Battery Swapping for Electric Vehicles 2022-2032: Technology, Players and Forecasts電気自動車向けバッテリースワップ 2022-2032年:技術、プレーヤー、予測 この調査レポートは、さまざまな車両セグメントにおけるスワップを取り上げ、技術、ビジネスモデル、業界内の関係者について詳細に調査・分析しています。 主な掲載内容(目... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2022年5月16日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

273

言語

英語

※価格はデータリソースまでお問い合わせください。

Summary

この調査レポートは、さまざまな車両セグメントにおけるスワップを取り上げ、技術、ビジネスモデル、業界内の関係者について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Battery swapping as an alternative to charging

Traditional cable based charging of EVs is now being complemented by another solution: battery swapping. In theory, the process is quicker and more convenient than a fast charge - 3-5 minutes for a swap as compared to 30-60 minutes on a DC fast charger. A driver drives into a battery swap station (BSS), and an automated system replaces the depleted battery with a fully charged spare without any user intervention or the driver having to leave the vehicle. This is the case for cars and heavy duty segment vehicles including trucks, buses and construction vehicles. From our research, we have found that in the case of cars, the most widespread approach is seen to be a pack swap from under the chassis of the car (as used widely by market leaders Nio and Aulton) whereas in trucks and buses it is often done using robotic cranes that lift battery packs from either above or from the side of the vehicle. In the case of swapping in the two and three-wheeler micromobility segment, a self-service approach is used wherein the user replaces smaller, lightweight battery packs themselves from a vending-machine-like swap station that holds spare batteries. Gogoro, Immotor and Swobbee are some of the key players in this market. As EV ranges get longer and batteries get bigger, fast-charging technology is fighting physics. Cable based charging units alone will not satisfy the market demand as EV sales outpace the installation rate. This is one of the motives in searching for other efficient publicly available solutions, and explains why battery-swapping has gained high attention.

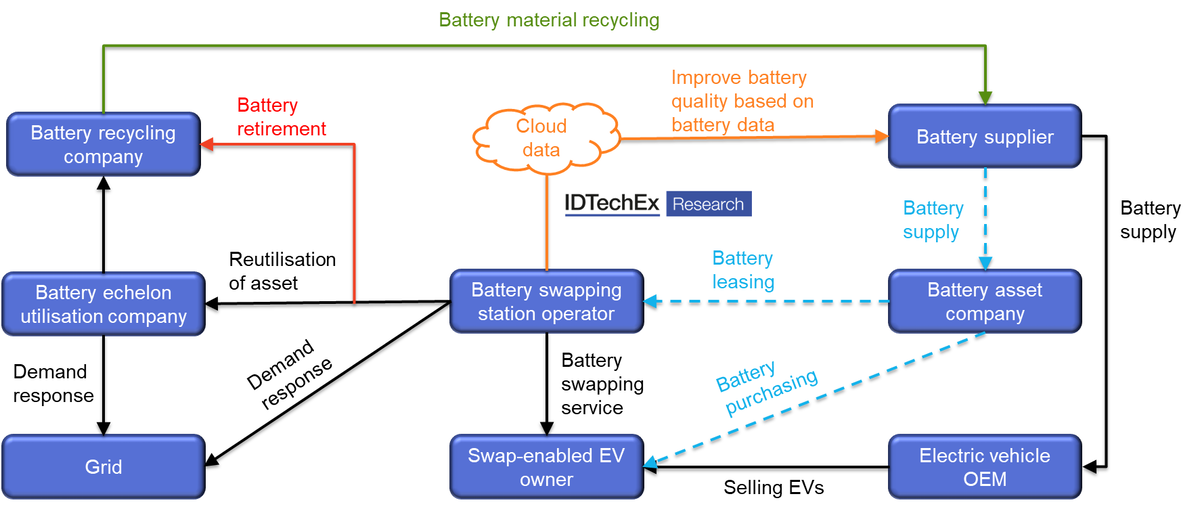

Battery swapping promotes new business models by decoupling the cost of the battery from the vehicle itself. The emergence of battery as a service (BaaS) business models and separate battery asset management companies is a trend we are noticing in the industry. Swapping can also benefit consumers. EV batteries lose range over the years but with a swap system, users can easily upgrade to the latest battery technologies provided their BMS is compatible. Centrally trickle charging batteries in a swap station also eliminates the degradation associated with DC fast charging. The technology will likely be a critical enabler for electrification, not just in cars, but micromobility, rideshare fleets, autonomous vehicles and heavy duty commercial fleets. It may also be one of the most economical ways to build the large stationary energy storage necessary to support the world's growing supplies of renewable energy.

The swapping ecosystem promotes the second life use and recycling of batteries. Source: IDTechEx

Battery swapping is successfully being carried out in population-dense regions of APAC. China is in the lead with around 1300 swap stations by the end of 2021 and pioneering swapping for cars. In neighboring regions, swapping is initially being adopted for electric two-wheelers and three-wheeler segments. Perhaps the biggest barrier to wide-scale adoption is that swapping systems demand standardisation of battery packs across large vehicle ranges to become feasible. This may be a challenge at present when manufacturers are holding their battery pack design as intellectual property and differentiation from one another. CATL being the industry's largest battery supplier has also recently announced its own swapping company which has brought the spotlight back to a once doomed industry. Whether all manufacturers are willing to come together and accept a single or a few types of battery packs to make them swappable is difficult to imagine but we are seeing commercial fleets adopting this technology widely with great success. IDTechEx also sees some promising applications for swapping within the electric heavy trucks (EHTs) and construction vehicles segment where high operational efficiency is achieved by utilising swapping.

The latest report from IDTechEx on Battery Swapping for Electric Vehicles 2022-2032 covers swapping across various vehicle segments and provides information on the technologies, business models and players involved within the industry. Newer technologies including modular battery swaps are also coming into the picture and their uptake is addressed within the market forecasts. The energy storage potential of various segments of swap stations is also presented with an increase in battery demand over the years. We provide a technological and business overview of the major established car battery swapping players including Chinese operators and also smaller players from Europe and the US. Extensive coverage of players within the micromobility swapping segment is also included. A cost comparison to AC/DC charging, total cost of ownership (TCO) analysis and profitability study are some of the highlights of this report.

Summary of report contents and forecasts:

Table of Contents

|