Summary

この調査レポートはADASと自動運転向け画像センシングと表示技術について詳細に調査・分析しています。

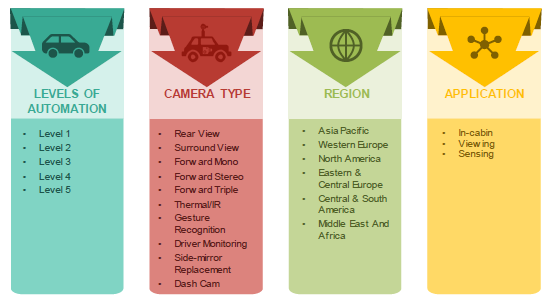

対象セグメント

-

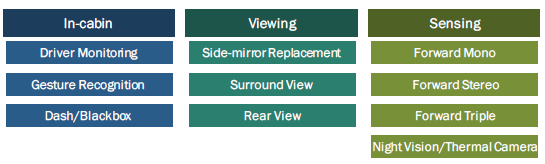

車内

-

運転監視

-

ジェスチャー認識

-

ダッシュボックス/ブラックボックス

-

表示

-

サイドミラー代替ディスプレイ

-

サラウンドビュー

-

リアビュー

-

センシング

-

前方単眼

-

前方両眼

-

前方トリプル

-

暗視/サーマルカメラ

対象地域

-

アジア太平洋地域

-

西欧

-

北米

-

中東欧

-

中南米

-

中東&アフリカ

主な掲載内容(目次より抜粋)

-

エグゼクティブサマリー

-

調査範囲とメソドロジー

-

変わりゆく産業ダイナミクス

-

ADASと自動運転車両市場

-

自動運転産業向け画像表示とセンシング

M14 Automotive Intelligence Vertical has detailed and exhaustive database available on the ADAS and autonomous driving industry. The Autonomous Driving Intelligence team is comprised of 10 Consultants and Subject Matter Experts. The author and co-authors of the report has more than 10 years and 5 years of experience respectively.

As a part of yearly publications, M14 Intelligence recently published an exhaustive industry analysis report on Imaging and Sensing Technology Market for ADAS and Autonomous Driving Industry, Edition 2019. This report provides a deep dive investigation into autonomous driving industry and detailed analysis on the camera imaging and sensing technologies, their components, and trends that enables autonomous driving. The report is analysis of more than 140 pages with 100+ infographics and data tables.

The scope of the research study is enlisted below

INDUSTRY DYNAMICS

-

Historical and recent new passenger car sales trend across major markets

-

Mandatory safety regulations for safer roads across major markets

-

Need for electrification of vehicles

-

Shared mobility for reduced road congestion

-

Government and private funding for autonomous driving

-

Drivers, Challenges, and Opportunities for autonomous driving industry

-

Supply/Demand trends in automotive industry

-

AV Readiness Index by leading automotive markets

COMPETITION ASSESSMENT

-

Car Manufacturers and their race for autonomous driving

-

Robotic Vehicles Trend ? Robotic Taxis and Autonomous Shuttles Providers

-

Partnership between Car Manufacturers and Tier 1s, Technology Providers, Robotic Vehicle Companies, Shared Mobility Companies, Imaging and Sensing System Suppliers, System Integrators, AV Testing & Simulation Companies, Telecom Providers, Artificial Intelligence Companies, Software Providers, Navigation and Mapping Companies

-

Market Share Analysis of all the sensors, processors, system, and technology providers, along with OEMs

LEVELS OF AUTONOMOUS DRIVING TECHNOLOGY

-

SAE Level 0 - No Automation

-

SAE Level 1 - Advanced Driver Assistance (ADAS)

-

SAE Level 2 - Partial Automation

-

SAE Level 3 - Conditional Automation

-

SAE Level 4 - High Automation

-

SAE Level 5 - Full Automation/Driverless Cars

-

Robotic Vehicles - Robotic taxis and autonomous shuttles

The historical, actual, and forecasts of the sales demand for the cars by levels of automation is covered in the report. In case of Level 2 vehicles, car sales of leading OEMs by models is also covered. In case of Level 3 and above autonomy, the car sales are estimated and forecasted based on the announcements by the leading OEM brands.

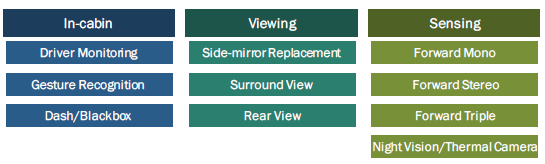

CAMERA TECHNOLOGIES THAT ENABLES AUTONOMOUS DRIVING

For all the technologies mentioned below, detailed analysis on the market size, sales demand, pricing breakdown, sensor content per vehicle, leading suppliers’ assessment, and important partnerships across the levels of autonomy and major markets is covered in this report.

