Summary

Metal Chemicals for FE & Advanced Packaging Market Report

Market Research & Supply-Chain Analysis Report on Metal Chemicals used for Semiconductor Device Manufacturing

-

Provides focused information on metal chemicals market trends and supply-chain as it applied to advanced packaging (wafer level) and semiconductor device manufacturing (damascene process).

-

Covers information about forecasts for copper plating and additives, market shares, technical trends, and supplier profiles.

Main contents

-

EXECUTIVE SUMMARY

-

SCOPE, PURPOSE AND METHODOLOGY

-

SEMICONDUCTOR INDUSTRY MARKET OUTLOOK

-

METAL CHEMICALS MARKET BY SEGMENT

-

TECHNICAL TRENDS

-

COMPETITIVE LANDSCAPE

-

ANALYST ASSESSMENT

-

SUPPLIER PROFILES

-

APPENDIX A: PACKAGING TECH TRENDS

SCOPE

-

This report covers the Metal Chemicals market trends and supply-chain as it applied to Advanced Packaging (wafer level) and Semiconductor Device Manufacturing (damascene process).

-

Included are forecasts for copper plating and additives, market shares, technical trends, and supplier profiles. Also included in the appendix is a supplier product comparison table of publicly available information on plating products used for advanced packaging.

-

The report contains data and analysis from TECHCET’s data base and Sr. Analyst experience, as well as that developed from primary and secondary market research.

PURPOSE

-

This Critical Materials Report™ (CMR) provides focused information for supply-chain managers, process integration and R&D directors, as well as business development managers, and financial analysts. The report covers information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

-

Providing current information and actionable content is the intent of the information contained within this report and the quarterly updates.

-

As important as the supply side of the equations is the demand requirements of the market in terms of the economic variables, leading edge technology requirements and the wafer start forecast.

