Summary

この調査レポートでは、配送・物流ロボット、清掃・消毒ロボット、ソーシャルロボット、農業ロボット、キッチン・レストランロボット、水中ロボットなど、サービスロボットの主要な応用分野について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

-

サービスロボティクス

-

除菌ロボット・清掃ロボット

-

ソーシャルロボット

-

農業用サービスロボット

-

厨房・レストラン向けサービスロボット

-

水中ロボット

Report Summary

Service robots are becoming increasingly popular. This report provides a comprehensive analysis of the major application areas of service robots, including delivery and logistics robots, cleaning and disinfection robots, social robots, agricultural robots, kitchen and restaurant robots, and underwater robots. It covers key technologies, market analysis, and 10-year granular regional market forecasts. The report provides an understanding of the market dynamics, competitive landscape, market outlook, and promising applications.

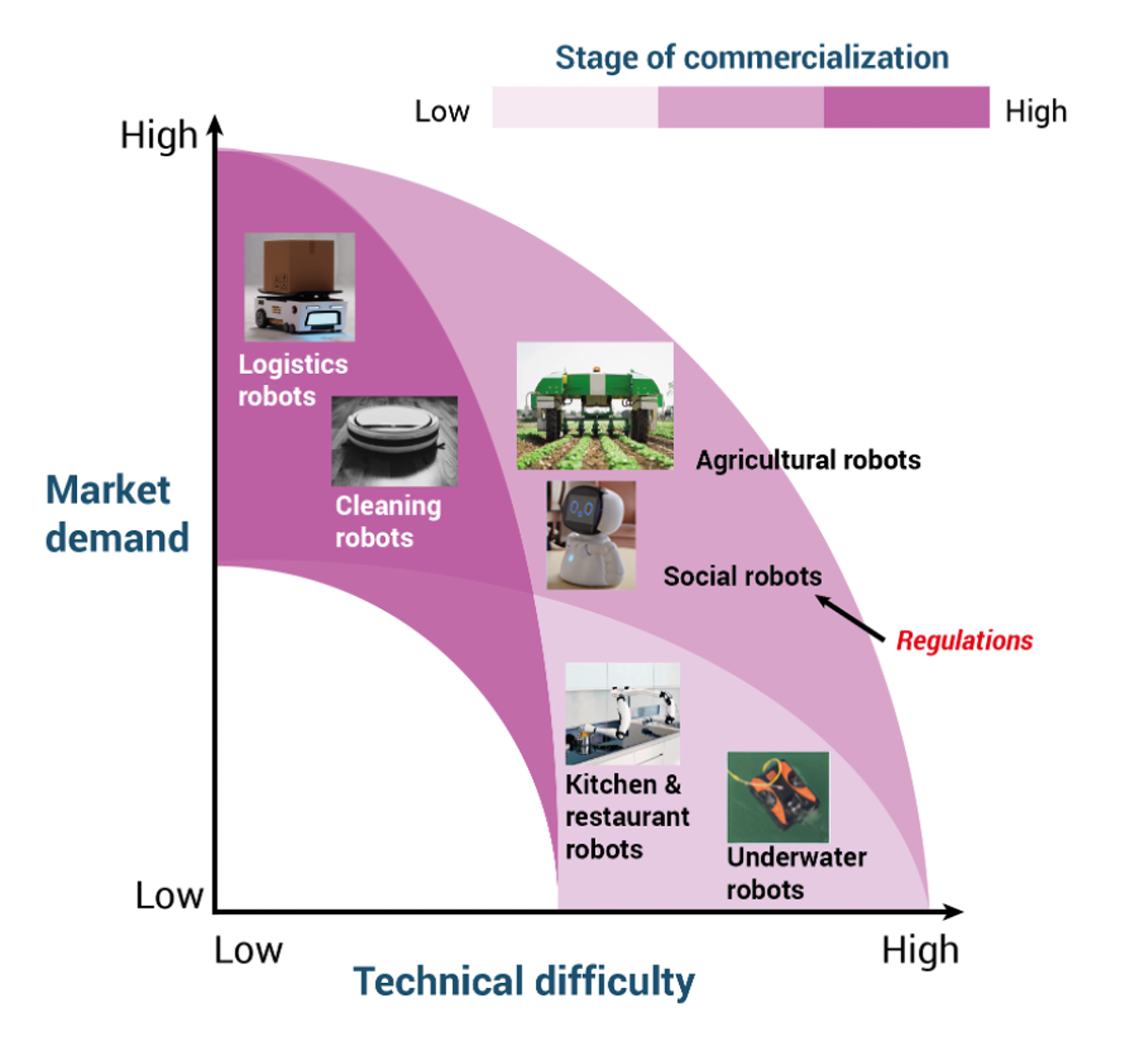

Robots have the potential to revolutionize so many aspects of the modern world, from optimizing industrial efficiency to improving our everyday lives. Unlike the traditional robots used in industrial applications, service robots are primarily designed to support people in their daily life. As a broad definition, service robot covers a wide range of applications and types of robots, ranging from logistics and delivery robots, social robots, cleaning robots, disinfection robots, robotic chefs/kitchen robots, robotic waiters/restaurant robots, agricultural robots, and underwater robots. While the service robot market is at a much earlier stage of development than the traditional industrial robots, there is increasing effort within this space to promote the adoption of service robots. The intensity of competition and stage of development varies significantly depending on the application. IDTechEx's latest report on "Service Robots 2022-2032" takes a deep dive into the applications mentioned above with an analysis of the technologies, players, and markets with granular forecasts for the next 10 years.

Robots categorized by their technical difficulty, market demand, and stage of commercialization. Source: IDTechEx

Service robots in delivery and logistics

Automation in the warehousing and logistics chain is a fast-growing market. A particularly exciting subset of this is the use of mobile robots, autonomous vehicles, and drones, for the automation of movement-based tasks. This field encompasses all manner of mobile robotic devices used in logistics, such as robotic carts/vehicles, on-road autonomous trucks, and drones, which help goods in their journey from origin to destination. Thanks to the relatively low technical complexity and massive demand market, logistics and delivery robots have a promising future. As one of the dominant applications of service robots, they are expected to have a CAGR of 21% in the upcoming decade.

Cleaning and disinfection robots

