Li-ion Batteries and Battery Management Systems for Electric Vehicles 2024-2034電気自動車用リチウムイオン電池と電池管理システム 2024-2034 この調査レポートでは、正極材料やシリコン負極から、セル・ツー・パックやデュアルケミストリーパックの設計、ワイヤレスBMSに至るまで、リチウムイオンセル、パック、バッテリー管理システム(BMS)の技術と... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートでは、正極材料やシリコン負極から、セル・ツー・パックやデュアルケミストリーパックの設計、ワイヤレスBMSに至るまで、リチウムイオンセル、パック、バッテリー管理システム(BMS)の技術と動向について詳細に調査・分析しています。

主な掲載内容(目次より抜粋)

Report Summary

Li-ion batteries and battery management systems for electric vehicles

The global market for Li-ion batteries in electric vehicles is forecast to reach over US$380 billion by 2034, driven primarily by demand for battery electric cars. Electrification and emissions targets, improving battery performance, and an increasingly attractive total cost of ownership for some vehicle segments are driving this growth in demand for battery electric vehicles (EV), and despite challenges relating to global supply chains, semiconductor shortages, and raw material availability, the EV market continued its upward trajectory in 2022. The Li-ion battery is the key technology that underpins and enables the deployment of EVs. This report details the technology and trends to Li-ion cells, packs, and battery management systems (BMS), from cathode materials and silicon anodes, to cell-to-pack and dual chemistry pack designs, to wireless BMS.

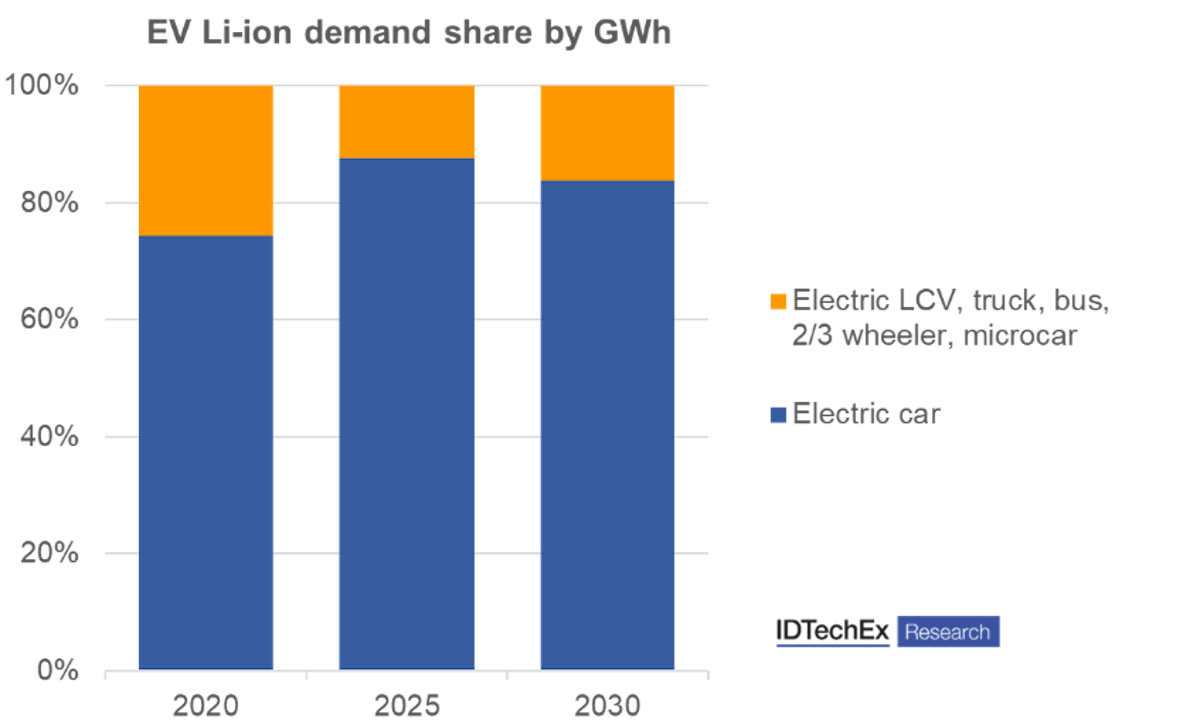

Share of Li-ion demand by EV segment. Source: IDTechEx.

Cells

Li-ion cell chemistries continue to evolve. Higher nickel layered oxides such as NMC 811 are being deployed for battery electric cars (BEV) to maximize energy density and minimize cobalt content but cost pressures have led to growth in the use of LFP, a lower energy density chemistry but also a lower cost one. Optimization of cell and pack design can help minimize this disadvantage. In commercial vehicles, higher cycle life is often needed, making the use of increasingly high-nickel cathodes difficult in the short-term, while in 2 and 3 wheelers a variety of Li-ion chemistries are being used to replace Pb-acid, including LMO, NMC and LFP, and combinations thereof. A range of chemistries are and will continue to be utilized depending on performance requirements, duty-cycles, cost, and availability. The report provides analysis on Li-ion cell technology, covering preferred cell form factors, changing cell chemistries, cathode forecasts, cell performance data and trends, discussion of next generation cell chemistries, as well as EV cell supplier shares.

