Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020-2040ロジスティクス、入庫、運搬におけるモバイルロボット、自律走行車両とドローン 2020-2040年:無人搬送車/カート;産業素材自律運搬車両、GTPロボット、自律協力モバイルロボット、モバイル運搬ロボット、ラスト1マイルの歩道上運搬ロボット:技術、市場、予測 このレポートは運搬に利用されるさまざまな車両やドローンの市場や技術を分析し、主要企業や市場予測について言及しています。 主な掲載内容 ※目次より抜粋 エグゼク... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2019年11月26日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

323

言語

英語

※価格はデータリソースまでお問い合わせください。

Summary

このレポートは運搬に利用されるさまざまな車両やドローンの市場や技術を分析し、主要企業や市場予測について言及しています。

主な掲載内容 ※目次より抜粋

Report Details

Automation in the delivery/logistic and warehousing/fulfilment chain is a growing market. A particularly exciting subset of this is the use of mobile robots, drones, and autonomous vehicles for automation of movement-based tasks. This field encompasses all manner of robots, drones, and autonomous vehicles, which help goods in their journey from origin to destination (see below). This report finds that the market for mobile robots, drones, and autonomous vehicles in delivery and warehousing is likely to reach a staggering $81 and $290 Billion in 2030 and 2040, respectively.

The report provides a comprehensive analysis of all the key players, technologies, and markets. It covers automated as well as autonomous carts and robots, automated goods-to-person robots, autonomous and collaborative robots, delivery robots, mobile picking robots, autonomous material handling vehicles such as tuggers and forklifts, autonomous trucks, vans, and last mile delivery robots and drones.

We provide technology roadmaps and twenty-year market forecasts, in unit numbers and revenue, for all the technologies outlined above (13 forecast lines). We built a twenty-year model because our technology roadmap suggests that these changes will take place over long timescales. In our detailed forecasts we clearly explain the different stages of market growth and outline the key assumptions/conditions as well as data points that underpin our model.

Furthermore, our granular forecast model includes price projections, often at component level, for all the technologies outlined above. Our technology assessments and price projections feed directly into our market forecast model, governing the adoption timescales and the estimated technology market share evolutions.

We further provide investment/trend analysis, always seeking to put each technology within its greater quantitative as well as qualitative context. We also include company interviews/profiles/reviews. Our company profiles and interviews provide valuable insight on company positioning, strategy, opportunities, and challenges

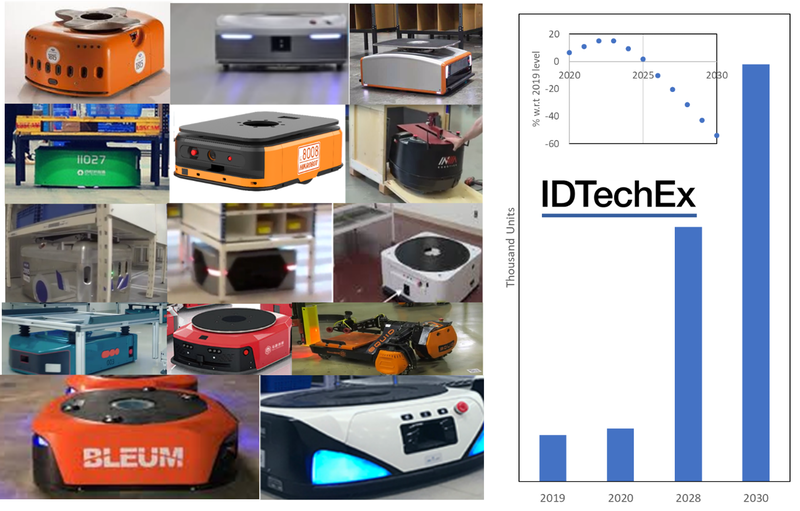

These show pictures of products and prototypes of various mobile robots and ground-based autonomous vehicles aimed at automating a part of the warehousing and delivery chain. These technologies- together with delivery drones- are examined in detail in this report.

