Summary

米国調査会社マインドコマース(Mind Commerce)の調査レポート「SD-WAN(ソフトウェア定義による広域ネットワーク)市場:コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎、産業毎 2019-2024年」は、SD-WAN市場のベンダやサービスプロバイダ等の企業、戦略、技術とソリューションについて査定している。コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎(通信サービスプロバイダ、企業、産業、政府行政)、企業垂直市場毎の分析と2019-2024年の予測も記載している。

米国調査会社マインドコマース(Mind Commerce)の調査レポート「SD-WAN(ソフトウェア定義による広域ネットワーク)市場:コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎、産業毎 2019-2024年」は、SD-WAN市場のベンダやサービスプロバイダ等の企業、戦略、技術とソリューションについて査定している。コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎(通信サービスプロバイダ、企業、産業、政府行政)、企業垂直市場毎の分析と2019-2024年の予測も記載している。

Overview:

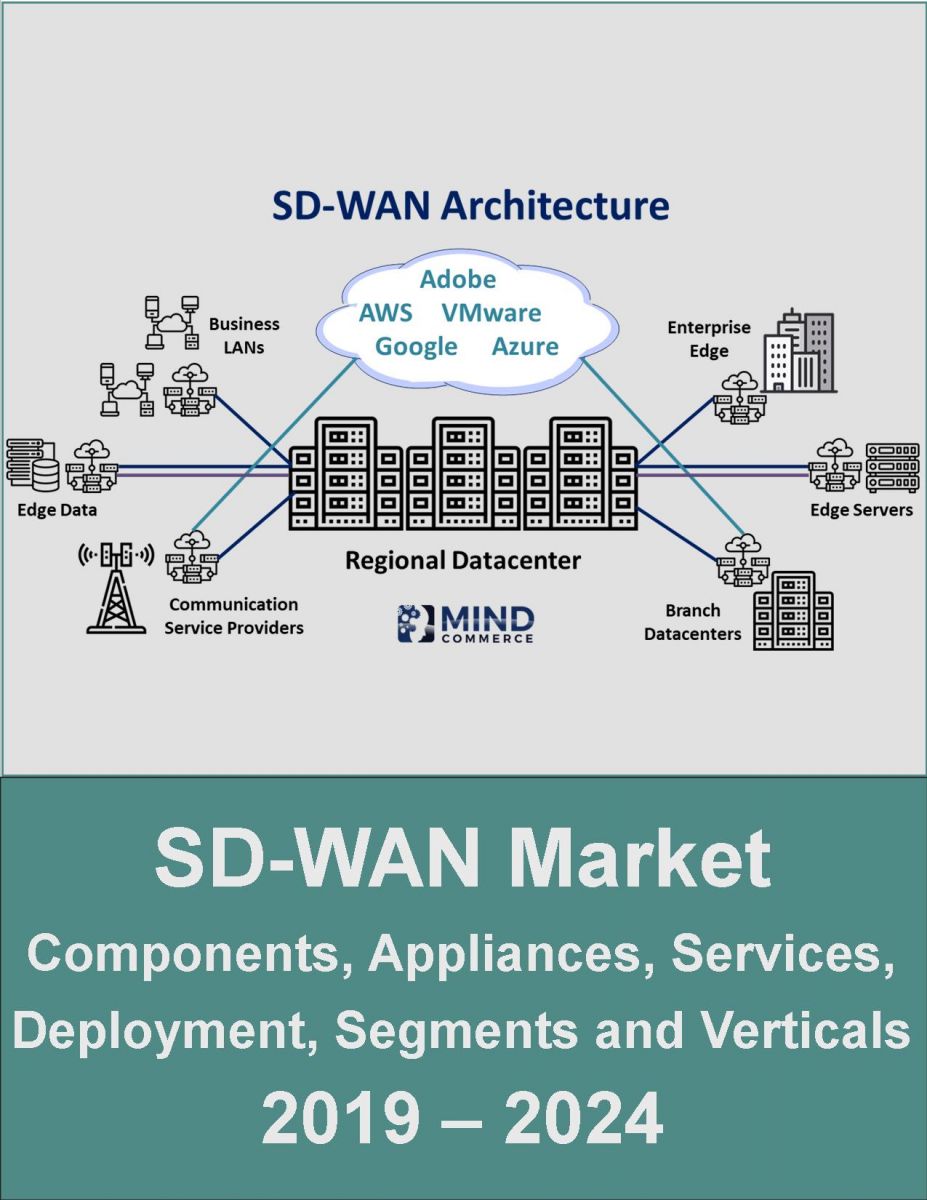

This SD-WAN market report evaluates the players (vendors and service providers), strategies, technologies and solutions. It includes analysis by Component, Appliance, Services, Deployment, Segment (Communication Service Providers, Enterprise, Industrial, and Government), and Enterprise Verticals with forecasts from 2019 to 2024.

SDN in support of Wide Area Networking (WAN), also known as SD-WAN is rapidly achieving mainstream adoption as both network operators and enterprise take a software-centric approach to more optimally manage WAN operations and provide efficient access to cloud applications. Part of the reason for its popularity is the technology enables solutions that provide a more open hardware architecture configuration. This facilitates greater flexibility overall as well as ease of migration from proprietary boxes and multiprotocol label switching services, which is a dominant industry trend as networks increasingly utilize virtualized infrastructure and non-proprietary equipment.

Many consider SD-WAN part of the evolution of SDN as applied to existing networking technologies such as Multiprotocol Label Switching (MPLS), which directs data from one node to the next based on short path labels rather than long network addresses. SD-WAN was often applied as an overlay to existing network technologies such as MPLS virtual private networks and the Internet as a whole. SD-WAN saw early favor with enterprise networks on a managed service basis, but has also gained great support with communication service providers (CSP) as a means of unifying networks that are increasingly becoming software-controlled and virtualized.

