Biostimulants and Biopesticides 2021-2031: Technologies, Markets and Forecastsバイオスティミュラントとバイオ農薬 2021-2031年:技術、市場と予測:自然由来製品、情報化学物質、ミクロビオームなどの農業生物学の概要 このレポートはバイオスティミュラントとバイオ農薬の市場を調査し、複数の製品カテゴリ、主要企業40社以上、世界の規制を踏まえ2030年までの市場を予測しています。 主な掲載内容 ... もっと見る

※価格はデータリソースまでお問い合わせください。

Summary

このレポートはバイオスティミュラントとバイオ農薬の市場を調査し、複数の製品カテゴリ、主要企業40社以上、世界の規制を踏まえ2030年までの市場を予測しています。

主な掲載内容 ※目次より抜粋

Report Details

The market for agricultural biologicals - biostimulants, biopesticides and biofertilizers - is growing rapidly as global agriculture looks to move towards more sustainable ways to boost yields and new methods of crop protection. Growers are increasingly looking to agricultural inputs based on natural products, semiochemicals (e.g. insect pheromones) and the plant microbiome to both reduce and complement the use of synthetic chemicals in their fields.

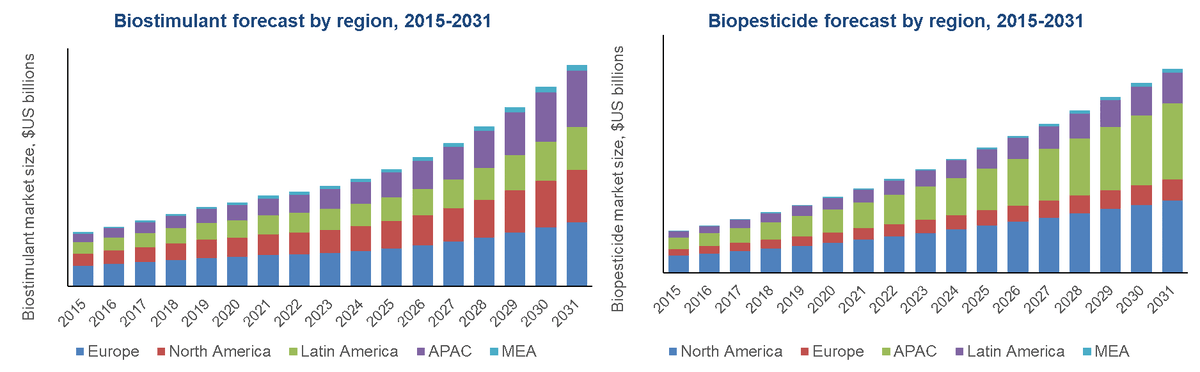

Biostimulants and Biopesticides 2021-2031: Technologies, Markets and Forecasts, a new report from IDTechEx, provides a comprehensive analysis of the markets, technologies and players in biostimulants and biopesticides. With coverage of multiple product families and over 40 companies, an in-depth discussion of the global regulations that will shape the industries, and market forecasts from 2021-2031, it is a comprehensive study of the emerging product areas. The report reveals significant opportunity - IDTechEx finds that, by 2031, the total market for agricultural biologicals will reach $19.5 billion, with the biostimulants market being worth $7.5 billion and the biopesticides market reaching $12 billion.

Source IDTechEx

Biostimulants are biologically-derived substances that can be applied to plants or soils to improve nutrient uptake and tolerance of stresses, i.e. things that improve the plant itself, rather than traditional fertilizers and pesticides. For example, California start-up Pivot Bio is developing PROVEN, a seed treatment that uses genetically engineered nitrogen-fixing bacteria to form a symbiotic relationship with the roots of corn plants in order to boost nutrient uptake. Biostimulants can improve the resilience of crops and reduce the need for chemical fertilizers, boosting yields and improving sustainability.

