Summary

Product Overview

Date of publication April 26, 2023

Format Electronic PDF

Geography North America

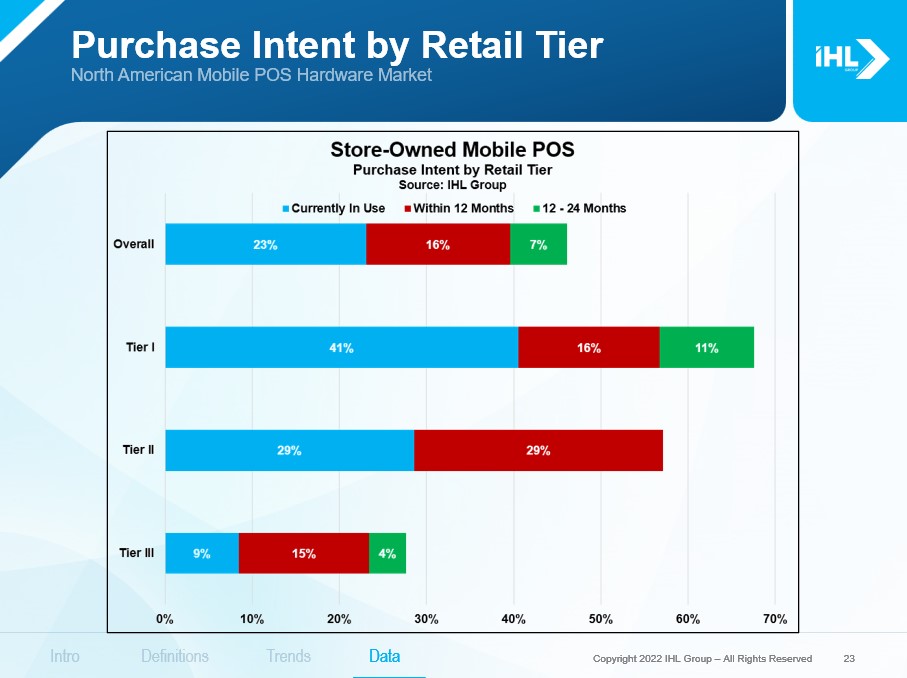

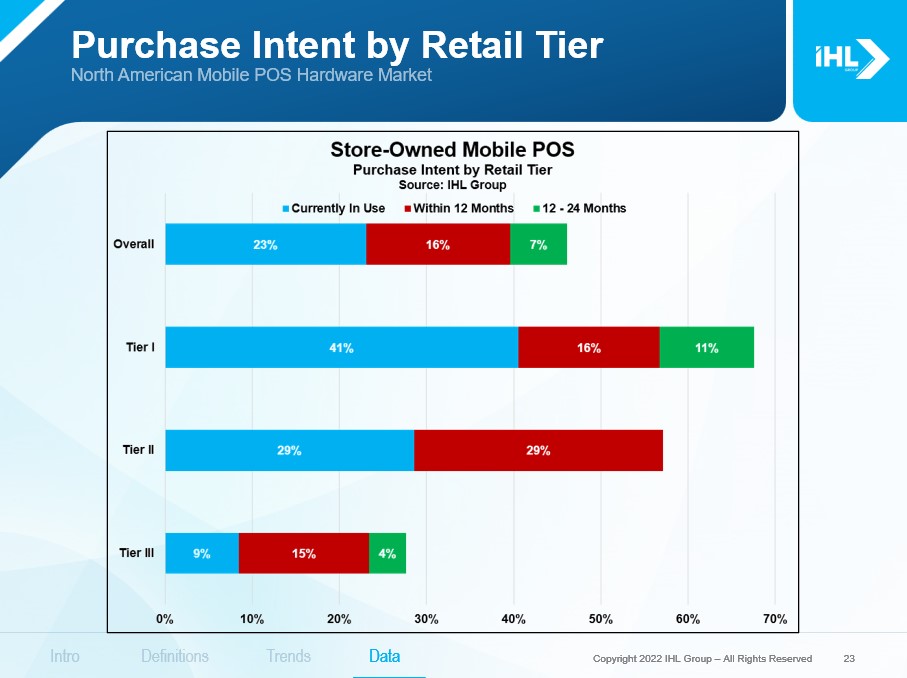

Historically, smaller retailers (Tier III) have been the most aggressive adopters of Mobile POS, mainly due to costs, user friendliness, flexibility, and the fact that they are seriously under-served by the leading POS vendors.

