培養肉 2021-2041:技術、市場、予測Cultured Meat 2021-2041: Technologies, Markets, Forecasts 培養肉とは、実験室で育てた動物の細胞を使って、動物の屠殺を必要とせずに食肉製品を作る新しい技術で、従来の農業が抱える環境問題を回避できる可能性を秘めています。今日の多くの代替食肉とは異なり、培養... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2021年5月13日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

296

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

培養肉とは、実験室で育てた動物の細胞を使って、動物の屠殺を必要とせずに食肉製品を作る新しい技術で、従来の農業が抱える環境問題を回避できる可能性を秘めています。今日の多くの代替食肉とは異なり、培養肉は、従来の食肉と全く同じ細胞や組織を含む製品を作る可能性を秘めています。

過去5年間で、培養肉は、ほとんど何もなかった状態から、最初の製品を市場に出そうと競争する50社以上の企業に成長し、6億ドル以上がこの分野に投資されています。

2020年12月には、シンガポールが世界で初めて、カリフォルニアのスタートアップ企業であるEat JUST社が製造した培養鶏肉製品の販売を規制当局から承認され、業界は大きく前進しました。

しかし、楽観的な見方をしていても、培養肉が1兆ドル規模の従来の食肉産業を破壊する立場になるまでには、業界には克服すべき大きな課題があります。培養肉の生産コストはまだ非常に高く、商業規模で培養肉を生産する方法を開発した企業はまだありません。とはいえ、ここ数年で技術は大幅に進歩しており、業界の多くは培養肉に対して楽観的な見方をしています。

本レポートは、多数の主要企業へのインタビューを含む、培養肉分野の広範な一次調査に基づいて、培養肉市場の技術および業界に関する詳細な評価を行っています。

本レポートでは、世界の食肉産業とその持続可能性の問題、食肉の化学的・物理的構成、培養肉の製造プロセス、培養肉産業の現状と規制について、産業界の主要プレーヤーの評価とともに説明しています。これらをもとに、10年および20年の培養肉市場の予測を行い、2031年には16億6000万ドル、2041年には111億3000万ドルの世界培養肉市場になると予測しています。

レポートに含まれる内容

培養肉業界は急速に成長しています。IDTechExは、培養肉市場が2041年までに111.3億ドルの規模になると予測しています。

培養肉:エキサイティングだが不確実な技術

培養肉(栽培肉)は、複数のステップを経て製造されます。

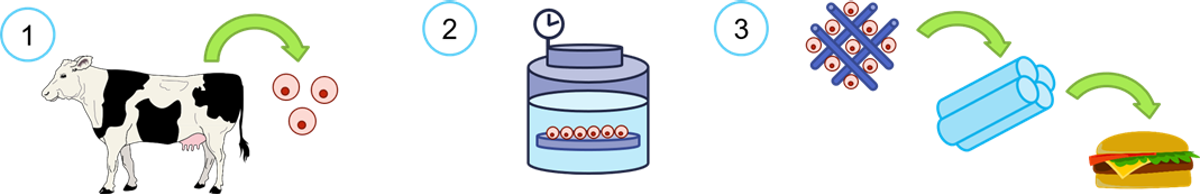

まず、通常は無傷の動物から生体組織を採取します。この生検から、関連する細胞株が分離され、生産プロセスのスターター細胞として使用される安定した細胞株に変換される。理想的なスターター細胞は、増殖力が高く、最終的に希望する細胞タイプ(通常は脂肪細胞や筋肉細胞)に容易に分化させることができる。培養肉の生産を目指す企業にとって、スターター細胞の選択は重要な判断材料となります。本レポートでは、最も一般的なスターター細胞の選択に関連する利点と課題について説明しています。スターター細胞は、大量のバイオマスになるまで培養室で増殖させます。

そのためには、組織の成長を促すために必要な栄養素やタンパク質を含んだ液体である成長培地を、バイオリアクター内で処理する必要があります。この培地を与えると、細胞は増殖し、数日後には2倍の数になります。現在、培養液の製造は非常に高価で、多くの企業が牛胎児血清(FBS)を使用しています。FBSは、一般的に動物の屠殺から得られるタンパク質の多い血清で、生産規模の拡大には適していません。十分な量の増殖細胞が得られたら、それらの細胞を食肉を構成する成熟細胞、例えば成人の筋肉細胞に分化させます。そのためには、別のバイオリアクターが必要となる。薄い培養細胞の層ではなく、立体的な肉を培養するためには、細胞を足場の上で培養する必要があります。足場は、組織の構造と秩序を指示し、細胞が成熟した形、例えば筋肉組織に成長するのを可能にします。足場は、成長中の細胞に栄養分を行き渡らせ、機械的に細胞を伸ばして、筋肉を「運動」させ、完全に発達させなければならない。

