AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts医療診断における人工知能(AI)2020-2030年:画像認識、企業、クリニカルアプリケーション、予測:画像認識の企業60社以上をベンチマーク - AI性能、市場の準備指数、価値提案、技術の成熟度、その他 - 12のクリニカルアプリケーションの詳細な市場予測、市場規模の分析と2030年までの普及率 このレポートはAIによって可能になる画像による医療診断に着目し、2030年までの市場や企業の分析を行っています。 主な掲載内容 ※目次より抜粋 エグゼクティブサマリ ... もっと見る

※価格はデータリソースまでお問い合わせください。

Summary

このレポートはAIによって可能になる画像による医療診断に着目し、2030年までの市場や企業の分析を行っています。

主な掲載内容 ※目次より抜粋

Report Details

Between 2010-2014, the field of image recognition and analysis was revolutionised by the introduction of deep learning, which enabled unprecedented performance leaps. These rapid advancements are fuelling the development of automated, accurate, accessible, and cost-effective medical diagnostics. Since 2010, over 60 entities including 40 new firms globally have set out to capitalise on these technological advances, seeking to commercialise AI-based diagnostics services in fields such as cancer and cardiovascular disease (CVD). More than $2.2 billion has been invested in new start-ups, with the investment since 2017 being 200% higher than the total since 2010.

