Solid-State and Polymer Batteries 2023-2033: Technology, Forecasts, Players固体電池とポリマー電池の2023-2033年:技術、予測、プレイヤー この調査レポートでは、固体電池の技術、材料、市場、サプライチェーン、プレイヤーを分析し、容量と市場価値の両方について3つの主要技術カテゴリの10のアプリケーション領域にわたって2023年から2033年... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートでは、固体電池の技術、材料、市場、サプライチェーン、プレイヤーを分析し、容量と市場価値の両方について3つの主要技術カテゴリの10のアプリケーション領域にわたって2023年から2033年にかけて予測しています。

主な掲載内容(目次より抜粋)

Report Summary

This report characterizes the solid-state battery technologies, materials, market, supply chain and players. It assesses and benchmarks the available solid-state battery technologies, introduces most players worldwide and analyzes the key players in this field, forecasted from 2023 to 2033 over 10 application areas of 3 key technology categories for both capacity and market value. The report also analyzes the hype and hopes behind solid-state batteries, providing deep technological and business insights.

Conventional lithium-ion batteries based on graphite anodes, layered oxide cathodes (LCO, NMC, NCA) and liquid electrolyte have been ubiquitously adopted in our daily life, from small consumer electronics to large electric vehicles and stationary energy storage systems. The requirement of decarbonization triggered electrification, further leading to the rapid growth of electric vehicle market, which has driven the development, manufacture and sales of batteries, especially lithium-ion batteries. Since their commercialization in 1991, lithium-ion batteries have had a dominant position in the battery market in various applications. In the meantime, due to their performance limitation, environmental consideration, and supply chain constraints, next-generation battery technologies are being researched, developed and commercialized. Among them, solid-state batteries have attracted the most attention, from research institutes, material providers, battery vendors, component suppliers, automotive OEMs, and venture capitals and investors.

The popular discussions on solid-state batteries have brought efforts both in academia and industry. With an increasing number of players working in this field and some milestones being achieved, a US$8 billion-market-size opportunity is potentially waiting for solid-state batteries.

Solid-state battery addressable market size. Source: IDTechEx

After years of development, a few solid-state batteries have been commercialized, with more under development. At the same time, with the continuous improvement of Li-ion batteries, there are discussions around which technologies are worth the resources and investment. There are hypes in solid-state batteries, as sometimes they are marketed as the definite replacement of conventional lithium-ion batteries. There are also pessimistic opinions, believing solid-state batteries are only in the lab and they won't bring actual superior value propositions compared with existing lithium-ion batteries.

In addition, there is a tremendous number of players announcing their technologies being the game changer of the world, together with their commercial and manufacturing plans. Solid-state batteries differ from conventional lithium-ion batteries, from the materials used, cell design, system design, to supply chain establishment, manufacturing, and recycling. It is not a mature industry yet, leaving lots of unclear questions to answer.

This report is tackling these doubts around solid-state batteries, providing introduction, analysis, and insights from various angles such as technology, commercialization, supply chain, manufacturing, markets, and players.

Within the solid-state battery regime, there are various technology approaches. Oxide, sulfide and polymer systems have become the most popular options in the next-generation development, with further variations under each category. In general, sulfide electrolytes have the advantages of high ionic conductivity - even better than liquid electrolyte - low processing temperature, and a wide electrochemical stability window. Many features make them appealing, being considered by many as the ultimate option. However, the difficulty of manufacturing and the toxic by-product hydrogen sulfide generated in the process make the commercialization relatively slow. Polymer systems are easy to fabricate, most compatible to existing manufacturing facility, and some of them are already in commercialization. The relatively high operating temperature, low anti-oxide potential, and worse stability indicate challenges. Oxide systems are more stable for lithium metal, with good electrochemical and thermal stabilities. However, the higher interface resistance and higher-cost, lower-yield manufacturing processes show some difficulties in general.

Comparison of solid-state batteries. Source: IDTechEx

There are also other technologies with further modifications within the three material systems, as well as beyond.

No technology is perfect, and complication of technical details, testing conditions, and data selected to be published can make the public very confused regarding the pros and cons of each technology. This report is therefore aiming to offer a detailed explanation and analysis from a technical angle, with our own opinions. The hypes and hopes of solid-state batteries are assessed as well. Although a few advantages cannot really be provided by current solid-state batteries, compared with conventional lithium-ion batteries, better safety, potential energy density increase, and system level design simplification are still the major drivers from solid-state batteries.

IDTechEx has been tracking the development of solid-state battery since 2014 and with years of experience, we have observed the gradual transition of efforts in this industry. For instance, early focuses were mostly on solid-state electrolyte and half/full cell demonstration. With further improvement, more things are considered for commercialization. Sample validation, system design, supply chain establishment, and manufacturing optimization are becoming increasingly important.

