People Monitoring and Safety Solutions – 7th Edition人物の監視と安全のソリューション (第7版) 消費者市場や企業市場での人物追跡(トラッキング)ソリューションの主要な用途には、モバイルワーカー管理、単独労務者(ローンワーカー)の保護、ファミリーロケータ(家族の携帯位置を知るサービス)、ペ... もっと見る

Summary

目次(抜粋)

Description

This report in the LBS Research Series from Berg Insight provides you with 230 pages of unique business intelligence including 5-year industry forecasts and expert commentary on which to base your business decisions. This report will allow you to:

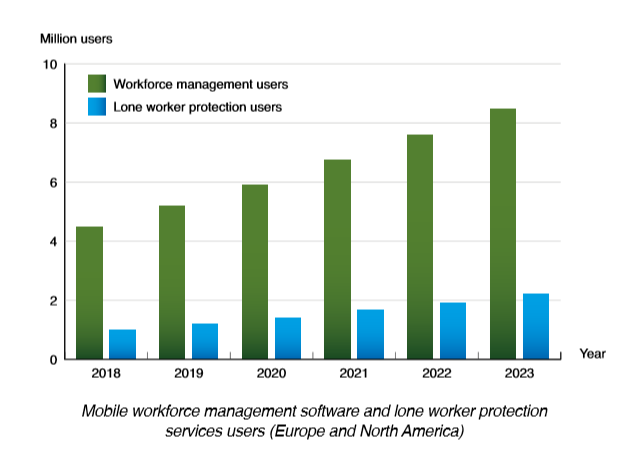

Modern people monitoring solutions rely on GPS and wireless communications technologies to determine the location of a person and transmit the data to a third party. Technological advancements have enabled substantial improvements in GPS receiver performance and cost. Dedicated people locator devices are available in a wide range of form factors including boxes, pendants, bracelets, watches and handsets designed for different use cases. The growing installed base of GPS-enabled smartphones have opened up the market for location based mobile apps, which are used in a number of people monitoring segments. Consumer-oriented people locator solutions range from family locator services that provide peace of mind for parents of children and teenagers, to solutions that assist caregivers of seniors and people suffering from various medical conditions. The market for handsetbased family locator services is dominated by freemium apps. Location sharing functionality is also offered by numerous widelyused apps such as Google Maps, Facebook Messenger, Snapchat and Apple’s Find My Friends. A number of companies market GPSenabled devices for children that are too young to use mobile phones. The market is still in its infancy, but is expected to grow in the coming years, especially in North America. Vendors including Bestie, Xplora and LG Electronics have designed locator devices for kids in the form of wristwatches. Many companies are also offering general GPS tracking devices that can be used for several different application areas. BrickHouse Security, WTS Positioning Solutions and Yepzon have launched locators that can be used to track luggage, pets, kids and more. The total addressable market for pet tracking devices is huge. There are over 300 million dogs and cats in households in Europe and North America. GPS based pet locator devices address two major concerns for pet owners – preventing the pet from getting lost and helping the pet stay healthy. People are often passionate about their pets and willing to spend considerable amounts of money on pet related products and services. The installed base of active pet locator devices in Europe and North America reached close to 600,000 in 2018. Tractive has grown rapidly to become the clear market leader in Europe as well as globally. Whistle Labs is the largest player on the North American market and one of the leading companies worldwide. Both companies offer pet locator devices, which in addition to location tracking also measure the pet’s activity to help the pet stay healthy. Telecare service providers are showing increasing interest in mobile telecare solutions, known as mobile Personal Emergency Response Systems (mPERS) in North America. Incumbents such as Philips Lifeline, Tunstall and Doro have recently launched new products in this category. There are also a number of companies offering solutions in various people monitoring segments, including mobile telecare. Navigil and SecuraTrac offer smartwatches to be used for lone workers as well as people with Alzheimer’s disease, elderly people and people suffering from various medical conditions. Over time, mobile telecare devices are likely to replace conventional telecare systems among seniors as they are better suited for a mobile lifestyle. The number of active mobile telecare systems in Europe and North America is estimated to have reached over 2.1 million at the end of 2018. People locator solutions addressing the needs of businesses are available from companies in industries such as fleet and asset tracking, as well as IT and specialist vendors. Mobile workforce management applications enable workers to report time, collect data in the field, access back-office information and communicate with managers. Berg Insight estimates that the market for mobile workforce management software in Europe and North America amounted to € 1.1 billion (US$ 1.2 billion) in 2018. The market for lone worker devices and services is growing as more employers become aware of the solutions available to protect their workforce. New and stricter regulations that specifically address the safety of lone workers also foster market growth. There were an estimated 725,000 and 300,000 monitored lone workers in Europe and North America respectively at the end of 2018.

