Summary

This study provides a comprehensive view of piracy threats and the evolution of anti-piracy techniques along with five-year forecasts of revenue loss in the US market for video service providers.

ページTOPに戻る

Table of Contents

Table of Contents

Definition: What is piracy?

Key questions and research approach

Executive Summary

Industry insights

Key findings: The impact of piracy

The piracy-antipiracy life cycle

Consumer Attitudes Toward Piracy

Consumer insights

Consumer engagement with piracy

Intention of Subscribing to a TV Service in Next 6 Months

Piracy Tool Used

Consumer Engagement in Piracy and Account Sharing

Average Percentage of Households Giving or Receiving Account Credentials

Pirate Tool Usage in OTT Service Business Models

Strong Agreement Towards Unlicensed Video Media Usage

Impact of Lower Pricing on Pirating Tool Users

Why Protect Against Piracy?

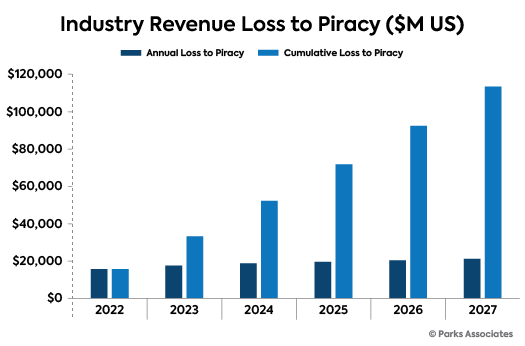

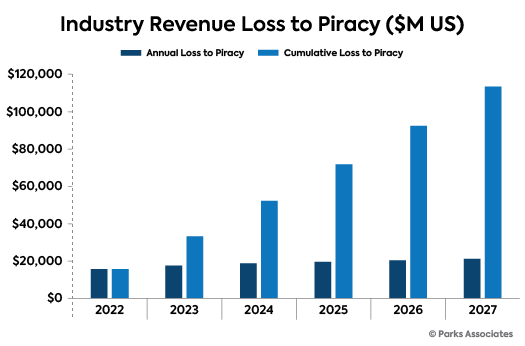

Revenue Loss to Piracy, All US Households ($M US)

Lifecycle of a Video Asset

Live Events: Decline in Value

The purpose of security

Key rationale for security

Protecting reputation and fighting piracy

Reducing the risk of theft, preserving revenue

Consumer Engagement in Piracy and Account Sharing

Additional consumer-facing paths to piracy

Meeting obligations, maintaining advertising integrity, and preserving reputation

Optimizing distribution

Piracy Life Cycle: Recognizing Piracy

The piracy-antipiracy life cycle: Recognition of piracy

Piracy orders of magnitude

The piracy ecosystem, from a distributor’s perspective

Piracy Life Cycle: Acquisition by Pirates

The piracy-antipiracy life cycle: Acquisition of content and services by pirates

Where theft occurs, from a video distributor’s perspective

Pirates steal services and content

Pirates compromise service delivery infrastructure, devices and software

Pirates exploit consumer access

Pirates exploit a variety of alternatives to capture content

Pirates profiting from stolen (legitimate) advertising

Pirates profit from fraudulent advertising (malvertising)

Close-up: examples of ransomware ads

Piracy Life Cycle: Distribution

The piracy-antipiracy life cycle: distribution

Consumer-to-consumer distribution: it’s not piracy if it’s allowed by rights-holder

Business-to-consumer distribution by pirates

Online distribution: peer-to-peer (P2P)

Online distribution: live streaming

Online distribution: media centers and app stores as hosts to pirate apps

Online distribution: compromised devices

Online distribution: illicit streaming devices (ISDs)

Online distribution: retail “IPTV” services

IPTV business models: consumer-facing offers

Setting up a piracy operation: choose a service platform and back-end

Close-up: the profits from piracy far outweigh the costs

Piracy business models: piracy-as-a-service

Piracy-as-a-service: outsource the entire operation, including the content

Piracy Life Cycle: Detection & Deterrence

The piracy-antipiracy life cycle: Piracy detection and deterrence

Piracy deterrence: pay TV and streaming security

Pay-TV antipiracy: detection through watermarking & monitoring

Piracy deterrence: platform requirements for usage monitoring and analytics

Piracy deterrence: protecting apps from penetration and reverse engineering

Piracy deterrence: service parameters and administration practices

Piracy deterrence: best practices for service administration

Piracy deterrence: conceptual guidelines

Piracy deterrence: business rules should guide detection parameters

Summary: components of an antipiracy framework

Piracy Life Cycle: Mitigation and Engagement

The piracy-antipiracy life cycle: mitigation & ecosystem engagement

Piracy mitigation: end-user mitigation practices and infrastructure and network issues

Piracy mitigation: operations and vendor administration

Ongoing deterrence: operations practices and countermeasures

Ecosystem Approaches Against Piracy

Non-technical countermeasures: ecosystem engagement

Industry collaborations against piracy: Americas

Antipiracy approaches differ region-to-region

Additional Piracy Use Cases

Cases: illegal distribution via ‘IPTV’ sites and illicit streaming devices (ISDs)

Cases: ransomware / piracy-as-a-service

Cases: VASTFLUX – exploiting ad automation by fraud

Cases: antipiracy through collaboration

Piracy Forecast

Market drivers and barriers

US Streaming Video Households (Millions)

US Streaming Revenue per Household ($US)

Streaming revenue - All US Households ($M)

Piracy Rate, Percentage of Streaming Revenue

Annual Revenue Loss to Piracy, per US HH ($US)

Revenue Loss to Piracy, All US HH ($M US)

Monthly Revenue Loss by Video Type ($M US)

Annualized Revenue Loss by Video type ($M US)

TV Piracy by Programming Type

Fraudulent Advertising to Web and Mobile - 2022-2027 ($M)

Breakout of Ad Fraud between Web and Mobile ($M)

Appendix: Key Suppliers

Core security / antipiracy suppliers and their security categories

Leaders in antipiracy products and solutions

Appendix: Definitions

Appendix: Piracy Reference

Appendix: Methodology

.png)