|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

What is Carbon Capture, Utilization and Storage (CCUS)? |

|

1.2. |

Why CCUS and why now? |

|

1.3. |

Development of the CCUS business model |

|

1.4. |

Carbon pricing and carbon markets |

|

1.5. |

Compliance carbon pricing mechanisms across the globe |

|

1.6. |

Alternative to carbon pricing: 45Q tax credits |

|

1.7. |

Capture from certain industries is already profitable |

|

1.8. |

CCUS business models: full chain, part chain, hubs and clusters |

|

1.9. |

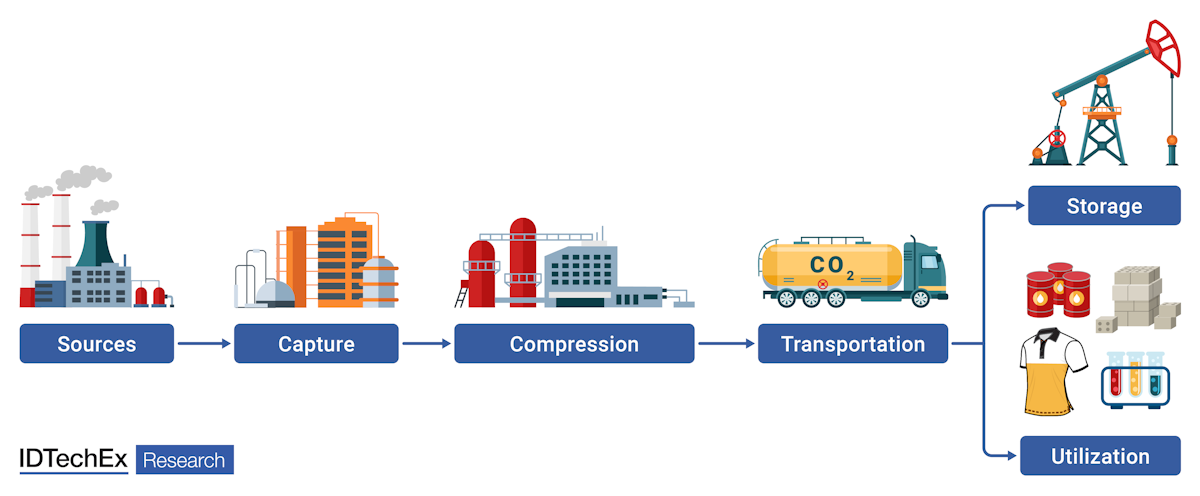

The CCUS value chain |

|

1.10. |

From which sectors has CO₂ been captured historically? |

|

1.11. |

CCUS could help decarbonize hard-to-abate sectors |

|

1.12. |

High-concentration CO₂ sources are the low-hanging fruits |

|

1.13. |

Which sectors will dominate CCUS? |

|

1.14. |

Point-source carbon capture capacity forecast by CO₂ source sector, Mtpa of CO₂ |

