Summary

このレポートでは、IDTechExが独自の市場予測、業界分析、および熱分解、解重合、ガス化、溶解プロセスに関する重要な技術評価を提供しています。

主な掲載内容(目次より抜粋)

Report Summary

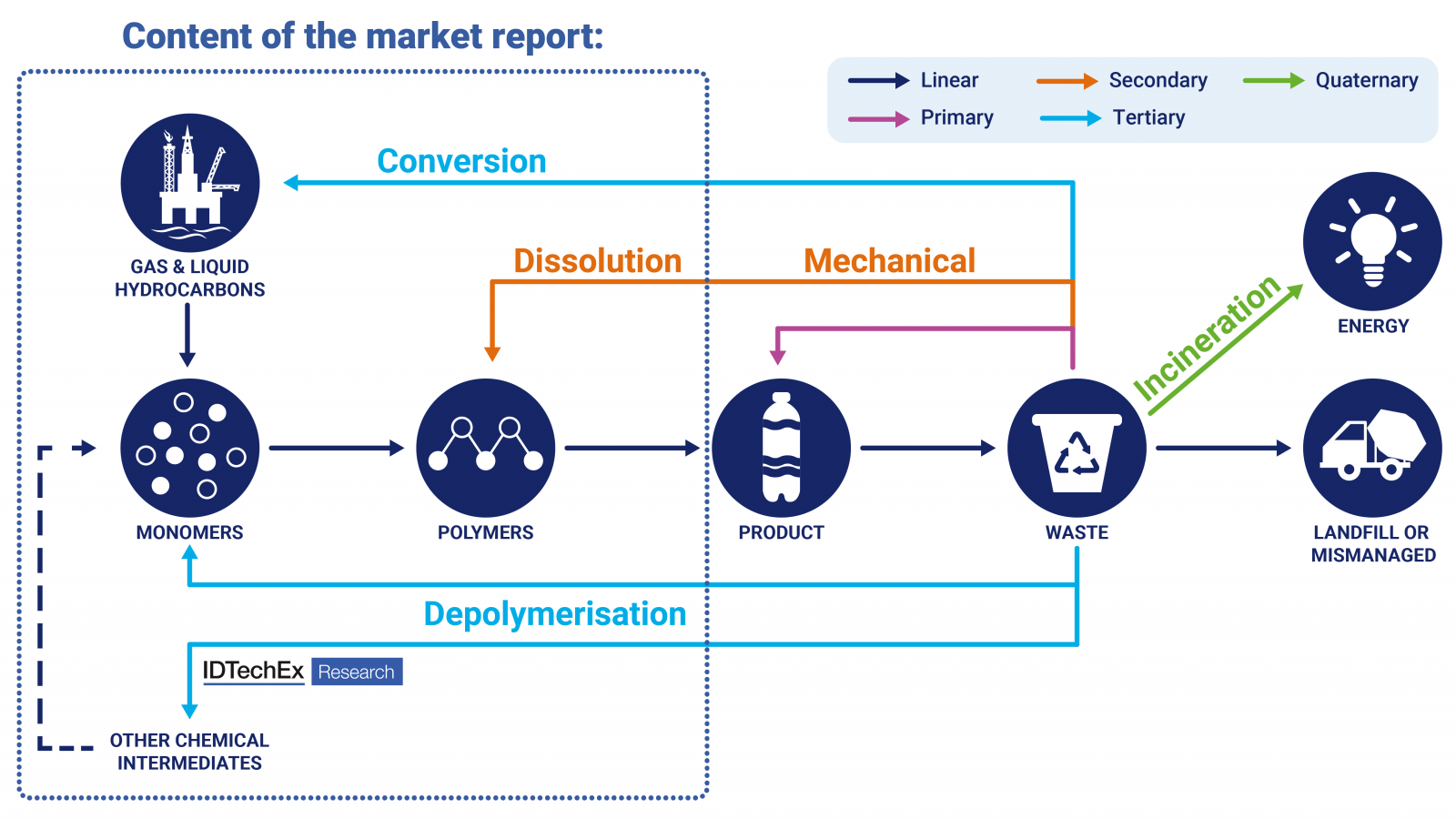

Creating a circular economy is an essential sustainability target for stakeholders across the plastic value chain. With notable market drivers, including increasing regulatory pressures, IDTechEx is witnessing a surge in market activity that will impact the global landscape over the next decade and beyond. Conventional mechanical recycling methods will continue to be necessary but given the inferior physical properties of the products, this downcycling can only go so far; this is where chemical recycling and dissolution enter the picture.

