|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Imminent Boom in eLCVs |

|

1.2. |

Electric LCV Unit Sales BEV, PHEV, FCEV 2017-2041 |

|

1.3. |

Electric LCVs and Covid-19 |

|

1.4. |

Plug-in hybrid LCVs |

|

1.5. |

Global Forecast Takeaways |

|

1.6. |

Forecast Takeaways |

|

1.7. |

eLCV (BEV, PHEV, FCEV) sales by region 2017-2041 (000s units) |

|

1.8. |

eLCV (BEV, PHEV, FCEV) battery forecast by region 2017-2041 (GWh) |

|

1.9. |

eLCV market revenue forecast by region 2017-2041 ($US billion) |

|

2. |

INTRODUCTION |

|

2.1. |

Electric Vehicle Terms |

|

2.2. |

Electric Vehicles: Basic Principle |

|

2.3. |

Electric Vehicles: Typical Specs |

|

2.4. |

LCV Definition |

|

2.5. |

Different segments of goods transportation by land |

|

2.6. |

Types of popular on-road truck |

|

2.7. |

LCV fleet description by region |

|

2.8. |

The Core Driver: Climate Change |

|

2.9. |

Global CO2 emission from transport |

|

2.10. |

CO2 emissions from the LCV sector |

|

2.11. |

CO2 emission from the LCV sector |

|

2.12. |

Urban air quality |

|

2.13. |

Urban air quality |

|

2.14. |

Urban air quality |

|

2.15. |

Pollution in India |

|

2.16. |

Road transport the main source of urban NOx |

|

2.17. |

Fossil Fuel Bans: Explained |

|

2.18. |

Official or Legislated Fossil Fuel Bans (National) |

|

2.19. |

Unofficial, Drafted or Proposed Fossil Fuel Bans (National) |

|

2.20. |

Fossil Fuel Bans (Cities) |

|

2.21. |

The worldwide freight transport industry |

|

2.22. |

Road Freight Market |

|

2.23. |

Projected increase in global road freight activity |

|

2.24. |

The rise of e-commerce: increased freight demand |

|

2.25. |

Fuel / emissions regulation for new LCVs |

|

2.26. |

GHG emission from LCVs |

|

2.27. |

Europe Emissions Standards: LCVs |

|

2.28. |

Drivers for LCV Electrification |

|

2.29. |

eLCV Market Drivers |

|

2.30. |

Considerations for eLCV adoption |

|

2.31. |

Do eLCVs offer sufficient range? |

|

2.32. |

Do eLCVs offer sufficient range? |

|

2.33. |

Do eLCVs offer sufficient range? |