Biopesticides are a form of pesticide based on microbes or natural products, although the report also considers "macrobials" - biocontrol methods based on natural enemies - under the umbrella of biopesticides. Biopesticides have several advantages over synthetic chemical pesticides. They are usually inherently less toxic than conventional pesticides and generally only affect the target pest and closely related organisms, in contrast to broad spectrum, conventional pesticides that may affect organisms as different as birds, insects and mammals. Biopesticides are often effective in very small quantities and often decompose quickly, resulting in lower exposures and avoiding some of the pollution problems caused by conventional pesticides. Finally, when used as a component of integrated pest management (IPM) strategies, biopesticides can greatly reduce the use of conventional pesticides without negatively impacting crop yields.

Source IDTechEx

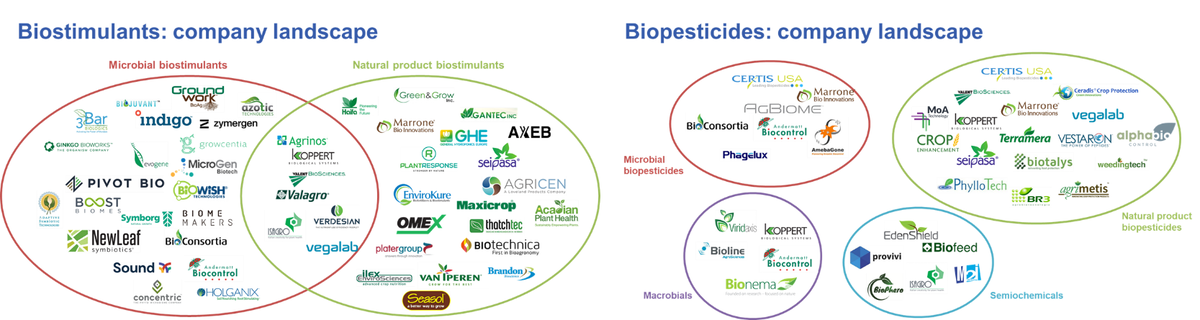

However, there are still several barriers to cross before the biostimulant and biopesticide industries can reach their full potential. The industries are still young and face challenges with product efficacy and consistency. Regulations are still evolving and both product categories struggle from the lack of a formal definition and clear regulatory pathways. For biostimulants, this means they must either fit into unsuitable regulatory categories that do not adequately ensure efficacy or performance, or they escape regulation altogether, leading to a crowded market with little guarantee of product quality. Biopesticides face the opposite challenge - they often need to go through the same registration process as synthetic chemical pesticides, or a process mostly derived from it. This can be very difficult as requirements are often poorly suited to biological products, e.g. purity requirements, making it unnecessarily hard to bring a biopesticide to market. Compared with the wider agrochemicals industry, which is highly consolidated, the agricultural biologicals market is fragmented. Although this means there are lower barriers to market entry and the industry is fast-moving and innovative, it creates an environment where it is difficult for developers to differentiate themselves and for farmers to navigate, potentially harming the credibility of the industry and hampering growth. Additionally, the large number of companies with limited product ranges means there are several disparate products on the market that may interfere with each other.

As such, the report addresses the challenges facing the biostimulant and biopesticide industries, providing insight on how companies can navigate this space and assessing how this will impact the future of the industries. The report discusses the science and technology behind biostimulants and biopesticides and what companies are doing to develop the next generation of effective, reliable products. The report goes on to discuss product registration in the US, EU, China, Brazil and India, the challenges that face companies wishing to bring a biostimulant or biopesticide product to market, and how the field is evolving. For example, the report discusses the changes stemming from the incoming EU Fertilising Products Regulation, the first set of regulations that explicitly define biostimulants, which could have a major influence on the development of the industry, both in Europe and across the world. Finally, the report discusses the state of the industry and its implications, including profiles of over 40 companies.

Key questions answered in this report:

Table of ContentsTable of Contents

|