ロボット手術の革新 2020-2030年:技術、企業&市場:ロボット手術全般、カテーテルと内視鏡のロボティックナビゲーション、手術ツールのロボットによる位置取り、手術中のカメラ操作用ロボットシステム、ロボット手術におけるAI、ロボット手術における光学フィードバックメカニズムInnovations in Robotic Surgery 2020-2030: Technologies, Players & Markets このレポートはロボット手術市場の新興技術について言及し、主要企業のハイライトや部門ごとの市場分析を行っています。部門や企業の収益データについても掲載しています。 Report D... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2020年3月19日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

216

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

このレポートはロボット手術市場の新興技術について言及し、主要企業のハイライトや部門ごとの市場分析を行っています。部門や企業の収益データについても掲載しています。

Report Details

For centuries, large incisions were the only way to provide surgeons with a full view of the organ they needed to treat. Recovery time for such a taxing procedure is extensive and post-operative complications are a common occurrence. The introduction of minimally invasive surgery (MIS) in operating theatres has drastically improved patient outcomes. Smaller incisions reduce the risk of infection and accelerate recovery. Many studies have shown that MIS procedures result in decreased post-operative hospital stays, a quicker return to the workforce, decreased pain and better immune function.

As attractive as MIS is, there are several drawbacks due to the technical and mechanical nature of the equipment. These limitations make minimally invasive procedures more challenging, reduce their efficiency and increase operating time.

Robotic surgery was developed to overcome the limitations of MIS and to expand its benefits. It is classified as a type of MIS and involves the use of robotic systems to execute surgical procedures. Although it has been around for over thirty years, robotic surgery is still in its infancy. The market is currently in a rapid state of expansion, however, as it has welcomed dozens of new companies in the last decade. The range of technologies, uses and applications of robotic surgery widens with each new entrant. This field is evolving at a considerable pace and is showing no signs of slowing down. Within the last five years, interest in robotic surgery has soared. Investments in companies operating in this space have skyrocketed since 2016, recording an increase of over 300% in three years, and total investment to date has reached $1.36 billion.

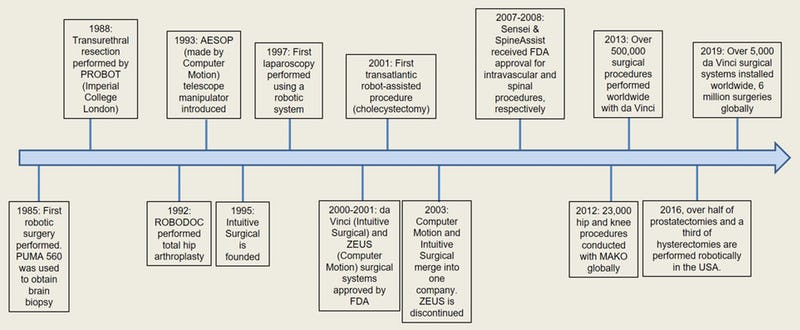

History of robotic surgery: an overview

Source: IDTechEx Report "Innovations in Robotic Surgery 2020-2030"

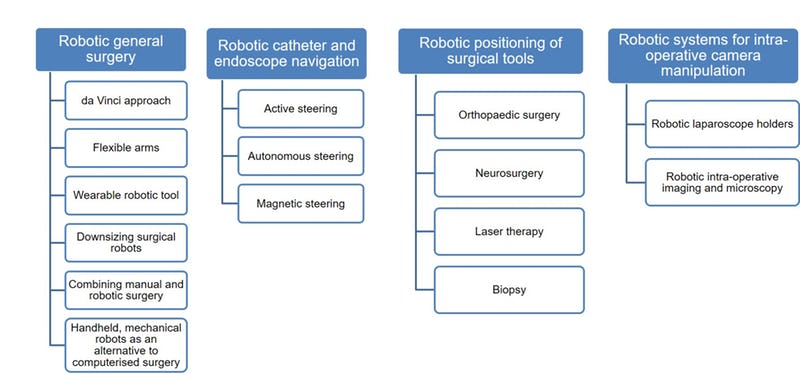

This report breaks down the robotic surgery market into four main sectors:

