Summary

This report covers the market landscape and supply-chain for silicon wafers used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

Silicon wafers are the fundamental starting point for nearly all semiconductor device fabrication. As such, the criticality of the role that this material plays in the semiconductor supply chain is hard to refute and is treated as such accordingly in this Critical Materials Reports

-

• Contains data and analysis from TECHCET’s database and Sr. Analyst experience, as well as that developed from primary and secondary market research

-

• Provides focused silicon wafers supply chain information for supply-chain managers, process integration and R andD directors, as well as business development and financial analysts

-

• Covers information about key silicon wafer suppliers, issues/trends in the silicon wafer supply chain, estimates on supplier market share, and silicon wafer market forecasting

ページTOPに戻る

Table of Contents

Table of Contents

1 EXECUTIVE SUMMARY 9

1.1 SILICON WAFER BUSINESS – MARKET OVERVIEW 10

1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK 11

1.3 SILICON WAFER 5-YEAR UNIT SHIPMENT FORECAST BY DIAMETER 12

1.4 SILICON WAFER 5-YEAR REVENUE FORECAST BY SEGMENT, INCLUDING SOI 13

1.5 SILICON WAFER SEGMENT TRENDS 14

1.6 TECHNOLOGY TRENDS 15

1.7 COMPETITIVE LANDSCAPE 16

1.8 MOST RECENTLY REPORTED QUARTERLY FINANCIALS OF TOP- 5 17

1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS 18

1.10 ANALYST ASSESSMENT OF SILICON WAFERS 19

2 SCOPE, PURPOSE AND METHODOLOGY 20

2.1 SCOPE 21

2.2 METHODOLOGY 22

2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS 23

3 SEMICONDUCTOR INDUSTRY MARKET STATUS and OUTLOOK 24

3.1 WORLDWIDE ECONOMY AND OUTLOOK 25

3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 27

3.1.2 SEMICONDUCTOR SALES GROWTH 28

3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS 29

3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 30

3.2.1 ELECTRONICS OUTLOOK 31

3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK 32

3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS 33

3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS 34

3.2.3 SMARTPHONE OUTLOOK 35

3.2.4 PC OUTLOOK 36

3.2.5 SERVERS / IT MARKET 37

3.3 SEMICONDUCTOR FABRICATION GROWTH and EXPANSION 38

3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS 39

3.3.2 NEW FABS IN THE US 40

3.3.3 WW FAB EXPANSION DRIVING GROWTH 41

3.3.4 EQUIPMENT SPENDING TRENDS 42

3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS 43

3.3.5.1 DRAM TECHNOLOGY ROADMAPS 44

3.3.5.2 3D NAND TECHNOLOGY ROADMAPS 45

3.3.6 FAB INVESTMENT ASSESSMENT 46

3.4 POLICY and TRADE TRENDS AND IMPACT 47

