Summary

この調査レポートでは、IDTechExがホワイトバイオテクノロジーの現状を独自に分析し、技術革新と歴史的、現在的、将来的なプロジェクトを批判的に考察することで、ホワイトバイオテクノロジーの将来についての客観的な評価を提供しています。

主な掲載内容(目次より抜粋)

-

市場分析

-

ホワイトバイオテクノロジー用細胞工場

-

技術開発

-

ブルーバイオテクノロジー

-

会社概要

Report Summary

White biotechnology: advancing the bioeconomy

The bioeconomy can be defined as an economic system in which society uses renewable biological resources (i.e. derived from land, fisheries, and aquaculture environments) to create biobased products such as food and nutrients, chemicals and materials, and bio-energy. Developing the bioeconomy is a key aspect of creating a more circular sustainable economy, an especially critical task as the effects of climate change are exacerbated by global reliance on fossil fuel resources.

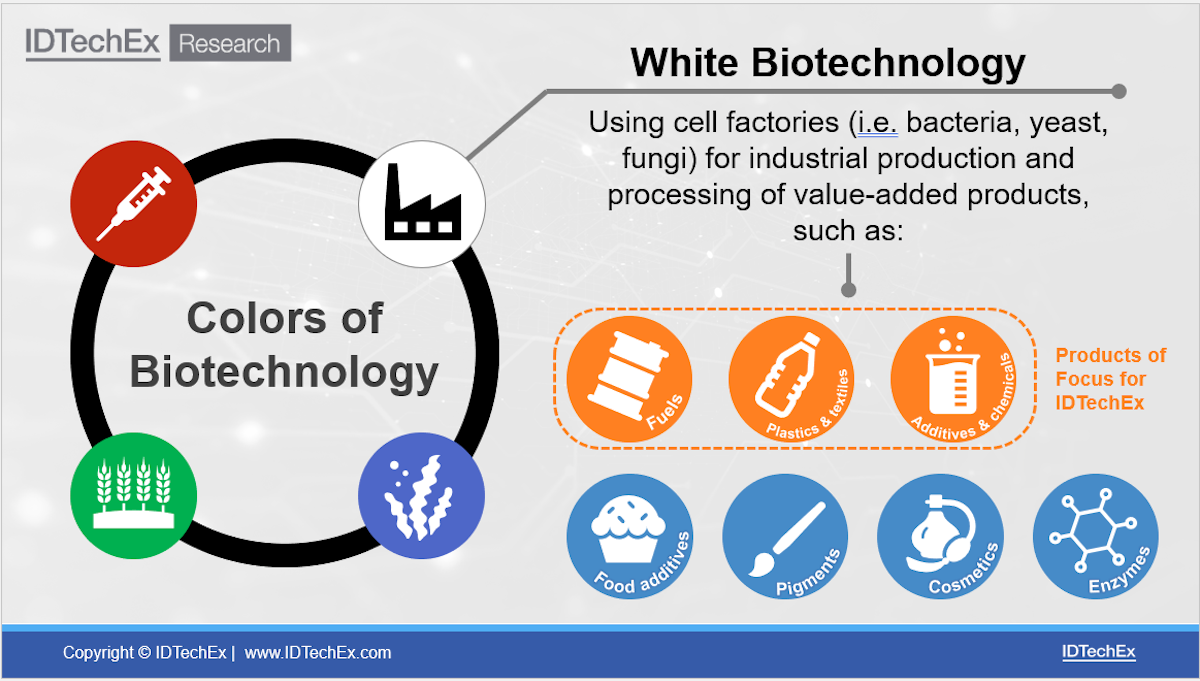

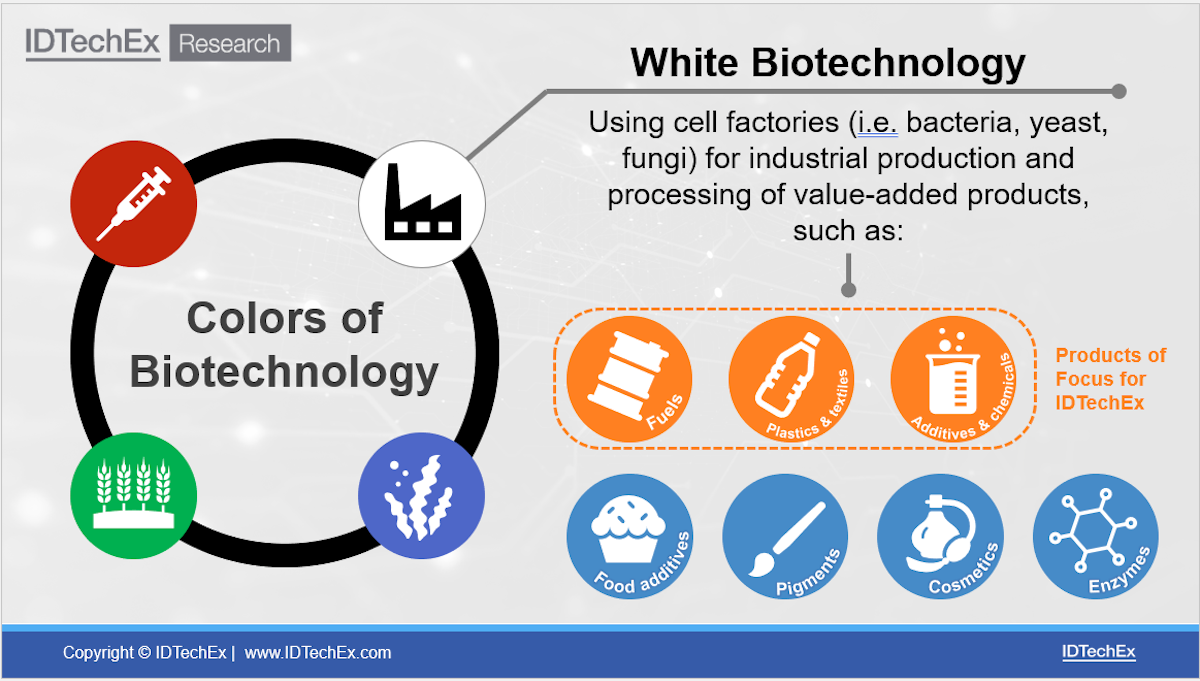

The advancement of biotechnology is critical to expanding the bioeconomy, as different areas (or "colors") of biotechnology can positively improve different sectors of the economy. For example, "green" biotechnology may be used to improve agricultural yields, while "red" biotechnology may be applied towards the creation of new vaccines. Of the numerous colors of the biotechnology spectrum, white biotechnology stands out as a key technology enabler for the bioeconomy by advancing the industrial production of biobased products through biological systems.

In this leading report, White Biotechnology 2024-2034, IDTechEx provides independent analysis of the status of white biotechnology, looking critically at technology innovations and historic, current, and future projects to provide an objective assessment of white biotechnology's future.

What is white biotechnology, and why does it matter?

