Summary

米国調査会社マインドコマース(Mind Commerce)の調査レポート「リッチコミュニケーションサービス市場概観と予測:技術毎、用途毎、ユーザタイプ毎、採用モデル毎、産業毎のRCS市場 2020-2025年」は、リッチコミュニケーションサービスの市場促進要因、技術、予測と今後の概観などの市場分析を記載している。LTEや5G上の音声サービスやデータ・メッセージングサービス、サードパーティの付加価値アプリへの統合、次世代の消費者と企業向けソリューションのためのキャリアのコンテンツを収益化しようとするあらゆる企業が注目すべき内容を提供している。

米国調査会社マインドコマース(Mind Commerce)の調査レポート「リッチコミュニケーションサービス市場概観と予測:技術毎、用途毎、ユーザタイプ毎、採用モデル毎、産業毎のRCS市場 2020-2025年」は、リッチコミュニケーションサービスの市場促進要因、技術、予測と今後の概観などの市場分析を記載している。LTEや5G上の音声サービスやデータ・メッセージングサービス、サードパーティの付加価値アプリへの統合、次世代の消費者と企業向けソリューションのためのキャリアのコンテンツを収益化しようとするあらゆる企業が注目すべき内容を提供している。

Overview

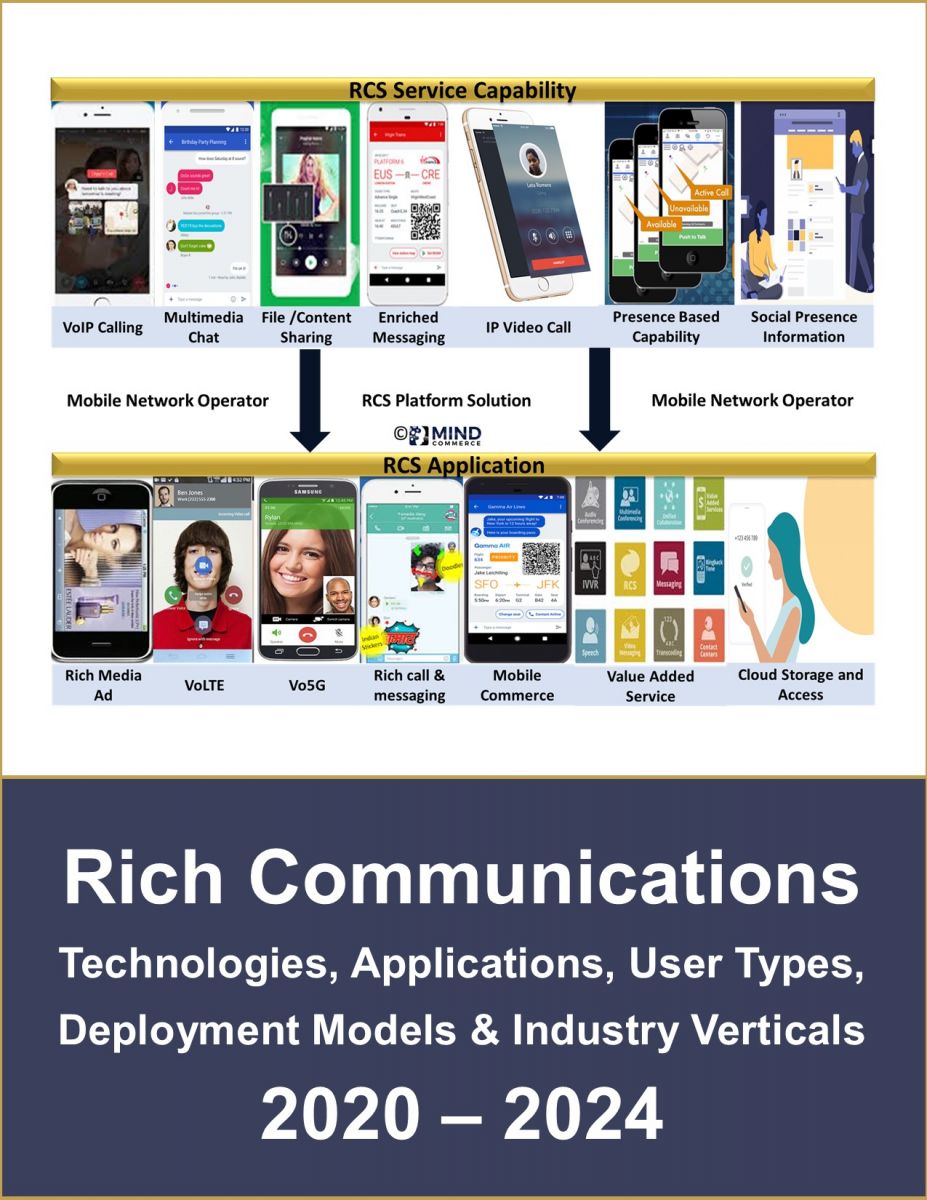

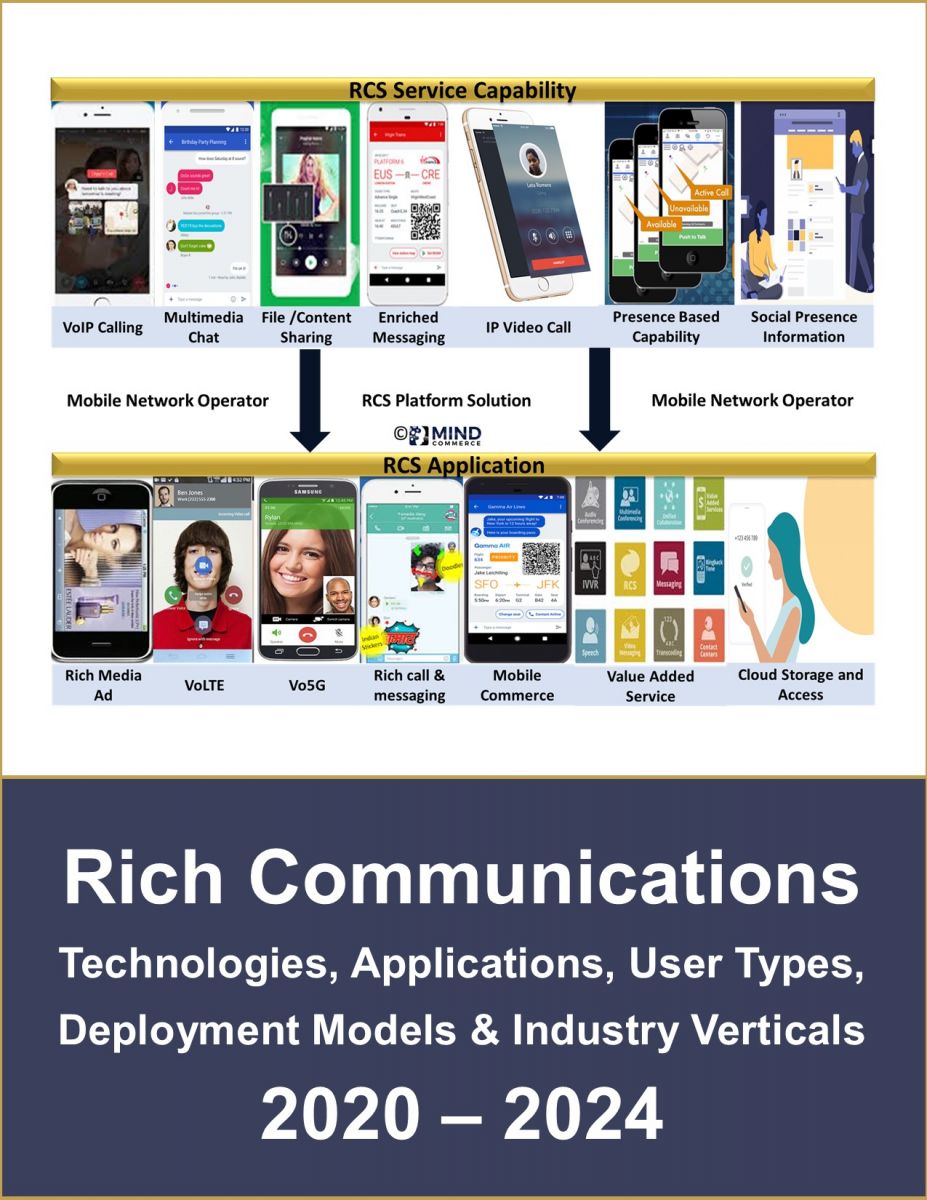

This report provides analysis of the RCS market including drivers, technical issues, forecasts and future outlook. It is must reading for any organization focused on monetizing voice over LTE and 5G, data and messaging services, and integrating third-party value-added apps and content with carriers for next generation consumer and enterprise solutions.

The report analyzes RCS technologies and capabilities for use in applications by legacy carriers as well as OTT players, enterprise, and other third parties. The report also evaluates vendor strategies and initiatives including plans for new RCS based solutions.

The report also assesses the RCS market outlook for communication service providers as well as opportunities for enterprise to leverage RCS capabilities such as the combination of rich calls, messaging, and videos as well as branded communications. The report includes analysis and forecasts by technology, application, user type, deployment model, and industry vertical globally and regionally for 2020 to 2024.

