Summary

Report Details

The Automotive Electronics Market Report 2024-2034: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

Growing Trend Towards Electric and Hybrid Vehicles Is Fuelling the Demand for Automotive Electronics

The automotive electronics market is witnessing significant growth globally, driven by several key factors. One of the primary drivers is the increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles, which rely heavily on sophisticated electronic components for functions such as collision avoidance, adaptive cruise control, and automated parking. Additionally, the growing trend towards electric and hybrid vehicles is fuelling the demand for automotive electronics, as these vehicles require specialised electronic systems for battery management, powertrain control, and energy efficiency optimisation.

Moreover, the rise of connected cars and the Internet of Things (IoT) is creating new opportunities in the automotive electronics market. Vehicle connectivity enables features such as remote diagnostics, over-the-air software updates, and enhanced infotainment systems, driving demand for communication modules, sensors, and onboard computing platforms. Furthermore, the emergence of electric and autonomous vehicles has spurred innovation in areas such as vehicle-to-everything (V2X) communication, artificial intelligence (AI) algorithms, and cybersecurity solutions, presenting lucrative opportunities for electronic component manufacturers and technology providers.

However, the automotive electronics market also faces several challenges that could impede its growth trajectory. One such challenge is the complexity of integrating various electronic systems within vehicles, as automakers strive to balance performance, reliability, and cost-effectiveness. Additionally, concerns regarding data privacy, cybersecurity vulnerabilities, and regulatory compliance pose significant hurdles for automotive electronics suppliers, requiring robust risk management strategies and investment in security solutions.

The High Costs Associated with Research, Development, and Implementation of Advanced Automotive Electronics Solutions Pose a Significant Restraint

In the automotive electronics market, several restraining factors hinder the seamless adoption and integration of advanced solutions. Firstly, the high costs associated with research, development, and implementation pose a significant challenge. Developing cutting-edge automotive electronics requires substantial investment in research and development to create innovative solutions that meet evolving industry standards and consumer demands. Moreover, implementing these solutions into existing vehicle architectures can be cost-prohibitive for manufacturers, especially in an industry with tight profit margins.

What Questions Should You Ask before Buying a Market Research Report?

-

How is the automotive electronics market evolving?

-

What is driving and restraining the automotive electronics market?

-

How will each automotive electronics submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2034?

-

How will the market shares for each automotive electronics submarket develop from 2024 to 2034?

-

What will be the main driver for the overall market from 2024 to 2034?

-

Will leading automotive electronics markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

-

How will the market shares of the national markets change by 2034 and which geographical region will lead the market in 2034?

-

Who are the leading players and what are their prospects over the forecast period?

-

What are the automotive electronics projects for these leading companies?

-

How will the industry evolve during the period between 2024 and 2034? What are the implications of automotive electronics projects taking place now and over the next 10 years?

-

Is there a greater need for product commercialisation to further scale the automotive electronics market?

-

Where is the automotive electronics market heading and how can you ensure you are at the forefront of the market?

-

What are the best investment options for new product and service lines?

-

What are the key prospects for moving companies into a new growth path and C-suite?

You need to discover how this will impact the automotive electronics market today, and over the next 10 years:

-

Our 398-page report provides 122 tables and 187 charts/graphs exclusively to you.

-

The report highlights key lucrative areas in the industry so you can target them – NOW.

-

It contains in-depth analysis of global, regional and national sales and growth.

-

It highlights for you the key successful trends, changes and revenue projections made by your competitors.

This report tells you TODAY how the automotive electronics market will develop in the next 10 years, and in line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2034 and other analyses reveal commercial prospects

-

In addition to revenue forecasting to 2034, our new study provides you with recent results, growth rates, and market shares.

-

You will find original analyses, with business outlooks and developments.

-

Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising automotive electronics prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, “V”, “L”, “W” and “U” are discussed in this report.

Segments Covered in the Report

Market Segment by Sales Channel

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

Market Segment by Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

-

Electric Vehicles

-

Hybrid Vehicles

Market Segment by Component Type

-

Electronic Control Units (ECUs)

-

Sensors & Actuators

-

Microcontrollers

-

Displays & Connectivity Solutions

-

Other Components

Market Segment by Application

-

Advanced Driver Assistance Systems (ADAS)

-

Infotainment Systems

-

Powertrain Electronics

-

Safety Systems

-

Body Electronics

-

Telematics

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for four regional and 20 leading national markets:

North America

Europe

-

Germany

-

Spain

-

United Kingdom

-

France

-

Italy

-

Rest of Europe

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Rest of Asia Pacific

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

Middle East & Africa

-

GCC

-

South Africa

-

Rest of Middle East & Africa

The report also includes profiles and for some of the leading companies in the Automotive Electronics Market, 2024 to 2034, with a focus on this segment of these companies’ operations.

Leading companies profiled in the report

-

Aisin Corporation

-

Aptiv PLC

-

Continental AG.