Packs

Cell technology and chemistry often takes centre stage in the discussion on battery technology but developments to battery pack designs are equally important. For example, cell-to-pack designs are becoming increasingly popular for electric cars as a means to optimize energy density and are being developed by players such as BYD, CATL, and Tesla, amongst others. Thermal management is also an increasingly important topic given its critical role in maintaining the safe operation of Li-ion batteries. Different players are pursuing air, liquid and refrigerant-cooled methods, as well as immersion cooling, each with their own benefits and weaknesses. Trends to various battery pack designs are analyzed in this report, including on thermal management strategies, modular and cell-to-pack designs, and material light-weighting.

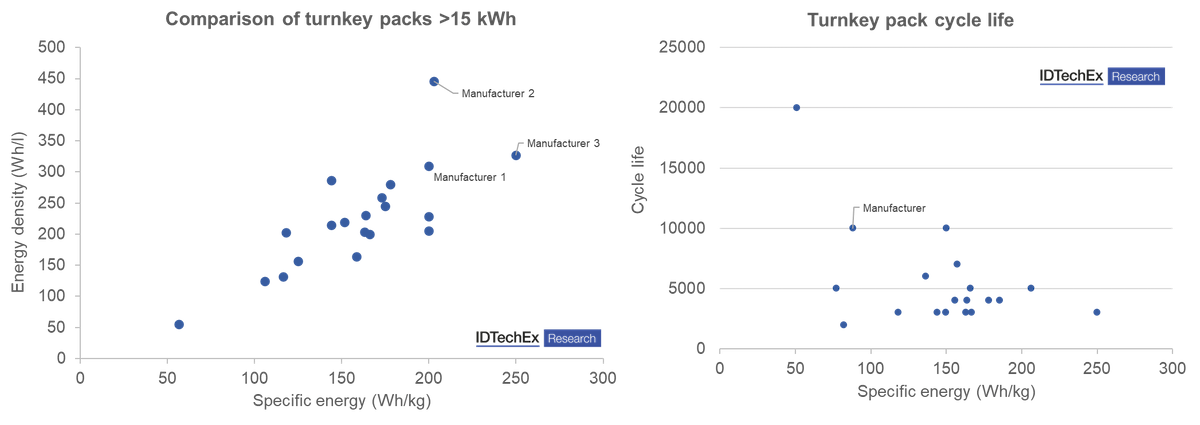

A study of battery pack manufacturers, primarily supplying packs to commercial, non-car vehicle segments, such as heavy duty-trucks, buses and logistics vehicles, is provided with a focus on the European and US players. Comparisons in the form factors, chemistries and performance of turnkey products are provided, along with a discussion of how pack manufacturers are differentiating themselves. The key markets and segments being targeted are outlined alongside analysis of how battery performance requirements change for different markets.

Comparison of battery pack performance. Source: IDTechEx.

Battery management systems

The battery management system is key to the safe and reliable operation of a Li-ion battery pack. While the core functions of a BMS are relatively well defined and the technology comparatively mature, new developments to battery management systems offer a unique opportunity to improve several aspects of battery performance simultaneously. Potential performance improvements from innovations to BMS and BMS software include increased energy density, faster charging rates, and more accurate battery lifetime estimation, which can be enabled through more accurate state estimation, in turn enabled through a combination of physics-based models, data-based models, and cloud analytics. Wireless BMS are also being developed, enabling easier scaling of pack designs and reducing the amount of wiring needed in a battery pack. GM announced they would utilize a wireless BMS in their Ultium batteries in 2020. The report details the functions of a battery management system, the players in involved in BMS manufacturing and development and key innovations and advancements to battery management systems.

EV market segments

Battery electric cars have been one of the key drivers behind growth in Li-ion demand over the past 10 years and are forecast to contribute 80% of the demand for Li-ion batteries by 2030. However, electrification is needed across a broad spectrum of vehicle segments and indeed growth in EVs across multiple sectors is expected. For light commercial vehicles (LCV), battery electrification is not only being explored for environmental reasons but increasingly for economic reasons. Though the market is still dwarfed by electric cars, growth is expected as pilot projects are completed and trust in electric vans is gained. For trucks, battery requirements can be more challenging and some low volume segments may continue to rely on 3rd party pack manufacturers. Nevertheless, OEMs such as Tesla, Daimler, VW and Volvo are all investing heavily in long-haul battery electric trucks. The report provides an overview of some of the key drivers, challenges and battery technology choices for electric vehicle segments including cars, LCVs, trucks, buses, 2 wheelers, marine, construction vehicles and trains. Forecasts for Li-ion batteries for electric vehicles (by GWh, $B) are provided for electric cars, LCVs, trucks, buses, and 2/3 wheelers are provided to 2034.

Table of Contents

|