Going forward, we expect the story to change a bit, as Tier I retailers have begun to embrace mPOS in a much bigger way with new customer journeys. This phase started with COVID, however, even the largest retailers are considering doing mobile first design for the POS so they only have one app regardless of the client. This is also leading many retailers to consider using mobile POS devices that can be fixed or mobile to be used in their stores.

There is a new level of maturity in systems and decisions for enterprise retailers. While consumer devices might look cooler, the need for enterprise class wi-fi and security with the explosion of IoT devices deployed has forced retailers to grow up. Also, that premium between enterprise class and consumer class is shrinking bringing many of these decisions to the forefront of CIO offices going forward. The customer of today and tomorrow are mobile and multi-channel causing retailers to adjust accordingly.

This research looks at the current state of Mobile POS in North America, the adoption rates of the various retail verticals, and the shipment and installed base details by type of device (Rugged Handheld, Non-Rugged Handheld, and Tablets). It includes market sizing, trends, and forecasts through 2027.

This study is designed for use by Private Equity Investors, Mobile POS Hardware and Software Providers, Service Providers, Maintenance Providers, Retailers and others who might have a vested interest in the North American Mobile Point-of-Sale Market.

Note, this study does not include share by vendor although it does discuss future retailer preferences. For detailed vendor share and forecasts we recommend our Mobile POS by Vendor research where we track the number of devices shipped by Apple, HP, Toshiba, Motorola, and others and our POS/mPOS ISV List

The study looks at the opportunity for each of the mobile devices for the following segments:

-

Food

-

Drug

-

Superstore/Warehouse Club

-

Mass Merchandisers

-

Department Stores

-

Other Specialty

-

Category Killers

-

Convenience/Gas

-

Bar Restaurant

-

Fast Food

-

Lodging

-

Ent. Casino-Cruise

-

Ent. Theme, Theaters, Sports

Highlights

The study looks at the opportunity for each of the mobile devices for the following segments:

Food

Drug

Superstore/Warehouse Club

Mass Merchandisers

Department Stores

Other Specialty

Category Killers

Convenience/Gas

Bar Restaurant

Fast Food

Lodging

Ent. Casino-Cruise

Ent. Theme, Theaters, Sports

Preview

Mobile POS (mPOS) Hardware

This report looks at the Mobile POS (mPOS) Hardware in North America, including how many devices were shipped for the last 3 years. It also includes how many are currently installed, and what the forecast is for new shipments in the next several years. While this is not market share by vendor, it does include the types of devices offered by HP, Apple, Oracle, Samsung and others.

FAQS

Is this a survey or a comprehensive market view?

It’s both, we have done multiple surveys of retailers, along with their plans, timeframes for replacing POS and merged that together with the overall sizing of the market starting from smaller retailers to the largest of retailers and hospitality establishments.

Does it include forecasts by device type?

Yes, we have a forecast by the type of device (Rugged, Tablets, Consumer devices) but we do not provide a specific forecast of models (for instance iPhone vs Android) in this study.

Does this report include vendor shipment share for Mobile POS?

Yes and No. We share the top vendors in the report but not the sizing of each. For detailed vendor share and forecasts we recommend our Mobile POS by Vendor research where we track the number of devices shipped by Apple, HP, Toshiba, Motorola, and others and our POS/mPOS ISV List

Are IHL Analysts available to present the findings to my management team or user’s group?

Sure, we do speaking engagements all the time.

Can I share this study in my company?

Yes, each of research products come with an enterprise license so it is free for anyone internal to your organization. See below for more.

