電気自動車用リチウムイオン電池 2021-2031年Lithium-ion Batteries for Electric Vehicles 2021-2031 今や、多くの形態の電気自動車を電動化するための競争に、リチウムイオン電池が勝利したことは明らかであり、市場は活況を呈しています。ここ数年、技術開発者や電池メーカーへの投資が活発化しており、電気自... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2021年5月7日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

325

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

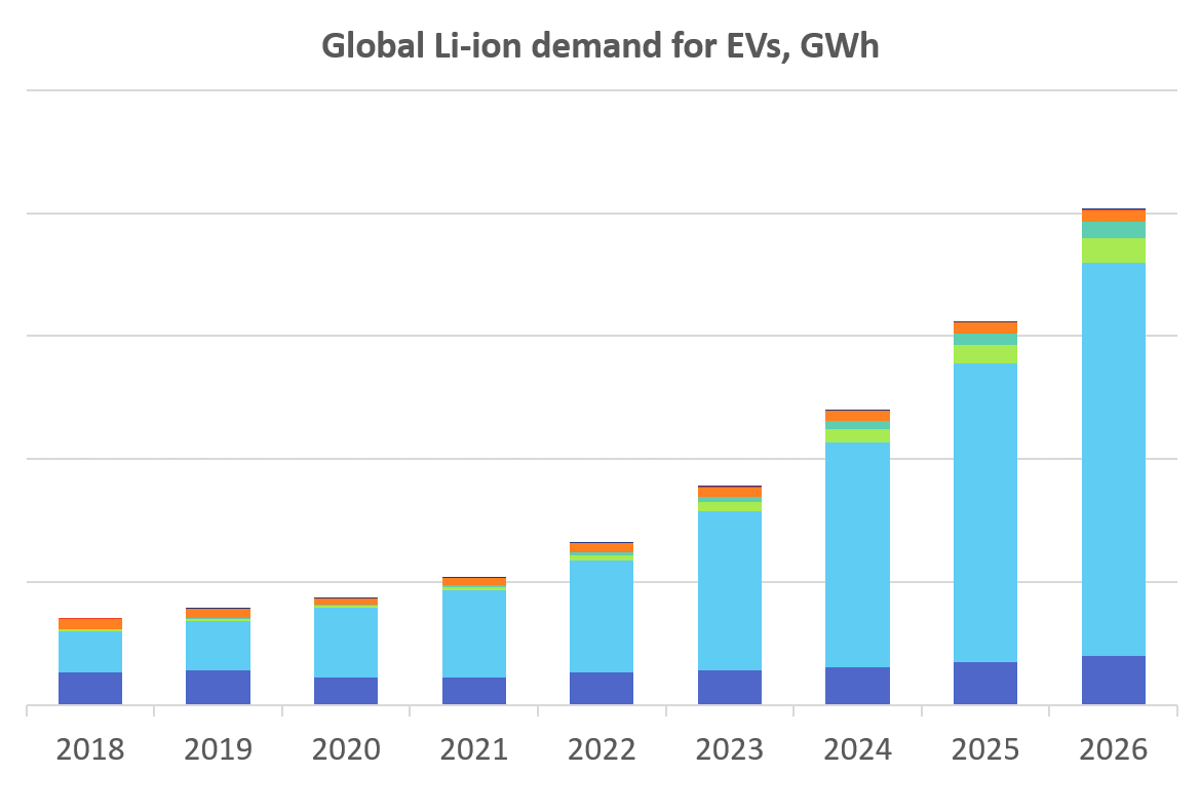

今や、多くの形態の電気自動車を電動化するための競争に、リチウムイオン電池が勝利したことは明らかであり、市場は活況を呈しています。ここ数年、技術開発者や電池メーカーへの投資が活発化しており、電気自動車のOEMメーカーも電動化戦略を発表し続けています。Covid-19の混乱が続いているにもかかわらず、2020年には電気自動車の販売が回復していることが、市場をさらに活性化させています。電気自動車に搭載されるリチウムイオン電池セルの市場規模は、2026年までに約700億ドルになると予測されています。本レポートでは、電気自動車、バス、バン、トラックの予測に加え、これらの市場を牽引する要因や阻害要因についても紹介しています。

とはいえ、現在、電気自動車の販売は、依然として政策や補助金によって牽引されています。これらの政策や補助金は、主要市場である欧州や中国で強化されており、バイデン政権下の米国でも強化される見込みです。消費者主導で大量に普及させるためには、リチウムイオン電池の技術をさらに向上させることが望まれますが、これは多くの車両セグメントに当てはまります。

本レポートでは、リチウムイオン電池の技術を深く掘り下げ、好まれる電池のフォームファクタや変化する電池の化学的性質などを取り上げています。

BEV向けには、NMC 622からNMC 811のような高ニッケル層状酸化物への移行という明確なトレンドがあるが、これらの高ニッケル正極は万能ではない。用途によっては、より高い安全性や高いサイクル寿命など、異なる性能特性が求められます。例えば、LFPは低コストの自動車で注目されており、中国の電子バスではほとんどこのセルケミストリーが使われています。この記事では、車両セグメントごとに異なる正極材料を評価し、OEMやパックメーカーの戦略を概説しています。また、2031年までの正極材の選択肢と需要の見通しを示している。

