リチウムイオン電池のサプライチェーン 2020-2030 年:生素材、地域分布、費用分析と需要予測The Li-ion Battery Supply Chain 2020-2030 このレポートは世界のリチウムイオン電池のサプライチェーンを調査し、リチウムイオン技術や費用、素材について言及しています。 主な掲載内容 ※目次より抜粋 エグゼクティブサマ... もっと見る

出版社

IDTechEx

アイディーテックエックス 出版年月

2019年10月21日

価格

お問い合わせください

ライセンス・価格情報/注文方法はこちら 納期

お問合わせください

ページ数

210

言語

英語

※価格はデータリソースまでお問い合わせください。

サマリー

このレポートは世界のリチウムイオン電池のサプライチェーンを調査し、リチウムイオン技術や費用、素材について言及しています。

主な掲載内容 ※目次より抜粋

Report Details

The expanding growth of electric vehicles is creating a huge demand for Li-ion batteries (LIBs). The demand for raw materials will therefore be hugely impacted and production in many cases will need to scale up rapidly.

Investment in the supply chain requires clarity on the technologies and chemistries that will be used over the coming decade but there are many types of LIB chemistries in use. Furthermore, considerable investment is being poured into the research and development of the next generation of LIBs with news items on the next battery breakthrough a regular occurrence - stakeholders want clarity on the chemistries that will be used over the coming decade. IDTechEx analysts appraise the possible LIB technology developments over the next decade, including alternative anodes, high-nickel cathodes and solid-state electrolytes. An analysis of the technical challenges and market activity for these key technological developments allows a technology outlook to be mapped, evaluating the evolving shares that different LIB chemistries and technologies will hold from 2020 to 2030.