Rich Communication Services (RCS) originally marketed by GSMA marks the transition of messaging and voice capabilities from Circuit Switched technology to an all-IP world. RCS and VoLTE share the same IP Multimedia Subsystem (IMS) investment and leverage the same IMS capabilities. For consumers, it has the potential to combine voice and SMS with instant messaging or chat, live video sharing and file transfer across all devices and networks.

RCS will facilitate many consumer-related applications and solutions. From the communication service provider’s perspective, RCS is an opportunity to better compete against OTT-based service offerings. From the third-party application and content provider perspective, RCS provides a means of leveraging telecom APIs to better integrate with communication apps.

With the introduction of RCS, enterprise can leverage various API interfaces to fully integrate with their operations, providing differentiation not found today. Integration can occur between mobile network operator (network infrastructure and databases) and enterprise assets such CRM and employee data. Businesses can enhance their communications infrastructure by providing a single interface from which users can initiate voice, video, and messaging sessions.

RCS provides access to these features directly from a device’s address book, whether the device is a smartphone, wearable, tablet, or PC. In addition to traditional contact information (name, number, email address, social media identity) the enhanced RCS address book positively identifies users and identifies whether each contact’s device can join a chat, initiate a video call, or send a file.

Mind Commerce also sees significant value via open API integration for various value-added enterprise RCS applications. One of those applications is the Corporate Enterprise Dashboard, which provides a key application for the carriers most-valued customers (businesses) to provide improved internal communications. In addition, RCS represents an opportunity for business to provide improved CRM via mixed media and branded customer contact, which is very important in the world of unwanted robocalls.

An alternative IP-based real-time communications solution, Web Real-time Communications (WebRTC) provides a framework, protocols, and API that facilitates real-time interactive voice, video, and data via a Web browser. The solutions, services, applications are supported by WebRTC are in direct competition with the CSP led initiative known as RCS. Therefore, WebRTC can be very disruptive to communication service provider business models, representing both an opportunity and a threat.

Why purchase this report? With rich communication services market analysis originating in 2013, Mind Commerce offers the most continuous and comprehensive RCS technologies, infrastructure, solutions, and applications market research available.

