Summary

Paumanok Publications, Inc. has published its 2024 study on NTC Thermistor markets, technologies and opportunities. Because of the dual use of NTC (Negative Temperature Coefficient) type thermistors as temperature sensors and circuit protection devices the component has found itself in significant demand in 2023 through year end with consumption in key end markets such as automotive, home appliances, digital electronics, industrial, and high-reliability end markets.

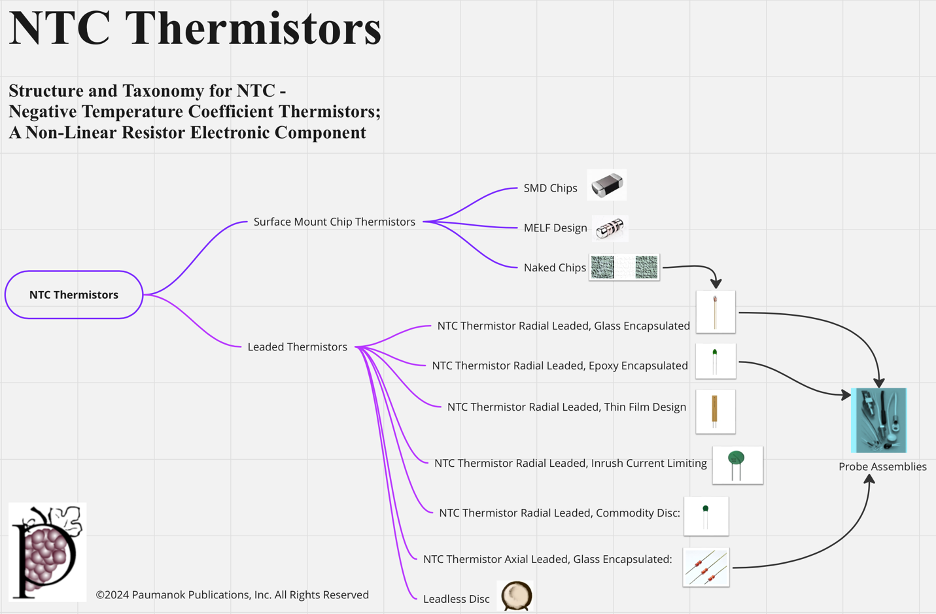

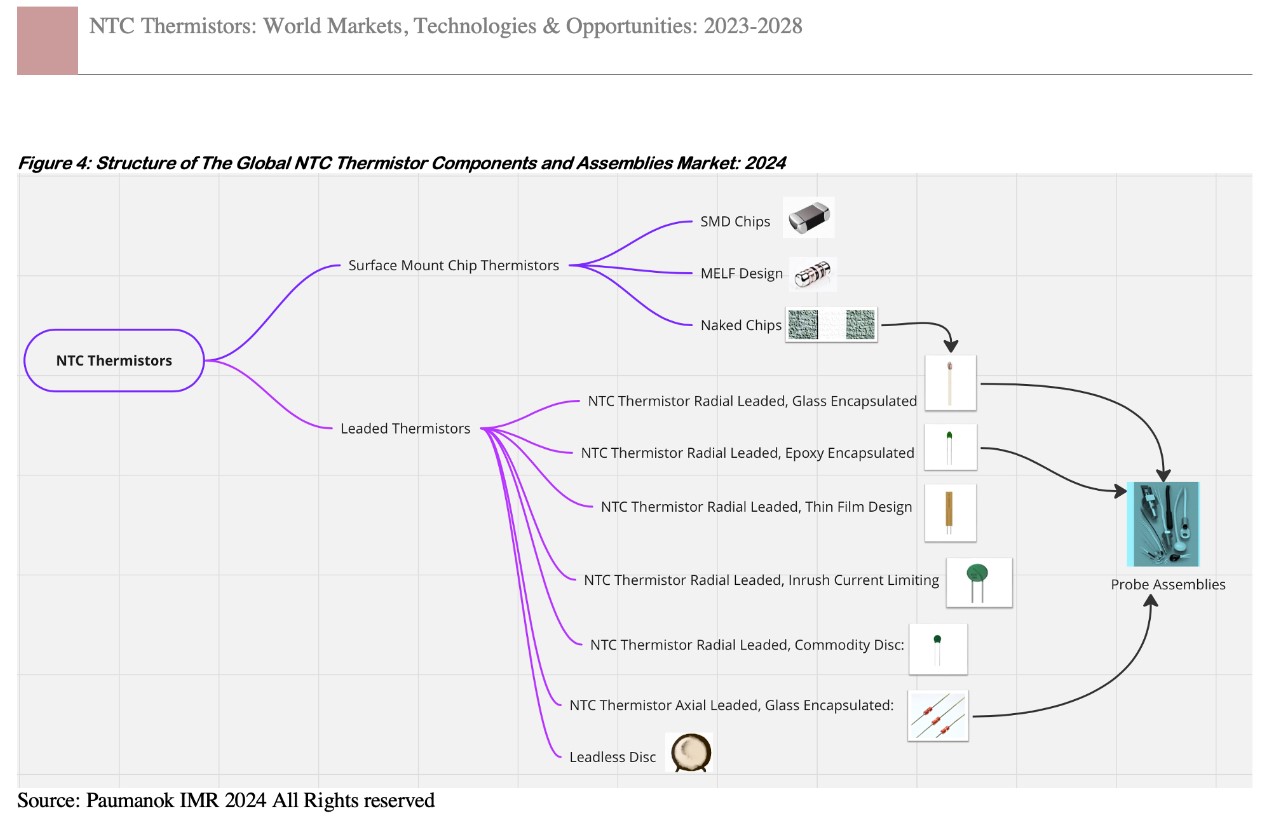

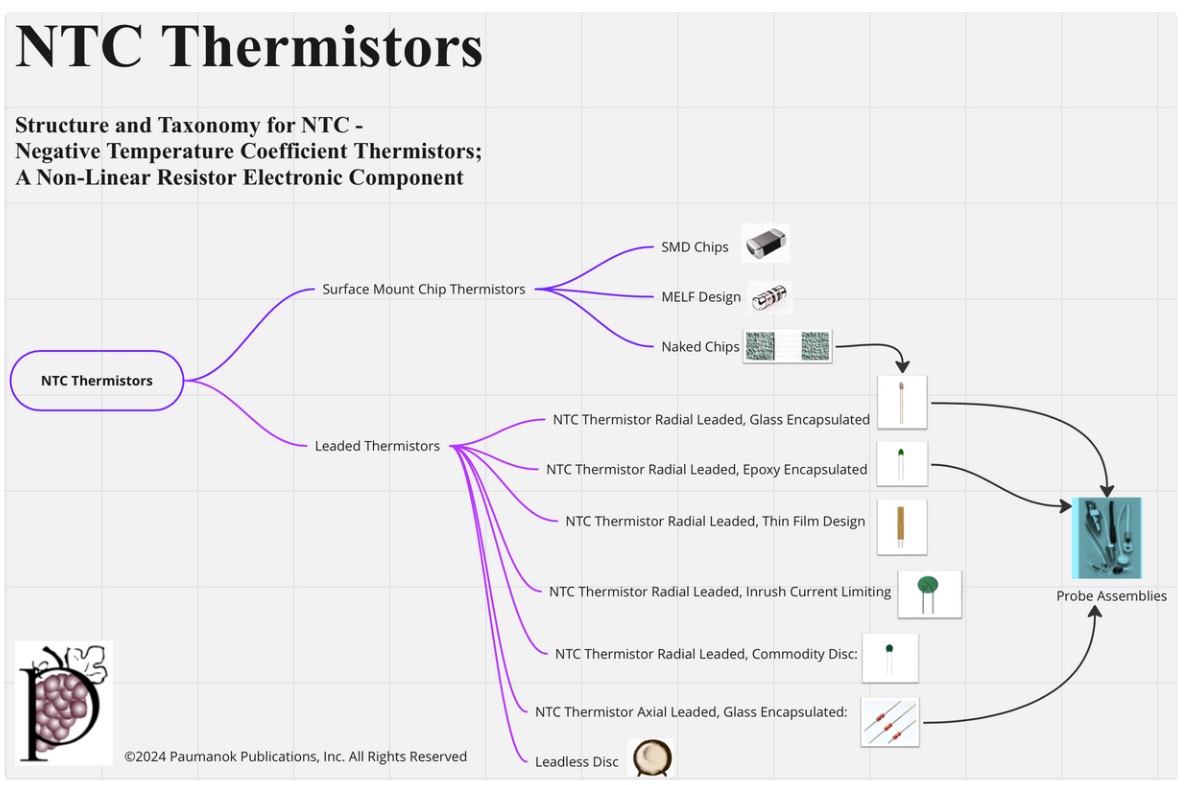

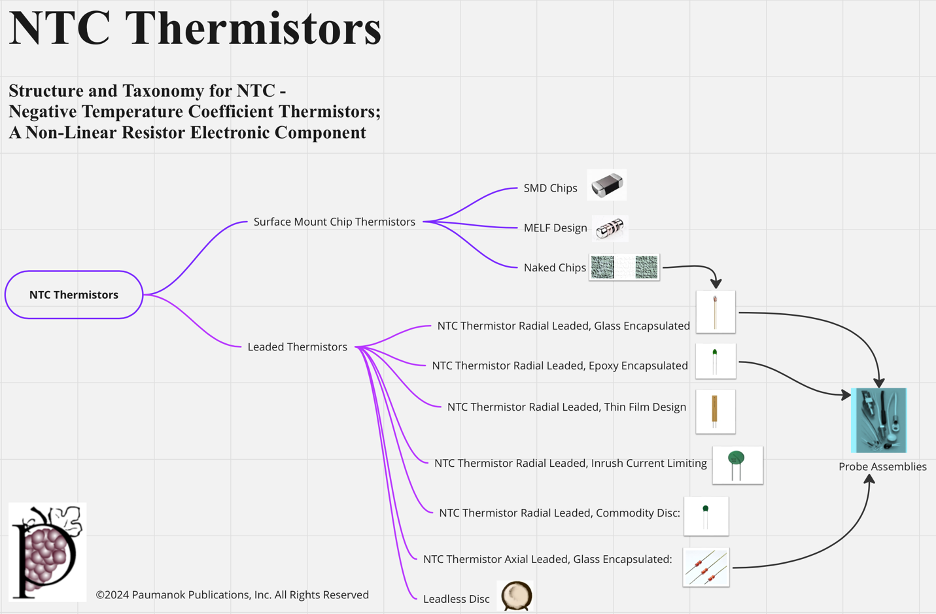

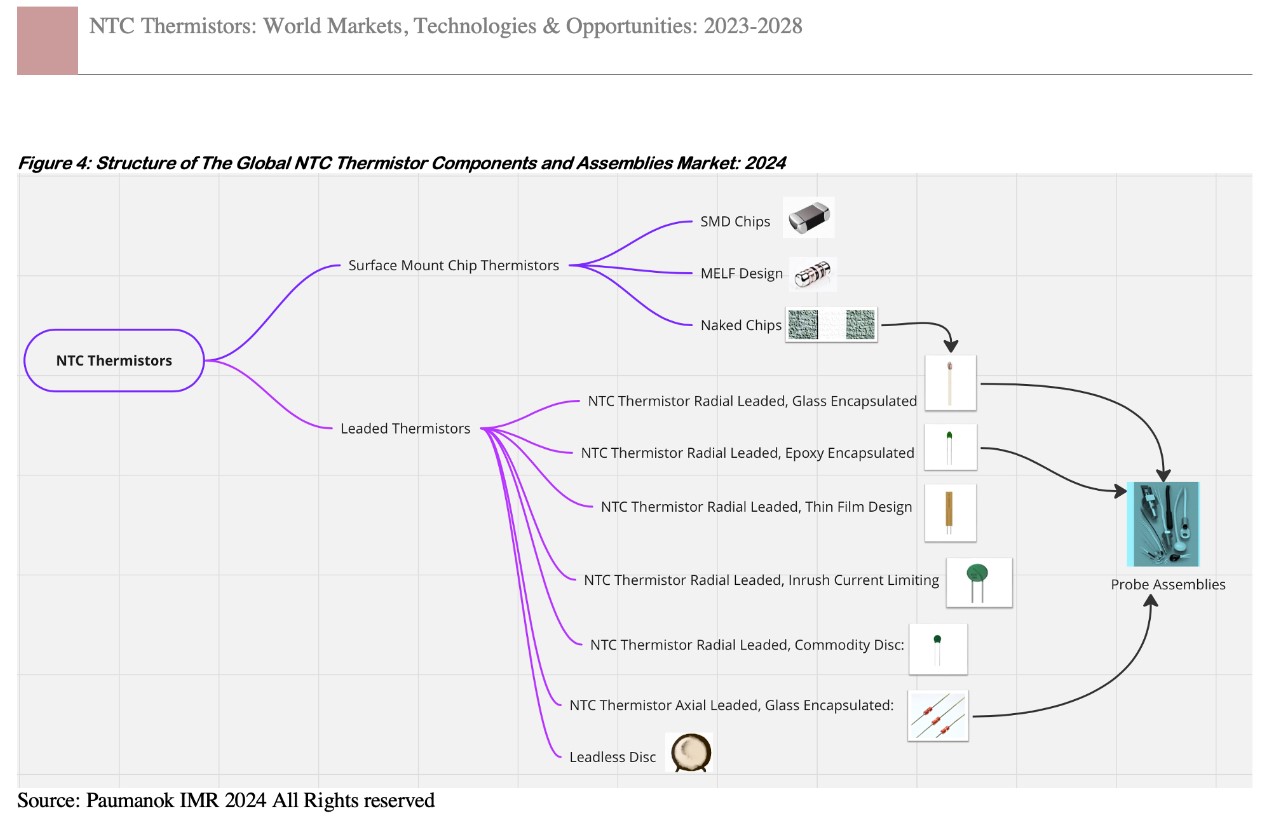

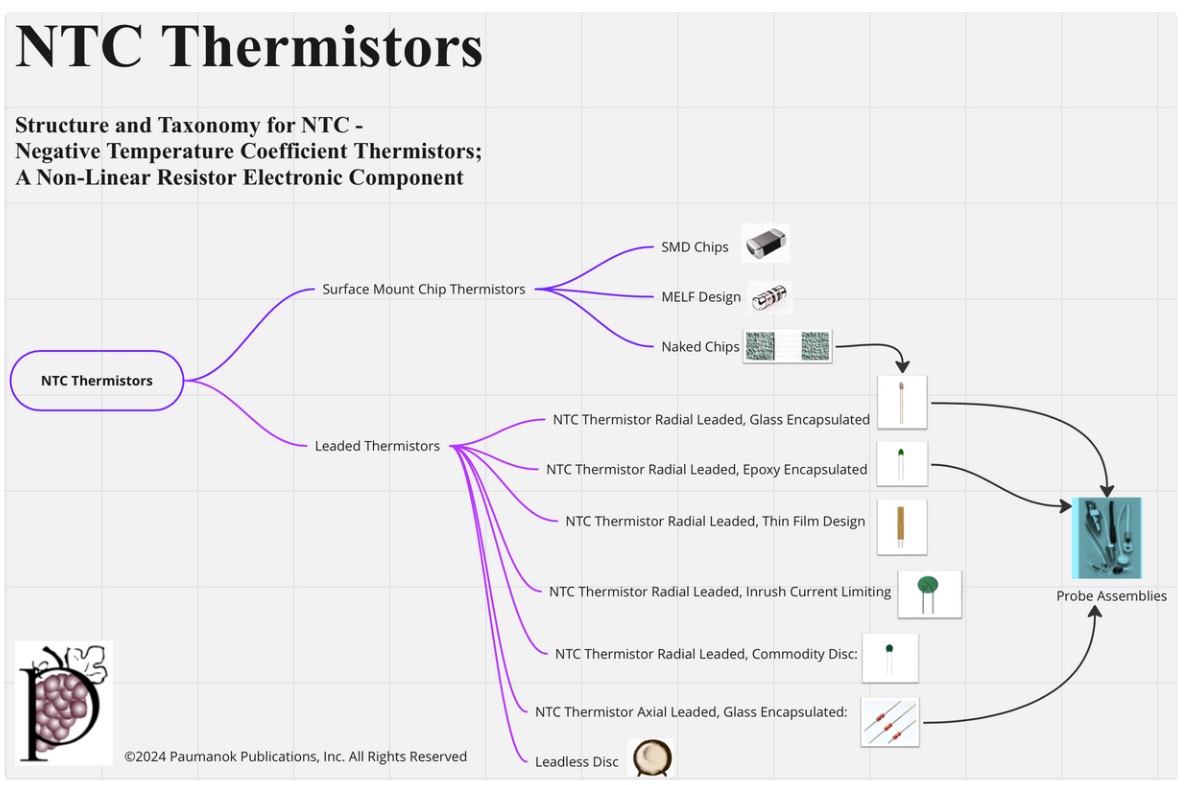

NTC Thermistor Products Covered-

The following NTC Thermistor product configurations are discussed in this report-

-

NTC Thermistor Radial Leaded, Glass Encapsulated

-

NTC Thermistor Radial Leaded, Epoxy Encapsulated

-

NTC Thermistor Radial Leaded, Inrush Current Limiting

-

NTC Thermistor Radial Leaded, Thin Film Design

-

NTC Thermistor Radial Leaded, Commodity Disc

-

NTC Thermistor Axial Leaded, Glass Encapsulated

-

NTC SMD Surface Mount Chip Thermistors in Ultra-Small to Large EIA Case Sizes

-

NTC Thermistor MELF Designs

-

NTC Thermistor Leadless Naked Chip

-

NTC Thermistor Leadless Discs

-

NTC Thermistor Probe Assemblies

NTC Thermistor End-Markets Covered: 2023-2028

The study also looks at the conversion of NTC thermistor components into probe assemblies and related markets in automotive, home appliance, digital electronics, industrial and specialty end-use market segments.

NTC Thermistor Markets In Automotive Electronics: 2023-2028

The study takes a detailed look at applications and end-markets for NTC thermistors in various automotive sub-assemblies including under-the-hood and beyond the firewall environments for temperature sensing and compensation.

NTC Thermistor Markets in Home Appliances: 2023-2028

The study also looks at the large and small home appliance business segment for NTC thermistors, including key sensing and compensation market applications in refrigerators and air conditioners as well as other large and small home appliances.

NTC Thermistor Markets In Digital Electronics: 2023-2028

