半導体チップ増設が米国のウェットケミカルのサプライチェーンに与える影響

Impact of Chip Expansion on US Chemical Supply-Chain

数量、売上高、ウェハスタート需要、米国の主要チップファブリケーターランキングなど、米国のウェットケミカル需要対供給に関する焦点を絞った情報を提供します。

本レポートの対象者... もっと見る

サマリー

-

数量、売上高、ウェハスタート需要、米国の主要チップファブリケーターランキングなど、米国のウェットケミカル需要対供給に関する焦点を絞った情報を提供します。

-

本レポートの対象者事業開発マネージャー、サプライチェーンマネージャー、金融投資/アドバイザー、チップ製造をサポートする米国半導体サプライチェーンのダイナミズムを理解することに関心のあるすべての方。

ページTOPに戻る

目次

1.0 要約 11

1.1 要旨事業拡大は大きな影響力を持つ

ウェハスタート 12

1.2 エグゼクティブサマリー化学需要の伸びが加速 13

1.3 要旨材料は全体的に増加している

スペクトル 14

1.4 エグゼクティブサマリーキャパシティの不足が予想される 15

1.5 エグゼクティブ・サマリー ?輸入依存関係 16

1.6 要旨 ?化学物質別(特になし

2022年から変更) 17

1.7 要旨"輸入が先、建設は後" 18

2.0 現状 19

2.1 縮小する国内製造業 20

2.2 国別世界市場シェア 21

2.3 グローバル・ダイナミクスが業界の展望に影響 22

2.4 素材市場は依然として重要 23

2.5 ウェットケミカルの需要に対する米国チップ拡張の影響 24

2.6 ロジック製造が牽引する湿式化学製品の需要増 25

2.7 先端デバイスが素材の増加を牽引 26

2.8 現在のサプライヤーサプライチェーンの特徴 27

2.8.1 現在のサプライヤー市場ランキング 28

2.8.2 現在のサプライヤー市場力学 29

2.8.2 現在のサプライヤー市場力学続く 30

3.0 予想は現状維持に変更 31

3.1 発表された工場拡張と計画更新 32

3.2 2022年チップと科学に関する法律 35

3.3 チップス法の規定 36

3.4 米国の新しい工場 37

3.5 米国の工場拡張の動き 38

3.6 チップ拡大が生産能力に与える影響 39

3.7 チップの拡大によるウェットケミカル需要の変化 40

3.8 ウェットケミカルの需要?サプライヤーへの強いメッセージ 41

4.0 供給、需要、キャパシティ 42

4.1 本レポートで使用されている用語の定義 43

4.2 半導体拡張ドライブ材料

需要の伸び 44

4.3 容量不足が予想される 45

4.4 化学需要予測、製造業

能力&ギャップ 46

4.5 純度の概要 47

4.6 国内工場拡張計画が加速 48

4.7 需要の伸びウェットケミカル別 49