As the second-largest application, cleaning and disinfection robots can be classified as either domestic cleaning robots or professional cleaning robots. Based on the cleaning approaches, they can also be classified as physical cleaning (using brushes) or non-physical cleaning (using sprays and/or UV lights). Driven by COVID, cleaning robots have gained lots of momentum and funding (especially for start-ups) during the past two years, particularly in their professional applications. IDTechEx expects to see a fast growth of professional cleaning robots in the upcoming decade.

Social robots

Social robots are essentially high-level artificial intelligence (AI) systems built into physical entities. The major application areas of social robots include hospitality and medical treatments. Social robots can be used to guide and provide information. Typical places we could find social robots would be airports and hotel foyers. Aside from the hospitality industry, another important application for social robots is treating people who suffer from cognitive impairment (e.g., autism), robots can be used to replace traditional physiotherapists and provide emotional and educational support. However, the emotional feedback causes debate as robots are not meant to have emotions, and the conversation is linked with multiple regulations and ethical issues.

Agricultural robots

Agricultural robots are an emerging application of service robots. Unlike logistics and delivery robots that primarily work in a relatively well-controlled environment and social robots that primarily work indoors, agricultural robots typically work in rural farmlands with limited access to infrastructure, difficult terrain, and unpredictable weather. These environmental factors bring a number of technical challenges to agricultural robots. Meanwhile, the agricultural industry is a low-margin industry so the high upfront costs of the agricultural robot could be another barrier to market uptake.

Restaurant and kitchen robots (robotic waiters and robotic chefs)

Restaurant robots (commonly known as robotic waiters) and kitchen robots (commonly known as robotic chefs) have gained lots of attention during the past two years due to the impact of COVID. Restaurant and kitchen robots can help restaurant owners better manage the food preparation such as maintaining stable food quality, reducing food waste, taking less space, etc. Despite these advantages, there are also several drawbacks. For instance, kitchen robots/robotic chefs are typically expensive (more than $200,000 per unit according to one of the commercialized products). The food service industry has high competition with thin profit margins; therefore, many restaurant owners are reluctant/unable to make such a big upfront investment, which presents a significant barrier to market uptake. However, given the massive potential of restaurant and kitchen robots, IDTechEx does see a number of market entry opportunities in the highly standardized fast-food industry.