Imaging and Sensing Technologies for Autonomous Driving - Market Segmentation

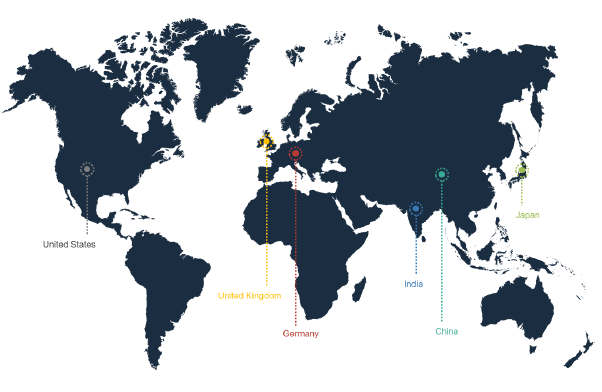

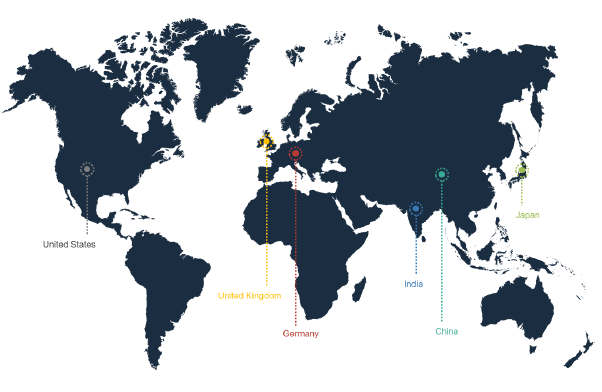

REGION AND COUNTRY-LEVEL ANALYSIS

Regions analyzed during this research are - North America, Central and South America, Western Europe, Eastern and Central Europe, Asia Pacific, Middle East and Africa. Of which, the U.S., U.K. Germany, China, Japan, and India are the few of the important markets that are covered exhaustively in the report.

Regional and Country-level Analysis - Imaging and Sensing Technologies for Autonomous Driving

