電気・燃料電池トラックの2025~2045年:技術、市場、予測Electric and Fuel Cell Trucks 2025-2045: Technologies, Markets, Forecasts 本レポートは、バッテリー電気トラック、プラグインハイブリッドトラック、燃料電池トラックを含む電気トラック市場の分析を提供します。さらに、セル、モジュール、パックレベルのバッテリー(LFPとNMC)、充... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

サマリー

本レポートは、バッテリー電気トラック、プラグインハイブリッドトラック、燃料電池トラックを含む電気トラック市場の分析を提供します。さらに、セル、モジュール、パックレベルのバッテリー(LFPとNMC)、充電インフラ、電気モーター、水素内燃エンジンについてもカバーしています。IDTechExでは、パワートレイン別、地域別、バッテリー需要(単位)別、市場規模(米ドル)別のトラックに関する20年間の予測ラインを提供しています。

電気トラック市場は、バッテリー電気トラック、燃料電池トラック、水素内燃エンジン(ゼロエミッションとみなすことができる)、プラグインハイブリッドなど、さまざまな速度で主流に移行しています。主要地域である欧州、中国、米国、さらにインドとブラジルの大規模な対応可能市場に後押しされたその他の地域でも、その普及はさまざまである。

IDTechExの調査レポート「電気・燃料電池トラック2025-2045年:市場、予測、技術」は、中型・大型電気トラック市場をパワートレイン技術と地域別に区分し、付随するバッテリー需要も含めて分析している。これには、バッテリー技術、充電インフラ、天然ガスや水素内燃エンジンなど他のソリューションの効果についての分析も含まれている。中型・大型トラックの2022年のCO2排出量は18億トンで、これは世界の運輸部門の排出量の約25%に相当する。世界の自動車保有台数と比較するとその数は比較的少ないにもかかわらず、トラックの圧倒的多数が大型ディーゼルエンジンを使用しており、そのほとんど(米国では85%)が1日100マイル(160km)以上走行し、乗用車を大幅に上回っている。

その結果、各国政府は、ネット・ゼロ・エミッション達成という広範な目標の一環として、トラックメーカー専用の排出基準を導入・更新してきた。例えば、EUは最近、トラックの排出量目標を更新し、対象車両の範囲を拡大し、2019年基準からの排出量削減率を、当初は30%であったが、2030年までに45%に引き上げた。米国もトラックの排出量削減について具体的な目標を掲げており、その結果、特定の車両セグメントでは、2032年までにゼロ・エミッション車の販売シェアが最大60%に達する可能性がある。米国は、ゼロ・エミッション・トラックの販売台数でEUや中国に遅れをとっているため、これらの目標が、当初カリフォルニア州で採用され、現在はオレゴン州、コロラド州、ニュージャージー州などを含む先進クリーントラック規制のような地方自治体による規制を伴う、全国的なさらなるインセンティブを必要とするかどうかはまだわからない。

電気トラック市場の現状

中国のOEMは、すべての車両セグメントで製品を提供し、国内市場でもバッテリー交換可能なモデルが成功を続けており、世界の電気トラック市場を支配し続けている。販売台数は、SANY、東風、SCMG、Sinotruk、その他多くの企業が競争の激しい市場で独占しており、2023年の大型電気トラックの販売台数は34,000台を超える。これは2024年末までには上回ると思われる。3大市場すべてで大きな成長が見られたが、米国ではトラック新車販売の0.1%しか電気自動車がなかった。欧州では、ボルボ・グループ(ボルボ・トラックとルノー・トラックを含む)が大型バッテリー電気トラック市場シェアの約70%を占めており、MANトラック・バス、メルセデス、スカニアはいずれも2024年にシリーズ生産を開始する新モデルを発表している。

トラック(および商用車全般)の乗用車に比べた長いデューティサイクルと高い積載量要件に起因する課題が残っている。バッテリー電気トラックは、ディーゼル同等車の平均積載量の80~90%であり、ディーゼルトラックに比べ長い充電時間と短い航続距離は、フリートオペレーターの懸念であり続けているが、これはより多くの充電ステーションとMW充電基準の導入によって改善されるであろう。他方、電気トラックはディーゼルトラックの最大2倍のコストがかかるが、総所有コスト(TCO)の観点からは、電気トラックは優位に立ち続けている。特に、カリフォルニア州ハイブリッド・ゼロエミッション・トラック・バス・バウチャー・インセンティブ・プロジェクト(HVIP)のようなバウチャー・イニシアチブや、EUの複数の州でディーゼルトラックを運行するとペナルティーが課される排出ガスに基づく通行料制度によって、電気トラックは優位に立ち続けている。