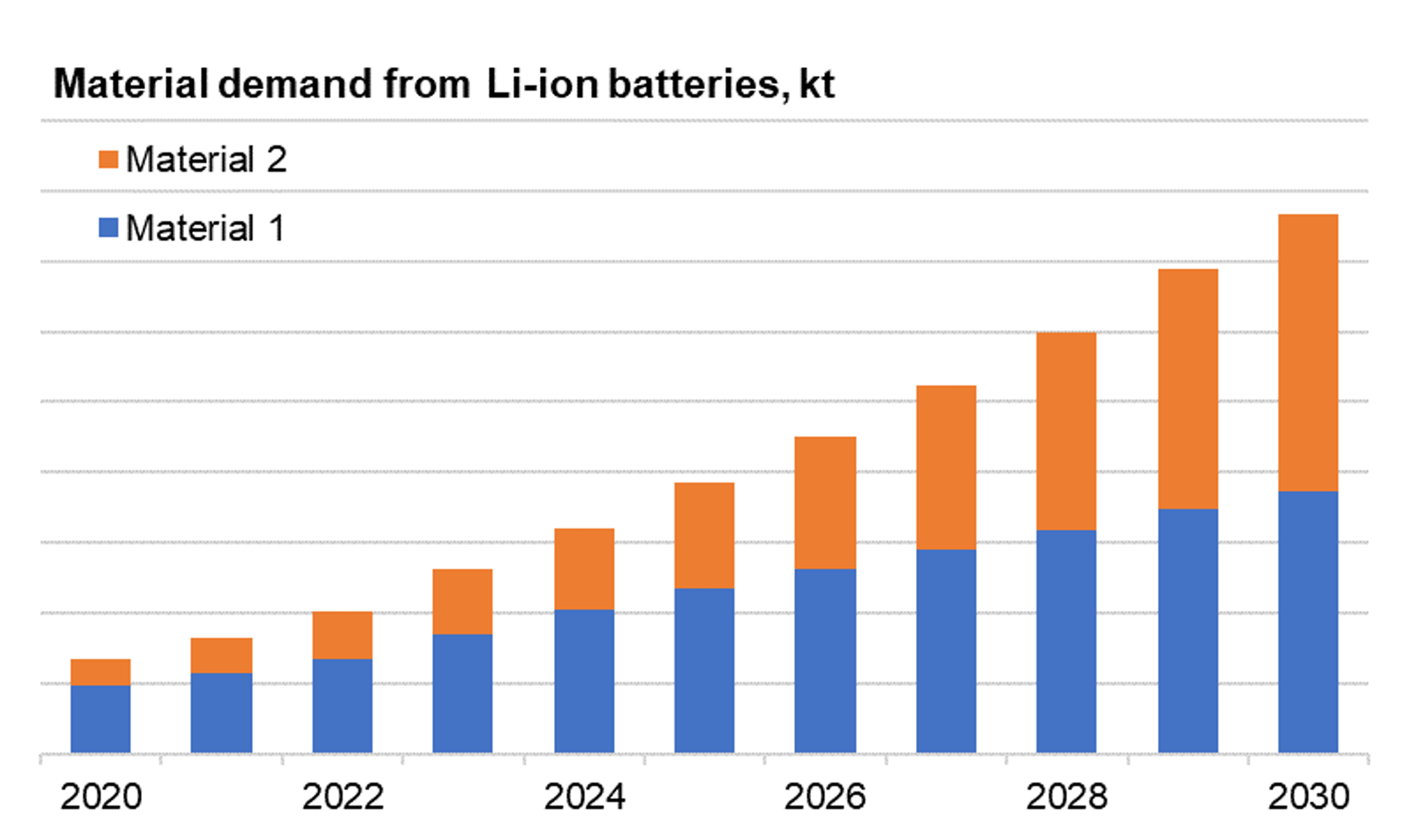

With a technology outlook in place, future material demand can be forecasted. The need for lithium, cobalt, graphite and nickel are all set to grow. Where are these materials mined and produced, do we have enough of them, and will there be supply disruptions? These are some key questions addressed in this report. China has a strong position in various segments of the supply chain and will continue to do so. However, production capacity will grow in Europe and the US as auto manufacturers seek greater control and proximity to cell production. Both areas are also seeking to develop domestic supplies of raw materials, with a number being deemed critical and of strategic importance. IDTechEx analyses the different segments of the Li-ion supply chain, breaking down the anode, cathode, component and raw material markets and the players involved.

Historic price reductions for LIBs have been well documented. However, the battery still accounts for a significant percentage of a battery electric vehicles (BEV) cost. To enable price parity between BEVs and internal combustion engine vehicles, further price reductions in LIBs are needed. This new report presents a LIB price forecast from 2020 to 2030 based on a detailed analysis of cell materials, their performance and the effect of increasing economies of scale.

By 2030, there could be over 250 GWh of LIB reaching end-of-life from electric vehicles alone. These batteries cannot just be landfilled. A number of jurisdictions are imposing collection requirements for automotive LIB packs. Re-purposing used EV batteries for 2nd-use presents an appealing opportunity to extend battery life and obtain additional values. However, given the costs associated with testing and re-purposing a used battery, there may be more value in recycling. Recycling will become increasingly important as a source of raw material to mitigate supply risks. IDTechEx outlines the methods that can be used to extract usable materials and the players actively recycling LIBs.

The forecasted growth in LIB demand makes it increasingly important to understand its supply chain. This new report provides insight on where materials come from, market players, recent investments in production and developments in the LIB technology. In addition to our 10-year demand forecasts and price analysis, the report will provide a comprehensive overview of the LIB supply chain.

The key issues addressed in this report:

• Overview and introduction to the Li-ion technology and supply chain

• How will LIB technology evolve, and which chemistries will win?

• Material and cost breakdowns

• Battery, material and price forecasts

• Is there enough raw material, can mining cope and will there be supply disruption?

• A dive into the recycling methods available for LIBs.

• Market analysis for materials, components, production and recycling.

