Summary

この調査レポートは、大型自律走行車の各業界独自の強みと課題について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

-

ロボシャトル

-

自律走行バス・トラック

-

技術開発カメラ

-

サーマルカメラ

-

LIDAR・RADAR

-

予測

Report Summary

IDTechEx has found significant activity in the autonomous heavy-duty commercial vehicle space, with hundreds of vehicles in various stages of trialling globally, and some companies on the precipice of fully unmanned commercial deployment. Each industry has unique strengths and challenges, this report explains them and gives market forecasts accordingly.

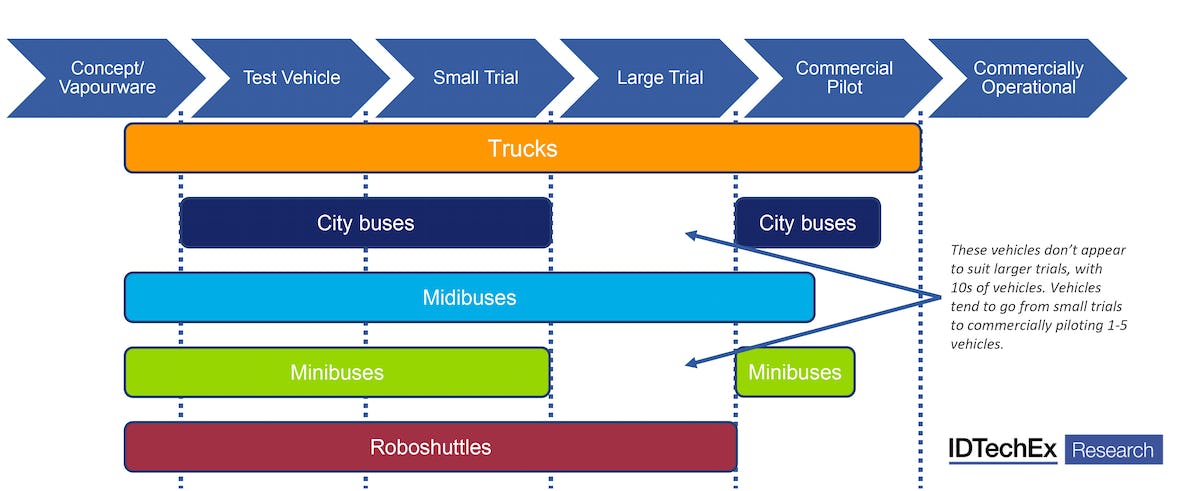

Image source: IDTechEx Research

Roboshuttles

Roboshuttles are a new and exciting form of transport which has seen the most player activity. Leaders in the field, EasyMile and Navya, have been in the game since 2014 and have accumulated around two thirds of all roboshuttle sales between them. But their sales in recent years have been dwindling. Despite this there have been recent pushes from China, with Yutong looking to put a large fleet on the road for large trials in 2022. IDTechEx has observed many small trial deployments of roboshuttles with less than five vehicles being tested by the public on very restricted routes. There have been some bigger deployments, such as Apolong in 2019, but it seems that the industry is getting stuck at turning these large pilots into commercial trials. This report looks at some of the biggest stumbling blocks for roboshuttles and considers when these may be overcome and how quickly the market can grow afterwards. One thing is certainly clear, with many trial activities in tens of cities around the world, when commercial deployments do happen, growth will be rapid.

Autonomous buses

While autonomous buses have seen less activity than roboshuttles, bus automation is not promising to revolutionize public transport. Here IDTechEx thinks that automation is going to provide iterative improvements to existing vehicles over the coming years. The advantage that buses have over roboshuttles is that the driver and conventional controls can remain in the vehicle during trials. Since both will be forced to operate near pedestrians, human supervision will likely be required for many years. Many bus companies see the driver transitioning to a supervisory role as the technology improves, with long term ambitions of uncrewed autonomous buses. Despite this, level 4 autonomy can bring benefits to buses today. The autonomy level will improve bus safety, and deployments in special use cases, such as in bus depots, airside airport buses and minibuses operating on controlled access campuses, could be accomplished in the next few years.

The big challenge for autonomous buses is simply the size of the industry today. Of the three heavy-duty sectors covered in this report, autonomous buses have the fewest vehicles on the road, with a total fleet size in the low tens, compared to the mid hundreds for both roboshuttles and autonomous trucks. It is likely that this is due to the expense of working on automating buses and this is reflected with approximately two thirds of the autonomous bus activity coming from established OEMs rather than autonomous start-ups which are more dominant in roboshuttles and autonomous trucks.

