Agricultural Robots, Drones, and AI: 2020-2040: Technologies, Markets, and Players農業ロボット、ドローン、人工知能 2020-2040年:農業の未来 - 超精密農業 - 自立農業 - 人工知能 - マシンビジョン - モバイルロボット - 自律走行トラクター このレポートは農業用ロボットとドローン市場を調査しています。農薬供給の基本を覆す超精密農業、農業マシンデザイン、農耕技術などを、ロボティクスとAI技術の発展がどのように実現させるか詳述しています。... もっと見る

※価格はデータリソースまでお問い合わせください。

Summaryこのレポートは農業用ロボットとドローン市場を調査しています。農薬供給の基本を覆す超精密農業、農業マシンデザイン、農耕技術などを、ロボティクスとAI技術の発展がどのように実現させるか詳述しています。 レポート内容 ※目次より抜粋

Report Details

The developments in agricultural robotics, machine vision, and AI will drive a deep and far-reaching transformation of the way farming is carried out. Yes, today the fleet sizes and the total area covered by new robots are still vanishingly small compared to the global agricultural industry. Yet, this should not lull the players into a false sense of security because the ground is slowly but surely shifting. Robotics and AI are enabling a revolution in affordable ultraprecision, which will eventually upend familiar norms in agrochemical supply, in agricultural machine design, and in farming practices.

This development frontier has the wind in its sails, pushed by rapidly advancing and sustainable hardware and software technology trends, and pulled by structural and growing challenges and needs. In our assessment, these technology developments can no longer be dismissed as gimmicks or too futuristic. They are here to stay and will only grow in significance. Indeed, all players in the agricultural value chain will need to develop a strategy today to benefit from, or at least to safeguard against, this transformative trend.

This report provides the following:

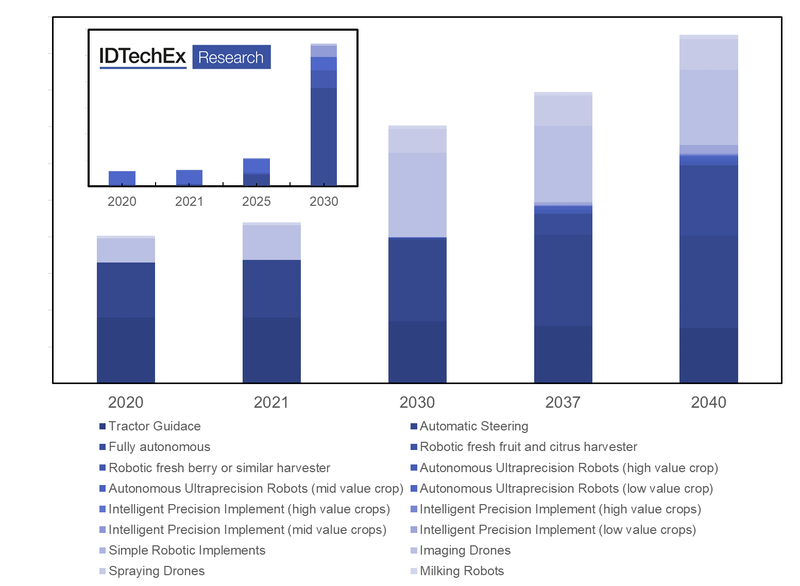

1. Application assessment and market forecasts: this report analyses all the emerging product types. It offers short- and long-term market forecasts, considering the addressable market size in area or tons and value, penetration rates, annual robot sales, accumulated fleet sizes, total RaaS (robot as a service) revenue projections and so on. Note that we built a twenty-year model because our technology roadmap suggests that these changes will take place over long timescales.

The forecasts cover 15 robot types and farming sectors. More specifically, these include the following: autonomous ultra-precision robots, intelligent vision-enabled robotic implements, simple robotic implements, fresh fruit and citrus harvesting robots, fresh berry harvesting robots, highly automated and autonomous tractors and high-power farm vehicles (levels 3, 4 and 5), imaging and spraying drones, automatic milking, mobile robots in dairy farming and others.

A detailed application assessment covering dairy farms, fresh fruit harvesting, organic farming, crop protection, data mapping, seeding, vertical farming, and so on. For each application/sector, a detailed overview of the existing industry is given, the needs for and the challenges facing the robotic technology are analysed, the addressable market size is estimated, and granular ten-year market projections are given.

