Barrier Films and Thin Film Encapsulation for Flexible and/or Organic Electronics 2019-2029フレキシブル/有機エレクトロニクス向けのバリア膜と薄膜封止 2019-2029年:多層バリア膜、薄膜封止、ALD、フレキシブルガラスとこれから このレポートはフレキシブルエレクトロニクスや有機エレクトロニクスで使われるバリア膜と薄膜封止の市場を調査し、2029年までの市場や技術について分析しています。 Report Details I... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2019年2月8日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

322

言語

英語

※価格はデータリソースまでお問い合わせください。

Summaryこのレポートはフレキシブルエレクトロニクスや有機エレクトロニクスで使われるバリア膜と薄膜封止の市場を調査し、2029年までの市場や技術について分析しています。

Report Details

IDTechEx Research has been analysing the technologies and markets for barriers films and thin film encapsulation since 2010 when it was published in the first version of this report. Since that time, it has stayed extremely close to the latest research and market developments via its interview programme and company and conference visits. Each year, IDTechEx Research has updated its assessment, staying up-to-date with the latest technology and market developments.

Furthermore, IDTechEx Research has engaged closely with many of its clients, helping them better understand the technology and market landscape. We helped some clients make equity investment decisions in nascent barrier companies, advised some on the market need and size for various barrier technologies, and aided others to set their technology and production strategies such that they would stay ahead of technology transitions.

In its analysis of thin film encapsulation, IDTechEx Research brings its wealth of expertise in analysing printed, flexible and/or organic electronics. We have been at the forefront of this technology for past decade and half, developing numerous market-leading reports on all aspects of this technology and organising the largest global exhibitions and conferences.

This long background in the industry puts us in a uniquely experienced position. Indeed, we even have deep expertise on all end use markets for barrier and thin film encapsulation including OLED lighting, OLED displays, quantum dots, organic photovoltaics, emerging PV technologies, and so on.

What this report offers

This report offers a detailed technology analysis assessing R2R multilayer barrier (MLB) film technologies, various inline thin film encapsulation (TFE) techniques, R2R spatial atomic layer deposition (s-ALD), flexible glass and more.

For all these technologies, IDTechEx reviews the latest progress in performance and commercialization, examines the key remaining challenges, identifies and highlights the latest commercial activities, and overviews the key active companies. This technical analysis is crucial because most barrier technologies remain technically constrained given the challenging market requirements in terms of performance, flexibility, thinness, cost, and so on.

Our technology assessment offers a critical benchmarking of the various existing and emerging solutions and gives its view as to how the technology mix will be transformed in each application sector over the short-, medium- and long-terms.

This report provides detailed application analysis, focusing on plastic and/or flexible displays, large-area OLED lighting, quantum dot displays, organic photovoltaics and other flexible PVs, and more. For each application, we provide a detailed assessment of the application itself, looking at its past, present and future. Here, we outline the technical and commercial challenges and prospects at the application-level and analyse the role that the barrier can play in aiding or hindering further commercial progress. This is a critical chapter because different applications have different needs in terms of performance, cost, flexibility, and size.

We also provide ten-year market forecasts, in sqm and value, segmented by technology as well as by application. This enables one to understand which technologies will win in what applications, and why. It also helps plan by knowing short-, medium-, and long-term market sizes for various barrier technologies. Note that our forecasts are built up our detailed technical know-how, our long-standing engagement with the community, and our deep understanding of all its end use markets. Our costs projections are based on our inhouse bottom-up cost models.

Finally, throughout the report, we identify and assess the progress made by different companies and leading research institutes in developing barrier film or TFE technologies. This enables you to develop a solid understanding of the value chain.

Report Overview

It took a decade and half to enable the first commercial products using a flexible barrier or thin film encapsulation technologies. Contrary to some assumptions however, this success does not mean that the question of barrier technology is forever settled. Indeed, there is still much work to do to render flexible barrier technology a ubiquitous, widely-available, and low-cost component in devices of all sizes, sensitivity levels, flexibility degrees, and so on.