Autonomous Trucks

Out of roboshuttles, autonomous buses and autonomous trucks, IDTechEx believes that trucks make the most compelling case for automation. There is a measurable need for truckers in China, the US and Europe. This once popular profession is failing to attract younger generations due to the long hours on the road and separation from family. The average age of truck drivers is increasing, and the industry is heading for a crisis as demand for haulage soars. This is the key driver for autonomous trucks, but it doesn't matter if the task is unachievable. Thankfully, autonomous trucks also have an achievable operational design domain, and therefore a promising route to deployment. In China and the US, many of the miles served by trucks are between distribution centres separated by vast stretches of open highway. These roads are not used by pedestrians, they have central reservations and flow in only one direction either side and are generally well maintained. This drastically reduces the challenges that autonomous systems in roboshuttles and autonomous buses encounter when operating in densely populated cities, with less predictable traffic and unpredictable pedestrians. Operating at night, when roads are quieter, also does not impact the value of the mission, unlike roboshuttles and autonomous buses whose operation is most valuable around peak travel times.

Key aspects

This report on heavy-duty autonomous vehicles provides detailed analysis of the companies and activities within autonomous commercial vehicles: roboshuttles, autonomous buses and autonomous trucks. Key challenges and opportunities are identified for each industry and predictions regarding their commercial deployment are made. The high-fidelity analysis of each market guides IDTechEx's 20-year forecasts.

Market Forecasts & Analysis:

20-year forecasts for roboshuttles, autonomous buses, and autonomous trucks

-

Unit sales

-

Revenue from vehicle sales

-

Revenue from commercial services

-

Adoption of electric powertrains

-

Sensors for heavy-duty autonomous vehicles

Cannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

ページTOPに戻る

Table of Contents

Enable Ginger

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Heavy-duty autonomous vehicles report |

|

1.2. |

What makes it a roboshuttle? |

|

1.3. |

Distribution of roboshuttle cities |

|

1.4. |

Autonomous bus introduction |

|

1.5. |

Categories of bus |

|

1.6. |

Autonomous trucking - the right conditions right now |

|

1.7. |

Why Automate Trucks? |

|

1.8. |

Technology Readiness |

|

1.9. |

Different powertrains for different vehicles |

|

1.10. |

Types of service for roboshuttles and buses |

|

1.11. |

Business model options for autonomous trucks |

|

1.12. |

Number Of Active Companies |

|

1.13. |

The Sensor Trifactor |

|

1.14. |

Sensor suites for heavy-duty autonomous vehicles |

|

1.15. |

SWOT analysis and comparisons for roboshuttles, autonomous buses and autonomous trucks. |

|

1.16. |

Commercial readiness and opportunity comparison, roboshuttle, autonomous buses, autonomous trucks. |