• Robotic general surgery

• Robotic catheter and endoscope navigation

• Robotic positioning of surgical tools

• Robotic systems for intra-operative camera manipulation

Sectors covered in this report

Source: IDTechEx Report "Innovations in Robotic Surgery 2020-2030"

General surgery is perhaps the best known aspect of robotic surgery due to the presence of Intuitive Surgical, the most famous surgical robot company, in this space. Intuitive Surgical's control on the market has forced the diversification of surgical robots as companies are keen to set themselves apart. There are multiple sectors within general surgery in which the company is not active and other manufacturers have targeted in order to distinguish themselves and their technology.

Medical instruments like catheters are widely used to conduct an intervention within the heart or blood vessels. Catheter ablation procedures require the wire to be pushed manually and expose surgeons to harmful X-ray radiation. Robotic systems discussed in this report may eliminate the need to manually manipulate the wire. This could greatly improve patient outcomes by increasing the speed and efficiency of the intervention. Surgeons could be in another room or a different city, controlling the device with a joystick, thereby reducing the level of radiation inflicted on them.

Robotic systems are increasingly being used to facilitate and optimise the positioning of instruments and tools during surgery. They have proven value in orthopaedic and neurosurgery procedures and are being explored as means to improve laser therapy and biopsy outcomes as well. These systems facilitate operating room workflows by ensuring that surgical tools are inserted at the appropriate angle and depth. The level of precision required often can't be achieved by humans, who are prone to involuntary tremors.

Robotic systems for intra-operative camera manipulation are crucial in surgical procedures as they enable surgeons to see the surgical site and their actions within the patient. They provide a stable view of the operating area, avoiding tremors and other disadvantages that occur when the laparoscope is held by a human. These systems negate the need for an assistant, which reduces the cost of surgery.

The report explores emerging technologies, highlights key players and provides market analysis for each sector. It only covers robots that are directly involved in performing surgical procedures. For instance, robotic systems designed for pre-operative planning purposes only (i.e.: not used intra-operatively) are not included. In the context of this report, the term surgery refers to minimally invasive surgery. Open surgery is not discussed as robotic systems are rarely used in these procedures. The focus is on disease diagnosis, management and treatment. Therefore, robots performing biopsies are included. However, fields such as robotic cosmetic, hair or dental surgery are not discussed. The report also excludes rehabilitation and physiotherapy robots as they do not perform surgery. The report also includes a description of the use of artificial intelligence (AI) and haptic feedback in robotic surgery today.

Historical revenue data (2015-2019) for each sector and the key players within them is provided in this report. Forecasts predicting the size of each market in the next decade (2020-2030) are also included. The ten year forecasts are built on information derived from company interviews, financial reports and press releases, among other sources. Parameters used to calculate values include size of the company, product range, number of units sold and pricing. Other factors such as competitive landscape, access to new entrants and regulatory frameworks were used to extrapolate data for the next decade. The report also provides information such as historical revenue data, market drivers & constraints and investments/funding in each sector.

目次Table of Contents

Summary

このレポートはロボット手術市場の新興技術について言及し、主要企業のハイライトや部門ごとの市場分析を行っています。部門や企業の収益データについても掲載しています。

Report Details

For centuries, large incisions were the only way to provide surgeons with a full view of the organ they needed to treat. Recovery time for such a taxing procedure is extensive and post-operative complications are a common occurrence. The introduction of minimally invasive surgery (MIS) in operating theatres has drastically improved patient outcomes. Smaller incisions reduce the risk of infection and accelerate recovery. Many studies have shown that MIS procedures result in decreased post-operative hospital stays, a quicker return to the workforce, decreased pain and better immune function.

As attractive as MIS is, there are several drawbacks due to the technical and mechanical nature of the equipment. These limitations make minimally invasive procedures more challenging, reduce their efficiency and increase operating time.

