リチウムイオン電池特許背景 2020年:技術、動向、企業比較、特許例Li-ion Battery Patent Landscape 2020 このレポートはリチウムイオン電池の市場を調査し、2020年における技術や特許を分析しています。 Report Details First commercialised in the 1... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2020年8月5日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

210

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

このレポートはリチウムイオン電池の市場を調査し、2020年における技術や特許を分析しています。

Report Details

First commercialised in the 1990s, the Li-ion battery consists of a graphitic or carbonaceous negative electrode, a lithium salt dissolved in an organic solvent as the electrolyte and a transition metal oxide as the cathode. While this setup has not fundamentally changed, the performance, safety and cost of Li-ion batteries have improved substantially as a result of continuous R&D into to almost all components of a Li-ion cell and battery. Indeed, further improvements may be necessary to truly disrupt automotive and power generation markets, and R&D effort has grown in line with the growth in the market, as can be demonstrated by the growth in Li-ion patents. There has been consistent growth in patents across Li-ion technology and across many technology groups. Specifically covered in the report are trends and analyses on NMC/NCA and Li- and Mn-rich cathodes, silicon and titanate, electrolytes and electrolyte additives, separators and nanocarbons. Significant growth in the number of applications per year, including for a number of individual topic areas, was seen particularly between 2010-2015. While all areas covered have seen growth since 2010, the number of patents regarding the use of nanocarbons in Li-ion have seen the most substantial growth over the past 10 years.

New battery advancements and energy storage technologies are regularly publicised, but they are competing against a moving target in Li-ion batteries. Reviewing the patent literature can provide valuable information and context for which direction innovation is heading in and which areas are seeing the most recent activity. NMC and NCA layered oxides have been commercial for many years now but development continues as the industry attempts to further increase nickel and lower cobalt content of these materials. At the anode, silicon can be added in small percentages to improve capacity, but increasing the amount of silicon beyond a few percent means silicon anodes are yet to enter the market. Beyond the active materials, solid-state batteries and electrolytes rightly receive considerable attention and hype. Nevertheless, liquid electrolytes are still a key area of development, with additives potentially playing a decisive role in commercialising new anode and cathode materials. This patent analysis will provide insight into how these materials are being developed, the challenges associated with incorporating new technologies, which companies are active in these topics, and how strategies may differ between the top assignees.