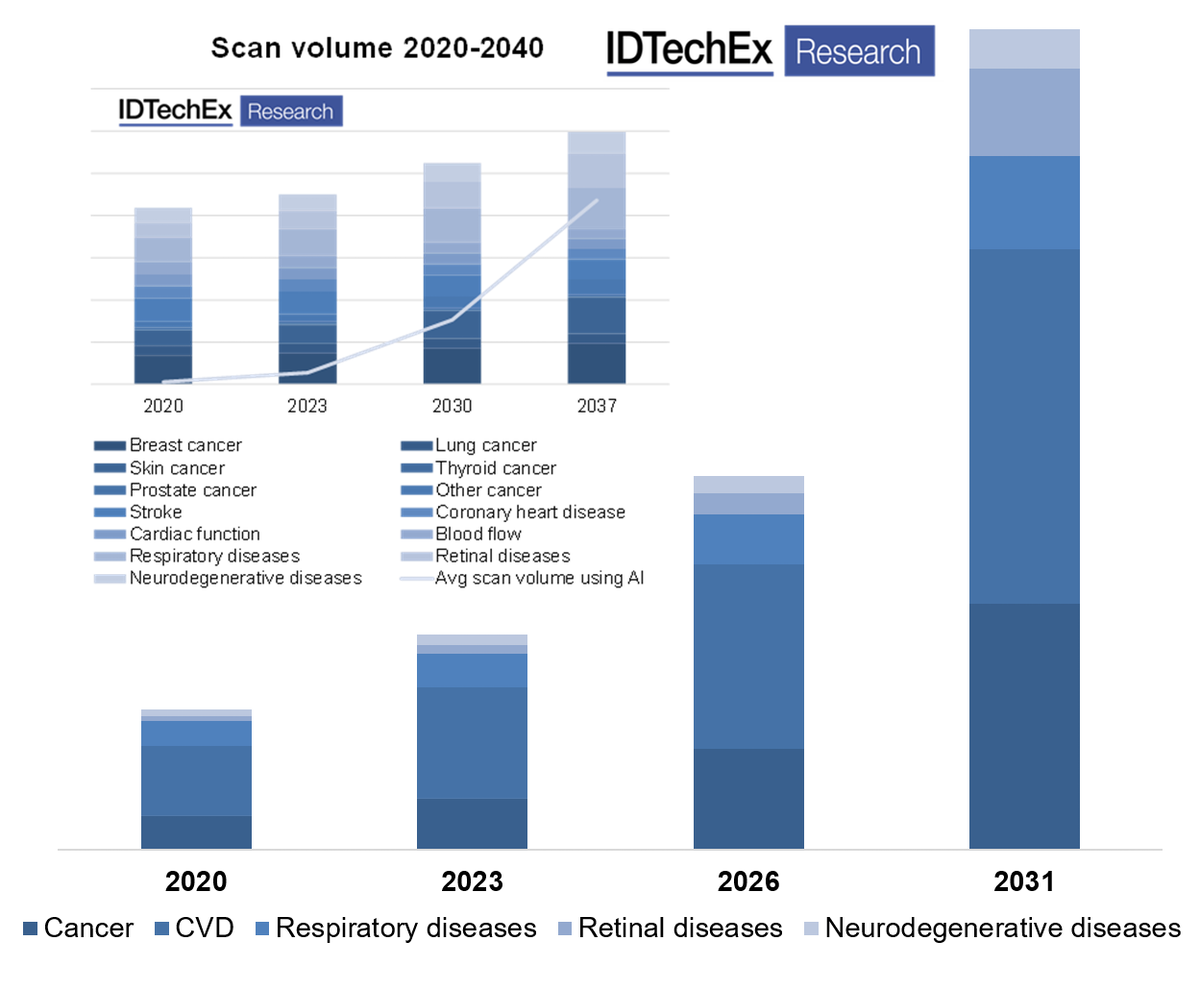

IDTechEx expects the market for AI-enabled image-based medical diagnostics to grow by nearly 10,000% until 2040 whilst the global addressable market (scan volume regardless of processing method) will grow by 50%. In value terms, we forecast the market for AI-enabled image-based medical diagnostics to exceed $3 billion by 2030 across five segments including cancer and CVD as well as respiratory, retinal and neurodegenerative diseases.

Technical threshold for automation reached, but is it a point of differentiation?

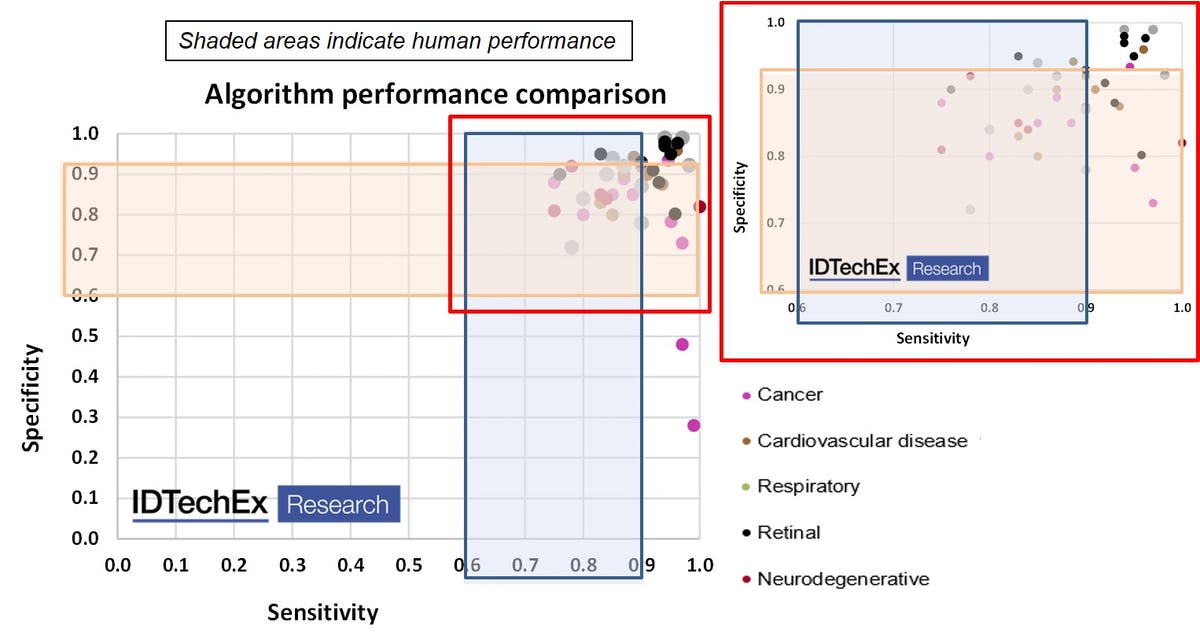

Algorithms are faster than humans and can be implemented on a massive scale with access to sufficient computing power via the cloud or even at the edge. Until recently, traditional hand-crafted algorithms would fail to meet the fundamental technical pre-requisite that they match or exceed the performance of human experts. The chart below shows that this is no longer the case and that this minimum technical milestone has already been surpassed, clearing away important technical barriers that had long held back automation in this field.