While the initial industry driver for SD-WAN has been reducing bandwidth costs and overall operational expense reduction, there are other benefits as businesses increasingly rely upon the cloud-based services model. Enabling more efficient operations, SD-WAN also facilitates a more robust and survivable environment such as the ability to support alternate/redundant paths for routing broadband traffic, which is especially important for cloud-based service quality of service support. This is especially important in a multi-cloud environment in which there is a need for visibility and control for hybrid networks involving centralize cloud and edge computing equipment as well as a combination of public, private, and hybrid cloud infrastructure.

It is important to note that SD-WAN is not only for network operators as it is has also become the go-to platform for deploying and managing new enterprise network services. In fact, leading communications service providers offer SD-WAN services to enterprise on a managed service basis. Carriers espouse this approach as less risky for enterprise including the ability to ramp-up costs as their network needs dictate. The initial wave of enterprise SD-WAN spending was a result of direct purchase from SD-WAN networking vendors, which places an onus upon enterprise to manage their own networks to some degree.

Accordingly, the majority of enterprise organizations are considering SD-WAN with plans towards utilizing solutions in a managed service environment. However, there remain a large proportion of enterprises that still rely upon MPLS. Those remaining are considering strategies to wean their dependency including limiting MPLS only to areas with infrastructure limitations, throttling traffic to data centers that still use MPLS, and other tactics. Enterprise hold-outs acknowledge that MPLS provides their existing quality of service needs for their buildings, campus networks, and metro Ethernet services.

CSPs offering SD-WAN managed services to enterprise include: Aryaka Networks, ASCO TLC, AT&T, BCM One, BCN Telecom, BT Global Services, BullsEye Telecom, CenturyLink, China Mobile, China Telecom Global, CMC Networks, Colt, Comcast Business, Consolidated Communications, Epsilon, Exponential-e, Frontier Communications, GeoLinks, Globe Telecom, GTT, Hutchison Global Communications, Internet Solutions, Kalaam Telecom, KDDI, Level 3, Macquarie Telecom, Masergy, MegaPath, MetTel, NetFortris, NetOne Systems, NTT Communications, Optus Business, Orange Business Services, PCCW Global, PLDT, Sify, SingTel, SK Broadband, Softbank, Telia Carrier, Spectrotel, Sprint, Tata Communications, Telefonica, TelePacific, Telstra, Telus, T-Systems, Vector Security Networks, Verizon, Viettel, Virgin Media, Vodafone, Vonage, indstream, and Zayo.