-

Denso Corporation

-

Hyundai Mobis

-

Infineon Technologies AG

-

Lear Corporation

-

Magna International Inc

-

Nvidia Corporation

-

NXP Semiconductors N.V.

-

Panasonic Holdings Corporation

-

Robert Bosch GmbH

-

Valeo S.A

-

Yazaki Corporation

-

ZF Friedrichshafen AG

Overall world revenue for Automotive Electronics Market, 2024 to 2034 in terms of value the market will surpass US$293.0 billion in 2024, our work calculates. We predict strong revenue growth through to 2034. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How will the Automotive Electronics Market, 2024 to 2034 report help you?

In summary, our 390+ page report provides you with the following knowledge:

-

Revenue forecasts to 2034 for Automotive Electronics Market, 2024 to 2034 Market, with forecasts for sales channel, vehicle type, component type, and application, each forecast at a global and regional level – discover the industry’s prospects, finding the most lucrative places for investments and revenues.

-

Revenue forecasts to 2034 for four regional and 20 key national markets – See forecasts for the Automotive Electronics Market, 2024 to 2034 market in North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. Also forecasted is the market in the US, Canada, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

-

Prospects for established firms and those seeking to enter the market – including company profiles for 15 of the major companies involved in the Automotive Electronics Market, 2024 to 2034.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with invaluable business intelligence.

Information found nowhere else

With our new report, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain’s study is for everybody needing commercial analyses for the Automotive Electronics Market, 2024 to 2034, market-leading companies. You will find data, trends and predictions.

ページTOPに戻る

Table of Contents

Table of Contents

1 Report Overview

1.1 Objectives of the Study

1.2 Introduction to Automotive Electronics Market

1.3 What This Report Delivers

1.4 Why You Should Read This Report

1.5 Key Questions Answered by This Analytical Report

1.6 Who Is This Report for?

1.7 Methodology

1.7.1 Market Definitions

1.7.2 Market Evaluation & Forecasting Methodology

1.7.3 Data Validation

1.7.3.1 Primary Research

1.7.3.2 Secondary Research

1.8 Frequently Asked Questions (FAQs)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2 Executive Summary

3 Market Overview

3.1 Key Findings

3.2 Market Dynamics

3.2.1 Market Driving Factors

3.2.1.1 Increasing Consumer Demand for Enhanced Driving Experiences, Convenience Features, and Connectivity Solutions

3.2.1.2 Growing Demand for Electrical Vehicle Supporting the Automotive Electronic Industry Development

3.2.1.3 Growing Popularity of Driver-Assisted Technology Driving the Market Growth

3.2.2 Market Restraining Factors

3.2.2.1 The High Costs Associated with Research, Development, and Implementation of Advanced Automotive Electronics Solutions Pose a Significant Restraint

3.2.2.2 Disruptions in the Global Supply Chain, Pose Challenges for Automotive Electronics Manufacturers

3.2.2.3 The Compatibility of New Electronic Components with Existing Vehicle Architectures and Systems Presents Challenges for Integration

3.2.3 Market Opportunities

3.2.3.1 Expansion in Emerging Markets Opportunities for the Automotive Electronics Manufacturers

3.2.3.2 Strategic Collaborations and Partnerships Between Automotive OEMs, Electronics Suppliers, and Technology firms Creating Opportunities for Market Growth

3.2.3.3 Investments in Electric Vehicle Infrastructure, Including Charging Networks and Battery Technology

3.3 Porter’s Five Forces Analysis

3.3.1 Bargaining Power of Suppliers (Medium)

3.3.2 Bargaining Power of Buyers (Medium to High)

3.3.3 Competitive Rivalry (High)

3.3.4 Threat from Substitutes (Low to Medium)

3.3.5 Threat of New Entrants (Low to Medium)

3.4 COVID-19 Impact Analysis

3.4.1 “V-Shaped Recovery”

3.4.2 “U-Shaped Recovery”

3.4.3 “W-Shaped Recovery”

3.4.4 “L-Shaped Recovery”