燃料電池トラックとH2ICEは比較的不透明なままである。

燃料電池トラックは、バッテリー電気トラックが苦戦し続けている問題のいくつかを解決する。水素タンクの重量は、電気トラックに必要な数百kgのバッテリーパックよりもはるかに軽く、燃料電池トラックへの燃料補給は10分もかからないはずだ。一般的に、燃料電池トラックの航続距離はバッテリー電気トラックより約150km長い(ただし、これは個々のモデルや用途によって大きく異なる)。ニコラは燃料電池トラックTREの初納入を行い、2024年第3四半期には88台が顧客の手に渡った。

ヒュンダイXcientも、主に韓国とスイスで限られた台数しか導入されていない。トヨタ、メルセデス、ボルボといった他のOEMメーカーも、試験走行やプロトタイプを所有している。

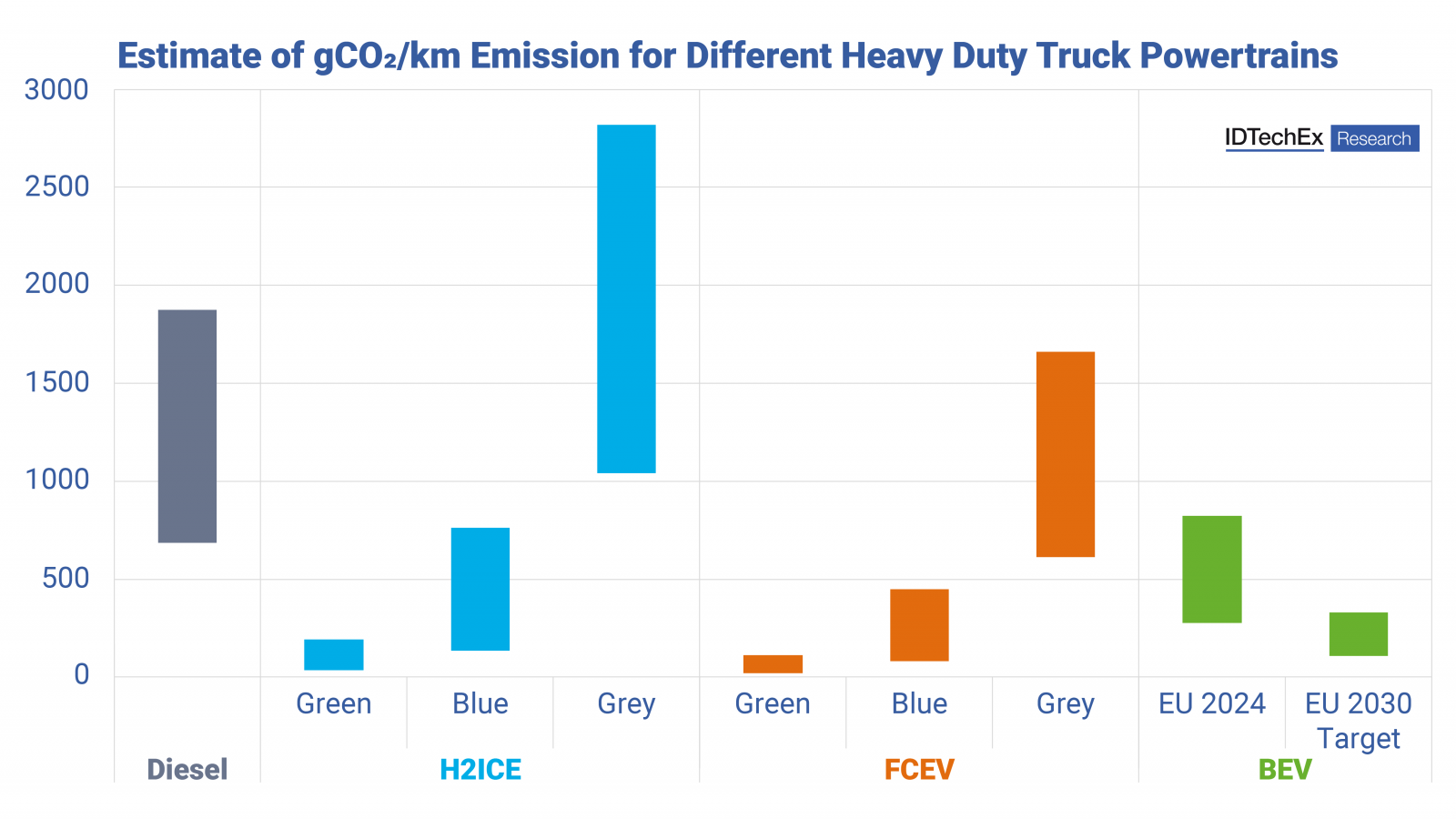

燃料電池トラックの導入は、TCOへの配慮と水素インフラがまばらであることから制限されるだろう。さらに、現在のところ、ほとんどの水素は灰色水素であり、排出量が非常に多く、バッテリー電気よりもディーゼル・トラックに匹敵する。理想的なのはグリーン水素だが、供給はまだ極めて限られている。世界的なエネルギー網の自然エネルギーへのシフトが進む中、生産されたエネルギーの75%が車輪に到達するグリーン水素製造よりも、この電力をバッテリー式電気トラックに使うべきだという議論が起こる。H2ICEの場合、これはわずか15%である。しかし、従来のディーゼルエンジンに対して90%以上の部品汎用性があり、より低純度の水素を使用できることから、H2ICEトラックには短期的な市場機会がある。しかし、2025年に200台のH2ICEトラックを生産しようとしているMAN Truck & Bus社を筆頭に、市場はまだ初期段階にある。IDTechExは、バッテリー電気トラック、プラグインハイブリッドトラック、燃料電池トラックの年間販売台数と市場規模を予測するために、プラグインハイブリッドトラックとともに、これらすべての技術の可能性を考慮している。

IDTechExによる、水素の色、EUの送電網構成、EUの2030年送電網目標に基づく、さまざまなパワートレインの排出量の分析。出典 電気・燃料電池トラック 2025-2045

IDTechExのレポート「電気・燃料電池トラック2025-2045年:市場、予測、技術」は、排出ガス、バッテリー、モーター、充電に関する追加カバレッジを提供し、トラックセクターのあらゆるビジネスに電気トラックの展望に関する総合的な洞察を提供する。これは、トラック販売、バッテリー需要、燃料電池需要、市場価値の20年間の見通しを示す80の予測ラインと組み合わされており、中型トラック市場と大型トラック市場の両方について個別の予測を行っています。

主要な側面

本レポートは、中型および大型電気トラックに関する技術的および商業的分析を提供しています:

Summary

この調査レポートは、バッテリー電気トラック、プラグインハイブリッドトラック、燃料電池トラックを含む電気トラック市場について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

