Summary

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「コネクテッドウェアラブル機器(第4版)」は、世界中の様々な市場で急速に拡大しているネットワーク接続するウェアラブル機器市場について調査している。ベルグインサイト社は、無線機能搭載のウェアラブルデバイスの世界の出荷数は2018年の1億1680万から年平均成長率(CAGR)15.4%で増加して、2023年には2億3850万になるだろうと予測している。予測期間終了時点でのセルラー搭載率は28.4%と予測している。

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「コネクテッドウェアラブル機器(第4版)」は、世界中の様々な市場で急速に拡大しているネットワーク接続するウェアラブル機器市場について調査している。ベルグインサイト社は、無線機能搭載のウェアラブルデバイスの世界の出荷数は2018年の1億1680万から年平均成長率(CAGR)15.4%で増加して、2023年には2億3850万になるだろうと予測している。予測期間終了時点でのセルラー搭載率は28.4%と予測している。

目次(抜粋)

-

ウェアラブル技術

-

ウェアラブルデバイスのバリューチェーンとベンダの概要

-

ネットワーク接続型フィットネスと活動トラッカー

-

スマートウオッチ

-

スマート眼鏡(スマートグラス)とヘッドマウントディスプレイ(HMD)

-

医療デバイスとモバイル医療

-

ウェアラブルデバイスの市場予測と動向

Description

Connected wearables are now becoming increasingly popular on many markets globally. Berg Insight estimates that worldwide shipments of wirelessly enabled wearable devices will grow from 116.8 million in 2018 at a compound annual growth rate (CAGR) of 15.4 percent to 238.5 million in 2023. The cellular attach rate at the end of the forecast period is forecasted to be 28.4 percent. Get up to date with the latest trends from all main product categories and regions with this unique 160 page report.

Connected Wearables is the fourth consecutive report from Berg Insight analysing the latest developments on the connected wearables market worldwide.

This strategic research report from Berg Insight provides you with 160 pages of unique business intelligence including 5-year industry forecasts and expert commentary on which to base your business decisions.

This report will allow you to:

-

Understand the key enablers for growth in the connected wearables market.

-

Identify key players in the connected wearables ecosystem.

-

Benefit from detailed forecasts for each device category lasting until 2023.

-

Learn about the markets for activity trackers, smartwatches, smart glasses and medical devices.

-

Evaluate the business opportunities in new innovative device categories.

-

Predict future market and technology developments.

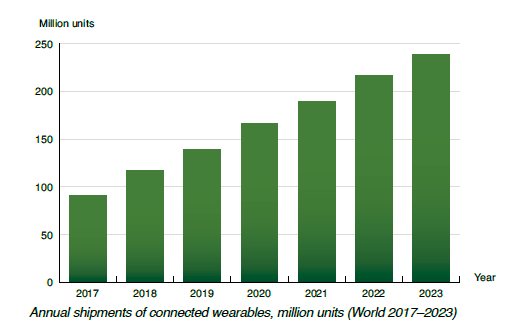

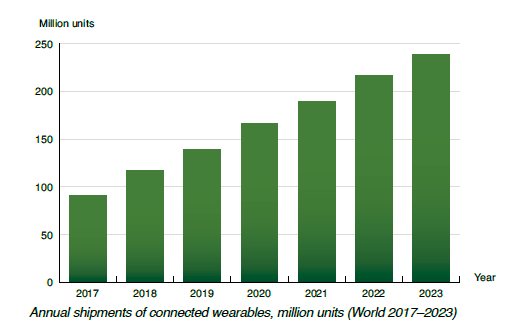

Annual shipments of connected wearables will reach 239 million in 2023

The wearable form factor enables hands-free operation and allows the user to multitask and get immediate access to information. It also enables continuous recording of useful data such as body metrics, location and environmental data. Berg Insight’s definition of a connected wearable is a device meant to be worn by the user and which incorporates data logging and some sort of wireless connectivity. Various forms of connected wearables have for long been used in professional markets to improve work processes and increase efficiency. The high smartphone adoption, cloud services, miniaturised hardware, sensor technology and low power wireless connectivity enabled wearables to emerge as a new promising consumer segment some years ago. Today, activity trackers and connected fitness devices as well as smartwatches are leading the wearable technology industry in terms of shipment volume and market maturity. However, the number of applications for wearable technology is vast and a plethora of device categories such as smart glasses, head-mounted displays, medical devices, wrist-worn computers and scanners, connected clothes and garments, gesture control devices and many more exist. These wearable devices target various market segments including infotainment & lifestyle, fitness & wellness, people monitoring & safety, medical & healthcare, enterprise & industrial and government & military.