This part of the study focuses on inrush current limiting applications for NTC thermistors (chip and disc) in power supplies. Power supplies are further consumed in computers, TV sets, lighting ballasts, DC Motors and IOT and backbone telecommunications infrastructure equipment.

NTC Thermistor Markets for High Reliability: 2023-2028

The study also focuses on thermistor markets in industrial, defense, space, medical, renewable and oil & gas electronics markets and focuses specifically on emerging opportunities for thermal sensing of battery electric systems.

NTC Thermistor Markets and Competition By Technology:2024

The “Competition by Technology” segment of the report analyzes competition among the top 33 NTC thermistor vendors based upon NTC thermistor sub-type and component configuration, NTC chip case size, and competition by end-use product market segment.

NTC Thermistor Vendor and Distributor Relationships: 2024

This section of the report notes the product lines for NTC thermistor line cards for the world’s top electronic component distributors. The study compares and contrasts the differences between major and specialty distributors and how they market NTC thermistors.

NTC Thermistor Vendor Market Shares:

The study shows global sales and market share for NTC thermistor Vendors.

NTC Thermistor MARKET FORECASTS: 2023-2028:

The forecast segment offers estimated for consumption of NTC thermistors between 2023 and 2028 in terms of value, volume and pricing as well as demand by world region and end-use market segment to 2028. 148 Pages; 35 Tables and Graphs,33 Producer Profiles; Published January 2024; Price: $3750.00 USD. Updates Paumanok IMR Prior editions under the same ISBN in ©1993 ©1998 ©2002 ©2005 ©2008 ©2010 ©2015 ©2021.

ABOUT NTC THERMISTORS- NTC thermistors demonstrate a decrease in resistance when subjected to an increase in temperature. This makes them unique in their functionality compared to other electronic components. It also makes them unique in their exposure to specific end-markets such as automotive and home appliance market segments. This study addresses the global market for NTC thermistors by type, configuration, application, world region, competition, and contains forecasts to 2028.