目次

Table of Contents

Summary

このレポートは世界のリチウムイオン電池のサプライチェーンを調査し、リチウムイオン技術や費用、素材について言及しています。

主な掲載内容 ※目次より抜粋

Report Details

The expanding growth of electric vehicles is creating a huge demand for Li-ion batteries (LIBs). The demand for raw materials will therefore be hugely impacted and production in many cases will need to scale up rapidly.

Investment in the supply chain requires clarity on the technologies and chemistries that will be used over the coming decade but there are many types of LIB chemistries in use. Furthermore, considerable investment is being poured into the research and development of the next generation of LIBs with news items on the next battery breakthrough a regular occurrence - stakeholders want clarity on the chemistries that will be used over the coming decade. IDTechEx analysts appraise the possible LIB technology developments over the next decade, including alternative anodes, high-nickel cathodes and solid-state electrolytes. An analysis of the technical challenges and market activity for these key technological developments allows a technology outlook to be mapped, evaluating the evolving shares that different LIB chemistries and technologies will hold from 2020 to 2030.

With a technology outlook in place, future material demand can be forecasted. The need for lithium, cobalt, graphite and nickel are all set to grow. Where are these materials mined and produced, do we have enough of them, and will there be supply disruptions? These are some key questions addressed in this report. China has a strong position in various segments of the supply chain and will continue to do so. However, production capacity will grow in Europe and the US as auto manufacturers seek greater control and proximity to cell production. Both areas are also seeking to develop domestic supplies of raw materials, with a number being deemed critical and of strategic importance. IDTechEx analyses the different segments of the Li-ion supply chain, breaking down the anode, cathode, component and raw material markets and the players involved.

Historic price reductions for LIBs have been well documented. However, the battery still accounts for a significant percentage of a battery electric vehicles (BEV) cost. To enable price parity between BEVs and internal combustion engine vehicles, further price reductions in LIBs are needed. This new report presents a LIB price forecast from 2020 to 2030 based on a detailed analysis of cell materials, their performance and the effect of increasing economies of scale.

By 2030, there could be over 250 GWh of LIB reaching end-of-life from electric vehicles alone. These batteries cannot just be landfilled. A number of jurisdictions are imposing collection requirements for automotive LIB packs. Re-purposing used EV batteries for 2nd-use presents an appealing opportunity to extend battery life and obtain additional values. However, given the costs associated with testing and re-purposing a used battery, there may be more value in recycling. Recycling will become increasingly important as a source of raw material to mitigate supply risks. IDTechEx outlines the methods that can be used to extract usable materials and the players actively recycling LIBs.

The forecasted growth in LIB demand makes it increasingly important to understand its supply chain. This new report provides insight on where materials come from, market players, recent investments in production and developments in the LIB technology. In addition to our 10-year demand forecasts and price analysis, the report will provide a comprehensive overview of the LIB supply chain.

The key issues addressed in this report:

• Overview and introduction to the Li-ion technology and supply chain

• How will LIB technology evolve, and which chemistries will win?

• Material and cost breakdowns

• Battery, material and price forecasts

• Is there enough raw material, can mining cope and will there be supply disruption?

• A dive into the recycling methods available for LIBs.

• Market analysis for materials, components, production and recycling.

Table of Contents

Table of Contents

ご注文は、お電話またはWEBから承ります。市場調査レポートのお見積もり作成・購入の依頼もお気軽にご相談ください。本レポートと同分野(電池)の最新刊レポートIDTechEx社の エネルギー、電池 - Energy, Batteries分野 での最新刊レポート

関連レポート(キーワード「リチウム」)よくあるご質問IDTechEx社はどのような調査会社ですか?IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る 調査レポートの納品までの日数はどの程度ですか?在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

注文の手続きはどのようになっていますか?1)お客様からの御問い合わせをいただきます。

お支払方法の方法はどのようになっていますか?納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

データリソース社はどのような会社ですか?当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

|

|