Payment Cards Issuing and Acquiring Europe 2020欧州の支払いカードの発行と加盟店契約 2020年 英国調査会社リテールバンキングリサーチ(RBR - Retail Banking Research)の調査レポート 「欧州の支払いカードの発行と加盟店契約 2020年 」 は、欧州の支払いカードの発行や 加盟店契約 と管理に関する詳... もっと見る

*ページ数は、欧州全体版のものです。各国のカントリーレポートを1600ポンド(印刷版)で提供しています。価格の詳細はお問合せください。

Summary

各国レポートは7つのセクションに区分している: 市場概観 カードタイプ

カードスキームと発行会社

カード利用

カード発行会社の処理と不正使用 加盟店獲得

発行者と加盟店の一覧

RBR’s Payment Cards Issuing and Acquiring Europe report is the authoritative source of reliable, detailed, country-by-country information on card issuing, acquiring and processing.

Austria • Belgium • Croatia • Czechia • Denmark • Finland • France • Germany • Greece • Hungary • Ireland • Israel • Italy • Netherlands • Norway • Poland • Portugal • Romania • Russia • Spain • Sweden • Switzerland • Turkey • UK • Ukraine

contents

Card schemes and issuers

Card usage

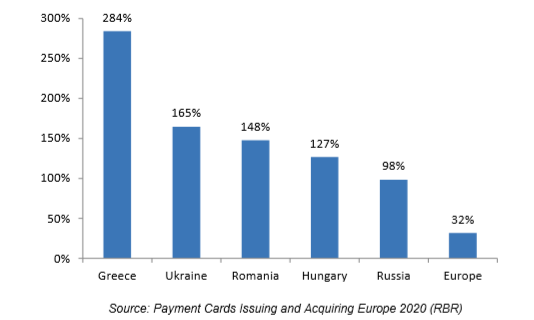

Detailed issuer and acquirer tables Press Release[プレスリリース原文] London, 23rd January 2020 Europeans spend €4 trillion per year on payment cards Expenditure on European payment cards has grown by a third since 2014 to reach €3.9 trillion, as cards are used increasingly for everyday purchases Rapidly rising usage spurs card spending RBR’s latest research, Payment Cards Issuing and Acquiring Europe 2020, shows that in 2018 cardholders in the UK, France and Germany spent the most, with the total increasing by 26%, 19% and 22% respectively since 2014. The fourth largest market, Russia, saw spending double over the same period. The RBR report showed that growth in spending is inextricably linked to the ramp up of card usage. Greece stands out in particular, as card usage grew sevenfold, following widespread state-mandated card acceptance at many merchants. Unsurprisingly, the country also saw the fastest growth in spend, which almost quadrupled over the four-year period. Eastern European markets tended to be the fastest growing in terms of expenditure, notably Ukraine, Romania and Hungary where spending more than doubled. Recent surges in card spending across Europe can in large part be attributed to the growing adoption and acceptance of contactless payments, as well as increased online shopping.

Fastest growing European markets by card expenditure, 2014-2018 Behavioural shift sees cards used for everyday transactions RBR’s report showed that, for Europe as a whole, the number of transactions grew nearly three times as fast as the rise in expenditure, with the result that the average value of each transaction continues to fall – from €46 in 2014 to just €34 in 2018. The reason for this is that cards are increasingly being used for everyday, low-value purchases, as customers rapidly adopt contactless and mobile payments. As a result, growth in the total number of card payments made by Europeans is accelerating year-onyear.

Russian cards see the lowest average ticket in Europe, at €12, while the number of payments in the country nearly quadrupled over four years. Whilst this echoes the general pattern seen elsewhere in Europe, in Russia in particular this has been driven by initiatives such as contactless ticketing on the Moscow and St. Petersburg metro systems, and lucrative cashback reward schemes, offered by a number of banks, incentivising use of cards ahead of cash. Increased debit card spending drives overall growth RBR’s research shows that the vast majority of markets in Europe have seen an increase in the proportion of spend made with debit cards. There has been a widespread consumer shift from pay-later credit cards to pay-now debit cards, as a result of economic uncertainty and increasing consumer frugality. RBR found that this shift is most stark in Greece, with debit growing from 26% of the country’s card expenditure in 2014 to 68% in 2018.

Thomas Madden, who led RBR’s Payment Cards Issuing and Acquiring Europe 2020 research, commented: “The increasing customer adoption of payment cards, as well as expanding acceptance networks across Europe, is helping drive the sustained growth seen in card expenditure. The rising use of debit cards, in particular, as the default payment method for many Europeans, has significantly boosted the amount they have spent on their cards in recent years”.

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(金融)の最新刊レポート

RBR - Retail Banking Research社のカードと決済 - Cards and Payments分野での最新刊レポート本レポートと同じKEY WORD()の最新刊レポート

よくあるご質問RBR - Retail Banking Research社はどのような調査会社ですか?リテールバンキングリサーチ(RBR - Retail Banking Research)は、銀行取引の自動化やATM、カード、支払い関連市場を中心に調査を行っている英国の調査会社です。ATMとセルフサ... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|

英国調査会社リテールバンキングリサーチ(RBR - Retail Banking Research)の調査レポート「欧州の支払いカードの発行と加盟店契約 2020年」は、欧州の支払いカードの発行や

英国調査会社リテールバンキングリサーチ(RBR - Retail Banking Research)の調査レポート「欧州の支払いカードの発行と加盟店契約 2020年」は、欧州の支払いカードの発行や