Technology View

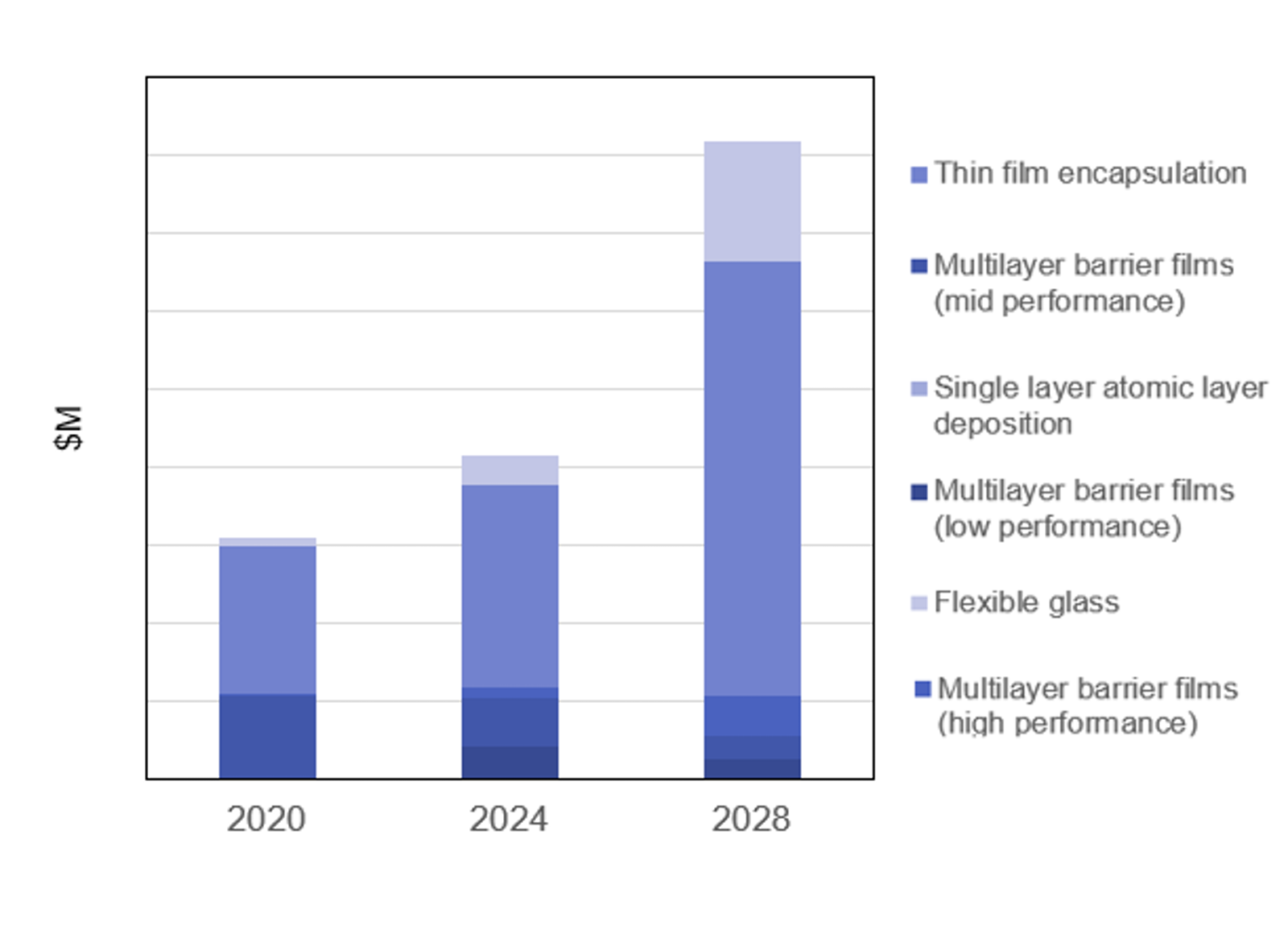

The figure above shows our market forecast, split by technology, in $M. Note that exact figures are available in the report. Further note that the order in which the legend is shown does not correspond sequentially to the figure.

Application View

Displays: First major success for inline TFE came around 2014 when it was used in rigid plastic OLED phones. This technology is now being readied for bendable displays too. Our report forecasts the market for barrier technologies in plastic and flexible OLED displays. This is a significant market. Indeed, flexible displays are finally on the cusp of commercialization, likely creating a long-lasting new technology paradigm.

How large will these markets be in sqm and value terms? Inline TFE will dominate in flexible small-sized devices but can it transition to large-area screens? And importantly how will the inline TFE technology itself adapt in terms of materials and processes for top and bottom barriers?

But many questions abound: will continued improvements in QD air stability relax barrier performance requirements, thus shrinking the market in value terms? QD displays will grow but can film-type integration keep its monopoly, or will it be replaced by other approaches such as color filter or on-chip type QDs? In total, how large will the market be in sqm and value terms? Who are the key players today?

But given the challenges, will OLED lighting ever be commercialized? If so, what is the likely market size in short-, medium- and long-terms? Given the cost and size requirements, which barrier technologies are being used now and which will win in the future? Who are the key players today?

Organic photovoltaics (OPVs): OPVs long had a seductive value proposition but reality has been harsher so far. The first companies fanned the flames of hype to raise funds but struggled to raise efficiency and cut costs. In the process, they made many mistakes such as basing their production on an existing large-sized printer that could not be adopted and optimized. In parallel, others took the patient approach of spending time to learn to process on pilot sized machine- be it solution processing or R2R evaporation- before recently embarking on scale-up which entails the development of custom equipment.

What is the past, present and future of OPV technology? Will OPVs ever become a commercial reality? If so, how large the market for barriers is likely to become? Who are the current players today and what is their production set-up? What barrier technology will win and what will be its market size?

The market for barrier films and inline thin film encapsulation split by end user market. Here we show the market M sqm. Note that the shape of the figure, i.e. the relative contribution of each application, will look very different if the figure is in SM, reflecting the wide difference is barrier costs per sqm depending on applications. The exact values are contained in the report. Further note that the order in which the legend is presented here does not correspond sequentially to the chart.

Table of ContentsTable of Contents

|