Industrial Automation and Wireless IoT – 4th Edition産業オートメーションと無線IoT(モノのインターネット) (第4版) スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート 「産業オートメーションと無線IoT(モノのインターネット) (第4版)」 は、世界の産業用オートメーションの無線モノのインターネッ... もっと見る

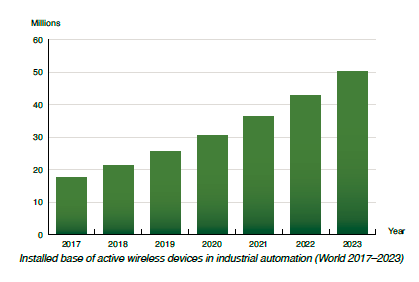

Summaryスウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「産業オートメーションと無線IoT(モノのインターネット) (第4版)」は、世界の産業用オートメーションの無線モノのインターネット(IoT)の市場を調査している。稼働している産業オートメーション産業の無線IoT機器の導入数は、2018年末の2130万台から年平均成長率(CAGR)18.8%で成長して2023年には5030万台に達するだろう。ビジネス上の意思決定に有益な5年間の市場予測と専門家の見解を提供している。主要企業の有力者のインタビュー、産業オートメーションIoTのエコシステム、主要な用途の概説、主要な市場動向と発展、69社の主要企業の詳細な概要、2023年までの最新の市場予測を無線技術毎、地域毎、垂直市場毎、デバイス毎に提供している。 目次(抜粋)

Description This study investigates the worldwide market for wireless IoT applications in industrial automation. The installed base of active wireless IoT devices in the industrial automation industry is forecasted to grow at a compound annual growth rate of 18.8 percent from 21.3 million units at the end of 2018 to 50.3 million units by 2023. Get up to date with the latest information about vendors, products and markets.

Industrial Automation and Wireless IoT is the fourth strategy report from Berg Insight analysing the latest developments on the market for wireless IoT applications in industrial automation worldwide.

The installed base of wireless IoT devices in Industrial Automation to reach 50.3 million in 2023

Wireless technologies are integrated into a wide range of devices that can be used throughout an automation system, from the supervisor level all the way to the control and field levels. The devices can be broadly divided into two segments: automation equipment and network equipment. In the automation equipment segment, highvolume product categories featuring wireless communications capability include instrumentation such as industrial sensors, as well as wireless I/O and field devices that connect to sensors, actuators and machines. Important product categories within the network equipment segment are wireless access points, gateways, routers and switches.

This report answers the following questions:

Who should buy this report? Table of Contents

Executive Summary

1.1 Introduction to industrial automation 2 Wireless IoT solutions in industrial automation

2.1 Wireless automation infrastructure 3 Market forecasts and trends

3.1 Market analysis 4 Global automation vendors

4.1 ABB 5 Device and software vendors

5.1 Industrial communications and control solution providers

Glossary Press Release[プレスリリース原文]

2019-01-21 According to a new research report from the M2M/IoT analyst firm Berg Insight, annual shipments of wireless devices for industrial automation applications reached 4.6 million units worldwide in 2018, accounting for approximately 6 percent of all new connected nodes. Growing at a compound annual growth rate (CAGR) of 16.3 percent, annual shipments are expected to reach 9.9 million in 2023. The installed base of wireless IoT devices in industrial automation reached at the same time 21.3 million in 2018. While wired networking solutions are still predominantly used for industrial communications between sensors, controllers and systems, wireless solutions have gained a strong foothold in a number of applications. Wireless solutions are used for wire replacement in parts of the plant that are hard to reach or uneconomical to connect through wired installations. In factory automation, wireless solutions are widely used to control cranes and automated guided vehicles (AGVs) in material handling applications. In process automation, wireless technologies are increasingly used to connect instruments, enabling plant operators to monitor and optimise processes in hazardous areas, while also ensuring worker safety. Major providers of wired industrial network equipment also offer wireless solutions to enable customers to monitor and control devices wirelessly in parts of the plant that are normally not connected to the control room due to accessibility or wiring costs. These include Siemens, Cisco, Belden, Moxa and Phoenix Contact, which all offer comprehensive portfolios of industrial wireless devices such as routers, gateways and wireless access points along their wired solutions. Industrial wireless solutions are also offered by many mid and small-sized companies, which often specialise in specific product categories. Examples include Acksys, Advantech, Beijer Electronics Group, FreeWave Technologies, GE’s industrial communications group GE MDS, HMS Networks, Red Lion Controls and Sierra Wireless. Wireless I/O and field devices are provided by many major industrial automation vendors including Emerson, Yokogawa, Honeywell, ABB, Schneider Electric, Siemens, Endress+Hauser and Pepperl+Fuchs. “Robust connectivity is critical to support industrial IoT use cases surrounding predictive maintenance and digital twins”, said Fredrik Stålbrand, IoT Analyst, Berg Insight. He adds that installation and maintenance of wireless solutions are more flexible and economical compared to wired technologies, enabling reconfigurable manufacturing system design. Although reliability and security remain a challenge, Wi-Fi has emerged as the most widely used wireless technology in industrial environments largely due to the wide availability of compatible hardware. There is also a growing trend among large industrial companies to deploy private 4G LTE networks instead of using Wi-Fi and even wired solutions. “The introduction of 5G cellular technologies broadens the addressable market for wireless communications even further as it allows for deployments in situations where requirements related to bandwidth, latency and capacity cannot be fulfilled today”, concluded Mr. Stålbrand.

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(M2M・IoT)の最新刊レポートBerg Insight 社の最新刊レポート本レポートと同じKEY WORD(モノのインターネット)の最新刊レポート

よくあるご質問Berg Insight社はどのような調査会社ですか?スウェーデンの調査会社ベルグインサイト社(Berg Insight)は、モバイルM2Mや位置情報サービス(LBS)、モバイルVAS、次世代技術など、通信関連市場を専門に調査しています。特に、M2Mと位... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

詳細検索

2024/07/05 10:26 162.17 円 175.82 円 209.73 円 |