Lidar 2024-2034: Technologies, Players, Markets & Forecastsライダー2024-2034:技術、プレーヤー、市場、予測 この調査レポートは、レーザー物理、半導体、光学、センサー、オプトエレクトロニクス、輸送などの分野における経験を活かし、技術や製品について詳細に調査・分析しています。 主な掲載内容... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートは、レーザー物理、半導体、光学、センサー、オプトエレクトロニクス、輸送などの分野における経験を活かし、技術や製品について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

In recent years, with the development and progress of autonomous-driving features, the automotive industry has witnessed remarkable advancements in sensor technologies, with one particular innovation gaining significant attention: three dimensional light detection and ranging (LiDAR), a remote sensing method that uses laser light to measure distances and create precise 3D maps of the surroundings.

The lidar market for automotive applications will grow to US$9.5 billion by 2034. The demand for lidars to be adopted in the automotive industry drives the huge investment and rapid progression of lidars, with the innovations in beam steering technologies, performance improvement, and cost reduction in lidar transceiver components. These efforts can enable lidars to be implemented in a wider application scenario beyond conventional usage and automobiles. IDTechEx leverages its experiences such as in laser physics, semiconductors, optics, sensors, optoelectronics, and transportation, to provide a comprehensive analysis on technologies and products. 10-year market forecasts on lidar units and market value with a focus on automotive have been provided. IDTechEx also offers major lidar adoption details such as vehicle model, launch time, lidar player, lidar model, lidar type, number of lidars adopted, location on the vehicle for current existing and near-future automotive adoptions.

Following a period of dedicated research by expert analysts, IDTechEx has published a report that offers unique insights into the global 3D lidar technology landscape and corresponding market. The report contains a comprehensive analysis of market status and forecasts focus on the automotive industry, with the technology analysis also potentially applied to lidars for industrial automation, robotics, smart city, security, and mapping. Importantly, the report presents an unbiased analysis of primary data gathered via our interviews with key players, and it builds on our expertise in the transport, electronics and photonics sectors.

This research delivers valuable insights for:

*or similar and competing sensors

The lidar revolution: Enabling more machines to see the world

Lidar, which stands for light detection and ranging, is a ranging technique that has existed for decades, with a long history that dates back to the invention of the laser around the 1960s, shortly after the invention of laser. Lidar has already been used in applications such as mapping, surveying, military, archaeology, agriculture, and geology.

However, it was not until the 2000s that the technology started to be applied in commercial automotive applications that benefited from the development of 3D LiDAR, which provides 3D information using a beam steering system. The invention of beam steering technologies enables lidar to reach 3D space for extended use scenarios.

3D lidar is an optical perception technology that enables machines to see the world, make decisions and navigate. At present, machines using lidar range from small service robots to large autonomous vehicles. The rapidly evolving lidar technologies and markets leave many uncertain questions to answer. The technology landscape is cluttered with numerous options for every component in a lidar system. IDTechEx identified four important technology choices that every lidar player and lidar user must make: measurement process, laser, beam steering mechanism, and photodetector. The beam steering mechanism is the most complicated and critical choice, while the emitter and receiver (transceiver) play an important role in future lidar cost reduction and further performance enhancement.

Four important technology choices in designing or selecting a 3D lidar module. Source: IDTechEx

Which to win: Competitive technology landscape

With numerous technological choices for the key components and measurement methods, various technology combinations can be generated, making players working in this space distinctive to each other. Most players in the space claim to offer a unique, next-generation product that is superior to competing technologies.

Lidar technology choices. Source: IDTechEx

However, the options are not unlimited. Certain components may work better with a particular technology, such as vertical cavity surface emitting laser (VCSEL) is a more popular choice for 3D flash lidar compared with edge emitting laser (EEL). While VCSEL is mature with 905 nm wavelength, it can be very difficult to realize using short wavelength infrared (SWIR). There are also fewer common combinations such as MEMS with FMCW due to more technical challenges.

With the experience in laser physics, semiconductor physics, optoelectronics, in addition to experience in advising multi-billion-dollar corporations on business growth and technology strategy, IDTechEx has built expertise in the transport, electronics and photonics sectors and can provide comprehensive technological analysis and benchmarking.

The technology choices made today will have immense consequences for performance, price, and scalability of lidar in the future. The present state of the lidar market is unsustainable because winning technologies and players will inevitably emerge, consolidating the technology and business landscapes.

Vision only or sensor fusion: Where will the market go?

As a representative company, Tesla stands by the vision-only camp, while the majority of automotive OEMs pursue sensor fusion with lidar included as their future answer. The demand of redundancy and increasing requirement for 3D information make lidar more and more attractive. The battle in automotive ADAS and the autonomous vehicle market helps to provide an opportunity for lidar to be accepted by other application markets with reducing price and increasing reliability. The efforts through the lidar supply chain, from materials suppliers to automotive OEMs, not only offer opportunities for conventional material and component companies, but also enables new lifestyles for the consumer with upcoming innovations.