The market for connected wearables has entered a strong growth phase that will last for many years to come. Berg Insight estimates that shipments of connected wearables reached 116.8 million units in 2018. The market is expected to grow at a CAGR of 15.4 percent to reach annual shipments of 238.5 million in 2023. Wearable activity trackers and connected fitness devices is the leading category, currently representing a majority of the shipments. Decreasing prices and extended capabilities will enable shipments in the segment to reach 88.9 million units in 2023. Smartwatches have also started to reach significant volumes. The market is led by Apple which accounted for close to half of the 45.5 million devices shipped in 2018. Smartwatches are increasingly incorporating activity tracking features as well as more advanced sensors for medical applications. Growing at a CAGR of 20.9 percent, the market segment is predicted to become the largest wearables category with shipments of 117.7 million devices in 2023. Sales of smart glasses and head-mounted displays have grown rapidly in recent years. During 2018, an estimated 1.5 million devices were shipped. Around 75 percent of these devices were VR/AR headsets to be used for gaming and entertainment purposes, while the remaining devices were mainly used by enterprises and the military. The category is projected to reach annual shipments of 11.9 million devices in 2023. Annual shipments of medical and mobile telecare/mPERS devices are forecasted to grow from 1.8 million devices in 2018 to 6.9 million devices in 2023. Finally, annual shipments of wearables not covered by the above product categories are predicted to grow at a CAGR of 34.1 percent from 3.0 million units in 2018 to reach 13.0 million units in 2023. The segment includes wearables such as authentication and gestures devices, smart rings, wrist-worn computers and scanners, smart jewellery and connected prosthetics.

North America is the largest market for connected wearables and accounted for about 44.4 million of the total shipments in 2018. The second largest market is Europe which reached shipments of 38.5 million devices followed by Asia-Pacific with 26.9 million devices. Berg Insight projects that North America will remain the largest regional market in 2023, but its market share will decrease from 38 percent in 2018 to around 33 percent at the end of the forecast period. Asia-Pacific is estimated to account for an increasing share and in 2023 account for 30 percent of the shipments, up from 23 percent in 2018. Emerging markets currently represent a relatively small share of the market. Demand in the Middle East and Africa mainly comes from a few developed countries and wider adoption in the region will be highly dependent on the overall economic development.

Bluetooth will remain the primary connectivity option in consumer centric wearables throughout the forecast period and smartphones will act as the principal hub for remote connectivity. The number of active cellular network connections from wearables is projected to grow from 23.8 million in 2018 to reach 176.8 million connections in 2023. The growth is mainly driven by increasing adoption of cellular connectivity in the smartwatch category. The most common connectivity option for wearable medical devices will be low power NFC technologies and Bluetooth which enable remote connectivity via medical monitoring system hubs. BYOD will have an increasing impact on the connected medical device category, especially for patient-driven models of connected care.

This report answers the following questions:

-

Which are the main device categories within connected wearables?

-

What are the main drivers on this market?

-

What are the general technology trends for connected wearables?

-

When will cellular connectivity be a common option in connected wearables?

-

Which connected wearables offer the best potential for embedded cellular connectivity?

-

Which are the leading wearables vendors?

-

How will the markets for smart watches and fitness trackers converge?

-

When will smart clothing become a success on the consumer market?

-

What new innovative wearables could become successes?