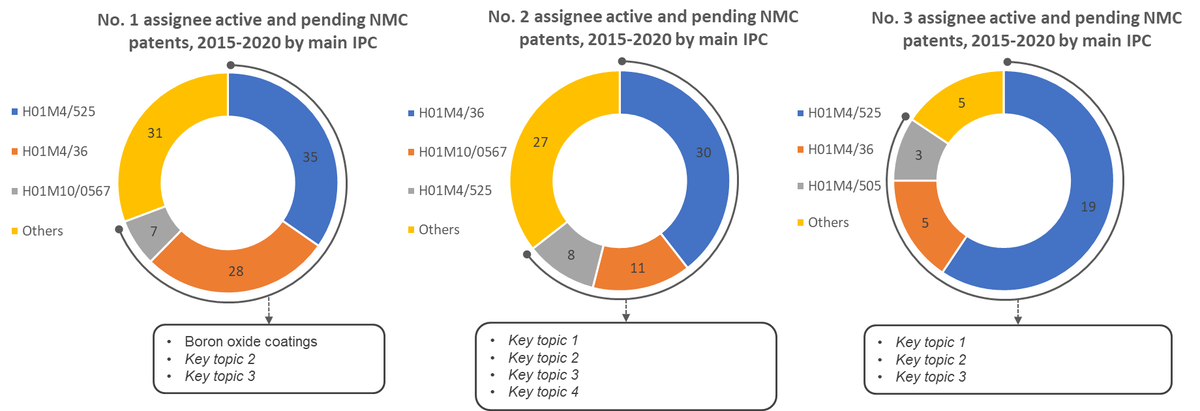

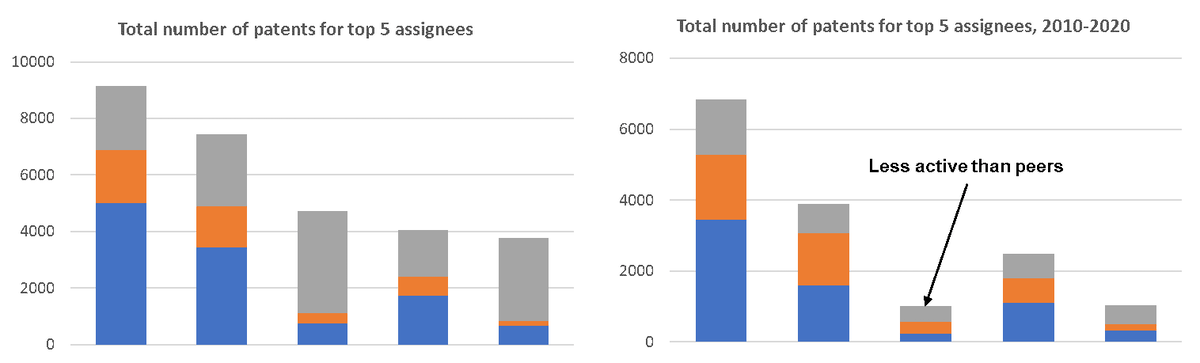

The report provides a view of the main IP trends with respect to geographical activity, player strategy and technological trends and can be used to help clarify what innovation is taking place in Li-ion batteries and where. The report also provides an overview of the patent trends for Li-ion players and assignees, ranks assignees in each topic category and provides a deeper dive and comparison on particular topics that are focussed on by the top assignees. A breakdown of patents that are active or pending, compared to the total number of applications made, is also provided to allow insight into assignees who have been recently active in Li-ion innovation.

This report will provide insight and discussion on where Li-ion performance improvements will come from and as an outcome of the analysis, example patents are also reviewed and discussed in the context of current Li-ion market developments alongside a discussion of future technology commercialisation. Highlighted in the report are key technology/IP trends, geographical activity, key players and assignees, and player rankings.

Included in the report:

目次Table of Contents

Summary

このレポートはリチウムイオン電池の市場を調査し、2020年における技術や特許を分析しています。

Report Details

First commercialised in the 1990s, the Li-ion battery consists of a graphitic or carbonaceous negative electrode, a lithium salt dissolved in an organic solvent as the electrolyte and a transition metal oxide as the cathode. While this setup has not fundamentally changed, the performance, safety and cost of Li-ion batteries have improved substantially as a result of continuous R&D into to almost all components of a Li-ion cell and battery. Indeed, further improvements may be necessary to truly disrupt automotive and power generation markets, and R&D effort has grown in line with the growth in the market, as can be demonstrated by the growth in Li-ion patents. There has been consistent growth in patents across Li-ion technology and across many technology groups. Specifically covered in the report are trends and analyses on NMC/NCA and Li- and Mn-rich cathodes, silicon and titanate, electrolytes and electrolyte additives, separators and nanocarbons. Significant growth in the number of applications per year, including for a number of individual topic areas, was seen particularly between 2010-2015. While all areas covered have seen growth since 2010, the number of patents regarding the use of nanocarbons in Li-ion have seen the most substantial growth over the past 10 years.

New battery advancements and energy storage technologies are regularly publicised, but they are competing against a moving target in Li-ion batteries. Reviewing the patent literature can provide valuable information and context for which direction innovation is heading in and which areas are seeing the most recent activity. NMC and NCA layered oxides have been commercial for many years now but development continues as the industry attempts to further increase nickel and lower cobalt content of these materials. At the anode, silicon can be added in small percentages to improve capacity, but increasing the amount of silicon beyond a few percent means silicon anodes are yet to enter the market. Beyond the active materials, solid-state batteries and electrolytes rightly receive considerable attention and hype. Nevertheless, liquid electrolytes are still a key area of development, with additives potentially playing a decisive role in commercialising new anode and cathode materials. This patent analysis will provide insight into how these materials are being developed, the challenges associated with incorporating new technologies, which companies are active in these topics, and how strategies may differ between the top assignees.

The report provides a view of the main IP trends with respect to geographical activity, player strategy and technological trends and can be used to help clarify what innovation is taking place in Li-ion batteries and where. The report also provides an overview of the patent trends for Li-ion players and assignees, ranks assignees in each topic category and provides a deeper dive and comparison on particular topics that are focussed on by the top assignees. A breakdown of patents that are active or pending, compared to the total number of applications made, is also provided to allow insight into assignees who have been recently active in Li-ion innovation.

This report will provide insight and discussion on where Li-ion performance improvements will come from and as an outcome of the analysis, example patents are also reviewed and discussed in the context of current Li-ion market developments alongside a discussion of future technology commercialisation. Highlighted in the report are key technology/IP trends, geographical activity, key players and assignees, and player rankings.

Included in the report:

Table of ContentsTable of Contents

ご注文は、お電話またはWEBから承ります。お見積もりの作成もお気軽にご相談ください。本レポートと同分野(電池)の最新刊レポートIDTechEx社の エネルギー、電池 - Energy, Batteries分野 での最新刊レポート

関連レポート(キーワード「リチウム」)よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|