電気自動車用リチウムイオン正極材の市場シェア。報告書に掲載されている予測データ。出典:IDTechExIDTechExリチウムイオンへの脅威 十分な性能を提供していないか、代替品として十分な成熟度に達していない。したがって、先進的なリチウムイオンセルと化学物質の開発と改良が、より性能の高いバッテリーと電気自動車のための最善策となります。本レポートでは、これらの開発について分析し、特に電気自動車に使用される固体/Li-金属およびシリコン負極セル技術の評価を行っています。この分野の主要企業を紹介するとともに、リチウムイオン電池の設計と化学の発展によって期待できる改善点を時系列で示しています。

電池だけでなく、パックレベルのエネルギー密度の改善も同様に重要です。

熱管理戦略、モジュール化、セルからパックへの設計、材料の軽量化など、さまざまなバッテリーパック設計の傾向を分析しています。熱管理は、リチウムイオン電池の安全な動作を維持する上で重要な役割を果たします。優れた熱管理の重要性は、最近発生した火災事故や、中国政府が特に公共交通機関でのバッテリーパックの運用の安全性を向上させるよう呼びかけたことでも強調されています。

主に大型トラック、バス、物流車両などの非自動車分野にパックを供給しているバッテリーパックメーカーについて、欧州と米国のメーカーを中心に調査しています。

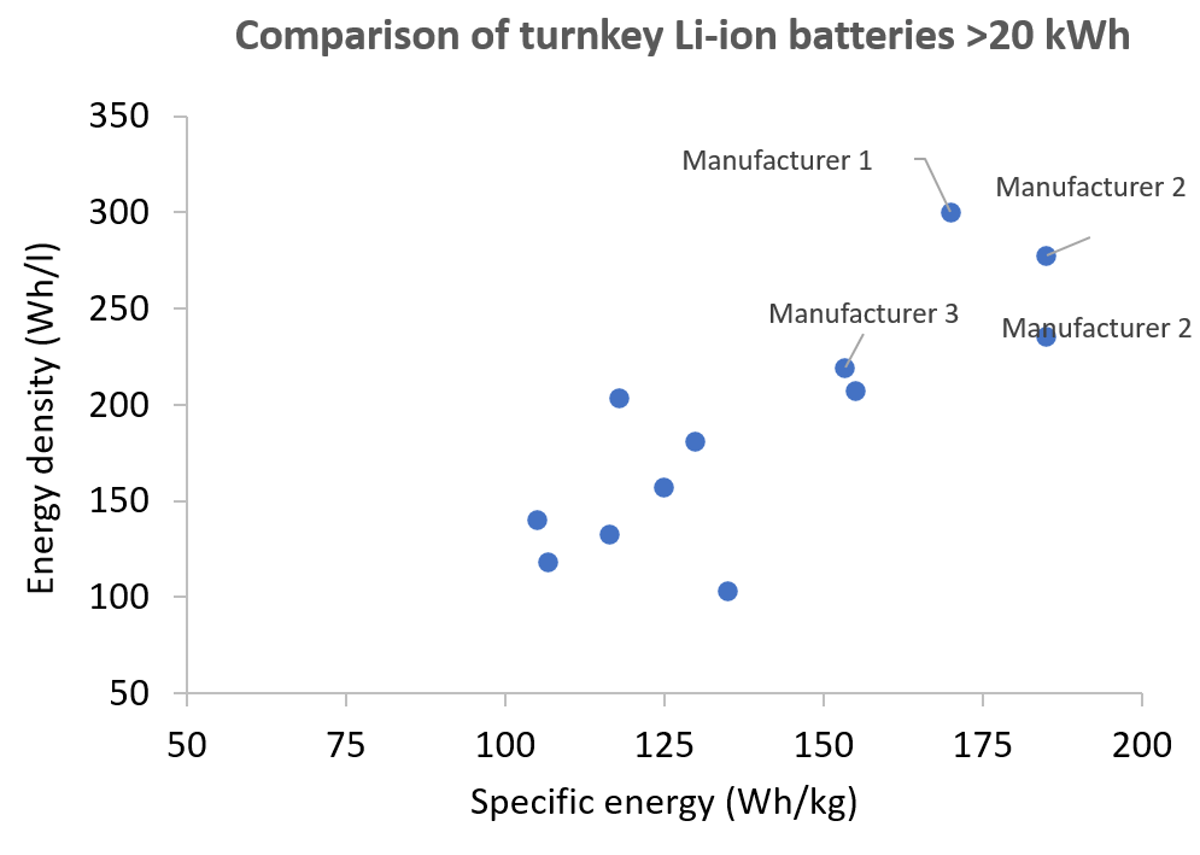

ターンキー製品のフォームファクタ、ケミストリ、性能の比較に加え、パックメーカーの差別化についても言及しています。また、ターゲットとしている主要な市場とセグメント、サプライヤー、顧客、パートナーシップについても概説しています。

リチウムイオン電池パックの比較。報告書に掲載されている追加データ。ソースはこちらIDTechEx

最後に、本レポートでは、使用済みのリチウムイオン電池がもたらす機会について、2ndライフバッテリーとリチウムイオンリサイクルの現状について紹介しています。

電気自動車の普及が予想される中、使用済みのリチウムイオン電池を適切に管理することは、不適切な廃棄や、潜在的に巨大な廃棄物管理問題の蓄積を避けるために不可欠なことです。心強いことに、多くのOEMメーカーは、2次利用とリサイクルの両方に基づいた循環型の戦略を構築しています。