Underwater robots (unmanned underwater vehicles)

Underwater robots, also commonly known as unmanned underwater vehicles (UUV) are primarily used for military applications. Examples include submarines and countermining robots, among others. Underwater robots have huge potential: they can be used for research and exploration, dam/tunnel/pipeline inspection, and several other applications. This report primarily focuses on the civil applications of underwater robots, and there are several technical and commercial hurdles. From a technical point of view, the harsh underwater environments come with limited visibility, unpredictable animal attack, and limited approaches for communication. In order to deal with these technical challenges, a number of sensors, infrastructures, and navigation technologies are needed, such as sonar, acoustic altimeters, pressure sensors, cameras, and inclinometers. These sensors and technologies lead to high manufacturing costs, which concomitantly leads to a high price for underwater robots. Despite the significant hurdles, IDTechEx expects the uptake of underwater robots to increase significantly over the coming decade.

.png)

The service robot market is expected to grow quickly and reach $70 billion by 2032. Source: IDTechEx

Cannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceLog in to edit with Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Robot categorisation |

|

1.2. |

Definition of service robots |

|

1.3. |

Application areas of service robots |

|

1.4. |

Categorisation of service robots |

|

1.5. |

Market size of different types of service robots in 2032 |

|

1.6. |

Geographical distribution of main players |

|

1.7. |

Service robots - overview |

|

1.8. |

Market size - Service robots by application: 2019-2032 |

|

1.9. |

Unit sales - Service robots by application: 2019-2032 |

|

1.10. |

Market size of logistics and delivery robots: 2019-2032 |

|

1.11. |

Cleaning robots - overview |

|

1.12. |

Cleaning robots by regions: 2018-2032 |

|

1.13. |

Social robots - overview |

|

1.14. |

Market size of social robots: 2019-2032 |

|

1.15. |

Kitchen and restaurant robots - overview |

|

1.16. |

Total market size for kitchen and restaurant robots: 2018-2032 |

|

1.17. |

Underwater robots - overview |

|

1.18. |

Underwater robots - Market size of different applications: 2018-2032 |

|

2. |

SERVICE ROBOTICS - INTRODUCTION AND OVERVIEW |

|

2.1. |

Evolution of robots - industrial to service robots |

|

2.2. |

What are robots? |

|

2.3. |

Two types of robots |

|

2.4. |

What are service robots? |

|

2.5. |

What is the market position of service robotics? |

|

2.6. |

Number of service robot manufacturers of all types by region of origin |

|

2.7. |

Consideration by market vertical |

|

2.8. |

Potential uses of service robotics |

|

2.9. |

Companies developing service robots |

|

3. |

SERVICE ROBOTS FOR DELIVERY AND LOGISTICS |

|

3.1.1. |

Challenges in the logistics and delivery industry |

|

3.1.2. |

How can service robots be used in logistics? |

|

3.1.3. |

Service robotics in logistics - overview |

|

3.1.4. |

Typical applications and categories of service robots for delivery and logistics application |