3.5 SEMICONDUCTOR MATERIALS OVERVIEW 48

3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028 49

3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028 50

4 SILICON WAFER MARKET TRENDS 51

4.1 SILICON WAFERS MARKET TRENDS – OUTLINE 52

4.1.1 2023 SILICON WAFER MARKET LEADING INTO 2024 53

4.1.2 SILICON WAFER MARKET OUTLOOK 54

4.1.2.1 SILICON WAFER 5-YEAR UNIT SHIPMENT FORECAST BY DIAMETER 55

4.1.2.2 SILICON WAFER 5-YEAR EPI UNIT SHIPMENT FORECAST BY DIAMETER 56

4.1.2.3 SILICON WAFER 2024 SHIPMENT FORECAST BY DIAMETER 57

4.1.2.4 SILICON WAFER 5-YEAR REVENUE FORECAST INCLUDING SOI 58

4.2 SILICON WAFER PRODUCTION CAPACITY OF TOP SUPPLIERS 59

4.2.1 SILICON WAFER CAPACITY / PRODUCTION BY REGION 60

4.3 SILICON WAFER EXPANSIONS AND INVESTMENTS- OVERVIEW 61

4.3.1 SILICON WAFER EXPANSIONS AND INVESTMENTSANNOUNCEMENTS 62

4.3.2 SILICON WAFER EXPANSIONS AND INVESTMENTS – COMMENTS 63

4.4 SILICON WAFER SUPPLY VS. DEMAND BALANCE - OVERVIEW 64

4.4.1 SUPPLY VS. DEMAND BALANCE – 300MM SILICON WAFERS 65

4.4.2 SUPPLY VS. DEMAND BALANCE – 200MM SILICON WAFERS 66

4.4.3 SUPPLY VS. DEMAND BALANCE – 300MM SILICON EPI WAFERS 68

4.5 PRICING TRENDS 69

4.6 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE 71

4.6.1 SILICON WAFER GENERAL TECHNOLOGY OVERVIEW 72

4.6.2 SILICON WAFER TECHNOLOGY TRENDS 73

4.6.3 SPECIALTY/EMERGING SILICON WAFER AND APPLICATIONS 74

4.7 REGIONAL CONSIDERATIONS 75

4.7.1 REGIONAL ASPECTS AND DRIVERS 76

4.8 EHS AND TRADE/LOGISTIC ISSUES 78

4.8.1 EHS ISSUES 79

4.8.2 TRADE/LOGISTICS ISSUES 80

4.9 ANALYST ASSESSMENT OF SILICON WAFER MARKET TRENDS 81

5 ACTIVITY OF LEADING WAFER SUPPLIERS 82

5.1 SILICON WAFER MARKET SHARE 83

5.1.1 CURRENT QUARTER - SUPPLIERS’ ACTIVITIES and REPORTED REVENUES 84

5.1.2 CURRENT QUARTER TOP-5 SUPPLIERS’ ACTIVITIES and REPORTED REVENUES 85

5.1.3 CURRENT QUARTER ACTIVITY – SHIN ETSU 86

5.1.4 CURRENT QUARTER ACTIVITY – SUMCO 87

5.1.5 CURRENT QUARTER ACTIVITY – GLOBALWAFERS 88

5.1.6 CURRENT QUARTER ACTIVITY – SILTRONIC 89

5.1.7 CURRENT QUARTER ACTIVITY – SK SILTRON 90

5.2 M andA ACTIVITY AND PARTNERSHIPS - NONE 91

5.3 PLANT CLOSURES 92

5.4 NEW ENTRANTS 93

5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS 94

5.6 TECHCET ANALYST ASSESSMENT OF SILICON WAFER SUPPLIERS 95

6 SUB-TIER SUPPLY-CHAIN, POLYSILICON 96

6.1 SUB-TIER SUPPLY CHAIN: SOURCES and MARKETS OVERVIEW 97

6.1.1 POLYSILICON MARKET BACKGROUND 98

6.1.2 POLYSILICON MARKET TRENDS 99

6.1.3 POLYSILICON - INDUSTRIAL VS. SEMICONDUCTOR-GRADE 100

6.1.4 SEMICONDUCTOR-GRADE POLYSILICON DEMAND 101

6.1.5 SUB-TIER SUPPLY CHAIN: POLYSILICON MARKET SHARE 102

6.1.6 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIERS and EXPANSION PLANS 103

