Summary

2024-2025 SPUTTERING TARGETS SUPPLY-CHAIN & MARKET ANALYSIS

A CRITICAL MATERIALS REPORT (CMR)

This report addresses sputtering, the dominant PVD technique used in semiconductor device fabrication, and specifically covers the market and supply-chain for targets within that segment. The report contains data and analysis from TECHCET’s data base and Sr. Analyst experience, as well as that developed from primary and secondary market research.

Report Details

• Provides a detailed look and analysis of the sputter targets market and supply chain

as applied to semiconductor device manufacturing

• Included are raw material supply chain dynamics and companies, target manufacturing cost considerations, pricing trends and more

• Provides focused information for supply-chain managers, process integration and R&D directors, as well as business development and financial analysts

• Covers information about key sputter target suppliers, issues/trends in the electronics material supply chain, estimates on supplier market share, and forecast for the electronic material segments

ページTOPに戻る

Table of Contents

1 EXECUTIVE SUMMARY 10

1.1 SPUTTERING TARGETS BUSINESS – MARKET OVERVIEW 11

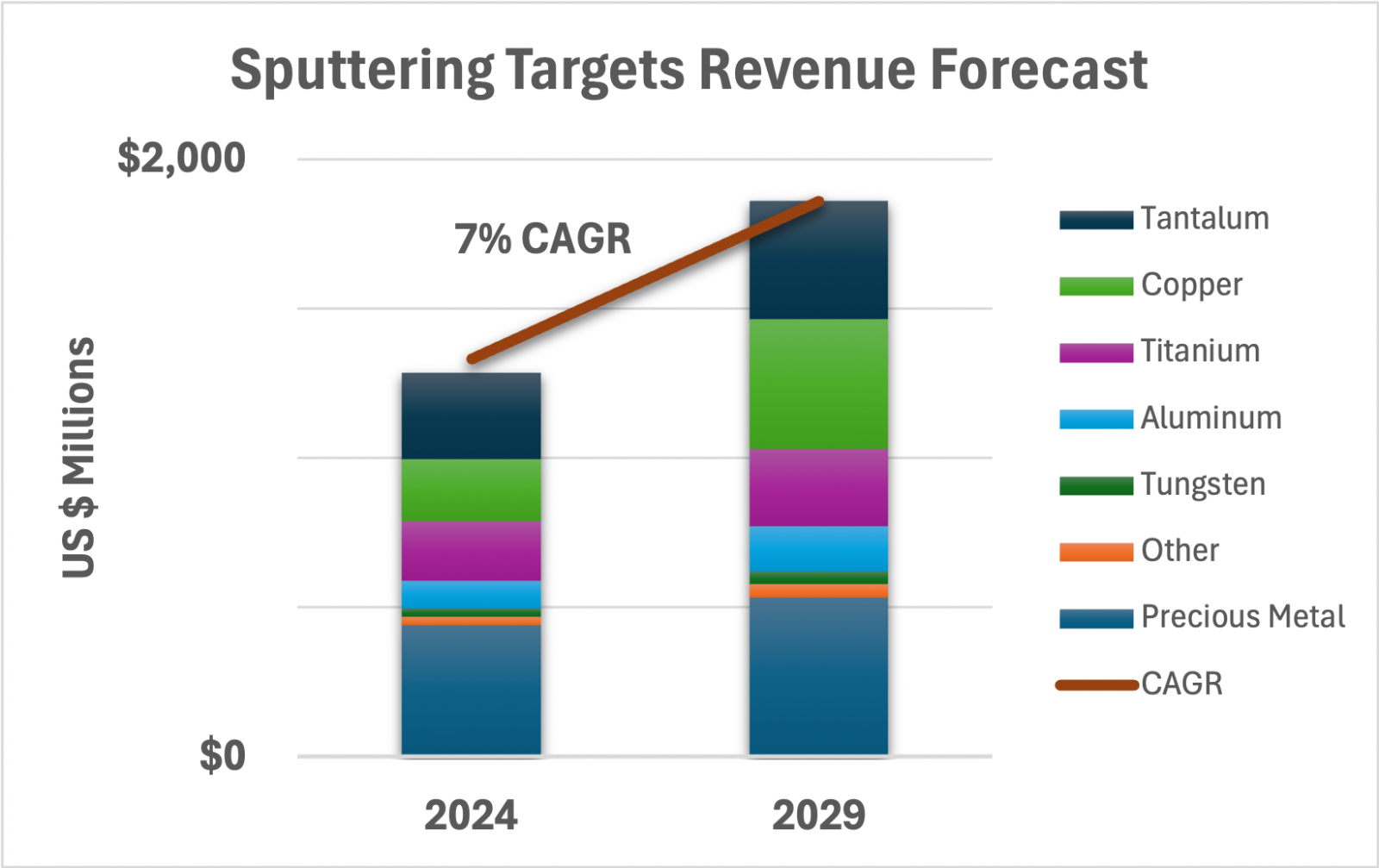

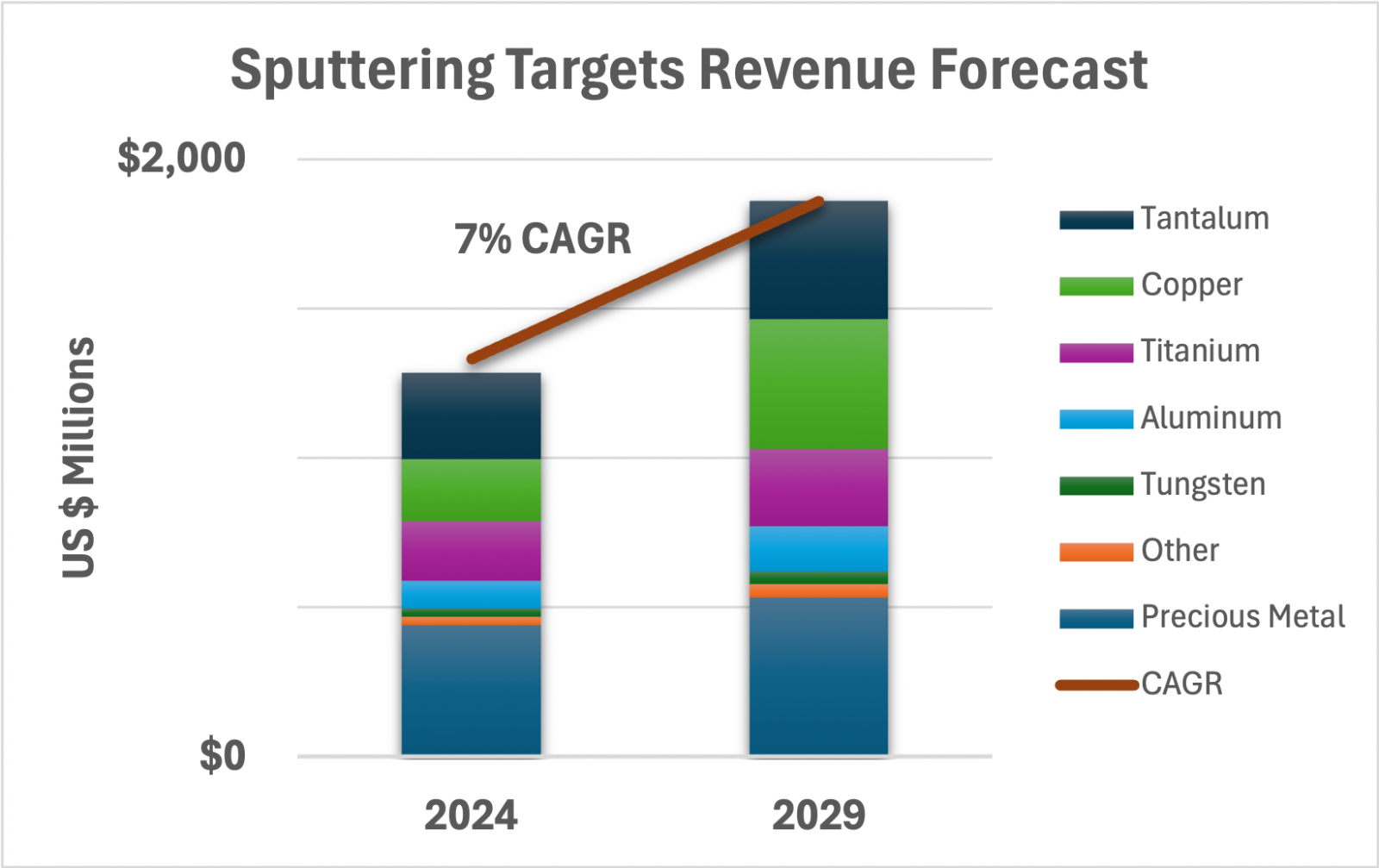

1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK 12

