Power Electronics for Electric Vehicles 2025-2035: Technologies, Markets, and Forecasts電気自動車用パワーエレクトロニクス 2025-2035:技術、市場、予測 この調査レポートでは、電気自動車向けパワーエレクトロニクス市場を分析し、インバータ、車載充電器、DC-DCコンバータにおけるSiC MOSFETの採用について、200mmウェハ(8インチ)から自動車OEMの動向まで考察... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートでは、電気自動車向けパワーエレクトロニクス市場を分析し、インバータ、車載充電器、DC-DCコンバータにおけるSiC MOSFETの採用について、200mmウェハ(8インチ)から自動車OEMの動向まで考察しています。

主な掲載内容(目次より抜粋)

Report Summary

This report provides an analysis of the power electronics market for electric vehicles, with insights regarding the adoption of SiC MOSFETs in the inverter, onboard charger, and DC-DC converter, from 200mm wafers (8 inch), to trends in automotive OEMs. GaN adoption in the automotive sector is also looked at, and potential technologies are analyzed. IDTechEx forecasts the power electronics market by voltage (600V, 1200V) and technology (Si, SiC, GaN).

The demand for electric vehicles (EVs) will grow rapidly over the next decade, and the EV power electronics market will grow even faster. To tackle consumer concerns about battery electric vehicles (BEVs) compared to internal combustion engines, automotive OEMs are looking for ways to increase range and speed up charging. Aside from battery and motor technologies, wide bandgap (WBG) semiconductors, silicon carbide (SiC) and gallium nitride (GaN), have the potential to revolutionize EV powertrains in displacing the incumbent silicon (Si) IGBTs and MOSFETs with 800V architectures and significant efficiency gains.

IDTechEx's report Power Electronics for Electric Vehicles 2025-2035 analyzes the growth potential and future trends in WBG technologies, from the rapid scaling of SiC MOSFETs to the potential of GaN to consolidate itself in the EV power electronics market. The report includes granular forecasts detailing unit sales, power (GW), and market size (US$) demand segmented by inverters, onboard chargers (OBC), and DC-DC converters by voltage (600V, 1200V) and semiconductor technology (Si, SiC, GaN).

IDTechEx forecasts the EV power electronics market to grow with a double-digit CAGR from 2023-2035. Source: Power Electronics for Electric Vehicles 2025-2035

SiC supply chain

SiC has an established supply chain from raw material to wafer, to processing technologies to device packaging. This, however, doesn't mean that there isn't room for developments in the SiC supply chain. SiC wafer supply is an area dominated by US companies, and OEMs are looking to multisource their SiC to guarantee supply and cost. The transition from 150mm to 200mm SiC wafers will significantly increase production capacity, which is vital for the automotive industry. Furthermore, there is a push to globalize the SiC supply chain, with companies in Europe and Asia scaling up wafer operations.

SiC MOSFETs will continue to be more expensive than Si IGBTs, despite significant reductions in prices over the past 5 years. This is due to infrastructure requirement, the much higher price of SiC wafers, and energy-intensive processing steps. IDTechEx does a cost analysis of implementing SiC MOSFETs in EVs, examining the impact at both the device and vehicle levels. Collaboration is happening across the supply chain: OEMs are borrowing EV platforms from others, device manufacturers are investigating innovative ways to increase yields, and suppliers are acquiring other companies to vertically integrate and strengthen their supply chain control. OEMs are collaborating with automotive semiconductor suppliers to get the most out of their powertrains.

