|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Energy storage: A Li-ion battery led market |

|

1.2. |

Global Li-ion BESS market headlines and key commentary |

|

1.3. |

Advantages and disadvantages of battery storage technologies |

|

1.4. |

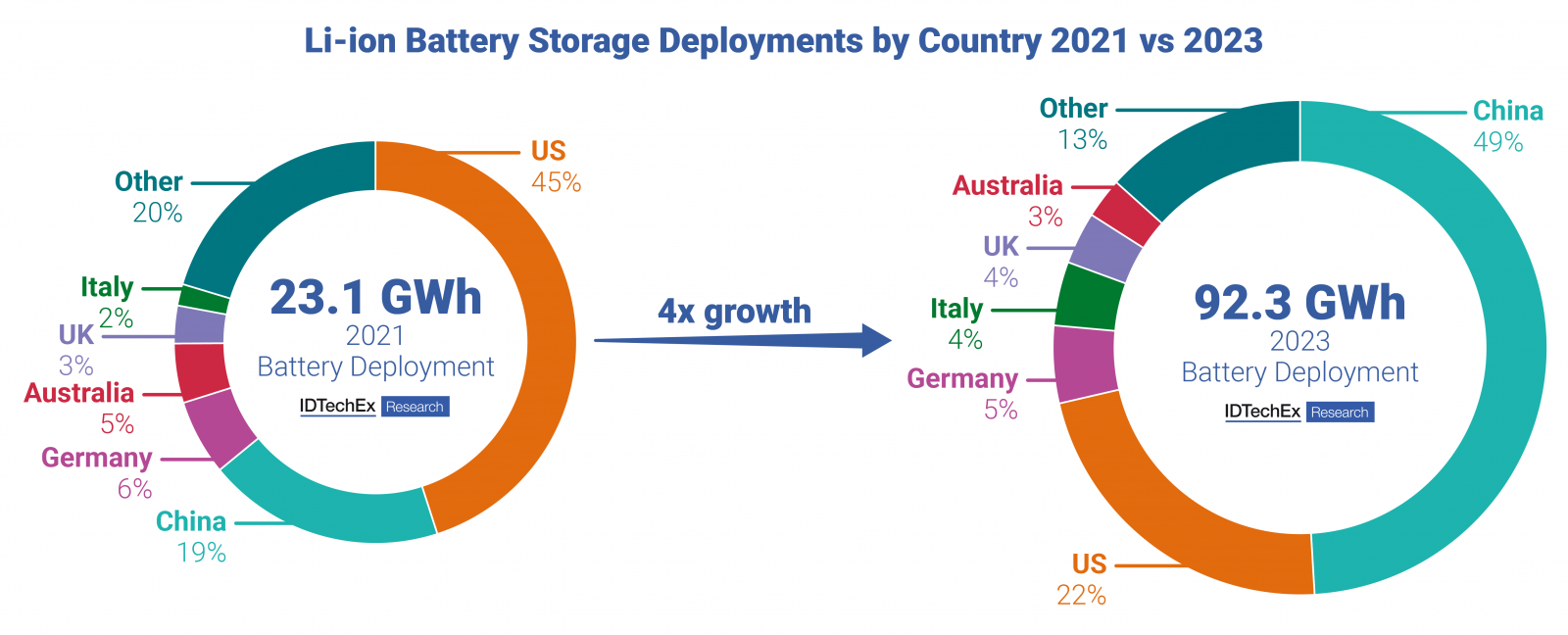

Li-ion battery storage deployments by country 2023 vs 2021 |

|

1.5. |

Na-ion batteries for stationary energy storage |

|

1.6. |

Li-ion BESS players technology benchmarking analysis |

|

1.7. |

Li-ion BESS players flagship grid-scale technology benchmarking |

|

1.8. |

Li-ion battery chemistry outlook - % split 2016-2035 |

|

1.9. |

Li-ion battery chemistries for residential storage - LFP vs NMC |

|

1.10. |

CATL zero degradation BESS and options enabling this claim |

|

1.11. |

Li-ion battery safety and thermal management summary (1) |

|

1.12. |

Li-ion battery safety and thermal management summary (2) |

|

1.13. |

BESS safety systems overview |

|

1.14. |

Forced air cooling vs liquid cooled BESS summary |

|

1.15. |

The impact of RES on the electricity grid |

|

1.16. |

Regional RES and battery storage targets |

|

1.17. |

Renewable energy targets and energy storage targets by country |

|

1.18. |

US states storage and targets overview map |

|

1.19. |

Australia storage policy, funding, and renewables targets |

|

1.20. |

Business models and revenue streams overview |

|

1.21. |

Revenue streams description |

|

1.22. |

Overview of ancillary services |

|

1.23. |

Li-ion BESS grid-scale / C&I market summary |

|

1.24. |

Leading FTM and C&I BESS integrators / players |

|

1.25. |

FTM and C&I BESS integrator / player pipelines by GWh |

|

1.26. |

Key BESS integrator / player pipelines by region |

|

1.27. |

Residential battery storage market overview |

|

1.28. |

Residential battery storage market commentary |

|

1.29. |

Global residential battery storage market forecasts by country 2016-2035 (GWh) |

|

1.30. |

Regional analysis summary |

|

1.31. |

Longer duration Li-ion BESS projects on the rise (1) |

|

1.32. |

Longer duration Li-ion BESS projects on the rise (2) |

|

1.33. |

Global Li-ion battery installations forecast by country 2016-2035 (GWh) |

|

1.34. |

Global Li-ion battery installations forecast by sector [Grid-scale, C&I, residential] 2016-2035 (GWh) |