Robotic surgery was developed to overcome the limitations of MIS and to expand its benefits. It is classified as a type of MIS and involves the use of robotic systems to execute surgical procedures. Although it has been around for over thirty years, robotic surgery is still in its infancy. The market is currently in a rapid state of expansion, however, as it has welcomed dozens of new companies in the last decade. The range of technologies, uses and applications of robotic surgery widens with each new entrant. This field is evolving at a considerable pace and is showing no signs of slowing down. Within the last five years, interest in robotic surgery has soared. Investments in companies operating in this space have skyrocketed since 2016, recording an increase of over 300% in three years, and total investment to date has reached $1.36 billion.

History of robotic surgery: an overview

Source: IDTechEx Report "Innovations in Robotic Surgery 2020-2030"

This report breaks down the robotic surgery market into four main sectors:

• Robotic general surgery

• Robotic catheter and endoscope navigation

• Robotic positioning of surgical tools

• Robotic systems for intra-operative camera manipulation

Sectors covered in this report

Source: IDTechEx Report "Innovations in Robotic Surgery 2020-2030"

General surgery is perhaps the best known aspect of robotic surgery due to the presence of Intuitive Surgical, the most famous surgical robot company, in this space. Intuitive Surgical's control on the market has forced the diversification of surgical robots as companies are keen to set themselves apart. There are multiple sectors within general surgery in which the company is not active and other manufacturers have targeted in order to distinguish themselves and their technology.

Medical instruments like catheters are widely used to conduct an intervention within the heart or blood vessels. Catheter ablation procedures require the wire to be pushed manually and expose surgeons to harmful X-ray radiation. Robotic systems discussed in this report may eliminate the need to manually manipulate the wire. This could greatly improve patient outcomes by increasing the speed and efficiency of the intervention. Surgeons could be in another room or a different city, controlling the device with a joystick, thereby reducing the level of radiation inflicted on them.

Robotic systems are increasingly being used to facilitate and optimise the positioning of instruments and tools during surgery. They have proven value in orthopaedic and neurosurgery procedures and are being explored as means to improve laser therapy and biopsy outcomes as well. These systems facilitate operating room workflows by ensuring that surgical tools are inserted at the appropriate angle and depth. The level of precision required often can't be achieved by humans, who are prone to involuntary tremors.

Robotic systems for intra-operative camera manipulation are crucial in surgical procedures as they enable surgeons to see the surgical site and their actions within the patient. They provide a stable view of the operating area, avoiding tremors and other disadvantages that occur when the laparoscope is held by a human. These systems negate the need for an assistant, which reduces the cost of surgery.

The report explores emerging technologies, highlights key players and provides market analysis for each sector. It only covers robots that are directly involved in performing surgical procedures. For instance, robotic systems designed for pre-operative planning purposes only (i.e.: not used intra-operatively) are not included. In the context of this report, the term surgery refers to minimally invasive surgery. Open surgery is not discussed as robotic systems are rarely used in these procedures. The focus is on disease diagnosis, management and treatment. Therefore, robots performing biopsies are included. However, fields such as robotic cosmetic, hair or dental surgery are not discussed. The report also excludes rehabilitation and physiotherapy robots as they do not perform surgery. The report also includes a description of the use of artificial intelligence (AI) and haptic feedback in robotic surgery today.

Historical revenue data (2015-2019) for each sector and the key players within them is provided in this report. Forecasts predicting the size of each market in the next decade (2020-2030) are also included. The ten year forecasts are built on information derived from company interviews, financial reports and press releases, among other sources. Parameters used to calculate values include size of the company, product range, number of units sold and pricing. Other factors such as competitive landscape, access to new entrants and regulatory frameworks were used to extrapolate data for the next decade. The report also provides information such as historical revenue data, market drivers & constraints and investments/funding in each sector.

Table of ContentsTable of Contents

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(SaaS(Software as a Service))の最新刊レポート

IDTechEx社の ロボティクス - Robotics分野 での最新刊レポート

よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|