Summary

この調査レポートでは、各技術とアプリケーションの技術・市場適合性を包括的に調査し、将来の家庭、工場、都市におけるガスセンシングの要件に関する知見を提供しています。

主な掲載内容(目次より抜粋)

-

市場予測

-

ガスセンサ

-

技術・アプリケーションのベンチマーク

-

環境アプリケーション

-

医療アプリケーション

-

車載アプリケーション

-

産業ガスセンサ

Report Summary

Gas sensors are simultaneously an established industry and well placed to benefit from the trend towards mass-digitization. Interest from consumers and policymakers in air quality has increased dramatically due to COVID-19, creating a growing market for distributed gas sensor networks. Through discussions with major and emerging sensor manufacturers, along with analysis of early-stage technologies, this report identifies opportunities and challenges across environmental, medical, automotive, and olfaction markets.

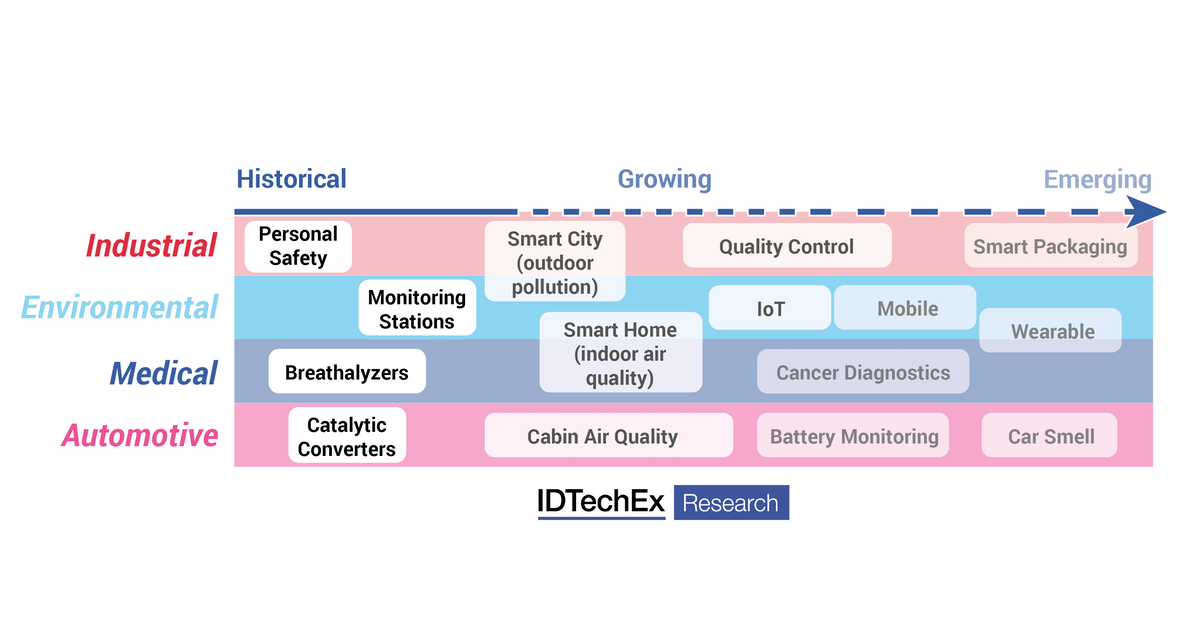

Gas detection methods span a diverse technology landscape, ranging from established approaches such as metal oxide detectors to innovative emerging approaches such as acoustic gas sensing. Determining which technologies are best suited to the broad application space, including the rapidly growing market for IoT applications, requires analysis of attributes such as sensitivity, selectivity, cost, and compactness. This report comprehensively explores the technology-market fit for each technology and application, providing insight into the gas sensing requirements for the home, factory, and city of the future.

A roadmap of emerging applications for gas sensor technology

Mass-digitization to drive widespread air quality monitoring

Vast sensor networks spanning our cities and integrated into our homes will offer greater automation and predictive maintenance, through continuous monitoring of parameters including air quality. Once a concern reserved for industrial facility managers, sophisticated air quality monitoring with gas sensors will both inform policy and enable consumers to make more informed choices regarding issues such as pollution, airborne pandemics and even climate change.

Widely distributed gas sensor networks will enable automated ventilation of schools and homes, monitor urban air quality, change government policies, control traffic, and more. The era of gas sensor data as technical information only accessible to scientists is ending, being overtaken by sensors which are easy to use, low power and affordable.

Mass-digitization of gas measurements will rely on software which goes beyond visualisation, adding value through improved sensitivity, companion apps and closed loop control. We assess the hardware and business models enabling continuous measurement and identify commercial opportunities within environmental monitoring and air quality.

Hype versus realistic opportunity for digitized smell

There is no denying that aroma is important to us. The quality of food and drink is often first assessed just after we smell it. This ranges from whether we think yesterday's milk is safe, to expert opinions on the merits of a wine vintage. Historically the human nose has been our only means of identifying aromas - until now.