ページTOPに戻る

Table of Contents

NTC THERMISTORS: 2024-2029 GLOBAL MARKET OUTLOOK: 18

1.0 INTRODUCTION TO NTC THERMISTOR MARKETS, TECHNOLOGIES & OPPORTUNITIES: 2024-2029 18

1.1 About The Author 18

1.2 Scope of Report Coverage: 18

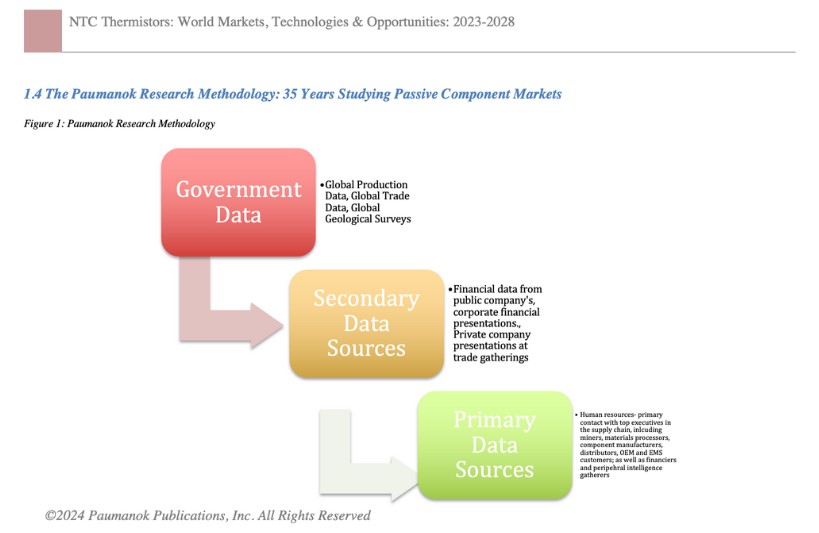

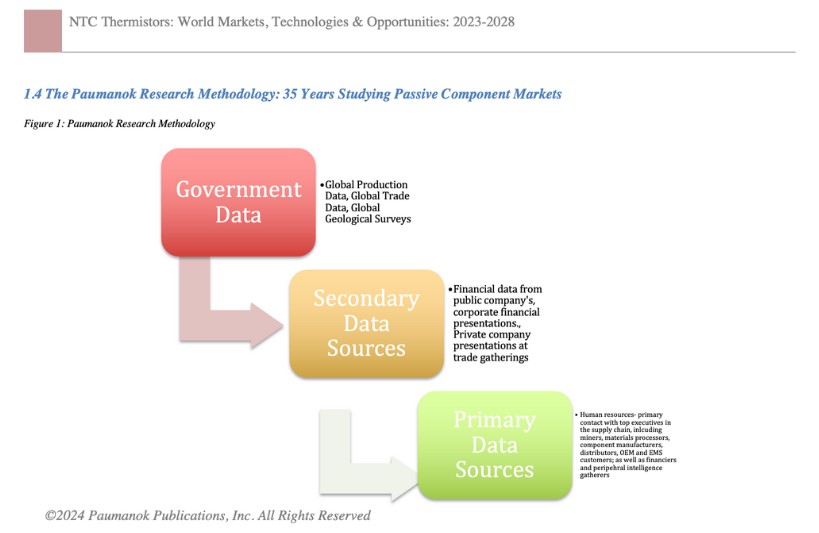

1.3 Research Methodology Employed: 19

1.4 The Paumanok Research Methodology: 27 Years Studying Passive Component Markets 20

1.3.1 Government Data Collection and Resources: 21

1.3.2 Secondary Published Sources: 21

1.3.3 Primary Intelligence Gathering: 21

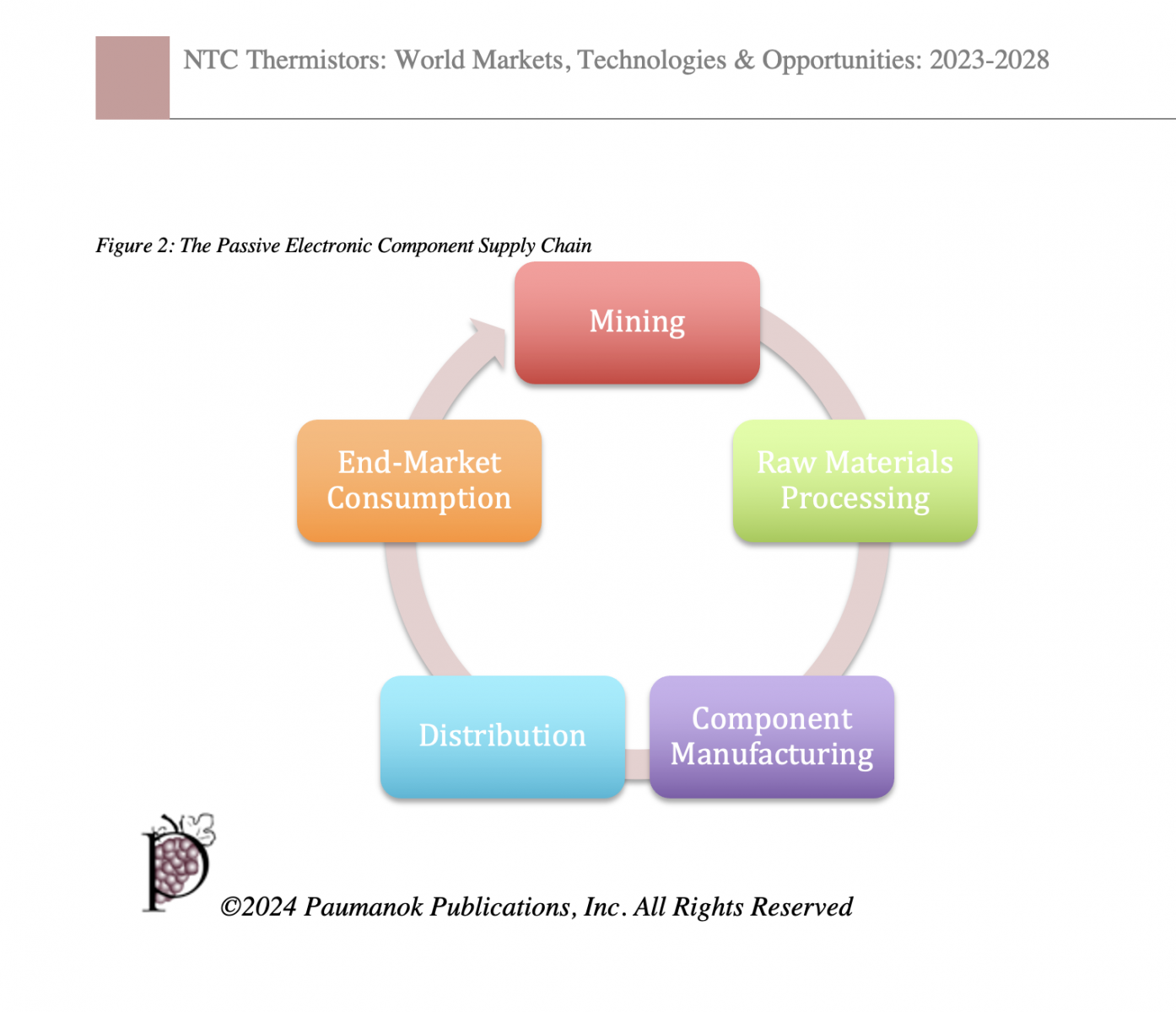

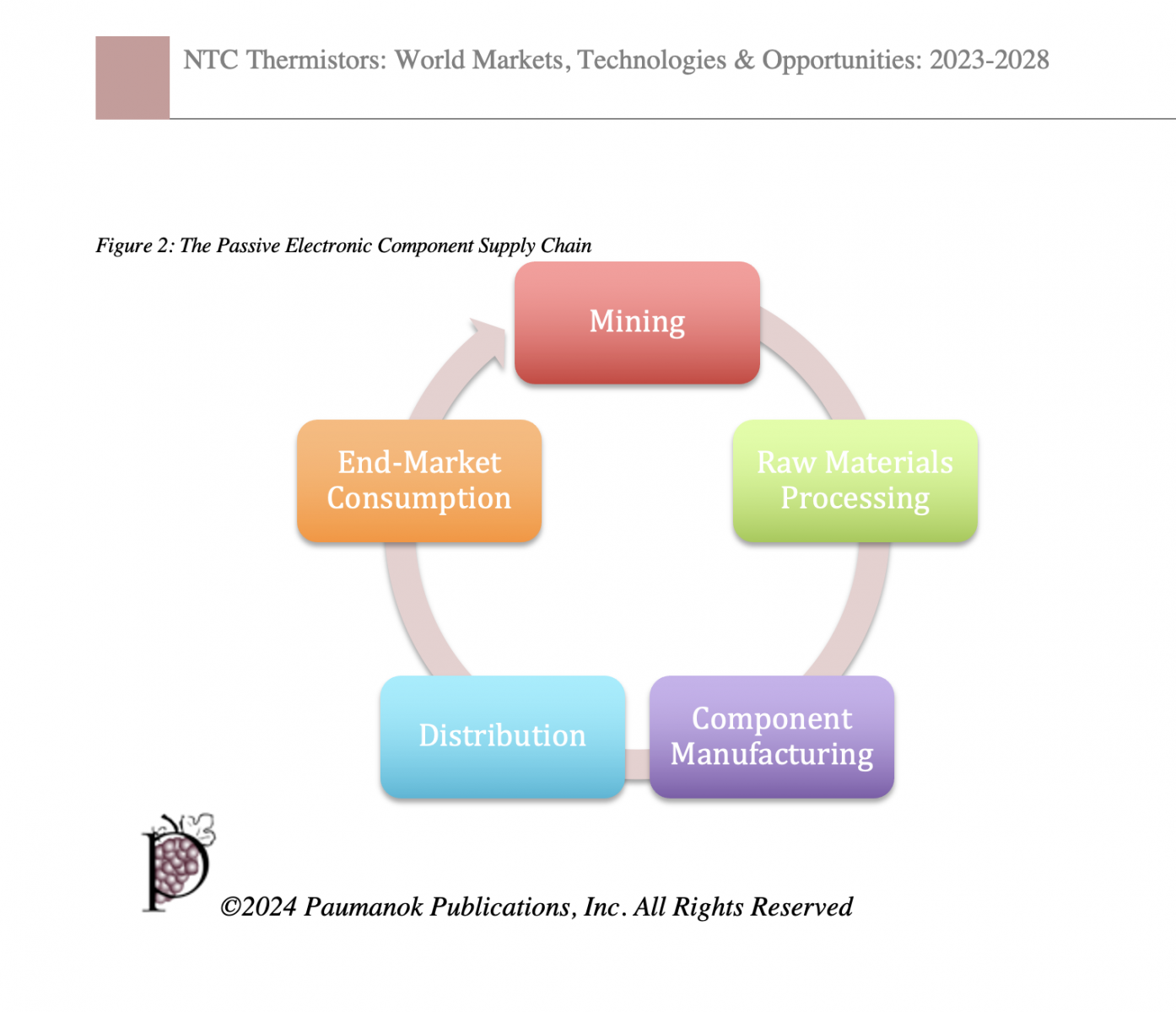

1.4 The Passive Component Supply Chain: 21

1.4.1 Mining of Raw Materials: 22

1.4.2 Raw Materials Processing: 23

1.4.3 Component Manufacturing: 23