1.3 SPUTTER TARGETS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT 13

1.4 SPUTTERING TARGETS 5-YEAR REVENUE FORECAST BY SEGMENT 14

1.5 SPUTTERING TARGETS SEGMENT TRENDS 15

1.6 TECHNOLOGY TRENDS 16

1.7 COMPETITIVE LANDSCAPE 17

1.8 MOST RECENTLY REPORTED QUARTERLY FINANCIALS OF TOP-5 SUPPLIERS 18

1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS 19

1.10 ANALYST ASSESSMENT OF SPUTTERING TARGETS 21

2 SCOPE, PURPOSE AND METHODOLOGY 23

2.1 SCOPE 24

2.2 PURPOSE & METHODOLOGY 25

2.3 OVERVIEW OF OTHER TECHCET CMR™ OFFERINGS 26

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 27

3.1 WORLDWIDE ECONOMY AND OUTLOOK 28

3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 30

3.1.2 SEMICONDUCTOR SALES GROWTH 31

3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS 32

3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 33

3.2.1 ELECTRONICS OUTLOOK 34

3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK 35

3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS 36

3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS 37

3.2.3 SMARTPHONE OUTLOOK 38

3.2.4 PC OUTLOOK 39

3.2.5 SERVERS / IT MARKET 40

3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 41

3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS 42

3.3.2 NEW FABS IN THE US 43

3.3.3 WW FAB EXPANSION DRIVING GROWTH 44

3.3.4 EQUIPMENT SPENDING TRENDS 45

3.3.5 TECHNOLOGY ROADMAPS 46