MARKET SEGMENTATION

ページTOPに戻る

Table of Contents

CONTENTS

1 EXECUTIVE SUMMARY 10

2 RESEARCH SCOPE AND METHODOLOGY 20

2.1. SCOPE OF THE STUDY 21

2.2. METHODOLOGY 30

3 CHANGING INDUSTRY DYNAMICS 32

3.1. ADAS AND AUTONOMOUS FUNCTIONS 33

3.1.1. ADAS COGNITIVE PROCESSES 33

3.1.2. THE MANY LEVELS OF AUTOMATION 33

3.1.3. SAE LEVELS USED BY THE INDUSTRY 35

3.2. BENEFITS, DRIVERS, CHALLENGES, AND OPPORTUNITIES IN ADOPTION OF AUTONOMOUS DRIVING 37

3.2.1. BENEFITS 38

3.2.2. OPPORTUNITIES 40

3.2.3. DRIVING FACTORS 52

3.2.4. CHALLENGES 53

3.3. AUTONOMOUS DRIVING PROJECTS 55

3.3.1. GOVERNMENT FUNDED PROJECTS 55

3.3.2. PRIVATE FUNDED PROJECTS 57

3.4. R&D EXPENSES IN AUTONOMOUS DRIVING 60

3.4.1. R&D EXPENSES OF CAR MAKERS 60

3.4.2. TOP AUTOMOTIVE SUPPLIERS R&D EXPENSES 65

3.5. AUTONOMOUS DRIVING FROM BUYERS PERSPECTIVE 68

3.6. ACCESSING COUNTRIES’ AUTONOMOUS VEHICLES READINESS INDEX 70

3.6.1. GOVERNMENT’S ROLE IN COUNTRY’S AV READINESS 71

3.6.2. SOCIAL ACCEPTANCE 72

3.6.3. EASE OF ADOPTION 72

3.6.4. TECHNOLOGICAL ADVANCEMENTS 73

3.7. ASSESSING COUNTRIES’ AUTONOMOUS DRIVING REGULATIONS AND IMPACT 74

3.7.1. NORTH AMERICA 74

3.7.2. EUROPE 76

3.7.3. LATIN AMERICA 77

3.7.4. AUSTRALASIA 77

3.7.5. SOUTHEAST ASIA 79

3.8. MOBILITY AS A SERVICE, EV, AND AUTONOMOUS DRIVING - CORRELATION AND IMPACT 80

3.9. SHARED MOBILITY - AUTONOMOUS VEHICLES BIGGEST MARKET OPPORTUNITY 84

3.10. CONNECTED AND AUTONOMOUS VEHICLES - COST TO BUYERS 86

3.11. MAPPING AND NAVIGATION MARKET - BENEFITED FROM AV 88

3.11.1. HERE MAPS 90

3.11.2. TOMTOM 91

3.11.3. CIVIL MAPS 92

3.11.4. NAVINFO 92

3.11.5. ZENRIN 92

3.11.6. LVL5 93

3.11.7. MAPBOX 93

3.11.8. DEEPMAP 94

3.11.9. USHR 94

3.11.10. CARMERA 94

3.11.11. MOMENTA 95

3.11.12. MAPILLARY 95

4 ADAS AND AUTONOMOUS VEHICLES MARKET 96

4.1. ASSUMPTIONS FOR MARKET SIZE ESTIMATION AND FORECAST 97

4.2. ADAS / LEVEL 1 CARS 100

4.3. PARTIAL AUTOMATION / LEVEL 2 CARS 102

4.4. CONDITIONAL AUTOMATION / LEVEL 3 CARS 104

4.5. HIGH - FULL AUTOMATION / LEVEL 4/5 CARS 106

4.6. ROBOTIC VEHICLE SALES 108

5 IMAGE VIEWING AND SENSING FOR AD INDUSTRY 109

5.1. CAMERA FOR AUTONOMOUS DRIVING - SUMMARY 110

5.2. FORWARD ADAS MONOCULAR CAMERA 119

5.3. FORWARD ADAS STEREO CAMERA 122

5.4. FORWARD ADAS TRIPLE/TRIFOCAL CAMERA 125

5.5. THERMAL / IR/ NIGHT VISION CAMERA 127

5.6. DRIVER MONITORING, IN-CABIN, DASH CAMERA, AND GESTURE RECOGNITION CAMERA 130

5.7. REAR-VIEW, SURROUND VIEW, AND SIDE-MIRROR REPLACEMENT CAMERA 133

6 REFERENCES 136

List of Figures

FIGURE 1-1 IMAGE SENSORS SHIPMENT, 2018 - 2020 16

FIGURE 1-2 IMAGE SENSORS AND VISION PROCESSORS MARKET, 2019 17

FIGURE 1-3 IMAGE SENSOR SALES BREAKDOWN BY TECHNOLOGY TYPE, 2019 17

FIGURE 3-1 SOCIETY OF AUTOMOTIVE ENGINEERS (SAE) LEVELS OF AUTOMATION 34

FIGURE 3-2 THE U.K. REPRESENTATION OF THE SAE LEVELS 34

FIGURE 3-3 R&D EXPENSE RATIO OF LEADING AUTOMOTIVE OEMS 60

FIGURE 3-4 R&D EXPENSE RATIO OF LEADING AUTOMOTIVE SUPPLIERS IN AUTONOMOUS DRIVING INDUSTRY 65

FIGURE 3-5 AUTONOMOUS VEHICLE READINESS INDEX SCORES BY COUNTRY 70

FIGURE 3-6 GOVERNMENT’S ROLE INDEX SCORE IN COUNTRY’S ROLE IN COUNTRY’S AV READINESS 71

FIGURE 3-7 SOCIAL ACCEPTANCE INDEX SCORE IN COUNTRY’S AV READINESS 72

FIGURE 3-8 EASE OF ADOPTION SCORE FOR COUNTRY’S AV READINESS 72

FIGURE 3-9 TECHNOLOGICAL ADVANCEMENTS SCORE FOR COUNTRY’S AV READINESS 73

