Summary

この調査レポートは、技術的、経済的、規制的、環境的側面の詳細な分析により、新興のCDR産業と炭素クレジット市場について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

-

DAC技術

-

炭素除去・貯蔵バイオマス(bicrs)

-

植林/森林再生

-

土壌炭素貯留

-

無機化ベースのCDR

-

海洋ベースの二酸化炭素除去

-

cdr市場予測

Report Summary

Meeting net-zero emissions targets will, above all, require swift and meaningful emissions reductions, which are expected to come from efforts such as fossil fuel replacement and efficiency improvement. However, it is becoming increasingly clear that removing carbon dioxide (CO₂) from the atmosphere will be needed to avoid global warming beyond 1.5-2°C. Estimates vary, but climate scenarios suggest that it will be almost impossible to meet the targets set out by the Paris Agreement without leveraging carbon dioxide removal (CDR) solutions. For this reason, negative emissions technologies (NETs) have been receiving increased attention from researchers, governments, investors, entrepreneurs, and various corporations with ambitious climate goals.

"Carbon Dioxide Removal (CDR) 2024-2044: Technologies, Players, Carbon Credit Markets, and Forecasts" provides a comprehensive outlook of the emerging CDR industry and carbon credit markets, with an in-depth analysis of the technological, economic, regulatory, and environmental aspects that are shaping this market. In it, IDTechEx focuses on technologies that actively draw CO₂ from the atmosphere and sequester it into carbon sinks, namely:

-

Direct air carbon capture and storage (DACCS), which leverages chemical processes to capture CO₂ directly from the air and sequester it in geologic formations or durable products.

-

Biomass with carbon removal and storage (BiCRS), which involves strategies that use biomass to remove CO₂ from the atmosphere and store it underground or in long-lived products. It includes approaches such as BECCS (bioenergy with carbon capture and storage), biochar, biomass burial, and bio-oil underground injection.

-

Land-based CDR methods that leverage biological processes to increase carbon stocks in soils, forests, and other terrestrial ecosystems, i.e. afforestation and reforestation and soil carbon sequestration techniques.

-

Mineralization NETs that enhance natural mineral processes that permanently bind CO₂ from the atmosphere with rocks through enhanced rock weathering, carbonation of mineral wastes, and oxide looping.

-

Ocean-based CDR methods that strengthen the ocean carbon pump through ocean alkalinity enhancement, direct ocean capture, artificial upwelling/downwelling, coastal blue carbon, algae cultivation/marine seaweed sinking, and ocean fertilization.