6.1.7 SEMICONDUCTOR-GRADE POLYSILICON EXPANSION PLANS andNEWS 104

6.2 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS 105

6.3 SUB-TIER SUPPLY-CHAIN M andA OR PARTNERSHIP ACTIVITY 106

6.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES 107

6.5 SUB-TIER SUPPLY-CHAIN “NEW” ENTRANTS 109

6.6 SUB-TIER SUPPLY-CHAIN PLANT UPDATES 110

6.7 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES 111

6.8 SUB-TIER SUPPLY-CHAIN PRICING TRENDS 112

6.9 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT 113

7 SUPPLIER PROFILES 114

CENGOL

CETC

CHONGQING AST

CREE/WOLFSPEED

…and 20+ more

8 APPENDIX 196

8.1 INVESTMENT ANNOUNCEMENTS – SUPPLEMENTAL 197

8.2 CHINA SUPPLIERS- 300 MM PLANTS/INVESTMENTS – SUPPLEMENTAL 199

8.3 CHINA SUPPLIERS- 200 MM PLANTS/INVESTMENTS – SUPPLEMENTAL 201

8.4 CHINA IMPACT ON GLOBAL 200 MM SUPPLY 202

8.5 SIC WAFERS - SUPPLEMENTAL 203

8.6 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIERS - SUPPLEMENTAL 204

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1.1: SILICON WAFER AREA SHIPMENT FORECAST 12

FIGURE 1.2: SILICON WAFER 5-YEAR REVENUE FORECAST BY SEGMENT, INCLUDING SOI 13

FIGURE 1.3: 2023 SILICON WAFER SUPPLIER MARKET SHARE BY REVENUE TOP 3 VS. TOP 5 16

FIGURE 1.4: 2023 SILICON WAFER SUPPLIER MARKET SHARE BY REVENUE 16

FIGURE 1.5: COMBINED REVENUES OF SHIN ETSU, SUMCO, GLOBALWAFERS, SILTRONIC, AND SK SILTRON 17

FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023) 27

FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES 28

FIGURE 3.3: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI) 29

FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS 30

FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS) 32

FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION 33

FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION 34

FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES 35

FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST 36

FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND 38

FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2022-2027 39

FIGURE 3.12: FAB EXPANSIONS WITHIN THE US 40

FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 41

FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE 42

FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW 43

FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW 44

FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW 45

FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024 46

FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS 49

FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD) 50

FIGURE 4.1: SILICON WAFER AREA SHIPMENT FORECAST 55

FIGURE 4.2: SILICON EPI WAFER AREA SHIPMENT FORECAST 56

FIGURE 4.3: SILICON WAFER QUARTERLY SHIPMENT FORECAST 57

FIGURE 4.4: SILICON WAFER REVENUE FORECAST 58

FIGURE 4.5: SILICON WAFER SUPPLIER SHARE OF 300MM CAPACITY 59

FIGURE 4.6: 300MM SILICON WAFER SUPPLY/DEMAND FORECAST 65

FIGURE 4.7: 200MM SILICON WAFER SUPPLY/DEMAND FORECAST 66

FIGURE 4.8: 200MM SILICON WAFER SUPPLY/DEMAND FORECAST, CHINA IMPACT 67

FIGURE 4.9: 300MM SILICON EPI WAFER SUPPLY/DEMAND FORECAST 68

FIGURE 4.10: WORLDWIDE SILICON WAFER ASP TREND 69

FIGURE 4.11:NWORLDWIDE SILICON WAFER ASP TREND BY DIAMETER 70

FIGURE 4.12: SPECIALTY/EMERGING SILICON WAFER APPLICATIONS 74

FIGURE 4.13: 2023 SILICON WAFER REVENUE SHARE BY REGION (COMPANY HQ) 75

FIGURE 5.1: 2023 SILICON WAFER SUPPLIER MARKET SHARE BY REVENUE 83

FIGURE 5.2: SILICON WAFER MAKERS’ QUARTERLY COMBINED SALES (INCLUDES SHIN ETSU, SUMCO, GLOBALWAFERS, SILTRONIC, AND SK SILTRON) 85