1.4.4 Component Distribution: 23

1.4.5 End-Market Consumption: 24

1.4.6 Recycling of Critical Materials: 24

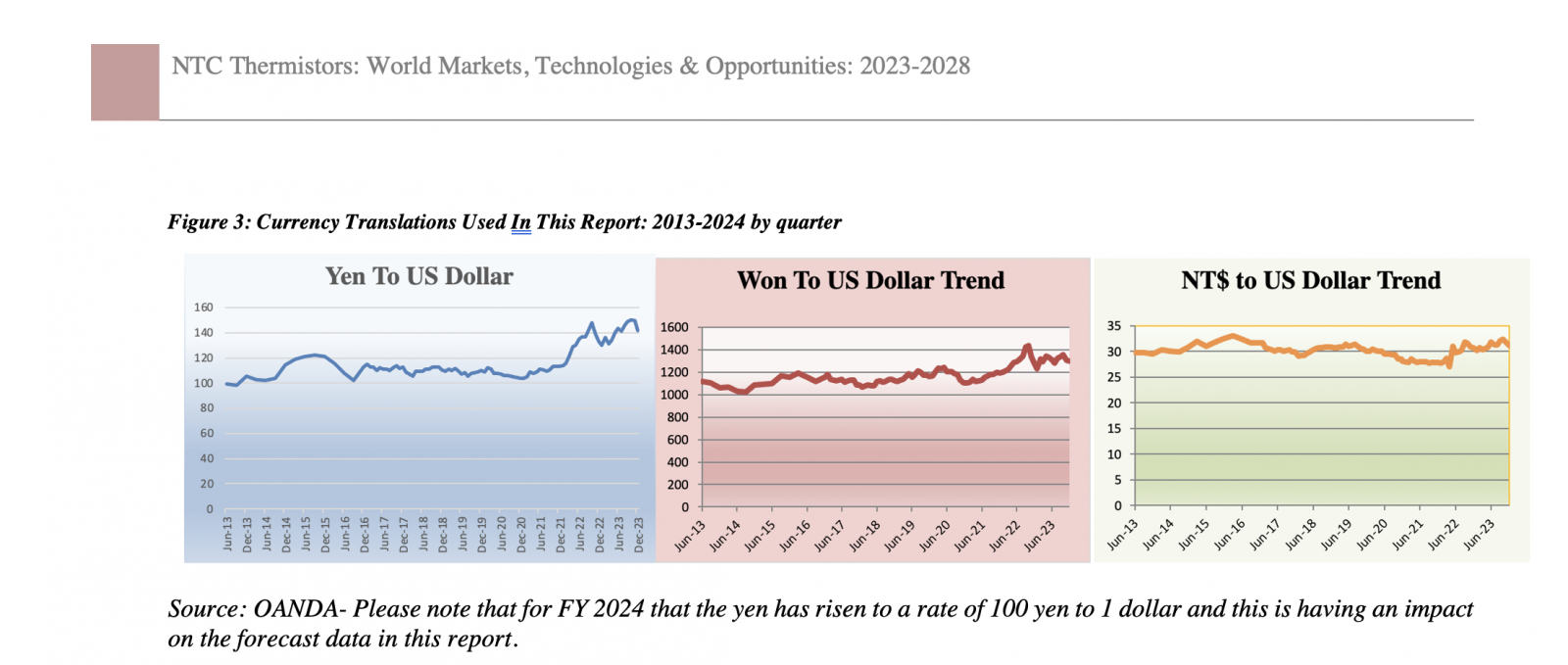

1.5 FINANCIAL CONSIDERATIONS WITH RESPECT TO THIS REPORT: 25

1.5.1 Fiscal Year Reporting 25

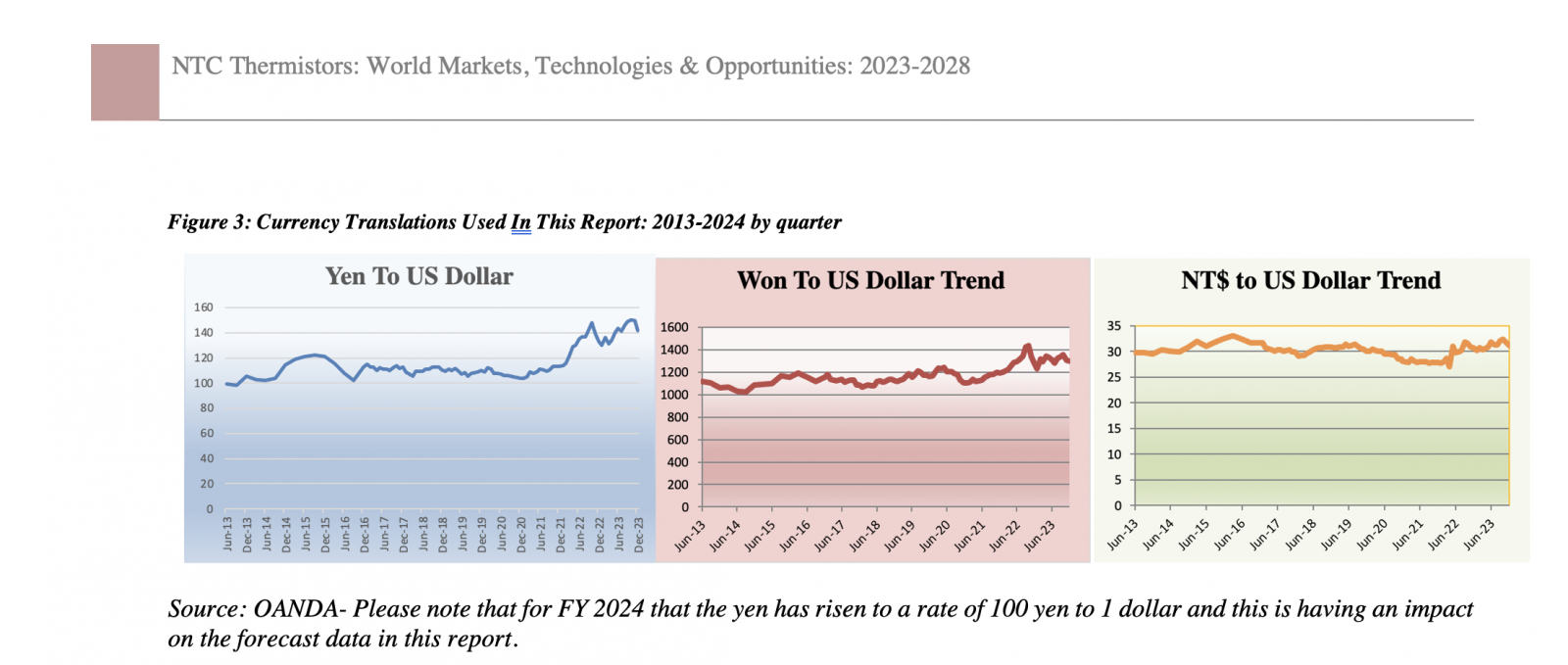

1.5.2 Currency Translation 25

1.5.3 Volume, Value and Pricing Data: 26

1.5.4 Forecasting Methodology: Fundamental Aspects of the 20 Year Growth Cycle In Passive Components: 26

1.6 UNDERSTANDING THE CURRENT GLOBAL ECONOMIC ENVIRONMENT: FY 2024 27

1.6.1 Global Economic Conditions and Outlook To 2029: 27

1.6.2 Positive Market Indicators: 28

1.6.3 Negative Market Indicators: 28

1.6.4 Overall Outlook To 2029: 29

1.6.5 Changing View on Unit Sales to 2029: 29 Greater Reliance on Emerging Markets For Passive Components Going Forward 30