|

2.34. |

Do eLCVs offer sufficient range? |

|

3. |

IDTECHEX TCO CALCULATIONS |

|

3.1. |

Total Cost of Ownership |

|

3.2. |

Environmental goodwill insufficient for uptake of eLCV |

|

3.3. |

TCO considerations for eLCV |

|

3.4. |

Overcoming barriers for low emission technologies |

|

3.5. |

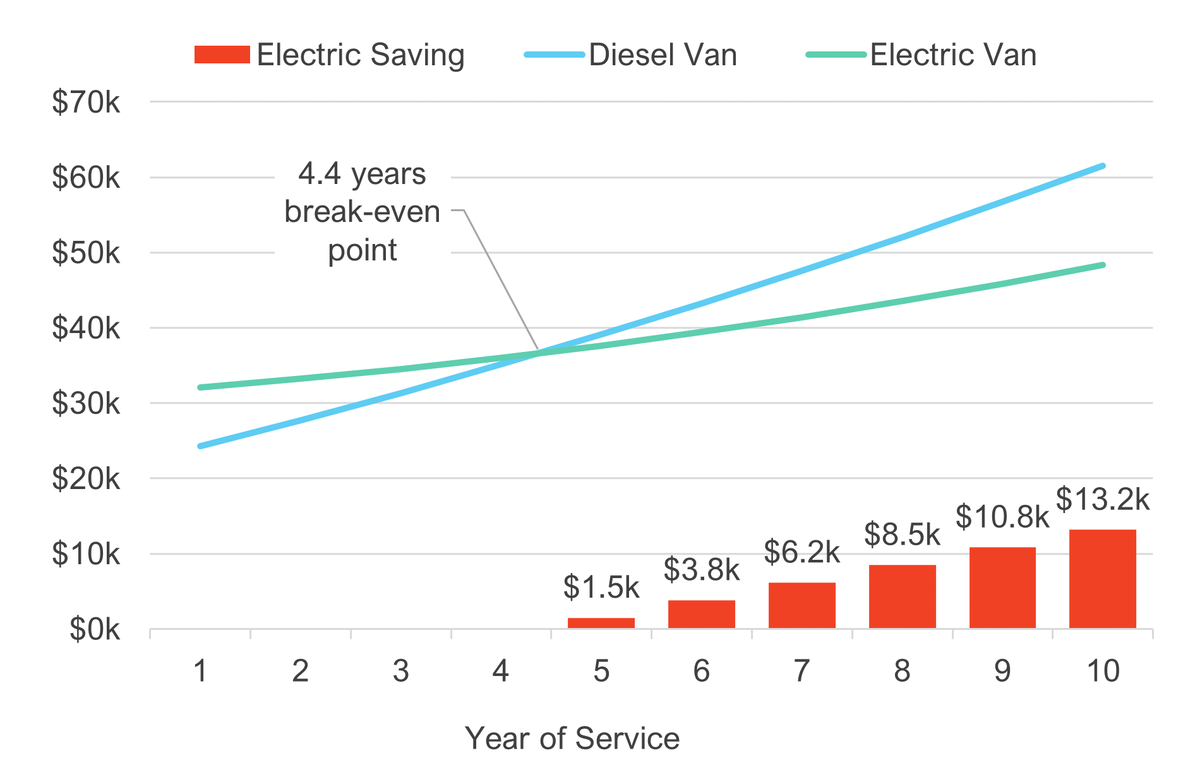

Example: TCO for eLCV (Renault Kangoo) |

|

3.6. |

Example: TCO for eLCV (Nissan e-NV200) |

|

3.7. |

Timeline for TCO parity between diesel and eLCV |

|

3.8. |

Electric and diesel LCV cost parity |

|

3.9. |

IDTechEx Battery-Electric Van TCO Analysis |

|

3.10. |

TCO: Small Vans |

|

3.11. |

TCO Analysis Assumptions: Small Van |

|

3.12. |

Small eVan Break-Even Point |

|

3.13. |

Small eVan Break-Even: Purchase Grant |

|

3.14. |

Small eVan Break-Even: Daily Duty Cycle Range |

|

3.15. |

TCO: Medium Vans |

|

3.16. |

TCO Analysis Assumptions: Medium Van |

|

3.17. |

Medium eVan Break-Even Without Purchase Grant |

|

3.18. |

Medium eVan Break-Even: Purchase Grant |

|

3.19. |

Medium eVan Break-Even: Daily Duty Cycle Range |

|

3.20. |

TCO: Large Vans |

|

3.21. |

TCO Analysis Assumptions: Large Van |

|

3.22. |

Large eVan Break-Even Without Purchase Grant |

|

3.23. |

Large eVan Break-Even: Purchase Grant |

|

3.24. |

Large eVan Break-Even: Daily Duty Cycle Range |

|

3.25. |

TCO Summary: Small, Medium and Large Electric Vans |

|

3.26. |

Strengthening TCO advantage for eVans |

|

4. |

EUROPE |

|

4.1. |

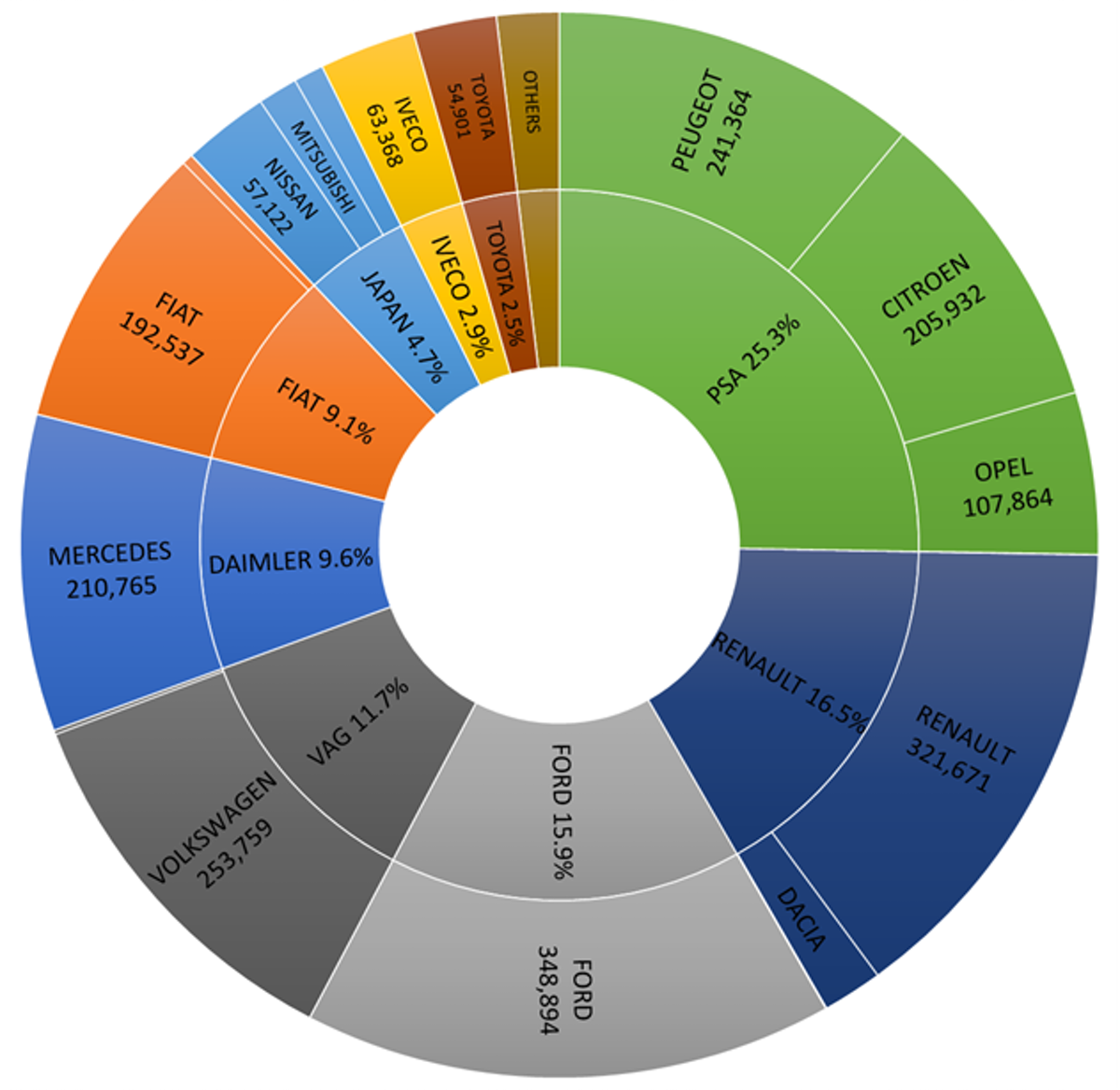

Europe: LCV sales 2019 |

|

4.2. |

European market for LCVs |

|

4.3. |

European in-use LCV fleet and new registrations |

|

4.4. |

New registrations in Europe's 8 largest LCV fleets |

|

4.5. |

2018 European eLCV Sales |

|

4.6. |

2019 European eLCV Sales |

|

4.7. |

Increasing eLCV sales in Europe |

|

4.8. |

Market outlook: national and local policy |

|

4.9. |

European eLCV market leaders |

|

4.10. |

Popular e-LCVs in Europe |

|

4.11. |

StreetScooter Timeline |

|

4.12. |

StreetScooter: End of the Road |

