Summary

この調査レポートは、有機金属骨格(MOF)材料、製造方法、価格に関する考察、およびいくつかの主要な新興用途に関する市場洞察を提供しています。

主な掲載内容(目次より抜粋)

-

有機金属骨格(Mofs)入門

-

製造方法と価格に関する考察

-

炭素回収のためのMofs

-

節水用Mofs

-

化学的分離と精製のためのMofs

Report Summary

Metal-organic frameworks (MOFs) are a class of materials with exceptionally high porosity and surface area (up to 7000m2/g). The design flexibility and structural versatility afforded by MOFs have attracted widespread interest in numerous applications albeit with several unsuccessful attempts to commercialize the materials historically. However, the tunability, cycling stability, and selective adsorption/desorption characteristics of these materials are opening opportunities for commercialization as energy-efficient alternatives for a range of critical energy-intensive technologies. These include carbon capture, water harvesting for potable water production and HVAC systems, and various chemical separations and purification processes (e.g. refrigerant reclamation and direct lithium extraction).

IDTechEx's report offers an independent analysis of these trends and considers applications of MOFs for several other early-stage technologies, including hydrogen storage, energy storage, sensors, and more. Informed by insights gained from primary research, the report analyzes key players in the field and provides market forecasts in terms of yearly mass demand and market value segmented by application.

Figure 1: The evolution of the price of MOFs towards commercial applications. Source: IDTechEx

Manufacturing MOFs

Industrial implementation depends on material availability, quality, and affordability. Most MOFs developed in research labs are synthesized using solvothermal methods on the milligrams scale. To produce MOFs on an industrial scale, the production methods need to be scalable. In addition, raw material availability is a critical factor in determining the commercial viability of a MOF. With over 100,000 reported structures, only a handful meet the criteria for potential commercialization. Using key insights gained from interviews with key players such as BASF and Promethean Particles, this report critically assesses the merits and challenges of the various approaches undertaken by manufacturers to upscale MOF production. Informed by primary research, the factors that impact the production costs and ultimately the selling price of MOFs are also addressed.

MOFs for Carbon Capture

Deploying carbon capture technologies is an important tool for meeting net zero emission goals. However, despite the fair level of maturity of amine solvent-based methods (i.e. amine scrubbing) to capture CO2, deployment is still limited mainly due to the large installation cost and energy consumption associated with solvent regeneration. MOF-based modular solid sorbent carbon capture systems are gaining momentum, driven by significantly reduced energy requirements for sorbent regeneration, improved sorbent stability, CO2 selectivity, and lower capital expenditure compared to solvent-based systems. This report examines the material properties and strategies to tune capture performance and assesses the progress in point source and direct air capture applications. Through interviews with players such as Nuada, AspiraDAC, and others, the market activity and outlook of systems being developed by players are addressed with comparisons of technology readiness levels and commercial opportunity.

MOFs for water harvesting and HVAC Technologies

Atmospheric water harvesting (AWH) technologies using advanced sorbents (e.g. MOFs) offer an opportunity to harness water resources in regions where traditional water sources are limited. Additionally, heating and cooling effects induced by water adsorption and desorption properties of MOFs can also be used for heating, ventilation, and air conditioning (HVAC) systems that can operate with up to 70% reduced electricity consumption compared to conventional vapor compression refrigeration technologies. This can facilitate the reduction in energy consumption by HVAC systems which currently account for ~10% of all global electricity consumption and is expected to triple by 2050 with the surge in demand, especially in the Asian market. Additionally, a significant reduction in the production of HFC refrigerants is expected in line with the Kigali Amendment and MOF-based systems can prove a viable alternative. IDTechEx's report covers material and technology advances in AWH and HVAC systems that integrate MOFs and compares the key performance metrics with other sorbents. The report also highlights the key players at the forefront of developing and commercializing these technologies.

MOFs for Chemical Separations and Purification

Chemical separation and purification constitute core operations of manufacturing industries such as chemical production, mining, and oil and gas refining. Conventional distillation-based thermal chemical separation processes have significant drawbacks: they require a large spatial footprint, substantial capital expenditure, and are very energy-intensive. Globally, this accounts for an estimated ~10-15% of total energy consumption. The tunable chemical selectivity and controllable pore architecture of MOFs enable selective separation of chemicals when used as solid sorbents or membranes. For example, MOF-based membrane manufacturer UniSieve told IDTechEx that it has demonstrated the separation of chemicals that have boiling points within ~5°C using its non-thermal membrane technology, which otherwise would require energy-intensive thermal separation using ~100m high distillation columns. Advances in applications such as refrigerant reclamation, direct lithium extraction, and several gas separation and purification processes such as biogas upgrading, and polymer grade propylene production, and more are evaluated within the report.

