The Connected Mining Solutions Market採掘業のネットワーク接続ソリューション市場 スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート 「採掘業のネットワーク接続ソリューション市場」 は、世界の採掘業(鉱業)のネットワーク接続ソリューション市場を予測している... もっと見る

Summary

Description

The Connected Mining Solutions Market is a comprehensive report from Berg Insight analysing the latest developments on the market for connected solutions used in the mining sector. This strategic research report from Berg Insight provides you with 180 pages of unique business intelligence including 5-year industry forecasts and expert commentary on which to base your business decisions. Highlights from this report:

Berg Insight forecasts connected mining solutions will reach 1.2 million units in 2023

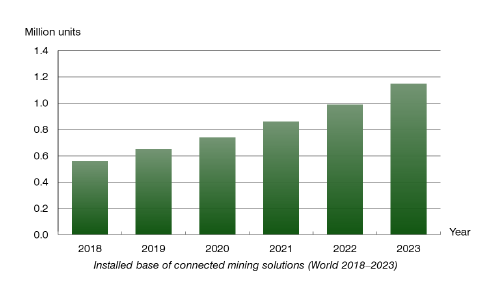

Berg Insight estimates that the total installed base of connected mining solutions reached almost 0.6 million units in use worldwide across the equipment, people and environment segments in 2018. The equipment segment accounts for the largest share of the total, representing connected devices deployed on machines and vehicles used in mining operations. This includes solutions ranging from OEM telematics systems on mining equipment to advanced connected solutions supplied by mining technology specialists. The people segment consists of various solutions deployed to support the safety and productivity of mining personnel, while the environment segment includes sensor technology implemented for environmental monitoring of the mine itself. Growing at a compound annual growth rate of 15.5 percent, the installed base of connected mining solutions across all segments is forecasted to reach close to 1.2 million units in 2023. Asia-Pacific is estimated to account for the largest share of the total installed base, followed by North America, the Middle East & Africa, Latin America and Europe.

This report answers the following questions:

Table of Contents

1 The mining industry

2 Connected mining solutions

3 Market analysis and trends

4 Company profiles and strategies Press Release[サマリー訳]

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「採掘業のネットワーク接続ソリューション市場」は、世界の採掘業(鉱業)のネットワーク接続ソリューション市場を予測している。機器、労働者、環境セグメントにおいてネットワーク接続アプリケーションが使用されている。鉱業における無線IoT(モノのインターネット)機器の導入数は、2018年末の60万から年平均成長率(CAGR)15.5%で成長して、2023年には120万に達するだろう。ベンダ、製品、市場に関する最新の情報を提供している。

[サマリー原文]

[プレスリリース原文] 2019-05-30 The global installed base of connected mining solutions will reach 1.2 million units in 2023 According to a new research report from the IoT analyst firm Berg Insight, the total active installed base of connected mining solutions reached almost 0.6 million units in the equipment, people and environment segments in 2018. The equipment segment accounts for the largest share of the total, representing connected units deployed on machines and vehicles used in mining operations. This includes solutions ranging from OEM telematics systems on mining equipment to advanced connected solutions supplied by mining technology specialists. The people segment includes various solutions deployed to support the safety and productivity of mining personnel, while the environment segment consists of sensor technology implemented for environmental monitoring of the mine itself. Growing at a compound annual growth rate of 15.5 percent, the total installed base of connected mining solutions in all these segments is forecasted to reach close to 1.2 million units in 2023. The top players active in the connected mining space include strikingly different types of companies, ranging from specialised independent technology suppliers of varying sizes up to the leading mining equipment manufacturers. “Many of the key players today serve both surface and underground mining customers”, said Rickard Andersson, Principal Analyst, Berg Insight. The surface segment is dominated by Modular Mining Systems (owned by Komatsu), Hexagon Mining, Wenco International Mining Systems (owned by Hitachi Construction Machinery) and Caterpillar through its Cat MineStar suite. “Modular, Hexagon and Caterpillar all serve underground customers in addition to a primary presence in the surface segment, while Wenco is fully focused on surface mining”, continued Mr. Andersson. He adds that VIST Group is also active in the surface segment and serves some underground operations as well. Examples of key technology providers focused specifically on underground applications are Newtrax Technologies (recently acquired by Sandvik) and Mobilaris (partially owned by Epiroc). The underground segment is in general less mature and more fragmented. “Mine Site Technologies, MICROMINE and rapidBizApps are additional players in the underground segment that all also serve surface customers to varying extents”, concluded Mr. Andersson.

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野の最新刊レポート

Berg Insight 社の最新刊レポート本レポートと同じKEY WORD()の最新刊レポート

よくあるご質問Berg Insight社はどのような調査会社ですか?スウェーデンの調査会社ベルグインサイト社(Berg Insight)は、モバイルM2Mや位置情報サービス(LBS)、モバイルVAS、次世代技術など、通信関連市場を専門に調査しています。特に、M2Mと位... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

詳細検索

2024/10/09 10:26 149.25 円 164.26 円 198.27 円 |

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「採掘業のネットワーク接続ソリューション市場」は、世界の採掘業(鉱業)のネットワーク接続ソリューション市場を予測している。機器、労働者、環境セグメントにおいてネットワーク接続アプリケーションが使用されている。鉱業における無線IoT(モノのインターネット)機器の導入数は、2018年末の60万から年平均成長率(CAGR)15.5%で成長して、2023年には120万に達するだろう。ベンダ、製品、市場に関する最新の情報を提供している。

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「採掘業のネットワーク接続ソリューション市場」は、世界の採掘業(鉱業)のネットワーク接続ソリューション市場を予測している。機器、労働者、環境セグメントにおいてネットワーク接続アプリケーションが使用されている。鉱業における無線IoT(モノのインターネット)機器の導入数は、2018年末の60万から年平均成長率(CAGR)15.5%で成長して、2023年には120万に達するだろう。ベンダ、製品、市場に関する最新の情報を提供している。