3.5 PEST Analysis

4 Automotive Electronics Market Analysis by Sales Channel

4.1 Key Findings

4.2 Sales Channel Segment: Market Attractiveness Index

4.3 Automotive Electronics Market Size Estimation and Forecast by Sales Channel

4.4 Original Equipment Manufacturer (OEM)

4.4.1 Market Size by Region, 2024-2034 (US$ Billion)

4.4.2 Market Share by Region, 2024 & 2034 (%)

4.5 Aftermarket

4.5.1 Market Size by Region, 2024-2034 (US$ Billion)

4.5.2 Market Share by Region, 2024 & 2034 (%)

5 Automotive Electronics Market Analysis by Vehicle Type

5.1 Key Findings

5.2 Vehicle Type Segment: Market Attractiveness Index

5.3 Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

5.4 Passenger Cars

5.4.1 Market Size by Region, 2024-2034 (US$ Billion)

5.4.2 Market Share by Region, 2024 & 2034 (%)

5.5 Commercial Vehicles

5.5.1 Market Size by Region, 2024-2034 (US$ Billion)

5.5.2 Market Share by Region, 2024 & 2034 (%)

5.6 Electric Vehicles

5.6.1 Market Size by Region, 2024-2034 (US$ Billion)

5.6.2 Market Share by Region, 2024 & 2034 (%)

5.7 Hybrid Vehicles

5.7.1 Market Size by Region, 2024-2034 (US$ Billion)

5.7.2 Market Share by Region, 2024 & 2034 (%)

6 Automotive Electronics Market Analysis by Component Type

6.1 Key Findings

6.2 Component Type Segment: Market Attractiveness Index

6.3 Automotive Electronics Market Size Estimation and Forecast by Component Type

6.4 Electronic Control Units (ECUs)

6.4.1 Market Size by Region, 2024-2034 (US$ Billion)

6.4.2 Market Share by Region, 2024 & 2034 (%)

6.5 Sensors & Actuators

6.5.1 Market Size by Region, 2024-2034 (US$ Billion)

6.5.2 Market Share by Region, 2024 & 2034 (%)

6.6 Microcontrollers

6.6.1 Market Size by Region, 2024-2034 (US$ Billion)

6.6.2 Market Share by Region, 2024 & 2034 (%)

6.7 Displays & Connectivity Solutions

6.7.1 Market Size by Region, 2024-2034 (US$ Billion)

6.7.2 Market Share by Region, 2024 & 2034 (%)

6.8 Other Components

6.8.1 Market Size by Region, 2024-2034 (US$ Billion)

6.8.2 Market Share by Region, 2024 & 2034 (%)

7 Automotive Electronics Market Analysis by Application

7.1 Key Findings

7.2 Application Segment: Market Attractiveness Index

7.3 Automotive Electronics Market Size Estimation and Forecast by Application

7.4 Advanced Driver Assistance Systems (ADAS)

7.4.1 Market Size by Region, 2024-2034 (US$ Billion)

7.4.2 Market Share by Region, 2024 & 2034 (%)

7.5 Infotainment Systems

7.5.1 Market Size by Region, 2024-2034 (US$ Billion)

7.5.2 Market Share by Region, 2024 & 2034 (%)

7.6 Powertrain Electronics

7.6.1 Market Size by Region, 2024-2034 (US$ Billion)

7.6.2 Market Share by Region, 2024 & 2034 (%)

7.7 Safety Systems

7.7.1 Market Size by Region, 2024-2034 (US$ Billion)

7.7.2 Market Share by Region, 2024 & 2034 (%)

7.8 Body Electronics

7.8.1 Market Size by Region, 2024-2034 (US$ Billion)

7.8.2 Market Share by Region, 2024 & 2034 (%)

7.9 Telematics

7.9.1 Market Size by Region, 2024-2034 (US$ Billion)

7.9.2 Market Share by Region, 2024 & 2034 (%)

8 Automotive Electronics Market Analysis by Region

8.1 Key Findings

8.2 Regional Market Size Estimation and Forecast

9 North America Automotive Electronics Market Analysis

9.1 Key Findings

9.2 North America Automotive Electronics Market Attractiveness Index

9.3 North America Automotive Electronics Market by Country, 2024, 2029 & 2034 (US$ Billion)

9.4 North America Automotive Electronics Market Size Estimation and Forecast

9.5 North America Automotive Electronics Market Size Estimation and Forecast by Country

9.6 North America Automotive Electronics Market Size Estimation and Forecast by Sales Channel

9.7 North America Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

9.8 North America Automotive Electronics Market Size Estimation and Forecast by Component Type

9.9 North America Automotive Electronics Market Size Estimation and Forecast by Application

9.10 U.S. Automotive Electronics Market Analysis

9.11 Canada Automotive Electronics Market Analysis

10 Europe Automotive Electronics Market Analysis

10.1 Key Findings

10.2 Europe Automotive Electronics Market Attractiveness Index

10.3 Europe Automotive Electronics Market by Country, 2024, 2029 & 2034 (US$ Billion)

10.4 Europe Automotive Electronics Market Size Estimation and Forecast

10.5 Europe Automotive Electronics Market Size Estimation and Forecast by Country

10.6 Europe Automotive Electronics Market Size Estimation and Forecast by Sales Channel

10.7 Europe Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

10.8 Europe Automotive Electronics Market Size Estimation and Forecast by Component Type

10.9 Europe Automotive Electronics Market Size Estimation and Forecast by Application

10.10 Germany Automotive Electronics Market Analysis

10.11 UK Automotive Electronics Market Analysis

10.12 France Automotive Electronics Market Analysis

10.13 Italy Automotive Electronics Market Analysis

10.14 Spain Automotive Electronics Market Analysis

10.15 Rest of Europe Automotive Electronics Market Analysis

11 Asia-Pacific Automotive Electronics Market Analysis

11.1 Key Findings

11.2 Asia-Pacific Automotive Electronics Market Attractiveness Index

11.3 Asia-Pacific Automotive Electronics Market by Country, 2024, 2029 & 2034 (US$ Billion)

11.4 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast

11.5 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast by Country

11.6 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast by Sales Channel

11.7 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

11.8 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast by Component Type

11.9 Asia-Pacific Automotive Electronics Market Size Estimation and Forecast by Application