1.7 KEY FINDINGS OF THIS REPORT: 30

2.0 INTRODUCTION AND NTC PRODUCT DESCRIPTION: 32

2.1 Recent Changes In The Global NTC Thermistor Markets: 32

2.2 Lasting Affects of The Tohoku Quake on The NTC Thermistor Supply Chain 32

2.3 Lasting Affects of The Thailand Flooding on The Thermistor Supply Chain 33

2.4 Automotive Manufacturers Encourage More Market Entrants Into The NTC Thermistor Supply Chain 33

2.5 Important Impact of Recent Acquisitions on the NTC Thermistor Markets Worldwide: 33

2.5.1 Historical Merger and Acquisition Activity Impacting The NTC Thermistor Markets: 34

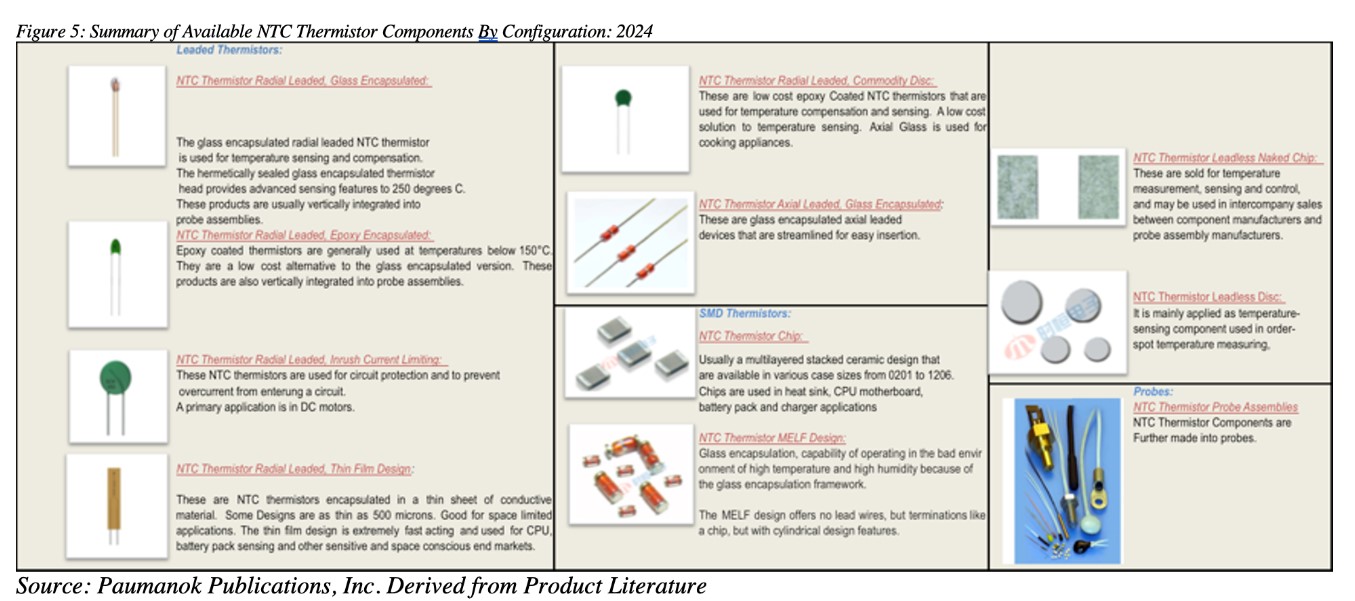

2.6 NTC Thermistor Product Descriptions: 34

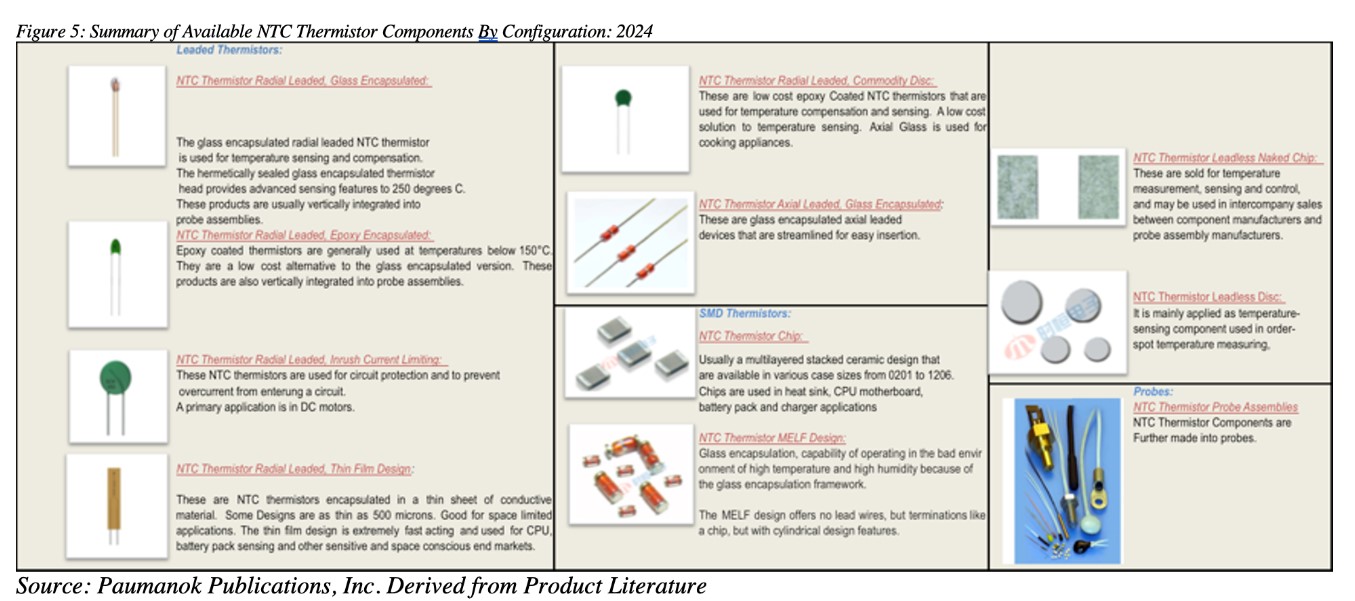

2.6.1 Leaded Thermistors: 34

2.6.1 (A) NTC Thermistor Radial Leaded, Glass Encapsulated: 35

2.6.1 (B) NTC Thermistor Radial Leaded, Epoxy Encapsulated: 35

2.6.1 (C ) NTC Thermistor Radial Leaded, Inrush Current Limiting: 36

2.6.1 (D) NTC Thermistor Radial Leaded, Thin Film Design: 36

2.6.1 (E) NTC Thermistor Radial Leaded, Commodity Disc: 37

2.6.1 (F) NTC Thermistor Axial Leaded, Glass Encapsulated: 37

2.6.2 Surface Mount Thermistors: 38 The NTC Thermistor Chip 38

2.6.2 (A) NTC Thermistor Chip: 38

2.6.2 (B) NTC Thermistor MELF Design: 39

2.6.2 (C ) NTC THERMISTOR LEADLESS NAKED CHIP: 39

2.6.2 (D) NTC Thermistor Leadless Disc: 40

2.7 Value-Added Module, Probes and Probe Assemblies: 40

2.8 Summary of NTC Thermistor Configurations: 2024 41

2.8 NTC Thermistor Production Process: 42

2.9 Raw Material Usage & Supply (Cr, Mn, Fe, Co and Ni): 43

2.10 NTC Thermistors: Circuit Applications: 2024 43

2.11 Temperature Sensing Markets: 43

2.11.1 NTC Thermistor Usage Volume Per Application for Temperature Sensing (Auto, Appliance, Specialty) 44

2.12 Temperature Compensation Markets: 44

2.12.1 NTC Thermistor Usage Volume Per Application for Temperature Compensation (Digital Electronics): 44

2.13 Inrush Current Limiting Markets: 45

2.13.1 NTC Thermistor Usage Volume Per Application for Inrush Current Limiters (Industrial and Digital Electronics) 45

3.0 END-USE MARKET SEGMENT OVERVIEW FOR NTC THERMISTORS: 2024 45

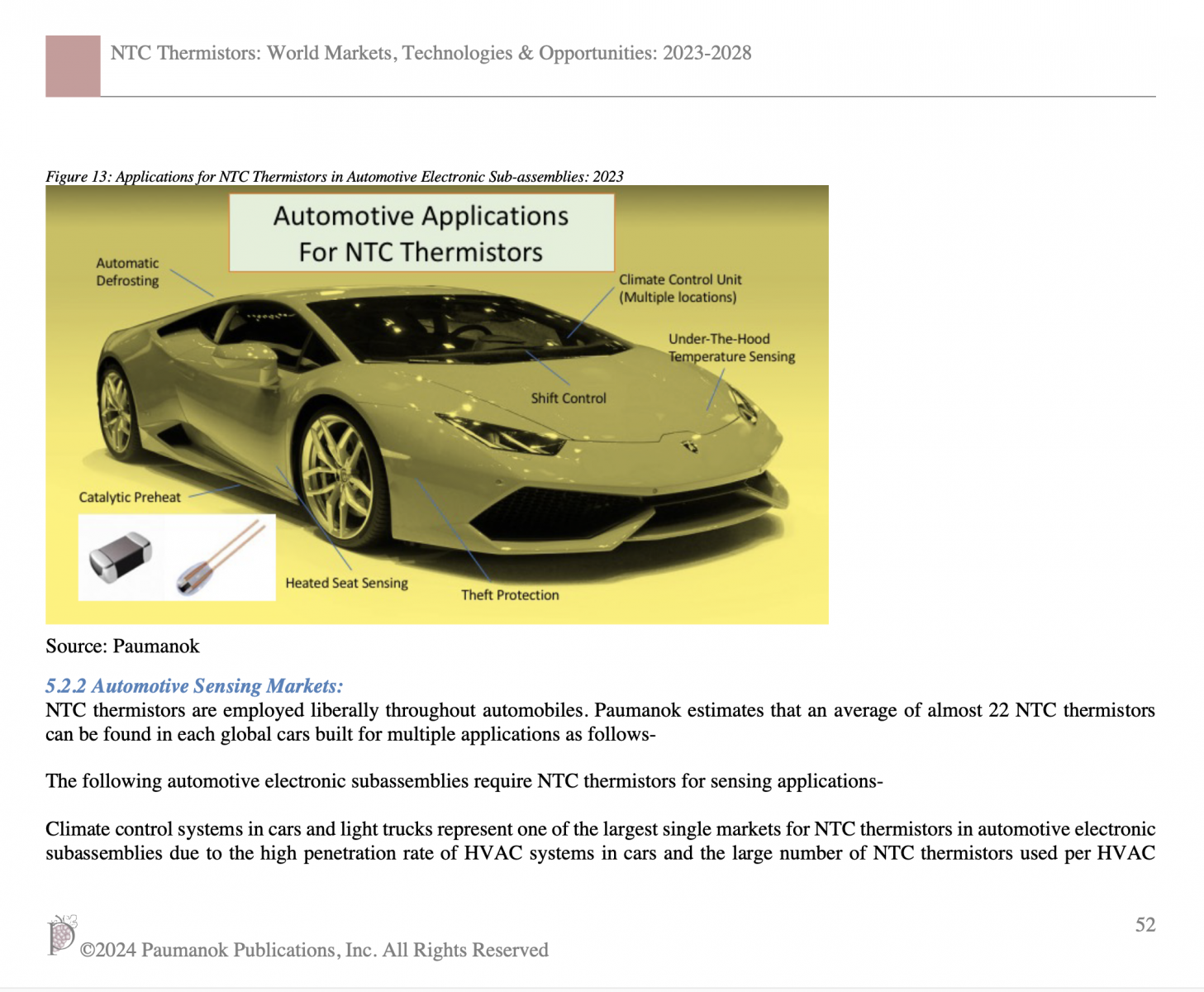

3.1 AUTOMOTIVE: 45

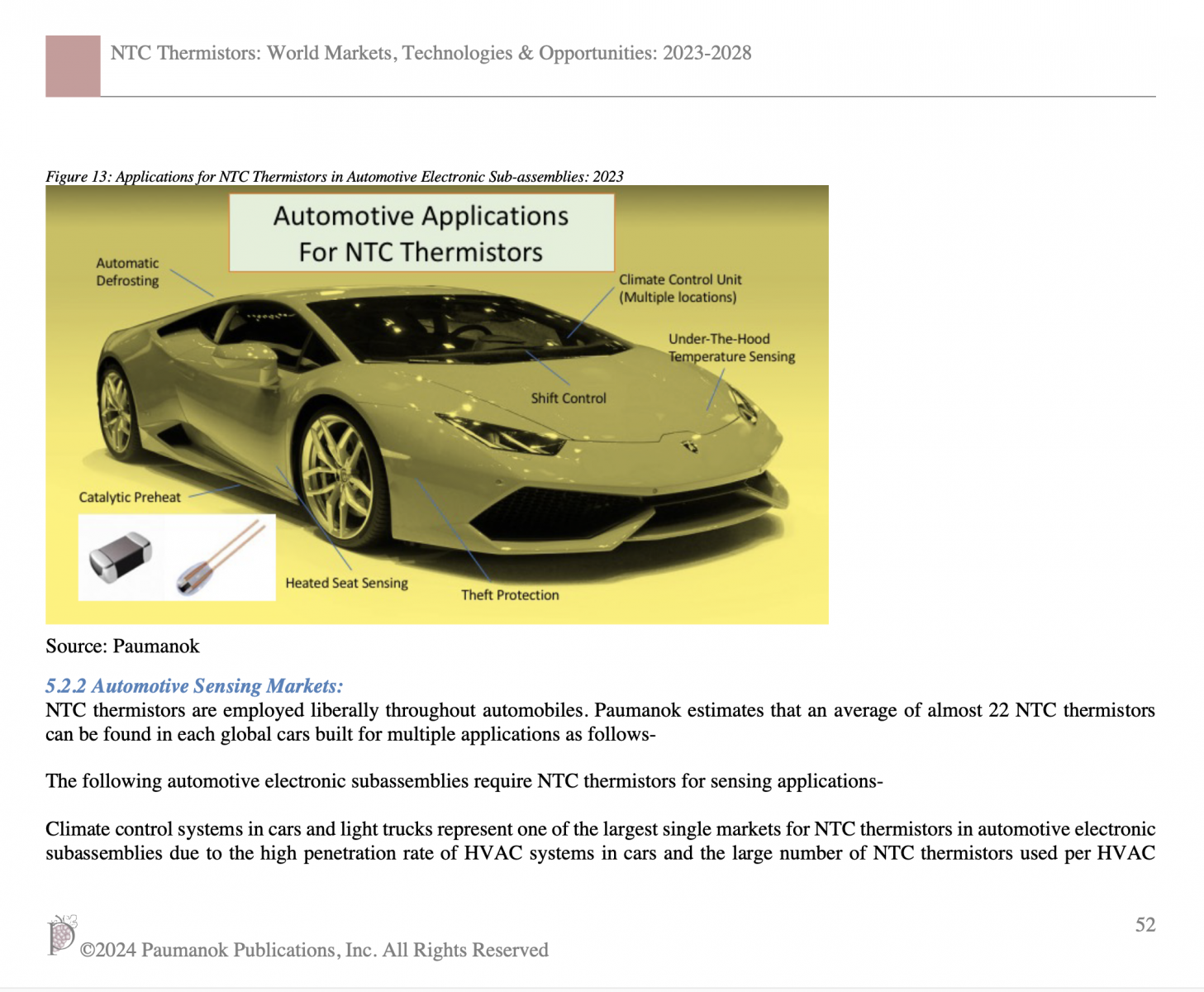

3.1.1 Applications for NTC Thermistors in Automotive Electronic Subassemblies: 45

3.2 HOME APPLIANCES: 46

3.2.1 Applications for NTC Thermistors in Home Appliances: 46

3.3 DIGITAL ELECTRONICS: 46

3.3.1 Applications for NTC Thermistors in Digital Electronics: 47

3.4 INDUSTRIAL ELECTRONICS: 47

3.4.1 Applications for NTC Thermistors in Industrial Electronics: 47

3.5 SPECIALTY ELECTRONICS: 48

3.5.1 Applications for NTC Thermistors in Medical and Defense Electronics: 48

4.0 NTC THERMISTORS: WORLD MARKETS: 2024 51

4.2 Historical NTC Thermistor Consumption Worldwide: 1998; 2013; 2024 Forecasts 52

4.3 Global NTC Thermistor Consumption Value, Volume & Average Unit Pricing: 1998-2013; 2024 Forecasts 53

4.4 Global NTC Thermistor Value Shipments: Sixteen- Year Market Summary: 1998-2013; 2024 Forecasts 53

4.5 NTC Thermistor Consumption Value (All Types): 1998-2024 54

4.6 Global NTC Thermistor Volume Shipments: Thirteen- Year Market Summary: 1998-2013; 2024 Forecasts 54

4.7 NTC Thermistor Consumption Volume (All Types & Configurations): 1998-2013; 2024 Forecasts 56

4.8 Global NTC Unit Pricing: Sixteen- Year Market Summary: 1998-2013; 2024 Forecasts 57

4.9 NTC Thermistor Unit Pricing Trend: 1998-2013; 2024 Forecasts 57

5.0 NTC THERMISTORS: END-USE MARKETS: 2024 58

5.1 Global Market Breakdown for NTC Thermistors: 2024 58

5.1.1 NTC Thermistor Consumption Value and Volume By End-Use Market Segment: Global Market Summary: 2024 58

5.2 AUTOMOTIVE MARKETS FOR NTC THERMISTORS: 2024 UPDATE 60

5.2.1 Applications for NTC Thermistors in Automotive Electronic Subassemblies: 60

5.2.2 Automotive Sensing Markets: 60

5.2.3 Solar Sensor: 61

5.2.4 Ambient temperature sensor: 61

5.2.5 Interior temperature sensor: 62

5.2.6 Coolant temperature sensor: 62

5.2.7 Evaporator sensor: 62

5.2.8 Automotive OE Climate Control Systems: 62