2. Technology assessment and roadmap: Agriculture is still largely non-automated and non-digitized. This has been mainly because the technological deficiencies have so far held back automation. This is, however, changing, largely (but not exclusively) thanks to leaps in four core technologies: (1) CNN-based machine vison and AI, (2) autonomous mobility, (3) electric drive and powertrains; and (4) affordable and robust robotic arms.

This report provides a detailed technology assessment covering all the key robotic/drone projects, prototypes, and commercial products relevant to the agricultural sector. The report details the increasing role that deep learning-based image recognition plays in enabling an affordable ultraprecision revolution. Furthermore, the report also outlines the state-of-the-art in the use of AI in agriculture beyond image recognition in applications such as localization, yield prediction, and disease detection.

The report also considers the trend towards autonomous mobility in small and large as well as ground and aerial machines. It examines perception and sensor technologies such as RTK-GPS, camera and Lidars needed in achieving autonomy in various environments. On this hardware aspect, the report considers long-term price and performance trends in transistors, memory, energy storage, electric motors, GPS, cameras, and MEMS technology. The key role of innovative end effectors, precision actuators, and robotic arms in fresh fruit harvesting, precision weeding, and automatic dairy farming is analysed. The report also highlights the role that power train electrification is playing, especially in enabling drones and novel small- and mid-sized autonomous robots.

3. Company profiles analysis: All key companies and research entities are overviewed. The readiness level of firms and their products are benchmarked. The business models, target markets, product details, development roadmaps, etc are discussed. The report provides a complete view of the competitive landscape.

Agricultural robots: a cost-effective ultraprecision revolution?

These are often small or mid-sized robots which are designed to autonomously navigate and to automatically take some precise plant-specific action (see examples below).

Machine vision technology is a core competency, enabling the robots to see, identify, localise, and to take some intelligent site-specific action on individual plants. The machine vision increasingly uses deep learning algorithms often trained on expert-annotated image datasets, allowing the technology to far exceed the performance of conventional algorithms and even at times expert agronomists. Crucially, this approach enables a long-term technology roadmap, which can be extended to recognize all types of crops and to analyse their associated conditions, e.g., water-stress, disease, etc.

Many versions of this emerging robotic class are autonomous. The autonomy challenge is incomparably simpler than a car. The legislation is today a hinderance, including in places such as California, but will become more accommodative relatively soon.

The rise of autonomous robots, provided they require little remote supervision, can alter the economics of machine design, enabling the rise of smaller and slower machines. Indeed, this elimination of the driver overhead per vehicle is the basis of the swarm concept. There is clearly a large productivity gap today between current large and high-power vehicles and those composed of fleets of slow, small robots. This productivity gap, however, can only narrow as the latter has substantial room for improvement even without a breakthrough or radical innovation.

The first major target market is in weeding. The ROI benefits here are driven by labour savings, chemical savings, boosted yields, and less soil compaction. Precision action (spraying, mechanical, or electrical) reduces consumption of agrochemicals, e.g., by 90%, and boosts yield by cutting herbicide-induced collateral damage, e.g., by 5-10%. This technology can further enable farmers to tackle herbicide-resistant weeds and leave behind no unusable compacted soil.

These robots are evolving. Many robots have already grown in size and capability since the earlier days, today offering faster speeds, higher frame-per-seconds, more ruggedized designs, higher on-board energy for longer operation time and a heavier load, and etc. This hardware and machine vision evolution will inevitably continue, just as with all other agricultural tools and vehicles. We are still at the beginning. The deployed fleet sizes worldwide are small, but this is about to dramatically change.

Examples of past and present autonomous agricultural robots. The image panel is not intended to be a comprehensive representation of all prototypes and products.

Intelligent robotic implements: the inevitable next generation of agricultural tools

Simple robotic implements utilising basic row-following vision technology are already mature and not uncommon in organic farms. Advances in vision technology are transforming tractor-pulled implements though, upgrading them into intelligent computerized tools able to take plant-specific precise action.

The core technology here is also the machine vision, which enables the identification and the localization of specific plants. The algorithms already surpass the capabilities of agronomists in specific cases, e.g., weed amongst cotton. Crucially, the systems are becoming ever more productive, closing the productivity gap with established technology. A leading product is a 40ft wide implement which is pulled at 12mph and covers 12 rows of crops. This system achieves 2-inch resolution and 20 fps imaging, deploying 30 cameras and 25 on-board GPUs.