このプロセスから商業的に実現可能な製品を作るのは非常に難しい。しかし、この5年間で技術は急速に進歩し、試作品を作る企業も増えてきた。

重要な課題は、すべての製造工程を費用対効果の高い方法で行うことです。2013年にマーストリヒト大学のマーク・ポスト教授の研究グループが開発した最初の試作品である培養ハンバーガーは、製造に30万ドル以上かかったと言われています。その後、コストは大幅に低下しており、2019年にEat JUST社は、同社のチキンナゲットの製造コストは1個あたり約50ドルだと主張していますが、従来の肉と同等のコストに到達することは、困難な課題です。

培養肉は、3段階のプロセスで製造されます。

まず、通常は動物を傷つけることなく、スターター細胞を抽出・分離します。次に、これらの細胞をバイオリアクターで増殖させ、大量のバイオマスを生産します。次に、これらの細胞を分化させて、成熟した筋肉や脂肪の組織を形成する。そのためには、複雑な足場やマイクロキャリア、高度なバイオリアクターが必要となる。

培養肉産業は過去5年間で急速に成長し、培養肉市場も急速に立ち上がっています。2016年には、培養肉企業は5社に満たず、それぞれがまだ初期の実証実験を行っていました。今では50社以上が存在し、試作品も当たり前になっています。この期間にこの分野への投資が急増し、2015年には25万ドルだったものが、2020年だけで約3億ドルにまで成長しています。

2020年12月、Eat JUSTはシンガポールで、植物性タンパク質と培養鶏細胞から作られたハイブリッド製品「GOOD Meat」の規制当局による承認を受け、培養肉製品としては初の承認となりました。

シンガポールは比較的小さな市場ですが、これは業界にとって大きな一歩であり、EU、米国、中国などの大きな市場での承認プロセスを加速させる可能性があります。今後数年間の開発は、培養肉業界の進展と、1兆ドル規模の世界の食肉業界を破壊する可能性において、極めて重要な役割を果たすことになるでしょう。

IDTechExの最新レポート「Cultured Meat 2021-2041」は、新興の培養肉市場の将来を形作る技術的および市場的要因を探り、10年および20年の培養肉市場の予測を提供しています。

目次

1. EXECUTIVE SUMMARY

1.1. The challenge of feeding a growing population

1.2. Meat is an inefficient source of nutrition

1.3. The environmental impact of animal agriculture

1.4. COVID-19: the latest zoonotic disease stemming from the meat industry

1.5. The world is unlikely to become vegetarian

1.6. A brief history of meat substitutes

1.7. Cultured meat

1.8. The potential of cultured meat

1.9. The state of cultured meat

1.10. How is cultured meat made?

1.11. The four main factors in cultured meat production

1.12. 1.) Starter cells

1.13. 2.) Growth medium

1.14. 3.) Bioreactors

1.15. Innovation in bioreactor technology

1.16. 4.) Scaffolds and structures

1.17. Challenges in scaffolding

1.18. Challenges of scale up

1.19. The cultured meat industry is growing rapidly

1.20. Companies in the cultured meat industry

1.21. The emergence of a cultured meat value chain

1.22. Geographical distribution of cultured meat companies*

1.23. Cultured meat producers by animal cells used

1.24. Cultured meat demonstration products

1.25. Evaluating a cultured meat company

1.26. Investments into the cultured meat industry by year

1.27. The 10 most well-funded cultured meat companies

1.28. Cultured meat market forecast by region, 2021-2031

1.29. Cultured meat market forecast 2021-2031: regional share

1.30. The long-term view: cultured meat market forecast, 2021-2041

1.31. Cultured meat forecast 2021-2041: structured vs. unstructured meat

2. INTRODUCTION

2.1. The meat industry: an overview

2.1.1. The meat industry - an overview

2.1.2. The American meat industry - an overview

2.1.3. Meat production across the world

2.1.4. Demand in the developed world has stagnated

2.1.5. Demand in the developing world is growing

2.1.6. Chicken is taking the lead

2.1.7. An overview of the seafood industry

2.2. Sustainability issues in the meat industry

2.2.1. The challenge of feeding a growing population

2.2.2. Meat is an inefficient source of nutrition

2.2.3. The environmental impact of animal agriculture

2.2.4. Beef has the highest environmental impact

2.2.5. Public health risks

2.2.6. COVID-19: the latest zoonotic disease stemming from the meat industry

2.2.7. The problem with seafood

2.3. Alternative proteins

2.3.1. The world is unlikely to become vegetarian

2.3.2. A brief history of meat substitutes

2.3.3. Plant-based meat

2.3.4. Impossible Foods

2.3.5. Plant-based meat sales are growing

2.3.6. Challenges of plant-based meat

2.3.7. Structured and unstructured meat

2.3.8. Fermentation derived proteins

2.4. Cultured Meat

2.4.1. Cultured meat

2.4.2. The potential of cultured meat

2.4.3. The state of cultured meat

2.4.4. GOOD Meat by Eat JUST - the first commercial product

2.4.5. Interest in cultured meat is growing

2.4.6. "Cultured meat", "cultivated meat", or "clean meat"?