|

1.35. |

Global Li-ion BESS market value by sector [Grid-scale, C&I, residential] 2016-2035 (US$B) |

|

1.36. |

Regional commentary (1) |

|

1.37. |

Regional commentary (2) |

|

1.38. |

Regional commentary (3) |

|

1.39. |

Regional commentary (4) |

|

1.40. |

Regional commentary (5) |

|

1.41. |

Access More with an IDTechEx Subscription |

|

2. |

INTRODUCTION |

|

2.1. |

Consumption of electricity is changing |

|

2.2. |

Renewables are leading the power source changes |

|

2.3. |

The advantage of energy storage in the power grid (1) |

|

2.4. |

The advantage of energy storage in the power grid (2) |

|

2.5. |

Stationary storage position in the power grid |

|

2.6. |

Different battery sizes for different uses |

|

2.7. |

Where can energy storage fit in? |

|

2.8. |

Battery storage systems |

|

2.9. |

Battery storage designed for self-consumption |

|

3. |

BATTERY STORAGE TECHNOLOGIES |

|

3.1. |

Li-ion Batteries |

|

3.1.1. |

Summary: Batteries for stationary energy storage |

|

3.1.2. |

More than one type of Li-ion battery |

|

3.1.3. |

A family tree of Li-based batteries |

|

3.1.4. |

Differences between cell, module, and pack |

|

3.2. |

Li-ion cathode materials |

|

3.2.1. |

Cathode materials - NMC, NCA, and LMO |

|

3.2.2. |

Cathode materials - LCO and LFP |

|

3.2.3. |

Cathode suitability for stationary Li-ion battery storage |

|

3.2.4. |

CAM price trend |

|

3.2.5. |

LFP or NMC for stationary energy storage? |

|

3.3. |

Li-ion anode materials |

|

3.3.1. |

Anodes compared (1) |

|

3.3.2. |

Anodes compared (2) |

|

3.3.3. |

Where will LTO play a role? |

|

3.3.4. |

IDTechEx wider reports on batteries for stationary energy storage |

|

3.4. |

Other batteries for stationary energy storage |

|

3.4.1. |

Na-ion batteries introduction |

|

3.4.2. |

Appraisal of Na-ion (1) |

|

3.4.3. |

Appraisal of Na-ion (2) |

|

3.4.4. |

Na-ion batteries for stationary energy storage |

|

3.4.5. |

Na-ion grid-scale battery storage deployments |

|

3.4.6. |

Redox flow batteries for stationary energy storage |

|

3.4.7. |

Metal-air batteries introduction |

|

3.4.8. |

Metal-air battery options for LDES |

|

3.4.9. |

Lead-acid batteries |

|

3.4.10. |

Thermal batteries introduction |

|

3.4.11. |

Thermal batteries working principles |

|

3.4.12. |

Advantages and disadvantages of battery storage technologies |

|

4. |

LI-ION BESS SAFETY AND THERMAL MANAGEMENT |

|

4.1. |

Summary |

|

4.1.1. |

Executive summary: Li-ion battery safety and thermal management (1) |

|

4.1.2. |

Executive summary: Li-ion battery safety and thermal management (2) |

|

4.2. |

Li-ion BESS fire incidents |

|

4.2.1. |

BESS fire in Arizona, US (2019) |

|

4.2.2. |

Battery fires in South Korea |

|

4.2.3. |

Reasons for battery fires in South Korea |

|

4.2.4. |

Victoria Big Battery fire and new mitigations for fire protection (2021) |

|

4.2.5. |

Global BESS failure incidents |

|

4.2.6. |

Root causes of BESS failures 2018-2023 (1) |

|

4.2.7. |

Root causes of BESS failures 2018-2023 (2) |

|

4.2.8. |

Root causes of BESS failures 2018-2023 (3) |

|

4.2.9. |

BESS age at failure |

|

4.3. |

Causes and stages of thermal runaway and battery fires |

|

4.3.1. |

Causes of battery failure |

|

4.3.2. |

Stages of thermal runaway (1) |

|

4.3.3. |

Stages of thermal runaway (2) |

|

4.3.4. |

Stages of thermal runaway (3) |

|

4.3.5. |

LiB cell temperature and likely outcome |

|

4.3.6. |

Thermal runaway propagation |

|

4.3.7. |

Summary of LiB failure events at different temperatures |

|

4.3.8. |

Cell chemistry and stability |

|

4.3.9. |

Cell chemistry impact on fire protection |

|

4.3.10. |

Cell form factor and chemistry impact on fire protection |

|

4.3.11. |

Na-ion battery safety |

|

4.3.12. |

0 V capability of Na-ion systems |

|

4.3.13. |

Summary of Na-ion safety |

|

4.4. |

Systems and materials for BESS fire protection and thermal runaway mitigation |

|

4.4.1. |

Methods to prevent battery fires |

|

4.4.2. |

BESS safety systems overview |

|

4.4.3. |

Large containerized BESS designs |

|

4.4.4. |

Examples of fire protection agents |

|

4.4.5. |

Opportunities to use fire protection materials used in EV batteries |

|

4.4.6. |

Other product and material opportunities: polymers |

|

4.4.7. |

Megapack thermal management and thermal runaway mitigation |

|

4.4.8. |

Fluence BESS Gridstack Pro Safety Features |

|

4.4.9. |

Fluence Cube Safety Features |

|

4.4.10. |

Johnson Controls gas detection and fire suppression systems for BESS (1) |

|

4.4.11. |

Johnson Controls gas detection and fire suppression systems for BESS (2) |

|

4.4.12. |

Key conclusions for Li-ion battery safety |

|

4.5. |

BESS thermal management: Air cooled vs liquid cooled BESS, technologies & players |