4.8 化学品の数量需要が75%増加 50

4.9 ウェットケミカル需給予測 51

4.9.1 硫酸 )アウトルック 52

4.9.1.1 UHPのH2SO4輸入量 53

4.9.1.2 H2SO4 米国市場の展望 54

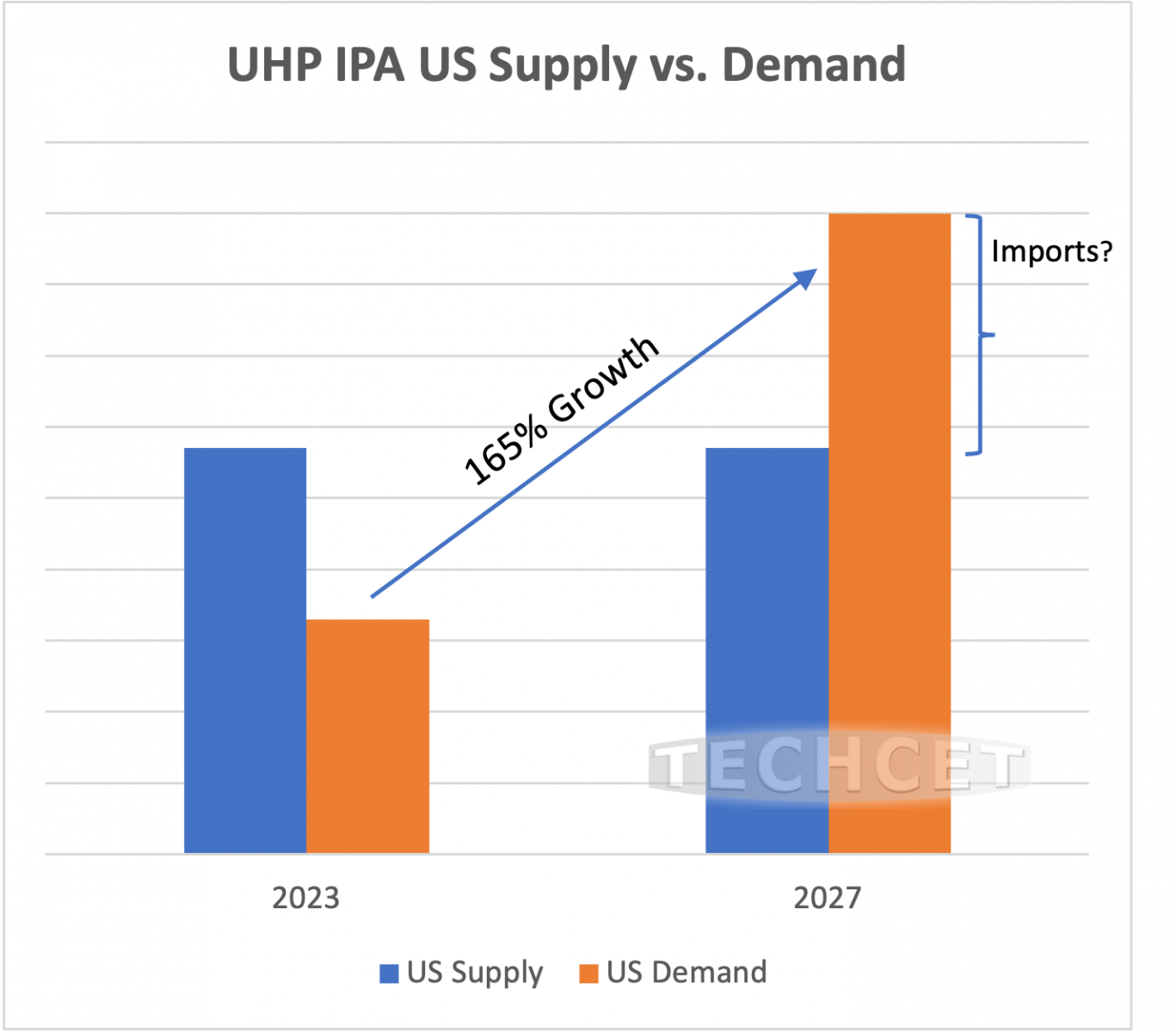

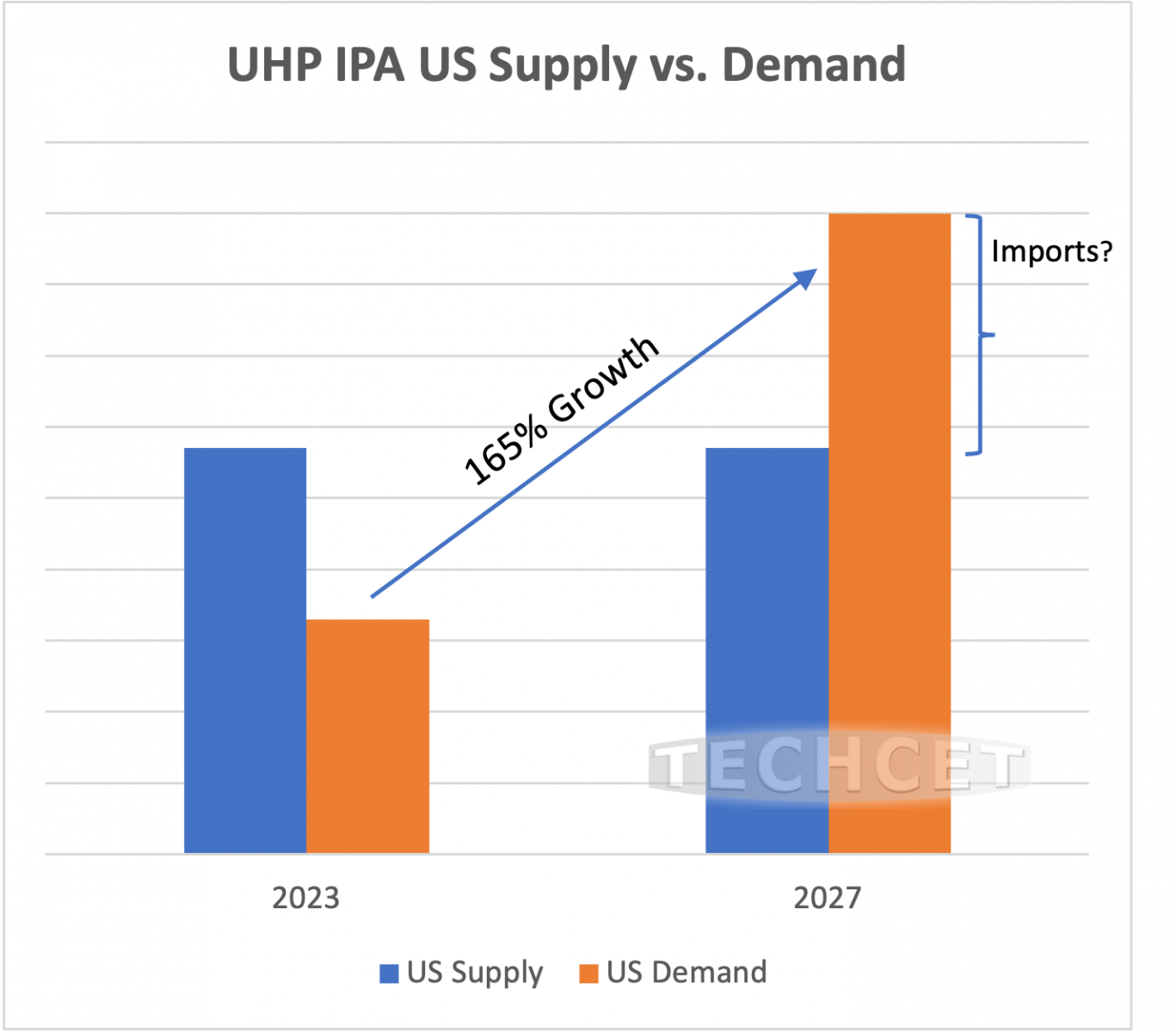

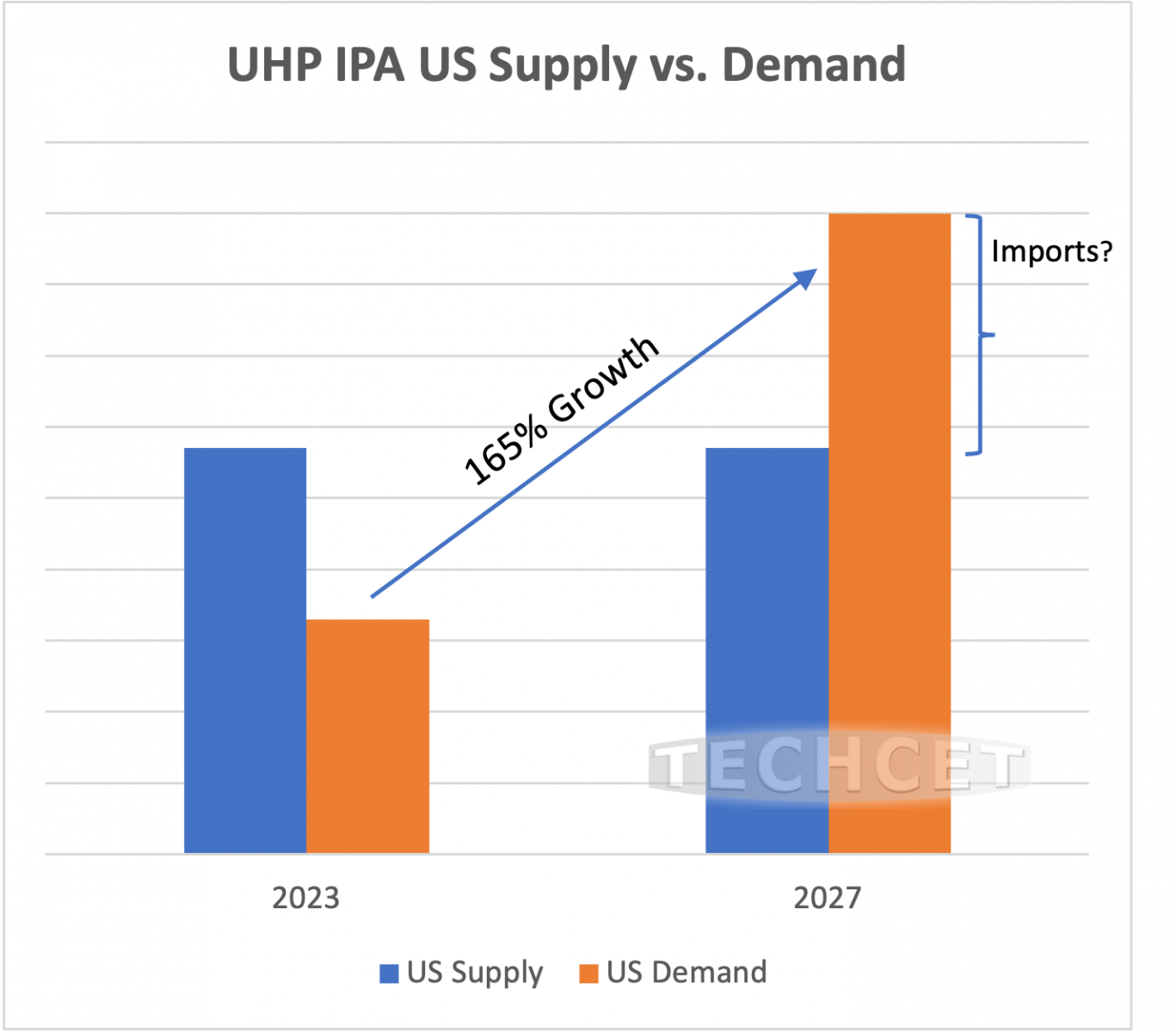

4.9.2 イソプロピルアルコール(IPA)の見通し 55

4.9.2.1 UHPの輸入量 56

4.9.2.2 IPA米国市場の展望 57

4.9.3 過酸化水素(h2o2)の見通し 58

4.9.3.1 uhp H2o2 の輸入量 59

4.9.3.2 H2O2 米国市場の展望 60

4.9.4 塩酸の見通し 61

4.9.4.1 uhp hclの輸入 62

4.9.4.2 HCL米国市場の展望 63

4.9.5 水酸化アンモニウム(NH4OH)の展望 64

4.9.5.1 uhp nh4ohの輸入量 65

4.9.5.2 NH4OH 米国市場の展望 66

4.9.6 フッ化水素酸の見通し 67

4.9.6.1 uhp HFの輸入 68

4.9.6.2 HF米国市場の展望 69

4.9.7 リン酸(H3PO4)の見通し 70

4.9.7.1 uhp h3po4の輸入量 71

4.9.7.2 H3PO4 米国市場の展望 72

4.9.8 硝酸(HNO3)の見通し 73

4.9.8.1 uhp hno3の輸入量 74

4.9.8.2 HNO3 米国市場の展望 75

4.10 主要サプライヤーの概要 76

5.0 予想される市場調整 77

5.1 予想される市場調整 78

5.2 予想されるアクション 79

5.3 サプライヤーによる工場拡張活動 80

5.4 サムスン/TSMC効果 83

5.5 参加者のコメント 84

6.0 依存関係&輸入の課題 87

6.1 湿式化学薬品輸入への依存 88

6.2 変化する輸入イメージ 89

6.3 「輸入するかしないか、それが問題だ 91

7.0 パッケージング&純度 95

7.1 進化するパッケージング要件 96

7.2 超高純度要求?負債か機会か? 97

7.3 化学純度の動向 98

7.3.1 ますます高まる純度への要求 99

7.4 コントロールする船と進化する要件 100

8.0 テクセトのリスクと機会の評価 101

8.1 テックセットの評価 ?一般的見解 102

8.2 テックセットの評価 ?国際的考察 103

8.3 テックセットの評価 ?サプライヤーの懸念 104

付録A:UHPケミカルの製造 105

ページTOPに戻る

図表リスト

図リスト

図1:2023年の米国のチップ生産能力 - 3390万枚

(200MM EQUIV.) 12