2.4.7. The environmental impact of cultured meat

2.4.8. The environmental impact of cultured meat

2.4.9. The first cultured meat products

2.4.10. When will cultured meat be widely available?

2.4.11. Challenges facing the cultured meat industry

3. WHAT IS MEAT?

3.1. Chapter overview

3.2. The structure of meat

3.3. Myocytes or myotubes

3.4. Myogenesis

3.5. Connective tissue - fibroblasts and chondrocytes

3.6. Adipocytes

3.7. The importance of fat in meat

3.8. The extracellular matrix (ECM)

3.9. Texture in meat

3.10. The taste of meat

3.11. The nutritional profile of meat

3.12. Nutrient profiles of animal and plant-based proteins

4. MAKING CULTURED MEAT: A TECHNOLOGY OVERVIEW

4.1. Starter cells

4.1.1. Starter cells

4.1.2. Creating meat from cultured cells

4.1.3. Choosing the right starter cells

4.1.4. Embryonic stem cells

4.1.5. Lab Farm Foods

4.1.6. Induced pluripotent stem cells (iPSCs)

4.1.7. Meatable

4.1.8. Higher Steaks

4.1.9. Future Meat Technologies

4.1.10. Mesenchymal stem cells (MSCs)

4.1.11. Cell Farm Food Tech

4.1.12. Myosatellite cells

4.1.13. Mosa Meat

4.1.14. Starter cell choice in making cultured meat

4.1.15. Myoblasts

4.1.16. Cultured fat

4.1.17. Mission Barns

4.1.18. Beyond fat and muscle

4.1.19. Avant Meats

4.1.20. GOURMEY

4.1.21. TurtleTree and Biomilq

4.1.22. Cell line banking

4.1.23. Cell line development - a key differentiator

4.1.24. Genetic engineering: a dirty word or a necessity?

4.1.25. Genetic engineering: potential areas of development

4.1.26. Genetic engineering case study: Memphis Meats

4.1.27. Memphis Meats

4.1.28. Developing cell lines for different species

4.1.29. Orbillion Bio

4.1.30. The unique benefits and challenges of cultured seafood

4.1.31. Wildtype

4.1.32. Finless Foods

4.1.33. Shiok Meats

4.2. Growth medium

4.2.1. Growth medium

4.2.2. What's in growth medium?

4.2.3. The problem with growth medium

4.2.4. Fetal bovine serum (FBS)

4.2.5. Many companies struggle to move beyond FBS

4.2.6. Why is developing serum free media difficult?

4.2.7. What's in serum?

4.2.8. Why is growth medium so expensive?

4.2.9. What's in basal medium?

4.2.10. How cheap could growth medium be in the future?

4.2.11. The seven scenarios for growth medium cost reduction

4.2.12. Costs under the seven scenarios

4.2.13. Are these scenarios realistic?

4.2.14. Decisions in media development

4.2.15. Growth medium optimisation

4.2.16. Merck KGaA

4.2.17. Innovation in growth media development

4.2.18. Integriculture

4.2.19. Integriculture and the CulNet system

4.3. Bioreactors

4.3.1. Bioreactors

4.3.2. A cell culture bioreactor must meet these demands

4.3.3. Comparison between bioreactors

4.3.4. Major types of dynamic bioreactor

4.3.5. Each bioreactor type has advantages and disadvantages

4.3.6. Packed/fixed bed bioreactors

4.3.7. Packed bed bioreactors - the Pall iCELLis bioreactor

4.3.8. Fluidised bed bioreactors

4.3.9. Hollow fibre bioreactors

4.3.10. Disposable bag bioreactors (DBBs)

4.3.11. A comparison of single use bioreactors

4.3.12. Cell seeding in bioreactors

4.3.13. Bioreactor design - lessons from other industries

4.3.14. Bioreactor optimisation

4.3.15. Innovation in bioreactor technology

4.3.16. CellulaREvolution

4.4. Scaffolds

4.4.1. Scaffolds and structures

4.4.2. Considerations in scaffolds

4.4.3. The importance of the physical environment

4.4.4. Anchorage-dependent cells

4.4.5. Microcarriers

4.4.6. Process considerations for microcarriers

4.4.7. More complex scaffolding

4.4.8. Common polymer options for scaffold materials

4.4.9. Biomaterial considerations in scaffold design

4.4.10. Challenges in scaffolding

4.4.11. Matrix Meats

4.4.12. Atlast Food Co. (Excell)

4.4.13. 3D bioprinting

4.4.14. The 3D bioprinting process

4.4.15. The four major 3D bioprinting technologies

4.4.16. Key specifications in 3D bioprinting

4.4.17. 3D bioprinting technology comparison

4.4.18. IDTechEx work on 3D bioprinting

4.4.19. 3D bioprinting of cultured meat

4.4.20. MeaTech

4.4.21. Aleph Farms

4.4.22. Cultured meat in space

4.5. Commercial scale-up in cultured meat production

4.5.1. Challenges of scale up

4.5.2. Challenges of scale up: the lack of hardware

4.5.3. Challenges of scale up: antibiotics

4.5.4. Design considerations in a scaled up plant

4.5.5. Bioreactor design considerations with scale

4.5.6. To scale-up or to scale-out?

4.5.7. Cost considerations of scale up - growth media

4.5.8. The seven scenarios for growth medium cost reduction

4.5.9. Cost considerations of scale up - growth media

4.5.10. Growth medium cost scenarios with different bioreactors

