Materials for Electric Vehicles: Electric Motors, Battery Cells & Packs, HV Cabling 2020-2030電気自動車用材料:電気モーター、バッテリーセル&パック、HVケーブリング 2020-2030年 この調査レポートは、電気自動車のバッテリーセルとパックレベルの材料、および電気牽引モーターの材料のトレンドを特定・分析し、これらのコンポーネントの設計と改良による材料需要を分析しています。 &... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2020年4月19日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

322

言語

英語

※価格はデータリソースまでお問い合わせください。

Summary

この調査レポートは、電気自動車のバッテリーセルとパックレベルの材料、および電気牽引モーターの材料のトレンドを特定・分析し、これらのコンポーネントの設計と改良による材料需要を分析しています。

主な掲載内容(目次より抜粋)

Traction batteries and motors in electric vehicles (EVs) are very different to the powertrain components of the internal-combustion engine vehicles they replace. Their meteoric rise will lead to much greater demand for several materials markets which otherwise would see only modest growth. For example, while the combustion engine and transmission relies heavily on aluminium and steel alloys, Li-ion batteries alone also require a great deal of nickel, cobalt, aluminium, lithium, copper, insulation, thermal interface materials and much more at the cell and pack level.

This comprehensive report from IDTechEx identifies and analyses trends in electric vehicle battery cell and pack-level materials, and electric traction motor materials, to determine the overall materials demand from the construction and future improvements of these components. For each, a granular breakdown is used to forecast each material required and its market value over the next 10 years.

An extensive database of electric passenger cars, collated by IDTechEx, is further used to determine trends in the battery cell and pack energy density, energy capacity, cell geometry, cell chemistry, thermal management strategy, motor technology and power output, leading to a comprehensive set of material demands and market value forecasts.

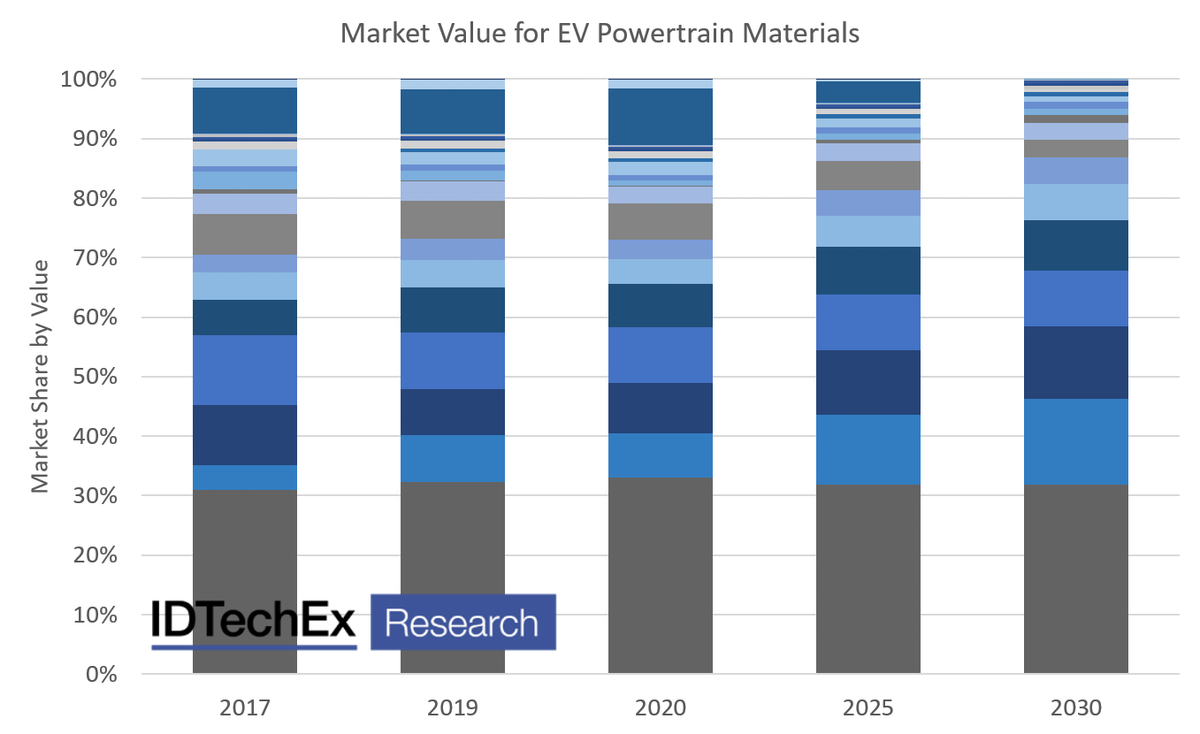

IDTechEx forecasts over 28 materials used in the construction of electric vehicle powertrains, each with shifting market shares. A rapid increase in demand is seen across several material markets after a small drop in 2020 due to COVID-19 implications for the automotive market. Source: IDTechEx report, Materials for Electric Vehicles 2020-2030.

Battery Cell Materials

Several of the raw materials used in electric vehicle components have questionable mining practices or volatile supply chains, leading OEMs to change the way they make batteries and motors. A commonly used cathode material, cobalt, has famously questionable mining practices. It is also a very expensive material with its supply and mining confined to a large majority in China and the Democratic Republic of Congo. As a result, OEMs are trending towards the use of higher nickel cathode chemistries such as NMC 622 and even NMC 811 in some new vehicles.

Another significant trend is the phase-out of LFP cathodes. The Chinese electric car market was, up until 2018, predominantly using LFP cathodes. This has now transitioned so that in 2019 only 3 % of cars were using LFP, however, the introduction of the Tesla Model 3 in China using LFP could upset this trend. Despite the reduction in market share of materials like cobalt, the rapidly increasing market for electric vehicles will drive demand for cobalt and many other materials drastically higher over the next 10 years.