Some CSPs rely upon existing enterprise relationships (e.g. already provide enterprise networking services such as MPLS), while others position themselves with a more unique value proposition. By way of example, Aryaka announced its “HybridWAN” solution to provide enterprise customers with the flexibility to run whatever applications over any architecture. This is part of the dominant trend of enterprise organization migration from leased-lines and legacy technologies to a hybrid infrastructure that involves both MPLS and SD-WAN. The company positions this solution approach as ideal for reducing complexity in hybrid networks that must simultaneously deal with application optimization, connectivity, security issues, and multi-cloud access. While many CSPs provide SD-WAN managed services based on infrastructure from market leaders such as Cisco/Viptela, Silver Peak, Versa Networks and VMware/VeloCoud, some utilize their own internally developed technologies.

One of the core drivers for growth in SD-WAN for enterprise is simply equipment upgrades. For example, SD-WAN is anticipated to continue to benefit from enterprise router replacement. Other drivers include the need to support an increasingly mobile and remote workforce as well as general network operations rationalization. In the case of remote workers, small offices, and SMBs, compact appliances are the targeted low-cost offering by leading vendors, although many customers are still vying for traditional-sized SD-WAN equipment.

In terms of the future direction of SD-WAN, Mind Commerce anticipates that it will become the go-to means for managing networking and security for a wide range of applications, services, and solutions including LTE, 5G, and Internet of Things (IoT) networks. For enterprise, SD-WAN may be used to provide greater reliability through a variety of strategies such as provisioning LTE and/or 5G as back-up in a fail-over scenario. With some companies making plans to launch a large number of LEO satellites for communications, satellite broad represents yet another point of integration for the SD-WAN market.

In the case of IoT, there are many device end-points, ranging from communication modules to consumer gear such as smartphones, wearables, and laptops. SD-WAN will ultimately become the primary means for managing connectivity and security for this many-to-many IoT device environment of the future. As enterprise and industrial segments add massive numbers of IoT-enabled “things”, there will be increasing number of devices for businesses to integrate and manage. Accordingly, simultaneously optimizing network and device resources will be very important in future IoT networks.

Unified Communications (UC) including UC as a Service (UCaaS) and Communications Platform as a Service (CPaaS) represent two additional growth areas for the SD-WAN market. UCaaS represents a platform and/or services upon which enterprise can manage communication services in a seamless fashion. CPaaS is part of a broader ICT landscape, which includes telecom APIs, CPaaS enabled services, UCaaS, call center as a service, instant authentication and trust ratings, conversational CRM and automated agents, WebRTC, and more. By way of example, Adaptiv provides SD-WAN to SkySwitch UCaaS customers in a manner in which the company is working with managed service providers on a white-label basis. This is represents another example of how the SD-WAN managed services approach is viewed as superior to directly to enterprise.

Almost every form of network infrastructure or service must consider cybersecurity from the ground up and SD-WAN is not an exception. Not surprisingly, leading equipment providers and managed services companies are partnering with firewall and security vendors to integrate cybersecurity into SD-WAN offerings. By way of example, Fortinet offers SD-WAN ASIC to secure the edge of WAN. The FortiGate 100F Next-Generation Firewall powered by the new SoC4 SD-WAN ASIC combines SD-WAN functionalities with advanced security into one single offering.

It is important to note that ensuring security in an SD-WAN environment is not a technology-led development but rather a market-driven need as enterprise leaders place improved security at the top of their list for SD-WAN deployment drivers followed by network management optimization and operational cost reduction respectively. One of the most important triggers for enterprise upgrade to SD-WAN is simply router upgrades. Upgrading to new router infrastructure provides the impetus for moving at least a portion of network operations to SD-WAN, which in turn will also allow for a comparative measure of benefits, justifying additional future upgrades.