ページTOPに戻る

Table of Contents

Table of Contents

TECHCET-CMR-MetalChems-CMC-091322LS

1 EXECUTIVE SUMMARY 8

1.1 EXECUTIVE SUMMARY 9

1.2 ADVANCED PACKAGING PER WAFER STARTS 10

1.3 DEVICE DEMAND DRIVERS - LOGIC 11

1.4 CU PLATING FORECAST FOR DAMASCENE (FE) AND ADVANCED PACKAGING 12

1.5 MARKET SHARES 13

1.6 SUPPLIER ACTIVITIES – VARIOUS ANNOUNCEMENTS 14

1.7 RISK FACTORS 15

1.8 ANALYST ASSESSMENT 16

2 SCOPE, PURPOSE AND METHODOLOGY 17

2.1 SCOPE 18

2.2 PURPOSE 19

2.3 METHODOLOGY 20

2.4 OVERVIEW OF OTHER TECHCET CMR™ REPORTS 21

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 22

3.1 WORLDWIDE ECONOMY 23

3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 25

3.1.2 SEMICONDUCTOR SALES GROWTH 26

3.1.3 TAIWAN MONTHLY SALES TRENDS 27

3.1.4 UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023 – SLOWER TO NEGATIVE SEMI REVENUE GROWTH EXPECTED 28

3.2 ELECTRONIC GOODS MARKET 29

3.2.1 SMARTPHONES 30

3.2.2 PC UNIT SHIPMENTS 31

3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS 32

3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS 33

3.2.3 SERVERS / IT MARKET 34

3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 35

3.3.1 FAB EXPANSION ANNOUNCEMENT SUMMARY 36

3.3.2 WW FAB EXPANSION DRIVING GROWTH 37

3.3.3 EQUIPMENT SPENDING TRENDS 38

3.3.4 TECHNOLOGY ROADMAPS 39

3.3.5 FAB INVESTMENT ASSESSMENT 40

3.4 POLICY & TRADE TRENDS AND IMPACT 41

3.4.1 POLICY AND TRADE ISSUES 42

3.5 SEMICONDUCTOR MATERIALS OUTLOOK 43

3.5.1 COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES? 44

3.5.2 CONTINUED LOGISTICS ISSUES PLAGUE THE WESTERN WORLD 45

3.5.3 TECHCET WAFER STARTS FORECAST THROUGH 2026 46

3.5.3.1 TECHCET WAFER START MODELING METHODOLOGY 47

3.5.4 TECHCET’S MATERIAL FORECAST 48

4 METAL CHEMICALS MARKET BY SEGMENT 49

4.1 DEFINITIONS 50

4.1.1 DEFINITIONS, CONTINUED 51

4.2 METAL PLATING CHEMICALS MARKET OVERVIEW 52

4.2.1 OVERVIEW - ADVANCED PACKAGING AND DAMASCENE METALLIZATION 53

4.2.2 OVERVIEW - PLATING MARKET TRANSITIONAL TRENDS 54

4.3 ADVANCED PACKAGING METALLIZATION – MARKET DRIVERS 55

4.3.1 ADVANCED PACKAGING - ADDITIVES FOR CU PLATING REVENUE 56

4.3.2 ADVANCED PACKAGING – COPPER CHEMICALS REVENUE 57

4.3.3 ADVANCED PACKAGING ADDITIVE VOLUMES 58

4.3.4 OTHER PLATING MATERIALS FOR ADVANCED PACKAGING 59

4.3.5 SN / SNAG PLATING 60

4.3.5.1 WW NI PLATING MARKET FORECAST 61

4.4 DAMASCENE GROWTH TRENDS 62

4.4.1 DAMASCENE GROWTH DRIVERS 63

4.4.2 DAMASCENE CU PLATING REVENUES 64

4.4.3 DAMASCENE ADDITIVE VOLUMES 65

5 TECHNICAL TRENDS 66

5.1 PACKAGING TECH TRENDS 67

5.1.1 PACKAGING TECHNICAL CHALLENGES 68

5.2 TECH TRENDS 69

5.2.1 MARKET DRIVES TECHNOLOGY TRENDS 70

5.2.2 ADV LOGIC INTERCONNECT WIRING TECHNOLOGY EVOLUTION 71

5.2.2.1 TRENDS - MOL AND BEOL IRDS ROADMAP 72

5.2.3 CU DAMASCENE QUALIFICATION REQUIREMENTS 73

5.2.4 LOGIC METALLIZATION ROADMAP 74

5.2.4.1 INTERCONNECT FOR ADVANCED LOGIC 75

5.2.5 ADV LOGIC BURIED POWER RAIL 76

5.2.6 TECHNOLOGY ROADMAP: DRAM WITH MO OR RU 77

5.2.6.1 GENERAL PROCESS FLOW ADVANCED DRAM 78

5.2.7 PRECURSOR TECHNOLOGY ROADMAP: 3D NAND USING MO OR RU 79

5.2.7.1 3D-NAND GENERATIONS 2020 -2025 80

5.2.8 EXAMPLE OF LOGIC PROCESS FLOW 20 NM TO 32 NM LOGIC PVD 81

5.2.8 TECHNICAL REQUIREMENTS SUMMARY 1/2 82

5.2.8.1 TECHNICAL REQUIREMENTS SUMMARY 2/2 83

6 COMPETITIVE LANDSCAPE 84

6.1 TOTAL ADVANCED PACKAGING AND DAMASCENE MARKET SHARES 85

6.2 OEM MARKET SHARE– PLATING EQUIPMENT 86

6.3 MARKET SHARE BY APPLICATION – CU PLATING FOR ADVANCED PACKAGING 87

6.4 REGIONAL PLAYERS AND OTHERS 88

6.5 M&A ACTIVITY 89

7 ANALYST ASSESSMENT 90

7.1 ADVANCED METAL PLATING APPLICATIONS MARKET ASSESSMENT91

8 SUPPLIER PROFILES 90

BASF

DUPONT

CHANG CHUN GROUP

INCHEON CHEMICAL COMPANY

ISHIHARA CHEMICAL/UNICON JX NIPPON

MINING AND METALS AND MORE..