3.3.6 FAB INVESTMENT ASSESSMENT 49

3.4 POLICY & TRADE TRENDS AND IMPACT 50

3.5 SEMICONDUCTOR MATERIALS OVERVIEW 51

3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028 52

3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028 53

4 SPUTTERING TARGETS MARKET TRENDS 54

4.1 SPUTTERING TARGETS MARKET TRENDS – OUTLINE 55

4.1.1 2023 SPUTTERING TARGETS MARKET LEADING INTO 2024 56

4.1.2 SPUTTERING TARGETS MARKET OUTLOOK 57

4.1.3 SPUTTERING TARGETS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT 58

4.1.4 SPUTTERING TARGETS 5-YEAR REVENUE FORECAST BY SEGMENT 59

4.2 SPUTTERING TARGETS MANUFACTURING LOCATIONS AND INVESTMENTS – BY REGION 60

4.2.1 SPUTTERING TARGETS MANUFACTURING LOCATIONS AND INVESTMENTS – CAPACITY EXPANSIONS 61

4.3 PRICING TRENDS 62

4.4 SPUTTERING TARGET TECHNOLOGY OVERVIEW 63

4.4.1 SPUTTERING TARGET TECHNOLOGY- Trends 64

4.4.2 SPUTTERING TARGET technology- DRIVERS BY DIAMETER 66

4.4.3 SPUTTERING TARGET technology- SPECIALTY/ EMERGING MATERIALS APPLICATIONS 67

4.5 REGIONAL CONSIDERATIONS 68

4.5.1 REGIONAL ASPECTS AND DRIVERS 69

4.6 EHS AND TRADE/LOGISTICS ISSUES 70

4.6.1 EHS ISSUES 71

4.6.2 TRADE/LOGISTICS ISSUES 73

4.7 TECHCET ANALYST ASSESSMENT OF SPUTTERING TARGETS MARKET TRENDS 74

5 SUPPLY-SIDE MARKET LANDSCAPE 75

5.1 SPUTTERING TARGETS MARKET SHARE 76

5.2.1 CURRENT QUARTER - SUPPLIERS’ ACTIVITIES & REPORTED REVENUES 77