|

4.5.1. |

Forced air cooled BESS |

|

4.5.2. |

Liquid cooled BESS (1) |

|

4.5.3. |

Liquid cooled BESS (2) |

|

4.5.4. |

Key comparisons between forced air cooled and liquid cooled BESS |

|

4.5.5. |

Key BESS cooling solution players |

|

4.5.6. |

Envicool cooling technologies for BESS |

|

4.5.7. |

Tongfei BESS cooling technologies |

|

4.5.8. |

Bergstrom cooling technologies for BESS |

|

4.5.9. |

Pfannenberg cooling technologies for BESS |

|

4.5.10. |

Example cooling technologies summary |

|

4.5.11. |

Forced air cooling vs liquid cooled BESS summary |

|

4.6. |

Thermal runaway and battery fire tests and regulations |

|

4.6.1. |

The nail penetration test |

|

4.6.2. |

UL 9450A thermal runaway testing |

|

4.6.3. |

UL 9450A - a need for more stringent BESS safety testing? (1) |

|

4.6.4. |

UL 9450A - a need for more stringent BESS safety testing? (2) |

|

4.6.5. |

BESS Safety in the EU Battery Regulation |

|

5. |

STATIONARY ENERGY STORAGE: DRIVERS, BUSINESS MODELS AND REVENUE STREAMS |

|

5.1. |

Business models and revenue streams |

|

5.1.1. |

Introduction to energy storage drivers |

|

5.1.2. |

ESS for every position in the value chain |

|

5.1.3. |

Power capacity vs discharge duration |

|

5.1.4. |

Business models and revenue streams overview |

|

5.1.5. |

Revenue streams overview |

|

5.1.6. |

Revenue streams description |

|

5.1.7. |

Capacity Market (CM) |

|

5.1.8. |

Power Purchase Agreements (PPA) |

|

5.1.9. |

Battery storage and flexibility optimization PPAs (1) |

|

5.1.10. |

Battery storage and flexibility optimization PPAs (2) |

|

5.1.11. |

Battery storage and flexibility optimization PPAs (3) |

|

5.1.12. |

Battery storage and flexibility optimization PPAs (4) |

|

5.1.13. |

Battery storage and flexibility optimization PPAs (5) |

|

5.2. |

Behind-the-Meter Applications |

|

5.2.1. |

BTM summary: values provided by battery storage - customer side |

|

5.2.2. |

Virtual power plants |

|

5.2.3. |

Virtual power plant players |

|

5.3. |

Front-of-the-Meter Applications |

|

5.3.1. |

FTM: Values provided by battery storage in ancillary services |

|

5.3.2. |

Ancillary services provision and revenue stacking |

|

5.3.3. |

Ancillary service requirements |

|

5.3.4. |

Frequency regulation |

|

5.3.5. |

Levels of frequency regulation |

|

5.3.6. |

Load following |

|

5.3.7. |

Spinning and non-spinning reserve |

|

5.3.8. |

Dynamic Containment (DC) (1) |

|

5.3.9. |

Dynamic Containment (DC) (2) |

|

5.3.10. |

Stacking revenues for battery storage asset owners (1) |

|

5.3.11. |

Stacking revenues for battery storage asset owners (2) |

|

5.3.12. |

FTM: values provided by battery storage in utility services |

|

5.3.13. |

Arbitrage volatility |

|

5.3.14. |

Negative electricity prices |

|

5.3.15. |

Gas peaker plant deferral |

|

5.3.16. |

Off-grid and remote applications |

|

5.3.17. |

Other utility applications |

|

6. |

RESIDENTIAL BATTERY STORAGE MARKET AND TECHNOLOGIES |

|

6.1. |

Summary |

|

6.1.1. |

Executive summary: residential battery storage |

|

6.1.2. |

Residential battery storage regional developments |

|

6.1.3. |

Global residential battery storage market forecasts by country 2016-2035 (GWh) |

|

6.2. |

Market drivers and key player activity |

|

6.2.1. |

Market drivers for residential BESS |

|

6.2.2. |

Key residential BESS player activity updates |

|

6.2.3. |

Tesla Powerwall Installations for Residential Applications |

|

6.3. |

Market overview and data analysis |

|

6.3.1. |

Residential battery storage market overview |

|

6.3.2. |

Residential battery storage market - demand in Germany |

|

6.3.3. |

Residential battery market players |

|

6.3.4. |

Residential battery player market share by revenues (US$M) |

|

6.3.5. |

Residential battery player market share by GWh installed |

|

6.3.6. |

Li-ion battery chemistries for residential storage - LFP vs NMC |

|

6.3.7. |

Battery chemistries for residential storage - undisclosed chemistries |

|

6.3.8. |

Residential battery capacities |

|

6.3.9. |

Modular residential battery designs |

|

6.3.10. |

Residential battery price/kg and energy density |

|

6.3.11. |

Outlier explanations |

|

6.3.12. |

Cycle life of residential batteries |

|

6.3.13. |

Residential battery warranties |

|

6.3.14. |

Redox flow batteries for residential battery storage? |

|

7. |

FRONT-OF-THE-METER AND C&I BESS MARKET |

|

7.1. |

Front-of-the-Meter and C&I BESS Market Overview |

|

7.1.1. |

Executive summary: FTM and C&I BESS players and technologies |

|

7.1.2. |

Front-of-the-meter players in the BESS value chain |

|

7.1.3. |

Energy storage integrators |

|

7.1.4. |

Companies in the BESS value chain |

|

7.1.5. |

Large Li-ion BESS assembly costs |

|

7.1.6. |

Leading FTM and C&I BESS integrators / players |

|

7.1.7. |

FTM and C&I BESS integrator / player pipelines by GWh |

|

7.1.8. |

Key BESS integrator / player pipelines by region |

|

7.1.9. |

FTM and C&I BESS integrator raw data (BESS deployed 2021 - 2023 and project pipelines (by GWh) |