In terms of SD-WAN standardization, MEF published the industry’s first global SD-WAN standard, SD-WAN Service Attributes and Services (MEF 70), to help accelerate market growth. It describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are directed over multiple underlay networks. Among other areas MEF 70 describes SD-WAN as a service instead of detailing the underlying protocol level, places SD-WAN into context with its LSO Reference Architecture view of the world, and provides an LSO API for SD-WAN. Many vendors do not fully comply with MEF's recently published SD-WAN specifications.

As vendors struggle for market share, there does not appear to be great interest in standardizing certain functions as suppliers instead focus upon their respective company positioning in terms of solution performance and feature richness such as multiple VPN and/or VRF and zero-touch provisioning. In this regard, leaders such as Cisco/Viptela, Nuage Networks, VMware/VeloCloud, and Silver Peak fight to preserve their market position versus challengers such as Aruba Networks, Huawei, Fortinet, and Versa. As the SD-WAN market is fast growing, it is also attractive to competition from smaller players. By way of example, Bigleaf Networks has recently raised $21 million Series B round of funding led by Updata Partners. This company positions itself to focus more on the underserved SMB SD-WAN market.

MEF also offers an SD-WAN Certified Professional (MEF-SDCP) program. This SD-WAN professional certification is the industry's only exam verifying knowledge, skills, and abilities in the domains of SD-WAN based on the MEF SD-WAN Service Attributes and Services (MEF 70) standard as well as other fundamentals of SD-WAN solutions. This exam is designed for technically-oriented SD-WAN professionals ranging from pre-sales to network/service engineering and operational personnel in the service provider, technology vendor, and enterprise communities. MEF and Spirent have already begun working with an initial group of 7 service providers and technology vendors selected to participate in the MEF 3.0 SD-WAN Certification Pilot Program. The first certified companies are expected to be announced in Q1 2020.

Select Report Findings:

• Overall global SD-WAN market will reach $5.9B by 2024

• Global SD-WAN support services market will reach $650M by 2024

• Leading vendors are focused on multi-cloud, edge enabled networks

• Managed SD-WAN services gaining ground in select enterprise verticals

• Equipment replacements a major drive for migration from MPLS to SD-WAN

• Important professional services include consulting, implementation, and training

Companies in Report:

• Adaptiv Networks

• Aryaka Networks

• ASCO TLC

• AT&T

• BCM One

• BCN Telecom

• Bigleaf Networks

• BT Global Services

• BullsEye Telecom

• Cato Networks

• CenturyLink

• China Mobile

• China Telecom Global

• Cisco

• Citrix

• Cloudgenix

• CMC Networks

• Colt

• Comcast Business

• Consolidated Communications

• Cradlepoint

• Epsilon

• Exponential-e

• Fatpipe

• Fortinet

• Frontier Communications

• GeoLinks

• Globe Telecom

• GTT

• HPE

• Huawei

• Hutchison Global Communications

• Infovista

• Internet Solutions

• Juniper Networks

• Kalaam Telecom

• KDDI

• Lavelle Networks

• Macquarie Telecom

• Martello

• Masergy

• MegaPath

• MetTel

• Mushroom Networks

• NetFortris

• NetOne Systems

• NTT Communications

• Nuage Networks (Nokia)

• Optus

• Oracle

• Orange Business Services

• PCCW Global

• Peplink

• PLDT

• Riverbed

• Sify

• Silver Peak

• SingTel

• SK Broadband

• SoftBank

• Spectrotel

• Sprint

• Tata Communications

• Telefonica

• TelePacific

• Telia Carrier

• Telstra

• Telus

• T-Systems

• Vector Security Networks

• VeloCloud (Vmware)