MOFs for Gas Storage and Other Early-Stage Applications

MOFs are also being explored for gas storage applications, with US-based MOF manufacturer Numat having commercialized its ION-X range for storage of dopant gases for the semiconductor industry. Several start-ups are also developing prototypes of MOF-based natural gas storage solutions to support gas supply networks, whilst developments in hydrogen storage applications are lagging. There are several other early-stage applications discussed in the report such as energy storage, catalysis, sensors, and more. However, these are generally studied in academic literature with limited examples of R&D conducted by startup companies.

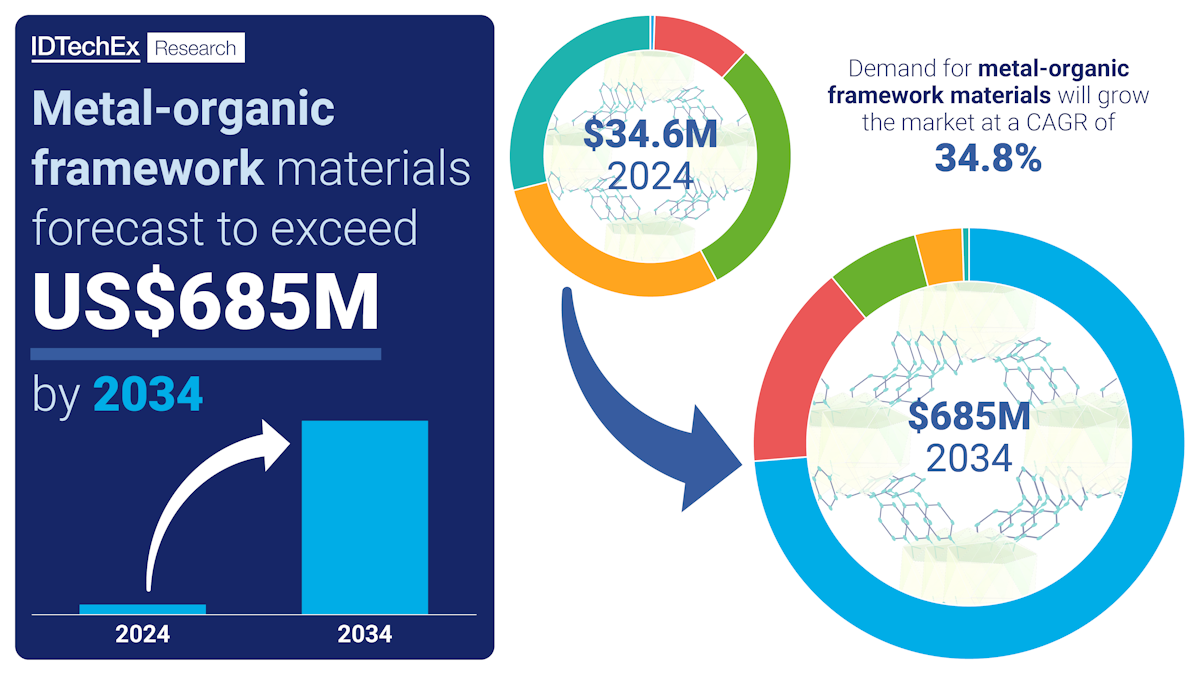

The varied applications of MOFs present a large scope for the adoption of MOF-based technologies, particularly in applications where MOFs can result in a material reduction in energy consumption and operational costs. These include carbon capture, chemical separations, and HVAC systems. However, these technologies have not yet been demonstrated on an industrial scale and novel technologies can be considered risky which may become a barrier to early adoption. Additionally, incumbent technologies have a stronghold in the key target markets, and MOFs may struggle to gain market share. With the advent of several commercial products over the next decade, MOF-based technologies will need to demonstrate their performance at scale. This must also be complemented by a sustained growth in manufacturing capacity using scalable methods. IDTechEx predicts this market will grow at 34.8% CAGR from 2024 to 2034.

Figure 2: Forecast and growth rate of MOFs. Source: IDTechEx

Key aspects

This report provides key market insights into metal-organic frameworks (MOF) materials, manufacturing methods, pricing considerations, and several key emerging applications.