4.5.11. A scaled up cultured meat facility - BlueNalu

4.5.12. BlueNalu's scaled up facility design

4.5.13. BlueNalu

4.5.14. Safety concerns in cultured meat

4.5.15. Is cost-effective production possible?

4.5.16. Improving the process economics of cultured meat production

4.5.17. Could genetic engineering help?

5. THE CULTURED MEAT INDUSTRY

5.1. Industry overview

5.1.1. The cultured meat industry is growing rapidly

5.1.2. Companies in the cultured meat industry

5.1.3. The emergence of a cultured meat value chain

5.1.4. The challenges of supplying the cultured meat industry

5.1.5. Major food companies are acting

5.1.6. Geographical distribution of cultured meat companies*

5.1.7. Geographical distribution of cultured meat producers

5.1.8. Cultured meat producers by animal cells used

5.1.9. Cultured meat demonstration products

5.1.10. Cultured fat: an early market opportunity?

5.1.11. Cubiq Foods

5.1.12. Blended hybrids: the first cultured meat products

5.1.13. Evaluating a cultured meat company

5.1.14. Investments into the cultured meat industry by year

5.1.15. Investments into the cultured meat industry by company

5.1.16. Investments into the cultured meat industry by company, 2018-2021

5.1.17. Investments into the cultured meat industry by region

5.1.18. The 10 most well-funded cultured meat companies

5.1.19. GOOD Meat by Eat JUST - a viable commercial product?

5.1.20. Eat JUST: a turbulent history

5.1.21. The Chicken by SuperMeat - the first restaurant serving cultured meat

5.1.22. The need for collaboration in the industry

5.2. Consumer attitudes to cultured meat

5.2.1. Will people eat a cultured burger?

5.2.2. Factors impacting consumer acceptance

5.2.3. Consumer concerns around cultured meat

5.2.4. Consumer acceptance - geographical considerations

5.2.5. Cultured meat and religious restrictions

5.2.6. Could cultured meat find a home in Africa?

5.3. Regulatory landscape

5.3.1. Cultured meat regulations: European Union

5.3.2. EU Novel Food Regulations: process overview

5.3.3. EU regulations: labelling requirements

5.3.4. EU labelling regulations and cultured meat

5.3.5. EU regulations: GMOs and GMP guidelines

5.3.6. Are there signs of EU support for cultured meat?

5.3.7. BioTech Foods

5.3.8. Cultured meat regulations: USA

5.3.9. FDA and USDA joint agreement on cultured meat

5.3.10. Cultured fish - an easier path to US approval?

5.3.11. Labelling regulations in the USA

5.3.12. US standards of identity

5.3.13. The importance of labelling

5.3.14. The Alliance for Meat, Poultry and Seafood Innovation

5.3.15. Cultured meat: similarities and differences between EU and US regulations

5.3.16. Singapore: the first home of cultured meat

5.3.17. Cultured meat regulations: Singapore

5.3.18. Cultured meat regulations: Hong Kong

5.3.19. Cultured meat regulations: China

5.3.20. Cultured meat regulations: Israel

6. CULTURED MEAT MARKET FORECASTS

6.1. Cultured meat market forecast by region, 2021-2031

6.2. Cultured meat market forecast 2021-2031: regional share

6.3. Cultured meat market forecast: key factors

6.4. Conventional meat production forecast by region

6.5. Global conventional meat production forecast by animal

6.6. Global conventional meat market forecast by region

6.7. Global conventional meat market forecast by animal

6.8. The long-term view: cultured meat market forecast, 2021-2041

6.9. Cultured meat forecast 2021-2041: structured vs. unstructured meat

7. APPENDIX: DATA TABLES AND LIST OF ABBREVIATIONS

7.1. Cultured meat market forecast by region, 2021-2031

7.2. The long-term view: cultured meat market forecast, 2021-2041

7.3. Cultured meat forecast 2021-2041: structured vs. unstructured meat

7.4. Conventional meat production forecast by region

7.5. Global conventional meat production forecast by animal

8. COMPANY PROFILES

Summary

この調査レポートは、多数の主要企業へのインタビューなどの一次調査に基づいて、培養肉市場の技術および業界に関する詳細な評価を行っています。世界の食肉産業とその持続可能性の問題、食肉の化学的・物理的構成、培養肉の製造プロセス、培養肉産業の現状と規制について、調査・分析しています。

主な掲載内容(目次より抜粋)

Report Details

Cultured meat, otherwise known as cultivated meat or cell-based meat, is an emerging technology area that uses lab-grown animal cells to create meat products without requiring animal slaughter, potentially avoiding the environmental problems of conventional agriculture. Unlike many of today's meat alternatives, cultured meat has the potential to create a product that is completely identical to conventional meat, containing exactly the same cells and tissue.