図2:2027年の米国のチップ生産能力 - 4,640万枚

(200MM EQUIV.) 12

図3:米国の年間ウェーハ生産能力予測 2023-2027

(200MM EQUIV.) 14

図4:輸出をリードする半導体 20

図5: 米国の半導体産業は好調、にもかかわらず

製造拠点は限られている。(売上高

本社所在地別売上高比率) 21

図6:2022年の半導体材料の世界市場

セグメント別 (717億米ドル) 23

図7:チップ製造業者別ウェットケミカル需要

2023~2027年(200mmウェーハ換算) 24

図8:ロジック・デバイスのウェーハ生産能力

NODE、2023~2027年(200mmウェーハ換算) 25

図9:メモリデバイスのウエハ容量NODE、

2023~2027年(200mmウェーハ換算) 26

図10:総需要に占める半導体需要の割合 30

図11:世界的なチップ拡張への投資 2022-2027

($500 B USD) 32

図12:米国のチップ拡張 2023-2027 37

図13:年間成長が期待されるチップの拡大

生産能力>35%増の46.4百万台(200MM EQUIV.) 39

図14:ウェットケミカルの需要は今後75%増加する

主要チップ工場 2023-2027 41

図 15: デバイス・タイプ別、ノード別ウェハ・スタート成長率 48

図 16:2023 年~2027 年の米国湿式化学製品需要予測 49

図17:米国のH2SO4供給量対需要量(kg) 52

図18:米国のH2SO4 uhpグレード?輸入依存度 53

図19:米国のH2SO4:71%の成長、11%の成長率 54

図20:米国の供給量対需要量(kg) 55

図21:米国IPAのUHPグレード?依存度の増加

輸入について 56

図22:米国のIPA需要量 92%成長 14%年率 57

図23:米国のH2O2供給量対需要量(kg) 58

図24:米国H2O2 のUHPグレード?ディペンダンス輸入について 59

図25:米国のH2O2需要量 80% 成長率 13% CAGR 60

図26:米国のHCL供給量対需要量(kg) 61

図27:米国HCLのUHPグレード?ディペンダンス輸入について 62

図28:米国のHC需要 70%の成長 11%の成長率 63

図29:米国のNH4O供給量と需要量(kg) 64

図 30 NH4OH UHP グレード依存性輸入について 65

図 31: NH4OH の米国需要量 77% 成長率 12% CAGR 66

図32:米国のHF供給量と需要量(kg) 67

図33:米国HFのUHPグレード依存性輸入について 68

図34:米国のHF量的需要 59 成長率10 69

図35:米国のH3PO4供給量対需要量(kg) 70

図 36: 米国 H3PO4 UHP グレード - 依存関係輸入について 71