目次

1.EXECUTIVE SUMMARY

1.1. Electric Vehicle Terms

1.2. Major EV categories

1.3. Major EV categories

1.4. Drivers for electric vehicles - China

1.5. Automotive EV plans

1.6. Covid-19: Electric Cars Resilient

1.7. LFP or NMC comparison

1.8. EV cathode chemistry market share

1.9. Cathode chemistry outlook

1.10. Cell vs Pack Energy Density - passenger cars

1.11. Increasing BEV battery cell energy density

1.12. Increasing EV battery cell specific energy

1.13. Automotive solid-state and silicon comparison

1.14. Silicon anodes vs lithium-metal solid-state

1.15. Timeline and outlook for Li-ion energy densities

1.16. Turnkey battery design choices - cell form factor and cooling

1.17. Energy density comparison by form factor

1.18. Chemistry choice of turnkey battery packs

1.19. Pack manufacturer revenue estimates

1.20. Growth in European gigafactory announcements

1.21. Growth in manufacturing capacity - Europe, US

1.22. Supply and demand overview

1.23. Electric vehicle Li-ion demand, GWh

1.24. EV Li-ion market, $ billion

1.25. EV anode demand

1.26. Cathode Demand Forecast

2. INTRODUCTION

2.1. Electric Vehicles: Basic Principle

2.2. Electric Vehicle Terms

2.3. Drivetrain Specifications

2.4. Parallel and Series Hybrids: Explained

2.5. Electric Vehicles: Typical Specs

2.6. Lithium-based Battery Family Tree

2.7. Underlying Drivers for Electric Vehicles

2.8. What are the Barriers for Electric Vehicles?

2.9. What are the Barriers for Electric Vehicles?

2.10. Carbon emissions from electric vehicles

3. LI-ION TECHNOLOGY

3.1. What is a Li-ion Battery?

3.2. Why Lithium?

3.3. The Li-ion Supply Chain

3.4. The Battery Trilemma

3.5. Battery wish list

3.6. The Li-ion supply chain

3.7. Comparing cathodes - a high-level overview

3.8. Comparing anodes - a high-level overview

3.9. Cathodes

3.9.1. Cathode recap

3.9.2. Cathode materials - LCO and LFP

3.9.3. Cathode materials - NMC, NCA and LMO

3.9.4. NMC development - from 111 to 811

3.9.5. Volkswagen Power Day

3.9.6. Cost reduction from cell chemistry

3.9.7. High manganese cathodes

3.9.8. High manganese cathodes - LMP, LMFP

3.9.9. High-voltage LNMO

3.9.10. Haldor Topsoe's LNMO

3.9.11. Developments for high-voltage LNMO

3.9.12. High-level performance comparison

3.9.13. High-level performance comparison

3.9.14. Material intensity of NMC, Li-Mn-rich, LNMO

3.9.15. Potential cost reduction from high manganese content

3.9.16. Concluding remarks on high manganese cathodes

3.9.17. LFP for Tesla Model 3

3.9.18. LFP for Tesla Model 3 continued

3.9.19. LFP or NMC comparison

3.9.20. LFP or NMC performance comparison discussed

3.9.21. LFP or NMC

3.9.22. IDTechEx energy density calculations - by cathode

3.9.23. Li-ion cell material cost estimate

3.9.24. Automotive announcements for LFP and NMC

3.9.25. Cathode choice for electric vehicles

3.9.26. Cathode suitability

3.9.27. Cathode outlook - which chemistries will be used? 1

3.9.28. Cathode outlook - which chemistries will be used? 2

3.9.29. Cathode market

3.9.30. EV cathode chemistry market share

3.9.31. EV cathode chemistry shifts

3.9.32. EV Models with NMC 811

3.9.33. Comparing commercial cell chemistries

3.9.34. Cathode chemistry outlook

3.9.35. Cathode Demand Forecast

3.10. Anodes

3.10.1. Anode materials

3.10.2. Introduction to graphite

3.10.3. The promise of silicon

3.10.4. The reality of silicon

3.10.5. How much can silicon improve energy density?

3.10.6. Introduction to lithium titanate oxide (LTO)

3.10.7. Where will LTO play a role?

3.10.8. Increased demand for LTO

3.10.9. LTO for e-buses

3.10.10. EV anode demand

3.11. Cell form factors

3.11.1. Commercial battery packaging technologies

3.11.2. Automotive format choices

3.11.3. Cell formats

3.11.4. Cell formats

3.11.5. Comparison of commercial cell formats

3.11.6. Which cell format to choose?

3.11.7. Passenger Car Market

3.11.8. Increasing BEV battery cell energy density

3.11.9. Increasing EV battery cell specific energy

3.11.10. Other Vehicle Categories

4. ADVANCED LI-ION TECHNOLOGY

4.1. Potential disruptors to Li-ion

4.2. Cell chemistry comparison - quantitative

4.3. Energy storage technology comparison

4.4. Current Li-ion technology for automotive

4.5. What is a solid-state battery?

4.6. Drivers for solid-state and silicon

4.7. Solid-state electrolytes

4.8. Partnerships and investors - solid-state and silicon

4.9. Silicon anodes vs lithium-metal solid-state

4.10. Comparing anodes - a high-level overview

4.11. Silicon anodes or lithium-metal solid-state

4.12. Silicon anodes or lithium-metal solid-state

4.13. Notable players for solid-state EV battery technology

4.14. Notable players for silicon EV battery technology

4.15. Lithium metal with liquid electrolytes

4.16. Solid-state and silicon timeline

4.17. Solid-state - Quantumscape

4.18. Solid-state - Solid Power

4.19. Solid-state - Blue Solutions