|

7.1.10. |

Li-ion BESS players analysis notes |

|

7.1.11. |

Li-ion BESS grid-scale / C&I market summary |

|

7.1.12. |

BESS player summary - revenues, deployments, pipelines, etc. |

|

7.1.13. |

Li-ion BESS players technology benchmarking notes |

|

7.1.14. |

Li-ion BESS players technology benchmarking analysis |

|

7.1.15. |

Li-ion BESS players flagship grid-scale technology benchmarking |

|

7.2. |

Front-of-the-Meter and C&I BESS Players, Technologies, and Market Activity |

|

7.2.1. |

Tesla BESS installations and revenues overview (2021- 2023) |

|

7.2.2. |

Tesla BESS products overview |

|

7.2.3. |

Megapack pricing and delivery factors |

|

7.2.4. |

Megapack pricing (US$/kWh vs capacity installed) |

|

7.2.5. |

Megapack pricing (US$/kWh vs number of units) |

|

7.2.6. |

Tesla grid-scale BESS revenues estimation (1) |

|

7.2.7. |

Tesla grid-scale BESS revenues estimation (2) |

|

7.2.8. |

Tesla "Generation and Other Services" revenues |

|

7.2.9. |

Key trends for Tesla's BESS development |

|

7.2.10. |

Tesla key BESS developments and projects (1) |

|

7.2.11. |

Tesla key BESS developments and projects (2) |

|

7.2.12. |

Tesla key projects summary |

|

7.2.13. |

Tesla Megapack and cell manufacturing developments |

|

7.2.14. |

Megapack thermal management and thermal runaway mitigation |

|

7.2.15. |

Victoria Big Battery fire and new mitigations for fire protection |

|

7.2.16. |

Key conclusions - Tesla in the BESS Market |

|

7.2.17. |

Fluence overview |

|

7.2.18. |

Fluence BESS technologies / products |

|

7.2.19. |

Fluence Cube |

|

7.2.20. |

Fluence key BESS projects (1) |

|

7.2.21. |

Fluence key BESS projects (2) |

|

7.2.22. |

Storage-as-a-Transmission Asset (SATA) |

|

7.2.23. |

Fluence key upcoming projects summary |

|

7.2.24. |

Fluence manufacturing developments |

|

7.2.25. |

Fluence pack manufacturing developments - IRA ITC and PTCs |

|

7.2.26. |

Fluence BESS Gridstack Pro Safety Features |

|

7.2.27. |

Fluence Cube Safety Features |

|

7.2.28. |

Sungrow overview |

|

7.2.29. |

Sungrow grid-scale BESS technologies |

|

7.2.30. |

Sungrow BESS technology advantages and disadvantages |

|

7.2.31. |

Sungrow key BESS projects (1) |

|

7.2.32. |

Sungrow key BESS projects (2) |

|

7.2.33. |

Sungrow key BESS projects (3) |

|

7.2.34. |

Sungrow key projects summary |

|

7.2.35. |

Wärtsilä overview |

|

7.2.36. |

Wärtsilä BESS technology |

|

7.2.37. |

Wärtsilä BESS safety features |

|

7.2.38. |

Wärtsilä new BESS technologies: Quantum High Energy and Quantum2 |

|

7.2.39. |

Wärtsilä technology summary |

|

7.2.40. |

Wärtsilä key installed BESS projects |

|

7.2.41. |

Wärtsilä key upcoming BESS projects and supply agreement |

|

7.2.42. |

Wärtsilä key upcoming BESS projects summary |

|

7.2.43. |

Powin overview |

|

7.2.44. |

Powin BESS technology and safety features |

|

7.2.45. |

Powin 5 MWh BESS technology |

|

7.2.46. |

Powin key upcoming BESS projects summary |

|

7.2.47. |

Powin battery cell supply agreements summary |

|

7.2.48. |

Powin commercial activity, partnerships, and supply agreements (1) |

|

7.2.49. |

Powin commercial activity, partnerships, and supply agreements (2) |

|

7.2.50. |

Powin commercial activity, partnerships, and supply agreements (3) |

|

7.2.51. |

HyperStrong overview |

|

7.2.52. |

HyperStrong BESS technologies |

|

7.2.53. |

HyperStrong BESS technology technical specifications |

|

7.2.54. |

HyperStrong commercial activity and key projects (1) |

|

7.2.55. |

HyperStrong commercial activity and key projects (2) |

|

7.2.56. |

BYD overview (1) |

|

7.2.57. |

BYD overview (2) |

|

7.2.58. |

BYD battery energy storage technologies |

|

7.2.59. |

BYD grid-scale BESS technical specifications |

|

7.2.60. |

BYD C&I and residential BESS technologies |

|

7.2.61. |

BYD technology and commercial strategy |

|

7.2.62. |

BYD key BESS projects (1) |

|

7.2.63. |

BYD key BESS projects (2) |

|

7.2.64. |

Narada Power overview |

|

7.2.65. |