5.2.2 CURRENT QUARTER REPORTING – JX ADVANCED METALS 78

5.2.3 CURRENT QUARTER REPORTING – HONEYWELL 80

5.2.4 CURRENT QUARTER REPORTING – KFMI 81

5.2.5 CURRENT QUARTER REPORTING – LINDE 82

5.2.6 CURRENT QUARTER REPORTING – TOSOH 83

5.3 M&A ACTIVITY AND PARTNERSHIPS 84

5.4 PLANT CLOSURES 85

5.5 NEW ENTRANTS 86

5.5.1 NEW ENTRANTS- BARRIERS TO ENTRY 87

5.5.2 NEW ENTRANTS- COMPANIES 88

5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS 89

5.7 TECHCET ANALYST ASSESSMENT OF MATERIAL SUPPLIERS 90

6 SUB-TIER SUPPLY-CHAIN, METALS 92

6.1 SUB-TIER SUPPLY-CHAIN: SOURCES & MARKETS OVERVIEW 93

6.1.1 SUB-TIER Metals MARKET BACKGROUND 95

6.1.2 SUB-TIER Metals MARKET TRENDS 97

6.1.3 SUB-TIER METALS MARKET STATISTICS 99

6.1.4 SUB-TIER METALS SUPPLY CHAIN MANAGEMENT CONSIDERATIONS 117

6.1.5 SUB-TIER METALS SUPPLY CHAIN SUPPLY SIDE OVERVIEW 122

6.1.6 SUB-TIER METALS SUPPLIER NEWS 130

6.2 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS 132

6.3 SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY 133

6.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES 136

6.5 SUB-TIER SUPPLY-CHAIN “NEW” ENTRANTS 139

6.6 SUB-TIER SUPPLY-CHAIN PLANT UPDATES 140

6.7 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES 142

6.9 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT 143

7 SUPPLIER PROFILES 145

ADVANCED TARGETS MATERIALS CO., LTD.