In this leading report, IDTechEx provides independent market forecasts, industry analysis and critical technical assessment on pyrolysis, depolymerization, gasification, and dissolution processes both in use today and being proposed for the near future to enable a circular economy.

The existing ISO definition defines chemical recycling as follows: feedstock (=chemical) recycling: recycling of plastic waste: conversion to monomer or production of new raw materials by changing the chemical structure of plastic waste through cracking, gasification, or depolymerization, excluding energy recovery and incineration.

Headlines on investments, planned expansions, and real-world product launches are all accelerating in their frequency and scale. The largest petrochemical companies, consumer goods companies, and other key stakeholders in the value chain are responding with both internal developments and external engagements; early-stage technology companies are announcing funding, strategic partnerships, joint development agreements, and offtake agreements from critical players in the supply chain.

However, chemical recycling is not without its critics. Many question both the environmental credentials and economic viability of these processes. Companies generally position their solution as a silver bullet, but the reality is more complex; there are benefits and limitations to every approach but that does not mean each cannot be a piece in the overall puzzle. There are also many examples of failures that should provide a suitable warning.

Chemical recycling of plastic waste

This is the area with the most attention right now. These tertiary processes break the polymer down either into constituent monomers or into raw materials further upstream in the plastics supply chain.

Depolymerization is one of the key emerging processes. This takes a relatively homogeneous feedstock and breaks the material down into its constituent monomers via thermal, chemical, or biological processes. Not all polymers are well suited to this with PET and PS being the most prominent but PU, PC, PLA, PMMA, PA, and more all have industrial activity.

Pyrolysis and gasification can convert mixed plastic waste into pyrolysis oil and syngas, respectively, via a thermochemical process. The main difference between the two is the oxygen present. The products could re-enter the polymer supply chain and create a circular economy or not be recycled and used directly for energy or converted into fuel. Pyrolysis is the most notable here with many chemical companies pursuing this and incorporating a mass balance methodology to account for sustainability. There are several technical limitations and specific considerations both upstream (sorting etc) and downstream (cracking etc) but these are beginning to be overcome. Like pyrolysis, gasification is not a new process; in fact, it has regularly been utilized for removing municipal solid waste (MSW) from landfill and converting it to energy. Gasification can be seen as the "backstop" when all other approaches are exhausted.

The chemical recycling market is on the cusp of significant growth. This unbiased market report provides a complete overview of the technology providers as well as a comprehensive list of the current plants and future projects. There is significant momentum, and the maturity will benefit the whole industry; more announcements will arrive but equally not all of those planned will ever be realized.

Overall, IDTechEx forecasts that pyrolysis and depolymerization plants will use over 17 million tonnes/year of plastic waste by 2034. This is a significant number but will require a major investment and continuous engagement from stakeholders across the value chain. Chemical recycling has a role to play in closing the loop, but it is just one small solution to a greater global challenge.

IDTechEx details recent increases in global chemical recycling capacity, with both pyrolysis and depolymerization plant capacities seeing increases of over 60% since early 2021.

Chemical recycling also has its notable critics. They point out the flaws in the claimed environmental benefits, such as the assumptions behind life cycle assessments including the comparison that waste would have otherwise been incinerated, and question the economic viability. The economics are challenging and not only influenced by the company's process but also the associated infrastructure, policy, and macroeconomic trends. The "green premium" for the products is a key factor; the further prices can be decoupled from that of oil, the greater the long-term success of these projects. This report aims to provide a balanced view of both those endorsing and criticizing the technology.

Unsurprisingly, the majority of the engagement is for FMCG packaging, but it is not limited to this sector with various textiles, automotive parts, electronic equipment, and other significant use cases.

There also remains a large amount of technology innovation, including microwave and enzymatic processes for depolymerization, hydrothermal approaches as a competition to pyrolysis, new polymer developments, and more. These developments are all detailed and appraised throughout the report.

Secondary recycling via dissolution

Secondary recycling involves recovering and re-using the plastic without breaking the chemical bonds. Mechanical routes are very well known but not always suitable and downcycle the product. An emerging space is selectively dissolving the polymer and subsequently precipitating this to produce the pure polymer; ideally, this is a low-energy process, and the recycled polymer retains properties closer to that of the virgin material.