Indoor automation

For a long time, automated guide carts and vehicles (AGC and AGV) have been in use. They are infrastructure dependent, meaning that they follow a fixed infrastructure, such as conductive wire or magnetic tape, in going from A to B. They are reliable and trusted to handle all manner of payloads. Their installation is however time-consuming, and their workflow is difficult to adapt.

Consequently, as a technology, they are on shaky ground, unless they adapt. This is because the technology is evolving towards more autonomous and infrastructure-independent navigation. We forecast that they will tend towards obsolescence and increasingly become confined to ever narrower market niches. Overall, we predict that their market will shrink by 50% in 2030 compared to the 2019 level.

A bright spot for automated robots

One very bright spot for automated robots is in goods-to-person automation within fulfilment centres. Special robot-only zones are created within warehouses in which these robot fleets move racks at high speeds to a manned picking station. The productivity gains are clear and proven.

This is a fast-growing market space. The landscape was set on fire when Amazon acquired Kiva Systems for $775M in 2012, thereby leaving a gap on the market. Today, significant well-funded alternatives such as GeekPlus (389$M), GreyOrange (170$M), and HIK Vision ($6Bn revenue) have emerged, achieving promising and growing deployment figures. The number of start-ups has also increased, especially between 2015-2017.

We forecast the annual unit sales to double within 6 years. Despite the large deployments already, we assess the real global inflection point to arrive around 2024. Indeed, our report forecasts that between 2020 and 2030, more than 1 million such robots will be sold accumulatively.

The images on the left show various examples of goods-to-person robots. The forecast figure on the right shows the near-term forecast for these goods-to-person robots. Our projections in the report extend until 2040. The forecast model considers the rate of growth of the addressable market by considering the growth in fulfilment centres, the size of these centres, and the number of robots deployed per area. The inset shows the decline of the traditional infrastructure dependent automated guided carts. The figure shows the rate of change w.r.t to the value in 2019.

Towards autonomous indoor robots and vehicles

The navigation technology is transitioning from automated to autonomous. The primary benefit is that the navigation becomes infrastructure independent, allowing the workflow to be easily modified and enabling various modes of collaborative workflows between robots and humans.

The technology is enabled by better SLAM algorithms. The algorithms- based on different sensors including stereo camera and 2D lidars- are evolved enough to handle safe autonomous navigation within many structured indoor environments. These robots are easy to install and to train.

The technology options are still many. A common approach is to use 2D lidars to develop a map of the facilities during the training phase, e.g., walking the robot around the facilities. The fixed reference objects will be marked during the set-up phase. Another approach is to use camera vision and deep learning to also identify and classify objects. This is computationally more complex, but will enable a more flexible system that can have more intelligent decision making in complex and changing environments.

The business models are also various and evolving. Some are offering their technology as RaaS (robot as a service). Others are following a traditional model of equipment sales. Even these suppliers will also need to build in a subscription platform into their business model to offer maintenance and upgrades, especially cloud-based software updates.

We assess that the market for such autonomous mobile robots (AMRs) will grow. There have also been prominent investments and acquisitions this year, e.g., by Shopify and Amazon. Overall, we forecast that more than 200k robots could be sold within the 2020-2030 period (this figure includes those that can perform picking of regularly or irregularly shaped items).

Picking mobile robots to dominate AMRs?

Picking or grasping technology is an essential component of warehouse automation. Today, many firms and research groups are deploying deep learning to enable robots to rapidly pick novel and irregularly-shaped items with high success rates. To this end, various strategies to data collection/annotation and to DNN training are being followed.

A limited number of firms have integrated picking arms on mobile platforms. Today, these mainly picked box-shaped items in known environments. However, technology progress will bring these technologies to more varied items. It will also allow better integration of robotic arm with the mobile platform.