New sensor technology claims to act as a digital replacement to the nose and brain, capable of objectively quantifying smells. Moreover, the size and power of these so called 'e-noses' is small enough to allow them to be integrated into everything from cars and fridges to smart home products and phones. But how does digital smell work, and does the technology readiness level match the hype?

We not only explain the principle of 'e-nose' technology but compare the performance of newly commercialised devices - extracting realistic opportunities from marketing hype.

Technological roadmap towards miniaturization

Sensors small enough to fit inside a smart phone sell in high volumes, and micron scale gas sensor technology is emerging from the lab. Demand from the public for air quality sensors spiked during the pandemic, a trend set to continue beyond 2022.

Newly commercialised technology uses carbon nanotube inks printed on thin films. These advanced materials are a thousand times more sensitive than competitor technology.

We benchmark the performance and application of this and other early-stage technology against established techniques. Alongside an in-depth review of printed sensors, we provide a roadmap towards ultra-miniaturized gas sensors.

Comprehensive benchmarking and market forecasts

IDTechEx has been covering the broad topic of sensor technology since 2008. We have interviewed a wide range of the major players over the years, attended multiple conferences and delivered both consulting projects and workshops on this topic. This dedicated gas sensor report evaluates the performance of multiple technologies in detail - comparing their key characteristics and compatibility to different application areas. It includes multiple company profiles from interviews with both major manufacturers and start-ups specialising in a range of different technologies.

We have developed 10-year market forecasts for each technology and application sector, presented by both revenue and volume. We forecast a growing market for environmental applications worldwide, with an increasing proportion of revenue generated from infra-red sensors and optical particle counters. It is anticipated that a consumer market for digital smell will become more established, with existing technology combined with AI utilised in white goods and quality control. The most disruptive technologies are predicted to be printed and acoustic gas sensors, which hold the most promise for ultra-low form factor applications such as smart packaging and wearables.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Report scope |

|

1.2. |

New markets for gas sensing |

|

1.3. |

What are the market and technology drivers for change? |

|

1.4. |

The pandemic created a global spike in air quality interest |

|

1.5. |

The hype around E-nose technology (1) |

|

1.6. |

The hype around E-nose technology (2) |

|

1.7. |

Gas Sensors future roadmap (1) |

|

1.8. |

Gas sensor future roadmap (2) |

|

1.9. |

Notable takeaways from the gas sensor roadmap |

|

1.10. |

10-year overall gas sensors revenue forecast by sensor type (USD) |

|

1.11. |

Analyte types overlap multiple application areas |

|

1.12. |

Industrial players are seeking growth in the overlapping environmental market |

|

1.13. |

The pandemic impact on gas sensor companies growth: increased demand tempered by disrupted supply chains |

|

1.14. |

Comparing key industrial players sensor innovations against ability to execute |

|

1.15. |

Notable company relationships within the gas sensor industry |

|

1.16. |

Main conclusions (1) : Outdoor pollution sensing should align itself with policy demands |

|

1.17. |

Main conclusions (2): Indoor air quality devices will be found in more locations, but continue using three fundamental sensor types |

|

1.18. |

Main conclusions (3) Diagnostic opportunities for gas sensors are broad for specific VOC detectors |

|

1.19. |

Main conclusions (4): Evolution of point-of-care testing will create long term opportunities for new gas sensor technology |

|

1.20. |

Main conclusions (5): Electric vehicles will fundamentally change gas sensor requirements of the automotive market |

|

1.21. |

Main conclusions (6): Digitizing smell will require both old and new gas sensing technology |

|

2. |

MARKET FORECASTS |

|

2.1. |

Market forecast methodology |

|

2.2. |

Challenges in forecasting a fragmented market |

|

2.3. |

Categorizing applications areas for forecasting |

|

2.4. |

Categorizing technology areas for forecasting |

|

2.5. |

10-year overall gas sensors forecast by sensor type (volume) |

|

2.6. |

10-year overall gas sensors revenue forecast by sensor type (USD) |

|

2.7. |

10-year overall gas sensors forecast by sector (volume) |

|

2.8. |

10-year overall gas sensors forecast by sector, excluding industrial and automotive (volume) |

|

2.9. |

10-year overall gas sensors forecast by sector, excluding industrial and automotive (revenue, USD) |