|

4.13. |

2019 Rise of the large eLCV? |

|

4.14. |

Movers 2019: Daimler enter the fray |

|

4.15. |

Vastly increasing eVan model choice |

|

4.16. |

New e-LCV models |

|

4.17. |

Ford Transit Custom PHEV |

|

4.18. |

Available PHEV LCVs |

|

4.19. |

Plug-in hybrid LCVs |

|

4.20. |

2020 Large Orders for eLCV |

|

4.21. |

A New Arrival |

|

4.22. |

Arrival's Business Model |

|

4.23. |

Specifications of eLCVs available in Europe |

|

4.24. |

e-LCVs in Europe: compact utility vehicles |

|

4.25. |

UK Electric Fleets Coalition |

|

5. |

ELCVS IN CHINA |

|

5.1. |

Chinese Market for LCVs |

|

5.2. |

China: Electric Special-Purpose Vehicle Sales 2018 |

|

5.3. |

China: Commercial Vehicle Sales 2019 |

|

5.4. |

China: SPV Production 2018 Top 15 Manufacturers |

|

5.5. |

China: Electric SPV Production 2019 |

|

5.6. |

China NEV eLCV production / sales fall in 2019 |

|

5.7. |

Best selling new energy LCVs in China |

|

5.8. |

Best selling new energy LCVs in China |

|

5.9. |

Popular Larger Electric LCVs in China |

|

5.10. |

China: Main Battery Suppliers to Chinese eLCVs |

|

5.11. |

Battery suppliers to the Chinese NEV SPV Market |

|

5.12. |

China: Main Motor Suppliers to Chinese eLCVs |

|

5.13. |

Drivers for the electrification of LCVs in China |

|

5.14. |

City Targets |

|

5.15. |

Market Outlook: China eLCVs |

|

5.16. |

China to support e-SPV sales in 2nd and 3rd Tier Cities |

|

5.17. |

BAIC EV5 with UV disinfection to counter covid-19 |

|

6. |

ELCVS IN THE US |

|

6.1. |

US: Commercial LCV Sales 2018 |

|

6.2. |

US: Commercial LCV Sales 2019 |

|

6.3. |

Growth in US commercial LCV sales |

|

6.4. |

US LCV Sales by OEM |

|

6.5. |

California's Advanced Clean Trucks Regulation |

|

6.6. |

CARB Voucher Incentive Project |

|

6.7. |

Lightning Systems - Electric Ford Transit Cargo LCV |

|

6.8. |

Workhorse C-Series Electric Delivery Trucks |

|

6.9. |

Rivian / Amazon electric delivery LCV |

|

6.10. |

Rivian: Three sizes of delivery LCV for Amazon |

|

6.11. |