Electronic monitoring (EM) of offenders is still relatively rare in the European and North American corrections systems. Monitoring systems based on radio frequency (RF) or GPS/cellular technology are used to provide alternative ways of sentencing offenders at various stages of the criminal justice system, including at pre-trial, at sentencing and following a period of incarceration. The average daily caseload of monitored individuals in Europe and North America amounted to about 37,000 and 210,000 respectively during 2018. In North America, 75 percent of the systems used are based on GPS/cellular technology. This report answers the following questions:

Table of Contents

Table of Contents . i Press Release

[プレスリリース原文]

2020-01-31 According to a new research report from the analyst firm Berg Insight, the market for lone worker protection solutions and services in Europe and North America is forecasted to grow from € 154 million in 2019, to reach € 284 million in 2023. The number of users of dedicated lone worker safety devices based on GPS and cellular technology on the European market is estimated to grow from 645,000 users in 2019 to reach 1.1 million users at the end of 2023. In North America, the number of such users is estimated to grow from 205,000 in 2019, to reach 380,000 at the end of 2023. In Europe, app-based solutions are estimated to account for around 25 percent of all solutions, while in North America more than 40 percent of the solutions are based on apps for smartphones and tablets. In both regions, app-based solutions are forecasted to account for an increasing share of lone worker safety solutions in the coming years. The lone worker safety market is led by a handful of specialist companies based in the UK and Canada, where legislation specifically addressing the safety of lone workers has fostered growth. SoloProtect and Send For Help Group have grown to become two of the world’s largest providers of lone worker safety solutions and services. Send For Help Group mainly serves the UK market and operates under the three subsidiaries Peoplesafe, Skyguard and Guardian24. SoloProtect is active in the US, Canada and other parts of Europe in addition to its main UK market. Both SoloProtect and Send For Help Group, also operate their own alarm receiving centre (ARC). Additional companies with notable market shares in the UK include Lone Worker Solutions, Reliance High-Tech, Orbis Protect and Safe Apps. In Canada, the main providers of safety devices and services for lone workers are Blackline Safety, Tsunami Solutions, Roadpost and Aware360. Blackline Safety is known for developing technologically advanced safety devices for lone workers using both cellular and satellite communications technology. The market drivers for lone worker safety solutions includes occupational safety regulations, increasing employee insurance costs and higher awareness of risks associated with lone working. The number of individuals working alone is also expected to grow as businesses strive for increased efficiency. A job previously performed by two persons or more is now being done by a single worker. “Traditionally, lone workers exposed to the highest social or environmental risks have been found in industries such as security services, social care, field services and in heavy industries such as oil & gas and construction” says Martin Backman, IoT Analyst at Berg Insight. He adds that companies in other industries are now also starting to see the benefits of these services. “There is now an increasing demand for lone worker safety services from workers in retail, financial services, education and more, which fuels market growth”, concludes Mr. Backman.

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(位置情報)の最新刊レポート

Berg Insight社の位置情報分野での最新刊レポート本レポートと同じKEY WORD()の最新刊レポート

よくあるご質問Berg Insight社はどのような調査会社ですか?スウェーデンの調査会社ベルグインサイト社(Berg Insight)は、モバイルM2Mや位置情報サービス(LBS)、モバイルVAS、次世代技術など、通信関連市場を専門に調査しています。特に、M2Mと位... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

詳細検索

2025/04/17 10:26 143.53 円 163.57 円 192.38 円 |