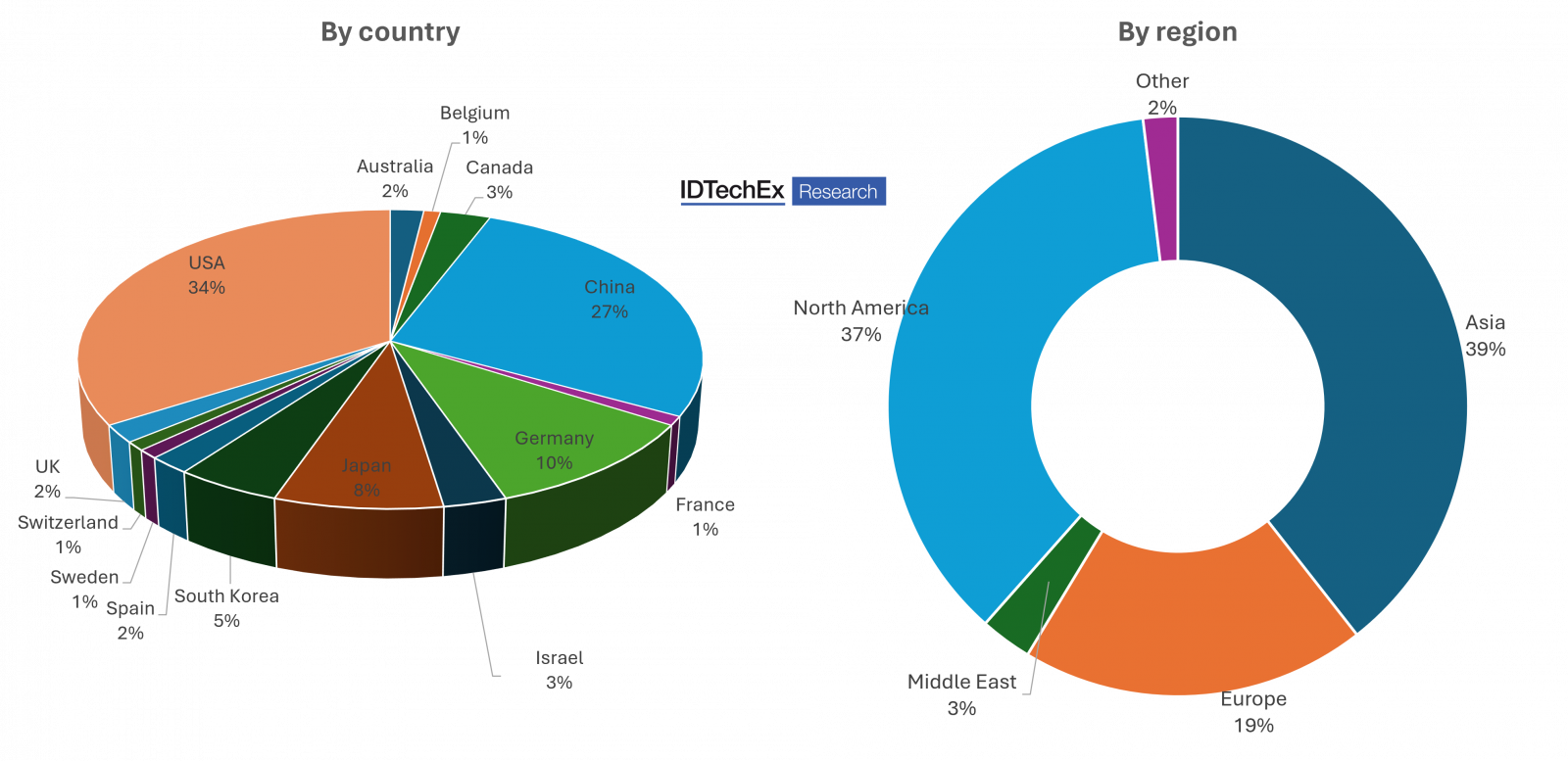

Global lidar player distribution. Source: IDTechEx

Chinese players vs non-Chinese players, OEMs/ Tier1s vs Lidar companies

Coming to 2024, numerous lidar adoptions have been addressed by the public. The initial purpose of integrating LiDAR into the automotive industry was to leverage its unique benefits to address the limitations of existing sensors like cameras, which is often highlighted by many LiDAR startup companies. However, recent research by IDTechEx suggests that the current and near-future adoption of LiDAR in automotive applications is not primarily driven by performance considerations. The OEMs and Tier 1 companies have very different considerations compared with Tier 2 lidar companies, with the latter focusing more on technology advancement and performance improvement, while the former values other factors equally or more: costs, reliability, the possibility to pass automotive grade, supply chain, mass-production capability, scalability and ease of integration, to name a few. In addition, the market landscape shows very different behavior in the Chinese market and non-Chinese markets.

IDTechEx has focused on players who position themselves as automotive Tier 2 suppliers, with a coverage of component suppliers and automotive OEMs. The report explores how innovations in lidar technology affect the growth of lidar market segments. In the technical analysis chapters, IDTechEx uses its experience in physics research to explain novel technical concepts to a non-specialist audience. Market forecasts are based on the extensive analysis of primary and secondary data, combined with careful consideration of market drivers, restraints, and key player activities. The technology adoption roadmaps for six types of lidar in four types of level 3+ autonomous vehicles are evaluated to provide a balanced outlook on market opportunities.

IDTechEx's model of the lidar market considers how the following variables evolve during the forecast period for each beam steering technology segment: technology readiness level of lidar, lidar unit price, vehicle production volume; autonomous vehicle technology adoption; lidar technology adoption; lidar market share per autonomous vehicle segment.

Our report answers important questions such as:

Examples of lidar configurations considered in our market analysis and forecasts for level 3+ autonomous vehicles. Source: IDTechEx

Key Aspects of this report:

Technology analysis & trends

Market Analysis & Forecasts:

Supply chain

Status and Trend

Table of Contents

|

.png)

.png)

.png)