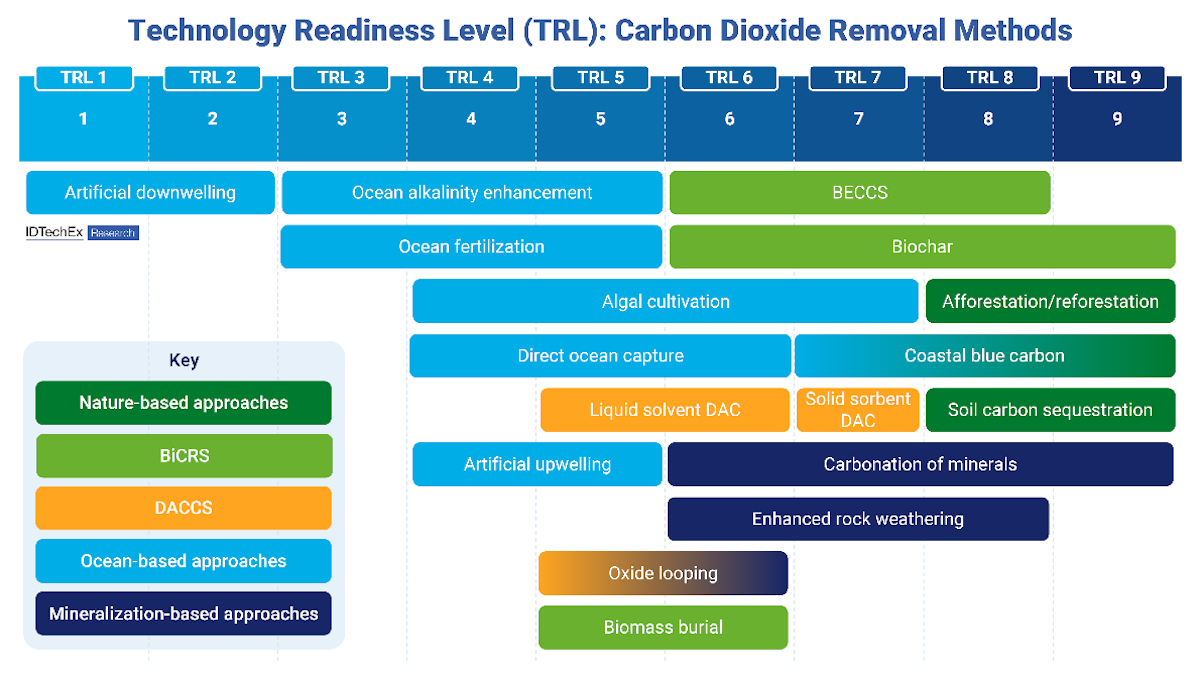

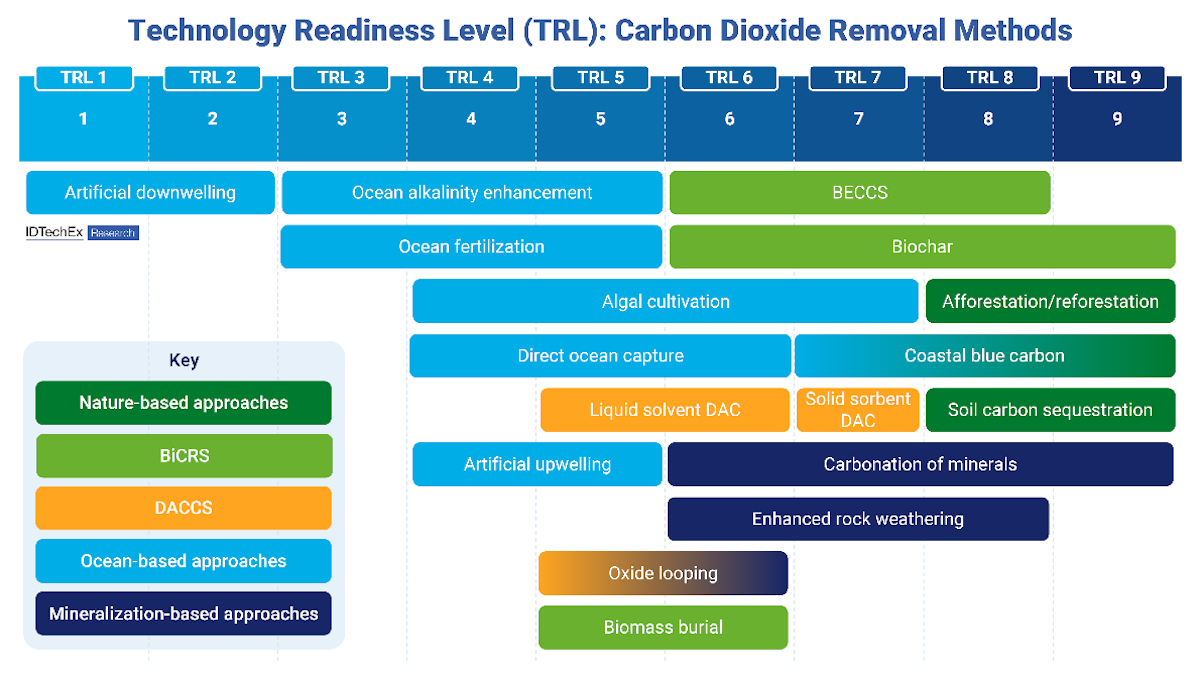

TRL (technology readiness level) chart of carbon dioxide removal technologies covered in the IDTechEx report. Source: IDTechEx

These CDR technologies are at vastly different stages of readiness. Some are nearly ready for large-scale deployment, whilst others require basic scientific research and further field trials.

