Thermal Management for Advanced Driver-Assistance Systems (ADAS) 2023-2033先進運転支援システム(ADAS)向けサーマルマネジメント 2023-2033年 この調査レポートでは、ADASにおける熱材料の市場分析として、トレンド、プレイヤー、きめ細かな市場予測について詳細に調査・分析しています。 主な掲載内容(目次より抜粋) ... もっと見る

※価格はデータリソースまでお問い合わせください。

Summary

この調査レポートでは、ADASにおける熱材料の市場分析として、トレンド、プレイヤー、きめ細かな市場予測について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

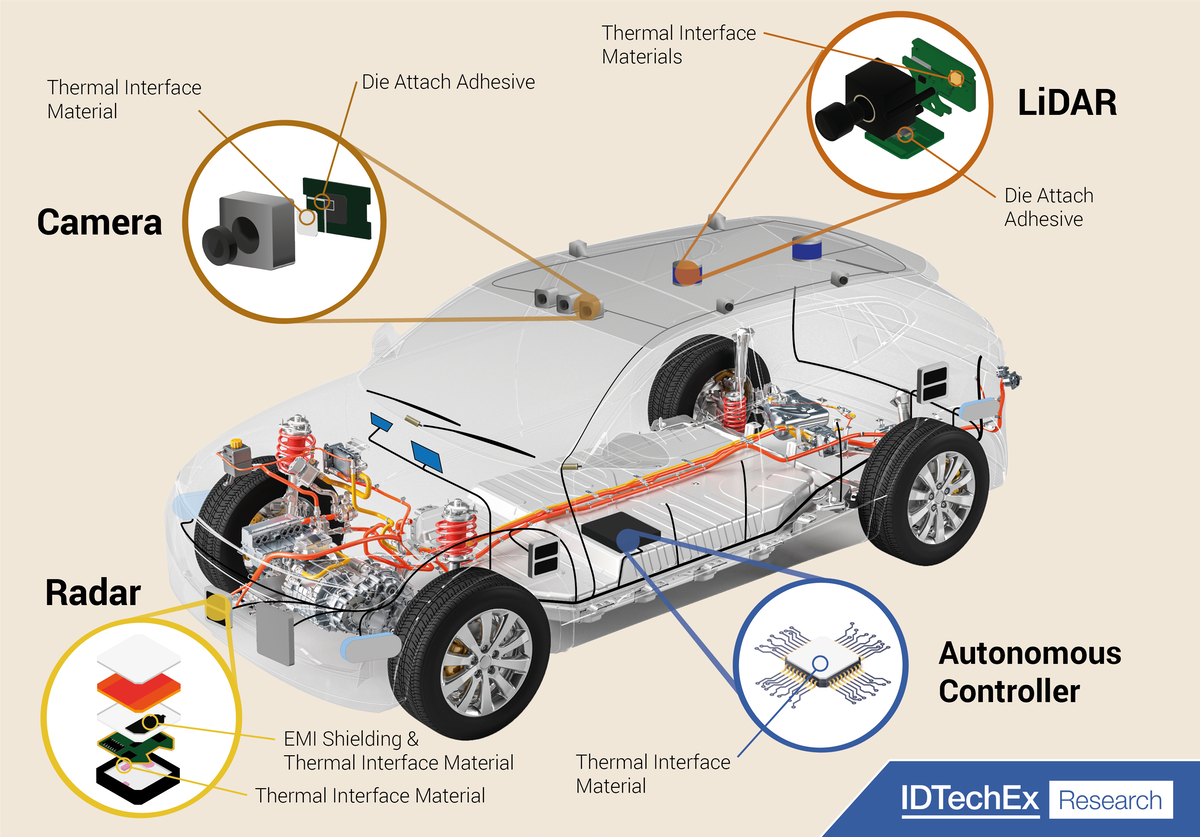

The automotive market is rapidly adopting autonomous features to aid in safety and driving convenience. This requires a suite of sensors (cameras, radars, and LiDARs) and computing platforms. These components are evolving and present thermal management challenges, leading to opportunities for thermal interface materials, die attach, radar radome materials, and electromagnetic interference (EMI) shielding. This report provides a market analysis for thermal materials in ADAS with trends, players, and granular market forecasts.