As with chemical recycling, there are many challenges as clearly demonstrated by failed projects. However, numerous players are climbing the technology and manufacturing readiness levels and progressing to notable plants. There is key proprietary know-how in both the solvent and process conditions which must be specifically tailored. There is also a range of waste polymers being pursued with PS, PP, and PET being the more prominent. This report provides an in-depth analysis of the technology, players, plants, economic viability, environmental impact, and market outlook.

IDTechEx has a longstanding history of providing an independent technical and market assessment of sustainable plastics. This market report includes:

-

10-year market forecasts for pyrolysis, depolymerization, gasification, and dissolution; appropriate forecasts segmented by different polymer types.

-

Overview of the environmental impact and economic viability of each technology.

-

Assessment of key manufacturers including their partnerships, funding & capacity expansions.

-

Success stories, including product launches, and failures. End-user activity from single-use plastics in FMCG packaging to various textiles, automotive parts, electronic equipment, and beyond.

-

Overview of solutions and developments for key polymers including: PP, PET, PS, PE, PU, PMMA, PA, PC, and PLA.

-

Analysis of the key market drivers: governments, companies (stakeholders across the value chain including product manufacturers, brands & retailers), NGOs, and the public.

-

Global view of the status of the plastic recycling market including recycling rates, chain of custody, location, design for recyclability, and more.

-

Technology appraisal of chemical recycling and dissolution processes that enable a circular economy. This includes strengths, limitations, challenges, criticisms, and outlook.

-

Comprehensive summary of technology providers for each process.

-

Complete list of operational plants and planned projects worldwide with corresponding chemical recycling market shares.

-

Analysis of the latest R&D and technology trends with a commercial impact. This includes microwave and enzymatic processes for depolymerization, hydrothermal approaches as a competition to pyrolysis, new polymer developments, and more.

-

Interview-based player profiles.