|

1.15. |

Point-source carbon capture forecast by CO₂ source - Gas and power |

|

1.16. |

Main CO₂ capture systems |

|

1.17. |

Technology Readiness Level (TRL): Carbon capture technologies |

|

1.18. |

Comparison of CO₂ capture technologies |

|

1.19. |

Solvent-based CO₂ capture |

|

1.20. |

Solid sorbent-based CO₂ separation |

|

1.21. |

Selecting a carbon capture technology |

|

1.22. |

What is direct air capture (DAC)? |

|

1.23. |

DAC: key takeaways |

|

1.24. |

Introduction to CO₂ transportation |

|

1.25. |

Key takeaways - CO₂ transportation |

|

1.26. |

CO₂ Utilization |

|

1.27. |

Comparison of emerging CO₂ utilization applications |

|

1.28. |

Analyst viewpoint - CO₂ utilization |

|

1.29. |

CO₂ storage |

|

1.30. |

CCUS capacity forecast by CO₂ endpoint, Mtpa of CO₂ |

|

1.31. |

CCUS forecast by CO₂ endpoint - Discussion |

|

1.32. |

Key takeaways - CO₂ storage |

|

1.33. |

Mixed performance from CCUS projects |

|

1.34. |

The momentum behind CCUS is building up |

|

1.35. |

CCUS market forecast - Overall discussion |

|

1.36. |

Access More With an IDTechEx Subscription |

|

2. |

INTRODUCTION |

|

2.1. |

What is Carbon Capture, Utilization and Storage (CCUS)? |

|

2.2. |

Why CCUS and why now? |

|

2.3. |

CCUS could help decarbonize hard-to-abate sectors |

|

2.4. |

The CCUS value chain |

|

2.5. |

Carbon capture |

|

2.6. |

The challenges in carbon capture |

|

2.7. |

Why CO₂ utilization? |

|

2.8. |

Carbon utilization |

|

2.9. |

Main emerging applications of CO₂ utilization |

|

2.10. |

Carbon storage |

|

2.11. |

Carbon transport |

|

2.12. |

The costs of CCUS |

|

2.13. |

When can CCUS be considered net-zero? |

|

2.14. |

The challenges in CCUS |

|

3. |

BUSINESS MODELS FOR CCUS |

|

3.1. |

Introduction |

|

3.1.1. |

Development of the CCUS business model |

|

3.1.2. |

Government funding support mechanisms for CCUS |

|

3.1.3. |

Government ownership of CCUS projects varies across countries |

|

3.1.4. |

CCUS business model: full value chain |

|

3.1.5. |

CCUS business model: networks and hub model |

|

3.1.6. |

CCUS industrial clusters in the UK: East Coast Cluster |

|

3.1.7. |

CCUS industrial clusters in the UK: HyNet |

|

3.1.8. |

CCUS industrial clusters in the UK: conclusions |

|

3.1.9. |

Part chain CCUS business models |

|

3.1.10. |

Why CO₂ utilization should not be overlooked |

|

3.2. |

Carbon pricing and carbon markets |

|

3.2.1. |

Carbon pricing and carbon markets |

|

3.2.2. |

Compliance carbon pricing mechanisms across the globe |

|

3.2.3. |

What is the price of CO₂ in global carbon pricing mechanisms? |

|

3.2.4. |

The European Union Emission Trading Scheme (EU ETS) |

|

3.2.5. |

Has the EU ETS had an impact? |

|

3.2.6. |

Carbon pricing in the US |

|

3.2.7. |

Alternative to carbon pricing: 45Q tax credits |

|

3.2.8. |

Carbon pricing in China |

|

3.2.9. |

The role of voluntary carbon markets in supporting CCUS |

|

3.2.10. |

Carbon accounting: double counting is not allowed |

|

3.2.11. |

Challenges with carbon pricing |

|

3.2.12. |

How high does carbon pricing need to be to support CCS? |

|

4. |

STATUS OF THE CCUS INDUSTRY |

|

4.1. |

The momentum behind CCUS is building up |

|

4.2. |

Momentum: Government support for CCUS |

|

4.3. |

Supportive legal and regulatory framework for CCUS |

|

4.4. |

Global pipeline of carbon capture facilities built and announced |

|

4.5. |

Analysis of CCUS development |

|

4.6. |

CO₂ source: From which sectors has CO₂ been captured historically? |

|

4.7. |

Which sectors will see the biggest growth in CCUS? |

|

4.8. |

CO₂ fate: Where does/will the captured CO₂ go? |

|

4.9. |

Regional analysis of CCUS Projects |

|

4.10. |

Major CCUS players |

|

4.11. |

Mixed performance from CCUS projects |

|

4.12. |

Major CCUS projects performance comparison (1/3) |

|

4.13. |

Major CCUS projects performance comparison (2/3) |

|

4.14. |

Major CCUS projects performance comparison (3/3) |

|

4.15. |

Boundary Dam - battling capture technical issues |

|

4.16. |

Petra Nova's long shutdown: lessons for the industry? |

|

4.17. |

How much does CCUS cost? |

|

4.18. |

Enabling large-scale CCUS |

|

5. |

CARBON DIOXIDE CAPTURE |

|

5.1. |

Introduction |

|

5.1.1. |

Main CO₂ capture systems |

|

5.1.2. |

The CCUS value chain |

|

5.1.3. |

Status of point source carbon capture |

|

5.1.4. |

Comparison of point-source CO₂ capture systems |

|

5.1.5. |

Natural gas sweetening |

|

5.1.6. |

Post-combustion CO₂ capture |

|

5.1.7. |

Post-combustion: Equipment space requirements |

|

5.1.8. |

Pre-combustion CO₂ capture |

|

5.1.9. |

Oxy-fuel combustion CO₂ capture |

|

5.1.10. |

Main CO₂ capture technologies |

|

5.1.11. |

Technology Readiness Level (TRL): Carbon capture technologies |

|

5.1.12. |

Carbon capture technology providers for existing large-scale projects |

|

5.1.13. |

Comparison of CO₂ capture technologies |

|

5.1.14. |

When should different carbon capture technologies be used? |

|

5.1.15. |

Typical conditions and performance for different capture technologies |

|

5.1.16. |

Carbon capture |

|

5.1.17. |

Going beyond CO₂ capture rates of 90% |

|

5.1.18. |

99% capture rate: Suitability of different PSCC technologies |

|

5.1.19. |

The challenges in carbon capture |

|

5.1.20. |

CO₂ capture: Technological gaps |

|

5.1.21. |

Metrics for CO₂ capture agents |

|

5.1.22. |

CO₂ concentration and partial pressure varies with emission source |

|

5.1.23. |

How does CO₂ partial pressure influence cost? |

|

5.1.24. |

High-concentration CO₂ sources are the low-hanging fruits |

|

5.1.25. |

PSCC technologies: Cost, energy demand, and CO₂ recovery |

|

5.1.26. |

Techno-economic comparison of CO₂ capture technologies (1/2) |

|

5.1.27. |

Techno-economic comparison of CO₂ capture technologies (2/2) |

|

5.2. |

Solvents for CO₂ capture |

|

5.2.1. |

Solvent-based CO₂ capture |

|

5.2.2. |

Chemical absorption solvents |

|

5.2.3. |

Amine-based post-combustion CO₂ absorption |

|

5.2.4. |

Hot Potassium Carbonate (HPC) process |

|

5.2.5. |

Comparison of key chemical solvent-based systems (1/2) |

|

5.2.6. |

Comparison of key chemical solvent-based systems (2/2) |

|

5.2.7. |

Chemical absorption solvents used in current operational CCUS point-source projects (1/2) |