図37:米国のH3PO4需要量79%成長、年平均成長率12 72

図38:米国のHNO3供給量対需要量(kg) 73

図 39: 米国 HNO3 UHP グレード - 依存度輸入について 74

図 40:HNO3 米国の数量需要 33%の成長、年率 6 75

図41:TSMCのアリゾナ施設の完成予想図 78

図 42: 中国から米国への海上貨物輸出価格動向 79

図43:コントロールする船 プロセスケミカルの例 100

表リスト

表1:化学製品の数量成長率 2023-2027 13

表2:予想されるウェットケミカルの過不足 15

TABLE 3: DEPENDENCY OF UHP PRODUCTS輸入について

WITHOUT

国内追加生産能力 16

表4:米国国内Tier Iサプライヤー上位3社

供給量 28

表5:米国のファブ稼働予測(200MM EQUIV.) 38

表6:最も需要の伸びが大きい湿式化学製品

2027年/2023年 44

表7:予想されるキャパシティ不足(表2と同じ) 45

表8:グラフに使用したUHPとICのグレード分け 46

表9:米国の半導体用化学製品の2027/2023年の販売数量成長率 50

表10:米国の主要サプライヤーの概要 76

表 11:米国の化学プラント拡張活動、

ページ 1 / 3 80

表 11:米国の化学プラント拡張活動、

ページ 2 / 3 81

表 11:米国の化学プラント拡張の動き、

ページ 3 / 3 82

表12:参加者のコメント 85

表12:参加者のコメント

続き 86

表13:2027年のUHPおよびUHPに占める輸入の割合

総需要 89

表14:UHP製品の輸入依存度の増加 90

表15:進化するパッケージング要件 96

表16:純度要件 99

表17:選ばれた参加者のコメント 109

表17:選ばれた参加者のコメント

続き 110

ページTOPに戻る

プレスリリース

化学品サプライヤー、米国での事業拡大計画への対応に苦慮

米国半導体の長期的成長は確実だが、短期的には混乱が予想される

2024年1月3日、カリフォルニア州サンディエゴ: テックセット半導体サプライチェーンに関するビジネスおよび技術情報を提供する電子材料アドバイザリー会社は、半導体工場拡張のサポートが高まるにつれて、半導体材料市場の米国内シェアが2027年までに13-15%に跳ね上がると予測している。この見通しは米国半導体業界にとって全般的にポジティブに見えるが、拡張時期の不確実性により、サプライヤーは効果的な計画を立てることが難しくなっており、CHIPS法の資金援助も役立っていないようである。多くの場合、サプライヤーは「拡張準備完了」で、チップメーカーからの需要シグナルを待っているだけである。その結果、米国のウェットケミカル生産能力の増設の多くは、「先に輸入し、後で製造する」戦略に焦点が当てられている。下のグラフに示すように、IPAに関しても同様である。潜在的成長率は高いが、その時期は不透明である。