ページTOPに戻る

Table of Contents

Executive Summary

1 Introduction to wearable technology

1.1 Introduction

1.1.1 Background

1.1.2 Definitions

1.2 Market segments

1.2.1 Infotainment & lifestyle

1.2.2 Fitness & wellness

1.2.3 People monitoring & safety

1.2.4 Medical & healthcare

1.2.5 Enterprise & industrial

1.2.6 Government & military

1.3 Technologies and platforms

1.3.1 Mobile operating systems and platforms

1.3.2 Battery and processor technologies

1.3.3 Wireless technologies

1.3.4 Sensors

1.3.5 Display technologies and user interface

2 Value chain and vendor landscape

2.1 Enabling technologies

2.1.1 Hardware component vendors

2.1.2 Mobile operating system vendors

2.2 Devices

2.2.1 Smartphone and consumer electronics manufacturers

2.2.2 Apparel and accessories companies

2.2.3 Specialist vendors

2.3 Connectivity services and IoT platforms

2.3.1 Wireless operators and managed service providers

2.3.2 IoT platforms

2.4 Apps and content

2.4.1 Software application developers and content providers

3 Connected fitness and activity trackers

3.1 The connected fitness and activity tracking market

3.1.1 Market size and major vendors

3.1.2 Fitness and activity tracking wristbands

3.1.3 Connected sports watches

3.1.4 Smart clothing

3.1.5 Other form factors

3.2 Fitness and activity trackers and wireless connectivity

3.3 Company profiles and strategies

3.3.1 Athos

3.3.2 Digitsole

3.3.3 Fitbit

3.3.4 Garmin

3.3.5 Hexoskin

3.3.6 Huawei

3.3.7 Moov

3.3.8 OMsignal

3.3.9 Sensoria

3.3.10 Xiaomi

4 Smartwatches

4.1 The smartwatch market

4.1.1 Market size and the largest vendors

4.1.2 Smartwatch platforms

4.1.3 Smartwatches for children

4.2 Smartwatches and wireless connectivity

4.3 Company profiles and strategies

4.3.1 Apple

4.3.2 Blocks Wearables

4.3.3 hereO

4.3.4 Fossil

4.3.5 Laipac Technology

4.3.6 LG Electronics

4.3.7 Samsung

4.3.8 Withings

5 Smart glasses & head-mounted displays

5.1 The smart glasses and HMD market

5.1.1 Key vendors and market landscape

5.1.2 Virtual Reality headsets

5.2 Smart glasses and wireless connectivity

5.3 Company profiles and strategies

5.3.1 Daqri

5.3.2 Epson

5.3.3 Everysight

5.3.4 Google

5.3.5 Kopin

5.3.6 Microsoft

5.3.7 North

5.3.8 Optinvent

5.3.9 Oculus VR (Facebook)

5.3.10 Osterhout Design Group

5.3.11 Vuzix

6 Medical devices and mobile telecare

6.1 Medical devices

6.1.1 The mHealth and home monitoring market

6.1.2 Regulatory environment

6.1.3 Wearable medical devices and implants

6.2 Next-generation telecare and mPERS solutions

6.2.1 Mobile telecare and mPERS devices

6.3 Company profiles and strategies

6.3.1 BioTelemetry

6.3.2 Dexcom

6.3.3 Everon

6.3.4 GreatCall

6.3.5 Medtronic

6.3.6 MobileHelp

6.3.7 Navigil

6.3.8 Nortek

6.3.10 Preventice Solutions

6.3.11 Proteus Digital Health

7 Market forecasts and trends

7.1 Global market outlook

7.1.1 Market segments

7.1.2 Regional market data

7.1.3 Cellular connections

7.2 Market forecasts – smartwatches

7.3 Market forecasts – smart glasses & head-mounted displays

7.4 Market forecasts – fitness and activity trackers

7.5 Market forecasts – medical devices and mobile telecare

7.6 Market forecasts – other connected wearables

7.7 Market trends and drivers

7.7.1 Wearables are at the intersection of fashion and technology

7.7.2 The myriad of use cases is wearables’killer app

7.7.3 The voice-controlled user interface enters the wearables market

7.7.4 Wearables raise privacy and security concerns

7.7.5 Long-term engagement: bringing it all together

7.7.6 Continued M&A activities anticipated to take place in the wearables industry

7.7.7 Activity tracking wrist-bands face increasing competition

7.7.8 Consumerisation of medical-grade mHealth devices

7.7.9 New mobile telecare solutions open up market opportunities

Glossary

Press Release

[サマリー訳]

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「コネクテッドウェアラブル機器(第4版)」は、世界中の様々な市場で急速に拡大しているネットワーク接続するウェアラブル機器市場について調査している。ベルグインサイト社は、無線機能搭載のウェアラブルデバイスの世界の出荷数は2018年の1億1680万から年平均成長率(CAGR)15.4%で増加して、2023年には2億3850万になるだろうと予測している。予測期間終了時点でのセルラー搭載率は28.4%と予測している。

[サマリー原文]

Connected wearables are now becoming increasingly popular on many markets globally. Berg Insight estimates that worldwide shipments of wirelessly enabled wearable devices will grow from 116.8 million in 2018 at a compound annual growth rate (CAGR) of 15.4 percent to 238.5 million in 2023. The cellular attach rate at the end of the forecast period is forecasted to be 28.4 percent. Get up to date with the latest trends from all main product categories and regions with this unique 160 page report.