4.20. Solid-state - Prologium

4.21. Silicon anodes - Enevate

4.22. Notable developments - Sila Nano

4.23. Automotive solid-state and silicon comparison

4.24. Automotive solid-state and silicon comparison

4.25. Silicon anodes vs lithium-metal solid-state

4.26. Silicon and solid-state concluding remarks

4.27. Multiple sources of improvement to Li-ion

4.28. What role for fuel cells?

4.29. High energy battery chemistry comparison

4.30. The problem with alternative technologies

4.31. Timeline and outlook for Li-ion energy densities

4.32. Concluding remarks

5. LI-ION MODULES AND PACKS

5.1. What makes a battery pack?

5.2. Li-ion Batteries: From Cell to Pack

5.3. Pack design

5.4. Battery KPIs for EVs

5.5. Henkel's Battery Pack Materials

5.6. DuPont's Battery Pack Materials

5.7. Lightweighting Battery Enclosures

5.8. Lightweighting - Voltabox expanded plastic foam

5.9. From Steel to Aluminium

5.10. Latest Composite Battery Enclosures

5.11. Towards Composite Enclosures?

5.12. Continental Structural Plastics - Honeycomb Technology

5.13. Battery Enclosure Materials Summary

5.14. Increasing cell sizes

5.15. Passenger Cars: Cell Energy Density Trends

5.16. Passenger Cars: Pack Energy Density Trends

5.17. General Motors' cell development

5.18. NCMA cathode

5.19. Ultium cell form factors

5.20. Modular pack designs

5.21. Ultium BMS

5.22. Key developments from the Ultium battery

5.23. BYD Blade battery

5.24. BYD battery design

5.25. CATL Cell to Pack

5.26. Cell-to-pack or modular?

5.27. Modular or not?

5.28. High voltage BEVs

5.29. Increasing BEV voltage

5.30. Thermal management of Li-ion batteries

5.30.1. Thermal management for Li-ion batteries

5.30.2. Stages of thermal runaway

5.30.3. Causes of thermal runaway

5.30.4. Fire protection

5.30.5. Active vs passive Cooling

5.30.6. Passive battery cooling methods

5.30.7. Active battery cooling methods

5.30.8. Air cooling - technology appraisal

5.30.9. Liquid cooling - technology appraisal

5.30.10. Liquid cooling - geometries

5.30.11. Refrigerant cooling - technology appraisal

5.30.12. Analysis of battery cooling methods

5.30.13. Material opportunities in and around a battery pack: overview

5.30.14. Thermal management - pack and module overview

5.30.15. Thermal Interface Material (TIM) - pack and module overview

5.31. BMS

5.31.1. Battery management system

5.31.2. Introduction to battery management systems

5.31.3. Fast charging and degradation

5.31.4. Importance of fast charging

5.31.5. Operational limits of LIBs

5.31.6. BMS - STAFL systems

5.31.7. Pulse charging

5.31.8. Cell balancing

5.31.9. Consequences of cell imbalance

5.31.10. Active or passive balancing?

5.31.11. State-of-charge estimation

5.31.12. State-of-health and remaining-useful-life estimation

5.31.13. Titan AES

5.31.14. Value of BMS

6. MODULE AND PACK MANUFACTURERS - BEYOND CARS

6.1. Module and pack manufacturing process

6.2. Module and pack manufacturing

6.3. Non-car battery pack manufacturing

6.4. Differences in design

6.5. Role of battery pack manufacturers

6.6. Metrics to compare pack manufacturers

6.7. Battery pack manufacturers - Europe

6.8. Battery pack manufacturers

6.9. Battery pack manufacturers - North America

6.10. Battery pack manufacturers

6.11. Asian module and pack manufacturers

6.12. Battery pack comparison

6.13. Battery module/pack comparison

6.14. Battery pack/module comparison

6.15. Battery design choices -cell form factor and cooling

6.16. Energy density comparison by form factor

6.17. Energy density comparison by cooling method

6.18. Chemistry choice

6.19. Chemistry and form factors of turnkey solutions

6.20. Pack manufacturer revenue estimates

6.21. Value chain differentiation

6.22. Romeo Power

6.23. Romeo Power thermal management

6.24. Forsee Power

6.25. Forsee Power applications

6.26. Xerotech

6.27. Microvast

6.28. Akasol

6.29. Akasol Energy Density Road Map for Commercial EVs

6.30. Akasol's 'Answer to Solid State'

6.31. Webasto Expanding Production

6.32. EnerDel: battery packs for trucks

6.33. BMZ

6.34. Kore Power

6.35. Proterra

6.36. Electrovaya

6.37. American Battery Solutions

6.38. Leclanche

6.39. Concluding remarks on battery manufacturers

7. CELL MANUFACTURING AND COSTS

7.1. Cell production steps

7.2. Power demand of LIB production

7.3. How Long to Build a Gigafactory?

7.4. Growing public and private investment - Q1 2021

7.5. European gigafactories announced by 2018

7.6. European gigafactories announced to date

7.7. Growth in European gigafactory announcements

7.8. Growth in European cell manufacturing

7.9. Growth in manufacturing capacity - Europe, US

7.10. Li-ion cell and pack price and cost

7.10.1. Li-ion cell material cost estimate

7.10.2. Cathode cost reduction scenarios

7.10.3. Role of silicon and high nickel NMC on cost

7.10.4. Cost reduction strategies

