Summary

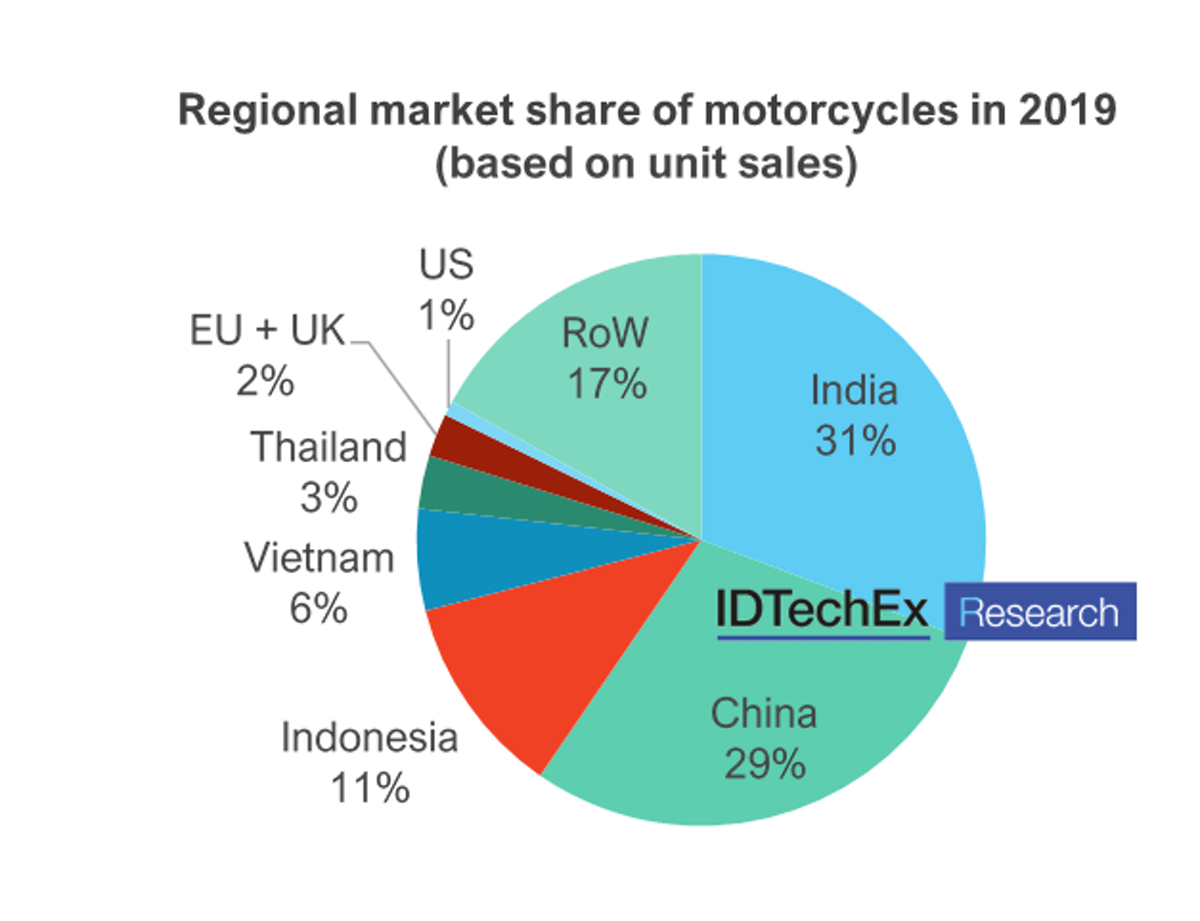

この調査レポートは電動二輪車両の市場を調査し、地域別、二輪車両のタイプ別に市場を予測しています。過去データは2015年にまで遡り、また2041年までの将来見通しを盛り込んでいます。地域は中国、インド、インドネシア、ベトナム、EU + 英国、米国、その他のブレイクダウンで分析を行っています。

主な掲載内容(目次より抜粋)

1. 全体概要

1.1. 電動二輪車の重要性

1.2. 電動二輪車分類

1.3. 電動二輪車販売台数 2015-2041

1.4. リチウムイオンおよび鉛蓄電池の需要 2015-2041 (GWh)

1.5. 電池の化学の選択肢

1.6. 電動二輪車市場規模 2015-2041 (10億ドル)

1.7. 2020年のマネーはどこで、2041年にどこにあるのか

While in the US and Europe the primary form of urban mobility is the car, in East Asia the dominant form of transportation is the motorcycle, which is much cheaper to own and run. Motorcycles are not always held to equivalent emissions standards as cars and can be highly polluting. In the past decade, India has overtaken China to become the world's largest motorcycle market, selling roughly 17 million in fiscal year 2020 in a global market of 57 million. It is no coincidence that India has seven out of the world's top ten most polluting cities. When we hear ambitious electrification targets from countries like India, it not the electrification of cars, but that of two-wheelers, micro-mobility and public transport which is the primary focus.