White biotechnology, sometimes called industrial biomanufacturing, is the industrial production and processing of chemicals, materials, and energy using living cell factories, like bacteria, yeast, and fungi. White biotechnology represents a more sustainable alternative to petroleum-based chemical production: one that not only decreases society's reliance on fossil fuels but also uses less energy, generates less waste, and potentially creates biodegradable products that are better for the environment.

White biotechnology is not particularly new; engineered enzymes for detergents have been produced via white biotechnology since the 1980s, and bacterial enzymes have been used as food additives for many, many years. That begs the question: why is white technology so interestingnow?

IDTechEx, in this report, sheds light on the technology innovations driving white biotechnology's growth and increasing relevance. With improvements in biotechnology tools and processes comes the ability to produce numerous important products, from commodity chemicals to high performance textiles, through white biotechnology. One main technology driver is synthetic biology - the artificial design and engineering of biological systems and living organisms for the purpose of improving applications for industry or research. IDTechEx offers extensive discussion on synthetic biology's importance to industrial biomanufacturing by considering synthetic biology's tools and techniques, applications, emerging players, etc. IDTechEx continues their analysis of the technology advances enabling white biotechnology with detailed examinations (including status, technical benefits and challenges, commercial activity), among other trends, of:

-

Novel biocatalysts for industrial fermentation

-

Improvements to bioprocesses

-

Cell-free systems

-

Alternative feedstocks for bioreactors - gases, cellulosic materials, etc.