7.10.5. Cost reduction overview

7.10.6. BEV Cell Price Forecast

7.10.7. Electric vehicle Li-ion price forecast

8. LI-ION IN EV SEGMENTS

8.1. Application battery priorities

8.2. Risks for pack manufacturers

8.3. Panasonic and Tesla

8.4. Automotive Format Choices

8.5. Passenger Car Market

8.6. Chinese EV Battery Value Chain

8.7. Other Vehicle Categories

8.8. Drivers and timing of bus electrification

8.9. Snapshot of Global and Regional Sales Trends

8.10. Regional demand forecast for Li-ion in e-buses

8.11. Future role for battery pack manufacturers

8.12. Electric Buses: Market History

8.13. Chemistries used in electric buses

8.14. Chemistries used in electric buses

8.15. E-bus battery suppliers

8.16. Why we need electric CAM vehicles

8.17. Electric CAM examples

8.18. Intralogistics shifting to Li-ion

8.19. Intralogistics Li-ion partnerships

8.20. Li-ion intralogistics chemistries

8.21. Why Electrify Marine?

8.22. Summary of Maritime Sectors

8.23. Leading Maritime Battery Vendor

8.24. Product Line-up

8.25. Electric and Diesel LCV Cost Parity

8.26. Small eVan Break-Even: Purchase Grant

8.27. Regional Li-ion demand forecast for LCVs

8.28. Electric Trucks: Drivers and Barriers

8.29. Range of zero emission medium and heavy trucks

8.30. Regional Li-ion demand for medium and heavy duty trucks

8.31. EV Li-ion demand by region

9. SECOND LIFE EV BATTERIES AND RECYCLING

9.1. Retired electric vehicle batteries can have a second-life before being recycled

9.2. Potential value of second-life batteries

9.3. Main companies involved in battery second use

9.4. Battery second use connects the electric vehicle and battery recycling value chains

9.5. When batteries retire from electric vehicles...

9.6. Redefining the 'end-of-life' of electric vehicle batteries: you live more than once

9.7. What is the 'second-life' of electric vehicle batteries?

9.8. Target markets for second-life batteries

9.9. Drivers for recycling Li-ion batteries

9.10. LIB recycling process overview

9.11. Recycling techniques compared

9.12. Recycling or second life?

9.13. Recycling value by cathode chemistry

9.14. Northvolt's Revolt recycling program

9.15. Volkswagen plans for retired EV batteries

9.16. BMW's strategic partnerships for EV battery recycling

9.17. Renault's circular economy efforts for Li-ion batteries

9.18. Volkswagen's in-house Li-ion battery recycling plant

9.19. 4R Energy

9.20. Tesla's 'circular Gigafactory'

10. FORECASTS

10.1. Electric vehicle Li-ion demand, GWh

10.2. EV Li-ion market, $ billion

10.3. EV anode demand

10.4. Cathode Demand Forecast

Summary

この調査レポートでは、リチウムイオン電池の技術を深く掘り下げ、好まれる電池のフォームファクタや変化する電池の化学的性質などを取り上げています。

主な掲載内容(目次より抜粋)

Report Details

It is now clear that Li-ion batteries have won the race to electrify many forms of electric vehicles and the market is booming. There has been a flurry of investment in technology developers and battery manufacturers over the past few years and electric vehicle OEMs continue to announce their electrification strategies. The market has been further buoyed by resilient electric vehicle sales during 2020, despite the ongoing disruption of Covid-19. The market for Li-ion battery cells in electric vehicles is forecast to be worth nearly $70 billion by 2026 and the report will break down forecasts for electric cars, buses, vans and trucks along with an introduction to the drivers and restraints for these markets.

Nevertheless, currently, EV sales remain driven by policies and subsidies, which are being strengthened in the key markets of Europe and China and look set be strengthened in the US under the Biden administration. In order to move toward consumer driven, mass-market adoption, further improvements to Li-ion battery technology are desirable and this applies to many vehicle segments. The variety of choices that can be made with regard to Li-ion chemistry and battery design allows them to be tailored to applications with differing performance requirements and to understand this, the opportunities for electric vehicles including cars, buses, trucks, and boats must be appraised.

The report provides a deep dive into Li-ion cell technology, covering aspects such as preferred cell form factors and changing cell chemistries. While there is a clear trend in moving toward higher nickel layered oxides for BEVs, such as from NMC 622 to NMC 811, these high nickel cathodes will not be universally suitable. Different applications will require different performance characteristics such as greater levels of safety or higher cycle lives. For example, the use of LFP has gained attention for low-cost vehicles and Chinese e-buses almost exclusively use this cell chemistry. Different cathode materials are appraised for different vehicle segments and the strategies of OEMs and pack manufacturers are outlined. An outlook on cathode choices and demand is provided through to 2031.