9 APPENDIX A: PACKAGING TECH TRENDS 152

FIGURES

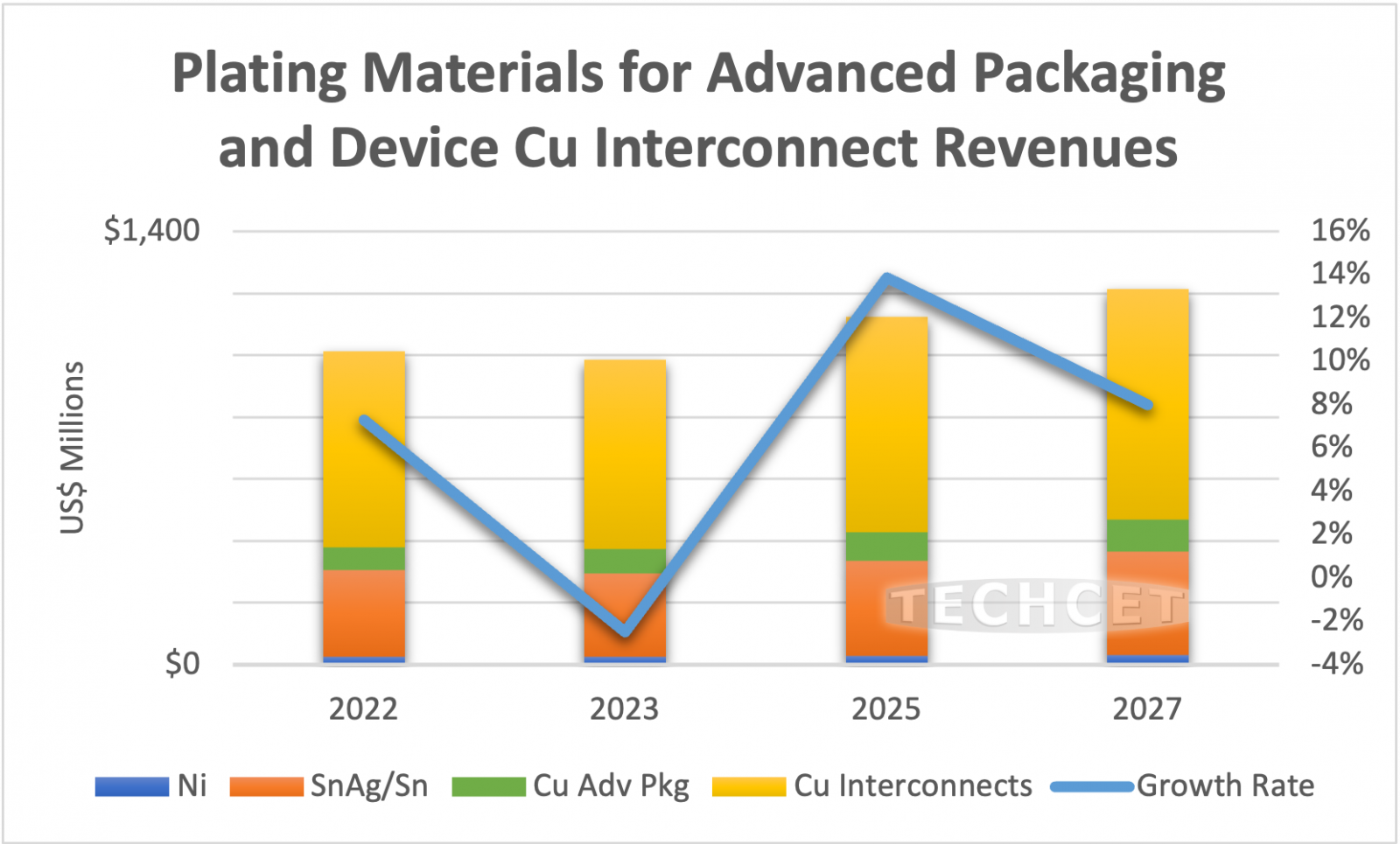

FIGURE 1: PLATING MATERIALS FOR ADVANCED PACKAGING AND DEVICE CU INTERCONNECT REVENUES ($M’S) 9

FIGURE 2: ADVANCED PACKAGING APPLICATIONS IN MILLIONS OF WAFERS 10

FIGURE 3: ADVANCED LOGIC DEVICES GROWTH FORECAST 11

FIGURE 4: COPPER PLATING CHEMICALS REVENUES ($M’S) FOR ADVANCED PACKAGING & FE/DAMASCENE 12

FIGURE 5: TOTAL PLATING MARKET SHARES FOR ADVANCED PACKAGING AND SEMICONDUCTOR DEVICE MFG. 2022 13

FIGURE 6: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2021) 25

FIGURE 7: WORLDWIDE SEMICONDUCTOR SALES 26

FIGURE 8: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX* 27

FIGURE 9: 2022 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS 28

FIGURE 10: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS 28

FIGURE 11: SEMICONDUCTOR CHIP APPLICATIONS 29

FIGURE 12: MOBILE PHONE SHIPMENTS WW ESTIMATES 30

FIGURE 13: WORLDWIDE PC AND TABLET FORECAST, 2021, Q3 31

FIGURE 14: GLOBAL EV TRENDS 32

FIGURE 15: SEMICONDUCTOR SPEND PER VEHICLE TYPE 33

FIGURE 16: TSMC CONSTRUCTION SITE IN ARIZONA 35

FIGURE 17: CHIP EXPANSIONS 2021-2026 > US$460 B 36

FIGURE 18: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 37

FIGURE 19: 3-MONTH AVERAGE SEMICONDUCTOR EQUIPMENT BILLINGS 38

FIGURE 20: OVERVIEW OF DEVICE TECHNOLOGY ROADMAP 39

FIGURE 21: EUROPE CHIP EXPANSION UPSIDE 44

FIGURE 22: TECHCET WAFER START FORECAST BY NODE 46

FIGURE 23: TECHCET MATERIALS FORECAST 48

FIGURE 24: PACKAGING METALLIZATION APPLICATIONS 50

FIGURE 25: USE OF SILICON INTERPOSER 51

FIGURE 26: VERSIONS OF TSV & PROCESS FLOW EXAMPLE 51

FIGURE 27: PLATING MATERIALS FOR ADVANCED PACKAGING AND DEVICE CU INTERCONNECT REVENUES ($M’S) 52

FIGURE 28: CU PLATING CHEMICALS 5-YEAR FORECAST 53

FIGURE 29: ADVANCED PACKAGING APPLICATIONS IN MILLIONS OF WAFERS 55

FIGURE 30: CU PLATING ADVANCED PACKAGING REVENUE FORECAST ESTIMATES 56

FIGURE 31: CU PILLAR & CU RDL SEGMENTED FORECAST 57

FIGURE 32: ADV. PACKAGING CU/VMS VOLUME DEMAND FORECAST 58

FIGURE 33: ADV. PACKAGING CU PLATING ADDITIVES VOLUME DEMAND FORECAST 58

FIGURE 34: MATERIALS STACK USING CU PILLAR (< 40 UM PITCH) 59

FIGURE 35: SN AND SNAG PLATING REVENUE 60

FIGURE 36: NICKEL PLATING REVENUE 61