-

Carbon neutral and carbon negative biomanufacturing

Biobased products from industrial biomanufacturing: a diverse spectrum

Just as important as the innovations improving white biotechnology are its applications - the chemicals, precursors, additives, and materials produced by the fermentation of engineered cell factories. The range of molecules and compounds that can be biomanufactured is incredibly diverse with use cases in everything from lubricants to leather, textiles to packaging, adhesives to additives, etc. These molecules include alcohols, diols, diamines, organic acids, proteins, and more.

To provide clarity on these many products of white biotechnology, IDTechEx provides detailed technical and market analysis on 40+ biomanufactured molecules, looking at essential factors for each molecule such as:

-

The molecule's biomanufacturing process

-

Comparison of the biomanufactured product with its petrochemical equivalent

-

Technical advantages of the biomanufacturing process

-

Current challenges

-

Downstream products and end-applications for the molecule

-

Technology readiness level

-

Players developing and producing the molecule via biomanufacturing

-

Market outlook

With these IDTechEx insights, a clear understanding of the status and growing versatility of the white biotechnology industry will be achieved.

White biotechnology: an active market of established and emerging players

With the diverse spectrum of molecules being produced through white biotechnology, there is a large number of companies attempting to advance their industrial biomanufacturing activities. Within this report, IDTechEx has considered well over 100 companies pursuing white biotechnology efforts, ranging from multinational material and chemical conglomerates to nascent startups. Important information such as partnerships, funding, past projects, molecules being pursued, current production capacity, and more are highlighted to understand how and why so many companies have chosen to engage with white biotechnology. These will be bolstered by IDTechEx's interview-based company profiles of key players in this market.

The player landscape of white biotechnology is just one component of the overall market dynamics that are shaping industrial biomanufacturing. There are numerous factors to be evaluated to determine the economic viability of certain white biotechnology projects, from internal factors such as process yield, ease of scale, and biocatalyst choice to external factors such as government regulations, crude oil prices, and the green premium. This report analyzes the white biotechnology market from these perspectives to offer understanding on the industry's prior trajectory and insight on what will determine its future success.

White biotechnology 10-year market forecast segmented by major molecules

Lastly, to identify the growth potential of the white biotechnology industry, IDTechEx provides industrial biomanufacturing forecasts that segments the market by ten major biomanufactured molecules based on global production capacity. The report looks at the current capacity, drivers, and constraints of each segment and then extrapolates them into a 10-year forecast, to explore the mature and emerging white biotechnology products, technology readiness, potential for disruption, and the future landscape of white biotechnology.

Key aspects

-

Discussion of white biotechnology within the bioeconomy.

-

Overview of biomanufacturing's application in fuels, plastics, textiles, additives, precursors, and other chemicals.

-

Identification of 40+ biobased molecules produced through biomanufacturing.

-

30+ granular technology analyses for major biomanufactured molecules, including biomanufacturing process, technology readiness level, challenges, comparison against petroleum incumbent, and downstream applications.

-

Benchmarking of current production capacity and outlook for major biobased molecules, including propanediol, PHAs, adipic acid, etc.

-

Analysis of synthetic biology and its impact on industrial biomanufacturing.

-

Technology developments influencing white biotechnology, including carbon capture, gaseous and lignocellulosic feedstock, and novel biocatalysts.

-

Assessment of market drivers (government legislation, brands, the public) and key technical challenges for white biotechnology

-

Pain points affecting economic viability for industrial biomanufacturing.

-

Discussion of current projects and previous efforts in white biotechnology, including analysis of factors for success or failure.

-

Detailed 10-year market forecasts segmented by major biomanufactured molecules, including lactic acid, butanediol, PHAs, succinic acid, and other organic acids.