The report provides an overview of MOFs, with critical assessment of material production and upscaling strategies:

-

Manufacturing methods adopted by key players to upscale production including key comparisons

-

Downstream processes

-

Material pricing considerations and key contributions to production costs

Material properties and analysis, market activity, key comparisons with incumbent technologies and more are evaluated for key applications, including:

-

Carbon capture including point source and direct air capture technologies using MOF sorbents and membranes

-

Water harvesting for atmospheric water harvesting and heating, ventilation, and air conditioning (HVAC) technologies using MOF sorbents

-

Chemical separations and purification technologies (e.g. air filtration, refrigerant reclamation, direct lithium extraction, gas separations, biogas upgrading, wastewater treatment, and more) using MOF membranes and sorbents

-

Gas storage and other early-stage applications including sensors, catalysis, energy storage (e.g. batteries, supercapacitors, and thermal management), biomedical applications (e.g. drug delivery), agricultural applications for soil cultivation and targeted release of actives, and more.

The report also provides 10 year market forecasts & analysis:

-

Total MOF market by application (tonnes)

-

Total MOF market by application (US$)

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Metal-organic frameworks are tunable, porous materials with high surface area |

|

1.2. |

Translation from laboratories to industrial manufacturing is a key challenge |

|

1.3. |

Standard batch synthesis is the preferred method by large manufacturers |

|

1.4. |

IDTechEx outlook for MOF production |

|

1.5. |

Main applications are carbon capture, water harvesting, and chemical separation |

|

1.6. |

North America, Europe, and Japan are driving key advances in MOF technologies |

|

1.7. |

Carbon capture technologies are key to achieving net zero emission goals |

|

1.8. |

MOFs can reduce energy requirements and operational costs for carbon capture |

|

1.9. |

Comparison of MOF-based point source capture with amine scrubbing |

|

1.10. |

MOF-based technologies are advancing in point source carbon capture |

|

1.11. |

IDTechEx Outlook for MOFs in Carbon Capture |

|

1.12. |

MOFs can increase energy efficiency of AWH and HVAC systems |

|

1.13. |

Comparison of sorbents for atmospheric water harvesting |

|

1.14. |

MOF-based technologies towards commercialization compared to incumbent |

|

1.15. |

MOF-based AWH and HVAC systems are approaching commercialization |

|

1.16. |

IDTechEx outlook for MOFs in water harvesting and HVAC systems |

|

1.17. |

Wide scope of applications for MOFs in chemical separations and purification |

|

1.18. |

IDTechEx outlook of MOFs in chemical separations and purifications |

|

1.19. |

Research on MOFs for numerous other applications is in the early stages |

|

1.20. |

Total Metal-Organic Frameworks Forecast (mass) |

|

1.21. |

Total Metal-Organic Frameworks Forecast (value) |

|

1.22. |

Metal-Organic Frameworks Forecast and Growth Opportunities |

|

2. |

INTRODUCTION TO METAL-ORGANIC FRAMEWORKS (MOFS) |

|

2.1. |

Introduction to metal-organic frameworks |

|

2.2. |

Numerous structures of MOFs exist with a large scope of applications |

|

2.3. |

MOFs in carbon capture and removal with emerging commercial applications |

|

2.4. |

Commercial applications emerging for MOFs in gas storage and transport |

|

2.5. |

MOF-based catalysts beginning to appear in the market for catalysis |

|

2.6. |

MOFs are promising candidates for separation and purification |

|

2.7. |

MOFs demonstrating potential in water harvesting and air conditioning systems |

|

2.8. |

MOF-based fuel cell membranes not ready for commercialisation |

|

2.9. |

MOFs in energy storage may be limited by complex material synthesis |

|

2.10. |

Academic research is driving exploration of MOFs in sensors |

|

2.11. |

MOFs in biomedical applications encounter barriers to clinical translation |

|

2.12. |

MOFs show better long-term cycling performance compared to other adsorbents |

|

2.13. |

Scalability and high cost have been main historical barriers to commercialization |