|

5.2.8. |

Chemical absorption solvents used in current operational CCUS point-source projects (2/2) |

|

5.2.9. |

Physical absorption solvents |

|

5.2.10. |

Comparison of key physical absorption solvents |

|

5.2.11. |

Physical solvents used in current operational CCUS point-source projects |

|

5.2.12. |

Innovation addressing solvent-based CO₂ capture drawbacks |

|

5.2.13. |

When should solvent-based carbon capture be used? |

|

5.3. |

Emerging solvents for carbon capture |

|

5.3.1. |

Innovation in carbon capture solvents |

|

5.3.2. |

Chilled ammonia process (CAP) |

|

5.3.3. |

Comparison of key chemical solvent-based systems - emerging |

|

5.3.4. |

Applicability of chemical absorption solvents capture solvents for post-combustion applications |

|

5.3.5. |

Next generation solvent technologies for point-source carbon capture |

|

5.4. |

Sorbents for CO₂ capture |

|

5.4.1. |

Solid sorbent-based CO₂ separation |

|

5.4.2. |

Overview of solid sorbents explored for carbon capture |

|

5.4.3. |

Metal organic framework (MOF) adsorbents |

|

5.4.4. |

Zeolite-based adsorbents |

|

5.4.5. |

Solid amine-based adsorbents |

|

5.4.6. |

Carbon-based adsorbents |

|

5.4.7. |

Polymer-based adsorbents |

|

5.4.8. |

Solid sorbents in pre-combustion applications |

|

5.4.9. |

Sorption Enhanced Water Gas Shift (SEWGS) |

|

5.4.10. |

Solid sorbents in post-combustion applications |

|

5.4.11. |

Comparison of emerging solid sorbent systems |

|

5.5. |

Membrane-based CO₂ capture |

|

5.5.1. |

Membrane-based CO₂ separation |

|

5.5.2. |

Membranes: Operating principles |

|

5.5.3. |

How is membrane performance characterised? |

|

5.5.4. |

Technical advantages and challenges for membrane-based CO₂ separation |

|

5.5.5. |

Comparison of membrane materials for CCUS (1/2) |

|

5.5.6. |

Comparison of membrane materials for CCUS (2/2) |

|

5.5.7. |

Commercial status of membranes in carbon capture (1/2) |

|

5.5.8. |

Commercial status of membranes in carbon capture (2/2) |

|

5.5.9. |

Membranes for post-combustion CO₂ capture |

|

5.5.10. |

Facilitated transport membranes could unlock low-cost operating conditions |

|

5.5.11. |

When should be membrane carbon capture be used? |

|

5.5.12. |

Membranes for pre-combustion capture (1/2) |

|

5.5.13. |

Membranes for pre-combustion capture (2/2) |

|

5.5.14. |

Key development areas for membranes in carbon capture |

|

5.6. |

Cryogenic CO₂ capture |

|

5.6.1. |

Cryogenic CO₂ capture: an emerging alternative |

|

5.6.2. |

When should cryogenic carbon capture be used? |

|

5.6.3. |

Status of cryogenic CO₂ capture technologies |

|

5.6.4. |

Cryogenic CO₂ capture in blue hydrogen: Cryocap™ |

|

5.7. |

Oxyfuel combustion capture |

|

5.7.1. |

Oxy-fuel combustion CO₂ capture |

|

5.7.2. |

Oxygen separation technologies for oxy-fuel combustion |

|

5.7.3. |

Oxyfuel CCUS projects in the cement industry |

|

5.7.4. |

Large-scale oxyfuel CCUS cement projects in the pipeline |

|

5.7.5. |

Oxyfuel CCUS in the power generation industry |

|

5.7.6. |

Novel oxyfuel: Chemical looping combustion (CLC) |

|

5.8. |

Novel CO₂ capture technologies |

|

5.8.1. |

LEILAC process: Direct CO₂ capture in cement plants |

|

5.8.2. |

LEILAC process: Configuration options |

|

5.8.3. |

Calcium Looping (CaL) |

|

5.8.4. |

Calcium Looping (CaL) configuration options |

|

5.8.5. |

CO₂ capture with Solid Oxide Fuel Cells (SOFCs) |

|

5.8.6. |

CO₂ capture with Molten Carbonate Fuel Cells (MCFCs) |

|

5.8.7. |

The Allam-Fetvedt Cycle |

|

5.8.8. |

Summary: PSCC technology readiness and providers (1/2) |

|

5.8.9. |

Summary: PSCC technology readiness and providers (2/2) |

|

5.9. |

Point-source Carbon Capture in Key Industrial Sectors |

|

5.9.1. |

Which sectors will see the biggest growth in CCUS? |

|

5.9.2. |

Capture costs vary by sector |

|

5.9.3. |

Power plants with CCUS generate less energy |

|

5.9.4. |

The impact of PSCC on power plant efficiency |

|

5.9.5. |

The cost of increasing the rate of CO₂ capture in the power sector |

|

5.9.6. |

Blue Hydrogen Production and Markets 2023-2033: Technologies, Forecasts, Players |