Can I share this study with partners and clients?

Not in entirety unless you have negotiated a distribution license with IHL. Basically we don’t want the study going to partners and clients who should otherwise purchase a license. This is what we do for a living, and if people violate this we can no longer do the research.

Can I quote this study in my presentations and press releases?

In most cases this is fine but we ask that you run it by us first at ihl(at)ihlservices.com. Typically things shared in percentages (ie. this is 20% increase) then that is fine. Items in raw $$$ or units typically we will not allow to share. But we can work with you on this. We realize that you buy the research to use, so we can usually find a nice compromise that protects our IP and meets your needs.

Was this a survey or a paper?

A little of both. When it comes to this sort of impact study it is part art and science. We have several primary research studies behind the numbers. These are then extrapolated across segments and markets to provide overall sizing. We run this by key clients and other analysts for their insight and view as well before we release. So the cornerstone is detailed primary research data with CIOs meshed with numerous analysts with over 100 combined years of retail sizing experience to build the models.

Is more detail available beyond what is in the study?

Yes, indeed. We have an extremely detailed Retail WorldView IT Sizing model that allows us to look at over 300 technologies across every region of the world by segment. So we can customize the research output just for your needs.

Can I get access to the analysts who wrote or partnered in the study?

Yes, one of the core differentiators of IHL Research Studies is that included in part of the price is up to 1 hour with the analyst to ask follow-up questions or dig further into any assumptions. This does not extend to getting more data, just better insight into how we arrived at the data and came to the conclusions from that data.

Pricing

License Options

Enterprise License – a license that allows for the research to be accessed and shared internally with anyone else within the organization and wholly owned subsidiaries.

IHL Group License and Fair Use Agreement

All of IHL Group’s generally available research are electronic licenses and are limited by the license type chosen for purchase. For Single User Licenses this means that the person buying the research is the only person to use the research.

For Enterprise Licenses, these can be shared freely within the company. We only ask that this information not be shared with partners or others outside the purchasing company without authorization from IHL Group. The license does not extend to joint ventures or other partnerships. If the relationship is not a wholly-owned subsidiary, then both parties would need a license.

Practically, this implies the following:

-

The purchasing company can use the data and research worldwide internally as long as the international organizations are wholly owned subsidiaries of the purchasing company.

-

The data or any research cannot be distributed in whole or in part to partners or customers without express written approval from IHL Group.

-

The purchasing company may quote components of the data (limited use) in presentations to customers such as specific charts. This is limited to percentage components, not individual unit information. Unit data cannot be shared externally without express written approval from IHL Group. All references to the data in presentations should include credit to IHL Group for the data.

-

The purchasing company can reference qualitative quotes in printed material with written approval from IHL Group.

-

All requests requiring written approval should be submitted to ihl(at)ihlservices.com and will be reviewed within one business day.

For Distributed Licenses, if applicable, the research can be shared with prospective customers and potential institutional investors. It cannot be shared with partners or other vendors who should be purchasing their own licenses.