FIGURE 5.3: SHIN ETSU CURRENT QUARTER FINANCIALS 86

FIGURE 5.4: #2 SUMCO CURRENT QUARTER FINANCIALS 87

FIGURE 5.5: GLOBALWAFERS CURRENT QUARTER FINANCIALS 88

FIGURE 5.6: SILTRONIC CURRENT QUARTER FINANCIALS 89

FIGURE 5.7: SK SILTRON CURRENT QUARTER FINANCIALS 90

FIGURE 5.8: AN AERIAL VIEW OF SILTRONIC’S BURGHAUSEN FACILITY 94

FIGURE 6.1: POLYSILICON DEMAND SEMICONDUCTOR VS. PHOTOVOLTAIC APPLICATIONS 100

FIGURE 6.2: POLYSILICON DEMAND FORECAST FOR SEMICONDUCTOR SILICON WAFERS (SEMICONDUCTOR APPLICATIONS) 101

FIGURE 6.3: UFLPA ENFORCEMENT METRICS SINCE IMPLEMENTATION OF THE ACT 108

FIGURE 6.4: PRICE TREND OF PV POLYSILICON 112

FIGURE 8.1: SIC WAFERING 203

TABLES

TABLE 1.1: SILICON WAFER GROWTH OVERVIEW 10

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES 25

TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024) 26

TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS 33

TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023 37

TABLE 4.1: ESTIMATED 300MM SILICON SHARE BY SUPPLIER 59

TABLE 4.2: SILICON WAFER SUPPLIER MANUFACTURING LOCATIONS 60

TABLE 4.3: OVERVIEW OF ANNOUNCED 2023/2024 SILICON WAFER SUPPLIER INVESTMENTS 62