Select Report Findings

• RCS will compete well against WebRTC and other RTC solutions

• Presence and context-related capabilities will have highest CAGR

• Social presence info will emerge as fastest growing RCS solution area

• The global market for social presence solutions will reach $1.6B by 2024

• The overall RCS market value in North Amercia will surpass $4B by 2024

• The Cross Carrier Messaging Initiative will facilitate substantial innovation

• OTT service providers will benefit significantly through content integration

• Enterprise customers will benefit greatly through branded customer contact

Report Benefits:

• Forecasting for RCS market globally and regionally for 2020 – 2024

• Understand the evolution process, and market dynamics of the RCS ecosystem

• Identify leading RCS applications and use cases for consumer and enterprise users

• Identify how MNOs and third-parties can leverage opportunities within RCS ecosystem

• Recommendations for vendors, service providers and other stakeholders in the RCS ecosystem

Companies in Report:

• AT&T

• Celcom

• China Mobile

• D2 Technologies

• Deutsche Telekom

• Dialogic

• Ericsson

• First Orion

• Freedom Mobile

• Google

• Huawei

• Hiya

• Infinite Convergence

• Interop Technologies

• KDDI

• LG Uplus

• Mavenir Systems

• Microsoft

• Myriad Group

• Neusoft Corporation

• Nokia Network

• O2

• Oracle

• Orange Business

• Ribbon Communications

• Rogers Communications

• Samsung

• SAP America

• Sinch

• SK Telecom

• Slovak Telekom

• Sprint

• Summit Technology

• Synchronoss Technologies

• Telefonica

• TELIT Communications

• Telstra Corporation

• Transaction Network Services

• T-Mobile USA

• Twilio

• Verizon Wireless

• Vodafone

ページTOPに戻る

Table of Contents

1.0 Executive Summary

2.0 Introduction

2.1 Rich Communication Services (RCS)

2.1.1 RCS Infrastructure

2.1.1.1 IP Multimedia Subsystem

2.1.1.2 Home Subscriber Server (HSS)

2.1.1.3 Call Session Control Function (CSCF)

2.1.1.4 Media and Application Servers

2.1.1.5 Gateway Functions

2.1.2 RCS Protocols

2.1.2.1 Session Initiation Protocol

2.1.2.2 SIP Session Components

2.1.2.2.1 SIP User Agents

2.1.2.2.2 SIP Register Servers

2.1.2.2.3 SIP Proxy Servers

2.1.2.2.4 SIP Redirect Servers.

2.1.2.3 Implications of SIP for IMS

2.1.2.4 SDP and MSRP

2.1.3 P2P vs. A2P Messaging

2.2 RCS Development and Implementation

2.2.1 3GPP Release

2.2.2 Joyn

2.2.3 RCS Universal Profile

2.2.4 GSMA and CCMI

2.2.5 Google vs. Apple

3.0 RCS Market Drivers

3.1 RCS Market Structure

3.2 RCS Business Models

3.3 RCS Market Dynamics

3.4 RCS Limitations

3.5 RCS Market Demand Analysis

3.6 Value Chain Analysis

4.0 RCS Capabilities and Applications

4.1 RCS Technology Analysis

4.1.1 VoIP Calling

4.1.2 Chat

4.1.3 File Transfer/Content Sharing

4.1.4 Rich Media / Advanced Messaging

4.1.5 IP Video Call

4.1.6 Presence Based Capability Exchange

4.1.7 Social Presence Information

4.2 Supporting Technologies

4.2.1 Artificial Intelligence

4.2.2 Internet of Things

4.2.3 Cloud Computing

4.2.4 LTE and 5G Networks

4.2.5 Telecom APIs

4.3 RCS as a Value-added Service Enabler