The report constructs realistic roadmaps, quantitatively outlining the current status, showing what challenges the technology still faces, and discussing how it is likely to evolve. The report identifies key commercial and technological issues currently limiting the uptake of image recognition AI and provides roadmaps describing when and how they are likely to be overcome over the next decade.

The chart above shows the sensitivity and specificity of over 35 algorithms implemented on various disease types. The shaded areas represent the range of human performance. The data was compiled by IDTechEx Research.

Source: IDTechEx report "AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts"

Rapid rise in company formation and investment

Since leaps in AI-based image recognition technology opened the market gates, over 60 entities including 40 new firms globally have set out to commercialize AI-based medical diagnostics based on various imaging modalities. The inset below shows the trend in company formation. Interestingly, this trend clearly correlates with the annual improvement reported in image recognition error rates between 2010 and now, highlighting how the technical and commercial developments are fully intertwined.

The chart also shows that money has been flowing into the start-up scene. Interestingly, the invested amounts have risen in the immediate past, partly reflecting the fact that the post-tech-demonstration companies now need larger financial reservoirs to pursue a scale-up strategy and to survive a potential consolidation phase. The inset also shows the more popular focus areas. In short, the disease segments with high scanned volumes and/or high value (e.g., preventing mortality with early detection) have received the most money thus far.

Investments into image recognition AI companies by year 2010-2019. Shades of blue in the chart refer to different companies.

Inset left: Cumulative number of active image recognition AI companies founded since 2010, displayed as a normalised change with relation to 2010.

Inset right: Investments into image recognition AI companies by disease application since 2010.

Source: IDTechEx report "AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts"

Company landscape and benchmarking

Each company, or each product of a company, sits at a different stage of readiness. The chart below provides a snapshot for commercialisation stage in cancer detection. Although multiple firms are already selling, this alone does not guarantee success. Companies are trying one or multiple of the following approaches to succeed:

The report analyses the competitive landscape, identifying and reviewing more than 60 companies and leading research institutes. It identifies key players in each sector and provides detailed insights into the market readiness of companies' AI software for a variety of disease applications. To facilitate the differentiation of each company, they are segmented and categorised by disease application, geography, modality, state of product development and more. IDTechEx also reveals the level of investments generated by image recognition AI technology and highlights the funding secured by individual companies and applications of this field.

The report contains over 50 company profiles covering large computing corporations, academic institutions, research centres and disruptive start-ups. IDTechEx analysts go far beyond what is publicly available by conducting an extensive number of primary interviews, providing the latest and most important information to the reader.

We have developed parameters to benchmark the strength of the companies' technology, including performance (e.g.: accuracy, sensitivity, specificity), state of development, market readiness, software complexity, value add (ie: depth of insights provided to doctors), technical maturity and more. We also discuss other non-technical aspects vital to the success of companies beyond a good tech story.

Cancer detection AI companies: State of product development. The report assesses the commercial status and state of development of over 60 companies and their products. It also assesses the technical maturity and value proposition of each company's software. In addition, the report details sector-specific roadblocks in the path to market. Note: Although large computing corporations such as Google are still developing their product, their CNN architectures are widely used by companies on the market (eg: Google's Inception).

Source: IDTechEx report "AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts"

Current and future market trends

AI in medical image diagnostics is already in existence and numerous companies are past clinical stages in many segments. Our assessment is that the inflection point is near and likely to be reached around 2023-2025.

Indeed, we have developed short- and long-term market forecasts from 2020 to 2040. We have estimated and forecasted the total addressable market per disease type in scan volume. We have leveraged out technological understanding and market insight to develop realistic market penetration and cost evolution projections per disease type, allowing us to create segmented market forecasts in scan volume and market value. The report highlights the current and future market share and size for 12 different applications and markets, including the detection of five types of cancer and four aspects of CVD. Insights into pricing strategies, uptake-limiting roadblocks and commercial opportunities complement our analysis to provide a comprehensive perspective of the market today and in the future.

Market forecast 2020-2031 by disease application.

Inset: Scan volume forecast 2020-2040. Bar charts show the addressable market in terms of scan volumes. Continuous line is the average of AI-enabled scan volumes weighted across different disease areas. To learn the dynamics of individual market segments please consult the report.

Source: IDTechEx report "AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts"

Key questions answered in this report:

Table of ContentsTable of Contents

|