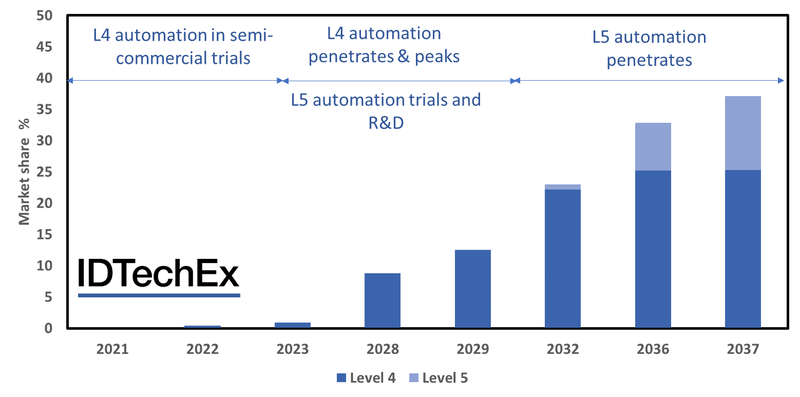

We forecast that picking mobile robots able to pick regularly shaped items will be in the learning and low volume deployment phase until 2024. Thereafter the sales will pick up. However, only after 2030 we forecast significant annual sales volumes. As for robots able to pick irregularly shaped items, we consider that the development and low-volume deployment phase could last until 2030. In the longer term though, we forecast that 36% and 38% of AMRs in warehouses sold in 2040 will be able to pick regular- as well as irregular-shaped items, respectively. This points towards a major technology transformation, requiring automation beyond just autonomy of movement.

Various collaborative AMRs are shown here. This figure excludes picking mobile robots currently on offer. Right figure shows market projections in unit numbers for collaborative mobile robots. We can see that picking robots will start to grow their share in the long run.

Is the future of forklifts and tuggers autonomous?

Today, nearly all forklifts are manually operated. However, the rise of autonomous mobility technology will transform this trend. Indeed, the journey has already long begun. Many have developed, demonstrated, and deployed autonomous forklifts and trucks.

The choice of navigation technology is varied. Some use RGB camera and RGB image processing technologies to navigate. Others deploy 2D lidars for navigating in structured indoor environments. The merits and strategic consequences of each approach is assessed in the report.

The cost of these forklifts is naturally higher, but the claimed ROI by many suppliers is within 12-18 months. The cost includes the installation and maintenance cost as well as the cost of the autonomous sensor suite, traction control and drivers, and the software, which can be amortized over a growing deployed fleet. Overall, price parity on an annual operational cost basis is nearly at hand in some high wage territories.

Our analysis and interviews suggest that inflection point is likely to be reached around the 2025-2027. After this point, we project the sales to grow, already exceeding 100k units by 2030. Note that we generally develop 20-year forecasts for autonomous mobility as the technology will inevitable take time to be rolled out.

The left image panel shows from autonomous tuggers and forklifts from various firms. The right chart shows our forecasts, in unit numbers, for autonomous forecasts. Note that these forecasts are long- term, covering the 2020-2040 period. Despite the recent pick-up in sales, we estimate the real inflection point to occur around the 2025-2027 period.

Sidewalk last mile delivery robots: a billion-dollar-market by 2030?

Last mile delivery is the most expensive part of the delivery chain, often representing more than 50% of the overall cost. In recent years, many companies have been innovating to utilize autonomous mobile robots, drones, and autonomous vehicle technology to automate this step. Examples of such products were shown in the image above.

The sidewalk robots are often designed to travel slowly at 4-6 km/hr. This is to increase safety, to give robots more thinking time, to give remote teleoperators the chance to intervene, and to enable categorising the robot as a personal device (vs. a vehicle), thus easing the legislative challenges.