FIGURE 4-1 OEM PASSENGER CARS AND ROBOTIC VEHICLE SALES, BREAKDOWN BY LEVELS OF AUTOMATION, 2018 - 2030 99

FIGURE 4-2 ADAS/LEVEL 1 EQUIPPED CAR SALES FORECAST 100

FIGURE 4-3 LEVEL 1 CAR SALES - BY REGION, 2019 AND 2030 101

FIGURE 4-4 TOP LEVEL 1 CAR SALES MARKETS 101

FIGURE 4-5 PARTIAL AUTOMATED CARS / LEVEL 2 CARS SALES, GROWTH, AND MARKET PENETRATION SNAPSHOT 102

FIGURE 4-6 TOP LEVEL 2 / PARTIAL AUTOMATED CARS MARKETS, 2019 AND 2030 103

FIGURE 4-7 LEVEL 2/ PARTIAL AUTOMATED CAR SALES - BY REGION, 2019 103

FIGURE 4-8LEVEL 3 CAR SALES AND MARKET PENETRATION SNAPSHOT 104

FIGURE 4-9 TOP LEVEL 3 CARS MARKETS, 2021 AND 2030 105

FIGURE 4-10 LEVEL 3 / CONDITIONAL AUTOMATED CAR SALES - BY REGION, 2021 AND 2030 105

FIGURE 4-11 LEVEL 4 AND 5 CAR SALES DEMAND ESTIMATION AND FORECAST SNAPSHOT 106

FIGURE 4-12 HIGHLY AUTONOMOUS CARS SALES DEMAND ESTIMATION - BY REGION, 2030 107

FIGURE 4-13 TOP MARKETS FOR LEVEL 4 AND 5 CARS, 2025 AND 2030 107

FIGURE 4-14 ROBOTIC VEHICLE SALES DEMAND FORECAST, 2019 - 2030 108

FIGURE 5-1 CAMERA SENSING TECHNOLOGY COMPARISON 111

FIGURE 5-2 ADAS FUNCTIONS SERVED BY CAMERA TECHNOLOGIES 111

FIGURE 5-3 AUTOMOTIVE IMAGE SENSOR SUPPLIERS MARKET SHARE, 2018 (%) 112

FIGURE 5-4 IMAGING PLAYERS ECOSYSTEM IN ADAS AND AUTONOMOUS DRIVING INDUSTRY 118

FIGURE 5-5 MONO CAMERA MODULE SALES DEMAND, 2018 - 2030 119

FIGURE 5-6 FORWARD MONO CAMERA SALES DEMAND BY LEVELS OF AUTOMATION, 2019 - 2030 120

FIGURE 5-7 MONO CAMERA MARKET SIZE, 2019 - 2030 120

FIGURE 5-8 FORWARD MONO CAMERA MARKET SIZE BY LEVELS OF AUTOMATION, 2019 - 2030 120

FIGURE 5-9 FORWARD STEREO CAMERA SALES, 2019 - 2030 122

FIGURE 5-10 FORWARD STEREO CAMERA MARKET SIZE AND PRICING TREND, BY LEVELS OF AUTOMATION 123

FIGURE 5-11 FORWARD STEREO CAMERA SALES DEMAND, BY LEVELS OF AUTOMATION 123

FIGURE 5-12 FORWARD ADAS TRIFOCAL CAMERA SALES DEMAND 125

FIGURE 5-13 THERMAL CAMERA SALES DEMAND, 2018 - 2030 128

FIGURE 5-14 THERMAL CAMERA ADOPTION TREND BY LEVELS OF AUTOMATION 128

FIGURE 5-16 THERMAL CAMERA PRICING TREND, 2019 - 2030 129

FIGURE 5-16 THERMAL CAMERA MARKET SIZE, 2019 - 2030 129

FIGURE 5-17 DRIVER MONITORING CAMERA SALES DEMAND AND MARKET SIZE, 2019 - 2030 131

FIGURE 5-18 DASH CAMERA SALES DEMAND AND MARKET SIZE, 2019 - 2030 131

List of Tables

TABLE 1-1 GNSS SUPPLIER MAPPING - BY OEMS, TIER 1S, ANTENNA CHIP PROVIDERS 19

TABLE 3-1 NVIDIA INORGANIC GROWTH STRATEGY IN AUTONOMOUS DRIVING INDUSTRY 44

TABLE 3-2 AIMOTIVE INORGANIC DEVELOPMENT STRATEGY 45

TABLE 3-3 ARGO AI INORGANIC DEVELOPMENT STRATEGY 45

TABLE 3-4 IBM WATSON INORGANIC DEVELOPMENT STRATEGY 46

TABLE 3-5 INTEL INORGANIC DEVELOPMENT STRATEGY 47

TABLE 3-6 MICROSOFT INORGANIC DEVELOPMENT STRATEGY 48

TABLE 3-7 NUANCE COMMUNICATION INORGANIC DEVELOPMENT STRATEGY 49

TABLE 3-8 PONY.AI INORGANIC DEVELOPMENT STRATEGY 49

TABLE 3-9 ROADSTART.AI INORGANIC DEVELOPMENT STRATEGY 49

TABLE 3-10 DRIVE.AI INORGANIC DEVELOPMENT STRATEGY 50

TABLE 3-11 PLUSAI INORGANIC DEVELOPMENT STRATEGY 50

TABLE 3-12 ASCENT ROBOTICS INORGANIC DEVELOPMENT STRATEGY 50

TABLE 3-13SENSETIME INORGANIC GROWTH STRATEGY 50

TABLE 3-14 CORTICA INORGANIC DEVELOPMENT STRATEGY 51

TABLE 3-15 MOMENTA INORGANIC DEVELOPMENT STRATEGY 51

TABLE 3-16 GOVERNMENT OF U.K. FUNDING FOR DRIVERLESS TECHNOLOGY 56

TABLE 3-17 RECENT PRIVATE FUNDED AUTONOMOUS DRIVING INDUSTRY PROJECTS 57

TABLE 3-18 VW R&D EXPENDITURE 61

TABLE 3-19 AUDI R&D EXPENDITURE 62