Conventional lithium-ion battery manufacturing has been dominated by East Asia, with Japan, China, and South Korea playing a significant role. US and European countries are competing in the race, shifting the added values away from East Asia and building battery manufacturing close to the application market. New material/component selection and change of manufacturing procedures show an indication of reshuffle of the battery supply chain. From both a technology and business point of view, development of solid-state battery has become part of the next-generation battery strategy. It has become a global game with regional interests and governmental supports. Opportunities will be available with new materials, components, systems, manufacturing methods and know-how.

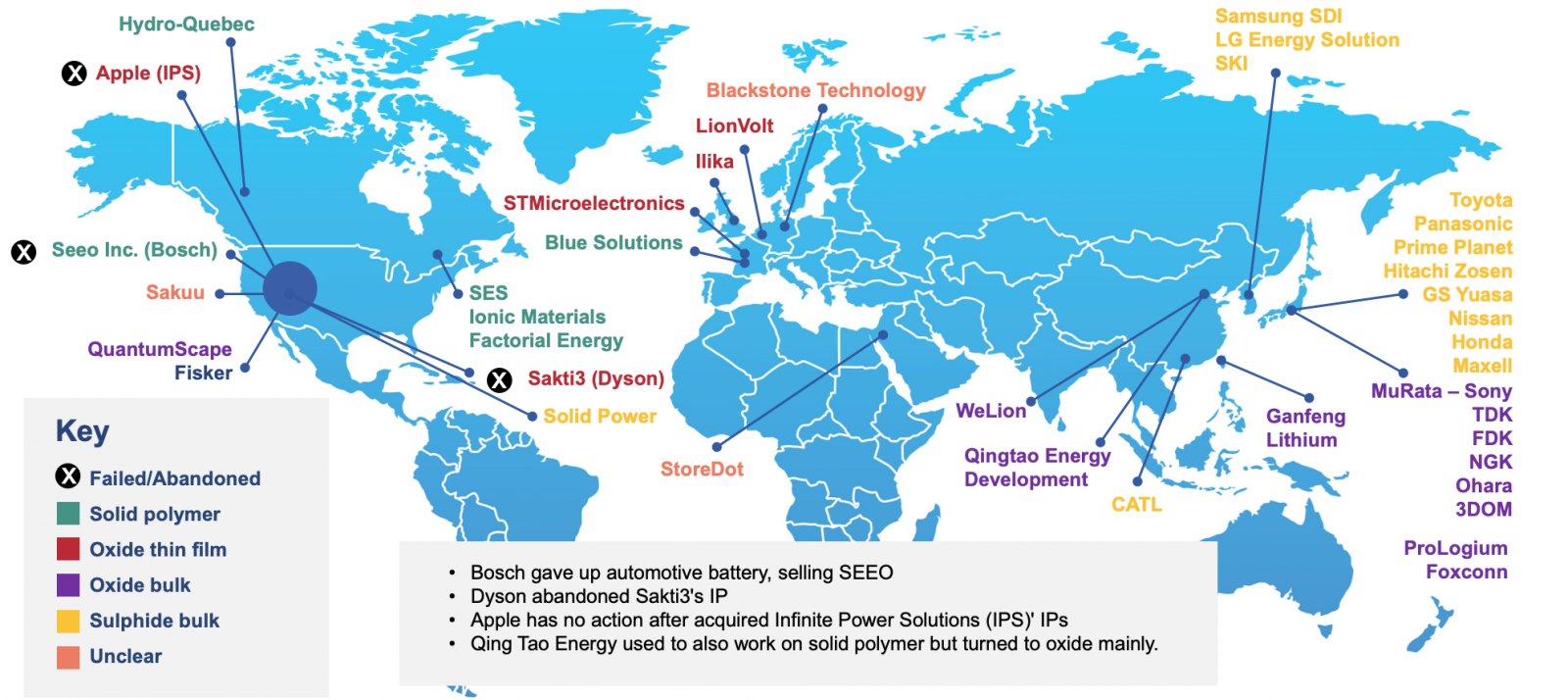

Global major solid-state battery players. Source: IDTechEx

The report covers the manufacturing procedures and how various companies try to address the limitations, as well as research progress and activities of important players. The global market analysis is provided, with 10-year forecasts until 2033 for both production capacity and market size, over 10 application areas and 3 major technology groups.

This report also talks about most of the players working in this area and profiles 45 of them in "Company Profile" section. It offers further detailed company analysis of the key players, such as its technology analysis, product introduction, roadmap, financial/funding, materials, cell specification, manufacturing, supply chain, partnerships, patent introduction, future business, and SWOT analysis.

Key takeaways from this report:

Table of Contents

|

.png)

(1).png)