Market share of Li-ion cathodes for electric vehicles. Forecast data available in the report. Source: IDTechEx

Threats to Li-ion do not offer sufficient performance or are not yet mature enough to offer a viable alternative. Developments and improvements to advanced Li-ion cells and chemistries are therefore the best for better performing batteries and electric vehicles. These developments are analysed, in particular, the report provides an appraisal of solid-state/Li-metal and silicon anode cell technology for use in electric vehicles. Some of the key players in this space are profiled and a timeline presented as to the improvements that can be expected from developments to Li-ion cell design and chemistry.

Beyond the cell, improvements to pack-level energy density are just as important. Trends to various battery pack designs are analysed, including on thermal management strategies, modular and cell-to-pack designs, and material light-weighting. Thermal management plays a critical role in maintaining the safe operation of Li-ion batteries. The importance of good thermal management has been highlighted by recent fires and the call from the Chinese government to improve the safety of battery pack operation, especially in public transport. Different players are pursuing air, liquid and refrigerant-cooled methods, each with their own benefits and weaknesses.

A study of battery pack manufacturers, primarily supplying packs to non-car vehicle segments, such as heavy duty-trucks, buses and logistics vehicles, is provided with a focus on the European and US players. Comparisons in the form factors, chemistries and performance of turnkey products is provided, along with a discussion of how pack manufacturers are differentiating themselves. The key markets and segments being targeted and suppliers, customers and partnerships are outlined.

Comparison of Li-ion battery packs. Additional data available in the report. Source: IDTechEx

Finally, the report gives an introduction into the opportunities that end-of-life Li-ion batteries represent, providing an introduction to 2nd life batteries and the current state of Li-ion recycling. Given the expected growth in electric vehicle adoption, suitable management of end-of-life Li-ion batteries is imperative to avoiding inappropriate disposal and a the build-up of a potentially huge waste management problem. Encouragingly, many OEMs are building strategies to incorporate circularity based on both 2nd-life applications and recycling.