11.10 China Automotive Electronics Market Analysis

11.11 India Automotive Electronics Market Analysis

11.12 Japan Automotive Electronics Market Analysis

11.13 South Korea Automotive Electronics Market Analysis

11.14 Australia Automotive Electronics Market Analysis

11.15 Rest of Asia-Pacific Automotive Electronics Market Analysis

12 Middle East and Africa Automotive Electronics Market Analysis

12.1 Key Findings

12.2 Middle East and Africa Automotive Electronics Market Attractiveness Index

12.3 Middle East and Africa Automotive Electronics Market by Country, 2024, 2029 & 2034 (US$ Billion)

12.4 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast

12.5 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast by Country

12.6 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast by Sales Channel

12.7 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

12.8 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast by Component Type

12.9 Middle East and Africa Automotive Electronics Market Size Estimation and Forecast by Application

12.10 GCC Automotive Electronics Market Analysis

12.11 South Africa Automotive Electronics Market Analysis

12.12 Rest of Middle East & Africa Automotive Electronics Market Analysis

13 Latin America Automotive Electronics Market Analysis

13.1 Key Findings

13.2 Latin America Automotive Electronics Market Attractiveness Index

13.3 Latin America Automotive Electronics Market by Country, 2024, 2029 & 2034 (US$ Billion)

13.4 Latin America Automotive Electronics Market Size Estimation and Forecast

13.5 Latin America Automotive Electronics Market Size Estimation and Forecast by Country

13.6 Latin America Automotive Electronics Market Size Estimation and Forecast by Sales Channel

13.7 Latin America Automotive Electronics Market Size Estimation and Forecast by Vehicle Type

13.8 Latin America Automotive Electronics Market Size Estimation and Forecast by Component Type

13.9 Latin America Automotive Electronics Market Size Estimation and Forecast by Application

13.10 Brazil Automotive Electronics Market Analysis

13.11 Mexico Automotive Electronics Market Analysis

13.12 Rest of Latin America Automotive Electronics Market Analysis

14 Company Profiles

14.1 Competitive Landscape, 2023

14.2 Strategic Outlook

14.3 Robert Bosch GmbH

14.3.1 Company Snapshot

14.3.2 Company Overview

14.3.3 Product Benchmarking

14.3.4 Strategic Outlook

14.4 Continental AG.

14.4.1 Company Snapshot

14.4.2 Company Overview

14.4.3 Financial Analysis

14.4.3.1 Net Revenue, 2018-2022

14.4.3.2 R&D, 2018-2022

14.4.3.3 Regional Revenue Share, 2022 (%)

14.4.3.4 Business Segment Revenue Share, 2022 (%)

14.4.4 Product Benchmarking

14.4.5 Strategic Outlook

14.5 Denso Corporation

14.5.1 Company Snapshot

14.5.2 Company Overview

14.5.3 Financial Analysis

14.5.3.1 Net Revenue, 2019-2023

14.5.4 Product Benchmarking

14.5.5 Strategic Outlook

14.6 Aptiv PLC

14.6.1 Company Snapshot

14.6.2 Company Overview

14.6.3 Financial Analysis

14.6.3.1 Net Revenue, 2019-2023

14.6.3.2 Business Segment Revenue Share, 2023 (%)

14.6.4 Product Benchmarking

14.6.5 Strategic Outlook

14.7 Infineon Technologies AG

14.7.1 Company Snapshot

14.7.2 Company Overview

14.7.3 Financial Analysis

14.7.3.1 Net Revenue, 2019-2023

14.7.3.2 R&D, 2019-2023

14.7.3.3 Regional Revenue Share, 2023 (%)

14.7.3.4 Business Segment Revenue Share, 2023 (%)

14.7.4 Product Benchmarking

14.7.5 Strategic Outlook

14.8 Valeo S.A

14.8.1 Company Snapshot

14.8.2 Company Overview

14.8.3 Financial Analysis

14.8.3.1 Net Revenue, 2019-2023

14.8.3.2 R&D, 2019-2023

14.8.3.3 Business Segment Revenue Share, 2023 (%)

14.8.4 Product Benchmarking

14.8.5 Strategic Outlook

14.9 Panasonic Holdings Corporation

14.9.1 Company Snapshot

14.9.2 Company Overview

14.9.3 Financial Analysis

14.9.3.1 Net Revenue, 2019-2023

14.9.3.2 R&D, 2019-2023

14.9.3.3 Regional Revenue Share, 2023 (%)

14.9.3.4 Business Segment Revenue Share, 2023 (%)

14.9.4 Product Benchmarking

14.9.5 Strategic Outlook

14.10 Magna International Inc

14.10.1 Company Snapshot

14.10.2 Company Overview

14.10.3 Financial Analysis

14.10.3.1 Net Revenue, 2019-2023

14.10.3.2 R&D, 2019-2023

14.10.3.3 Regional Revenue Share, 2023 (%)

14.10.3.4 Business Segment Revenue Share, 2023 (%)

14.10.4 Product Benchmarking

14.10.5 Strategic Outlook

14.11 ZF Friedrichshafen AG

14.11.1 Company Snapshot

14.11.2 Company Overview

14.11.3 Product Benchmarking

14.12 NXP Semiconductors N.V.

14.12.1 Company Snapshot

14.12.2 Company Overview

14.12.3 Financial Analysis

14.12.3.1 Net Revenue, 2019-2023

14.12.3.2 R&D, 2019-2023

14.12.3.3 Regional Revenue Share, 2023 (%)

14.12.4 Product Benchmarking

14.12.5 Strategic Outlook

14.13 Lear Corporation

14.13.1 Company Snapshot

14.13.2 Company Overview

14.13.3 Financial Analysis

14.13.3.1 Net Revenue, 2019-2023

14.13.3.2 Regional Revenue Share, 2023 (%)

14.13.3.3 Business Segment Revenue Share, 2023 (%)

14.13.4 Product Benchmarking

14.13.5 Strategic Outlook

14.14 Aisin Corporation

14.14.1 Company Snapshot

14.14.2 Company Overview

14.14.3 Financial Analysis

14.14.3.1 Net Revenue, 2019-2023

14.14.3.2 R&D, 2019-2023

14.14.4 Product Benchmarking

14.14.5 Strategic Outlook

14.15 Nvidia Corporation

14.15.1 Company Snapshot

14.15.2 Company Overview

14.15.3 Financial Analysis

14.15.3.1 Net Revenue, 2020-2024

14.15.3.2 R&D, 2020-2024

14.15.3.3 Regional Revenue Share, 2023 (%)

14.15.3.4 Business Segment Revenue Share, 2023 (%)

14.15.4 Product Benchmarking

14.15.5 Strategic Outlook

14.16 Yazaki Corporation

14.16.1 Company Snapshot

14.16.2 Company Overview

14.16.3 Product Benchmarking

14.16.4 Strategic Outlook