FIGURE 37: ADVANCED LOGIC DEVICES GROWTH FORECAST 62

FIGURE 38: ADV LOGIC METAL PLATING WAFER PASSES 63

FIGURE 39: WW DAMASCENE REVENUE FORECAST ESTIMATES 64

FIGURE 40: DAMASCENE CU VMS VOLUME DEMAND FORECAST ESTIMATES 65

FIGURE 41: DAMASCENE CU PLATING ADDITIVES CHEMICAL VOLUME DEMAND FORECAST 65

FIGURE 42: KEY TRENDS IN ADVANCED PACKAGING 67

FIGURE 43: CHALLENGES OF ELECTROPLATING VIA FILL 68

FIGURE 44: METAL LEVELS PER LOGIC NODE 70

FIGURE 45: INTERCONNECT METAL COMPARISON BY RESISTIVITY 71

FIGURE 46: CU DAMASCENE QUALIFICATION 73

FIGURE 47: LEADING EDGE LOGIC POWER RAIL SCHEMES 76

FIGURE 48: DRAM STRUCTURE 77

FIGURE 49: 3D NAND STRUCTURE 79

FIGURE 50: TOTAL PLATING FOR ADV. PACKAGING AND SEMICONDUCTOR DEVICE MANUFACTURING 2022 85

FIGURE 51: PLATING EQUIPMENT OEM MARKET SHARES 2020% 86

FIGURE 52: PLATING CHEMICAL SUPPLIER FOR DAMASCENE AND ADVANCED PACKAGING APPLICATIONS 87

FIGURE 53: CLEANING COMPLEXITY 94

FIGURE 54: OSATS PACKAGING BUSINESS CANNIBALIZATION TREND 96

FIGURE 55: WAFER LEVEL PLATING 97

FIGURE 56: ADVANCED PACKAGING MARKET DRIVERS AND APPLICATIONS 98

FIGURE 57: COMPARISON WITH DAMASCENE- TYPE RDL 100

FIGURE 58: USE OF SILICON INTERPOSER 101

FIGURE 59: APPLE EXAMPLE INTERPOSERS 102

FIGURE 60: TSV PROCESS FLOW EXAMPLE 103

TABLES

TABLE 1: GLOBAL GDP AND SEMICONDUCTOR REVENUES* 23

TABLE 2: IMF ECONOMIC OUTLOOK* 24

TABLE 3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES FORECAST 2021 34

TABLE 4: IRDS 2022 LOGIC CORE INTERCONNECT ROADMAP 72

TABLE 5: LOGIC DEVICE ROADMAP FOR METALS 74

TABLE 6: METALS REQUIRED FOR DEVICE FEATURES 75

TABLE 7: DRAM USE OF MO OR RU PRESENT & FUTURE 77

TABLE 8: GENERAL PROCESS FLOW ADVANCED DRAM 78

TABLE 9: 3D NAND MATERIAL CHANGES PRESENT & FUTURE 79

TABLE 10: NUMBER OF STACKS (S) & LAYERS (L) PER GENERATION OF 3DNAND 80

TABLE 11: EXAMPLE OF LOGIC PROCESS FLOW 20 NM TO 32 NM LOGIC PVD 81

TABLE 12: TECHNICAL REQUIREMENTS SUMMARY 1/2 83

TABLE 13: TECHNICAL REQUIREMENTS SUMMARY 2/2 83

TABLE 14: REGIONAL PLAYERS – MARKET LEADER AND “OTHERS” 88

TABLE 15: CU PACKAGING APPLICATIONS AND REQUIREMENTS 105

Press Release

Semiconductor Metal Plating Chemicals Revenues Slowing in 2023

June 27, 2023

Increases in Interconnect Layers and Advanced Packaging Use to Revamp Growth