Bollinger Motors Deliver-E All-Electric Concept LCV |

|

6.12. |

Karma Automotive E-Flex Utility LCV |

|

6.13. |

Ford: Finally an OEM offering an eVan option in the US |

|

6.14. |

General Motors All-Electric Delivery LCV BV1 |

|

6.15. |

Popular Electric LCVs in the US |

|

6.16. |

eLCV Demand: Corporate Electric Vehicle Alliance |

|

6.17. |

Business to drive electrification of LCV fleet in US? |

|

7. |

ELCVS IN THE ROW |

|

7.1. |

Toyota PROACE |

|

7.2. |

Yamato / DHL StreetScooter |

|

7.3. |

Mitsubishi MiniCab MiEV LCV |

|

7.4. |

Hyundai Porter EV and Kia Bongo EV |

|

7.5. |

Tata Motors Ace |

|

7.6. |

Mahindra eSupro Cargo LCV |

|

7.7. |

Mahindra and REE eLCV Partnership |

|

7.8. |

Maruti Suzuki India Eeco Charge Concept |

|

7.9. |

Croyance Electro 1.T and Electro 2.T |

|

7.10. |

SEA E4V Delivery LCV |

|

8. |

TECHNOLOGIES |

|

8.1. |

Li-ion Batteries |

|

8.1.1. |

What is a Li-ion battery? |

|

8.1.2. |

The Battery Trilemma |

|

8.1.3. |

Electrochemistry Definitions |

|

8.1.4. |

Lithium-based Battery Family Tree |

|

8.1.5. |

Battery Wish List |

|

8.1.6. |

More Than One Type of Li-ion battery |

|

8.1.7. |

NMC: from 111 to 811 |

|

8.1.8. |

Cobalt: Price Volatility |

|

8.1.9. |

Cathode Performance Comparison |

|

8.1.10. |

811 Commercialisation Examples |

|

8.1.11. |

Commercial Anodes: Graphite |

|

8.1.12. |

The Promise of Silicon-based Anodes |

|

8.1.13. |

The Reality of Silicon |

|

8.1.14. |

Silicon: Incremental Steps |

|

8.1.15. |

What is in a Cell? |

|

8.1.16. |

Inactive Materials Negatively Affect Energy Density |

|

8.1.17. |

Commercial Battery Packaging Technologies |

|

8.1.18. |

Comparison of Commercial Cell Geometries |

|

8.1.19. |

What is NCMA? |

|

8.1.20. |

Lithium-based Batteries Beyond Li-ion |

|

8.1.21. |

Li-ion Chemistry Snapshot: 2020, 2025, 2030 |

|

8.2. |

Electric Traction Motors |

|

8.2.1. |

Electric Traction Motors: Introduction |

|

8.2.2. |

Electric Traction Motors: Introduction |

|

8.2.3. |

Brushless DC Motors (BLDC): Working Principle |

|

8.2.4. |