|

5.9.7. |

Blue hydrogen: main syngas production technologies |

|

5.9.8. |

Blue hydrogen production - SMR with CCUS |

|

5.9.9. |

Pre- vs post-combustion CO₂ capture for blue hydrogen |

|

5.9.10. |

CO₂ capture retrofit options for blue H2 production (1/2) |

|

5.9.11. |

CO₂ capture retrofit options for blue H2 production (2/2) |

|

5.9.12. |

CO₂ capture retrofit options - Honeywell UOP example |

|

5.9.13. |

Example project value chain |

|

5.9.14. |

Notable blue hydrogen projects |

|

5.9.15. |

Cost comparison: Commercial CO₂ capture systems for blue H2 |

|

5.9.16. |

The cost of CO₂ capture in blue hydrogen production |

|

5.9.17. |

CO₂ capture for blue hydrogen production |

|

5.9.18. |

Summary of point-source carbon capture for blue H2 |

|

5.9.19. |

Early CCUS opportunity: BECCS |

|

5.9.20. |

The role of CCUS in decarbonizing cement |

|

5.9.21. |

Status of carbon capture in the cement industry |

|

5.9.22. |

Major future CCUS projects in the cement sector |

|

5.9.23. |

Carbon capture technologies demonstrated in the cement sector |

|

5.9.24. |

SkyMine® chemical absorption: The largest CCU demonstration in the cement sector |

|

5.9.25. |

Carbon Capture and Utilization (CCU) in the cement sector: Fortera's ReCarb™ |

|

5.9.26. |

Algae CO₂ capture from cement plants |

|

5.9.27. |

Cost and technological status of carbon capture in the cement sector |

|

5.9.28. |

Maritime carbon capture: Onboard Carbon Capture and Storage |

|

5.10. |

Direct Air Capture |

|

5.10.1. |

DAC vs point-source carbon capture |

|

5.10.2. |

What is direct air capture (DAC)? |

|

5.10.3. |

Why DACCS as a CDR solution? |

|

5.10.4. |

Current status of DACCS |

|

5.10.5. |

Momentum: private investments in DAC |

|

5.10.6. |

Momentum: public investment and policy support for DAC |

|

5.10.7. |

Momentum: DAC-specific regulation |

|

5.10.8. |

DAC land requirement is an advantage |

|

5.10.9. |

CO₂ capture/separation mechanisms in DAC |

|

5.10.10. |

Direct air capture technologies |

|

5.10.11. |

DAC solid sorbent swing adsorption processes (1/2) |

|

5.10.12. |

DAC solid sorbent swing adsorption processes (2/2) |

|

5.10.13. |

Electro-swing adsorption of CO₂ for DAC |

|

5.10.14. |

Solid sorbents in DAC |

|

5.10.15. |

Emerging solid sorbent materials for DAC |

|

5.10.16. |

Liquid solvent-based DAC |

|

5.10.17. |

Process flow diagram of S-DAC |

|

5.10.18. |

Process flow diagram of L-DAC |

|

5.10.19. |

Process flow diagram of CaO looping |

|

5.10.20. |

Solid sorbent- vs liquid solvent-based DAC |

|

5.10.21. |

Electricity and heat sources |

|

5.10.22. |

Requirements to capture 1 Mt of CO₂ per year |

|

5.10.23. |

DAC companies by country |

|

5.10.24. |

Direct air capture company landscape |

|

5.10.25. |

A comparison of the three DAC pioneers |

|

5.10.26. |

TRLs of direct air capture players |

|

5.10.27. |

Climeworks |

|

5.10.28. |

Carbon Engineering |

|

5.10.29. |

Global Thermostat |

|

5.10.30. |

Heirloom |

|

5.10.31. |

DACCS carbon credit sales by company |

|

5.10.32. |

Challenges associated with DAC technology (1/2) |

|

5.10.33. |

Challenges associated with DAC technology (2/2) |

|

5.10.34. |

Oil and gas sector involvement in DAC |

|

5.10.35. |

DACCS co-location with geothermal energy |

|

5.10.36. |

Will DAC be deployed in time to make a difference? |

|

5.10.37. |

What can DAC learn from the wind and solar industries' scale-up? |

|

5.10.38. |

What is needed for DAC to achieve the gigatonne capacity by 2050? |

|

5.10.39. |

The economics of DAC |

|

5.10.40. |

The CAPEX of DAC |

|

5.10.41. |

The CAPEX of DAC: sub-system contribution |

|

5.10.42. |

The OPEX of DAC |

|

5.10.43. |

Overall capture cost of DAC (1/2) |

|

5.10.44. |

Overall capture cost of DAC (2/2) |

|

5.10.45. |

Component specific capture cost contributions for DACCS |

|

5.10.46. |

Financing DAC |

|

5.10.47. |

DACCS SWOT analysis |

|

5.10.48. |

DACCS: summary |

|

5.10.49. |

DAC: key takeaways |

|

6. |

CARBON DIOXIDE REMOVAL (CDR) |

|

6.1. |

Introduction |

|

6.1.1. |

Carbon Dioxide Removal (CDR) 2024-2044: Technologies, Players, Carbon Credit Markets, and Forecasts |