• Verizon

• Versa Networks

• Viettel

• Virgin Media

• Vodafone

• Vonage

• Windstream

• Zayo

• Zenlayer

ページTOPに戻る

Table of Contents

1.0 Executive Summary

2.0 Introduction

2.1 Virtualized and Programmable Infrastructure

2.1.1 Softwarization

2.1.2 Virtualization

2.2 Evolution of Software Controlled Networks

2.3 Software Defined Wide Area Networks

3.0 SD-WAN Benefits

3.1 Cost Savings

3.2 Flexible Network Management

3.3 Survivability and Reliability

3.4 Efficient Multi-cloud Environment

4.0 SD-WAN Market Drivers

4.1 Equipment Upgrades

4.2 Standardization

4.3 Open Networking

4.4 Neutral Hosting

5.0 SD-WAN Challenges and Opportunities

5.1 Developing More Secure Networks

5.2 Optimizing Web-scale Architecture

5.3 Improving Operational Efficiency

6.0 SD-WAN Vendor Analysis

6.1 Adaptiv Networks

6.2 Aryaka Networks

6.3 Bigleaf Networks

6.4 Cato Networks

6.5 Cisco

6.6 Citrix

6.7 Cloudgenix

6.8 Cradlepoint

6.9 Fatpipe

6.10 Fortinet

6.11 HPE

6.12 Huawei

6.13 Infovista

6.14 Juniper Networks

6.15 Lavelle Networks

6.16 Martello

6.17 Mushroom Networks

6.18 Nuage Networks (Nokia)

6.19 Oracle

6.20 Peplink

6.21 Riverbed

6.22 Silver Peak

6.23 VeloCloud (Vmware)

6.24 Versa Networks

6.25 Zenlayer

7.0 SD-WAN Managed Service Provider Analysis

7.1 ASCO TLC

7.2 AT&T

7.3 BCM One

7.4 BCN Telecom

7.5 BT Global Services

7.6 BullsEye Telecom

7.7 CenturyLink

7.8 China Mobile

7.9 China Telecom Global

7.10 CMC Networks

7.11 Colt

7.12 Comcast Business

7.13 Consolidated Communications

7.14 Epsilon

7.15 Exponential-e

7.16 Frontier Communications

7.17 GeoLinks

7.18 Globe Telecom

7.19 GTT

7.20 Hutchison Global Communications

7.21 Internet Solutions

7.22 Kalaam Telecom

7.23 KDDI

7.24 Macquarie Telecom

7.25 Masergy

7.26 MegaPath

7.27 MetTel

7.28 NetFortris

7.29 NetOne Systems

7.30 NTT Communications

7.31 Optus

7.32 Orange Business Services

7.33 PCCW Global

7.34 PLDT

7.35 Sify

7.36 SingTel

7.37 SK Broadband

7.38 SoftBank

7.39 Spectrotel

7.40 Sprint

7.41 Tata Communications

7.42 Telefonica

7.43 TelePacific

7.44 Telia Carrier

7.45 Telstra

7.46 Telus

7.47 T-Systems

7.48 Vector Security Networks

7.49 Verizon

7.50 Viettel

7.51 Virgin Media

7.52 Vodafone

7.53 Vonage

7.54 Windstream

7.55 Zayo

8.0 SD-WAN Market Analysis and Forecasts 2019 – 2024

8.1 SD-WAN Carrier and Enterprise Markets

8.1.1 Communication Service Provider SD-WAN

8.1.1 SD-WAN Managed Services

8.1.2 SD-WAN in Enterprise

8.2 Global SD-WAN Forecast 2019 – 2024

8.3 SD-WAN by Components 2019 – 2024

8.3.1 SD-WAN by Appliance Type 2019 – 2024

8.3.2 SD-WAN by Service Type 2019 – 2024

8.3.2.1 SD-WAN Professional Services 2019 – 2024

8.3.2.2 SD-WAN Managed Services 2019 – 2024

8.4 Regional SD-WAN Markets 2019 – 2024

8.5 SD-WAN by Market Segment 2019 – 2024

8.5.1 SD-WAN by Communication Service Providers 2019 – 2024

8.5.2 SD-WAN by Enterprise Vertical 2019 – 2024

8.6 SD-WAN by Region 2019 – 2024