These robots also come with various hardware choices, e.g., number of motor-controlled wheels, payload size and compartment design, battery size, etc. Almost all have HD cameras around the robot to give teleoperators the ability to intervene All also have IMUs and GPS and most have ultrasound sensors for near-field sensing.

A critical choice is whether to use lidar-only, stereo-vision-only, or hybrid. Lidar can give excellent 360deg ranging information with spatial resolution and a dense point cloud which enables good signal processing. Lidars however have are expensive and can have near-field (a few cm) blindspot. The first could jeopardize the business model unless lidar prices- as we have forecasted- fall. The other approach is to go lidar-free, using stereo camera as the main perception-for-navigation sensor. This will require the development of camera-based algorithms for localization, object detection, classification, semantic segmentation, and path planning.

These sidewalk robots are still far from being totally autonomous. First, they are often deployed in environments such as US university campuses where there is little sidewalk traffic and where the sidewalks are well-structured. Many robots are also restricted to daylight and perception-free conditions. Critically, the suppliers also have remote teleoperator centres. The ratio of operators to robots will need to be kept to an absolute minimum if such businesses are to succeed.

There is still much work to do to improve the navigation technology. The robots will need to learn to operate in more complex and varied environments with minimal intervention. Furthermore, capital is also essential. The end markets are also highly competitive, imposing tough price constraints.

In general, we forecast a 200k unit fleet size until 2035 (accounting for replacement). The inflection point will not occur until around 2025 period given the readiness level of the technology.

Autonomous Delivery Trucks and Vans

Autonomous mobility seeks to address several key painpoints facing the trucking industry. One is driver shortage. In the US alone, the driver shortage is estimated to reach 160k persons by 2028. The other is productivity. Currently, legislations limits drive time per driver per day, thus decreasing asset up time in favour of increasing safety.

Start-ups have raised more than $400M since late 2016 to enable autonomous trucks. Major firms such as Daimler have also announced significant investment plans ($500M) for the next five years. Many are now in the semi-commercial prototyping phase. Nonetheless, the number deployed autonomous trucks is currently low with the main players having a fleet of fifty or so. Next year we expect to see an expansion, bringing the total to 1200-1500 trucks. Nonetheless, these will also be in the trial phase, seeking to collect data to further improve the driving AI.

In general, highway driving in certain territories might offer a relatively low hanging fruit in terms of autonomous mobility technology. However, the technology will need to be specifically developed for trucks as these vehicles have different braking distances and different perception requirements.

The business models and exact approaches are in a state of flux. Some propose to rely only on cameras for navigation and to restrict autonomous driving to highways with humans or teleoperators taking over in complex urban environments. Others have a hybrid approach in which the camera scans the long-distance and lidars only focuses on objects of interest within the 150-200meter radius. The challenge for using lidar for very long-range detection is in power consumption and signal-to-noise ratio.

We forecast level-4 autonomous trucks to exceed 300k units per year by 2028. Within this period, level-5 deployments will remain nearly zero. By 2035, more than 800k and 170k of autonomous level-4 and level-5 trucks will be sold per year. Thereafter, we project deployments of level-5 autonomous trucks to rapidly take off. Our forecasts are in market share, unit numbers, and market value. The latter is also segmented by contribution of each autonomous mobility technology, e.g., lidar, radar, software, mapping, etc.

Autonomous delivery vans and pods are also emerging. Many are electrical built-to-purpose on-road vehicles. They are also a competitor to sidewalk last mile delivery robots. The sensor suite and algorithms are similar to autonomous cars although two considerations ease the technical burden: (1) delivery pods travel slowly therefore the perception technology does not need to accommodate as long a range and also the robot has more thinking and reaction time, and (2) the robots are likely to be deployed in limited known neighbourhood areas, thus allowing more detailed HD maps to be developed to aid autonomous navigation. Our report also provides forecasts for these delivery vans in unit number and value segmented by the level of autonomy.

Table of ContentsTable of Contents

|

.png)