|

6.1.2. |

Why carbon dioxide removal (CDR)? |

|

6.1.3. |

What is CDR and how is it different from CCUS? |

|

6.1.4. |

Description of the main CDR methods |

|

6.1.5. |

Technology Readiness Level (TRL): Carbon dioxide removal methods |

|

6.1.6. |

The state of CDR in compliance markets |

|

6.1.7. |

The state of CDR in the voluntary carbon market |

|

6.1.8. |

Shifting buyer preferences for durable CDR in carbon credit markets |

|

6.2. |

BECCS |

|

6.2.1. |

Bioenergy with carbon capture and storage (BECCS) |

|

6.2.2. |

Opportunities in BECCS: heat generation |

|

6.2.3. |

The economics of BECCS |

|

6.2.4. |

Opportunities in BECCS: waste-to-energy |

|

6.2.5. |

BECCS Value Chain |

|

6.2.6. |

BECCS current status |

|

6.2.7. |

Trends in BECCUS projects (1/2) |

|

6.2.8. |

Trends in BECCUS projects (2/2) |

|

6.2.9. |

The challenges of BECCS |

|

6.2.10. |

What is the business model for BECCS? |

|

6.2.11. |

BECCS carbon credits |

|

6.2.12. |

The energy and carbon efficiency of BECCS |

|

6.2.13. |

Is BECCS sustainable? |

|

6.2.14. |

BECCS Outlook: Government support and large-scale demonstrations needed |

|

6.2.15. |

Ocean-based NETs |

|

6.2.16. |

Direct ocean capture |

|

6.2.17. |

State of technology in direct ocean capture |

|

6.2.18. |

Future direct ocean capture technologies |

|

6.2.19. |

Ocean-based CDR: key takeaways |

|

6.3. |

Ocean-based CDR and direct ocean capture |

|

6.3.1. |

Biochar: key takeaways |

|

6.3.2. |

Afforestation and reforestation: key takeaways |

|

6.3.3. |

Mineralization: key takeaways |

|

6.3.4. |

CDR technologies: key takeaways |

|

7. |

CARBON DIOXIDE UTILIZATION |

|

7.1. |

Introduction |

|

7.1.1. |

Carbon Dioxide Utilization 2024-2044: Technologies, Market Forecasts, and Players |