BLDC Motors: Advantages, Disadvantages |

|

8.2.5. |

BLDC Motors: Benchmarking Scores |

|

8.2.6. |

Permanent Magnet Synchronous Motors (PMSM): Working Principle |

|

8.2.7. |

PMSM: Advantages, Disadvantages |

|

8.2.8. |

PMSM: Benchmarking Scores |

|

8.2.9. |

Wound Rotor Synchronous Motor (WRSM): Working Principle |

|

8.2.10. |

WRSM Motors: Benchmarking Scores |

|

8.2.11. |

WRSM: Advantages, Disadvantages |

|

8.2.12. |

AC Induction Motors (ACIM): Working Principle |

|

8.2.13. |

AC Induction Motor (ACIM) |

|

8.2.14. |

AC Induction Motors: Benchmarking Scores |

|

8.2.15. |

AC Induction Motor: Advantages, Disadvantages |

|

8.2.16. |

Reluctance Motors |

|

8.2.17. |

Reluctance Motor: Working Principle |

|

8.2.18. |

Switched Reluctance Motor (SRM) |

|

8.2.19. |

Switched Reluctance Motors: Benchmarking Scores |

|

8.2.20. |

Permanent Magnet Assisted Reluctance (PMAR) |

|

8.2.21. |

PMAR Motors: Benchmarking Scores |

|

8.3. |

Electric Traction Motors: Summary and Benchmarking Results |

|

8.3.1. |

Comparison of Traction Motor Construction and Merits |

|

8.3.2. |

Benchmarking Electric Traction Motors |

|

8.3.3. |

Motor Efficiency Comparison |

|

8.3.4. |

Magnet Price Increase? |

|

8.3.5. |

Multiple Motors: Explained |

|

8.3.6. |

LCVs & Trucks |

|

8.3.7. |

Motors per Vehicle and kWp per Vehicle Assumptions |

|

8.3.8. |

Brushed DC: Small Presence in LCVs |

|

8.3.9. |

LCVs and Trucks Motor Outlook |

|

8.4. |

Fuel Cells |

|

8.4.1. |

Proton Exchange Membrane Fuel Cells |

|

8.4.2. |

Fuel Cell Inefficiency and Cooling Methods |

|

8.4.3. |

Challenges for Fuel Cells |

|

8.4.4. |

Infrastructure Costs |

|

8.4.5. |

Fuel Cell Charging Infrastructure in the US |

|

8.4.6. |

Fuel Cost per Mile: FCEV, BEV, internal-combustion |

|

8.4.7. |

Fuel Cell LCVs |

|

8.4.8. |

Example Fuel Cell LCV Specifications |

|

8.4.9. |

Outlook for Fuel Cell LCVs |

|

9. |

FORECASTS |

|

9.1. |

Forecast Assumptions |

|

9.2. |

Forecast Methodology |

|

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|