Data sources: Industry associations, Marklines, IDTechEx

This report addresses and forecasts two-wheelers with pure electric modes under 4kW ('electric scooters') and over 4kW ('electric motorcycles'). While cosmetic or functional differences can exist for two-wheelers under 4kW, they belong to the same class if they have pure electric modes and travel under 45kmph. This category is distinct from pedal-assist bicycles (pedelecs), not included here, which typically have 250W motors activated only by pedalling action (popular in Europe).

The average price for the electric scooter is roughly the equivalent of $420 and $850 in China and India, respectively, the two largest markets. In contrast, European models are typically sold for a few thousand dollars. In Asia, the trend is for electric moto makers to design and sell two-wheelers at upfront price parity by downsizing the batteries and sacrificing range. As battery costs fall for two-wheelers, it is performance that increases, rather than upfront price decreasing. Generally, the opposite is true in the US and Europe.

For electric motorcycles, the addressable markets are not high-volume urban environments in Asia. It is instead environmentally conscious moto enthusiasts curious to try electric models out, perhaps whilst keeping a Harley Davidson safe in the garage. Users of > 250cc motorcycles are declining in the US and Europe, and the electric motorcycle market is made up of only a small number of players. In the US, motorcycles are not driven because they meet a core mobility need: the king of mobility in the US is the car, which most can afford and choose as their primary transport mode above all else. Indeed, motorcycles in the US are predominantly ridden for enjoyment and as part of a lifestyle choice; this in turn makes it harder to sell the electric motorcycle, because of the nostalgia and lifestyle associated with 'loud pipes'.

The report further looks at the core technologies enabling electric two-wheelers. There is a general transition away from lead-acid batteries for two-wheelers in Asia, which currently dominate for low cost but are highly toxic and not disposed of safely. With the transition to Li-ion comes challenges in countries like India because of the high temperatures of 45 degrees C in the summer, and the culture to leave vehicles parked out in the hot sun when charging or residing at home or work. Market leaders are working with battery suppliers to design chemistries to help solve this issue.

The report also addresses electric traction motor technologies; here solutions vary dramatically from custom, innovative permanent magnet synchronous motors designed in California, to off the shelf brushless DC solutions made and imported from China.

Summary of forecasts and data provided in this report:

-

Electric two-wheeler unit sales by power class and region 2015-2041

-

Electric two-wheeler battery demand (GWh) by power class and region 2015-2041

-

Electric two-wheeler battery demand (GWh) by Lead-acid / Li-ion split and region 2015-2041

-

Electric two-wheeler revenue generation by power class and region 2015-2041

-

Market shares of electric two-wheeler companies in India

-

Market shares of Li-ion electric two-wheeler OEMs in China

-

Market shares of electric motorcycle makers in the US

Forecast regions are China, India, Indonesia, Vietnam, EU + UK, US, RoW.

Power classes are < 4kW (electric scooters) and > 4kW (electric motorcycles).

