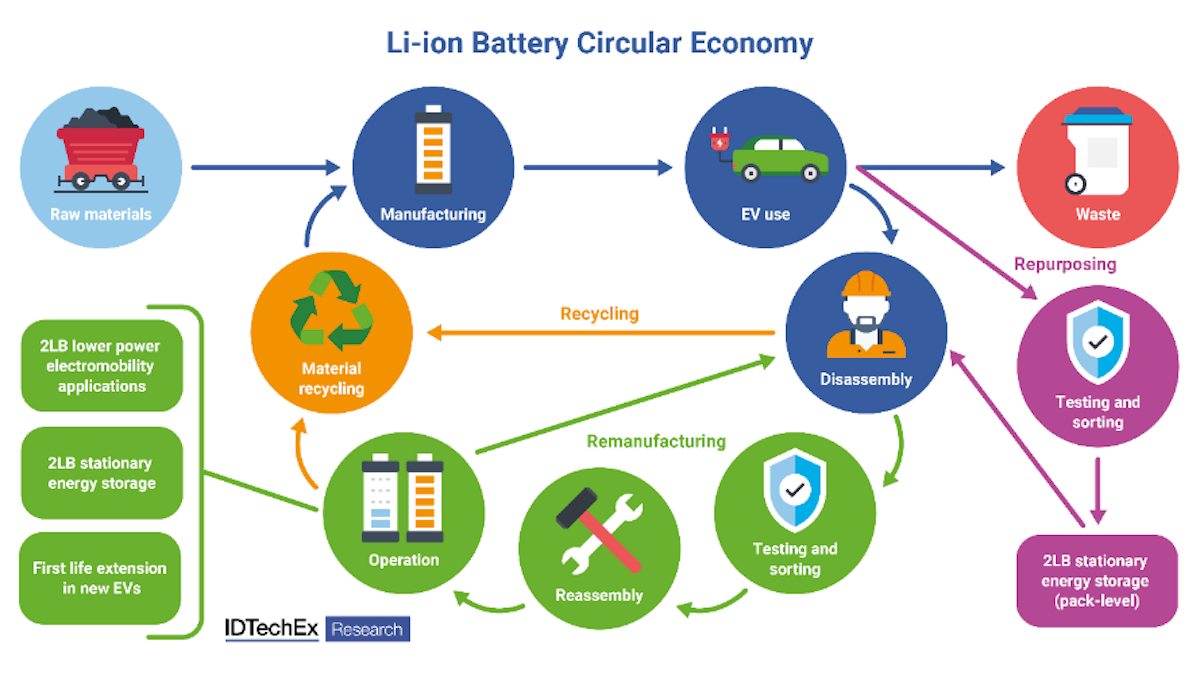

リチウムイオン電池の循環経済。出典:IDTechEx

市場の動き

欧州と米国の再利用業者は、二次電池の導入量を着実に増やし続けている。これらの定置式または移動式システムは、主に商業・産業(C&I)顧客向けに設置されており、再生可能エネルギーの自家消費、ピークカット、EV充電の最適化に利用されている可能性がある。再利用者の中には、住宅用蓄電池技術を開発しているところもある。再利用者の中には、より大型のコンテナ型バッテリー蓄電システム(BESS)を開発しているところもあり、これらはグリッド規模のアプリケーションに使用される可能性がある。IDTechExは、中国がすでに電気通信バックアップパワーアプリケーション用の二次電池の配備を拡大していると考えているが、ヨーロッパでは中国以外で最も高いレベルの活動が続いており、20の再利用者がこの地域で二次電池を開発していることが確認されている。このIDTechExレポートは、再利用業者と自動車OEMが開発した主要な二次電池技術、プレーヤー別の市場シェア、ビジネスモデル、資金調達、収益創出メカニズム、自動車OEMとの主要パートナーシップに関する考察と分析を提供している。

再利用業者と再製造業者。出典:IDTechEx.

セカンドライフEVバッテリーのコストと寿命末期バッテリー診断

しかし、欧州と米国で見られる第一世代リチウムイオンBESS技術の大幅なコスト削減により、再利用業者が顧客に対してシステムの価格競争力を維持することは著しく困難になっている。第二世代BESS技術は、EV電池が第一世代で劣化を受け、その結果、本質的に性能の悪い第二世代システムを生み出すことを考えると、第一世代LiイオンBESSよりも価格を低くせざるを得ない。

二次使用BESSのコスト上昇には、引退したEVバッテリーの配送ロジスティクス、バッテリーの材料と部品、バッテリーのグレーディング時間、分解、再組み立てを含む再利用プロセスなど、多くの要因が関係している。再利用者は、これらすべての面でコスト削減を目指すことになる。例えば、半自動バッテリー分解技術を使ったプロジェクトがいくつか出てきており、成功すれば、特定の再利用工程における人の介在の必要性を減らし、人件費を削減することができる。本報告書では、多くの新興企業によって開発されている主要な先進バッテリーグレーディング技術についても論じている。これらの技術は、一般的なサイクル技術のように数時間ではなく、数分でバッテリーの健全性(SOH)を判定する車載寿命末バッテリー試験となる可能性があり、試験時間の短縮、ひいてはコストの削減につながる。