TABLE 3-20 DAIMLER R&D EXPENDITURE 62

TABLE 3-21 MERCEDES BENZ R&D EXPENDITURE 62

TABLE 3-22 BMW R&D EXPENDITURE 63

TABLE 3-23 TOYOTA R&D EXPENDITURE 63

TABLE 3-24 FORD R&D EXPENDITURE 63

TABLE 3-25 VOLVO R&D EXPENDITURE 64

TABLE 3-26 NISSAN R&D EXPENDITURE 64

TABLE 3-27 TESLA R&D EXPENDITURE 64

TABLE 3-28 GM R&D EXPENDITURE 64

TABLE 3-29 HYUNDAI R&D EXPENDITURE 64

TABLE 3-30 HONDA R&D EXPENDITURE 65

TABLE 3-31 IIHS RATINGS-2019 WINNER MODELS OF MINICARS, MID-SIZE LUXURY, MID -SIZE AND SMALL CARS 75

TABLE 3-32 EURO NCAP 2019 RATINGS FOR CARS 77

TABLE 3-33 ANCAP STAR RATINGS FOR CARS 78

TABLE 3-34 ASEAN NCAP STAR RATINGS FOR CARS IN 2018-19 79

TABLE 3-35 PARTNERSHIPS BETWEEN OEM AND RIDESHARING COMPANIES GLOBALLY 85

TABLE 3-36 ADDITIONAL EQUIPMENT AND SERVICES FOR AUTONOMOUS VEHICLES 86

TABLE 3-37 HERE MAPS INORGANIC DEVELOPMENT STRATEGIES 90

TABLE 3-38 TOMTOM’S INORGANIC DEVELOPMENT STRATEGIES 91

TABLE 3-39 CIVIL MAPS INORGANIC DEVELOPMENT STRATEGIES 92

TABLE 3-40 NAVINFO INORGANIC DEVELOPMENT STRATEGIES 92

TABLE 3-41 ZENRIN INORGANIC DEVELOPMENT STRATEGIES 92

TABLE 3-42 LVL 5 INORGANIC DEVELOPMENT STRATEGIES 93

TABLE 3-43 MAPBOX INORGANIC DEVELOPMENT STRATEGIES 93

TABLE 3-44 DEEPMAP INORGANIC DEVELOPMENT STRATEGIES 94

TABLE 3-45 USHR INORGANIC DEVELOPMENT STRATEGIES 94

TABLE 3-46 CARMERA INORGANIC DEVELOPMENT STRATEGIES 94

TABLE 3-47 MOMENTA INORGANIC DEVELOPMENT STRATEGIES 95

TABLE 3-48 MAPILLARY INORGANIC DEVELOPMENT STRATEGIES 95

TABLE 5-1 CMOS IMAGE SENSOR SUPPLIERS - PARTNERSHIP MAPPING 113

TABLE 5-2 PARTNERSHIP MAPPING - OEMS & MODELS, TIER 1S, CAMERA SYSTEM SUPPLIERS, AND IMAGE SENSOR SUPPLIERS 114

TABLE 5-3 MONO CAMERA SUPPLIERS MAPPING 121

TABLE 5-4 STEREO CAMERA SUPPLIERS MAPPING 124

TABLE 5-5 NIGHT VISION CAMERA SUPPLIER MAPPING 129

TABLE 5-6 DRIVER MONITORING SYSTEM COMPANIES PARTNERSHIPS IN AUTONOMOUS DRIVING INDUSTRY 131

1. EXECUTIVE SUMMARY ........................ 10

2. RESEARCH SCOPE AND METHODOLOGY ................. 20

2.1. SCOPE OF THE STUDY ...................... 21

2.2. METHODOLOGY ......................... 30

3. CHANGING INDUSTRY DYNAMICS ................... 32

3.1. ADAS AND AUTONOMOUS FUNCTIONS.................. 33

3.1.1. ADAS COGNITIVE PROCESSES .................... 33

3.1.2. THE MANY LEVELS OF AUTOMATION .................. 33

3.1.3. SAE LEVELS USED BY THE INDUSTRY ................ 35

3.2. BENEFITS, DRIVERS, CHALLENGES, AND OPPORTUNITIES IN ADOPTION OF AUTONOMOUS DRIVING ............................ 37

3.2.1. BENEFITS ........................... 38

3.2.2. OPPORTUNITIES ....................... 40

3.2.3. DRIVING FACTORS ...................... 52

3.2.4. CHALLENGES .......................... 53

3.3. AUTONOMOUS DRIVING PROJECTS .................. 55

3.3.1. GOVERNMENT FUNDED PROJECTS .................... 55

3.3.2. PRIVATE FUNDED PROJECTS .................... 57

3.4. R&D EXPENSES IN AUTONOMOUS DRIVING................ 60

3.4.1. R&D EXPENSES OF CAR MAKERS .................. 60

3.4.2. TOP AUTOMOTIVE SUPPLIERS R&D EXPENSES ................ 65

3.5. AUTONOMOUS DRIVING FROM BUYERS PERSPECTIVE............ 68

3.6. ACCESSING COUNTRIES’ AUTONOMOUS VEHICLES READINESS INDEX ........ 70

3.6.1. GOVERNMENT’S ROLE IN COUNTRY’S AV READINESS ............ 71

3.6.2. SOCIAL ACCEPTANCE ...................... 72

3.6.3. EASE OF ADOPTION ....................... 72