Over the last five years, cultured meat has grown from almost nothing to over 50 companies racing to bring the first products to market, with over $600 million having been invested in the space. In December 2020, the industry received a major boost when Singapore became the first region in the world to grant regulatory approval for the sale of a cultured meat product, a cultured chicken product made by Californian start-up Eat JUST. Many in the industry are excited by the potential of the cultured meat market.

However, despite the optimism, the industry still has some major challenges to overcome before cultured meat is in a position to disrupt the $1 trillion conventional meat industry. Cultured meat is still extremely expensive to produce and no company has yet developed a method for producing cultured meat at a commercial scale. Nevertheless, technology has advanced significantly in recent years and many in the industry remain optimistic about cultured meat.

This report provides an in-depth technology and industry evaluation of the cultured meat market based on extensive primary research into the sector, including interviews with numerous key players. The report discusses the global meat industry and its sustainability issues, the chemical and physical make-up of meat, the process of making cultured meat, the current state of the cultured meat industry, and the regulations governing it, alongside an evaluation of the key players in the industry. Based on this, the report then provides both 10 and 20-year cultured meat market forecasts, predicting that the global cultured meat market will be worth $1.66 billion by 2031 and $11.13 billion by 2041.

Key questions answered in this report

The cultured meat industry is growing rapidly. IDTechEx forecasts the cultured meat market to be worth $11.13 billion by 2041

Cultured meat: an exciting but uncertain technology

Cultured meat, or cultivated meat, is produced in a multi-step process. First, biopsies are taken from from an animal, which is usually unharmed by the process. From these biopsies, the relevant cell lines are isolated and converted into stable cell lines that will be used as starter cells for the production process. Ideal starter cells are highly proliferative and can be easily induced into differentiating into the desired final cell type - usually fat or muscle cells. The choice of starter cells is a key decision for companies aiming to produce cultured meat, with the report outlining the benefits and challenges associated with the most common starter cell choices.

The starter cells are then proliferated in a until they reach a large quantity of biomass. This requires treatment with growth medium - a liquid containing the necessary nutrients and proteins to stimulate tissue growth - and is performed inside a bioreactor. When fed this medium, the cells proliferate, doubling in number every few days. Development of the growth medium remains the key R&D challenge facing the cultured meat industry - it is currently very expensive to produce and many companies still rely on fetal bovine serum (FBS), a protein-rich serum generally derived from animal slaughter that is incompatible with scaled-up production. The report discusses some of the key opportunities and challenges in growth medium and bioreactor development, alongside the implications on production costs.

Once there is a large enough quantity of proliferating cells, they are induced to differentiate into the mature cells that make up meat, e.g., adult muscle cells. This can require a separate bioreactor. In order to culture three-dimensional meat, rather than just a thin layer of cultured cells, the cells must be grown on a scaffold, which directs the structure and order of the tissue, enabling the cells to grow into their mature form, e.g., muscle tissue. Scaffolds must let nutrients reach the growing cells and must mechanically stretch the cells, 'exercising' the muscles and letting them fully develop. Once they are fully developed, the mature muscle cells are harvested as meat.

Producing a commercially viable product from this process is extremely difficult, although technology has progressed rapidly over the last five years and an increasing number of companies have produced prototype products. The key challenge is performing all of the production steps in a cost-effective manner - the first prototype product, a cultured burger developed by Professor Mark Post's research group at Maastricht University in 2013, reportedly cost over $300,000 to produce. Costs have fallen significantly since then - in 2019, Eat JUST claimed that its chicken nuggets cost about $50 each to produce - but reaching cost parity with conventional meat will be an arduous task.