|

3.1.5. |

Acquisition |

|

3.1.6. |

Regulation recent updates - for delivery vehicles |

|

3.2. |

Intralogistics material transporting robots |

|

3.2.1. |

Different types of mobile robotics in material handling |

|

3.2.2. |

Different types of mobile robots in intralogistics material transporting |

|

3.2.3. |

Automated Guide Vehicles & Carts (AGV/Cs) |

|

3.2.4. |

Grid-based automated guided carts (grid-based AGC) |

|

3.2.5. |

Autonomous Mobile Robots(AMRs) |

|

3.2.6. |

Comparison of technologies |

|

3.2.7. |

Sensors for object detection |

|

3.2.8. |

Transition to AGVs and AMRs |

|

3.2.9. |

AGV/Cs vs. AMRs |

|

3.2.10. |

Key market players analysis |

|

3.2.11. |

Players - Leading Companies for AGVs |

|

3.2.12. |

Players - Leading Companies for grid-based AGC |

|

3.2.13. |

Players - Leading Companies for AMR |

|

3.2.14. |

Forecasts |

|

3.2.15. |

Forecast - market size of intralogistics material transporting |

|

3.3. |

Mobile picking robots |

|

3.3.1. |

Two forms of mobile picking robots on the current market |

|

3.3.2. |

Market players |

|

3.3.3. |

HAI Robotics |

|

3.3.4. |

Exotec Systems |

|

3.3.5. |

InVia Robotics |

|

3.3.6. |

Magazino |

|

3.3.7. |

Applications of mobile picking manipulators |

|

3.3.8. |

Fetch Robotics |

|

3.3.9. |

Youibot |

|

3.3.10. |

Forecasts |

|

3.3.11. |

Forecasts - mobile picking robots: 2019-2032 |

|

3.4. |

Autonomous last mile delivery |

|

3.4.1. |

What is last mile delivery? |

|

3.4.2. |

Why autonomous last mile delivery? |

|

3.4.3. |

How can the items be autonomously delivered in the last mile? |

|

3.4.4. |

Comparison: ground-based vehicles vs. drones |

|

3.4.5. |

Technologies |

|

3.4.6. |

Sensors |

|

3.4.7. |

Localisation and mapping |

|

3.4.8. |

Vehicle connection |

|

3.4.9. |

Technologies for ground-based delivery vehicles: restrictions |

|

3.4.10. |

Technologies for drones: sensors |

|

3.4.11. |

Regulations - for delivery vehicles |

|

3.4.12. |

Market players |

|

3.4.13. |

Players - autonomous delivery ground-based vehicles |

|

3.4.14. |

Players - autonomous delivery drones |

|

3.4.15. |

Forecast |

|

3.4.16. |

Market revenue forecasts for autonomous last-mile delivery robots: 2019-2032 |

|

4. |

DISINFECTION ROBOTS AND CLEANING ROBOTS |

|

4.1. |

Introduction |

|

4.1.1. |

What are cleaning robots? |

|

4.1.2. |

Cleaning robots inspired by the Pandemic - disinfection robots |

|

4.1.3. |

Disinfection robot - reduce healthcare-associated infection in hospitals |

|

4.1.4. |

Increasing attention from venture capitals and increasing number of companies and sales |

|

4.1.5. |

A note on technology readiness levels (TRLs) |

|

4.1.6. |

Readiness level of different technologies in different application sectors |

|

4.1.7. |

Categorization of cleaning robots |

|

4.2. |

Key enabling technologies, supply chain and key players |

|

4.2.1. |

Key components of floor cleaning robots |

|

4.2.2. |

Evolution of disinfection technologies |

|

4.2.3. |

Cleaning efficiency - autonomous mobility |

|

4.2.4. |

Cleaning efficiency - end-effector systems |

|

4.2.5. |

Direct interaction: SWOT analysis |

|

4.2.6. |

Indirect interaction: SWOT analysis |

|

4.2.7. |

Path planning |

|

4.2.8. |

LDS (Laser Distance Sensor) SLAM and vSLAM |

|

4.2.9. |

Obstacle avoidance techniques - comparison |

|

4.2.10. |

Window and wall cleaning robots - safety and reliability |

|

4.2.11. |

Key players by geography |

|

4.2.12. |

Robotic cleaning vs traditional cleaning |

|

4.3. |

Drivers and barriers |

|

4.3.1. |

Driver - increasing automation in household appliances |

|

4.3.2. |

Driver - cost-saving and big potential market |

|

4.3.3. |

Driver - Covid and high efficiency of cleaning robots |

|

4.3.4. |

Barrier - decreased spending on consumer electronics |

|

4.3.5. |

Barrier - noises and frequent maintenance |

|

4.3.6. |

Barrier - chip shortage and higher price |

|

4.3.7. |

Key takeaways - drivers

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|

.png)