このIDTechExの報告書では、主要な再利用事業者への一次インタビューのデータに基づき、再利用コスト(US$/kWhベース)を分析し、異なる再利用シナリオに対する感度分析を提供し、エネルギー密度やサイクル寿命を含むコストと主要性能指標を比較しながら、二次電池BESSと一次電池Li-ion BESSの技術経済分析を提供している。

セカンドライフとEVバッテリーの動向

引退したEVバッテリーは、パック、モジュール、セルレベルなど、さまざまな分解の深さで再利用することができる。分解深度を深くすると時間がかかるため、人件費がかさむ。しかし、これによって最も性能の良いモジュールやセルを再組み立てすることができ、より性能の良いシステムを作ることができる。IDTechExは、再利用者が一般的にパックレベルまたはモジュールレベルの再利用技術を採用していることを確認しており、これは今後も続くと予想される。分解の深さ別に配備された第二世代BESSに関する更なる分析を提供する。

EV バッテリーの様々な分解深度を実施する再利用業者の割合。出典:IDTechEx

EVバッテリーの動向は、長期的な再利用の経済的実現可能性にも影響を与える可能性がある。例えば、セル・ツー・パック(CTP)設計は、バッテリーパックのエネルギー密度を向上させ、EVの走行距離を向上させることができる。しかし、このような設計では一般的に構造用接着剤やスポット溶接が多用されるため、解体工程で除去するために溶剤や熱の使用が必要となり、解体コストが増加する可能性がある。IDTechExの本レポートは、EV用バッテリー技術、設計、化学物質(LFP対NMCなど)の多くの動向と、これらが第二世代EV用バッテリー市場にどのような影響を及ぼす可能性があるかについて分析し、徹底的な考察を行っている。

使用済みバッテリーの規制

各地域でバッテリーのリサイクルに関する規制はあるが、EV用二次電池に特化した規制はほとんど存在しない。二次電池の潜在的価値を認識し、EU、中国、米国を含む地域は現在、二次電池と再利用を促進するための規制枠組みに取り組んでいる。2022年12月にEU電池規制の草案が作成されて以来、IDTechExは、セカンドライフ用途の電池の再利用に関する用語と認識が相応に変化していることを確認している。しかし、これらの電池を早急にリサイクルするのではなく、再利用することにインセンティブを与えるために、より大きな重点を置くことは可能である。このIDTechExの報告書では、主要地域における二次電池に関する主要な規制と政策を徹底的に調査し、EUバッテリーパスポート、関係者間でのEOL電池データの提供、拡大生産者責任(EPR)、政策が企業活動にどのような影響を与えるかといったトピックを取り上げて明確な解説を行っている。

セカンドライフEVバッテリーの地域別立法活動。出典:IDTechEx

予測

IDTechExの本レポートでは、2022年から2035年までのEV用二次電池市場について、地域別(欧州、米国、中国、RoW)、用途別、導入量別(GWh)、金額別(億米ドル)の10年間の市場予測も行っている。2020-2035年のEV電池全体の供給力とLFP EV電池の供給力予測を地域別、EVタイプ別に掲載しています。

企業プロファイル

このIDTechExレポートには30社以上の企業プロフィールが掲載されており、EV用二次電池市場に参入している、または参入を検討している主要な二次電池再利用業者、高度電池試験診断業者、リチウムイオン電池リサイクル業者に関するさらなる洞察を提供しています。

主要な側面

Summary

この調査レポートは、2025-2035年の電気自動車用二次電池市場について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

As the availability of retired EV batteries will grow over the coming decade, IDTechEx forecasts the second-life EV battery market will be valued at US$4.2B by 2035.

Electric vehicle (EV) batteries are eventually retired at the end of their first-life, once they no longer meet the performance requirements for the EV. These Li-ion batteries could be recycled to reclaim the valuable and critical raw materials and see these reintroduced into new EV batteries. However, repurposing these batteries for second-life applications, prior to recycling, maximizes the value of the EV battery, extends their lifetime, and contributes to a battery circular economy. In some cases, some modules or cells could be replaced in a battery pack, seeing its first-life extended in an EV application. Repurposed second-life EV batteries, however, are used for stationary battery storage or lower power electromobility applications, which are use cases less demanding than that of EVs.

Li-ion Battery Circular Economy. Source: IDTechEx.