San Diego, CA, June 27, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is estimating that the market for Semiconductor Metal Plating Chemicals will reach US$987M in 2023, a 2% decrease from 2022. The decrease in the 2023 forecast is due to lower expectations for the amount of overall wafer starts. Additionally, the decline may be influenced by the overbuying of materials in 2020-2021 and subsequent inventory corrections within the market. The largest revenue within the 2023 metal plating chemicals segment is forecasted for copper, with $373M for copper advanced packaging wiring, and $614M for interconnect copper plating. Despite the current slowdown, the overall 2022-2027 CAGR is expected to be a positive 3.7% for advanced packaging and 3.3% for interconnect metal chemicals, as highlighted in TECHCET’s new Quarterly Update to the Metal Chemicals Critical Material Report.

.png)

Current economic environments will likely cause overall semiconductor device production to be reduced until at least the end of 2Q 2023. However, demand for more devices used for electric cars, faster charging stations, stronger data storage, and more applications, are expected to produce higher density and lower power devices in the coming years. Simultaneously, the US Chips Act and similar investments by Europe and China will push these developments along. This will drive increases in metal interconnect layers and advanced packaging use, which should revamp growth in the metal chemical plating market.

TECHCET is following new technologies for metal deposition, such as the introduction of Ruthenium (Ru) or Molybdenum (Mo) (or Vanadium (V) or Iridium (Ir)) to possibly displace the Tantalum (Ta) & Cobalt (Co) barrier layers at the smallest interconnect dimensions for the GAA nodes. Ru or Mo (ALD or CVD, not plating) will possibly fill the interconnects & vias between M0 to M2 metal layers for Advanced Logic. Possible wafer backside connections to the backside power rail will add Copper (Cu) plating to possibly match or exceed the Cu plating lost at the M8-M14 layers.

For more details on Metal Deposition market trends, supply-chain issues and supplier profiles like Dupont, Chang Chun Group, JX Nippon, Moses Lake Industries, MacDermid and more, go to

.png)