14.17 Hyundai Mobis

14.17.1 Company Snapshot

14.17.2 Company Overview

14.17.3 Financial Analysis

14.17.3.1 Net Revenue, 2019-2023

14.17.3.2 R&D, 2019-2023

14.17.3.3 Regional Revenue Share, 2023 (%)

14.17.3.4 Business Segment Revenue Share, 2023 (%)

14.17.4 Product Benchmarking

14.17.5 Strategic Outlook

15 Conclusion and Recommendations

15.1 Concluding Remarks from Visiongain

15.2 Recommendations for Market Players

ページTOPに戻る

List of Tables/Graphs

List of Tables

Table 1 Automotive Electronics Market Snapshot, 2024 & 2034 (US$ Billion, CAGR %)

Table 2 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

Table 3 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

Table 4 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

Table 5 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

Table 6 Global Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 7 Original Equipment Manufacturer (OEM) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 8 Aftermarket Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 9 Global Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 10 Passenger Cars Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 11 Commercial Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 12 Electric Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 13 Hybrid Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 14 Global Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 15 Electronic Control Units (ECUs) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 16 Sensors & Actuators Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 17 Microcontrollers Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 18 Displays & Connectivity Solutions Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 19 Other Components Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 20 Global Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 21 Advanced Driver Assistance Systems (ADAS) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 22 Infotainment Systems Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 23 Powertrain Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 24 Safety Systems Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 25 Body Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 26 Telematics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 27 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 28 North America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 29 North America Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 30 North America Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 31 North America Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 32 North America Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 33 North America Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 34 US Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 35 Canada Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 36 Europe Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 37 Europe Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 38 Europe Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 39 Europe Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 40 Europe Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 41 Europe Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 42 Germany Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 43 UK Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 44 France Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 45 Italy Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 46 Spain Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 47 Rest of Europe Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 48 Asia-Pacific Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 49 Asia-Pacific Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 50 Asia-Pacific Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 51 Asia-Pacific Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 52 Asia-Pacific Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 53 Asia-Pacific Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 54 China Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 55 India Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 56 Japan Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 57 South Korea Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 58 Australia Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 59 Rest of Asia-Pacific Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 60 Middle East & Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 61 Middle East & Africa Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 62 Middle East & Africa Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 63 Middle East & Africa Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 64 Middle East & Africa Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 65 Middle East & Africa Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 66 GCC Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 67 South Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 68 Rest of Middle East & Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 69 Latin America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 70 Latin America Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 71 Latin America Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 72 Latin America Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 73 Latin America Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 74 Latin America Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 75 Brazil Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 76 Mexico Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