ページTOPに戻る

Table of Contents

Table of Contents

Executive Summary

Introduction

1.0 Background

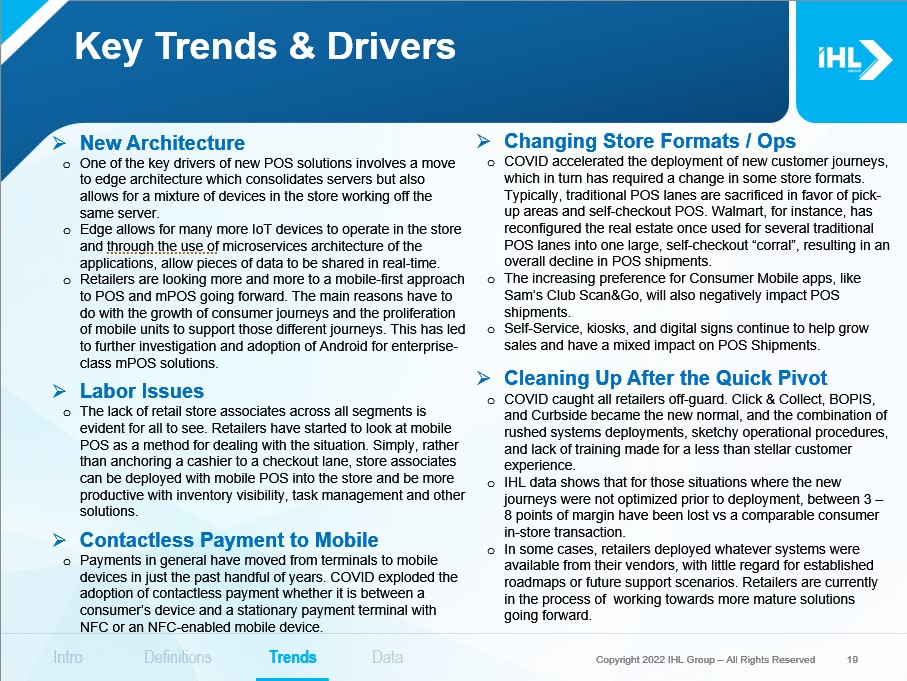

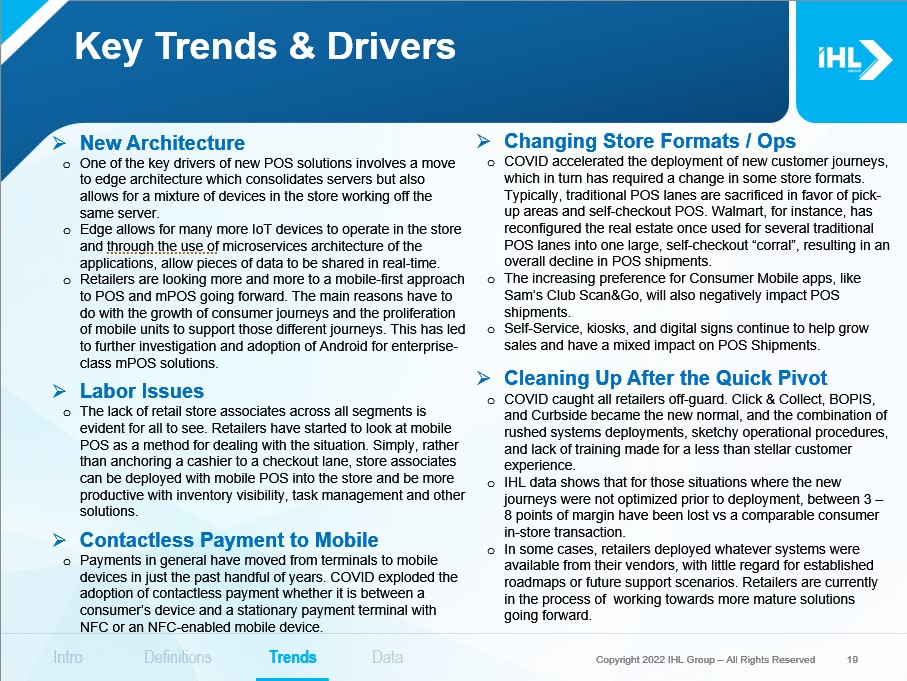

2.0 Trends and Market Drivers

2.1 Trends Driving mPOS Adoption

2.2 Trends Slowing mPOS Adoption

2.3 Challenges When Deploying Mobile

3.0 Market Size and Forecasts

3.1 North American mPOS Shipments through 2026

3.2 Fixed vs True Mobile Shipments through 2026

3.3 mPOS North America Installed Base Forecast through 2026

3.4 Fixed vs True Mobile Installed Base Forecast through 2026

4.0 Retailer Purchase Plans

5.1 mPOS Purchase Timing and Intent by Segment

5.2 mPOS Purchase Timing and Intent by Size of Retailer

5.0 What We See Ahead

References and Methodology