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

The Importance of Electric Two-wheelers |

|

1.2. |

Electric Two-wheeler Classification |

|

1.3. |

Electric Two-wheelers Unit Sales 2015-2041 |

|

1.4. |

Li-ion & Lead-acid Battery Demand 2015-2041 (GWh) |

|

1.5. |

Battery Chemistry Choices |

|

1.6. |

Electric Two-wheelers Market Size 2015-2041 ($ billion) |

|

1.7. |

Where's the Money in 2020, Where it Will be in 2041 |

|

2. |

INTRODUCTION |

|

2.1. |

Electric Vehicle Terms |

|

2.2. |

Electric Vehicles: Basic Principle |

|

2.3. |

Low Maintenance |

|

2.4. |

Electric Two-wheelers: Power Classes |

|

2.5. |

Two-wheelers vs. Other Electric Vehicles |

|

2.6. |

Electric Two-wheeler Voltage Characteristics |

|

2.7. |

Electric Two-wheelers Over 4kW |

|

2.8. |

Electric Two-wheelers: Drivers |

|

2.9. |

High Pollution and Oil Imports Drive Electrification |

|

2.10. |

Electric Two-wheelers: Drivers |

|

2.11. |

No noise: good or bad? |

|

2.12. |

Electric Motorcycle Performance |

|

2.13. |

Barriers for Electric Two-wheelers |

|

2.14. |

Fossil Fuel Bans: Explained |

|

2.15. |

Official or Legislated Fossil Fuel Bans |

|

2.16. |

Unofficial, Drafted or Proposed Fossil Fuel Bans |

|

2.17. |

Debunking EV Myths: Emissions Just Shift to Electricity Generation? |

|

2.18. |

Hybrid Two-wheelers |

|

2.19. |

Hybrid Two-wheelers: Historic Failures |

|

2.20. |

Honda: PCX Hybrid Scooter |

|

3. |

CHINA |

|

3.1. |

Car Sales and Two-wheeler Sales in China |

|

3.2. |

How Chinese Two-wheelers are Different |

|

3.3. |

What's Driving Electrification in China? |

|

3.4. |

Regulation History & Safety Concerns |

|

3.5. |

China's Current Two-wheeler Policy (April 2019) |

|

3.6. |

E2W Bans in China |

|

3.7. |

E2W in China: The Party's Over |

|

3.8. |

Rise of Li-ion in Chinese Electric Two-wheelers |

|

3.9. |

Why is Lead-acid Production Rising? |

|

3.10. |

Li-ion OEM Market Share |

|

3.11. |

Chinese Electric Two-wheeler Prices |

|

4. |

INDIA |

|

4.1. |

India: Transportation Diversity |

|

4.2. |

Mobility Trends in India |

|

4.3. |

The World's Largest Moto Market |

|

4.4. |

Emissions Regulation |

|

4.5. |

Incumbent Moto Market Shares FY20 |

|

4.6. |

High Pollution and Oil Imports Drive Electrification |

|

4.7. |

New Delhi: Pollution Equal to 50 Cigarettes a Day |

|

4.8. |

India Moto Market Forecast |

|

4.9. |

India: Historic E2W Market Growth |

|

4.10. |

India: Flawed Electric Vehicle Policy |

|

4.11. |

FAME in FY19: Low-speed Impact |

|

4.12. |

Electrification Target Confusion |

|

4.13. |

Electric OEM Market Shares |

|

4.14. |

Rise of Li-ion in India |

|

4.15. |

Gigafactories in India |

|

4.16. |

India Li-ion Battery Pack Chemistry & Price Forecast |

|

4.17. |

Performance Parity |

|

4.18. |

Hero Electric Models |

|

4.19. |

List of EV Startups in India |

|

4.20. |

Ather Energy |

|

4.21. |

E-motion - Surge |

|

4.22. |

22Motors - Flow |

|

4.23. |

Harley Davidson Failure |

|

4.24. |

Bajaj Auto Chetak |

|

4.25. |

IDTechEx Portal Profiles |

|

5. |

US |

|

5.1. |

The US Moto Market |

|

5.2. |

US Electric Motorcycle Forecast |

|

5.3. |

Incentives for Electric Two-wheelers |

|

5.4. |

Zero-emission Motorcycles in the US |

|

5.5. |

US Electric Motorcycle OEM Market Shares |

|

5.6. |

Electric Scooters in the US |

|

5.7. |

GenZe |

|

5.8. |

Electric Motorcycles in California |

|

5.9. |

Zero Motorcycles |

|

5.10. |

Zero Motorcycle's Technology |

|

5.11. |

Increasing Battery Capacity |

|

5.12. |

New Sources of Growth in a Stagnating Industry |

|

5.13. |

Alta Motors: A Cautionary Tale |

|

6. |

EUROPE |

|

6.1. |

The European Moto Market |

|

6.2. |

European Two-wheeler Classification |

|

6.3. |

Historic Electric Two-wheeler Sales in Europe |

|

6.4. |

European Electric Two-wheeler Forecast 2015-2041 |

|

6.5. |

Govecs |

|

6.6. |

Vespa Elettrica |

|

6.7. |

Kymco |

|

6.8. |

Valeo's 48V Scooter Powertrain |

|

6.9. |

Continental's 48V Scooter Powertrain |

|

6.10. |

BMW C Evolution |

|

6.11. |

Volta |

|

6.12. |

Electric Motion |

|

6.13. |

Energica |

|

6.14. |

IV Electrics |

|

6.15. |

KTM |

|

7. |

SOUTH-EAST ASIA |

|

7.1. |

Indonesia: Historic Motorcycle Sales |

|

7.2. |

Indonesia: Electric Two-wheeler Forecast |

|

7.3. |

Indonesia: Case Study |

|

7.4. |

Garansindo |

|

7.5. |

Indonesia: Honda Pilot |

|

7.6. |

Vietnam: Historic Motorcycle Sales |

|

7.7. |

Vietnam: Takuda Motor |

|

8. |

REST OF WORLD MARKETS |

|

8.1. |

Taiwan: Historic Motorcycle Sales |

|

8.2. |

Gogoro |

|

8.3. |

Battery Swapping |

|

8.4. |

China Motor Corp |

|

8.5. |

Kymco (versus Gogoro) |

|

9. |

ENERGY STORAGE |

|

9.1. |

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|