3.6.4. TECHNOLOGICAL ADVANCEMENTS .................. 73

3.7. ASSESSING COUNTRIES’ AUTONOMOUS DRIVING REGULATIONS AND IMPACT...... 74

3.7.1. NORTH AMERICA ....................... 74

3.7.2. EUROPE ........................... 76

3.7.3. LATIN AMERICA ......................... 77

3.7.4. AUSTRALASIA.......................... 77

3.7.5. SOUTHEAST ASIA ........................ 79

3.8. MOBILITY AS A SERVICE, EV, AND AUTONOMOUS DRIVING - CORRELATION AND IMPACT .... 80

3.9. SHARED MOBILITY - AUTONOMOUS VEHICLES BIGGEST MARKET OPPORTUNITY ...... 84

3.10. CONNECTED AND AUTONOMOUS VEHICLES - COST TO BUYERS ........... 86

3.11. MAPPING AND NAVIGATION MARKET - BENEFITTED FROM AV........... 88

3.11.1. HERE MAPS .......................... 90

3.11.2. TOMTOM .......................... 91

3.11.3. CIVIL MAPS ......................... 92

3.11.4. NAVINFO .......................... 92

3.11.5. ZENRIN .......................... 92

3.11.6. LVL5 ............................. 93

3.11.7. MAPBOX ........................... 93

3.11.8. DEEPMAP ........................... 94

3.11.9. USHR ........................... 94

3.11.10. CARMERA ........................ 94

3.11.11. MOMENTA .......................... 95

3.11.12. MAPILLARY ........................ 95

4. ADAS AND AUTONOMOUS VEHICLES MARKET ................ 96

4.1. ASSUMPTIONS FOR MARKET SIZE ESTIMATION AND FORECAST ............ 97

4.2. ADAS / LEVEL 1 CARS ...................... 100

4.3. PARTIAL AUTOMATION / LEVEL 2 CARS ................... 102

4.4. CONDITIONAL AUTOMATION / LEVEL 3 CARS.................. 104

4.5. HIGH - FULL AUTOMATION / LEVEL 4/5 CARS ................ 106

4.6. ROBOTIC VEHICLE SALES ....................... 108

5. IMAGE VIEWING AND SENSING FOR AD INDUSTRY ................ 109

5.1. CAMERA FOR AUTONOMOUS DRIVING - SUMMARY ................ 110

5.2. FORWARD ADAS MONOCULAR CAMERA ................ 119

5.3. FORWARD ADAS STEREO CAMERA .................... 122

5.4. FORWARD ADAS TRIPLE/TRIFOCAL CAMERA ................ 125

5.5. THERMAL / IR/ NIGHT VISION CAMERA .................. 127

5.6. DRIVER MONITORING, IN-CABIN, DASH CAMERA, AND GESTURE RECOGNITION CAMERA .. 130

5.7. REAR-VIEW, SURROUND VIEW, AND SIDE-MIRROR REPLACEMENT CAMERA ....... 133

6. REFERENCES .......................... 136

LIST OF FIGURES

FIGURE 1-1 IMAGE SENSORS SHIPMENT, 2018 - 2020 ................. 16

FIGURE 1-2 IMAGE SENSORS AND VISION PROCESSORS MARKET, 2019 .............. 17

FIGURE 1-3 IMAGE SENSOR SALES BREAKDOWN BY TECHNOLOGY TYPE, 2019........... 17

FIGURE 3-1 SOCIETY OF AUTOMOTIVE ENGINEERS (SAE) LEVELS OF AUTOMATION ......... 34

FIGURE 3-2 THE U.K. REPRESENTATION OF THE SAE LEVELS............... 34

FIGURE 3-3 R&D EXPENSE RATIO OF LEADING AUTOMOTIVE OEMS ............. 60

FIGURE 3-4 R&D EXPENSE RATIO OF LEADING AUTOMOTIVE SUPPLIERS IN AUTONOMOUS DRIVING INDUSTRY 65

FIGURE 3-5 AUTONOMOUS VEHICLE READINESS INDEX SCORES BY COUNTRY ........... 70

FIGURE 3-6 GOVERNMENT’S ROLE INDEX SCORE IN COUNTRY’S ROLE IN COUNTRY’S AV READINESS ... 71

FIGURE 3-7 SOCIAL ACCEPTANCE INDEX SCORE IN COUNTRY’S AV READINESS ............ 72

FIGURE 3-8 EASE OF ADOPTION SCORE FOR COUNTRY’S AV READINESS............ 72

FIGURE 3-9 TECHNOLOGICAL ADVANCEMENTS SCORE FOR COUNTRY’S AV READINESS ......... 73

FIGURE 4-1 OEM PASSENGER CARS AND ROBOTIC VEHICLE SALES, BREAKDOWN BY LEVELS OF AUTOMATION, 2018 - 2030 ............................ 99