Durable engineered removals versus nature-based CDR solutions

Nature-based solutions, particularly land-based, have dominated the supply of CDR historically due to their low cost and high maturity. However, demand for this type of removal carbon credit has been dropping in voluntary markets over the past few years due to several high-profile scandals, and the low durability and low permanence associated with nature-based CDR. Corporate buyers have instead increasingly turned towards highly durable engineered carbon removal credits generated from approaches such as DACCS and BECCS. These removals offer credible climate action, but have a high price tag and are in short supply. Most durable engineered approaches are yet to be included in compliance markets, and therefore rely on pre-purchases from corporate buyers for early-stage commercial development, with this report examining the status of CDR in both voluntary and compliance carbon markets.

The report provides insights into the most promising technologies being developed in CDR, highlighting the pros and cons of each method, examining key drivers and barriers for growth, and comparing the removal potential, capture cost, and durability of all technologies. Despite limited current capacity, there has been much interest in DACCS as a solution to permanently remove CO₂ from the atmosphere and reverse climate change. DACCS is immediate, measurable, allows for permanent storage, can be located practically anywhere, is likely to cause minimal ecosystem impacts, and can achieve large-scale removals.

However, the rate at which DACCS can be scaled-up is likely a limiting factor. The challenges of deploying DACCS analysed in this report include the large energy inputs (requiring substantial low-carbon energy resources), the high cost, and the sorbent requirements. The industry is aiming for the ambitious target of gigatonne-scale of DACCS removals by 2050. To make this happen, corporate action, investments, policy shapers, and regulatory guidelines need to come together to bring down the costs.

Although BECCS is currently the most mature and widely deployed durable engineered CDR technology, scale-up has historically been slow, and planned capacity is modest. Despite the technologies behind BECCS being relatively mature, there is a risk that using biomass for CO₂ removal and storage may compete with agricultural land and water or negatively impact biodiversity and conservation. IDTechEx analysis has indicated that BECCS has a large potential to contribute to climate change mitigation, though not at the scale assumed in some models due to economic and environmental risk factors.

Is carbon dioxide removal deferring the problem?

There are growing concerns that valuable resources will be allocated to drawing down CO₂ from the air as opposed to preventing emissions from reaching the atmosphere in the first place. Indeed, although most of the world's mitigation efforts will need to be done by reducing emissions, there is evidence that deploying certain NETs may be more cost-effective and less disruptive than reducing some hard-to-abate emissions.

Incremental reductions in anthropogenic emissions will likely become more expensive once they reach very low levels, whilst the cost of effective NETs will likely reduce with deployment. In such a scenario, methods for reduction and removal of emissions may become competitors for an extended period. Nevertheless, a competitive scenario can be desirable as it can improve the world's ability to manage unexpected risks inherent to mitigation actions. The vast availability of low-cost mitigation solutions will only become a reality if both CDR and emission abatement solutions are developed in tandem and act as complementary components of a diverse mitigation portfolio.

Comprehensive analysis and market forecasts

This IDTechEx report assesses the CDR carbon credit market in detail, evaluating the different technologies, latest advancements, and potential adoption drivers and barriers. The report also includes a granular forecast until 2044 for the deployment of nine NET categories (DACCS, BECCS, biochar, biomass burial, direct ocean capture, ocean alkalinity enhancement, seaweed sinking, enhanced rock weathering, and carbonation of minerals), alongside exclusive analysis and interview-based company profiles.

Some of the key questions answered in this report:

-

What are the requirements (energy, land, water, feedstocks, supply chain) for the deployment of CDR methods?

-

What is the climate impact of implementing CDR on a large scale?

-

Which gaps (technological, regulatory, business model) need to be addressed to enable each NET?

-

What is the status of CDR within compliance markets and voluntary carbon credit markets and what is the market potential?

-

What are the key drivers and hurdles for CDR market growth?

-

How much do CDR solutions cost today and may cost in the future?

-

Who are the key players in the CDR space?

-

What is needed to further develop the CDR sector?

Key aspects

This report provides the following information:

Technology and market analysis:

-

Data and context on each type of NET (negative emission technology).

-

Analysis of the challenges and opportunities in the nascent CDR (carbon dioxide removal) carbon credit markets.

-

State of the art and innovation in the field.