8.7 North America SD-WAN by Component 2019 – 2024

8.7.1 North America SD-WAN by Appliance Type 2019 – 2024

8.7.2 North America SD-WAN by Service Type 2019 – 2024

8.7.2.1 North America SD-WAN Professional Services 2019 – 2024

8.7.2.2 North America SD-WAN Managed Services 2019 – 2024

8.7.3 North America SD-WAN Deployment Type 2019 – 2024

8.7.4 North America SD-WAN Market Segment 2019 – 2024

8.7.5 North America SD-WAN by Enterprise Vertical 2019 – 2024

8.8 South America SD-WAN by Components 2019 – 2024

8.8.1 South America SD-WAN by Appliance Type 2019 – 2024

8.8.2 South America SD-WAN by Service Type 2019 – 2024

8.8.2.1 South America SD-WAN Professional Services 2019 – 2024

8.8.2.2 South America SD-WAN Managed Services 2019 – 2024

8.8.3 South America SD-WAN Deployment Type 2019 – 2024

8.8.4 South America SD-WAN by Market Segment 2019 – 2024

8.8.5 South America SD-WAN by Enterprise Vertical 2019 – 2024

8.9 Europe SD-WAN by Components 2019 – 2024

8.9.1 Europe SD-WAN by Appliance Type 2019 – 2024

8.9.2 Europe SD-WAN by Service Type 2019 – 2024

8.9.2.1 Europe SD-WAN Professional Services 2019 – 2024

8.9.2.2 Europe SD-WAN Managed Services 2019 – 2024

8.9.3 Europe SD-WAN by Deployment Type 2019 – 2024

8.9.4 Europe SD-WAN Market Segment 2019 – 2024

8.9.5 Europe SD-WAN by Enterprise Vertical 2019 – 2024

8.10 Asia Pacific SD-WAN by Components 2019 – 2024

8.10.1 Asia Pacific SD-WAN by Appliance Type 2019 – 2024

8.10.2 Asia Pacific SD-WAN by Service Type 2019 – 2024

8.10.2.1 Asia Pacific SD-WAN Professional Services 2019 – 2024

8.10.2.2 Asia Pacific SD-WAN Managed Services 2019 – 2024

8.10.3 Asia Pacific SD-WAN by Deployment Type 2019 – 2024

8.10.4 Asia Pacific SD-WAN Market Segment 2019 – 2024

8.10.5 Asia Pacific SD-WAN by Enterprise Vertical 2019 – 2024

8.11 Middle East & Africa SD-WAN by Components 2019 – 2024

8.11.1 Middle East & Africa SD-WAN by Appliance Type 2019 – 2024

8.11.2 Middle East & Africa SD-WAN by Service Type 2019 – 2024

8.11.2.1 Middle East & Africa SD-WAN Professional Services 2019 – 2024

8.11.2.2 Middle East & Africa SD-WAN Managed Services 2019 – 2024

8.11.3 Middle East & Africa SD-WAN by Deployment Type 2019 – 2024

8.11.4 Middle East & Africa SD-WAN by Market Segment 2019 – 2024

8.11.5 Middle East & Africa SD-WAN by Enterprise Vertical 2019 – 2024

9.0 Future Outlook for SD-WAN

10.0 Conclusions and Recommendations

Figures

Figure 1: Software Control vs. Virtualization

Figure 2: End User Support

Figure 3: Business Operations

Figure 4: Cloud Operations

Figure 5: Global SD-WAN 2019 – 2024

Figure 6: SD-WAN by Component 2019 – 2024

Figure 7: SD-WAN by Appliance Type 2019 – 2024

Figure 8: SD-WAN by Service Type 2019 – 2024

Figure 9: SD-WAN Professional Services 2019 – 2024

Figure 10: SD-WAN Managed Service 2019 – 2024

Figure 11: SD-WAN Deployment 2019 – 2024

Figure 12: SD-WAN by Market Segment 2019 – 2024

Figure 13: SD-WAN by Communication Service Providers 2019 – 2024

Figure 14: SD-WAN by Enterprise Vertical 2019 – 2024