SiC MOSFET adoption in the EV market

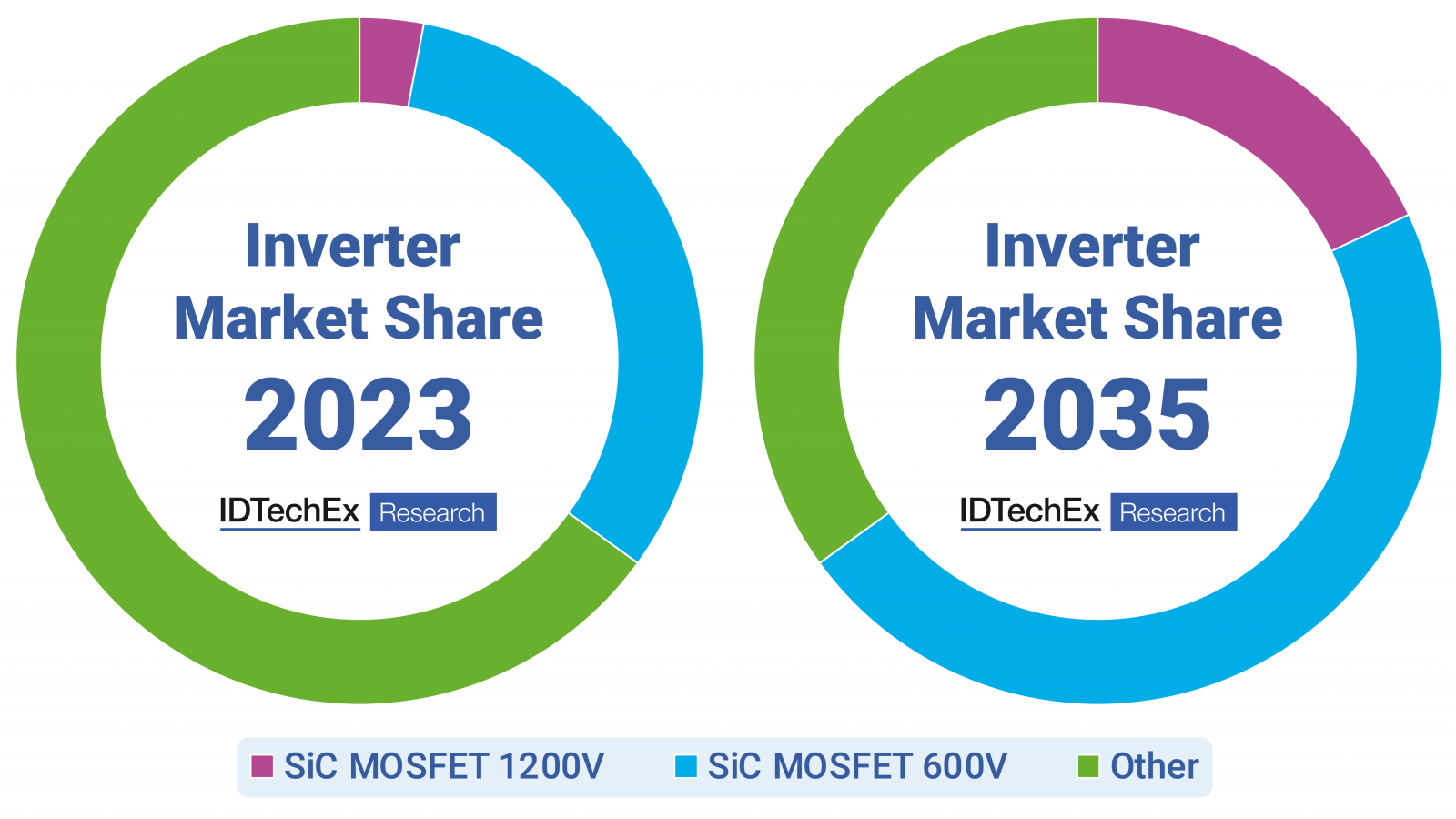

Si IGBTs have been the singular option for the traction inverter for 20 years, accompanied by Si MOSFETs and diodes for the onboard charger and DC-DC converter. They have proven to be reliable at the medium-high power levels for the inverter, yet current generation EVs are transitioning to SiC MOSFETs, and ramping in market share will continue to grow, with IDTechEx predicting that SiC MOSFETs will be the majority of the EV inverter market by 2035 Compared with Si IGBT, SiC MOSFETs offer several desirable features, including high temperature operation, better thermal conductivity, faster switching speeds potentially increasing EV ranges by 7%, and smaller die and general form factor for weight and volume savings. Development in SiC MOSFET technology, from packaging to trench technologies has improved massively over the past 10 years, to tackle concerns over supply chain, thermal management, and reliability. More information on the SiC MOSFETs and supply chain analysis, please refer to Power Electronics for Electric Vehicles 2025-2035.

SiC MOSFETs will continue to eat up market share, with 1200V MOSFETs enabling 800V architectures. Source: Power Electronics for Electric Vehicles 2025-2035

OBCs and DC-DC converters operate at powers an order of magnitude lower than inverters, yet the advantages of SiC MOSFET persist: higher power density, a reduction in losses, and a slight increase in range. Moreover, SiC in the OBC allows for faster charging, and in the DC-DC converter, transfers power more efficiently to the low voltage battery, making the auxiliary power-hungry devices in an EV (infotainment, heat pumps, headlights) less wasteful. This drives SiC MOSFET adoption in the OBC and DC-DC converters, and the lower power requirements mean that IDTechEx predicts GaN to enter this market earlier than for inverters.

GaN Technologies for Automotive

GaN HEMTs and FETs have a role in the automotive semiconductor market. The extent of this role depends on certain developments needed to maximize the potential of a material that can convert power more efficiently than SiC. Currently, most GaN devices on the market are limited to 650V and are lateral in construction. To maximize the potential of automotive GaN, steps need to be taken to make it feasible at higher voltages, especially as 800V architectures gain market share in the mainstream EV sector. Whether through improvements in engineering technology or at the device level, IDTechEx analyzes ways that GaN can realize its potential in the automotive industry. Alternatives to GaN-on-Si devices are investigated, and companies analyzed. IDTechEx's latest research Power Electronics for Electric Vehicles 2025-2035 includes a 10-year forecast of GaN in power electronics for EVs, expecting significant headway for OBCs and DC-DC converters, with inverters to come later.

Power Electronics Innovations

While ongoing improvements at the device level continue, OEMs and tier-one suppliers also focus on enhancing EV performance. Key considerations include reducing size of the wiring and costs of the passive components, as well as understanding the most effective cooling methods. The integration of power electronics with the powertrain represents a key growth area for EVs, aiming to maximize performance while minimizing cost. IDTechEx examines available market solutions and active components in this space. The degree of integration varies widely, ranging from mechanical integration to electronic integration, with the potential to consolidate all power electronics into a single unit.

This report provides the following key information:

Table of Contents

|

.png)