-

Detailed overview of CDR technologies: land-based, mineralization-based, ocean-based, DACCS (direct air carbon capture with storage), and BiCRS (biomass with carbon capture and storage).

-

Market potential (both voluntary and compliance) of CDR carbon offsets.

-

Key strategies for scaling long-term CDR technologies.

-

The economics of scaling up CDR operations.

-

Assessment of requirements (infrastructure, energy, supply chain, etc) for CDR market uptake.

-

Climate benefit potential of main CDR solutions.

-

Benchmarking based on factors such as technology readiness level (TRL), cost, and scale potential.

-

Key regulations and policies influencing the CDR market.

Player analysis and trends:

-

Primary information from key CDR-related companies.

-

Analysis of CDR players' latest developments, observing projects announced, funding, trends, partnerships, and key patents.

Market forecasts and analysis:

-

Granular market forecasts until 2044 for durable, engineered CDR solutions, subdivided into nine technological areas.

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Why carbon dioxide removal (CDR)? |

|

1.2. |

What is CDR and how is it different from CCUS? |

|

1.3. |

The CDR technologies covered in this report (1/2) |

|

1.4. |

The CDR technologies covered in this report (2/2) |

|

1.5. |

Carbon dioxide removal technology benchmarking |

|

1.6. |

The CDR business model and its challenges: carbon credits |

|

1.7. |

Prices of CDR credits |

|

1.8. |

The state of CDR in the voluntary carbon market |

|

1.9. |

Shifting buyer preferences for durable CDR in carbon credit markets |

|

1.10. |

Carbon credit market sizes |

|

1.11. |

What is needed to further develop the CDR sector? |

|

1.12. |

The potential of DACCS as a CDR solution |

|

1.13. |

The DACCS market is nascent but growing |

|

1.14. |

CO₂ capture/separation mechanisms in DAC |

|

1.15. |

Challenges associated with DAC technology |

|

1.16. |

DACCS: key takeaways |

|

1.17. |

Biomass with carbon removal and storage (BiCRS) |

|

1.18. |

The status and outlook of BECCS |

|

1.19. |

The challenges of BECCS |

|

1.20. |

Biochar: key takeaways |

|

1.21. |

Afforestation and reforestation: key takeaways |

|

1.22. |

Mineralization: key takeaways |

|

1.23. |

Ocean-based NETs |

|

1.24. |

Ocean-based CDR: key takeaways |

|

1.25. |

Carbon dioxide removal capacity forecast by technology (million metric tons of CO₂ per year), 2024-2044 |

|

1.26. |

Carbon dioxide removal annual revenue forecast by technology (billion US$), 2024-2044 |