TABLE 4.4: REGIONAL SILICON WAFER MARKETS 76

TABLE 4.5: REGIONAL SILICON WAFER MARKETS, CONTINUED 77

TABLE 5.1: MOST RECENT QUARTERLY WAFER SUPPLIER SALES (IN LOCAL REPORTING CURRENCY) 84

TABLE 6.1: ESTIMATED 2023 POLYSILICON SUPPLIER RANKING 102

TABLE 6.2: SEMICONDUCTOR–GRADE POLYSILICON SUPPLIERS 103

TABLE 8.1: OVERVIEW OF ANNOUNCED 2023 WAFER SUPPLIER INVESTMENTS 197

TABLE 8.2: OVERVIEW OF ANNOUNCED 2023 WAFER SUPPLIER INVESTMENTS, CONTINUED 198

TABLE 8.3: CHINA WAFER SUPPLIER 300 MM STATUS 199

TABLE 8.4: CHINA WAFER SUPPLIER 300 MM STATUS, CONTINUED 200

TABLE 8.5: CHINA WAFER SUPPLIER 200 MM STATUS 201

TABLE 8.6: ESTIMATED 200 MM WAFER CAPACITY CHINA SUPPLIERS 202

TABLE 8.7: EG POLYSILICON SUPPLIERS IN CHINA 204

Press Release

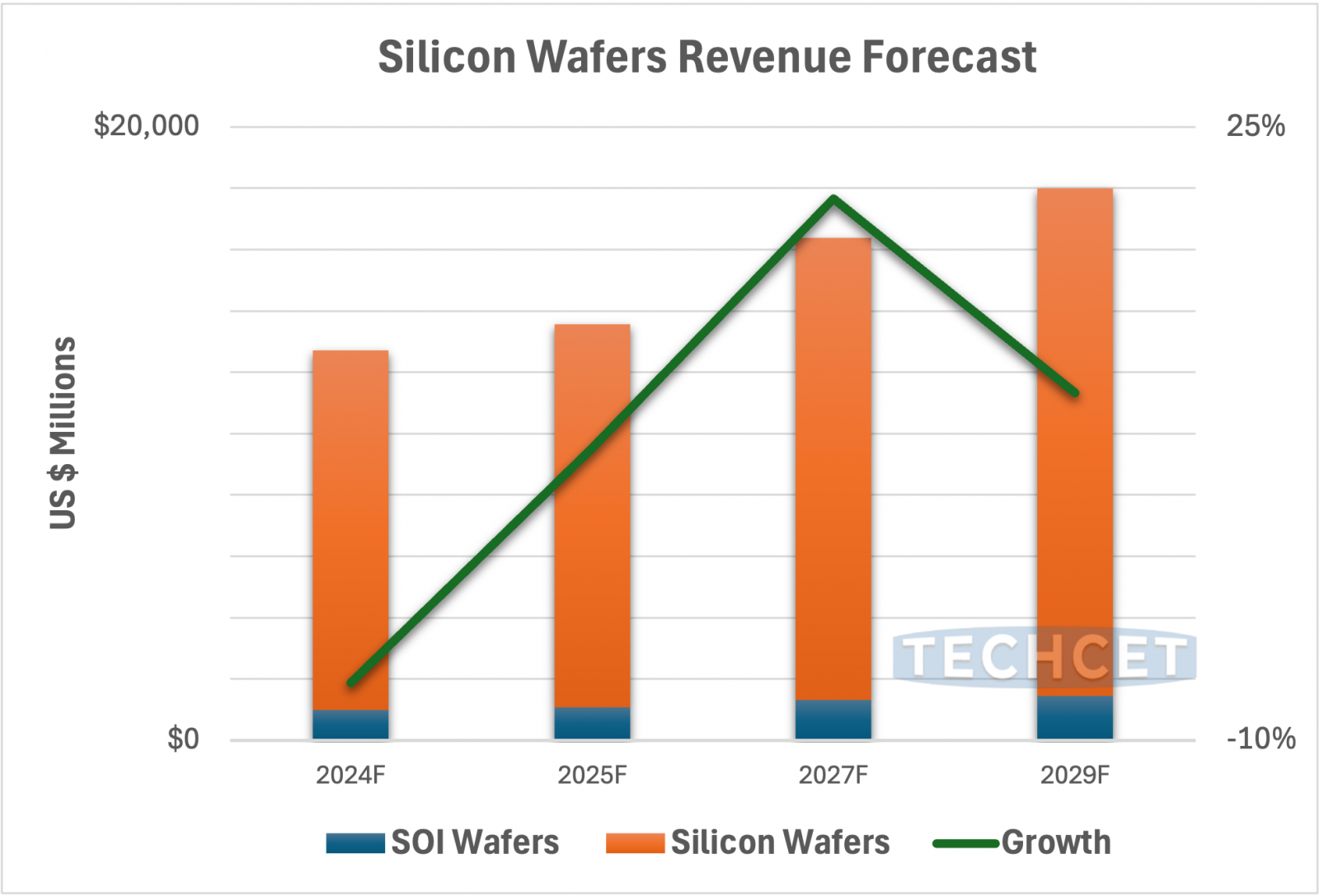

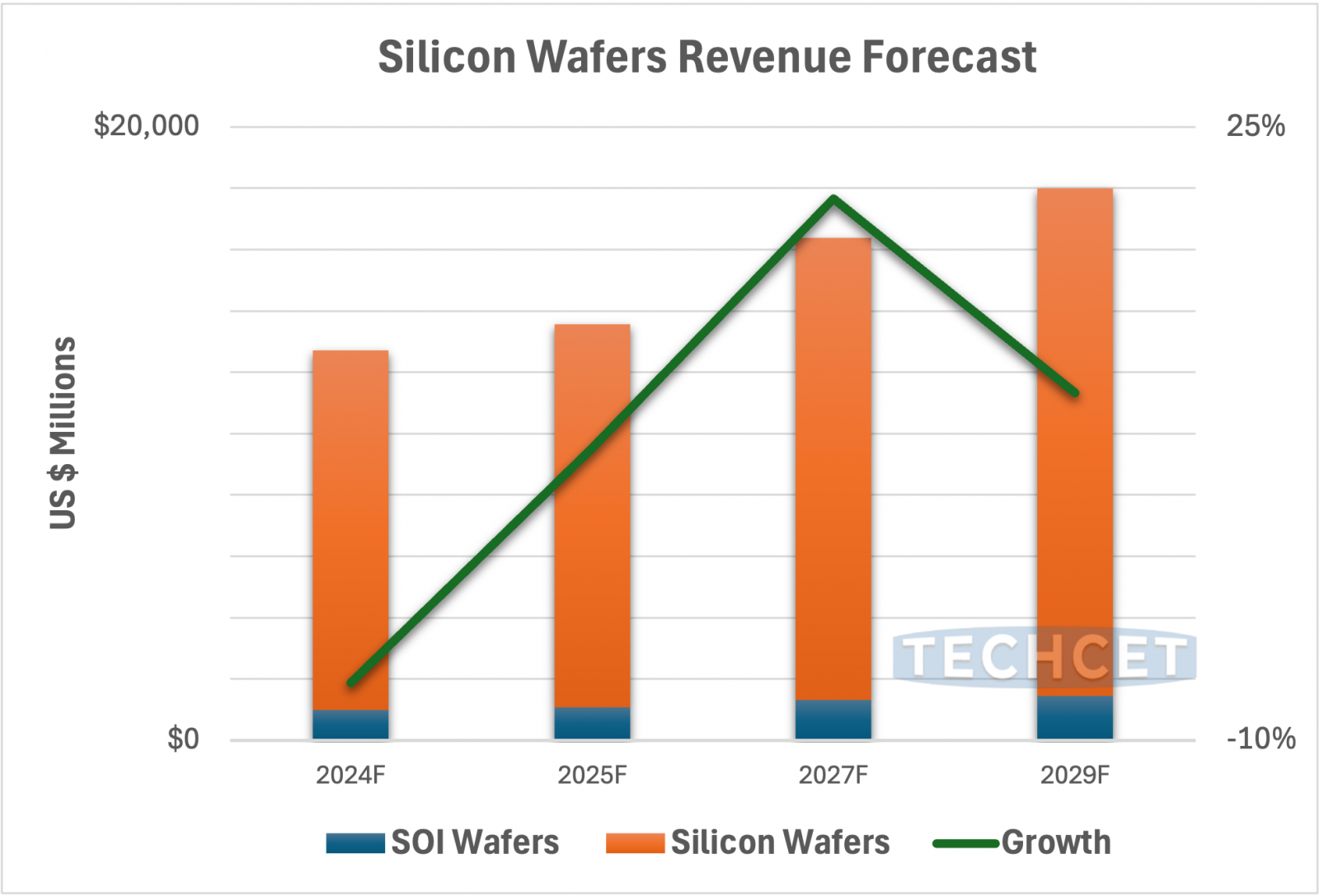

San Diego, CA, March 5, 2025: TECHCET the electronic materials advisory firm providing semiconductor materials supply chain information - forecasts a steady improvement for the silicon wafers market, projecting an annual growth of ~7% in 2025, with stronger gains in 2026. While 300mm wafers will see the highest growth, fueled in part by increasing demand for advanced packaging, smaller diameters like 150mm are expected to decline as the legacy device segment of the market increasingly shifts toward 200mm. Overall, wafer shipments are expected to see a 5% CAGR through 2029, as inventory levels stabilize and demand picks up in the second half of the year, as indicated in TECHCET’s Critical Materials Report(TM) on Silicon Wafers.

Silicon Wafers Revenue Forecast 2024-2029

In 2024, weaker drawdowns of inventories impacted new shipments, and the anticipated recovery failed to materialize, resulting in a ~4% YoY decline. This was compounded by a sequential revenue drop of ~7%, driven by sluggish demand and softer pricing.

Looking ahead, suppliers are likely to continue shifting their focus toward more profitable opportunities in advanced packaging and larger wafer sizes. At the same time, increased competition from China’s expanding domestic production is intensifying market pressures, driving companies to innovate and streamline operations to maintain their competitive edge.