While this import-focused approach helps meet initial fab needs, it keeps the US chip industry dependent on exports, which can bring instability to the supply chain. As wafer start capacity grows, this dependence on exports will grow in parallel, unless suppliers are able to ramp capacity accordingly, as shown in テックセット’s new market report on the “チップ拡張が米国ウェットケミカルサプライチェーンに与える影響."

AUECC、ENF、MGCなどアジアを拠点とするサプライヤーは、国内のチップ製造の拡大をサポートするため、米国に事業所を設立したり、拡大したりしている。さらに、米国を拠点とするサプライヤー(PVS、Entegrisなど)の中には、半導体用ウェットケミカルの生産能力を増強する計画を開始または発表しているところもある。しかし、関東やケムトレードなど、多くの提携活動は、工場設立の発表と同時に止まったり始まったりしているため、タイミングの不確実性が依然として問題となっている。

サプライヤーは現在、米国CHIPS・科学法が当初期待されたようなサプライチェーン全体への支援になっていないことを懸念している。ファブや装置メーカーは、依然としてCHIPS法資金の優先事項である。材料サプライヤーは、資金提供の機会に関する通知(NOFO)が、税制優遇措置なしにはほとんど支援を提供しないと見ており、自分たちのためにどのような資金が残されるのか不明である。さらに、NOFOは小規模なプロジェクトを推奨しており、2,000万ドル以下のプロジェクトが承認される可能性は低いと述べている。

ページTOPに戻る

Summary

-

Provides focused information on US wet chemical demand vs. supply including volumes, revenues, wafer start demand and ranking of leading US chip fabricators.

-

Who should get this report? Business Development Managers, Supply-Chain Managers, Financial Investment/Advisors, anyone interested in understanding the dynamic of the US Semiconductor Supply-Chains that support chip manufacturing.