Table of Contents

1.EXECUTIVE SUMMARY

1.1. Electric Vehicle Terms

1.2. Major EV categories

1.3. Major EV categories

1.4. Drivers for electric vehicles - China

1.5. Automotive EV plans

1.6. Covid-19: Electric Cars Resilient

1.7. LFP or NMC comparison

1.8. EV cathode chemistry market share

1.9. Cathode chemistry outlook

1.10. Cell vs Pack Energy Density - passenger cars

1.11. Increasing BEV battery cell energy density

1.12. Increasing EV battery cell specific energy

1.13. Automotive solid-state and silicon comparison

1.14. Silicon anodes vs lithium-metal solid-state

1.15. Timeline and outlook for Li-ion energy densities

1.16. Turnkey battery design choices - cell form factor and cooling

1.17. Energy density comparison by form factor

1.18. Chemistry choice of turnkey battery packs

1.19. Pack manufacturer revenue estimates

1.20. Growth in European gigafactory announcements

1.21. Growth in manufacturing capacity - Europe, US

1.22. Supply and demand overview

1.23. Electric vehicle Li-ion demand, GWh

1.24. EV Li-ion market, $ billion

1.25. EV anode demand

1.26. Cathode Demand Forecast

2. INTRODUCTION

2.1. Electric Vehicles: Basic Principle

2.2. Electric Vehicle Terms

2.3. Drivetrain Specifications

2.4. Parallel and Series Hybrids: Explained

2.5. Electric Vehicles: Typical Specs

2.6. Lithium-based Battery Family Tree

2.7. Underlying Drivers for Electric Vehicles

2.8. What are the Barriers for Electric Vehicles?

2.9. What are the Barriers for Electric Vehicles?

2.10. Carbon emissions from electric vehicles

3. LI-ION TECHNOLOGY

3.1. What is a Li-ion Battery?

3.2. Why Lithium?

3.3. The Li-ion Supply Chain

3.4. The Battery Trilemma

3.5. Battery wish list

3.6. The Li-ion supply chain

3.7. Comparing cathodes - a high-level overview

3.8. Comparing anodes - a high-level overview

3.9. Cathodes

3.9.1. Cathode recap

3.9.2. Cathode materials - LCO and LFP

3.9.3. Cathode materials - NMC, NCA and LMO

3.9.4. NMC development - from 111 to 811

3.9.5. Volkswagen Power Day

3.9.6. Cost reduction from cell chemistry

3.9.7. High manganese cathodes

3.9.8. High manganese cathodes - LMP, LMFP

3.9.9. High-voltage LNMO

3.9.10. Haldor Topsoe's LNMO

3.9.11. Developments for high-voltage LNMO

3.9.12. High-level performance comparison

3.9.13. High-level performance comparison

3.9.14. Material intensity of NMC, Li-Mn-rich, LNMO

3.9.15. Potential cost reduction from high manganese content

3.9.16. Concluding remarks on high manganese cathodes

3.9.17. LFP for Tesla Model 3

3.9.18. LFP for Tesla Model 3 continued

3.9.19. LFP or NMC comparison

3.9.20. LFP or NMC performance comparison discussed

3.9.21. LFP or NMC

3.9.22. IDTechEx energy density calculations - by cathode

3.9.23. Li-ion cell material cost estimate

3.9.24. Automotive announcements for LFP and NMC

3.9.25. Cathode choice for electric vehicles

3.9.26. Cathode suitability

3.9.27. Cathode outlook - which chemistries will be used? 1

3.9.28. Cathode outlook - which chemistries will be used? 2

3.9.29. Cathode market

3.9.30. EV cathode chemistry market share

3.9.31. EV cathode chemistry shifts

3.9.32. EV Models with NMC 811

3.9.33. Comparing commercial cell chemistries

3.9.34. Cathode chemistry outlook

3.9.35. Cathode Demand Forecast

3.10. Anodes

3.10.1. Anode materials

3.10.2. Introduction to graphite

3.10.3. The promise of silicon

3.10.4. The reality of silicon

3.10.5. How much can silicon improve energy density?

3.10.6. Introduction to lithium titanate oxide (LTO)

3.10.7. Where will LTO play a role?

3.10.8. Increased demand for LTO

3.10.9. LTO for e-buses

3.10.10. EV anode demand

3.11. Cell form factors

3.11.1. Commercial battery packaging technologies

3.11.2. Automotive format choices

3.11.3. Cell formats

3.11.4. Cell formats

3.11.5. Comparison of commercial cell formats

3.11.6. Which cell format to choose?

3.11.7. Passenger Car Market

3.11.8. Increasing BEV battery cell energy density

3.11.9. Increasing EV battery cell specific energy

3.11.10. Other Vehicle Categories

4. ADVANCED LI-ION TECHNOLOGY

4.1. Potential disruptors to Li-ion

4.2. Cell chemistry comparison - quantitative

4.3. Energy storage technology comparison

4.4. Current Li-ion technology for automotive

4.5. What is a solid-state battery?

4.6. Drivers for solid-state and silicon

4.7. Solid-state electrolytes

4.8. Partnerships and investors - solid-state and silicon

4.9. Silicon anodes vs lithium-metal solid-state

4.10. Comparing anodes - a high-level overview

4.11. Silicon anodes or lithium-metal solid-state

4.12. Silicon anodes or lithium-metal solid-state

4.13. Notable players for solid-state EV battery technology

4.14. Notable players for silicon EV battery technology

4.15. Lithium metal with liquid electrolytes

4.16. Solid-state and silicon timeline

4.17. Solid-state - Quantumscape

4.18. Solid-state - Solid Power

4.19. Solid-state - Blue Solutions

4.20. Solid-state - Prologium

4.21. Silicon anodes - Enevate

4.22. Notable developments - Sila Nano

4.23. Automotive solid-state and silicon comparison

4.24. Automotive solid-state and silicon comparison

4.25. Silicon anodes vs lithium-metal solid-state

4.26. Silicon and solid-state concluding remarks

4.27. Multiple sources of improvement to Li-ion

4.28. What role for fuel cells?

4.29. High energy battery chemistry comparison

4.30. The problem with alternative technologies

4.31. Timeline and outlook for Li-ion energy densities

4.32. Concluding remarks

5. LI-ION MODULES AND PACKS

5.1. What makes a battery pack?

5.2. Li-ion Batteries: From Cell to Pack

5.3. Pack design

5.4. Battery KPIs for EVs

5.5. Henkel's Battery Pack Materials

5.6. DuPont's Battery Pack Materials

5.7. Lightweighting Battery Enclosures

5.8. Lightweighting - Voltabox expanded plastic foam

5.9. From Steel to Aluminium

5.10. Latest Composite Battery Enclosures

5.11. Towards Composite Enclosures?

5.12. Continental Structural Plastics - Honeycomb Technology

5.13. Battery Enclosure Materials Summary

5.14. Increasing cell sizes

5.15. Passenger Cars: Cell Energy Density Trends

5.16. Passenger Cars: Pack Energy Density Trends

5.17. General Motors' cell development

5.18. NCMA cathode

5.19. Ultium cell form factors

5.20. Modular pack designs

5.21. Ultium BMS