Market Activity

Repurposers in Europe and the US have continued to steadily increase their volume of second-life battery deployments. These stationary or mobile systems have primarily been installed for commercial and industrial (C&I) customers, who may be using them for optimization of renewable energy self-consumption, peak shaving, and EV charging. Some repurposers have also developed residential battery storage technologies. Some repurposers are developing larger containerized battery energy storage systems (BESS), which could be used for grid-scale applications. While IDTechEx believes China is already scaling up deployments of second-life batteries for telecom backup power applications, Europe continues to see the highest level of activity outside China with 20 identified repurposers developing second-life batteries in this region. This IDTechEx report provides discussion and analysis on key second-life battery technologies developed by repurposers and automotive OEMs, market shares by player, business models, funding, revenue generation mechanisms, and key partnerships with automotive OEMs.

Second-Life Repurposers and Remanufacturers by HQ. Source: IDTechEx.

Second-life EV Battery Costs and End-of-Life Battery Diagnostics

Significant cost reductions of first-life Li-ion BESS technologies seen in Europe and the US have, however, made it significantly difficult for repurposers to remain competitive on their systems' prices to customers. Second-life BESS technologies will have to be priced lower than first-life Li-ion BESS, given that EV batteries will have undergone degradation in their first life, and thus give rise to an inherently worse-performing second-life system.

Many factors can contribute to higher second-life BESS costs, including retired EV battery delivery logistics, battery materials and components, and the repurposing process itself, including battery grading times, disassembly, and reassembly. Repurposers will be aiming to reduce their costs across all these fronts. For example, several projects using semi-automated battery disassembly technologies are emerging, and if successful, could reduce the need for human intervention for certain repurposing steps, reducing labor costs. This report also discusses key advanced battery grading technologies being developed by a number of start-ups. These technologies could be in-vehicle end-of-life battery testing to determine battery State-of-Health (SOH) in the order of minutes rather than hours as per typical cycling techniques, reducing testing time and therefore cost.

This IDTechEx report analyzes repurposing costs (on a US$/kWh basis) based on data from primary interviews with key repurposers, provides a sensitivity analysis for different repurposing scenarios, and provides a techno-economic analysis of second-life BESS vs first-life Li-ion BESS, comparing costs and key performance metrics including energy density and cycle life.

Second-life and EV Battery Trends

Retired EV batteries can be repurposed at different depths of disassembly, namely at pack-, module-, or cell-level. Increasing the depth of disassembly takes longer and therefore incurs greater labor costs. However, this allows for the reassembly of the best performing modules or cells, thus creating a better-performing system. IDTechEx has identified that repurposers are typically adopting pack-level or module-level repurposing techniques and would expect this to continue. Further analysis on second-life BESS deployed by depth of disassembly is provided.

Proportion of Repurposers Performing Various Depth of EV Battery Disassembly. Source: IDTechEx.

EV battery trends may also impact the economic feasibility of repurposing long-term. For instance, cell-to-pack (CTP) designs can improve the energy density of the battery pack and thus the driving range of the EV. However, these designs typically make greater use of structural adhesives, or spot-welding, which could require the use of solvents or heat to remove in the disassembly process, increasing the cost of disassembly. This IDTechEx report analyzes and provides thorough discussion on the many trends in EV battery technologies, designs, and chemistries (e.g., LFP vs NMC) and how these could influence the second-life EV battery market.

Second-life Battery Regulations

While there are some regulations on the recycling of batteries across different regions, few regulations exist that specifically address second-life EV batteries. Realizing the potential value of second-life batteries, regions including the EU, China and the US are now working on their regulatory frameworks to facilitate second-life batteries and repurposing. Since the draft version of the EU Battery Regulation made in December 2022, IDTechEx has observed a reasonable shift in terminology and recognition for repurposing batteries for second-life applications. However, a greater emphasis could still be made to incentivize players to repurpose instead of prematurely recycle these batteries. This IDTechEx report thoroughly examines and provides clear commentary on the key regulations and policies for second-life batteries in key regions, covering topics such as the EU Battery Passport, provision of EOL battery data across stakeholders, extended producer responsibility (EPR), and how policies may impact company activity.

Second-Life EV Battery Legislative Activity by Region. Source: IDTechEx.

Forecasts

This IDTechEx report also provides 10-year market forecasts for the second-life EV battery market by installations (GWh) by region (Europe, US, China, RoW), application, and by value (US$B) for the 2022-2035 period. Overall EV battery availability and LFP EV battery availability forecasts are provided by region and type of EV for the 2020-2035 period.

Company Profiles

This IDTechEx report includes 30+ company profiles, offering further insights into key second-life battery repurposers, advanced battery testing diagnosticians, and Li-ion battery recyclers participating, or looking to participate, in the second-life EV battery market.

Key Aspects:

Table of Contents

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(自動車)の最新刊レポート

IDTechEx社の 自動車 - Vehicles分野 での最新刊レポート

よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|

.png)

.png)

.png)

.png)

.png)

.png)

.png)