ページTOPに戻る

Table of Contents

1.0 EXECUTIVE SUMMARY 11

1.1 EXECUTIVE SUMMARY – EXPANSIONS HAVE A MAJOR IMPACT

ON WAFER STARTS 12

1.2 EXECUTIVE SUMMARY – CHEMICAL DEMAND GROW ACCELERATES 13

1.3 EXECUTIVE SUMMARY – MATERIALS INCREASES ACROSS

THE SPECTRUM 14

1.4 EXECUTIVE SUMMARY – CAPACITY SHORTFALLS EXPECTED 15

1.5 EXECUTIVE SUMMARY – IMPORT DEPENDENCIES 16

1.6 EXECUTIVE SUMMARY – BY CHEMICAL (NO SIGNIFICANT

CHANGE FROM 2022) 17

1.7 EXECUTIVE SUMMARY – “IMPORT FIRST, BUILD LATER” 18

2.0 THE CURRENT STATE OF AFFAIRS 19

2.1 SHRINKING DOMESTIC MANUFACTURING 20

2.2 GLOBAL MARKET SHARE BY COUNTRY 21

2.3 GLOBAL DYNAMICS IMPACT INDUSTRY OUTLOOK 22

2.4 MATERIAL MARKETS REMAIN SIGNIFICANT 23

2.5 IMPACT OF US CHIP EXPANSION ON WET CHEMICAL DEMAND 24

2.6 WET CHEMICAL DEMAND INCREASE LED BY LOGIC MANUFACTURING 25

2.7 ADVANCED DEVICES DRIVE MATERIALS INCREASES 26

2.8 CURRENT SUPPLIERS – SUPPLY CHAIN CHARACTERISTICS 27

2.8.1 CURRENT SUPPLIERS – MARKET RANKINGS 28

2.8.2 CURRENT SUPPLIERS – MARKET DYNAMICS 29

2.8.2 CURRENT SUPPLIERS – MARKET DYNAMICS, CONTINUED 30

3.0 THE FORECAST CHANGES TO THE STATUS QUO 31

3.1 ANNOUNCED AND PLANNED FAB EXPANSIONS UPDATE 32

3.2 CHIPS AND SCIENCE ACT OF 2022 35

3.3 CHIPS ACT PROVISIONS 36

3.4 NEW FABS IN THE US 37

3.5 US FAB/PLANT EXPANSION ACTIVITY 38

3.6 US CHIP EXPANSION EFFECT ON CAPACITY 39

3.7 CHIP EXPANSION CHANGES IN WET CHEMICAL DEMAND 40

3.8 WET CHEMICAL DEMAND – A STRONG MESSAGE TO SUPPLIERS 41

4.0 SUPPLY, DEMAND & CAPACITY 42

4.1 DEFINITIONS OF THE TERMS USED THROUGHOUT THIS REPORT 43

4.2 SEMICONDUCTOR EXPANSION DRIVES MATERIALS

DEMAND GROWTH 44

4.3 CAPACITY SHORTFALLS EXPECTED 45

4.4 CHEMICAL DEMAND FORECAST, MANUFACTURING

CAPABILITIES & GAP 46

4.5 PURITY OVERVIEW 47

4.6 DOMESTIC FAB EXPANSION PLANS ACCELERATE 48

4.7 DEMAND GROWTH BY WET CHEMICAL TYPE 49

4.8 CHEMICAL VOLUME DEMAND GROWS BY 75% 50

4.9 WET CHEMICAL SUPPLY/DEMAND FORECASTS 51

4.9.1 SULFURIC ACID (H2SO ) OUTLOOK 52

4.9.1.1 US IMPORTS OF UHP H2SO4 53

4.9.1.2 H2SO4 US MARKET LANDSCAPE 54

4.9.2 ISOPROPYL ALCOHOL (IPA) OUTLOOK 55

4.9.2.1 US IMPORTS OF UHP IPA 56

4.9.2.2 IPA US MARKET LANDSCAPE 57

4.9.3 HYDROGEN PEROXIDE (H2O2) OUTLOOK 58

4.9.3.1 US IMPORTS OF UHP H2O2 59

4.9.3.2 H2O2 US MARKET LANDSCAPE 60

4.9.4 HYDROCHLORIC ACID (HCL) OUTLOOK 61

4.9.4.1 US IMPORTS OF UHP HCL 62

4.9.4.2 HCL US MARKET LANDSCAPE 63

4.9.5 AMMONIUM HYDROXIDE (NH4OH) OUTLOOK 64

4.9.5.1 US IMPORTS OF UHP NH4OH 65

4.9.5.2 NH4OH US MARKET LANDSCAPE 66

4.9.6 HYDROFLUORIC ACID (HF) OUTLOOK 67

4.9.6.1 US IMPORTS OF UHP HF 68

4.9.6.2 HF US MARKET LANDSCAPE 69

4.9.7 PHOSPHORIC ACID (H3PO4) OUTLOOK 70

4.9.7.1 US IMPORTS OF UHP H3PO4 71

4.9.7.2 H3PO4 US MARKET LANDSCAPE 72

4.9.8 NITRIC ACID (HNO3) OUTLOOK 73

4.9.8.1 US IMPORTS OF UHP HNO3 74

4.9.8.2 HNO3 US MARKET LANDSCAPE 75

4.10 KEY SUPPLIERS SUMMARY 76

5.0 ANTICIPATED MARKET ADJUSTMENTS 77

5.1 ANTICIPATED MARKET ADJUSTMENTS 78

5.2 ANTICIPATED ACTIONS 79

5.3 SUPPLIER US PLANT EXPANSION ACTIVITY 80

5.4 THE SAMSUNG/TSMC EFFECT 83

5.5 COMMENTS FROM THE PARTICIPANTS 84

6.0 DEPENDENCIES & CHALLENGES OF IMPORTS 87

6.1 US DEPENDENCE ON WET CHEMICAL IMPORTS 88

6.2 A CHANGING IMPORT PICTURE 89

6.3 “TO IMPORT OR NOT TO IMPORT, THAT IS THE QUESTION” 91

7.0 PACKAGING & PURITY 95

7.1 EVOLVING PACKAGING REQUIREMENTS 96

7.2 ULTRA HIGH PURITY DEMANDS – A LIABILITY OR OPPORTUNITY? 97

7.3 CHEMICAL PURITY TRENDS 98

7.3.1 EVER INCREASING PURITY REQUIREMENTS 99

7.4 SHIP TO CONTROL & EVOLVING REQUIREMENTS 100