Cultured meat is produced in a three-step process. First, starter cells are extracted and isolated, generally without harming the animal. These cells are then proliferated in a bioreactor to produce a large quantity of biomass. The cells are then differentiated, in order to form mature muscle and fat tissue. This can require complex scaffolds, microcarriers, and advanced bioreactors. Once the tissue is fully developed, it can be harvested and processed into meatlike products for consumption.

The cultured meat industry has grown rapidly over the last 5 years and the cultured meat market is rapidly emerging. In 2016, there were less than 5 cultured meat companies, each of which was still performing early proof-of-concept experiments. Now, there are over 50 companies and prototype products are commonplace. Investments into the space have surged in this time period, growing from $250,000 in 2015 to around $300 million in 2020 alone.

In December 2020, Eat JUST received regulatory approval in Singapore for its GOOD Meat cultured chicken product, a hybrid product created from plant proteins and cultured chicken cells, the first approval of a cultured meat product. Although Singapore is a relatively small market, it represents a big step for the industry and could accelerate the approval process in bigger markets such as the EU, US and China.

Developments over the next few years are set to play a pivotal role in the progress of the cultured meat industry and its potential to disrupt the $1 trillion global meat industry. Cultured Meat 2021-2041, a new report from IDTechEx, explores the technological and market factors that will shape the future of the emerging cultured meat market and provides ten- and twenty-year cultured meat market forecasts..

Table of Contents

1. EXECUTIVE SUMMARY

1.1. The challenge of feeding a growing population

1.2. Meat is an inefficient source of nutrition

1.3. The environmental impact of animal agriculture

1.4. COVID-19: the latest zoonotic disease stemming from the meat industry

1.5. The world is unlikely to become vegetarian

1.6. A brief history of meat substitutes

1.7. Cultured meat

1.8. The potential of cultured meat

1.9. The state of cultured meat

1.10. How is cultured meat made?

1.11. The four main factors in cultured meat production

1.12. 1.) Starter cells

1.13. 2.) Growth medium

1.14. 3.) Bioreactors

1.15. Innovation in bioreactor technology

1.16. 4.) Scaffolds and structures

1.17. Challenges in scaffolding

1.18. Challenges of scale up

1.19. The cultured meat industry is growing rapidly

1.20. Companies in the cultured meat industry

1.21. The emergence of a cultured meat value chain

1.22. Geographical distribution of cultured meat companies*

1.23. Cultured meat producers by animal cells used

1.24. Cultured meat demonstration products

1.25. Evaluating a cultured meat company

1.26. Investments into the cultured meat industry by year

1.27. The 10 most well-funded cultured meat companies

1.28. Cultured meat market forecast by region, 2021-2031

1.29. Cultured meat market forecast 2021-2031: regional share

1.30. The long-term view: cultured meat market forecast, 2021-2041

1.31. Cultured meat forecast 2021-2041: structured vs. unstructured meat

2. INTRODUCTION

2.1. The meat industry: an overview

2.1.1. The meat industry - an overview

2.1.2. The American meat industry - an overview

2.1.3. Meat production across the world

2.1.4. Demand in the developed world has stagnated

2.1.5. Demand in the developing world is growing

2.1.6. Chicken is taking the lead

2.1.7. An overview of the seafood industry

2.2. Sustainability issues in the meat industry

2.2.1. The challenge of feeding a growing population

2.2.2. Meat is an inefficient source of nutrition

2.2.3. The environmental impact of animal agriculture

2.2.4. Beef has the highest environmental impact

2.2.5. Public health risks

2.2.6. COVID-19: the latest zoonotic disease stemming from the meat industry

2.2.7. The problem with seafood

2.3. Alternative proteins

2.3.1. The world is unlikely to become vegetarian

2.3.2. A brief history of meat substitutes

2.3.3. Plant-based meat

2.3.4. Impossible Foods

2.3.5. Plant-based meat sales are growing

2.3.6. Challenges of plant-based meat

2.3.7. Structured and unstructured meat

2.3.8. Fermentation derived proteins

2.4. Cultured Meat

2.4.1. Cultured meat

2.4.2. The potential of cultured meat

2.4.3. The state of cultured meat

2.4.4. GOOD Meat by Eat JUST - the first commercial product

2.4.5. Interest in cultured meat is growing

2.4.6. "Cultured meat", "cultivated meat", or "clean meat"?