5.2.9 Automotive OE Liquid Control: 62

5.2.10 Battery Temperature Sensor 63

5.2.11 Electronic Fuel Injection 63

5.2.12 Heated Seat Temperature 64

5.2.13 Automatic Defrost Systems 64

5.2.15 Catalytic Converter Pre-Heat: 65

5.2.16 NTC Thermistors and Theft-Protection Devices: 65

5.2.17 NTC Thermistors and Shift Control Systems: 65

5.2.18 Changes In The Global Automotive Markets- Impact on NTC Thermistor Demand 65

5.2.18.1 Global Car, Truck and Bus Production Volume By Country: 2024 YE Forecasts By Country 66

5.2.18.2 Global Car, Truck and Bus Production Volume By Country: 2024 YE Forecasts By World Region 66

5.2.18.3 NTC Thermistor Consumption Value and Volume By Automotive Subassembly: 2024 Forecasts 67

5.2.18.4 FORECASTS: NTC Thermistor Consumption Value and Volume By Automotive Subassembly: 2024 -2029 Forecasts 69

5.3 HOME APPLIANCE MARKETS FOR NTC THERMISTORS: 2024 UPDATE 70

5.3.1 Cooking Appliance Control System Applications for Thermistors 70

5.3.2 Refrigerator Temperature Control Applications for Thermistors 71

5.3.3 Washing & Drying Appliance Temperature Control Applications for Thermistors (Clothes and Dishes): 71

5.3.4 Small Home Appliance Markets: 2024 71

5.3.5 Heat & Humidity Sensors in Small Home Appliances: 72

5.3.6 Large Home Appliance Consumption By Key Country and World Region: 2024 72

5.3.7 Value and Volume of NTC Thermistor Consumption By Appliance Type: 2024 74

5.4 DIGITAL ELECTRONICS MARKETS FOR NTC THERMISTORS: 2024 UPDATE 74

5.4.1 Power Supplies & DC/DC Converters: 75

5.4.2 Computer/Business Machines 75

5.4.3 Telecommunications 75

5.4.4 (A) Value and Volume of NTC Thermistor Consumption By Product Type in Digital Electronics: 2024 76

5.5 INDUSTRIAL ELECTRONICS MARKET FOR NTC THERMISTORS: 2024 UPDATE 76

5.5.2 Electronic Ballasts 77

5.2.5 Industrial Electronics End-Markets For NTC Thermistors: 2024 78

5.6 MEDICAL ELECTRONICS MARKETS FOR NTC THERMISTORS: 2024 UPDATE 79

5.7 DEFENSE AND SPECIALTY ELECTRONICS MARKETS FOR NTC THERMISTORS: 2024 UPDATE 79

5.8 Additional Electronics Markets For NTC Thermistors: 80

6.0 NTC THERMISTORS: WORLD REGIONS: 80

6.1 NTC Thermistor Sales By World Region: 2024 80

6.1.1 Global Consumption Value for NTC Thermistors by World Region (Asia-Pacific, Americas, Europe): 2024 Estimates 81

6.1.1 (A) Asia-Pacific Markets For NTC Thermistors: 2024 81

6.1.1 (B) American Markets for NTC Thermistors: 2024 82

6.1.1 (C ) European Markets for NTC Thermistors: 2024 82

7.0 NTC THERMISTORS: MARKETS BY CONFIGURATION: 82

7.1 Global Consumption Value for NTC Thermistors By Component Configuration: 2024 82

7.1.1 Radial Leaded and Disc NTC Thermistor Component Markets Versus SMD Chips: 2024 82

7.1.2 NTC Thermistor Consumption Value and Volume By Configuration (Throughole Versus SMD Chip): 2024 83

7.1.3 Consumption of Radial Leaded NTC Thermistors By Type: 2024 83

7.1.3 (A) Epoxy Molded, Thin Lead NTC Thermistor Markets: 2024 83

7.1.3 (B) Inrush Current Limiter Markets: 2024 84

7.1.3 (C ) Glass Hermetic Sealed, Thin Lead NTC Thermistor Markets: 2024 84

7.1.3 (D) Commodity Disc Thermistors: 2024 Markets 84

7.1.3 (E) Thin Film Radial Leaded NTC Thermistors: 2024 Markets 84

7.1.4 SMD Chip Thermistor Market Volume and Value: 2024 85

7.1.4 (A) Consumption of SMD NTC Thermistor Chips By Case Size: 2024 86

7.1.5 NTC Thermistors: Conversion Markets In Probe Assemblies: 2024 87

7.1.5 (A) Automotive, Large Home Appliance and Specialty Probe Assembly Markets: 2024 87

7.1.6 Global Market for Probe Assemblies as a Subset of the Worldwide NTC Thermistor Markets: 2024 88

8.0 NTC THERMISTORS: COMPETITION: 2024 89

8.1 NTC THERMISTOR COMPETITIVE ENVIRONMENT: 2024 89

8.1.1 NTC Thermistor Vendors by Component Configuration (Chip, Disc, Leadless, ICL, Axial, Thin Film, Hi-Rel and Probe Assembly): 2024 89

8.1.2 Radial Leaded NTC Thermistors: Competition by Type: 2024 91

8.1.3 NTC Thermistor Chips: Competition By Case Size: 2024 93

8.1.4 NTC Thermistor Competitive Environment By Market Sub-Category (Product Markets For NTC Thermistors By Vendor): 2024 94