|

3. |

MANUFACTURING METHODS AND PRICING CONSIDERATIONS |

|

3.1. |

Overview |

|

3.1.1. |

Translation from laboratories to industrial manufacturing is challenging |

|

3.1.2. |

Factors to consider for industrial manufacturing of MOFs |

|

3.2. |

Manufacturing Processes |

|

3.3. |

Overview of common manufacturing processes |

|

3.4. |

Solvothermal and hydrothermal synthesis used for bench scale production |

|

3.5. |

Mechanochemical synthesis can enable large scale continuous production |

|

3.6. |

Electrochemical synthesis |

|

3.7. |

Spray-drying synthesis |

|

3.8. |

Other examples of synthesis methods |

|

3.9. |

Assessment of common processing methods (1/2) |

|

3.10. |

Assessment of common processing methods (2/2) |

|

3.11. |

Downstream Processes |

|

3.12. |

Downstream Processing |

|

3.13. |

Shaping processes are necessary to obtain functional MOF products |

|

3.14. |

Market Activity |

|

3.15. |

BASF uses large scale batch synthesis for industrial MOF production |

|

3.16. |

BASF's position on batch vs continuous processes |

|

3.17. |

BASF's process and cost considerations |

|

3.18. |

Continuous flow hydrothermal synthesis for large-scale manufacturing |

|

3.19. |

Morphologies obtained using Promethean's manufacturing process |

|

3.20. |

Immaterial is scaling up its process to manufacture monolithic MOFs |

|

3.21. |

Atomis has a patented process to manufacture MOFs |

|

3.22. |

SyncMOF can recommend and manufacture MOFs on the tonnes scale |

|

3.23. |

Numat is expanding its manufacturing capability and commercializing products |

|

3.24. |

Cost and Pricing Considerations |

|

3.25. |

Key contributions to the production costs |

|

3.26. |

Cost of raw materials is often prohibitive for large scale MOF production |

|

3.27. |

MOFs with industrially available ligands can target a competitive selling price |

|

3.28. |

Company Landscape |

|

3.29. |

Overview of MOF manufacturers |

|

3.30. |

Company landscape of MOF manufacturers |

|

3.31. |

Outlook |

|

3.32. |

IDTechEx outlook for MOF production |

|

4. |

MOFS FOR CARBON CAPTURE |

|

4.1. |

Overview |

|

4.1.1. |

Carbon capture technologies are key to achieving net zero emission goals |

|

4.1.2. |

Industrial sources of emission and CO₂ content varies with emission source |

|

4.1.3. |

Absorption-based capture methods dominate however others are emerging |

|

4.1.4. |

Current large-scale carbon capture facilities use solvent-based capture |

|

4.2. |

Solid Sorbent-based CO₂ Capture |

|

4.2.1. |

Overview of solid sorbents explored for carbon capture |

|

4.2.2. |

Operation of solid sorbent-based DAC and point source adsorption systems |

|

4.2.3. |

MOF-based sorbents approaching commercialization in carbon capture |

|

4.2.4. |

Key applications of MOFs span point source and direct air capture |

|

4.2.5. |

Gas composition impacts the CO₂ adsorption characteristics of MOFs |

|

4.2.6. |

Different strategies for MOF development and binding mechanisms |

|

4.2.7. |

Examples of MOFs with open metal sites |

|

4.2.8. |

CO₂ selectivity in humid conditions is a key challenge for DAC |

|

4.2.9. |

Using AI tools to advance the discovery of new MOFs for carbon capture |

|

4.2.10. |

CALF-20: a MOF that is being commercialized for point source capture |

|

4.2.11. |

Other solid sorbents: Solid amine-based adsorbents |

|

4.2.12. |

Other solid sorbents: Zeolite-based adsorbents |

|

4.2.13. |

Other solid sorbents: Carbon-based adsorbents |

|

4.2.14. |

Other solid sorbents: Polymer-based adsorbents |

|

4.3. |

Considerations for MOF Selection |

|

4.3.1. |

Factors to consider when selecting MOF sorbents for carbon capture (1/2) |

|

4.3.2. |

Factors to consider when selecting MOF sorbents for carbon capture (2/2) |

|

4.3.3. |

Lower energy penalty for regeneration is a key driver for MOF-based sorbents |

|

4.4. |

Market Activity for Solid Sorbents |

|

4.4.1. |

Promethean Particles targets its MOFs for applications in carbon capture |

|

4.4.2. |

Nuada's point source carbon capture technology is operating at pilot scale |

|

4.4.3. |

Svante's carbon capture technology is approaching commercialization |

|

4.4.4. |

Estimated capture costs using Svante's technology |

|

4.4.5. |

AspiraDAC's modular solar-powered DAC units gearing towards pilot scale |

|

4.4.6. |

Mosaic Materials is upscaling its modular MOF-based DAC systems |

|

4.4.7. |

Atoco is developing MOF-based point source and DAC solutions |

|

4.4.8. |

CSIRO's Airthena™ DAC technology for industrial onsite gaseous CO₂ supply |

|

4.4.9. |

SyncMOF manufactures MOFs and engineers devices for carbon capture |

|

4.4.10. |

Comparison of key MOF-based point source capture systems (1/2) |

|

4.4.11. |

Comparison of key MOF-based point source c

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|

.png)