This report provides an analysis of the electric truck market, including battery electric trucks, plug-in hybrid trucks, and fuel cell trucks. Furthermore, coverage on batteries (LFP and NMC) at the cell, module, and pack level, as well as charging infrastructure, electric motors, and hydrogen internal combustion engines, is provided. IDTechEx provides 20-year forecast lines on trucks split by powertrain, region, battery demand, in units, and market size US$.

The market for electric trucks is transitioning into the mainstream at different rates, whether that be battery-electric trucks, fuel-cell trucks, hydrogen internal combustion engines (which can be considered zero-emissions) or plug-in hybrids. Adoption varies between the key regions Europe, China, and the US, and additionally in the rest of the world, fueled by the large addressable markets in India and Brazil.

IDTechEx's report "Electric and Fuel Cell Trucks 2025-2045: Markets, Forecasts, Technologies", analyzes the medium and heavy-duty electric truck market, segmented by powertrain technology and region, as well as accompanying battery demand. This includes analysis of battery technologies, charging infrastructure, and the effect of other solutions, such as natural gas and hydrogen internal combustion engines. Medium and heavy-duty trucks were responsible for 1.8 billion tonnes of CO2 emissions in 2022, which is approximately 25% of the emissions of the transport sector globally. Despite their relatively low number compared to the global vehicle fleet, the overwhelming majority of trucks use heavy-duty diesel engines, with most (85% in the US) driving over 100 miles/160km a day, significantly more than a passenger vehicle.