|

1.17. |

IDTechEx predicted timelines |

|

1.18. |

Roboshuttle fleet size and unit sales 2020-2043 |

|

1.19. |

Roboshuttle revenues, vehicle sales and passenger fares 2020-2043 |

|

1.20. |

Autonomous bus unit sales 2023-2043 |

|

1.21. |

Autonomous bus revenue 2023-2043 |

|

1.22. |

Heavy Duty Trucking Unit Sales 2022-2042 |

|

1.23. |

Heavy Duty Trucking Revenue 2022-2042 |

|

1.24. |

Heavy Duty Autonomous Unit Sales 2023-2043 |

|

1.25. |

Heavy Duty Autonomous Revenue 2023-2043 |

|

1.26. |

Sensors for Heavy Duty Autonomous Vehicles 2023-2043 |

|

1.27. |

Access to 20 IDTechEx Portal Company Profiles |

|

2. |

ROBOSHUTTLES: PLAYERS AND ANALYSIS |

|

2.1. |

Introduction |

|

2.1.1. |

Key Takeaways For Roboshuttles |

|

2.1.2. |

What Makes it a Roboshuttle? - Part 1 |

|

2.1.3. |

What Makes it a Roboshuttle? - Part 2 |

|

2.1.4. |

Table Comparison Of Active Companies (1) |

|

2.1.5. |

Table Comparison Of Active Companies (2) |

|

2.1.6. |

Table Comparison Of Active Companies (3) |

|

2.1.7. |

Funding |

|

2.1.8. |

EasyMile |

|

2.1.9. |

EasyMile Real World Trials And Testing |

|

2.1.10. |

EasyMile Business Model |

|

2.1.11. |

Navya |

|

2.1.12. |

Navya Testing Locations |

|

2.1.13. |

Navya Use Case Examples |

|

2.1.14. |

Navya's Installation Process |

|

2.1.15. |

Navya's Business Model |

|

2.1.16. |

ZF - A Robot Shuttle Future. |

|

2.1.17. |

ZF - Robot Shuttle Deployment |

|

2.1.18. |

ZF 2getthere Trial in Saudi Arabia |

|

2.1.19. |

Coast |

|

2.1.20. |

Cruise Origin |

|

2.1.21. |

Toyota e-PALETTE |

|

2.1.22. |

Sensible 4 - GACHA |

|

2.1.23. |

IAV and the HEAT project |

|

2.1.24. |

Lohr, Torc and Transdev |

|

2.1.25. |

Torc/Lohr i-Cristal Sensor Suite |

|

2.1.26. |

May Mobility |

|

2.1.27. |

NEVS |

|

2.1.28. |

Ohmio - Lift |

|

2.1.29. |

Yutong |

|

2.1.30. |

Apollo - Autonomous Branch of Baidu |

|

2.1.31. |

Higer |

|

2.1.32. |

Zoox |

|

2.1.33. |

Zoox Sensor Suite |

|

2.1.34. |

Service Providers |

|

2.2. |

Roboshuttle projects that have discontinued |

|

2.2.1. |

Continental |

|

2.2.2. |

Bosch |

|

2.2.3. |

Local Motors - Olli |

|

2.2.4. |

e.Go Moove |

|

2.2.5. |

DGWORLD |

|

2.2.6. |

Projects That Are No Longer Active (1) |

|

2.2.7. |

Projects That Are No Longer Active (2) |

|

2.2.8. |

Projects That Are No Longer Active (3) |

|

2.3. |

Roboshuttles analysis and conclusions |

|

2.3.1. |

Technology Readiness |

|

2.3.2. |

Decline in Roboshuttle Companies |

|

2.3.3. |

Technology Readiness - Still Active |

|

2.3.4. |

Where Players Exit |

|

2.3.5. |

Where Are Players In The Value Chain |

|

2.3.6. |

Speed And Distance |

|

2.3.7. |

Passenger Capacity |

|

2.3.8. |

Total Cost of Ownership Analysis |

|

2.3.9. |

Reasons Roboshuttles Will Succeed |

|

2.3.10. |

Reasons Roboshuttles Will Fail |

|

2.3.11. |

IDTechEx Opinion On Roboshuttles |

|

3. |

AUTONOMOUS BUSES: PLAYERS AND ANALYSIS |

|

3.1. |

Introduction |

|

3.1.1. |

Categories of Bus |

|

3.1.2. |

Bus Category Sizing |

|

3.1.3. |

Reasons to automate |

|

3.1.4. |

Types Of Autonomous Services |

|

3.1.5. |

Challenges Of Automating |

|

3.1.6. |

Table Comparison Of Active Players (1) |

|

3.1.7. |

Table Comparison Of Active Players (2) |

|

3.1.8. |

Table Comparison Of Active Players (3) |

|

3.2. |

Players - Minibuses |

|

3.2.1. |

King Long |

|

3.2.2. |

Aurrigo |

|

3.2.3. |

Hyundai Autonomous Bus |

|

3.2.4. |

Volkswagen |

|

3.2.5. |

Volkswagen ID.Buzz - Sensor Suite |

|

3.2.6. |

Volkswagens MOIA Project |

|

3.2.7. |

Perrone Robotics - Overview |

|

3.2.8. |

Perrone Robotics - Sensor Suite |

|

3.2.9. |

Perrone Robotics - Deployment And Planned Rollout |

|

3.3. |

Players - Midibuses |

|

3.3.1. |

ADASTEC and Karsan |

|

3.3.2. |

ADASTEC And Karsan - Sensor Suite |

|

3.3.3. |

Golden Dragon ASTAR |

|

3.3.4. |

QCraft |

|

3.3.5. |

QCraft - Sensor Suite |

|

3.3.6. |

LILEE |

|

3.3.7. |

Zhongtong |

|

ページTOPに戻る

IDTechEx社の自動車 - Vehicles分野での最新刊レポート

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|