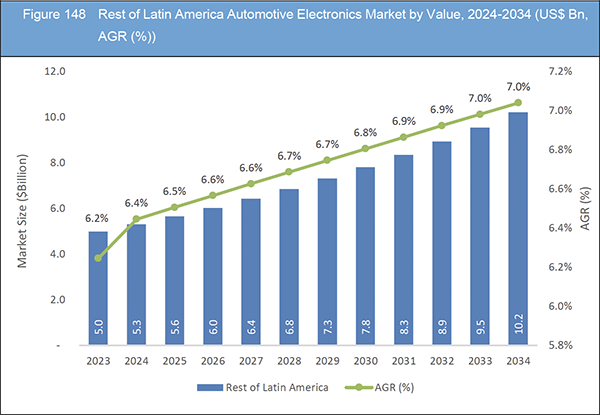

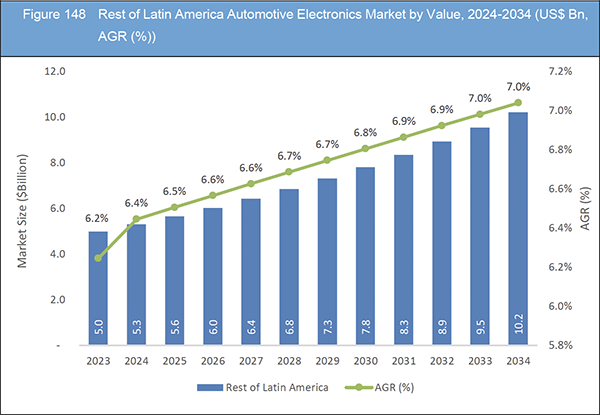

Table 77 Rest of Latin America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 78 Strategic Outlook - Contract

Table 79 Robert Bosch GmbH: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 80 Robert Bosch GmbH: Product Benchmarking

Table 81 Robert Bosch GmbH: Strategic Outlook

Table 82 Continental AG.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 83 Continental AG.: Product Benchmarking

Table 84 Continental AG.: Strategic Outlook

Table 85 Denso Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 86 Denso Corporation: Product Benchmarking

Table 87 Denso Corporation: Strategic Outlook

Table 88 Aptiv PLC: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 89 Aptiv PLC: Product Benchmarking

Table 90 Aptiv PLC: Strategic Outlook

Table 91 Infineon Technologies AG: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 92 Infineon Technologies AG: Product Benchmarking

Table 93 Infineon Technologies AG: Strategic Outlook

Table 94 Valeo S.A: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 95 Valeo S.A.: Product Benchmarking

Table 96 Valeo S.A.: Strategic Outlook

Table 97 Panasonic Holdings Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 98 Panasonic Holdings Corporation: Product Benchmarking

Table 99 Panasonic Holdings Corporation: Strategic Outlook

Table 100 Magna International Inc: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 101 Magna International Inc: Product Benchmarking

Table 102 Magna International Inc: Strategic Outlook

Table 103 ZF Friedrichshafen AG: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 104 ZF Friedrichshafen AG: Product Benchmarking

Table 105 NXP Semiconductors N.V.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 106 NXP Semiconductors N.V.: Product Benchmarking

Table 107 NXP Semiconductors N.V.: Strategic Outlook

Table 108 Lear Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 109 Lear Corporation: Product Benchmarking

Table 110 Lear Corporation: Strategic Outlook

Table 111 Aisin Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 112 Aisin Corporation: Product Benchmarking

Table 113 Aisin Corporation: Strategic Outlook

Table 114 Nvidia Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 115 Nvidia Corporation: Product Benchmarking

Table 116 Nvidia Corporation: Strategic Outlook

Table 117 Yazaki Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 118 Yazaki Corporation: Product Benchmarking

Table 119 Yazaki Corporation: Strategic Outlook

Table 120 Hyundai Mobis: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 121 Hyundai Mobis: Product Benchmarking

Table 122 Hyundai Mobis: Strategic Outlook

List of Figures

Figure 1 Automotive Electronics Market Segmentation

Figure 2 Automotive Electronics Market by Sales Channel: Market Attractiveness Index

Figure 3 Automotive Electronics Market by Vehicle Type: Market Attractiveness Index

Figure 4 Automotive Electronics Market by Component Type: Market Attractiveness Index

Figure 5 Automotive Electronics Market by Application: Market Attractiveness Index

Figure 6 Automotive Electronics Market Attractiveness Index by Region

Figure 7 Automotive Electronics Market: Market Dynamics

Figure 8 Automotive Electronics Market: Porter’s Five Forces Analysis

Figure 9 Global Automotive Electronics Market Share Forecast by COVID, 2024-2034 (%)

Figure 10 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%)) (V-Shaped Recovery Scenario)

Figure 11 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%)) (U-Shaped Recovery Scenario)

Figure 12 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%)) (W-Shaped Recovery Scenario))

Figure 13 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%)) (L-Shaped Recovery Scenario)

Figure 14 Automotive Electronics Market: PEST Analysis

Figure 15 Automotive Electronics Market by Sales Channel: Market Attractiveness Index

Figure 16 Global Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 17 Automotive Electronics Market Share Forecast by Sales Channel, 2024, 2029, 2034 (%)

Figure 18 Original Equipment Manufacturer (OEM) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 19 Original Equipment Manufacturer (OEM) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 20 Aftermarket Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 21 Aftermarket Market Share Forecast by Region, 2024 & 2034 (%)