8.1.5 NTC Thermistor Suppliers: 2013 CY Sales & Market Shares 96

9.0 NTC THERMISTORS: WORLD MARKET FORECASTS: 2024-2029: 98

9.1 NTC Thermistor Global Market Forecasts: 2024-2029 (Value, Volume and Pricing) 98

9.1.1 NTC Thermistors: Global Market Forecasts for Value, Volume and Prices: 2024-2029 98

9.2 NTC Thermistors: Changes In Global Consumption By End-Use Market Segment: 2024-2029 Forecasts 98

9.2.1 NTC Thermistor Consumption Value By End-Use Market Segment: 2024-2029 99

9.3 Shifts In NTC Thermistor Consumption By World Region: 2024-2029 99

9.3.1 Global NTC Thermistor Consumption By World Region: 2024-2029 100

9.4 MARKET OPPORTUNITIES FOR MANUFACTURERS OF NTC THERMISTORS: 2024-2029 100

9.5 Emerging Markets For NTC Thermistors in the Internet of Things: 101

9.5.1 Dichotomizing the Growing List of IoT Devices: 101

9.5.1 (A) Wearable Electronics and Related Product Lines: 102

9.5.1 (B) Dwelling Electronics and Related Product Lines: 102

10.0 NTC THERMISTORS: PRODUCER PROFILES 104

10.1 INTRODUCTION TO THE WORLD’S TOP NTC THERMISTOR MANUFACTURERS: 104

10.2 BETATHERM 104

10.2.1 BETATHERM CORPORATION (NTC) {MEASUREMENT SPECIALTIES, INC.} 104

10.2.1 (A) Betatherm: Company Description: 104

10.2.1 (B) Acquisition by Measurement Specialties: 105

10.2.1 (C ) Betatherm: Circuit Protection Product Portfolio: 105

10.2.1 (D) Betatherm: Plant Locations: 105

10.2.1 (E) Betatherm-Revenues: 105

10.2.1 (F) About Betatherm’s-Parent Company: 105

10.2.1 (G) Revenue Growth at BetaTherm’s Parent Company- Measurement Specialties 106

10.2.1 (H) MEAS Revenues By Product Line: 2013 107

10.2.1 (I) MEAS Revenues By End-Use Market Segment: 2013 108

10.2.1 (J) MEAS Revenues By World Region: 2013 108

10.2.1 (K) MEAS Targeting Growth Markets: 2024-2029 109

10.2.1 (L) MEAS New Product and Materials Developments: 110

10.3 GE SENSING 110

10.3.1 GE SENSING & INSPECTION TECHNOLOGIES (NTC/PTC) 110

10.3.1 (A) Thermometrics Plant 111

10.3.1 (B) GE-Sensing: About This Company 111

10.3.1 (C ) GE Sensing: Product Lines 112

10.3.1 (D) GE Thermometrics Product Line 113

10.3.1 (D1) SMD Thermistors 113

10.3.1 (D2) NTC Glass Thermistors 113

10.3.1 (D2) Inrush Current Limiting 114

10.3.1 (D3) PTC Thermistors 114

10.3.1 (E) GE Thermometrics End-Market Applications: 114

10.3.1 (E1) Medical Assemblies 114

10.3.1 (E2) Transportation Assemblies 114

10.3.1 (E3) Industrial Assemblies 114

10.3.1 (G) GE Sensing: Strategies: 115

10.4 HONEYWELL 115

10.4.1 HONEYWELL SENSING AND CONTROL (NTC): 115

10.4.1 (A) About This Company: 115

10.4.1 (A1) Sensing & Control Division: 116

10.4.1 (A2) NTC Thermistor Product Portfolio: 116

10.5 HUICHANG ELECTRONICS 116

10.5.1 HUICHANG ELECTRONICS COMPANY LTD. (CHANGZHOU) (NTC): 116

10.5.1 (A) About This Company: 117

10.5.1 (B) Huichang Production Capabilities: 117

10.5.1 (C ) Huichang Major Customers: 118

10.5.1 (D) Huichang Certifications: 118

10.5.1 (E) Huichang Trends and Directions: 118

10.6 HUICHANG SENSOR 118

10.6.1 CHANGZHOU HUICHANG SENSOR COMPANY LIMITED (NTC) 118

10.6.1 (A) About This Company: 119

10.6.1 (B) Thermistor Output: 119

10.6.1 (C ) Product Lines: 119

10.6.1 (D) Market Focus: 119

10.7 HONGZHI 119

10.7.1 SHANTOU HONGZHI ENTERPRISES CO. LTD. (MOV/NTC) 119

10.7.1 (A) About This Company: 120

10.7.1 (B) Hongzhi Circuit Protection Products: 120

10.7.1 (C ) Hongzhi: Production Capabilities: 120

10.7.1 (D) Hongzhi: Recent R&D Developments: 120

10.7.1 (E) Hongzhi: Certifications: 120

10.8 HYPER-SENSE 121

10.8.1 HYPER-SENSE TECHNOLOGY CO., LTD (MOV/PPTC/NTC/TVS/ZENER) 121

10.8.1 (A) Hyper Sense: About This Company: 121

10.8.1 (B) Hyper-Sense: Circuit Protection Products: 121

10.8.1 (C ) Hyper-Sense: New Product Development 122

10.8.1 (C1) RTD Development: 122

10.8.1 (C2) Thermocouple Development: 122

10.8.1 (C3) NTC For Heater Applications: 122

10.9 ISHIZUKA (SEMITEC) 122

10.9.1 ISHIZUKA ELECTRONICS CORPORATION (MOV/NTC/) 122

10.9.1 (A) Ishizuka: About This Company 123

10.9.1 (B) Ishizuka Name Change To SemiTec: 123

10.9.1 (C ) Ishizuka: Circuit Protection Products: 123

10.9.1 (D) Ishizuka: Major Customers 124

10.9. 1 (E) Latest News: 125

10.9.1 (F) Locations 126

10.10 JOYIN 126

10.10.1 JOYIN COMPANY LIMITED (MOV//NTC) 126

10.10.1 (A) Joyin: About This Company: 127

10.10.1 (B) Joyin: Circuit Protection Products: 127

10.10.1 (C ) Joyin; Revenues 127

10.10.1 (D) Joyin: Product Lines & Technology Base 127

10.10.1 (E) Joyin: Growth Strategy 128

10.10.1 (F) Joyin: Plant Locations 128

10.10.1 (G) Joyin Strengths 128

10.10.1 (H) Joyin: Key Customers: 129

10.10.1 (I) Joyin: Private Lable Customers: 129

10.10.1 (J) Joyin: Certifications: 129

10.11 KOA 130

10.11.1 KOA CORP. (MOV/PTC/NTC) 130

10.11.1 (A) KOA: Company Description 130

10.11.1 (B) KOA Passive Component Revenues: 130

10.11.1 (C ) KOA Corporation: Annualized Revenues & Trends: 2011-2024 131

10.11.1 (D) KOA Corp. Quarterly Revenues & Outlook: FY 2011-FY 2024 131

10.11.1 (E) KOA TAMA Electric Subsidiary: 133

10.11.1 (F) KOA Revenues by World Region: 133

10.11.1 (G) KOA Revenues by End-Use Market Segment: 133

10.11.1 (H) KOA Manufacturing Facilities & Production By World Region: 133

10.11.1 (I) KOA Circuit Protection Product Portfolio: 133

10.11.1 (J) KOA Corporation SWOT Analysis 134

10.11.1 (J1) KOA Strengths: 134

10.11.1 (J2) KOA Weaknesses: 134

10.11.1 (J3) KOA Opportunities: 134

10.11.1 (J4) KOA Threats: 134

10.12 LATTRON 135

10.12.1 LATTRON COMPANY LIMITED (NTC/MOV) 135

10.12.1 (A) Lattron: About This Company: 135

10.11.1 (B) Lattron: Factories: 135

10.11.1 (C ) Lattron: Certification: 135

10.11.1 (D) Lattron Trends & Directions: 135

10.13 MAIDA 136

10.13.1 MAIDA DEVELOPMENT COMPANY (MOV//NTC) 136

10.13.1 (A) Maida: About This Company: 136

10.13.1 (B) Maida: Circuit Protection Products: 137

10.14 MITSUBISHI 137

10.14.1 MITSUBISHI MATERIALS CORPORATION (FUSES/NTC) 137

10.14.1 (A) MMC: About This Company: 138

10.14.2 (Electronic Components Manufacturing Locations: 139

10.14.3 MMC Electronic Materials Components Division: 139 MMC: Target Markets and Directions: 140

10.15 MURATA 140

10.15.1 MURATA MANUFACTURING COMPANY LIMITED (PTC/NTC/MOV) 140

10.15.2 Murata: About This Company: 141

10.15.3 Murata: Revenue Trend: 2009-2024 141

10.15.4 Murata: Company Strengths 142

10.15.5 Murata” Passive Component Portfolio: 142

10.15.6 Murata: Circuit Protection Product Portfolio 142

10.15.7 Circuit Protection Component Production Locations: 143

10.15.7 (A) Murata Electronics (Thailand) Limited 143

10.15.7 (B) Murata Amazonia Industria E Comercio, Manaus, Brazil 143

10.15.7 (C ) Wuxi Murata Electronics Co., Ltd., 144

10.15.8 Murata Revenues By End-Use Market Segment: FY 2024. 144

10.15.8 (A) Murata: Revenues By End-Use Market Segment: 2009-2024 145

10.15.9 Murata Revenues By World Region & Trends: 146

10.16 OHIZUMI 148

10.16.1 OHIZUMI MANUFACTURING COMPANY LIMITED (NTC/PTC/MOV) 148

10.16.2 Ohizumi Company Details: 148

10.16.3 Ohizumi: About This Company: 148

10.16.4 Ohizumi: About The Circuit Protection Product Portfolio: 149

10.16.4 (A) NTC Thermistors: 149

10.16.4 (B) PTC Thermistors: 149

10.16.4 (C ) Metal Oxide Varistors: 149

10.16.5 Ohizumi: Company Revenues: 2013-2013; 2024 Forecast: 150

10.16.6 Ohizumi: Trends & Directions: 150

10.17 PANASONIC 151

10.17.1 PANASONIC ELECTRONIC DEVICES (NTC/MOV/FUSE) 151

10.17.2 PED: About This Company: 151

10.17.3 Panasonic: Net Sales Trend: Ten Years 151

10.17.3 (A) Development of the “Automotive and Industrial Systems Group- Post 2024.” 151