Narada Power BESS technologies |

|

7.2.66. |

Narada Power BESS technology technical specifications |

|

7.2.67. |

Narada Power 305Ah and 690Ah zero-degradation battery cells |

|

7.2.68. |

Advantages of larger cell formats and capacities |

|

7.2.69. |

Narada Power commercial activity and key projects (1) |

|

7.2.70. |

Narada Power commercial activity and key projects (2) |

|

7.2.71. |

CATL overview |

|

7.2.72. |

CATL zero-degradation BESS |

|

7.2.73. |

What underpins CATL's zero degradation ESS battery |

|

7.2.74. |

Pre-lithiation likely to play key role in 'zero-degradation' claim |

|

7.2.75. |

Cathode pre-lithiation additives |

|

7.2.76. |

Data highlights the possibility for claiming zero-degradation |

|

7.2.77. |

CATL additive related patents |

|

7.2.78. |

CATL pre-lithiation additive patent example (1) |

|

7.2.79. |

CATL pre-lithiation additive patent example (2) |

|

7.2.80. |

CATL pre-lithiation additive patent example (3) |

|

7.2.81. |

CATL electrolyte additive patent example |

|

7.2.82. |

"Zero-degradation" battery highlights multiple design levers |

|

7.2.83. |

Concluding remarks on zero degradation batteries |

|

7.2.84. |

CATL other BESS technologies |

|

7.2.85. |

CATL BESS technology benchmarking |

|

7.2.86. |

CATL 314Ah cells |

|

7.2.87. |

CATL key BESS projects |

|

7.2.88. |

LG Energy Solution Vertech overview |

|

7.2.89. |

LG ES technology benchmarking |

|

7.2.90. |

LG ES (Vertech) market activity |

|

7.2.91. |

Samsung SDI overview |

|

7.2.92. |

Samsung SDI technology benchmarking |

|

7.2.93. |

Samsung SDI market activity and cell manufacturing updates |

|

7.2.94. |

Samsung SDI solid-state battery developments |

|

8. |

REGIONAL ANALYSIS |

|

8.1. |

Summary |

|

8.1.1. |

Executive summary: regional analysis |

|

8.1.2. |

Longer duration Li-ion BESS projects on the rise (1) |

|

8.1.3. |

Longer duration Li-ion BESS projects on the rise (2) |

|

8.2. |

Regional Analysis 2022-2024 Key Updates and Regional Summaries |

|

8.2.1. |

Australia commentary: 2024 and future outlook |

|

8.2.2. |

Australia 2022-2024 key updates |

|

8.2.3. |

Australia storage policy, funding, and renewables targets |

|

8.2.4. |

Key upcoming large-scale BESS in Australia |

|

8.2.5. |

Japan commentary: 2024 and future outlook |

|

8.2.6. |

South Korea commentary: 2024 and future outlook |

|

8.2.7. |

India commentary: 2024 and future outlook |

|

8.2.8. |

India 2022-2024 key updates |

|

8.2.9. |

Indian Li-ion battery gigafactory development |

|

8.2.10. |

China commentary: 2024 and future outlook |

|

8.2.11. |

China energy storage by technology split |

|

8.2.12. |

US commentary: 2024 and future outlook |

|

8.2.13. |

United States 2022-2024 key updates |

|

8.2.14. |

US States storage and targets overview map |

|

8.2.15. |

World's largest BESS: Edwards & Sanborn solar-plus-storage project |

|

8.2.16. |

US electricity costs |

|

8.2.17. |

Inflation Reduction Act: Section 45X Advanced Manufacturing Production Tax Credit (PTC) |

|

8.2.18. |

Inflation Reduction Act: Section 48 Investment Tax Credit (ITC) |

|

8.2.19. |

Germany commentary: 2024 and future outlook |

|

8.2.20. |

Germany 2022-2024 key updates |

|

8.2.21. |

Italy commentary: 2024 and future outlook |

|

8.2.22. |

Italy 2022-2024 key updates |

|

8.2.23. |

Residential battery storage in Italy |

|

8.2.24. |

Existing situation of grid-scale battery storage in Italy |

|

8.2.25. |

New storage tenders and Italian TSO's expected battery storage requirements in Italy |

|

8.2.26. |

UK commentary: 2024 and future outlook |

|

8.2.27. |

UK 2022-2024 updates |

|

8.2.28. |

UK capacity market timeline |

|

8.2.29. |

Battery storage de-rating factors in recent UK capacity market auctions |

|

8.2.30. |

How do de-rating factors and capacity market contracts impact the covering of Li-ion BESS project cost? (1) |

|

8.2.31. |

How do de-rating factors and capacity market contracts impact the covering of Li-ion BESS project cost? (2) |