Figure 22 Automotive Electronics Market by Vehicle Type: Market Attractiveness Index

Figure 23 Global Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 24 Automotive Electronics Market Share Forecast by Vehicle Type, 2024, 2029, 2034 (%)

Figure 25 Passenger Cars Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 26 Passenger Cars Market Share Forecast by Region, 2024 & 2034 (%)

Figure 27 Commercial Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 28 Commercial Vehicles Market Share Forecast by Region, 2024 & 2034 (%)

Figure 29 Electric Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 30 Electric Vehicles Market Share Forecast by Region, 2024 & 2034 (%)

Figure 31 Hybrid Vehicles Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 32 Hybrid Vehicles Market Share Forecast by Region, 2024 & 2034 (%)

Figure 33 Automotive Electronics Market by Component Type: Market Attractiveness Index

Figure 34 Global Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 35 Automotive Electronics Market Share Forecast by Component Type, 2024, 2029, 2034 (%)

Figure 36 Electronic Control Units (ECUs) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 37 Electronic Control Units (ECUs) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 38 Sensors & Actuators Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 39 Sensors & Actuators Market Share Forecast by Region, 2024 & 2034 (%)

Figure 40 Microcontrollers Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 41 Microcontrollers Market Share Forecast by Region, 2024 & 2034 (%)

Figure 42 Displays & Connectivity Solutions Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 43 Displays & Connectivity Solutions Market Share Forecast by Region, 2024 & 2034 (%)

Figure 44 Other Components Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 45 Other Components Market Share Forecast by Region, 2024 & 2034 (%)

Figure 46 Automotive Electronics Market by Application: Market Attractiveness Index

Figure 47 Global Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 48 Automotive Electronics Market Share Forecast by Application, 2024, 2029, 2034 (%)

Figure 49 Advanced Driver Assistance Systems (ADAS) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 50 Advanced Driver Assistance Systems (ADAS) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 51 Infotainment Systems Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 52 Infotainment Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 53 Powertrain Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 54 Powertrain Electronics Market Share Forecast by Region, 2024 & 2034 (%)

Figure 55 Safety Systems Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 56 Safety Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 57 Body Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 58 Body Electronics Market Share Forecast by Region, 2024 & 2034 (%)

Figure 59 Telematics Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 60 Telematics Market Share Forecast by Region, 2024 & 2034 (%)

Figure 61 Automotive Electronics Market Forecast by Region 2024 and 2034 (Revenue, CAGR%)

Figure 62 Automotive Electronics Market Share Forecast by Region 2024, 2029, 2034 (%)

Figure 63 Global Automotive Electronics Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 64 North America Automotive Electronics Market Attractiveness Index

Figure 65 North America Automotive Electronics Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 66 North America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 67 North America Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 68 North America Automotive Electronics Market Share Forecast by Country, 2024 & 2034 (%)

Figure 69 North America Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 70 North America Automotive Electronics Market Share Forecast Sales Channel, 2024 & 2034 (%)

Figure 71 North America Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 72 North America Automotive Electronics Market Share Forecast by Vehicle Type, 2024 & 2034 (%)

Figure 73 North America Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 74 North America Automotive Electronics Market Share Forecast by Component Type, 2024 & 2034 (%)

Figure 75 North America Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 76 North America Automotive Electronics Market Share Forecast by Application, 2024 & 2034 (%)

Figure 77 US Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 78 Canada Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 79 Europe Automotive Electronics Market Attractiveness Index

Figure 80 Europe Automotive Electronics Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 81 Europe Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 82 Europe Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 83 Europe Automotive Electronics Market Share Forecast by Country, 2024 & 2034 (%)

Figure 84 Europe Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 85 Europe Automotive Electronics Market Share Forecast Sales Channel, 2024 & 2034 (%)

Figure 86 Europe Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 87 Europe Automotive Electronics Market Share Forecast by Vehicle Type, 2024 & 2034 (%)

Figure 88 Europe Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 89 Europe Automotive Electronics Market Share Forecast by Component Type, 2024 & 2034 (%)

Figure 90 Europe Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 91 Europe Automotive Electronics Market Share Forecast by Application, 2024 & 2034 (%)

Figure 92 Germany Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 93 UK Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 94 France Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 95 Italy Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 96 Spain Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 97 Rest of Europe Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 98 Asia-Pacific Automotive Electronics Market Attractiveness Index

Figure 99 Asia-Pacific Automotive Electronics Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 100 Asia-Pacific Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 101 Asia-Pacific Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 102 Asia-Pacific Automotive Electronics Market Share Forecast by Country, 2024 & 2034 (%)

Figure 103 Asia-Pacific Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 104 Asia-Pacific Automotive Electronics Market Share Forecast Sales Channel, 2024 & 2034 (%)

Figure 105 Asia-Pacific Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 106 Asia-Pacific Automotive Electronics Market Share Forecast by Vehicle Type, 2024 & 2034 (%)

Figure 107 Asia-Pacific Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 108 Asia-Pacific Automotive Electronics Market Share Forecast by Component Type, 2024 & 2034 (%)