AMERICAN ELEMENTS

FURUYA METAL CO

GO ELEMENT

GRIKIN

…AND 20+ MORE

8 APPENDIX 258

8.1 ADVANCED PROCESSES, EMERGING STRUCTURES, AND SPECIALTY FILMS USING PVD 259

8.1.1 LOGIC, 10 NM & BELOW 260

8.1.2 DRAM – PVD VERSUS OTHER DEPOSITIONS 261

8.1.3 3D NAND – PVD VERSUS OTHER DEPOSITIONS 262

8.1.4 NEW DEVELOPMENTS IN THE TECHNOLOGY OR MARKETS:UNIVERSITY AND SUPPLIER R&D IN 5-7 YEARS 263

8.1.5 BPR ARCHITECTURE 264

8.1.6 SPECIALTY (STT MRAM, FE RAM, OTHER) MEMORY PVD MATERIALS 265

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1.1: SPUTTERING TARGET SHIPMENT FORECAST BY SEGMENT 13

FIGURE 1.2: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT 14

FIGURE 1.3: 2023 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE 17

FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023) 30

FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES 31

FIGURE 3.3: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000’S OF NTD 32

FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS 33

FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS) 35

FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION 36

FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION 37

FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES 38

FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST 39

FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND 41

FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028 42

FIGURE 3.12: FAB EXPANSIONS WITHIN THE US 43

FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 44

FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE 45

FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW 46

FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW 47

FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW 48

FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024 49

FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS 52

FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD) 53

FIGURE 4.1: SPUTTER TARGET SHIPMENT FORECAST BY SEGMENT 58

FIGURE 4.2: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT 59

FIGURE 4.3: US CHIPS ACT DIRECT FUNDING OVERVIEW 61

FIGURE 4.4: JX ADVANCED METALS’ PLANNED EXPANSIONS 61

FIGURE 4.5: MARKET METAL PRICE TRENDS (2019 = 100) 62

FIGURE 4.6: HIGH MAGNIFICATION IMAGES OF AL SPUTTERING TARGET SURFACES 64

FIGURE 4.7: 2023 SPUTTERING TARGET REVENUE SHARE BY REGION 68

FIGURE 4.8: AN EXAMPLE OF CIRCULARITY OF MATERIALS IN METALLURGY 71

FIGURE 5.1: 2023 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE 77

FIGURE 5.2: ENEOS HOLDINGS METALS SEGMENT QUARTER ENDING 06/30/2024 FINANCIALS 79

FIGURE 5.3: HONEYWELL ADVANCED MATERIALS QUARTER ENDING 06/30/2024 FINANCIALS 80

FIGURE 5.4: KFMI SALES BY REGION (M CNY) 81

FIGURE 5.5: LINDE QUARTER ENDING 06/30/2024 FINANCIALS 82

FIGURE 5.6: TOSOH SPECIALTY QUARTER ENDING 06/30/2024 FINANCIALS 83

FIGURE 6.1: METAL PURIFICATION SOURCING IN-HOUSE VERSUS OUTSOURCED TRADEOFFS 96

FIGURE 6.2: PRICE COMPARISON OF VARIOUS METALS 97

FIGURE 6.3: PRICE INDICES OF BASE VS. PRECIOUS METALS 97

FIGURE 6.4: DIAMETER AND THICKNESS IMPACT ON VOLUME 98

FIGURE 6.5: AL TARGET SAMPLE PRICING OFFERED BY A DISTRIBUTOR 98

FIGURE 6.6: TARGET EROSION PROFILE 98

FIGURE 6.7: CU PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART 100

FIGURE 6.8: CU 5-YEAR PRICE HISTORY 101

FIGURE 6.9: AL PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART 102

FIGURE 6.10: AL 5-YEAR PRICE HISTORY 103

FIGURE 6.11: TI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 104

FIGURE 6.12: TA PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 105

FIGURE 6.13: W PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 106

FIGURE 6.14: NI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 107

FIGURE 6.15: CO PRODUCTION, APPLICATION HIGHLIGHTS,AND 5-YEAR PRICE HISTORY QUADRANT CHART 108

FIGURE 6.16: MO PRODUCTION, APPLICATION HIGHLIGHTS,AND 5-YEAR PRICE HISTORY QUADRANT CHART 109

FIGURE 6.17: CR PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 110

FIGURE 6.18: IN PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 111