Figure 15: SD WAN by Region 2019 – 2024

Figure 16: North America SD-WAN by Component 2019 – 2024

Figure 17: North America SD-WAN by Appliance Type 2019 – 2024

Figure 18: North America SD-WAN by Service Type 2019 – 2024

Figure 19: North America SD-WAN Professional Services 2019 – 2024

Figure 20: North America SD-WAN Managed Service 2019 – 2024

Figure 21: North America SD-WAN Deployment 2019 – 2024

Figure 22: North America SD-WAN Market Segment 2019 – 2024

Figure 23: North America SD-WAN by Enterprise Vertical 2019 – 2024

Figure 24: South America SD-WAN by Component 2019 – 2024

Figure 25: South America SD-WAN by Appliance Type 2019 – 2024

Figure 26: South America SD-WAN by Service Type 2019 – 2024

Figure 27: South America SD-WAN Professional Services 2019 – 2024

Figure 28: South America SD-WAN Managed Service 2019 – 2024

Figure 29: South America SD-WAN Deployment 2019 – 2024

Figure 30: South America SD-WAN Market Segment 2019 – 2024

Figure 31: South America SD-WAN by Industry 2019 – 2024

Figure 32: Europe SD-WAN by Component 2019 – 2024

Figure 33: Europe SD-WAN by Appliance Type 2019 – 2024

Figure 34: Europe SD-WAN by Service Type 2019 – 2024

Figure 35: Europe SD-WAN Professional Services 2019 – 2024

Figure 36: Europe SD-WAN Managed Service 2019 – 2024

Figure 37: Europe SD-WAN Deployment 2019 – 2024

Figure 38: Europe SD-WAN Market Segment 2019 – 2024

Figure 39: Europe SD-WAN by Enterprise Vertical 2019 – 2024

Figure 40: Asia Pacific SD-WAN by Component 2019 – 2024

Figure 41: Asia Pacific SD-WAN by Appliance Type 2019 – 2024

Figure 42: Asia Pacific SD-WAN by Service Type 2019 – 2024

Figure 43: Asia Pacific SD-WAN Professional Services 2019 – 2024

Figure 44: Asia Pacific SD-WAN Managed Service 2019 – 2024

Figure 45: Asia Pacific SD-WAN Deployment 2019 – 2024

Figure 46: Asia Pacific SD-WAN Market Segment 2019 – 2024

Figure 47: Asia Pacific SD-WAN by Enterprise Vertical 2019 – 2024

Figure 48: Middle East & Africa SD-WAN by Component 2019 – 2024

Figure 49: Middle East & Africa SD-WAN by Appliance Type 2019 – 2024

Figure 50: Middle East & Africa SD-WAN by Service Type 2019 – 2024

Figure 51: Middle East & Africa SD-WAN Professional Services 2019 – 2024

Figure 52: Middle East & Africa SD-WAN Managed Service 2019 – 2024

Figure 53: Middle East & Africa SD-WAN Deployment 2019 – 2024

Figure 54: Middle East & Africa SD-WAN Market Segment 2019 – 2024

Figure 55: Middle East & Africa SD-WAN by Enterprise Vertical 2019 – 2024

Tables

Table 1: Global SD-WAN 2019 – 2024

Table 2: SD-WAN by Components 2019 – 2024

Table 3: SD-WAN by Appliance Type 2019 – 2024

Table 4: SD-WAN by Service Type 2019 – 2024

Table 5: SD-WAN Professional Services 2019 – 2024

Table 6: SD-WAN Managed Services 2019 – 2024

Table 7: SD-WAN Deployment 2019 – 2024

Table 8: SD-WAN by End-User 2019 – 2024

Table 9: SD-WAN by Enterprise Vertical 2019 – 2024

Table 10: SD-WAN by Region 2019 – 2024

Table 11: North America SD-WAN by Component 2019 – 2024