4.3.1 Value-added Services

4.3.2 Role of RCS in VAS

4.4 RCS Feature/Functionality Analysis

4.4.1 Subscriber Identity Management

4.4.2 Cloud Storage and Access

4.4.3 Presence Capabilities

4.4.4 RCS VoIP

4.4.4.1 VoLTE

4.4.4.2 Vo5G

4.4.5 Rich Calls and Messaging

4.4.6 Rich Media Integration

4.4.7 Mobile Commerce

4.5 RCS Consumer Use Cases

4.6 RCS Enterprise Use Cases

4.6.1 Enterprise Internal Communication

4.6.2 Customer Relationship Management

4.6.2.1 RCS Business Calling

4.6.2.2 RCS Business Messaging

4.6.3 Enterprise Vertical-specific Use Cases

4.6.3.1 Telecom and IT

4.6.3.2 Banking and NBFI

4.6.3.3 Retail and E-Commerce

4.6.3.4 Healthcare

4.6.3.5 Media and Entertainment

4.6.3.6 Tourism and Logistics

4.6.3.7 Government and Utilities

4.7 RCS End-user Analysis

4.8 RCS Global Adoption and Implementation

4.9 RCS vs. OTT Messaging

4.10 RCS vs. WebRTC

5.0 Company Analysis

5.1 AT&T

5.2 Celcom

5.3 China Mobile

5.4 Synchronoss Technologies

5.5 Deutsche Telekom

5.6 Dialogic

5.7 Ericsson

5.8 Ribbon Communications

5.9 Google

5.10 Huawei

5.11 Interop Technologies

5.12 KDDI

5.13 Mavenir Systems

5.14 Microsoft

5.15 Neusoft Corporation

5.16 Nokia Network

5.17 Oracle

5.18 Orange Business

5.19 Samsung

5.20 SK Telecom

5.21 Sprint

5.22 Telefonica

5.23 T-Mobile USA

5.24 Verizon Wireless

5.25 Vodafone

5.26 D2 Technologies

5.27 Other Companies

5.27.1 Freedom Mobile

5.27.2 Infinite Convergence

5.27.3 LG Uplus

5.27.4 Myriad Group

5.27.5 O2

5.27.6 Rogers Communications

5.27.7 SAP America

5.27.8 Slovak Telekom

5.27.9 Summit Technology

5.27.10 TELIT Communications

5.27.11 Telstra Corporation

5.27.12 Sinch

6.0 RCS Market Analysis and Forecasts 2020 – 2025

6.1 Global RCS Market 2020 – 2025

6.1.1 Total RCS Market 2020 – 2025

6.1.2 RCS Market by Technology 2020 – 2025

6.1.3 RCS Market by Application 2020 – 2025

6.1.4 RCS Market by Industry Vertical 2020 – 2025

6.1.5 RCS Market by User Type 2020 – 2025

6.1.5.1 RCS Market by Enterprise Type 2020 – 2025

6.1.6 RCS Market by Deployment 2020 – 2025

6.1.6.1 RCS Market by Cloud Deployment 2020 – 2025

6.2 Regional RCS Market 2020 – 2025

6.2.1 RCS Market by Region 2020 – 2025

6.2.2 North America RCS Market Forecast 2020 – 2025

6.2.3 APAC RCS Market Forecast 2020 – 2025

6.2.4 Europe RCS Market Forecast 2020 – 2025

6.2.5 Latin America RCS Market Forecast 2020 – 2025

6.2.6 Middle East and Africa RCS Market Forecast 2020 – 2025

7.0 Future of RCS for CSPs, OTT Providers, and Enterprise

8.0 Conclusions and Recommendations

9.0 Appendix: RCS Supporting Infrastructure

Figures

Figure 1: RCS Service Architecture

Figure 2: IMS Infrastructure

Figure 3: RCS A2P Messaging

Figure 4: RCS Universal Profile Ecosystem

Figure 5: RCS Business Models

Figure 6: Rich Media Messages

Figure 7: IoT RCS Application

Figure 8: Global RCS Messages 2020 – 2025

Figure 9: Mobile Commerce in RCS

Figure 10: RCS and Dynamic Address Book

Figure 11: RCS Integration with Apps and Content

Figure 12: RCS Enterprise Dashboard

Figure 13: RCS Enterprise Employee Finder Application

Figure 14: Call Data Analytics and Enterprise Call Completion