8.0 TECHCET’S ASSESSMENT OF RISKS AND OPPORTUNITIES 101

8.1 TECHCET’S ASSESSMENT – GENERAL OBSERVATIONS 102

8.2 TECHCET’S ASSESSMENT – INTERNATIONAL CONSIDERATIONS 103

8.3 TECHCET’S ASSESSMENT – SUPPLIER CONCERNS 104

APPENDIX A: MANUFACTURING UHP CHEMICALS 105

ページTOPに戻る

List of Tables/Graphs

FIGURES

FIGURE 1: 2023 US CHIP FAB CAPACITY - 33.9 M WAFERS

(200MM EQUIV.) 12

FIGURE 2: 2027 US CHIP FAB CAPACITY - 46.4 M WAFERS

(200MM EQUIV.) 12

FIGURE 3: US ANNUAL WAFER CAPACITY FORECAST 2023-2027

(200MM EQUIV.) 14

FIGURE 4: SEMICONDUCTORS LEAD US EXPORTS 20

FIGURE 5: US SEMICONDUCTOR INDUSTRY IS STRONG, DESPITE

LIMITED MANUFACTURING PRESENCE. (REVENUES AS A

PERCENT

OF TOTAL SALES BY HQ LOCATION) 21

FIGURE 6: 2022 GLOBAL SEMICONDUCTOR MATERIALS MARKET

BY SEGMENT (US$71.7B) 23

FIGURE 7: US WET CHEMICAL DEMAND BY CHIP FABRICATOR

2023-2027 (200MM EQUIV. WAFERS) 24

FIGURE 8: US WAFER START CAPACITY FOR LOGIC DEVICES BY

NODE, 2023-2027 (200MM EQUIV. WAFERS) 25

FIGURE 9: US WAFER CAPACITY FOR MEMORY DEVICES BY NODE,

2023-2027 (200MM EQUIV. WAFERS) 26

FIGURE 10: SEMICONDUCTOR DEMAND AS A PERCENT OF TOTAL 30

FIGURE 11: INVESTMENT IN GLOBAL CHIP EXPANSIONS 2022-2027

($500 B USD) 32

FIGURE 12: US CHIP EXPANSIONS 2023-2027 37

FIGURE 13: CHIP EXPANSION EXPECTED TO GROW ANNUAL

CAPACITY >35% TO 46.4M (200MM EQUIV.) 39

FIGURE 14: WET CHEMICAL DEMAND WILL RISE 75% FROM

LEADING CHIP FABS 2023-2027 41

FIGURE 15: US WAFER START GROWTH BY DEVICE TYPE AND NODE 48

FIGURE 16: US 2023 – 2027 US WET CHEMICAL DEMAND FORECAST 49

FIGURE 17: US H2SO4 SUPPLY VS. DEMAND VOLUME (MKG) 52

FIGURE 18: US H2SO4 UHP GRADE – DEPENDENCE ON IMPORTS 53

FIGURE 19: US H2SO4: 71% GROWTH, 11% CAGR 54

FIGURE 20: US SUPPLY VS. DEMAND VOLUME (MKG) 55

FIGURE 21: US IPA UHP GRADE – INCREASING DEPENDENCE

ON IMPORTS 56

FIGURE 22: US IPA VOLUME DEMAND 92% GROWTH 14% CAGR 57

FIGURE 23: US H2O2 SUPPLY VS. DEMAND (MKG) 58

FIGURE 24: US H2O2 UHP GRADE – DEPENDENCE ON IMPORTS 59

FIGURE 25: US H2O2 US VOLUME DEMAND 80% GROWTH 13% CAGR 60

FIGURE 26: US HCL SUPPLY VS. DEMAND (MKG) 61

FIGURE 27: US HCL UHP GRADE – DEPENDENCE ON IMPORTS 62

FIGURE 28: US HCI US DEMAND 70% GROWTH 11% CAGR 63

FIGURE 29: US NH4OH SUPPLY VS. DEMAND (MKG) 64

FIGURE 30 US NH4OH UHP GRADE DEPENDENCE ON IMPORTS 65

FIGURE 31: US NH4OH US VOLUME DEMAND 77% GROWTH

12% CAGR 66

FIGURE 32: US HF SUPPLY VS. DEMAND (MKG) 67

FIGURE 33: US HF UHP GRADEDEPENDENCE ON IMPORTS 68

FIGURE 34: US HF VOLUME DEMAND 59% GROWTH, 10% CAGR 69

FIGURE 35: US H3PO4 SUPPLY VS. DEMAND (MKG) 70

FIGURE 36: US H3PO4 UHP GRADE - DEPENDENCY ON IMPORTS 71

FIGURE 37: US H3PO4 US VOLUME DEMAND79% GROWTH,

12% CAGR 72

FIGURE 38: US HNO3 SUPPLY VS. DEMAND (MKG) 73

FIGURE 39: US HNO3 UHP GRADE - DEPENDENCE ON IMPORTS 74

FIGURE 40: US HNO3 US VOLUME DEMAND 33% GROWTH, 6% CAGR 75

FIGURE 41: RENDERING OF TSMC’S ARIZONA FACILITY 78

FIGURE 42: CHINA TO US OCEAN FREIGHT EXPORT PRICE TRENDS 79

FIGURE 43: SHIP TO CONTROL FOR PROCESS CHEMICALS EXAMPLE 100

TABLES

TABLE 1: CHEMICAL VOLUME GROWTH 2023-2027 13

TABLE 2: US WET CHEMICAL EXCESS/SHORTFALLS EXPECTED 15

TABLE 3: DEPENDENCY OF UHP PRODUCTS ON IMPORTS

WITHOUT

ADDITIONAL DOMESTIC CAPACITY 16

TABLE 4: US DOMESTIC TIER I TOP 3 SUPPLIERS BY

VOLUME SUPPLIED 28

TABLE 5: US FAB RAMP FORECAST (200MM EQUIV.) 38

TABLE 6: WET CHEMICALS WITH THE HIGHEST DEMAND GROWTH

IN THE US 2027/2023 44

TABLE 7: CAPACITY SHORTFALLS EXPECTED (SAME AS TABLE 2) 45

TABLE 8: UHP AND IC GRADE SPLIT USED FOR GRAPHS 46