FIGURE 4-2 ADAS/LEVEL 1 EQUIPPED CAR SALES FORECAST ............... 100

FIGURE 4-3 LEVEL 1 CAR SALES - BY REGION, 2019 AND 2030 ............... 101

FIGURE 4-4 TOP LEVEL 1 CAR SALES MARKETS .................. 101

FIGURE 4-5 PARTIAL AUTOMATED CARS / LEVEL 2 CARS SALES, GROWTH, AND MARKET PENETRATION SNAPSHOT.................................. 102

FIGURE 4-6 TOP LEVEL 2 / PARTIAL AUTOMATED CARS MARKETS, 2019 AND 2030 ........ 103

FIGURE 4-7 LEVEL 2/ PARTIAL AUTOMATED CAR SALES - BY REGION, 2019 .......... 103

FIGURE 4-8LEVEL 3 CAR SALES AND MARKET PENETRATION SNAPSHOT ............. 104

FIGURE 4-9 TOP LEVEL 3 CARS MARKETS, 2021 AND 2030 ................ 105

FIGURE 4-10 LEVEL 3 / CONDITIONAL AUTOMATED CAR SALES - BY REGION, 2021 AND 2030 . 105

FIGURE 4-11 LEVEL 4 AND 5 CAR SALES DEMAND ESTIMATION AND FORECAST SNAPSHOT...... 106

FIGURE 4-12 HIGHLY AUTONOMOUS CARS SALES DEMAND ESTIMATION - BY REGION, 2030 .. 107

FIGURE 4-13 TOP MARKETS FOR LEVEL 4 AND 5 CARS, 2025 AND 2030 ............ 107

FIGURE 4-14 ROBOTIC VEHICLE SALES DEMAND FORECAST, 2019 - 2030 ............. 108

FIGURE 5-1 CAMERA SENSING TECHNOLOGY COMPARISON .............. 111

FIGURE 5-2 ADAS FUNCTIONS SERVED BY CAMERA TECHNOLOGIES .............. 111

FIGURE 5-3 AUTOMOTIVE IMAGE SENSOR SUPPLIERS MARKET SHARE, 2018 (%) ......... 112

FIGURE 5-4 IMAGING PLAYERS ECOSYSTEM IN ADAS AND AUTONOMOUS DRIVING INDUSTRY ..118

FIGURE 5-5 MONO CAMERA MODULE SALES DEMAND, 2018 - 2030 ............. 119

FIGURE 5-6 FORWARD MONO CAMERA SALES DEMAND BY LEVELS OF AUTOMATION, 2019 - 2030 .. 120

FIGURE 5-7 MONO CAMERA MARKET SIZE, 2019 - 2030 .................. 120

FIGURE 5-8 FORWARD MONO CAMERA MARKET SIZE BY LEVELS OF AUTOMATION, 2019 - 2030 .. 120

FIGURE 5-9 FORWARD STEREO CAMERA SALES, 2019 - 2030 ................ 122

FIGURE 5-10 FORWARD STEREO CAMERA MARKET SIZE AND PRICING TREND, BY LEVELS OF AUTOMATION ... 123

FIGURE 5-11 FORWARD STEREO CAMERA SALES DEMAND, BY LEVELS OF AUTOMATION ....... 123

FIGURE 5-12 FORWARD ADAS TRIFOCAL CAMERA SALES DEMAND ............ 125

FIGURE 5-13 THERMAL CAMERA SALES DEMAND, 2018 - 2030 ............... 128

FIGURE 5-14 THERMAL CAMERA ADOPTION TREND BY LEVELS OF AUTOMATION ......... 128

FIGURE 5-16 THERMAL CAMERA PRICING TREND, 2019 - 2030 ............... 129

FIGURE 5-16 THERMAL CAMERA MARKET SIZE, 2019 - 2030 ................ 129

FIGURE 5-17 DRIVER MONITORING CAMERA SALES DEMAND AND MARKET SIZE, 2019 - 2030 ..131

FIGURE 5-18 DASH CAMERA SALES DEMAND AND MARKET SIZE, 2019 - 2030 .......... 131

LIST OF TABLES

TABLE 1-1 GNSS SUPPLIER MAPPING - BY OEMS, TIER 1S, ANTENNA CHIP PROVIDERS ......... 19

TABLE 3-1 NVIDIA INORGANIC GROWTH STRATEGY IN AUTONOMOUS DRIVING INDUSTRY ....... 44

TABLE 3-2 AIMOTIVE INORGANIC DEVELOPMENT STRATEGY ................ 45

TABLE 3-3 ARGO AI INORGANIC DEVELOPMENT STRATEGY ............... 45

TABLE 3-4 IBM WATSON INORGANIC DEVELOPMENT STRATEGY ................ 46

TABLE 3-5 INTEL INORGANIC DEVELOPMENT STRATEGY ................. 47

TABLE 3-6 MICROSOFT INORGANIC DEVELOPMENT STRATEGY .............. 48

TABLE 3-7 NUANCE COMMUNICATION INORGANIC DEVELOPMENT STRATEGY .......... 49

TABLE 3-8 PONY.AI INORGANIC DEVELOPMENT STRATEGY ............... 49

TABLE 3-9 ROADSTART.AI INORGANIC DEVELOPMENT STRATEGY ............... 49