|

2.10. |

10-year emerging gas sensors forecast by sensor type (volume) |

|

2.11. |

10-year emerging gas sensors revenue forecast by sensor type (USD) |

|

2.12. |

Metal-oxide semiconductor gas sensor forecast by application (volume) |

|

2.13. |

Metal-oxide semiconductor gas sensor revenue forecast by application (USD) |

|

2.14. |

Electrochemical gas sensor forecast by application (volume) |

|

2.15. |

Electrochemical gas sensor revenue forecast by application (USD) |

|

2.16. |

Infra-red gas sensor forecast by application (volume) |

|

2.17. |

Infra-red gas sensor forecast for the automotive market (volume) |

|

2.18. |

Infrared gas sensor revenue forecast by application (USD) |

|

2.19. |

Optical particle counter forecast by application (volume) |

|

2.20. |

Optical particle counter revenue forecast by application (USD) |

|

2.21. |

Pellistor sensors forecast by application (volume) |

|

2.22. |

Pellistors revenue forecast by application (USD) |

|

2.23. |

Ionization detectors forecast by application (volume) |

|

2.24. |

Ionization detectors revenue forecast by application (USD) |

|

2.25. |

Printed gas sensors forecast by application (volume) |

|

2.26. |

Printed gas sensors revenue forecast by application (USD) |

|

2.27. |

Acoustic gas sensors forecast by application (volume) |

|

2.28. |

Acoustic gas sensors revenue forecast by application (USD) |

|

2.29. |

3D printed and other printed gas sensors forecast by application (volume) |

|

2.30. |

Environmental Sensors - Total sales volume by technology type |

|

2.31. |

Environmental Gas Sensors - Total Revenue in $USD by technology type |

|

2.32. |

Industrial Sensors - Total sales volume by technology type |

|

2.33. |

Industrial Gas Sensors - Total Revenue in $USD by technology type |

|

2.34. |

Automotive Sensors - Total sales volume by technology type |

|

2.35. |

Automotive Gas Sensors - Total Revenue in $USD by technology type |

|

2.36. |

Medical Sensors - Total sales volume by technology type |

|

2.37. |

Medical Gas Sensors - Total Revenue in $USD by technology type |

|

2.38. |

Olfaction Sensors - Total sales volume by technology type |

|

2.39. |

Olfaction Gas Sensors - Total Revenue in $USD by technology type |

|

3. |

INTRODUCTION |

|

3.1. |

Gas sensors are utilized in multiple industries |

|

3.2. |

Report scope |

|

3.3. |

A brief history of gas sensor technology |

|

3.4. |

Why is gas sensor technology still emerging? |

|

3.5. |

What are the market and technology drivers for change? |

|

3.6. |

Key metrics for assessing a gas sensor |

|

3.7. |

Health risks motivates gas sensing across all sectors |

|

3.8. |

Introduction to outdoor pollution |

|

3.9. |

Introduction to indoor air quality |

|

3.10. |

Introduction to automotive gas sensors |

|

3.11. |

Introduction to gas sensors for breath diagnostics |

|

4. |

GAS SENSORS -TECHNOLOGY APPRAISAL AND KEY PLAYERS |

|

4.1.1. |

There is continual innovation for existing technologies, and new opportunities emerging from the lab |

|

4.2. |

Core Gas Sensor Technologies: Metal Oxide Sensors |

|

4.2.1. |

Introduction to Metal Oxide (MOx) gas sensors |

|

4.2.2. |

Typical specifications of MOx sensors |

|

4.2.3. |

Traditional versus MEMS MOx gas sensors |

|

4.2.4. |

Advantages of MEMS MOx sensors |

|

4.2.5. |

Categorizing MOx sensors manufacturers |

|

4.2.6. |

N-Type vs. P-Type semiconductors in MOx sensors |

|

4.2.7. |

BOSCH Sensortec MOx sensors |

|

4.2.8. |

AMS MOx sensors |

|

4.2.9. |

Printed MOx sensors |

|

4.2.10. |

Screen Printed MOx sensors |

|

4.2.11. |

SWOT analysis of MOx gas sensors |

|

4.2.12. |

Summary: Metal oxide gas sensors |

|

4.3. |

Core Gas Sensor Technologies: Electrochemical Sensors |

|

4.3.1. |

Introduction to electrochemical gas sensors |

|

4.3.2. |

Typical specifications of electrochemical sensors |

|

4.3.3. |

Innovations in electrochemical sensing |

|

4.3.4. |

Printed Electrochemical Sensors |

|

4.3.5. |

Printed Electrochemical Sensors |

|

4.3.6. |

Traditional versus printed electrochemical sensors |

|

4.3.7. |

Electrochemical Lambda Sensor |

|

4.3.8. |

Major manufacturers of electrochemical sensors |

|

4.3.9. |

SWOT analysis of electrochemical gas sensors |

|

4.3.10. |

Summary: Electrochemical sensors |

|

4.4. |

Core Gas Sensor Technologies: Infra-red Sensors |

|

4.4.1. |

Introduction to infrared gas sensors |

|

4.4.2. |

Non-dispersive infrared most common for gas sensing |

|

4.4.3. |

Infra-red sensors can be used for explosive limit measurements |

|

4.4.4. |

Categorization of infra-red sensor manufacturers |

|

4.4.5. |

Typical specifications of NDIR gas sensors |

|

4.4.6. |

SWOT analysis of infra-red gas sensors |

|

4.4.7. |

Summary: Infra-red sensors |

|

4.5. |

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

関連レポート(キーワード「センサ」)

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|

ページTOPに戻る