Battery Electric & Hydrogen Fuel Cell Trains 2023-2043バッテリーエレクトリック&水素燃料電池電車 2023-2043年 この調査レポートでは、IDTechExが、ディーゼル車の使用量が減少し、エネルギー貯蔵技術が急速に進歩する中で、バッテリー電気(BEV)および燃料電池(FC)列車に出現するグローバルな機会を評価しています。 ... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートでは、IDTechExが、ディーゼル車の使用量が減少し、エネルギー貯蔵技術が急速に進歩する中で、バッテリー電気(BEV)および燃料電池(FC)列車に出現するグローバルな機会を評価しています。

主な掲載内容(目次より抜粋)

Report Summary

Rail networks today already largely consist of electric trains 'tethered' to electric overhead and live rail systems. However, this is not feasible everywhere due to the high infrastructure cost/mile, remote geographic locations, and the practicality of building through tunnels and bridges. For these stretches of track, rail OEMs and operators currently rely on diesel fuel - which is their number two cost. Use of diesel cannot continue forever in any market, and multiple rail OEMs and operators believe the time is now to transition towards zero emission rail technologies.

Indeed, the IDTechEx report shows demand for untethered electric trains will increase rapidly over the coming years as rail OEMs seek to reduce high diesel costs and follow broad climate goals such as the Paris Agreement and 'Fit for 55' in Europe. Industry momentum has been building through the rapid advancement of Li-ion battery technology, with systems now capable of reaching the multi mega-watt hour (MWh) level in confined carriage spaces. Systems up to ~14.5MWh are being installed today in the largest trains, known as battery electric (BEV) locomotives, or BELs. In the future, the vast energy requirements of rail will eventually lead to some of the largest traction battery deployments across all electric vehicle markets - potentially beyond 20MWh per train. Improvements in battery energy density and charging technology is expected to increase over the forecast period, but even then, the longest-range requirements will create some opportunities for green hydrogen fuel cells.

In this report, IDTechEx assesses the global opportunities emerging for battery-electric (BEV) and fuel cell (FC) trains as diesel use declines and energy storage technologies advance rapidly. Granular 20-year forecasts include train deliveries, battery demand (GWh), fuel cell demand (MW) and market value ($ billion) across locomotives, multiple units, and shunter trains. The cost evolution of railroad batteries, fuel cells and green hydrogen is also explored to assess the long-term feasibility of each solution, drawing from primary research across multiple company interviews.