|

7.1.2. |

Why CO₂ utilization? |

|

7.1.3. |

How is CO₂ used and sourced today? |

|

7.1.4. |

CO₂ utilization pathways |

|

7.1.5. |

Emerging applications of CO₂ utilization |

|

7.1.6. |

Comparison of emerging CO₂ utilization applications |

|

7.1.7. |

Factors driving CO₂ U future market potential |

|

7.1.8. |

Carbon utilization potential and climate benefits |

|

7.1.9. |

Cost effectiveness of CO₂ utilization applications |

|

7.1.10. |

Traction in CO₂ U: funding worldwide |

|

7.1.11. |

Technology readiness and climate benefits of CO₂ U pathways |

|

7.1.12. |

When can CO₂ utilization be considered "net-zero"? |

|

7.1.13. |

How is CO₂ utilization treated in existing regulations? |

|

7.1.14. |

CO₂ utilization: Analyst viewpoint (i) |

|

7.1.15. |

CO₂ utilization: Analyst viewpoint (ii) |

|

7.1.16. |

Carbon utilization business models |

|

7.2. |

CO₂ -derived concrete |

|

7.2.1. |

The Basic Chemistry: CO₂ Mineralization |

|

7.2.2. |

CO₂ use in the cement and concrete supply chain |

|

7.2.3. |

CO₂ utilization in concrete curing or mixing |

|

7.2.4. |

CO₂ utilization in carbonates (aggregates and additives) |

|

7.2.5. |

CO₂ -derived carbonates from waste |

|

7.2.6. |

CO₂ -derived carbonates from waste (ii) |

|

7.2.7. |

The market potential of CO₂ use in the construction industry |

|

7.2.8. |

Supplying CO₂ to a decentralized concrete industry |

|

7.2.9. |

Future of CO₂ supply for concrete |

|

7.2.10. |

Prefabricated versus ready-mixed concrete markets |

|

7.2.11. |

Market dynamics of cement and concrete |

|

7.2.12. |

CO₂ U business models in building materials |

|

7.2.13. |

CO₂ utilization players in mineralization |

|

7.2.14. |

Concrete carbon footprint of key CO₂ U companies |

|

7.2.15. |

Key takeaways in CO₂ -derived building materials |

|

7.2.16. |

Key takeaways in CO₂ -derived building materials (ii) |

|

7.2.17. |

Key takeaways in CO₂ -derived building materials (iii) |

|

7.3. |

CO₂ -derived chemicals and polymers |

|

7.3.1. |

CO₂ can be converted into a giant range of chemicals |

|

7.3.2. |

Using CO₂ as a feedstock is energy-intensive |

|

7.3.3. |

The basics: types of CO₂ utilization reactions |

|

7.3.4. |

CO₂ may need to be first converted into CO or syngas |

|

7.3.5. |

Fischer-Tropsch synthesis: syngas to hydrocarbons |

|

7.3.6. |

Direct Fischer-Tropsch synthesis: CO₂ to hydrocarbons |

|

7.3.7. |

Electrochemical CO₂ reduction |

|

7.3.8. |

Electrochemical CO₂ reduction technologies |

|

7.3.9. |

Low-temperature electrochemical CO₂ reduction |

|

7.3.10. |

High-temperature solid oxide electrolyzers |

|

7.3.11. |

Cost parity has been a challenge for CO₂ -derived methanol |

|

7.3.12. |

Thermochemical methods: CO₂ -derived methanol |

|

7.3.13. |

Major CO₂ -derived methanol projects |

|

7.3.14. |

Aromatic hydrocarbons from CO₂ |

|

7.3.15. |

"Artificial photosynthesis" - photocatalytic reduction methods |

|

7.3.16. |

Plasma technology for CO₂ conversion |

|

7.3.17. |

Major pathways to convert CO₂ into polymers |

|

7.3.18. |

CO₂ -derived linear-chain polycarbonates |

|

7.3.19. |

Commercial production of polycarbonate from CO₂ |

|

7.3.20. |

Commercial production of CO₂ -derived polymers |

|

7.3.21. |

Carbon nanostructures made from CO₂ |

|

7.3.22. |

Players in CO₂ -derived chemicals by end-product |

|

7.3.23. |

CO₂-derived chemicals: Market potential |

|

7.3.24. |

Are CO₂ -derived chemicals climate beneficial? |

|

7.3.25. |

Centralized or distributed chemical manufacturing? |

|

7.3.26. |

Could the chemical industry run on CO₂ ? |

|

7.3.27. |

Which CO₂ U technologies are more suitable to which products? |

|

7.3.28. |

Technical feasibility of main CO₂ -derived chemicals |