As a result, governments have introduced and updated emissions standards specifically for truck manufacturers, as part of the broader target to hit net-zero emissions. For example, the EU has recently updated its target for emissions of trucks, extending the scope of vehicles covered, and increasing the emissions reduction from the 2019 baseline to 45% by 2030, when it was originally 30%. The US has specific targets for emission reductions of trucks also, which could result in up to 60% zero-emissions vehicle sales share by 2032 for certain vehicle segments. The US lags behind the EU and China in zero-emission truck sales, so it remains to be seen whether these targets will require further incentives nationally, to accompany regulations by local governments, such as the Advanced Clean Trucks regulation originally adopted by California, now including Oregon, Colorado, and New Jersey among others.

The current landscape of the electric truck market

Chinese OEMs continue to dominate the global electric truck market, with offerings in all vehicle segments, as well as the continued success of battery-swappable models in the domestic market. Sales are dominated by the likes of SANY, Dongfeng, SCMG, Sinotruk, and many others in a competitive market, with over 34,000 heavy-duty electric truck sales in 2023. This is likely to be surpassed by the end of 2024. While all three major markets saw significant growth, only 0.1% of new truck sales in the US were electric. In Europe, Volvo Group (including Volvo Trucks and Renault Trucks) claimed approximately 70% of the heavy-duty battery electric truck market share, while MAN Truck and Bus, Mercedes, and Scania have all announced new models to enter series production in 2024.

Challenges remain due to the long duty cycles and high payload requirements of trucks (and commercial vehicles generally) compared to passenger vehicles: battery electric trucks average 80-90% the payload of diesel equivalents, and longer charging times and shorter ranges compared to diesel trucks continue to be a concern for fleet operators, which will be remedied by the introduction of more charging stations and MW charging standards. On the other hand, although electric trucks can cost up to double the amount of a diesel truck, they continue to gain ground from a total cost of ownership (TCO) standpoint, especially with voucher initiatives such as those provided by the California Hybrid and Zero Emission Truck and Bus Voucher Incentive Project (HVIP), and emissions-based tolling, which yields a penalty for operating a diesel truck in multiple EU states.

Fuel Cell Trucks and H2ICE remain relatively unclear

Fuel cell trucks solve some of the issues that battery-electric trucks continue to struggle with. Hydrogen tanks weigh much less than the battery packs required for electric trucks, which are hundreds of kg, and refueling a fuel cell truck should take less than ten minutes. Generally, fuel cell trucks possess a range approximately 150km greater than a battery electric truck (although this varies greatly by individual model and application). Nikola made its first deliveries of its TRE fuel cell truck, with 88 being taken by customers in Q3 2024.

The Hyundai Xcient has also seen a limited number of deployments, mostly in South Korea and Switzerland. Other OEMs such as Toyota, Mercedes, and Volvo all have running trials or prototypes.

Fuel cell truck uptake will be limited by TCO considerations and sparse hydrogen infrastructure. Furthermore, currently most hydrogen is grey hydrogen, which is very emissions heavy, and more comparable to diesel trucks than battery-electric. Ideally, green hydrogen is used, but supply is still extremely limited. With the global energy grid shifting more to renewables, the argument arises that this electricity should be used for battery-electric trucks over green hydrogen production, where 75% of the energy produced reaches the wheels, compared to just 25% in fuel-cell trucks. For H2ICE, this is only 15%. However, with over 90% universality in parts to a traditional diesel engine, and the ability to use lower-purity hydrogen, there is a short-term market opportunity for H2ICE trucks. However, the market is still in its nascent stages, led by MAN Truck & Bus, which is looking to produce 200 H2ICE trucks in 2025. IDTechEx considers the potential of all these technologies, along with plug-in hybrid trucks, to forecast yearly unit sales and market size of battery-electric, plug-in hybrid, and fuel cell trucks.

IDTechEx analysis of emissions of different powertrains, sourced by hydrogen color, EU grid mix, and EU 2030 grid target. Source: Electric and Fuel Cell Trucks 2025-2045

IDTechEx's report, "Electric and Fuel Cell Trucks 2025-2045: Markets, Forecasts, Technologies", provides additional coverage on emissions, batteries, motors, and charging, providing a holistic insight into the electric truck landscape for any business across the truck sector. This is combined with 80 forecast lines, giving a twenty-year outlook for truck sales, battery demand, fuel cell demand, and market value, with separate forecasts for both the medium and heavy-duty truck markets.

Key Aspects

This report provides technical and commercial analysis on medium and heavy-duty electric trucks, including:

Table of Contents

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(自動車)の最新刊レポート

IDTechEx社の自動車 - Vehicles分野での最新刊レポート

本レポートと同じKEY WORD()の最新刊レポート

よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|

.png)