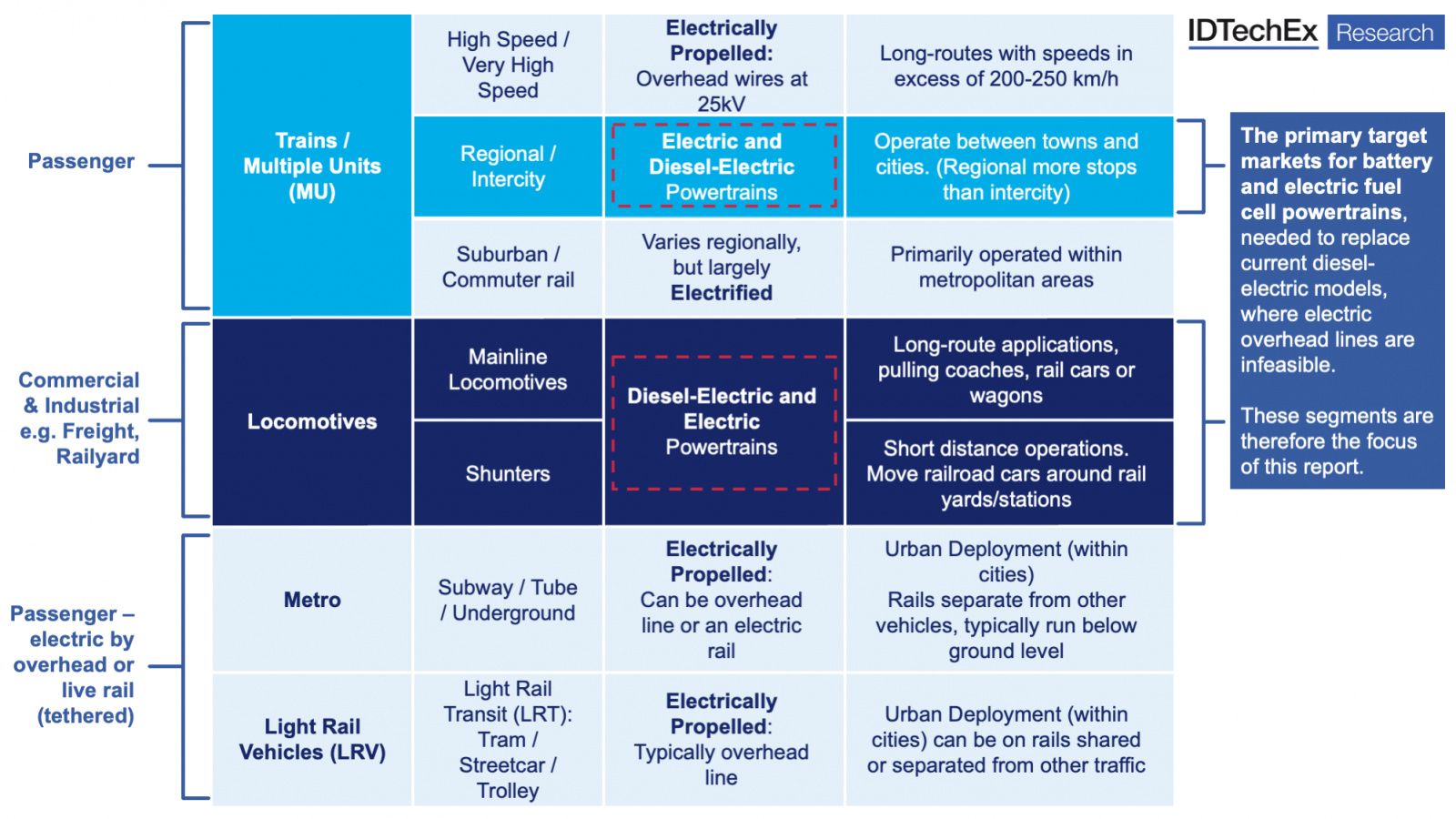

Electric trains: Locomotives, shunters & multiple units

Initial rail electrification will be led by multiple units (MU), which are trains used for passenger operations. BEV MUs are being developed to replace the diesel MUs currently operating between regional and intercity lines. Initial deployments have focused on route lengths of up to around 100km, which requires battery systems comparable to commercial road vehicles today.

In the longer term, electrification will be led by locomotives, with adoption timelines provided in the report for mainline locomotives ('locomotives') and shunter locomotives ('shunters'), also known as switchers. Shunters are railyard vehicles used for moving various cars around yards or stations. This sector does not require range and has greater potential for opportunity charging. As a result, there is a wider range of energy storage possibilities, from LTO to typical G/NMC based Li-ion batteries, with analysis in the report.

Mainline locomotives are largely commercial & industrial freight trains, although this varies between key electrification regions such as the US, Europe, and China. Locomotives have a larger addressable market than multiple units, and since they are larger and more expensive vehicles, often with long range requirements, they require mega-watt hour battery systems. Locomotives represent the greatest opportunity for the heavy-duty battery supply chain, with battery demand assessed in the report.

Source: IDTechEx

Rail Li-ion battery systems, fuel cell systems, and green hydrogen

Battery-electric vehicles are at the forefront of the zero-emission technology being considered in rail, and improvements in battery energy density and charging technology is expected to increase over the forecast period. In the report, IDTechEx evaluates different battery chemistry options and their suitability for trains, comparing NMC, NCA, LFP, LTO, solid-state and lithium metal. IDTechEx shares primary research from over eight heavy-duty pack suppliers with leaders identified. Access to primary research interviews on the IDTechEx portal are also provided with the purchase of this report.

Rail has unique advantages because operations are highly predictable. Energy regeneration and route efficiency optimisation plays a large role in reducing energy (fuel) needs and has been a focus of the diesel industry for decades. This has laid the groundwork for BEV train adoption, where fuel economy will be the primary driver. An advanced energy management system (EMS) will have exact knowledge of the train (the number of locomotives/power), the track length, the train's load, the terrain, the signal and speed limits and more to optimize for fuel efficiency.

While there are many fuel cell suppliers for heavy duty EV applications, a small number are specifically targeting the rail market, although IDTechEx expects most can pivot to the sector as the opportunity emerges (another prime example of this is the marine market). Most companies make PEMFC with a small number making SOFC mostly targeted at stationary or marine markets. Ultimately, the high cost of green hydrogen, explored in the report, will remain a long-term challenge, while grey hydrogen will not be approved for use due to high carbon emissions.

Key aspects:

Table of Contents

|

|