TABLE 3-10 DRIVE.AI INORGANIC DEVELOPMENT STRATEGY................ 50

TABLE 3-11 PLUSAI INORGANIC DEVELOPMENT STRATEGY ............... 50

TABLE 3-12 ASCENT ROBOTICS INORGANIC DEVELOPMENT STRATEGY ............ 50

TABLE 3-13SENSETIME INORGANIC GROWTH STRATEGY ................ 50

TABLE 3-14 CORTICA INORGANIC DEVELOPMENT STRATEGY ............... 51

TABLE 3-15 MOMENTA INORGANIC DEVELOPMENT STRATEGY ................ 51

TABLE 3-16 GOVERNMENT OF U.K. FUNDING FOR DRIVERLESS TECHNOLOGY ............ 56

TABLE 3-17 RECENT PRIVATE FUNDED AUTONOMOUS DRIVING INDUSTRY PROJECTS .......... 57

TABLE 3-18 VW R&D EXPENDITURE ........................ 61

TABLE 3-19 AUDI R&D EXPENDITURE ........................ 62

TABLE 3-20 DAIMLER R&D EXPENDITURE ...................... 62

TABLE 3-21 MERCEDES BENZ R&D EXPENDITURE .................... 62

TABLE 3-22 BMW R&D EXPENDITURE ........................ 63

TABLE 3-23 TOYOTA R&D EXPENDITURE ..................... 63

TABLE 3-24 FORD R&D EXPENDITURE ...................... 63

TABLE 3-25 VOLVO R&D EXPENDITURE .................... 64

TABLE 3-26 NISSAN R&D EXPENDITURE ...................... 64

TABLE 3-27 TESLA R&D EXPENDITURE ..................... 64

TABLE 3-28 GM R&D EXPENDITURE ........................ 64

TABLE 3-29 HYUNDAI R&D EXPENDITURE ...................... 64

TABLE 3-30 HONDA R&D EXPENDITURE ...................... 65

TABLE 3-31 IIHS RATINGS-2019 WINNER MODELS OF MINICARS, MID-SIZE LUXURY, MID -SIZE AND SMALL CARS ..75

TABLE 3-32 EURO NCAP 2019 RATINGS FOR CARS ................... 77

TABLE 3-33 ANCAP STAR RATINGS FOR CARS .................... 78

TABLE 3-34 ASEAN NCAP STAR RATINGS FOR CARS IN 2018-19 ............... 79

TABLE 3-35 PARTNERSHIPS BETWEEN OEM AND RIDESHARING COMPANIES GLOBALLY ....... 85

TABLE 3-36 ADDITIONAL EQUIPMENT AND SERVICES FOR AUTONOMOUS VEHICLES ........ 86

TABLE 3-37 HERE MAPS INORGANIC DEVELOPMENT STRATEGIES ............... 90

TABLE 3-38 TOMTOM’S INORGANIC DEVELOPMENT STRATEGIES .............. 91

TABLE 3-39 CIVIL MAPS INORGANIC DEVELOPMENT STRATEGIES ................ 92

TABLE 3-40 NAVINFO INORGANIC DEVELOPMENT STRATEGIES ............... 92

TABLE 3-41 ZENRIN INORGANIC DEVELOPMENT STRATEGIES .............. 92

TABLE 3-42 LVL 5 INORGANIC DEVELOPMENT STRATEGIES ............... 93

TABLE 3-43 MAPBOX INORGANIC DEVELOPMENT STRATEGIES ............... 93

TABLE 3-44 DEEPMAP INORGANIC DEVELOPMENT STRATEGIES ................ 94

TABLE 3-45 USHR INORGANIC DEVELOPMENT STRATEGIES ................. 94

TABLE 3-46 CARMERA INORGANIC DEVELOPMENT STRATEGIES ................ 94

TABLE 3-47 MOMENTA INORGANIC DEVELOPMENT STRATEGIES ............... 95

TABLE 3-48 MAPILLARY INORGANIC DEVELOPMENT STRATEGIES ................ 95

TABLE 5-1 CMOS IMAGE SENSOR SUPPLIERS - PARTNERSHIP MAPPING ........... 113

TABLE 5-2 PARTNERSHIP MAPPING - OEMS & MODELS, TIER 1S, CAMERA SYSTEM SUPPLIERS, AND IMAGE SENSOR SUPPLIERS ............................ 114

TABLE 5-3 MONO CAMERA SUPPLIERS MAPPING ................... 121

TABLE 5-4 STEREO CAMERA SUPPLIERS MAPPING ................... 124

TABLE 5-5 NIGHT VISION CAMERA SUPPLIER MAPPING .................. 129

TABLE 5-6 DRIVER MONITORING SYSTEM COMPANIES PARTNERSHIPS IN AUTONOMOUS DRIVING INDUSTRY .. 131