FIGURE 6.19: RU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 112

FIGURE 6.20: AU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 113

FIGURE 6.21: AG PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 114

FIGURE 6.22: PT PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 115

FIGURE 6.23: PD PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART 116

FIGURE 6.24: METALS MAKEUP IN CLEANTECH, BY MASS 118

FIGURE 6.25: METAL USAGE INDICES IN CLEANTECH BY SCENARIO 118

FIGURE 6.26: SUPPLY / DEMAND BALANCE AND CLEANTECH’S IMPACT 119

FIGURE 6.27: RELATED CHINA MINING AND REFINING PRODUCTION 120

FIGURE 6.28: RISK ASSESSMENT OF METALS 121

FIGURE 6.29: KEY PLAYERS IN THE SPUTTERING TARGET SUPPLY CHAIN 123

FIGURE 6.30: CAPITAL EXPENDITURE ($B) FROM EACH MINING GROUP 125

FIGURE 6.31: CAPITAL SPENDING CONTRIBUTION FROM EACH MINING GROUP 126

FIGURE 6.32: RECENT EXPLORATION SPENDING, IN $B 127

FIGURE 6.33: VENTURE CAPITAL INVESTMENT IN CRITICAL MINERALS OPERATIONS 128

FIGURE 6.34: A COMPARISON OF METAL TO MINING ETFS 129

FIGURE 6.35: A GUIDE TO UNDERSTANDING THE TVPRA LIST 137

FIGURE 6.36: PGM LCA FROM 2022 AND SELECTIVE COMPARISON VERSUS 2017 138

FIGURE 8.1: ILLUSTRATION OF 3D NAND ARCHITECTURE 262

FIGURE 8.2: ILLUSTRATION OF THE BPR ARCHITECTURE AND NOTABLE CHARACTERISTICS 264

FIGURE 8.3: ILLUSTRATION OF MRAM DEVICE STRUCTURE 265

TABLES

TABLE 1.1: SPUTTERING TARGET GROWTH OVERVIEW 11

TABLE 1.2: MOST RECENT QUARTERLY SUPPLIER SALES (IN LOCAL REPORTING CURRENCY) 18

TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES 28

TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS 36

TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023 40

TABLE 4.1: A SELECTED LIST OF SPUTTERING TARGET SUPPLIER MANUFACTURING LOCATIONS 60

TABLE 4.2: PRINCIPAL PVD APPLICATIONS BY WAFER DIAMETER 66

TABLE 4.3: REGIONAL SPUTTERING TARGET MARKETS 69

TABLE 5.1: MOST RECENT QUARTERLY SUPPLIER SALES 78

TABLE 5.2: ENTRY BARRIERS TO THE SPUTTERING TARGET MARKET AND MITIGATION APPROACHES 87

TABLE 6.1: HEIGHTENED RISK SUMMARIZATION 121

TABLE 6.2: KEY OPERATIONS OF SUB-TIER METALS SUPPLIERS AND THEIR COMPANY-WIDE INVESTMENTS 124

TABLE 6.3: SUMMARY OF CAPEX GROWTH FROM EACH MINING GROUP 125

TABLE 8.1: LOGIC PVD APPLICATIONS 260

TABLE 8.2: DRAM PVD APPLICATIONS 261

TABLE 8.3: 3D NAND PVD APPLICATIONS 262

Press Release

TECHCET Forecasts Strong Expansion in Sputtering Targets

San Diego, CA, April 3, 2025:

TECHCET — the electronic materials advisory firm providing semiconductor materials supply chain information — projects semiconductor sputtering target revenues to grow near 9% in 2025, reaching $1.45 billion. This increase is driven by improving semiconductor demand and rising metal prices. For the first time, the market for non-precious metal targets is expected to surpass $1 billion in 2026, with significant contributions from metals like copper and tungsten. Overall, the sputtering target market is set to experience a 5-year CAGR of 7% through 2029, as noted in TECHCET’s Critical Materials Report on Sputtering Targets.

Sputtering Targets Revenue Forecast 2024-2029

In 2024, sputtering target revenues showed modest growth falling short of more favorable expectations, aided principally by stronger segment demand for semiconductor devices, particularly related to AI including high-performance compute and high-bandwidth memory, among others and strengthening metal prices. Those prospects were challenged as global economic growth remained subdued, and trade tensions, particularly between the U.S. and China, created market volatility. In the face of these evolving challenges, manufacturers are increasingly diversifying supply chains to mitigate these risks and reduce reliance on China for critical materials.

Looking ahead, sputtering target revenues are expected to continue growing, even with a brief market correction projected in 2028. While metal prices will remain volatile, demand from emerging technologies such as AI and the ongoing importance of PVD in semiconductor production will help stabilize and drive long-term growth in the sector.