TABLE 9: US SEMICONDUCTOR CHEMICAL VOLUME GROWTH

2027/2023 50

TABLE 10: SUMMARY OF KEY US SUPPLIERS 76

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 1 OF 3 80

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 2 OF 3 81

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 3 OF 3 82

TABLE 12: COMMENTS FROM THE SELECTED PARTICIPANTS 85

TABLE 12: COMMENTS FROM THE SELECTED PARTICIPANTS,

CONTINUED 86

TABLE 13: 2027 IMPORTS AS A PERCENTAGE OF UHP AND

TOTAL DEMAND 89

TABLE 14: INCREASING DEPENDENCY OF UHP PRODUCTS

ON IMPORTS 90

TABLE 15: EVOLVING PACKAGING REQUIREMENTS 96

TABLE 16: PURITY REQUIREMENTS 99

TABLE 17: COMMENTS FROM THE SELECTED PARTICIPANTS 109

TABLE 17: COMMENTS FROM THE SELECTED PARTICIPANTS,

CONTINUED 110

ページTOPに戻る

Press Release

Chemical Suppliers Struggle to Keep Up with US Expansion Plans

Long-term US semiconductor growth is certain, but short-term chaos is likely

San Diego, CA, January 3, 2024: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting a jump in the US domestic share of the semiconductor material market to 13-15% by 2027, as support grows for incoming fab expansions. While this outlook is looking generally positive for the US semiconductor industry, uncertainties with timing expansions have made it difficult for suppliers to plan effectively and CHIPS Act funding does not seem to be helping. In many cases, suppliers are “expansion-ready,” and are just awaiting demand signals from chip manufacturers. As a result, much of the incremental US wet chemical capacity is focused on an “import first, build later” strategy, meaning capacity is being used to warehouse, possibly purify, repackage, and distribute imported chemicals, rather than manufacture them domestically. This is the case in regard to IPA, as shown in the graph below. Although the potential growth is high, the timing is uncertain.

While this import-focused approach helps meet initial fab needs, it keeps the US chip industry dependent on exports, which can bring instability to the supply chain. As wafer start capacity grows, this dependence on exports will grow in parallel, unless suppliers are able to ramp capacity accordingly, as shown in TECHCET’s new market report on the “Impact of Chip Expansions on the US Wet Chemicals Supply Chain.”

Asia-based suppliers such as AUECC, ENF, and MGC among others, have established and/or are expanding US operations to support the domestic chip manufacturing expansion. In addition, some US-based suppliers (PVS, Entegris, etc.) have initiated or announced plans to increase capacity for semiconductor wet chemicals. Timing uncertainties have remained an issue though, as many of the partnership activities, such as with Kanto and Chemtrade, have been stopping and starting with fab announcements.

Suppliers are currently concerned that the US CHIPS and Science Act is not supporting the full supply chain as originally hoped. Fabs and equipment manufacturers remain the priority of CHIPS Act funding. Material suppliers see the Notice of Funding Opportunity (NOFO) as offering little support without tax incentives, and are unclear what funding will be left over for them. Furthermore, the NOFO discourages small projects, stating that projects under $20M are unlikely to be approved.

ページTOPに戻る

Techcet社のスペシャルレポート分野での最新刊レポート

本レポートと同じKEY WORD(chip)の最新刊レポート

よくあるご質問

Techcet社はどのような調査会社ですか?

テクセット社は、長年の経験を持ち、半導体業界の中で十分かつ正確に市場や技術動向を分析することのできるエキスパート達によって運営されています。同社がこれまでコンサルタントを委託された企業は多く、材料メー... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|