Table 12: North America SD-WAN by Appliance Type 2019 – 2024

Table 13: North America SD-WAN by Service Type 2019 – 2024

Table 14: North America SD-WAN Professional Services 2019 – 2024

Table 15: North America SD-WAN Managed Services 2019 – 2024

Table 16: North America SD-WAN Deployment Type 2019 – 2024

Table 17: North America SD-WAN by Market Segment 2019 – 2024

Table 18: North America SD-WAN by Industry 2019 – 2024

Table 19: South America SD-WAN by Components 2019 – 2024

Table 20: South America SD-WAN by Appliance Type 2019 – 2024

Table 21: South America SD-WAN by Service Type 2019 – 2024

Table 22: South America SD-WAN Professional Services 2019 – 2024

Table 23: South America SD-WAN Managed Services 2019 – 2024

Table 24: South America SD-WAN by Deployment Type 2019 – 2024

Table 25: South America SD-WAN by Market Segment 2019 – 2024

Table 26: South America SD-WAN by Enterprise Vertical 2019 – 2024

Table 27: Europe SD-WAN by Components 2019 – 2024

Table 28: Europe SD-WAN by Appliance Type 2019 – 2024

Table 29: Europe SD-WAN by Service Type 2019 – 2024

Table 30: Europe SD-WAN Professional Services 2019 – 2024

Table 31: Europe SD-WAN Managed Services 2019 – 2024

Table 32: Europe SD-WAN Deployment Type 2019 – 2024

Table 33: Europe SD-WAN by Market Segment 2019 – 2024

Table 34: Europe SD-WAN by Enterprise Vertical 2019 – 2024

Table 35: Asia Pacific SD-WAN by Components 2019 – 2024

Table 36: Asia Pacific SD-WAN by Appliance Type 2019 – 2024

Table 37: Asia Pacific SD-WAN by Service Type 2019 – 2024

Table 38: Asia Pacific SD-WAN Professional Services 2019 – 2024

Table 39: Asia Pacific SD-WAN Managed Services 2019 – 2024

Table 40: Asia Pacific SD-WAN by Deployment Type 2019 – 2024

Table 41: Asia Pacific SD-WAN by Market Segment 2019 – 2024

Table 42: Asia Pacific SD-WAN by Enterprise Vertical 2019 – 2024

Table 43: Middle East & Africa SD-WAN by Components 2019 – 2024

Table 44: Middle East & Africa SD-WAN by Appliance Type 2019 – 2024

Table 45: Middle East & Africa SD-WAN by Service Type 2019 – 2024

Table 46: Middle East & Africa SD-WAN Professional Services 2019 – 2024

Table 47: Middle East & Africa SD-WAN Managed Services 2019 – 2024

Table 48: Middle East & Africa SD-WAN by Deployment Type 2019 – 2024

Table 49: Middle East & Africa SD-WAN by Market Segment 2019 – 2024

Table 50: Middle East & Africa SD-WAN by Industry 2019 – 2024

米国調査会社マインドコマース(Mind Commerce)の調査レポート「SD-WAN(ソフトウェア定義による広域ネットワーク)市場:コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎、産業毎 2019-2024年」は、SD-WAN市場のベンダやサービスプロバイダ等の企業、戦略、技術とソリューションについて査定している。コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎(通信サービスプロバイダ、企業、産業、政府行政)、企業垂直市場毎の分析と2019-2024年の予測も記載している。

米国調査会社マインドコマース(Mind Commerce)の調査レポート「SD-WAN(ソフトウェア定義による広域ネットワーク)市場:コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎、産業毎 2019-2024年」は、SD-WAN市場のベンダやサービスプロバイダ等の企業、戦略、技術とソリューションについて査定している。コンポーネント毎、機器毎、サービス毎、採用毎、セグメント毎(通信サービスプロバイダ、企業、産業、政府行政)、企業垂直市場毎の分析と2019-2024年の予測も記載している。