|

1.27. |

Carbon dioxide removal market forecast, 2024-2044: discussion |

|

1.28. |

Carbon dioxide removal: key takeaways |

|

2. |

INTRODUCTION |

|

2.1. |

Introduction and general analysis |

|

2.1.1. |

What is carbon dioxide removal (CDR)? |

|

2.1.2. |

Description of the main CDR methods |

|

2.1.3. |

Why carbon dioxide removal (CDR)? |

|

2.1.4. |

What is the difference between CDR and CCUS? |

|

2.1.5. |

High-quality carbon removals: durability, permanence, additionality |

|

2.1.6. |

Technology Readiness Level (TRL): Carbon dioxide removal methods |

|

2.1.7. |

Carbon dioxide removal technology benchmarking |

|

2.1.8. |

Status and potential of CDR technologies |

|

2.1.9. |

Alternative revenue streams improve economic viability of CDR technologies |

|

2.1.10. |

Geological storage is not the only permanent destination for CO₂ |

|

2.1.11. |

Engineered carbon dioxide removal value chain |

|

2.1.12. |

Monitoring, reporting, and verification of CDR |

|

2.1.13. |

Potential role of policy in CDR deployment |

|

2.1.14. |

CDR: deferring the problem? |

|

2.1.15. |

What is needed to further develop the CDR sector? |

|

2.1.16. |

CDR market traction in 2023 |

|

2.1.17. |

The Xprize Carbon Removal |

|

2.2. |

Carbon credit markets and the status of CDR credits |

|

2.2.1. |

Carbon pricing and carbon markets |

|

2.2.2. |

Compliance carbon pricing mechanisms across the globe |

|

2.2.3. |

What is the price of CO₂ in global carbon pricing mechanisms? |

|

2.2.4. |

What is a carbon credit? |

|

2.2.5. |

Carbon removal vs carbon avoidance offsetting |

|

2.2.6. |

Carbon removal vs emission reduction offsets (2/2) |

|

2.2.7. |

How are carbon credits certified? |

|

2.2.8. |

Carbon crediting programs |

|

2.2.9. |

The role of carbon registries in the credit market |

|

2.2.10. |

Measurement, Reporting, and Verification (MRV) of Carbon Credits |

|

2.2.11. |

Quality of carbon credits |

|

2.2.12. |

How are voluntary carbon credits purchased? |

|

2.2.13. |

Advanced market commitment in CDR |

|

2.2.14. |

Interaction between compliance markets and voluntary markets (geographical) |

|

2.2.15. |

Interaction between compliance markets and voluntary markets (sectoral) |

|

2.2.16. |

The state of CDR in compliance markets |

|

2.2.17. |

The state of CDR in the voluntary carbon market |

|

2.2.18. |

Shifting buyer preferences for durable CDR in carbon credit markets |

|

2.2.19. |

Biggest durable carbon removal buyers |

|

2.2.20. |

Pre-purchases still dominate the durable CDR space |

|

2.2.21. |

Prices of CDR credits |

|

2.2.22. |

How expensive were durable carbon removals in 2023? |

|

2.2.23. |

Current carbon credit prices by company and technology |

|

2.2.24. |

Carbon market sizes |

|

2.2.25. |

Which durable CDR technologies had the largest market share in 2023? |

|

2.2.26. |

The carbon removal market players |

|

2.2.27. |

Challenges in today's carbon market |

|

2.2.28. |

CDR technologies: key takeaways |

|

3. |

DIRECT AIR CARBON CAPTURE AND STORAGE (DACCS) |

|

3.1. |

Introduction to direct air capture (DAC) |

|

3.1.1. |

What is direct air capture (DAC)? |

|

3.1.2. |

Why DACCS as a CDR solution? |

|

3.1.3. |

Current status of DACCS |

|

3.1.4. |

Momentum: private investments in DAC |

|

3.1.5. |

Momentum: public investment and policy support for DAC |

|

3.1.6. |

Momentum: DAC-specific regulation |

|

3.1.7. |

DAC land requirement is an advantage |

|

3.1.8. |

DAC vs point-source carbon capture |

|

3.2. |

DAC technologies |

|

3.2.1. |

CO₂ capture/separation mechanisms in DAC |

|

3.2.2. |

Direct air capture technologies |

|

3.2.3. |

DAC solid sorbent swing adsorption processes (1/2) |

|

3.2.4. |

DAC solid sorbent swing adsorption processes (2/2) |

|

3.2.5. |

Electro-swing adsorption of CO₂ for DAC |

|

3.2.6. |

Solid sorbents in DAC |

|

3.2.7. |

Emerging solid sorbent materials for DAC |

|

3.2.8. |

Liquid solvent-based DAC |

|

3.2.9. |

Process flow diagram of S-DAC |

|

3.2.10. |

Process flow diagram of L-DAC |

|

3.2.11. |

Process flow diagram of CaO looping |

|

3.2.12. |

Solid sorbent- vs liquid solvent-based DAC |

|

3.2.13. |

Electricity and heat sources |

|

3.2.14. |

Requirements to capture 1 Mt of CO₂ per year |

|

3.3. |

DAC companies |

|

3.3.1. |

DAC companies by country |

|

3.3.2. |

Direct air capture company landscape |

|

3.3.3. |

A comparison of the three DAC pioneers |

|

3.3.4. |

TRLs of direct air capture players |

|

3.3.5. |

Climeworks |

|

3.3.6. |

Carbon Engineering |

|

3.3.7. |

Global Thermostat |

ページTOPに戻る

本レポートと同分野(エネルギー貯蔵)の最新刊レポート

IDTechEx社のエネルギー、電池 - Energy, Batteries分野での最新刊レポート

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|