Figure 15: Enterprise Branded Calls

Figure 16: RCS Business Message Metrics

Figure 17: Dialogic PowerMedia XMS Media Server

Figure 18: Interop Rich Communication Suite

Figure 19: Orange UCC Framework for RCS

Figure 20: Global RCS Market 2020 – 2025

Tables

Table 1: RCS Monthly Active User by Technology 2020 – 2025

Table 2: RCS Monthly Active User by Region 2020 – 2025

Table 3: Global RCS Market by Technology 2020 – 2025

Table 4: Global RCS Market by Application 2020 – 2025

Table 5: Global RCS Market by Industry Vertical 2020 – 2025

Table 6: Global RCS Market by User Type 2020 – 2025

Table 7: Global RCS Market by Enterprise Type 2020 – 2025

Table 8: Global RCS Market by Deployment 2020 – 2025

Table 9: Global RCS Market by Cloud Deployment 2020 – 2025

Table 10: RCS Market by Region 2020 – 2025

Table 11: North America RCS Market by Technology 2020 – 2025

Table 12: North America RCS Market by Application 2020 – 2025

Table 13: North America RCS Market by Industry Vertical 2020 – 2025

Table 14: North America RCS Market by User Type 2020 – 2025

Table 15: North America RCS Market by Enterprise Type 2020 – 2025

Table 16: North America RCS Market by Deployment 2020 – 2025

Table 17: North America RCS Market by Cloud Deployment 2020 – 2025

Table 18: North America RCS Market by Country 2020 – 2025

Table 19: APAC RCS Market by Technology 2020 – 2025

Table 20: APAC RCS Market by Application 2020 – 2025

Table 21: APAC RCS Market by Industry Vertical 2020 – 2025

Table 22: APAC RCS Market by User Type 2020 – 2025

Table 23: APAC RCS Market by Enterprise Type 2020 – 2025

Table 24: APAC RCS Market by Deployment 2020 – 2025

Table 25: APAC RCS Market by Cloud Deployment 2020 – 2025

Table 26: APAC RCS Market by Country 2020 – 2025

Table 27: Europe RCS Market by Technology 2020 – 2025

Table 28: Europe RCS Market by Application 2020 – 2025

Table 29: Europe RCS Market by Industry Vertical 2020 – 2025

Table 30: Europe RCS Market by User Type 2020 – 2025

Table 31: Europe RCS Market by Enterprise Type 2020 – 2025

Table 32: Europe RCS Market by Deployment 2020 – 2025

Table 33: Europe RCS Market by Cloud Deployment 2020 – 2025

Table 34: Europe RCS Market by Country 2020 – 2025

Table 35: Latin America RCS Market by Technology 2020 – 2025

Table 36: Latin America RCS Market by Application 2020 – 2025

Table 37: Latin America RCS Market by Industry Vertical 2020 – 2025

Table 38: Latin America RCS Market by User Type 2020 – 2025

Table 39: Latin America RCS Market by Enterprise Type 2020 – 2025

Table 40: Latin America RCS Market by Deployment 2020 – 2025

Table 41: Latin America RCS Market by Cloud Deployment 2020 – 2025

Table 42: Latin America RCS Market by Country 2020 – 2025

Table 43: MEA RCS Market by Technology 2020 – 2025

Table 44: MEA RCS Market by Application 2020 – 2025

Table 45: MEA RCS Market by Industry Vertical 2020 – 2025

Table 46: MEA RCS Market by User Type 2020 – 2025

Table 47: MEA RCS Market by Enterprise Type 2020 – 2025

Table 48: MEA RCS Market by Deployment 2020 – 2025

Table 49: MEA RCS Market by Cloud Deployment 2020 – 2025

Table 50: MEA RCS Market by Country 2020 – 2025