|

7.3.29. |

Key takeaways in CO₂ -derived chemicals |

|

7.4. |

CO₂ -derived fuels |

|

7.4.1. |

What are CO₂ -derived fuels (power-to-X)? |

|

7.4.2. |

CO₂ can be converted into a variety of fuels |

|

7.4.3. |

Summary of main routes to CO₂ -fuels |

|

7.4.4. |

The challenge of energy efficiency |

|

7.4.5. |

CO₂ -fuels are pertinent to a specific context |

|

7.4.6. |

CO₂ -fuels in road vehicles |

|

7.4.7. |

CO₂ -fuels in shipping |

|

7.4.8. |

CO₂ -fuels in aviation |

|

7.4.9. |

Power-to-methane |

|

7.4.10. |

Synthetic natural gas - thermocatalytic pathway |

|

7.4.11. |

Biological fermentation of CO₂ into methane |

|

7.4.12. |

Drivers and barriers for Power-to-Methane technology adoption |

|

7.4.13. |

Power-to-Methane projects worldwide - current and announced |

|

7.4.14. |

Can CO₂ -fuels achieve cost parity with fossil-fuels? |

|

7.4.15. |

CO₂ -fuels rollout is linked to electrolyzer capacity |

|

7.4.16. |

Low-carbon hydrogen is crucial to CO₂ -fuels |

|

7.4.17. |

CO₂ -derived fuels projects announced - regional |

|

7.4.18. |

CO₂ -derived fuels projects worldwide over time - current and announced |

|

7.4.19. |

CO₂ -fuels from solar power |

|

7.4.20. |

Companies in CO₂ -fuels by end-product |

|

7.4.21. |

Are CO₂ -fuels climate beneficial? |

|

7.4.22. |

CO₂ -derived fuels SWOT analysis |

|

7.4.23. |

CO₂ -derived fuels: market potential |

|

7.4.24. |

Key takeaways in CO₂ -derived fuels |

|

7.5. |

CO₂ utilization in biological yield boosting |

|

7.5.1. |

CO₂ utilization in biological processes |

|

7.5.2. |

Main companies using CO₂ in biological processes |

|

7.5.3. |

CO₂ enrichment in greenhouses |

|

7.5.4. |

CO₂ enrichment in greenhouses: market potential |

|

7.5.5. |

CO₂ enrichment in greenhouses: pros and cons |

|

7.5.6. |

Advancements in greenhouse CO₂ enrichment |

|

7.5.7. |

CO₂ -enhanced algae or cyanobacteria cultivation |

|

7.5.8. |

CO₂ -enhanced algae cultivation: open systems |

|

7.5.9. |

CO₂ -enhanced algae cultivation: closed systems |

|

7.5.10. |

Algae has multiple market applications |

|

7.5.11. |

The algae-based fuel market has been rocky |

|

7.5.12. |

CO₂ -enhanced algae cultivation: pros and cons |

|

7.5.13. |

CO₂ utilization in biomanufacturing |

|

7.5.14. |

CO₂ -consuming microorganisms |

|

7.5.15. |

Food and feed from CO₂ |

|

7.5.16. |

CO₂ -derived food and feed: market |

|

7.5.17. |

Carbon fermentation: pros and cons |

|

7.5.18. |

Key takeaways in CO₂ biological yield boosting |

|

8. |

CARBON DIOXIDE STORAGE |

|

8.1. |

Introduction |

|

8.1.1. |

The case for carbon dioxide storage or sequestration |

|

8.1.2. |

Storing supercritical CO₂ underground |

|

8.1.3. |

Mechanisms of subsurface CO₂ trapping |

|

8.1.4. |

CO₂ leakage is a small risk |

|

8.1.5. |

Earthquakes and CO₂ leakage |

|

8.1.6. |

Storage type for geologic CO₂ storage: saline aquifers |

|

8.1.7. |

Storage type for geologic CO₂ storage: depleted oil and gas fields |

|

8.1.8. |

Unconventional storage resources: coal seams and shale |

|

8.1.9. |

Unconventional storage resources: basalts and ultra-mafic rocks |

|

8.1.10. |

Estimates of global CO₂ storage space |

|

8.1.11. |

CO₂ storage potential by country |

|

8.1.12. |

Permitting and authorization of CO₂ storage |

|

8.1.13. |

Monitoring, reporting, and verification (MRV) in CO₂ storage |

|

8.1.14. |

MRV Technologies and Costs in CO₂ Storage |

|

8.1.15. |

Carbon storage: Technical challenges |

|

8.2. |

Status of CO₂ Storage Projects |

|

8.2.1. |

Technology status of CO₂ storage |

|

8.2.2. |

World map of operational and under construction large-scale dedicated CO₂ storage sites |