This approach does not focus on autonomy, although the tractor itself can readily be made autonomous to render the entire system automatic if needed. This system is designed to become competitive in large farms, which demand high productivity, which in turn is linked to technology parameters such as fps (frame per second), false positives, sprayer controller speed, and so on. In the future, the system costs will likely fall, particularly if lighter versions of the algorithms on the inference side become available to render GPU processors unessential without a major performance sacrifice.

This image is the evolution of Blue River's (now John Deere) machine over the years, showing how the implement has evolved from a prototype to become rugged and productive.

Autonomous tractors and high-power vehicles: fewer but more autonomous systems will be the future?

Autonomous navigation is not new to tractors. Thanks to RTK-GPS, tractors have long been benefiting from tractor guidance and autosteer. The latter is in fact level-4 autonomy since the tractor can autonomously drive outdoors along pre-determined GPS coordinates without human intervention. The cost of implementation as well as the adoption of such technologies has increased. In short, the technical challenge does not hinder deployment.

Level-5 or fully autonomous tractors have also been demonstrated for some years. The technical barrier here is low. The determining factors here are farmer perception and added value. The additional cost incurred in going from level-4 to level-5 will not justify the additional benefits until level-5 can enable many new possibilities. This means that more tasks, and not just movement, should become automated.

The rise of autonomous mobility is also giving rise to novel designs. Some examples are shown in the panel below. In particular, the weight distribution can be altered without scarifying the horsepower, helping alleviate soil compaction issues. In the longer term, though, other agricultural robots will eat into the tasks that tractors perform today, potentially denting overall demand.

Robotic fresh fruit picking: is it technically and commercially viable?

Fresh fruit picking is still largely manual as deficient technical ability had thus far held automation back. As such, farms are faced with high harvesting costs and are, more importantly, grappling with the growing challenge of assembling sufficiently large armies of seasonal pickers. Is this about to change?

Today machine vision technology can identify and localize different visible fruits against complex and varying backgrounds with a high success rate. The rise of deep learning-based image recognition technologies has caused a leap in performance. Crucially, a clear pathway exists for algorithm development for new fruit-environment combinations, enabling the applicability of machine detection and localization to be extended to many fruits. The robotic path planning, picking strategy and the motion control of the robotic arm are also challenges. Here, too, there are algorithmic improvements. More importantly, companies are developing novel end-effectors which can accelerate gentle fresh fruit picking whilst lightening the computational load.

Humans today are still faster – e.g., 2-3s per picked strawberry vs 8-10s for the robot. This speed gap will almost certainly narrow in the future, lowering the comparative advantage of humans. In addition, robots can have many arms, compensating for the slowness of each arm (both articulated and delta arms are deployed). The key to commercial success lies in the development of robust robotic and associated AI platforms which can be utilized across the harvesting season of different crops.

The total deployed number of units is small, thus the robotically harvested amount of fresh fruit is still vanishingly small compared to the addressable market. However, the technical viability is long proved. The emphasis is now in bridging the productivity gap to offer a reliable solution with reasonable ROI compared with the incumbent human picking. Importantly, there is still ample room to boost productivity and applicability by making constant incremental gains. As such, no breakthrough is required, making it more a question when and not if.

Examples of robots automatically harvesting apples, strawberries, etc.

Drones

Drones are an increasingly common tool. Currently remote-controlled consumer or prosumer drones are utilized for aerial image acquisition. They have helped reduce the acquisition cost and the resolution of aerial farm images, making the technology accessible to all manner of farmers. Indeed, the hardware platform is now widely available. Note that the business landscape on the platform side has gone through a brutal consolidation phase, establishing the winning supplier and design.

Attention has been increasingly shifting to software and service. Indeed, many firms are in parallel offering the data analytics, starting from simple indexes such as NDVI and progressing to more complex analytics. Aerial drone-based sprayers have also been launched. These however remain currently niche.

Note that the use of unmanned aerial technology is not just limited to drones. Indeed, unmanned remote-controlled helicopters have already been spraying rice fields in Japan since early 1990s. This is a maturing technology/sector with overall sales in Japan having plateaued. This market may however benefit from a new injection of life as suppliers diversify into new territories

Dairy farming

Automated milking has been in the making for 25 years. The technology is already proven with high and growing installations worldwide. Indeed, this multi-billion market is showing high annual growth rates. An important enabling innovation was the development of (1) a robust robotic arm that could survive when, for example, crushed by the animal, and (b) a teat localization mechanism (often based on measuring the change in a projected pattern). In parallel to fixing automatic milking assets, heavy mobile robots acting as automatic feed pushers are also gaining further popularity.

Table of ContentsTable of Contents

|