[プレスリリース原文]

2019-05-06

Shipments of connected wearables will reach 239 million in 2023

Berg Insight, the world’s leading M2M/IoT market research provider, today released new findings about the connected wearables market. Shipments of connected wearables reached 116.8 million worldwide in 2018. Growing at a compound annual growth rate (CAGR) of 15.4 percent, total shipments of smartwatches, smart glasses, fitness & activity trackers, smart clothing, mobile telecare and medical devices as well as other wearable devices are forecasted to reach 238.5 million units in 2023. Bluetooth will remain the primary connectivity option in the coming years. A total of 67.7 million of the wearables sold in 2023 are forecasted to incorporate embedded cellular connectivity, mainly in the smartwatch and telecare and medical device categories. The connected fitness & activity tracker segment is led by Chinese Xiaomi, which has been successful with its Mi Band fitness tracker. Fitbit, a pioneer in the segment, is still also among the largest vendors in the segment along with Huawei and Garmin. Berg Insight estimates that shipments in the segment reached 65.0 million units in 2018. This product category is now facing fierce competition from smartwatches that in most cases include activity tracking features. Apple entered the connected wearables market in Q2-2015 and quickly became the leading smartwatch vendor. In 2018, the company accounted for almost half of the total 45.5 million smartwatches sold during the year. “Apple continues to hold a firm grip on the smartwatch market and is at the forefront of innovation in the industry” says Martin Bäckman, IoT Analyst at Berg Insight.

The competition has responded with increasingly capable and attractive devices from Wear OS vendors including Fossil, LG and Huawei as well as from vendors betting on other platforms such as Fitbit and Samsung. The smartwatch segment is expected to surpass fitness & activity trackers and become the largest device category within wearable technology in terms of shipments in 2021. “Technology advancements, increased consumer awareness and wide availability of devices in different price segments will enable smartwatches to reach shipments of 117.7 million units in 2023” concludes Mr Bäckman. Sales of smart glasses and head-mounted displays have so far been modest, but promising use cases in professional markets as well as in niche consumer markets will enable it to become a sizeable connected wearable device category in the next five years. A number of vendors including Daqri, ODG, Epson, Google, Microsoft, Kopin and Vuzix are active in the segment. Standalone VR headsets from companies such as Oculus and HTC aimed for the consumer market are gaining traction and accounted for a large share of the total 1.5 million devices shipped in the segment during 2018. Berg Insight forecasts that shipments of smart glasses and head-mounted displays will reach 11.9 million units by 2023. Annual shipments of medical devices and mobile telecare/mPERS devices are forecasted to grow from 1.8 million devices in 2018 to 6.9 million devices in 2023. The segment includes wearables such as cardiac rhythm management devices, ECG monitors and mobile telecare devices. Finally, annual shipments of wearables not covered by the above product categories such as authentication and gestures devices, smart rings, wrist-worn computers and scanners, smart jewellery and connected prosthetics are predicted to grow from 3.0 million units in 2018 to reach 13.0 million units in 2023.

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「コネクテッドウェアラブル機器(第4版)」は、世界中の様々な市場で急速に拡大しているネットワーク接続するウェアラブル機器市場について調査している。ベルグインサイト社は、無線機能搭載のウェアラブルデバイスの世界の出荷数は2018年の1億1680万から年平均成長率(CAGR)15.4%で増加して、2023年には2億3850万になるだろうと予測している。予測期間終了時点でのセルラー搭載率は28.4%と予測している。

スウェーデンの調査会社ベルグインサイト社(Berg Insight)の調査レポート「コネクテッドウェアラブル機器(第4版)」は、世界中の様々な市場で急速に拡大しているネットワーク接続するウェアラブル機器市場について調査している。ベルグインサイト社は、無線機能搭載のウェアラブルデバイスの世界の出荷数は2018年の1億1680万から年平均成長率(CAGR)15.4%で増加して、2023年には2億3850万になるだろうと予測している。予測期間終了時点でのセルラー搭載率は28.4%と予測している。