Electric Truck Markets 2021-2041電気自動車市場 2021-2041年 この調査レポートは、バッテリー式電動トラック、プラグイン・ハイブリッドおよび燃料電池式トラックに関する72種の予測を提供しており、そこで中国、米国および欧州などの主要地域における中型および大型トラ... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2020年11月10日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

322

言語

英語

※価格はデータリソースまでお問い合わせください。

Summary

この調査レポートは、バッテリー式電動トラック、プラグイン・ハイブリッドおよび燃料電池式トラックに関する72種の予測を提供しており、そこで中国、米国および欧州などの主要地域における中型および大型トラックの売上、市場浸透度、バッテリー需要と市場価値に関する20年先の見通しを説明しています。

主な掲載内容(目次より抜粋)

Report Details

Despite medium and heavy duty trucks representing only 9% of the global vehicle stock, large diesel truck engines combined with high average annual mileage mean that the truck sector contributes 39% of the transport sectors' greenhouse gas emissions, which equates to about 5% of all global fossil fuel derived CO2 emission. It is this disproportionate contribution to emissions which makes trucks a target for governments. If the global community is going to meet its targets to reduce greenhouse gas emissions and limit the impact of climate change then it is clear that a rapid decarbonisation of the truck sector must be a priority. Consequently, the days of the fossil fuel powered combustion engine are numbered. Governments around the world, recognising the potentially catastrophic repercussions of unfettered climate change and witnessing the detrimental impact on human health from vehicle exhaust pollutant emissions in urban environments, are taking decisive action, that will, in the coming decades, drive vehicle manufacturers to zero on-road exhaust emission powertrain solutions.

The Electric Truck Markets 2021-2041 report is designed to help businesses across the automotive value chain plan for the future in this developing market. The report provides a total of 72 COVID-19 adjusted forecast lines for battery electric, plug-in hybrid and fuel cell electric trucks. The forecasts describe a twenty-year outlook for truck sales, market penetration, battery demand and market value, with separate forecasts for both the medium and heavy-duty truck markets. Along with a global forecast, regional forecasts are provided for China, the US, Europe and the RoW. The report covers the current status of the battery and fuel cell truck market, with detail about battery electric and fuel cell electric truck projects being undertaken by major players in the industry. Developments in the electric truck market are covered, including fuel cell applications and electric hybridization, along with discussion of key enabling technologies for electric truck deployment such as batteries, motors and charging infrastructure.

IDTechEx Electric Truck Markets 2021-2041 forecast segmentation:

Vehicle electrification offers a solution which effectively eliminates on-road exhaust emission and passes the pressure of decarbonisation on to electricity generation. A majority of manufactures, including Tesla, Daimler, VW and Volvo are investing heavily in all-electric trucks, a smaller minority, Toyota, Hyundai, and Nikola, have chosen to focus their efforts on fuel cell EV as the powertrain of the future. Despite issues with the efficiency of hydrogen as a fuel, FCEV remains in the conversation as a technology for long haul trucking applications, where a greater range is required, though the viability of this technology is dependent on the production cheap low carbon hydrogen. Chinese manufacturers are starting to produce electric trucks, leveraging their experience in electric buses and battery production. Given the Chinese governments strong support for the entire EV industry it likely that this is where the most significant deployment of EV trucks will be seen in the near future.

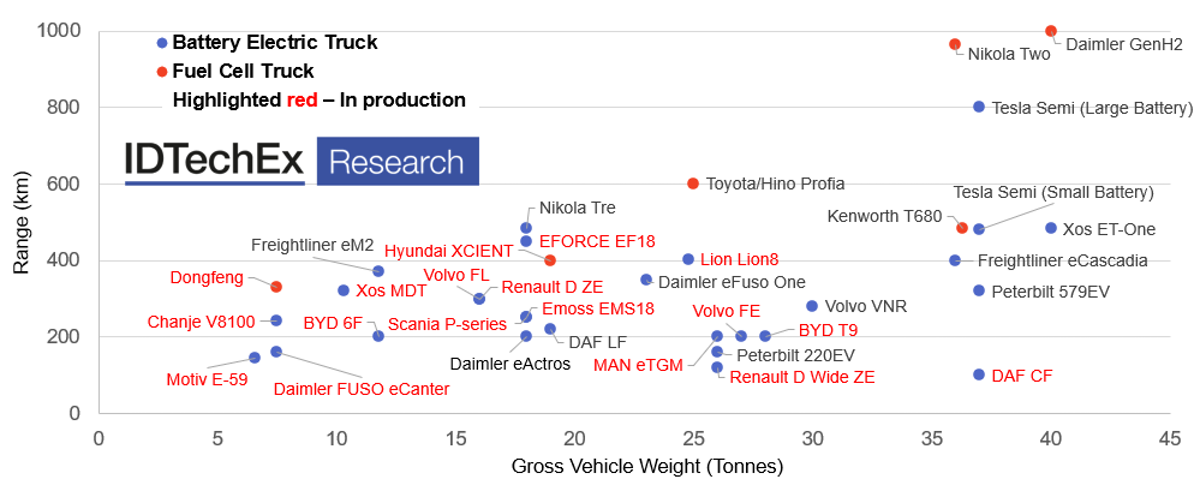

Zero-emission medium and heavy-duty trucks by technology and production status

Source: IDTechEx Electric Truck Markets 2021-2041, IEA

In the short to medium term, a range of financial incentives for electric trucks in the form of subsidies and tax breaks will be necessary to offset the high initial capital investment required to purchase electric trucks. However, over the next decade, as tightening emission regulation forces diesel truck manufacturers to fit increasingly expensive emissions control devices, raising the cost of diesel trucks, and the cost of electric trucks decreases due to falling battery prices and economies of scale savings on the cost of electric components and vehicle manufacturing, the TCO balance increasingly swings in favour of electric trucks. By the end of the 2020s, with electric trucks produced in volume, the difference in initial capital investment will be offset by the fuel savings and maintenance over the lifetime of the truck.

An increasing number of cities and nations around the world are targeting a complete phase out of diesel and petrol fuelled vehicles on their roads. The electrification of truck fleets, especially those operating in urban environments, is likely to happen rapidly, once the cost benefit and ability of the technology to deliver the required daily duty cycles have been demonstrated.

Table of Contents

|