The automotive market is trending towards greater levels of autonomy, with advanced driver-assistance systems (ADAS) becoming increasingly adopted to improve the safety of drivers and pedestrians or even just to make driving a more convenient experience. ADAS encompasses a huge variety of functions from automatic emergency braking all the way to fully autonomous driving. Something that all ADAS features have in common is the need for high quality sensors and the associated processing of their data. The quantity of sensors per vehicle also increases rapidly with greater levels of autonomy. These sensors and their evolution provide new markets for thermal management materials within the automotive industry.

IDTechEx's report 'Thermal Management for ADAS 2023-2033' builds on IDTechEx's thermal management portfolio to cover the adoption of autonomy and ADAS features, the trends in ADAS sensors and their thermal management, thermal interface materials, die attach materials, and radar radome materials with an analysis of the requirements, players, and market forecasts for the next ten years.

The adoption of ADAS features requires a sensor suite, each of which has its own thermal material opportunities. Source: Thermal Management for ADAS.

What's changing with ADAS components?

Cameras and radars are already ubiquitous in vehicles, but greater levels of autonomy will require larger sensor suites with greater capabilities in each sensor. IDTechEx is predicting that there will be more than a sixfold increase in the yearly demand for automotive sensors, including cameras, radars, and LiDARs, by 2033. A key factor is integration; to fit more sensors to vehicles in an aesthetically pleasing fashion, the units will require smaller form factors, leading to densification of components and hence thermal management challenges. This is especially true for LiDAR where many autonomous vehicle testbeds use LiDAR systems mounted on top of or separate to the vehicle body, which is not viable for a production passenger vehicle.

ADAS sensors are also often used in non-ideal environments for electronics. In addition to the obvious vibration and shock requirements, sensors may be mounted in locations near a combustion engine where heat can build up. For many sensor locations, active cooling will not be viable and in hot climates the temperatures of sensors could increase significantly whilst the vehicle is stationary.

Another factor to consider is data processing. More sensors and sensors with greater fidelity will generate more data that needs processing by the vehicle. Some parts of this will be done within the sensor units themselves, but a central computer or electronic control unit (ECU) will be required to communicate this information to the relevant vehicle controls. The greater data requirements lead to using more power dense integrated circuits (ICs) and hence a greater thermal management requirement. We have already seen this with Tesla's adoption of a liquid cooling circuit for their computer, highlighting the heat generated.

What are the material trends?

Like any modern electronics component, ADAS sensors and computers require thermal interface materials (TIMs) to help spread heat from the heat-generating element to a heat sink or unit enclosure. Cameras, radars, LiDARs, and ECUs all have their own TIM requirements and as their designs evolve, so too do their TIM needs. Whilst the average ECU now may use a fairly typical TIM with 3-4 W/m·K thermal conductivity, the increased processing power required for autonomous functions could see this rise significantly.

Many of the sensors spread throughout the vehicle will be relatively small and low power, hence not necessarily needing a high performance TIM. However, the rapidly growing market for ADAS features means that the volume demands for TIMs will increase significantly. IDTechEx is forecasting an increase in TIM demand of three times in just the next five years for ADAS sensors. The report details the current and future requirements for TIMs within ADAS sensors and computers in terms of thermal conductivity and other crucial properties.

Another material that is often important when considering thermal reliability is die attach. In electronic packages, the die attach is often the failure point under thermal cycling. Automotive camera image sensors and radar transceiver ICs are typically low power and hence do not require a great deal of emphasis on the die attach, but will still require reliable materials and the rapidly growing market will create new demand for them. LiDAR tends to be higher power and the laser drivers may have to consider this option more carefully. This is especially true given how ubiquitous GaN FETs are in LiDAR and their potential for high power densities. The 'Thermal Management for ADAS 2023-2033' report discusses the die attach requirements for automotive cameras, radars, and LiDARs with a ten-year market forecast in area and tonnage.

Overview

The rapid adoption of ADAS features and autonomy in the automotive market presents great opportunities for thermal management material suppliers with sensor design evolving and a growing market for ADAS components. IDTechEx's report 'Thermal Management for ADAS 2023-2033' uses both primary and secondary research to cover these trends for ADAS sensor and computer evolution with a focus on thermal interface materials and die attach, as well as additional chapters on combined EMI and thermal materials and radar radome materials. Company profiles/interviews are also included along with ten-year market forecasts in terms of material area, tonnage, and market value.

Table of Contents

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

1)お客様からの御問い合わせをいただきます。

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|