|

8.2.32. |

Chile commentary: 2024 and future outlook |

|

8.2.33. |

Chile ESS developments |

|

8.3. |

Australia |

|

8.3.1. |

Australia introduction |

|

8.3.2. |

Australia 2022-2024 key updates |

|

8.3.3. |

Australia storage policy, funding, and renewables targets |

|

8.3.4. |

Key upcoming large-scale BESS in Australia |

|

8.3.5. |

Other Australian energy storage targets, policies, and rules |

|

8.3.6. |

Other state policies, schemes, and targets |

|

8.3.7. |

Victoria's Neighbourhood Battery Initiative (1) |

|

8.3.8. |

Victoria's Neighbourhood Battery Initiative (2) |

|

8.3.9. |

Australia's Li-ion gigafactory and supply chain |

|

8.3.10. |

Victoria Big Battery |

|

8.3.11. |

Australia commentary: 2024 and future outlook |

|

8.3.12. |

Australia Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.4. |

Japan |

|

8.4.1. |

Japan introduction |

|

8.4.2. |

Japan electricity supply status |

|

8.4.3. |

Japan's multiples approached toward energy resiliency |

|

8.4.4. |

A trend shift in Japan's BESS landscape |

|

8.4.5. |

Phase out of Feed-in-Tariffs |

|

8.4.6. |

Private households investing in solar and batteries |

|

8.4.7. |

Peer-to-peer (P2P) residential energy trading |

|

8.4.8. |

Tesla entering Japanese home battery market |

|

8.4.9. |

Other approaches besides home batteries |

|

8.4.10. |

Vehicle-to-grid (V2G) |

|

8.4.11. |

Japan's grid-scale battery situation and project examples. |

|

8.4.12. |

Grid-scale batteries in Hokkaido |

|

8.4.13. |

The "Basic Hydrogen Roadmap" |

|

8.4.14. |

10 MW Fukushima electrolyser |

|

8.4.15. |

Japan commentary: 2024 and future outlook |

|

8.5. |

South Korea |

|

8.5.1. |

South Korea introduction |

|

8.5.2. |

South Korea energy supply status |

|

8.5.3. |

Government approach towards ES systems |

|

8.5.4. |

South Korea market drivers |

|

8.5.5. |

South Korean Renewable Energy Certificate (REC) |

|

8.5.6. |

South Korea's state of electricity generation and battery storage |

|

8.5.7. |

South Korea: ESS developer and market share |

|

8.5.8. |

Reduced battery installations after 2018 |

|

8.5.9. |

Battery fires in South Korea |

|

8.5.10. |

Causes of battery fires |

|

8.5.11. |

Utility scale battery storage projects |

|

8.5.12. |

South Korea commentary: 2024 and future outlook |

|

8.6. |

India |

|

8.6.1. |

India introduction |

|

8.6.2. |

India 2022-2024 key updates |

|

8.6.3. |

A lead-acid dominated industry |

|

8.6.4. |

Battery storage and solar capacity trajectory |

|

8.6.5. |

Battery storage tenders and government push |

|

8.6.6. |

Challenges and developments in battery storage in India |

|

8.6.7. |

Indian Li-ion battery gigafactory development |

|

8.6.8. |

India's rooftop solar PV market and residential batteries market |

|

8.6.9. |

India commentary: 2024 and future outlook |

|

8.6.10. |

India Li-ion battery storage forecast 2022-2035 (GWh) |

|

8.7. |

China |

|

8.7.1. |

China introduction |

|

8.7.2. |

Chinese power grid upgrade |

|

8.7.3. |

China's historic energy storage deployments |

|

8.7.4. |

Recent regulation and target developments |

|

8.7.5. |

China energy storage by technology split |

|

8.7.6. |

China commentary: 2024 and future outlook |

|

8.7.7. |

China Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.8. |

United States |

|

8.8.1. |

United States introduction |

|

8.8.2. |

United States 2022-2024 key updates |

|

8.8.3. |

US States storage and targets overview map |

|

8.8.4. |

US retail electricity prices |