2.4.7. The environmental impact of cultured meat

2.4.8. The environmental impact of cultured meat

2.4.9. The first cultured meat products

2.4.10. When will cultured meat be widely available?

2.4.11. Challenges facing the cultured meat industry

3. WHAT IS MEAT?

3.1. Chapter overview

3.2. The structure of meat

3.3. Myocytes or myotubes

3.4. Myogenesis

3.5. Connective tissue - fibroblasts and chondrocytes

3.6. Adipocytes

3.7. The importance of fat in meat

3.8. The extracellular matrix (ECM)

3.9. Texture in meat

3.10. The taste of meat

3.11. The nutritional profile of meat

3.12. Nutrient profiles of animal and plant-based proteins

4. MAKING CULTURED MEAT: A TECHNOLOGY OVERVIEW

4.1. Starter cells

4.1.1. Starter cells

4.1.2. Creating meat from cultured cells

4.1.3. Choosing the right starter cells

4.1.4. Embryonic stem cells

4.1.5. Lab Farm Foods

4.1.6. Induced pluripotent stem cells (iPSCs)

4.1.7. Meatable

4.1.8. Higher Steaks

4.1.9. Future Meat Technologies

4.1.10. Mesenchymal stem cells (MSCs)

4.1.11. Cell Farm Food Tech

4.1.12. Myosatellite cells

4.1.13. Mosa Meat

4.1.14. Starter cell choice in making cultured meat

4.1.15. Myoblasts

4.1.16. Cultured fat

4.1.17. Mission Barns

4.1.18. Beyond fat and muscle

4.1.19. Avant Meats

4.1.20. GOURMEY

4.1.21. TurtleTree and Biomilq

4.1.22. Cell line banking

4.1.23. Cell line development - a key differentiator

4.1.24. Genetic engineering: a dirty word or a necessity?

4.1.25. Genetic engineering: potential areas of development

4.1.26. Genetic engineering case study: Memphis Meats

4.1.27. Memphis Meats

4.1.28. Developing cell lines for different species

4.1.29. Orbillion Bio

4.1.30. The unique benefits and challenges of cultured seafood

4.1.31. Wildtype

4.1.32. Finless Foods

4.1.33. Shiok Meats

4.2. Growth medium

4.2.1. Growth medium

4.2.2. What's in growth medium?

4.2.3. The problem with growth medium

4.2.4. Fetal bovine serum (FBS)

4.2.5. Many companies struggle to move beyond FBS

4.2.6. Why is developing serum free media difficult?

4.2.7. What's in serum?

4.2.8. Why is growth medium so expensive?

4.2.9. What's in basal medium?

4.2.10. How cheap could growth medium be in the future?

4.2.11. The seven scenarios for growth medium cost reduction

4.2.12. Costs under the seven scenarios

4.2.13. Are these scenarios realistic?

4.2.14. Decisions in media development

4.2.15. Growth medium optimisation

4.2.16. Merck KGaA

4.2.17. Innovation in growth media development

4.2.18. Integriculture

4.2.19. Integriculture and the CulNet system

4.3. Bioreactors

4.3.1. Bioreactors

4.3.2. A cell culture bioreactor must meet these demands

4.3.3. Comparison between bioreactors

4.3.4. Major types of dynamic bioreactor

4.3.5. Each bioreactor type has advantages and disadvantages

4.3.6. Packed/fixed bed bioreactors

4.3.7. Packed bed bioreactors - the Pall iCELLis bioreactor

4.3.8. Fluidised bed bioreactors

4.3.9. Hollow fibre bioreactors

4.3.10. Disposable bag bioreactors (DBBs)

4.3.11. A comparison of single use bioreactors

4.3.12. Cell seeding in bioreactors

4.3.13. Bioreactor design - lessons from other industries

4.3.14. Bioreactor optimisation

4.3.15. Innovation in bioreactor technology

4.3.16. CellulaREvolution

4.4. Scaffolds

4.4.1. Scaffolds and structures

4.4.2. Considerations in scaffolds

4.4.3. The importance of the physical environment

4.4.4. Anchorage-dependent cells

4.4.5. Microcarriers

4.4.6. Process considerations for microcarriers

4.4.7. More complex scaffolding

4.4.8. Common polymer options for scaffold materials

4.4.9. Biomaterial considerations in scaffold design

4.4.10. Challenges in scaffolding

4.4.11. Matrix Meats

4.4.12. Atlast Food Co. (Excell)

4.4.13. 3D bioprinting

4.4.14. The 3D bioprinting process

4.4.15. The four major 3D bioprinting technologies

4.4.16. Key specifications in 3D bioprinting

4.4.17. 3D bioprinting technology comparison

4.4.18. IDTechEx work on 3D bioprinting

4.4.19. 3D bioprinting of cultured meat

4.4.20. MeaTech

4.4.21. Aleph Farms

4.4.22. Cultured meat in space

4.5. Commercial scale-up in cultured meat production

4.5.1. Challenges of scale up

4.5.2. Challenges of scale up: the lack of hardware

4.5.3. Challenges of scale up: antibiotics

4.5.4. Design considerations in a scaled up plant