|

8.2.3. |

Available CO₂ storage will soon outstrip CO₂ captured |

|

8.2.4. |

Dedicated geological storage will soon outpace CO₂ -EOR |

|

8.2.5. |

Can CO₂ storage be monetized? |

|

8.2.6. |

Part-chain storage project in the North Sea: The Longship Project |

|

8.2.7. |

Part-chain storage project in the North Sea: The Porthos Project |

|

8.2.8. |

The cost of carbon sequestration (1/2) |

|

8.2.9. |

The cost of carbon sequestration (2/2) |

|

8.2.10. |

Storage-type TRL and operator landscape |

|

8.2.11. |

Key takeaways |

|

8.3. |

CO₂ -EOR |

|

8.3.1. |

What is CO₂ -EOR? |

|

8.3.2. |

What happens to the injected CO₂ ? |

|

8.3.3. |

Types of CO₂ -EOR designs |

|

8.3.4. |

Global status of CO₂ -EOR: U.S. dominates but other regions arise |

|

8.3.5. |

World's large-scale CO₂ capture with CO₂ -EOR facilities |

|

8.3.6. |

CO₂ -EOR potential |

|

8.3.7. |

Most CO₂ in the U.S. is still naturally sourced |

|

8.3.8. |

CO₂ -EOR main players in the U.S. |

|

8.3.9. |

CO₂ -EOR main players in North America |

|

8.3.10. |

CO₂ -EOR in China |

|

8.3.11. |

The economics of promoting CO₂ storage through CO₂ -EOR |

|

8.3.12. |

The impact of oil prices on CO₂ -EOR feasibility |

|

8.3.13. |

Climate considerations in CO₂ -EOR |

|

8.3.14. |

The climate impact of CO₂ -EOR varies over time |

|

8.3.15. |

CO₂ -EOR: an on-ramp for CCS and DACCS? |

|

8.3.16. |

CO₂ -EOR: Progressive or "Greenwashing" |

|

8.3.17. |

Future advancements in CO₂ -EOR |

|

8.3.18. |

CO₂ -EOR SWOT analysis |

|

8.3.19. |

Key takeaways: market |

|

8.3.20. |

Key takeaways: environmental |

|

9. |

CARBON DIOXIDE TRANSPORTATION |

|

9.1. |

Introduction to CO₂ transportation |

|

9.2. |

Phases of CO₂ for transportation |

|

9.3. |

Overview of CO₂ transportation methods and conditions |

|

9.4. |

Status of CO₂ transportation methods in CCS projects |

|

9.5. |

CO₂ transportation by pipeline |

|

9.6. |

CO₂ pipeline infrastructure development in the US |

|

9.7. |

CO₂ pipelines: Technical challenges |

|

9.8. |

CO₂ transportation by ship |

|

9.9. |

CO₂ transportation by ship: innovations in ship design |

|

9.10. |

CO₂ transportation by rail and truck |

|

9.11. |

Purity requirements of CO₂ transportation |

|

9.12. |

General cost comparison of CO₂ transportation methods |

|

9.13. |

CAPEX and OPEX contributions |

|

9.14. |

Cost considerations in CO₂ transport |

|

9.15. |

Transboundary networks for CO₂ transport: Europe |

|

9.16. |

Available CO₂ transportation will soon outstrip CO₂ captured |

|

9.17. |

Potential for cost reduction in transport and storage |

|

9.18. |

CO₂ transport operators |

|

9.19. |

CO₂ transport and/or storage as a service business model |

|

9.20. |

Key takeaways |

|

10. |

MARKET FORECASTS |

|

10.1.1. |

CCUS forecast methodology |

|

10.1.2. |

CCUS forecast breakdown |

|

10.1.3. |

CCUS market forecast - Overall discussion |

|

10.1.4. |

CCUS capture capacity forecast by CO₂ endpoint, Mtpa of CO₂ |

|

10.1.5. |

CCUS forecast by CO₂ endpoint - Discussion |

|

10.1.6. |

CCUS forecast by CO₂ endpoint - CO₂ storage |

|

10.1.7. |

CCUS forecast by CO₂ endpoint - CO₂ enhanced oil recovery (EOR) |

|

10.1.8. |

Emerging CO₂ utilization capacity forecast by CO₂ end-use, Mtpa of CO₂ |

|

10.1.9. |

CCUS forecast by CO₂ endpoint - Emerging CO₂ utilization |

|

10.1.10. |

CCUS revenue potential for captured CO₂ offtaker, billion US $ |

|

10.1.11. |

CCUS revenue for captured CO₂ offtaker |

|

10.1.12. |

CCUS capacity forecast by capture type, Mtpa of CO₂ |

|

10.1.13. |

CCUS forecast by capture type - Direct Air Capture (DAC) capacity forecast |

|

10.1.14. |

Point-source CCUS capture capacity forecast by CO₂ source sector, Mtpa of CO₂ |

|

10.1.15. |

Point-source carbon capture forecast by CO₂ source - Industry |

|

10.1.16. |

Point-source carbon capture forecast by CO₂ source - blue hydrogen and blue ammonia |

|

10.1.17. |

Point-source carbon capture forecast by CO₂ source - Gas and power |

|

10.1.18. |

Point-source carbon capture forecast by CO₂ source - BECCUS |

|

11. |

COMPANY PROFILES |

|

11.1. |

3R-BioPhosphate |

|

11.2. |

Adaptavate |

|

11.3. |

Aether Diamonds |

|

11.4. |

Airco Process Technology |

|

11.5. |

Airex Energy |

|

11.6. |

Airhive |

|

11.7. |

Aker Carbon Capture |

|

11.8. |

Arborea |

|

11.9. |

Ardent |

|

11.10. |

AspiraDAC: MOF-Based DAC Technology Using Solar Power |

|

11.11. |

Atoco (MOF-Based AWH and Carbon Capture) |

|

11.12. |

Avantium: Volta Technology |

|

11.13. |

BC Biocarbon |

|

11.14. |

Bright Renewables: Carbon Capture |

|

11.15. |

C-Capture |

|

11.16. |

CapChar |

|

11.17. |

CarbiCrete |

|

11.18. |

Carbo Culture |

|

11.19. |

Carboclave |

|

11.20. |

Carbofex |

|

11.21. |

Carbogenics |

|

11.22. |

Carboclave |

|

11.23. |

Carbon Engineering |

|

11.24. |

Carbon Neutral Fuels |

|

11.25. |

Carbon Recycling International |

|

11.26. |

Carbonaide |

|

11.27. |

CarbonBlue |

|

11.28. |

CarbonBuilt |

|

11.29. |

CarbonCapture Inc. |

|

11.30. |

CarbonCure |

|

11.31. |

CarbonFree |

|

11.32. |

Carbyon |

|

11.33. |

CERT Systems |

|

11.34. |

Chiyoda: CCUS |

|

11.35. |

Climeworks |

|

11.36. |

CO2 GRO Inc. |

|

11.37. |

CO₂ Capsol |

|

11.38. |

CSIRO: MOF-Based DAC Technology (Airthena) |

|

11.39. |

Deep Branch |

|

11.40. |

Dimensional Energy |

|

11.41. |

Econic Technologies |

|

11.42. |

Equatic |

|

11.43. |

Fluor: Carbon Capture |

|

11.44. |

Fortera Corporation |

|

11.45. |

FuelCell Energy |

|

11.46. |

Future Biogas |

|

11.47. |

Giammarco Vetrocoke |

|

11.48. |

Global Thermostat |

|

11.49. |

Graphyte |

|

11.50. |

GreenCap Solutions |

|

11.51. |

Greenore |

|

11.52. |

Heirloom |

|

11.53. |

LanzaTech |

|

11.54. |

Liquid Wind |

|

11.55. |

Mission Zero Technologies |

|

11.56. |

Mosaic Materials: MOF-Based DAC Technology |

|

11.57. |

Myno Carbon |

|

11.58. |

NeoCarbon |

|

11.59. |

neustark |

|

11.60. |

NovoMOF |

|

11.61. |

Noya |

|

11.62. |

Nuada: MOF-Based Carbon Capture |

|

11.63. |

O.C.O Technology |

|

11.64. |

Orchestra Scientific: MOF-Based Carbon Separation |

|

11.65. |

OXCCU |

|

11.66. |

Paebbl |

|

11.67. |

Pentair: Carbon Capture |

|

11.68. |

Prometheus Fuels |

|

11.69. |

PyroCCS |

|

11.70. |

Seaweed Generation |

|

11.71. |

Seratech |

|

11.72. |

Skytree |

|

11.73. |

Solar Foods |

|

11.74. |

Soletair Power |

|

11.75. |

Solidia Technologies |

|

11.76. |

Svante: MOF-Based Carbon Capture |

|

11.77. |

Synhelion |

|

11.78. |

Takachar |

|

11.79. |

UNDO |

|

11.80. |

UniSieve: MOF-Based Membrane Technology |

|

11.81. |

UP Catalyst |

|

11.82. |

Verdox |

|

11.83. |

Vycarb |

|

11.84. |

WasteX |

.png)

.png)

.png)