|

8.8.5. |

US key developments: Inflation Reduction Act |

|

8.8.6. |

Inflation Reduction Act: Section 45X Advanced Manufacturing Production Tax Credit (PTC) |

|

8.8.7. |

Inflation Reduction Act: Section 48 Investment Tax Credit (ITC) |

|

8.8.8. |

US older developments: American Energy Innovation Act |

|

8.8.9. |

US older developments: FERC Order 2222 |

|

8.8.10. |

FERC 2222 advantages for ES market |

|

8.8.11. |

US older developments: FERC Order 841 |

|

8.8.12. |

US older key anecdotes (1) |

|

8.8.13. |

US older key anecdotes (2) |

|

8.8.14. |

US older key anecdotes (3) |

|

8.8.15. |

US commentary: 2024 and future outlook |

|

8.8.16. |

US Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.8.17. |

California |

|

8.8.18. |

California overview |

|

8.8.19. |

World's largest BESS: Edwards & Sanborn solar-plus-storage project |

|

8.8.20. |

Moss Landing Project - California, US |

|

8.8.21. |

Large utility battery projects (2) |

|

8.8.22. |

Bellefield Solar and Energy Storage Farm |

|

8.8.23. |

California residential battery policies: SGIP |

|

8.8.24. |

California residential battery policies: NEM |

|

8.8.25. |

California residential battery storage players |

|

8.8.26. |

Texas |

|

8.8.27. |

Texas overview |

|

8.8.28. |

Key grid-scale battery and energy storage projects in Texas |

|

8.8.29. |

Hawaii |

|

8.8.30. |

Hawaii introduction |

|

8.8.31. |

Hawaii clean energy initiative |

|

8.8.32. |

Renewables + storage competitive with fossil fuels |

|

8.8.33. |

Large utility battery project in O'ahu |

|

8.8.34. |

Net Energy Metering (NEM) and upgrades |

|

8.8.35. |

New York |

|

8.8.36. |

New York state energy storage roadmap |

|

8.8.37. |

Utility-scale BESS project in New York |

|

8.8.38. |

New York grid-scale and C&I battery summary |

|

8.8.39. |

Virginia |

|

8.8.40. |

Virginia Clean Economy Act (1) |

|

8.8.41. |

Virginia Clean Economy Act (2) |

|

8.8.42. |

South Carolina |

|

8.8.43. |

South Carolina: Energy Freedom Act |

|

8.9. |

Germany |

|

8.9.1. |

Germany introduction |

|

8.9.2. |

Germany 2022-2024 key updates |

|

8.9.3. |

Structure and targets of the 'Energy Concept' |

|

8.9.4. |

Germany overview and residential storage subsidies |

|

8.9.5. |

German electricity generation |

|

8.9.6. |

Electricity grid upgrade |

|

8.9.7. |

FTM battery storage in Germany |

|

8.9.8. |

Innovation auctions |

|

8.9.9. |

Arbitrage opportunities for utility-scale BESS in Germany |

|

8.9.10. |

BigBattery Lausitz |

|

8.9.11. |

RWE large batteries with hydropower |

|

8.9.12. |

BTM: home batteries as a solution |

|

8.9.13. |

Solar plus storage costs in Germany |

|

8.9.14. |

KfW bank subsidy |

|

8.9.15. |

Further options after the FiT |

|

8.9.16. |

Sonnen in residential battery VPP market |

|

8.9.17. |

Residential battery market in Germany |

|

8.9.18. |

Germany commentary: 2024 and future outlook |

|

8.9.19. |

Germany Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.10. |

Italy |

|

8.10.1. |

Italy introduction |

|

8.10.2. |

Italy 2022-2024 key updates |

|

8.10.3. |

Italian Feed-in-Tariff and RES Decree |

|

8.10.4. |

Italian historical Feed-in-Tariff |

|

8.10.5. |

VPP development in Italy |

|

8.10.6. |

Residential battery storage in Italy |

|

8.10.7. |

Growing solar installations in Italy |

|

8.10.8. |

Existing situation of grid-scale battery storage in Italy |

|

8.10.9. |

New storage tenders and Italian TSO's expected battery storage requirements in Italy |