10.17.3 (B) PED: Revenue Trend: 152

10.17.3 (C ) Panasonic Revenues by Market Segment: 153

10.17.4 Merger With Sanyo: 154

10.17.5 PED: Revenues by World Region: 154

10.17.6 Panasonic: Revenue Trend By World Region 155

10.17.7 PED: Circuit Protection Product Portfolio: 155

10.17.8 Circuit Protection Component Production At PED: 156

10.17.8 (A) Hokkaido Matsushita Electric Co., Ltd. 156

10.18 QUALITY THERMISTOR 157

10.18.1 QUALITY THERMISTOR, INC. (NTC AND PTC) 157

10.18.2 Quality Thermistor: About This Company 157

10.18.3 Quality Thermistor: Product Line 157

10.19 SHIBAURA 158

10.19.1 SHIBAURA ELECTRONICS COMPANY (NTC) 158

10.19.2 Shibaura: About This Company 158

10.19.3 Shibaura: Leader in NTC Thermistors 159

10.19.4 Shibaura: NTC Product Portfolio 159

10.19.5 Shibaura: Target Markets and Products: 2024 159

10.19.6 Shibaura: Revenues: 2003-2013 160

10.19.7 Shibaura: Manufacturing Facilities: 161

10.19.8 Shibaura: Revenues By End-Use Market Segment: 161

10.19.9 Shibaura: New Product Development: 162

10.20 SHIHENG 162

10.20.1 NANJING SHIHENG ELECTRONIC TECHNOLOGY CO., LTD. (NTC/PTC/MOV) 162

10.20.2 Shiheng Electronics: About This Company: 163

10.21 SINOCHIP: 163

10.21.1 SINOCHIP ELECTRONICS COMPANY LIMITED (NTC) 163

10.21.2 About SinoChip: 163

10.21.3 PPTC Product Portfolio: 163

10.22 TATEYAMA 164

10.22.1 TATEYAMA KAGAKU INDUSTRIAL CO. LTD (NTC) 164

10.22.2 Tateyama: About This Company: 164

10.22.2 Tateyama: Revenues: 164

10.23 TDK 165

10.23.1 TDK CORPORATION (MOV/NTC/PTC) 165

10.23.2 TDK: About This Company: 165

10.23.3 TDK: Revenue Trend: 166

10.23.4 TDK: Revenues By Product Grouping: 2024 167

10.23.5 TDK: Circuit Protection Product Portfolio: 167

10.23.5 (A) TDK-EPCOS AG (GDT/MOV/PTC/NTC) 168

10.23.5 (B) EPCOS Recent Events: TDK Acquisition: 169

10.23.5. (C ) EPCOS Ceramic Components Division: 169

10.23.5 (D) EPCOS Revenues by World Region: 169

10.23.5 (E) EPCOS Revenues by End-Use Market Segment: 169

10.23.5 (F) Thermistor Production At EPCOS 169

10.23.5 (G) EPCOS Thermistor Revenues: 170

10.24 THINKING ELECTRONIC 170

10.24.1 THINKING ELECTRONIC INDUSTRIAL CO., LTD (PTC/NTC/MOV/GDT) 170

10.24.2 Thinking: About This Company: 171

10.24.3 Thinking: Circuit Protection Portfolio: 171

10.24.4 Thinking: Revenue Trend: 2010-2013; 2024 Forecasts: 172

10.25 TONZE ELECTRON 173

10.25.1 GUANGDONG TONZE ELECTRIC COMPANY LIMITED (NTC/MOV/GDT) 173

10.25.2 Tonze:About This Company 173

10.26 UPPERMOST 174

10.26.1 UPPERMOST ELECTRONIC INDUSTRIES COMPANY LIMITED (MOVPTC/NTC) 174

10.26.2 UEI: About This Company: 174

10.26.3 UEI: Circuit Protection Portfolio: 174

10.26.4 UEI: Factories: 175

10.27 US SENSOR 175

10.27.1 US SENSOR CORPORATION (NTC) 175 US Sensor: About This Company: 176

10.28 VATRONICS 176

10.28.1 VATRONICS TECHNOLOGIES LIMITED (MOV/NTC) 176

10.28.2 Vatronics: About This Company: 176

10.29 VISHAY 177

10.29.1 VISHAY INTERTECHNOLOGY (TVS/NTC/PTC/MOV) 177

10.29.2 Vishay: About This Company: 177

10.29.3 Vishay: Annual Revenues: 2010-2013 and 2024 Forecasts: 178

10.29.4 Vishay Revenues by Product Group: 2013 179

10.29.5 Vishay Revenues By End-Use Market Segment: 2013 180

10.29.6 Vishay: Revenues By World Region: 2013 181

10.29.7 Vishay: Important Acquisitions in Circuit Protection: 181

10.29.8 Vishay BC Components: 182

10.29.9 Vishay: Thermistor Products 183

10.30 WALSIN 183

10.30.1 WALSIN TECHNOLOGY CORPORATION (MOV) 183

10.30.2 Walsin: About This Company: 184

10.30.3 Annual Revenues For WALSIN Technology Corp.: 2009-2024 184

10.30.4 Annual Outputs For WALSIN Technology Corp. In Units 185

10.30.5 Walsin: Circuit Protection Products: 185

10.31 WAYON 186

10.31.1 SHANGHAI CHANGYUAN WAYON CIRCUIT PROTECTION CO. LTD. 186

10.31.2 Wayon: About This Company: 186

10.31.3 About The Changyuan Group (Parent Company) 187

10.31.4 Revenues of The Changyuan Group: 2010-2013 187 Wayon: Circuit Protection Product Portfolio: 188

10.32 WESTERN ELECTRONIC 188

10.32.1 WESTERN ELECTRONIC COMPONENTS (NTC/PTC) 188

10.32.2 WECC: About This Company: 189

10.32.3 WECC: Product offering in Thermistors 189

10.33 ZEITGEIST 190

10.33.1 SHENZHEN ZEITGEIST ELECTRONICS COMPANY LTD. (NTC) 190

10.31.2 Zeitgeist: About This Company 190

10.31.3 NTC Thermistor Production Capacity: 190

ページTOPに戻る

List of Tables/Graphs

FIGURE 1: PAUMANOK RESEARCH METHODOLOGY 21

FIGURE 2: THE PASSIVE ELECTRONIC COMPONENT SUPPLY CHAIN 23

FIGURE 3: CURRENCY TRANSLATIONS USED IN THIS REPORT: 2013-2024 BY QUARTER 27

FIGURE 4: SUMMARY OF AVAILABLE NTC THERMISTOR COMPONENTS BY CONFIGURATION: 2024 42

FIGURE 5: NTC THERMISTORS FOR TEMPERATURE SENSING: AVERAGE CONTENT IN PRIMARY END-PRODUCTS: 2024 44

FIGURE 6: NTC THERMISTORS FOR TEMPERATURE COMPENSATION: AVERAGE CONTENT IN PRIMARY END-PRODUCTS: 2024 45

FIGURE 7: NTC THERMISTORS FOR INRUSH CURRENT LIMITING: AVERAGE UNIT CONTENT PER PRODUCT MARKET: 2024 45

FIGURE 8: GLOBAL CONSUMPTION VALUE FOR NTC THERMISTORS: 2008-20913; 2024F 51

FIGURE 9: HISTORICAL CONSUMPTION VALUE, VOLUME AND PRICING TREND FOR NTC THERMISTORS: 1998-2024 53

FIGURE 10: GLOBAL NTC THERMISTOR CONSUMPTION VALUE: 1998-2013; 2024 FORECASTS 53

FIGURE 11: GLOBAL NTC THERMISTOR CONSUMPTION VOLUME: 1998-2013; 2024 FORECASTS 55

FIGURE 12: NTC THERMISTOR PRICING ESTIMATES: 1998-2013; 2024 FORECASTS 56

FIGURE 13: GLOBAL VALUE, VOLUME AND AVERAGE UNIT PRICING FOR NTC THERMISTORS BY END-USE MARKET SEGMENT FOR 2024 57

FIGURE 14: HISTORICAL CHANGES IN GLOBAL CAR, TRUCK AND BUS PRODUCTION BY COUNTRY: 2010-2013; 2024 FORECASTS 64

FIGURE 15: HISTORICAL CHANGES IN GLOBAL CAR, TRUCK AND BUS PRODUCTION BY WORLD REGION: 2010-2013; 2024 FORECASTS 65

FIGURE 16: NTC THERMISTOR CONSUMPTION VALUE AND VOLUME BY AUTOMOTIVE ELECTRONIC SUB-ASSEMBLY: 2024 66

FIGURE 17: FORECASTS: GLOBAL VALUE AND VOLUME OF NTC THERMISTOR CONSUMPTION IN AUTOMOTIVE ELECTRONIC SUBASSEMBLIES: 2024-2029 68

FIGURE 18: GLOBAL CONSUMPTION VOLUME FOR LARGE HOME APPLIANCES BY KEY COUNTRY AND WORLD REGION: 2024 72

FIGURE 19: GLOBAL CONSUMPTION VALUE AND VOLUME FOR NTC THERMISTORS IN THE HOME APPLIANCE MARKET: 2024 73

FIGURE 20: GLOBAL CONSUMPTION VALUE AND VOLUME FOR NTC THERMISTORS IN DIGITAL ELECTRONICS MARKET: 2024 75

FIGURE 21: INDUSTRIAL ELECTRONICS MARKETS FOR NTC THERMISTORS: 2024 77

FIGURE 22: GLOBAL CONSUMPTION VALUE FOR NTC THERMISTORS BY WORLD REGION: 2024 80

FIGURE 23: GLOBAL CONSUMPTION VALUE, VOLUME AND PRICING FOR NTC THERMISTORS BY COMPONENT CONFIGURATION: 2024 81

FIGURE 24: GLOBAL CONSUMPTION VALUE FOR RADIAL LEADED TYPE NTC THERMISTORS BY SUB-TYPE: 2024 84

FIGURE 25: SMD NTC THERMISTORS: GLOBAL VALUE OF DEMAND ESTIMATES BY CASE SIZE; 2024 85

FIGURE 26: GLOBAL ESTIMATES ON THE WORLDWIDE NTC THERMISTOR PROBE ASSEMBLY MARKETS 86

FIGURE 27: COMPETITIVE ENVIRONMENT IN NTC THERMISTOR SALES BY TYPE AND CONFIGURATION: 2024 89

FIGURE 28: RADIAL LEADED NTC THERMISTOR COMPONENTS: COMPETITION BY SUB-TYPE: 2024 91

FIGURE 29: NTC THERMISTOR CHIP VENDORS BY CASE SIZE: 2024 92

FIGURE 30: NTC THERMISTOR VENDORS BY THE PRODUCT MARKETS THEY SERVE: 2024 93

FIGURE 31: NTC THERMISTOR VENDORS: CY 2013 ESTIMATED WORLDWIDE MARKET SHARES 96

FIGURE 32: VALUE, VOLUME AND AVERAGE UNIT PRICING FORECASTS FOR NTC THERMISTORS: 2024-2029 97

FIGURE 33: NTC THERMISTOR GLOBAL CONSUMPTION FORECASTS BY END-USE MARKET SEGMENT: 2024-2029 98

FIGURE 34: NTC THERMISTOR GLOBAL CONSUMPTION FORECASTS BY WORLD REGION: 2024-2029 99