Materials forecasted for the cells include aluminium, carbon, cobalt, copper, graphite, iron, lithium, manganese, nickel, silicon, phosphorous, polyvinylidene fluoride and polyolefins.

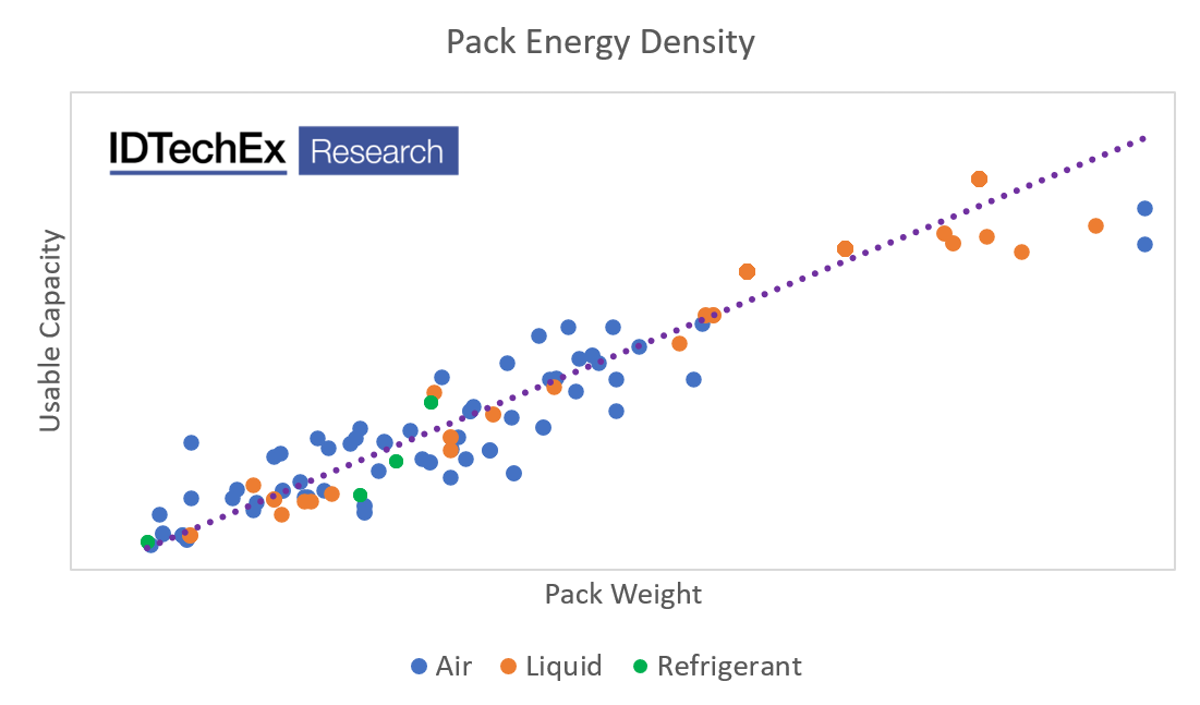

Battery Pack Materials

Cell energy density is increasing, but we also see that pack energy density is increasing. With manufacturers improving their battery designs, the mass of materials being used around the cells is steadily being reduced allowing for a lighter battery pack or more cells to be used for the same mass. This can be largely affected by the choice of material for the enclosure, with OEMs becoming more interested in composite utilisation. The thermal management strategy also has a significant impact. This includes the choice of active or passive cooling variants, thermal interface materials, thermal runaway prevention and fire-retardant materials. With greater energy density and consumer demand for fast charging, more effective thermal management is required in a smaller and lighter package. This may lead to a decrease in many battery pack materials per vehicle, but this may be overshadowed by the total market increase for EVs.

Pack materials forecasted include aluminium, copper, thermal management materials, thermal interface materials, steel, glass fibre reinforced polymers, carbon fibre reinforced polymers, inter-cell insulation and compression foams and pack fire-retardant materials.

IDTechEx considered over 150 battery-electric and plug-in hybrid cars sold between 2015-2019 to show trends in energy density by thermal management strategy and by year. Full data available in IDTechEx report, Materials for Electric Vehicles 2020-2030.

Electric Motor Materials

Alongside the batteries, the demand for electric traction motors will increase rapidly over the next 10 years, not just from the overall vehicle sales but also with the rise of vehicles using more than one motor, specifically in premium cars and heavy-duty vehicles. Critical to materials, the majority of the EV market is using motors with permanent magnet-based rotors. These materials typically contain several rare-earths such as neodymium and dysprosium, both of which have a very geographically constrained supply chain and a volatile price history. Whilst they are in a relatively small quantity in the motor, they can make up a very significant portion of the cost of the motor. We are seeing some manufacturers like Renault using motors with no magnets, whereas Tesla has transitioned to a magnet-based motor for the potential improvements in efficiency which can increase range and hence, reduce the requirements for other critical battery materials.

Motor materials forecasted include aluminium, boron, cobalt, copper, dysprosium, iron, neodymium, niobium, silicon-steel, terbium and praseodymium.

Report Summary

Materials demand from the following EV components and parts are considered:

Cathodes

Anodes

Electrolyte, separators, binders and casings

Interconnects

Housings

Thermal management

Thermal interface materials

Inter-cell pads and insulation

Fire-retardant papers/blankets

Magnets

Windings

Rotor and stator construction

Housings

High voltage cables

Market assessments:

Forecast lines, material demand and market value (2020-2030):

Table of Contents

|