|

8.10.10. |

Energy Dome: Liquefied CO2 energy storage |

|

8.10.11. |

Energy Dome commercial activity |

|

8.10.12. |

Italy commentary: 2024 and future outlook |

|

8.10.13. |

Italy Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.11. |

United Kingdom |

|

8.11.1. |

UK introduction |

|

8.11.2. |

UK key updates 2022-2024 |

|

8.11.3. |

FTM and BTM overview |

|

8.11.4. |

A step forward for clean energy sources |

|

8.11.5. |

Capacity Markets (CM) (1) |

|

8.11.6. |

Capacity Markets (CM) (2) |

|

8.11.7. |

UK capacity market timeline |

|

8.11.8. |

Battery storage de-rating factors in the capacity market |

|

8.11.9. |

Battery storage de-rating factors in older UK capacity market auctions |

|

8.11.10. |

Battery storage de-rating factors in recent UK capacity market auctions |

|

8.11.11. |

How do de-rating factors and capacity market contracts impact the covering of Li-ion BESS project cost? (1) |

|

8.11.12. |

How do de-rating factors and capacity market contracts impact the covering of Li-ion BESS project cost? (2) |

|

8.11.13. |

Revenue stacking (1) |

|

8.11.14. |

Revenue stacking (2) |

|

8.11.15. |

Revenue stacking (3) |

|

8.11.16. |

Large UK BESS project developments 2022 |

|

8.11.17. |

UK residential battery market |

|

8.11.18. |

UK commentary: 2024 and future outlook |

|

8.11.19. |

UK Li-ion battery storage forecast 2016-2035 (GWh) |

|

8.12. |

Chile |

|

8.12.1. |

Chile electricity supply status |

|

8.12.2. |

Chile ESS developments |

|

8.12.3. |

Chile commentary: 2024 and future outlook |

|

8.12.4. |

Chile Li-ion battery storage forecast 2022-2035 (GWh) |

|

8.13. |

Africa |

|

8.13.1. |

Africa overview |

|

9. |

LI-ION BESS MARKET FORECASTS |

|

9.1.1. |

Global Li-ion BESS market headlines and key commentary |

|

9.1.2. |

Market forecast assumptions and methodology |

|

9.1.3. |

Global Li-ion battery installations forecast by country 2016-2035 (GWh) |

|

9.1.4. |

Global Li-ion battery installations forecast by sector [Grid-scale, C&I, residential] 2016-2035 (GWh) |

|

9.1.5. |

Global Li-ion battery installations forecast by sector [FTM, BTM] 2016-2035 (GWh) |

|

9.1.6. |

Global Li-ion BESS market value by sector [Grid-scale, C&I, residential] 2016-2035 (US$B) |

|

9.1.7. |

Global residential battery storage market forecasts by country 2016-2035 (GWh) |

|

9.1.8. |

Global Li-ion battery storage market by chemistry split % across sectors 2016-2035 |

|

9.1.9. |

China Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.10. |

US Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.11. |

Australia Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.12. |

India Li-ion battery storage forecast 2022-2035 (GWh) |

|

9.1.13. |

Italy Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.14. |

Germany Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.15. |

UK Li-ion battery storage forecast 2016-2035 (GWh) |

|

9.1.16. |

Chile Li-ion battery storage forecast 2022-2035 (GWh) |

|

10. |

COMPANY PROFILES |

|

10.1. |

Aggreko (Energy Storage) |

|

10.2. |

BSL Battery |

|

10.3. |

BYD Energy Storage |

|

10.4. |

BYD: Residential Batteries |

|

10.5. |

CATL - Battery Energy Storage Systems (BESS) |

|

10.6. |

E3/DC GmbH |

|

10.7. |

Electric Era |

|

10.8. |

Engie Storage |

|

10.9. |

Fluence Energy |

|

10.10. |

Fluence — Battery Energy Storage Systems (BESS) |

|

10.11. |

HyperStrong — Battery Energy Storage Systems (BESS) |

|

10.12. |

Kokam (2020) |

|

10.13. |

Leclanché (2019) |

|

10.14. |

LG Energy Solution Vertech |

|

10.15. |

Narada Power - Battery Energy Storage Systems (BESS) |

|

10.16. |

Powin — Battery Energy Storage Systems (BESS) |

|

10.17. |

Samsung SDI - Battery Energy Storage Systems (BESS) |

|

10.18. |

Schneider Electric (Energy Storage) |

|

10.19. |

Sungrow |

|

10.20. |

Tesla — Battery Energy Storage Systems (BESS) |

|

10.21. |

Wärtsilä — Battery Energy Storage Systems (BESS) |

.png)

.png)

.png)