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY AND CONCLUSIONS |

|

1.1. |

The circular economy |

|

1.2. |

What is chemical recycling? |

|

1.3. |

The increasing pace of global plastics production |

|

1.4. |

The four types of recycling: Process definitions |

|

1.5. |

Summary of chemical recycling approaches |

|

1.6. |

Chemical recycling plant economics and pricing: Overview |

|

1.7. |

Environmental viability of chemical recycling |

|

1.8. |

Environmental viability of chemical recycling (2) |

|

1.9. |

Environmental viability of chemical recycling (3) |

|

1.10. |

Chemical recycling partnerships: Mixed plastics |

|

1.11. |

Chemical recycling partnerships: Mixed plastics |

|

1.12. |

Chemical recycling partnerships: Polyethylene terephthalate |

|

1.13. |

Chemical recycling partnerships: Polystyrene |

|

1.14. |

Chemical recycling applications: Packaging |

|

1.15. |

Chemical recycling plant capacity by technology provider |

|

1.16. |

Chemical recycling plant capacity: Continuing expansion since 2021 |

|

1.17. |

Market drivers of chemical recycling |

|

1.18. |

Chemical recycling market forecast by recycling process 2024-2034 |

|

1.19. |

Chemical recycling market forecast by process and polymer 2024-2034 |

|

1.20. |

Chemical recycling market forecast by process and polymer 2024-2034 |

|

1.21. |

Scope for gasification processes in a circular economy |

|

2. |

MARKET ANALYSIS |

|

2.1. |

Chemical recycling market forecasts |

|

2.1.1. |

Market forecast methodology |

|

2.1.2. |

Dissolution market forecast by polymer type 2024-2034 |

|

2.1.3. |

Depolymerization market forecast by polymer type 2024-2034 |

|

2.1.4. |

Pyrolysis market forecast 2024-2034 |

|

2.1.5. |

Recycling municipal solid waste: Gasification market forecast 2024-2034 |

|

2.1.6. |

Gasification market forecast 2024-2034 |

|

2.2. |

Key developments |

|

2.2.1. |

Recent developments in chemical recycling and dissolution |

|

2.2.2. |

Recent chemical recycling plant announcements |

|

2.2.3. |

Recent chemical recycling plant announcements: Continued |

|

2.2.4. |

Feedstock agreements |

|

2.2.5. |

Technology developments: Enzymatic recycling of textiles |

|

2.2.6. |

AI and research into enzymes for plastic recycling |

|

2.2.7. |

Technology developments: PHA chemical recycling |

|

2.2.8. |

Technology developments: PHA chemical recycling |

|

2.2.9. |

Technology developments: Enzymatic recycling of PLA by Carbios |

|

2.2.10. |

Pricing of rPET and the impact on chemical recycling players |

|

2.3. |

Industry activity: Partnerships and products |

|

2.3.1. |

Partnerships: Mixed plastics |

|

2.3.2. |

Partnerships: Mixed plastics |

|

2.3.3. |

Partnerships: PET |

|

2.3.4. |

Partnerships: PS |

|

2.4. |

Market drivers |

|

2.4.1. |

Market drivers: Governments |

|

2.4.2. |

Market drivers: Governments |

|

2.4.3. |

Market drivers: Governments |

|

2.4.4. |

Market drivers: Governments |

|

2.4.5. |

Market drivers: Governments |

|

2.4.6. |

Market drivers: Product producers, brands & retailers in fast-moving consumer goods |

|

2.4.7. |

Market drivers: Product producers, brands & retailers in textiles |

|

2.4.8. |

Market drivers: Automotive OEMs |

|

2.4.9. |

Market drivers: NGOs |

|

2.4.10. |

Market drivers: Public |

|

2.5. |

Environmental and economic viability |

|

2.5.1. |

Impact of oil price |

|

2.5.2. |

Overview of public companies |

|

2.5.3. |

Lessons from chemical recycling project failures |

|

2.5.4. |

Lessons from chemical recycling project failures |

|

2.5.5. |

Plant economics and pricing: Overview |

|

2.5.6. |

Criticisms of chemical recycling |

|

2.5.7. |

Criticisms of chemical recycling (2) |

|

2.5.8. |

The environmental argument: LCAs |

|

2.5.9. |

Life Cycle Assessments (LCA): Polystyrene |

|

2.5.10. |

Life Cycle Assessments (LCA): Pyrolysis |

|

2.5.11. |

Utilising renewable energy in chemical recycling |

|

2.5.12. |

Chemical recycling for packaging |

|

2.5.13. |

Chemical recycling for packaging: Examples |

|

2.5.14. |

Recycled content for automotive applications |

|

2.5.15. |

Chemical recycling in the automotive industry |

|

2.5.16. |

Chemical recycling in the automotive industry |

|

2.5.17. |

Chemical recycling in the automotive industry (2) |

|

2.5.18. |

Electronics: Chemical recycling opportunity |

|

2.5.19. |

Carpets: Feedstock and application for chemical recycling |

|

2.5.20. |

Mattresses: Feedstock and application for chemical recycling |

|

2.5.21. |

Textiles: Feedstock and application for chemical recycling |

|

2.5.22. |

Construction: Feedstock and application for chemical recycling |

|

3. |

CHEMICAL RECYCLING OVERVIEW |

|

3.1. |

The four types of recycling: Process definitions |

|

3.2. |

Understanding end-of-life plastics |

|

3.3. |

Single vs multiple stream recycling |

|

3.4. |

Why are plastic recycling rates so low? |

|

3.5. |

Multi-material layered packaging |

|

3.6. |

Plastic recycling varies by polymer type |

|

3.7. |

Recycling key polymer types |

|

3.8. |

Are bioplastics the answer? |

|

3.9. |

What is chemical recycling? |

|

3.10. |

Complementary approaches for recycling |

|

3.11. |

Chemical recycling PET |

|

3.12. |

Chemical recycling PE |

|

3.13. |

Chemical recycling PP |

|

3.14. |

Chemical recycling PS |

|

3.15. |

Chemical recycling other polymer types |

|

3.16. |

Technology status by polymer feedstock |

|

3.17. |

Closing the loop on chemical recycling |

|

3.18. |

Tracking recycling: The chain of custody |

|

3.19. |

Chain of custody: mass balance (1) |

|

3.20. |

Chain of custody: Mass balance (2) |

|

3.21. |

Other chain of custody approaches |

|

3.22. |

Chemical tracers and markers |

|

3.23. |

Chemical tracers and markers |

|

3.24. |

Chain of custody and legislation |

|

3.25. |

Chain of custody and legislation (2) |

|

3.26. |

Designing polymers with dynamic bonds |

|

3.27. |

Alternative recycling routes for MSW |

|

3.28. |

Alternative recycling routes for MSW (2) |

|

3.29. |

What is recyclability by design? |

|

4. |

PYROLYSIS |

|

4.1. |

Introduction to pyrolysis |

|

4.1.1. |

Pyrolysis of plastic waste: Introduction |

ページTOPに戻る

IDTechEx社の 持続可能性 - Sustainability分野での最新刊レポート

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|