4.5.5. Bioreactor design considerations with scale

4.5.6. To scale-up or to scale-out?

4.5.7. Cost considerations of scale up - growth media

4.5.8. The seven scenarios for growth medium cost reduction

4.5.9. Cost considerations of scale up - growth media

4.5.10. Growth medium cost scenarios with different bioreactors

4.5.11. A scaled up cultured meat facility - BlueNalu

4.5.12. BlueNalu's scaled up facility design

4.5.13. BlueNalu

4.5.14. Safety concerns in cultured meat

4.5.15. Is cost-effective production possible?

4.5.16. Improving the process economics of cultured meat production

4.5.17. Could genetic engineering help?

5. THE CULTURED MEAT INDUSTRY

5.1. Industry overview

5.1.1. The cultured meat industry is growing rapidly

5.1.2. Companies in the cultured meat industry

5.1.3. The emergence of a cultured meat value chain

5.1.4. The challenges of supplying the cultured meat industry

5.1.5. Major food companies are acting

5.1.6. Geographical distribution of cultured meat companies*

5.1.7. Geographical distribution of cultured meat producers

5.1.8. Cultured meat producers by animal cells used

5.1.9. Cultured meat demonstration products

5.1.10. Cultured fat: an early market opportunity?

5.1.11. Cubiq Foods

5.1.12. Blended hybrids: the first cultured meat products

5.1.13. Evaluating a cultured meat company

5.1.14. Investments into the cultured meat industry by year

5.1.15. Investments into the cultured meat industry by company

5.1.16. Investments into the cultured meat industry by company, 2018-2021

5.1.17. Investments into the cultured meat industry by region

5.1.18. The 10 most well-funded cultured meat companies

5.1.19. GOOD Meat by Eat JUST - a viable commercial product?

5.1.20. Eat JUST: a turbulent history

5.1.21. The Chicken by SuperMeat - the first restaurant serving cultured meat

5.1.22. The need for collaboration in the industry

5.2. Consumer attitudes to cultured meat

5.2.1. Will people eat a cultured burger?

5.2.2. Factors impacting consumer acceptance

5.2.3. Consumer concerns around cultured meat

5.2.4. Consumer acceptance - geographical considerations

5.2.5. Cultured meat and religious restrictions

5.2.6. Could cultured meat find a home in Africa?

5.3. Regulatory landscape

5.3.1. Cultured meat regulations: European Union

5.3.2. EU Novel Food Regulations: process overview

5.3.3. EU regulations: labelling requirements

5.3.4. EU labelling regulations and cultured meat

5.3.5. EU regulations: GMOs and GMP guidelines

5.3.6. Are there signs of EU support for cultured meat?

5.3.7. BioTech Foods

5.3.8. Cultured meat regulations: USA

5.3.9. FDA and USDA joint agreement on cultured meat

5.3.10. Cultured fish - an easier path to US approval?

5.3.11. Labelling regulations in the USA

5.3.12. US standards of identity

5.3.13. The importance of labelling

5.3.14. The Alliance for Meat, Poultry and Seafood Innovation

5.3.15. Cultured meat: similarities and differences between EU and US regulations

5.3.16. Singapore: the first home of cultured meat

5.3.17. Cultured meat regulations: Singapore

5.3.18. Cultured meat regulations: Hong Kong

5.3.19. Cultured meat regulations: China

5.3.20. Cultured meat regulations: Israel

6. CULTURED MEAT MARKET FORECASTS

6.1. Cultured meat market forecast by region, 2021-2031

6.2. Cultured meat market forecast 2021-2031: regional share

6.3. Cultured meat market forecast: key factors

6.4. Conventional meat production forecast by region

6.5. Global conventional meat production forecast by animal

6.6. Global conventional meat market forecast by region

6.7. Global conventional meat market forecast by animal

6.8. The long-term view: cultured meat market forecast, 2021-2041

6.9. Cultured meat forecast 2021-2041: structured vs. unstructured meat

7. APPENDIX: DATA TABLES AND LIST OF ABBREVIATIONS

7.1. Cultured meat market forecast by region, 2021-2031

7.2. The long-term view: cultured meat market forecast, 2021-2041

7.3. Cultured meat forecast 2021-2041: structured vs. unstructured meat

7.4. Conventional meat production forecast by region

7.5. Global conventional meat production forecast by animal

8. COMPANY PROFILES

ご注文は、お電話またはWEBから承ります。市場調査レポートのお見積もり作成・購入の依頼もお気軽にご相談ください。本レポートと同分野(医療IT)の最新刊レポート

IDTechEx社の 食品 - Food分野 での最新刊レポート関連レポート(キーワード「培養肉」)よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|