Figure 109 Asia-Pacific Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 110 Asia-Pacific Automotive Electronics Market Share Forecast by Application, 2024 & 2034 (%)

Figure 111 China Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 112 India Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 113 Japan Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 114 South Korea Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 115 Australia Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 116 Rest of Asia-Pacific Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 117 Middle East and Africa Automotive Electronics Market Attractiveness Index

Figure 118 Middle East and Africa Automotive Electronics Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 119 Middle East & Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 120 Middle East & Africa Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 121 Middle East and Africa Automotive Electronics Market Share Forecast by Country, 2024 & 2034 (%)

Figure 122 Middle East & Africa Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 123 Middle East and Africa Automotive Electronics Market Share Forecast Sales Channel, 2024 & 2034 (%)

Figure 124 Middle East & Africa Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 125 Middle East and Africa Automotive Electronics Market Share Forecast by Vehicle Type, 2024 & 2034 (%)

Figure 126 Middle East & Africa Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 127 Middle East and Africa Automotive Electronics Market Share Forecast by Component Type, 2024 & 2034 (%)

Figure 128 Middle East & Africa Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 129 Middle East and Africa Automotive Electronics Market Share Forecast by Application, 2024 & 2034 (%)

Figure 130 GCC Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 131 South Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 132 Rest of Middle East & Africa Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 133 Latin America Automotive Electronics Market Attractiveness Index

Figure 134 Latin America Automotive Electronics Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 135 Latin America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 136 Latin America Automotive Electronics Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 137 Latin America Automotive Electronics Market Share Forecast by Country, 2024 & 2034 (%)

Figure 138 Latin America Automotive Electronics Market by Sales Channel, 2024-2034 (US$ Bn, AGR (%))

Figure 139 Latin America Automotive Electronics Market Share Forecast Sales Channel, 2024 & 2034 (%)

Figure 140 Latin America Automotive Electronics Market by Vehicle Type, 2024-2034 (US$ Bn, AGR (%))

Figure 141 Latin America Automotive Electronics Market Share Forecast by Vehicle Type, 2024 & 2034 (%)

Figure 142 Latin America Automotive Electronics Market by Component Type, 2024-2034 (US$ Bn, AGR (%))

Figure 143 Latin America Automotive Electronics Market Share Forecast by Component Type, 2024 & 2034 (%)

Figure 144 Latin America Automotive Electronics Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 145 Latin America Automotive Electronics Market Share Forecast by Application, 2024 & 2034 (%)

Figure 146 Brazil Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 147 Mexico Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 148 Rest of Latin America Automotive Electronics Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 149 Automotive Electronics Market: Company Share, 2023

Figure 150 Continental AG.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 151 Continental AG.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 152 Continental AG.: Regional Revenue Share, 2022 (%)

Figure 153 Continental AG.: Business Segment Revenue Share, 2022 (%)

Figure 154 Denso Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 155 Aptiv PLC.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 156 Aptiv PLC.: Business Segment Revenue Share, 2023 (%)

Figure 157 Infineon Technologies AG.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 158 Infineon Technologies AG.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 159 Infineon Technologies AG.: Regional Revenue Share, 2023 (%)

Figure 160 Infineon Technologies AG.: Business Segment Revenue Share, 2023 (%)

Figure 161 Valeo S.A.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 162 Valeo S.A..: R&D, 2019-2023 (US$ Million, AGR%)

Figure 163 Valeo S.A..: Business Segment Revenue Share, 2023 (%)

Figure 164 Panasonic Holdings Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 165 Panasonic Holdings Corporation.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 166 Panasonic Holdings Corporation.: Regional Revenue Share, 2023 (%)

Figure 167 Panasonic Holdings Corporation.: Business Segment Revenue Share, 2023 (%)

Figure 168 Magna International Inc.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 169 Magna International Inc.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 170 Magna International Inc.: Regional Revenue Share, 2023 (%)

Figure 171 Magna International Inc.: Business Segment Revenue Share, 2023 (%)

Figure 172 NXP Semiconductors N.V..: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 173 NXP Semiconductors N.V..: R&D, 2019-2023 (US$ Million, AGR%)

Figure 174 NXP Semiconductors N.V..: Regional Revenue Share, 2023 (%)

Figure 175 Lear Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 176 Lear Corporation.: Regional Revenue Share, 2023 (%)

Figure 177 Lear Corporation.: Business Segment Revenue Share, 2023 (%)

Figure 178 Aisin Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 179 Aisin Corporation.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 180 Nvidia Corporation.: Net Revenue, 2020-2024 (US$ Million, AGR%)

Figure 181 Nvidia Corporation.: R&D, 2020-2024 (US$ Million, AGR%)

Figure 182 Nvidia Corporation.: Regional Revenue Share, 2023 (%)

Figure 183 Nvidia Corporation.: Business Segment Revenue Share, 2023 (%)

Figure 184 Hyundai Mobis.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 185 Hyundai Mobis.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 186 Hyundai Mobis.: Regional Revenue Share, 2023 (%)

Figure 187 Hyundai Mobis.: Business Segment Revenue Share, 2023 (%)