5.22. Key developments from the Ultium battery

5.23. BYD Blade battery

5.24. BYD battery design

5.25. CATL Cell to Pack

5.26. Cell-to-pack or modular?

5.27. Modular or not?

5.28. High voltage BEVs

5.29. Increasing BEV voltage

5.30. Thermal management of Li-ion batteries

5.30.1. Thermal management for Li-ion batteries

5.30.2. Stages of thermal runaway

5.30.3. Causes of thermal runaway

5.30.4. Fire protection

5.30.5. Active vs passive Cooling

5.30.6. Passive battery cooling methods

5.30.7. Active battery cooling methods

5.30.8. Air cooling - technology appraisal

5.30.9. Liquid cooling - technology appraisal

5.30.10. Liquid cooling - geometries

5.30.11. Refrigerant cooling - technology appraisal

5.30.12. Analysis of battery cooling methods

5.30.13. Material opportunities in and around a battery pack: overview

5.30.14. Thermal management - pack and module overview

5.30.15. Thermal Interface Material (TIM) - pack and module overview

5.31. BMS

5.31.1. Battery management system

5.31.2. Introduction to battery management systems

5.31.3. Fast charging and degradation

5.31.4. Importance of fast charging

5.31.5. Operational limits of LIBs

5.31.6. BMS - STAFL systems

5.31.7. Pulse charging

5.31.8. Cell balancing

5.31.9. Consequences of cell imbalance

5.31.10. Active or passive balancing?

5.31.11. State-of-charge estimation

5.31.12. State-of-health and remaining-useful-life estimation

5.31.13. Titan AES

5.31.14. Value of BMS

6. MODULE AND PACK MANUFACTURERS - BEYOND CARS

6.1. Module and pack manufacturing process

6.2. Module and pack manufacturing

6.3. Non-car battery pack manufacturing

6.4. Differences in design

6.5. Role of battery pack manufacturers

6.6. Metrics to compare pack manufacturers

6.7. Battery pack manufacturers - Europe

6.8. Battery pack manufacturers

6.9. Battery pack manufacturers - North America

6.10. Battery pack manufacturers

6.11. Asian module and pack manufacturers

6.12. Battery pack comparison

6.13. Battery module/pack comparison

6.14. Battery pack/module comparison

6.15. Battery design choices -cell form factor and cooling

6.16. Energy density comparison by form factor

6.17. Energy density comparison by cooling method

6.18. Chemistry choice

6.19. Chemistry and form factors of turnkey solutions

6.20. Pack manufacturer revenue estimates

6.21. Value chain differentiation

6.22. Romeo Power

6.23. Romeo Power thermal management

6.24. Forsee Power

6.25. Forsee Power applications

6.26. Xerotech

6.27. Microvast

6.28. Akasol

6.29. Akasol Energy Density Road Map for Commercial EVs

6.30. Akasol's 'Answer to Solid State'

6.31. Webasto Expanding Production

6.32. EnerDel: battery packs for trucks

6.33. BMZ

6.34. Kore Power

6.35. Proterra

6.36. Electrovaya

6.37. American Battery Solutions

6.38. Leclanche

6.39. Concluding remarks on battery manufacturers

7. CELL MANUFACTURING AND COSTS

7.1. Cell production steps

7.2. Power demand of LIB production

7.3. How Long to Build a Gigafactory?

7.4. Growing public and private investment - Q1 2021

7.5. European gigafactories announced by 2018

7.6. European gigafactories announced to date

7.7. Growth in European gigafactory announcements

7.8. Growth in European cell manufacturing

7.9. Growth in manufacturing capacity - Europe, US

7.10. Li-ion cell and pack price and cost

7.10.1. Li-ion cell material cost estimate

7.10.2. Cathode cost reduction scenarios

7.10.3. Role of silicon and high nickel NMC on cost

7.10.4. Cost reduction strategies

7.10.5. Cost reduction overview

7.10.6. BEV Cell Price Forecast

7.10.7. Electric vehicle Li-ion price forecast

8. LI-ION IN EV SEGMENTS

8.1. Application battery priorities

8.2. Risks for pack manufacturers

8.3. Panasonic and Tesla

8.4. Automotive Format Choices

8.5. Passenger Car Market

8.6. Chinese EV Battery Value Chain

8.7. Other Vehicle Categories

8.8. Drivers and timing of bus electrification

8.9. Snapshot of Global and Regional Sales Trends

8.10. Regional demand forecast for Li-ion in e-buses

8.11. Future role for battery pack manufacturers

8.12. Electric Buses: Market History

8.13. Chemistries used in electric buses

8.14. Chemistries used in electric buses

8.15. E-bus battery suppliers

8.16. Why we need electric CAM vehicles

8.17. Electric CAM examples

8.18. Intralogistics shifting to Li-ion

8.19. Intralogistics Li-ion partnerships

8.20. Li-ion intralogistics chemistries

8.21. Why Electrify Marine?

8.22. Summary of Maritime Sectors

8.23. Leading Maritime Battery Vendor

8.24. Product Line-up

8.25. Electric and Diesel LCV Cost Parity

8.26. Small eVan Break-Even: Purchase Grant

8.27. Regional Li-ion demand forecast for LCVs

8.28. Electric Trucks: Drivers and Barriers

8.29. Range of zero emission medium and heavy trucks

8.30. Regional Li-ion demand for medium and heavy duty trucks

8.31. EV Li-ion demand by region

9. SECOND LIFE EV BATTERIES AND RECYCLING

9.1. Retired electric vehicle batteries can have a second-life before being recycled

9.2. Potential value of second-life batteries

9.3. Main companies involved in battery second use

9.4. Battery second use connects the electric vehicle and battery recycling value chains

9.5. When batteries retire from electric vehicles...

9.6. Redefining the 'end-of-life' of electric vehicle batteries: you live more than once

9.7. What is the 'second-life' of electric vehicle batteries?

9.8. Target markets for second-life batteries

9.9. Drivers for recycling Li-ion batteries

9.10. LIB recycling process overview

9.11. Recycling techniques compared

9.12. Recycling or second life?

9.13. Recycling value by cathode chemistry

9.14. Northvolt's Revolt recycling program

9.15. Volkswagen plans for retired EV batteries

9.16. BMW's strategic partnerships for EV battery recycling

9.17. Renault's circular economy efforts for Li-ion batteries

9.18. Volkswagen's in-house Li-ion battery recycling plant

9.19. 4R Energy

9.20. Tesla's 'circular Gigafactory'

10. FORECASTS

10.1. Electric vehicle Li-ion demand, GWh

10.2. EV Li-ion market, $ billion

10.3. EV anode demand

10.4. Cathode Demand Forecast

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(電気自動車)の最新刊レポートIDTechEx社の エネルギー、電池 - Energy, Batteries分野 での最新刊レポート

関連レポート(キーワード「リチウム」)よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|

.png)