-

Identification of 100+ emerging startups and established players operating in industrial biomanufacturing, segmented by molecule.

ページTOPに戻る

Table of Contents

|

1. |

EXECUTIVE SUMMARY |

|

1.1. |

Glossary of terms |

|

1.2. |

Colors of biotechnology |

|

1.3. |

What is white biotechnology? |

|

1.4. |

White Biotechnology 2024-2034: scope |

|

1.5. |

Trends and drivers in white biotechnology |

|

1.6. |

Synthetic biology as applied to white biotechnology |

|

1.7. |

Technology trends in white biotechnology |

|

1.8. |

Overview of alternative feedstocks for white biotechnology |

|

1.9. |

Major market challenges for white biotechnology |

|

1.10. |

Technical challenges facing white biotechnology |

|

1.11. |

Products derived from white biotechnology: overview |

|

1.12. |

Molecules that can be produced through industrial biomanufacturing |

|

1.13. |

Molecules that can be produced through industrial biomanufacturing |

|

1.14. |

Company landscape in white biotechnology |

|

1.15. |

Company landscape in white biotechnology |

|

1.16. |

Next-generation fuels through white biotechnology |

|

1.17. |

Bioplastics through white biotechnology |

|

1.18. |

Navigating biobased polymers from monosaccharides |

|

1.19. |

Common bioplastics and polymer precursors synthesized via white biotechnology |

|

1.20. |

Status of molecules produced through white biotechnology |

|

1.21. |

White biotechnology market share by molecule 2024-2034 |

|

1.22. |

White biotechnology global capacity forecast 2024-2034 |

|

1.23. |

White biotechnology global capacity forecast 2024-2034: discussion |

|

1.24. |

Emerging areas of white biotechnology forecast 2024-2034 |

|

1.25. |

Company profiles |

|

2. |

INTRODUCTION |

|

2.1. |

Glossary of acronyms |

|

2.2. |

Glossary of terms |

|

2.3. |

Colors of biotechnology |

|

2.4. |

What is white biotechnology? |

|

2.5. |

The bioeconomy and white biotechnology |

|

2.6. |

Report focus |

|

3. |

MARKET ANALYSIS |

|

3.1. |

Market Drivers for White Biotechnology |

|

3.1.1. |

Market drivers: demand for biobased products |

|

3.1.2. |

Market drivers: government regulation on petroleum-based plastic use |

|

3.1.3. |

Market drivers: government support of biotechnology |

|

3.1.4. |

Market drivers: carbon taxes |

|

3.2. |

Economic Viability of White Biotechnology |

|

3.2.1. |

Factors affecting the economic viability of white biotechnology projects |

|

3.2.2. |

Effects of Brent crude prices on biobased products |

|

3.2.3. |

The Green Premium |

|

3.2.4. |

Rising feedstock prices |

|

3.2.5. |

Effect of cell factory on cost |

|

3.2.6. |

Identifying the chemicals with the most potential to become biobased based on price |

|

3.2.7. |

How scale-up affects cost |

|

3.2.8. |

Zymergen: case study on economics of synthetic biology |

|

3.2.9. |

Synthetic biology: shift from commodity products to lower volume, high value markets |

|

3.2.10. |

Major market challenges for white biotechnology |

|

3.3. |

Player and Start-up Landscape |

|

3.3.1. |

Players: synthetic biology tools and platforms |

|

3.3.2. |

Players: vertically integrated biomanufacturing |

|

3.3.3. |

Emerging players segmented by molecule |

|

3.3.4. |

Overview of chemicals and materials companies involved in white biotechnology |

|

4. |

CELL FACTORIES FOR WHITE BIOTECHNOLOGY |

|

4.1. |

Cell factories for biomanufacturing: factors to consider |

|

4.2. |

Cell factories for biomanufacturing: a range of organisms |

|

4.3. |

Escherichia coli (E.coli) |

|

4.4. |

Corynebacterium glutamicum (C. glutamicum) |

|

4.5. |

Bacillus subtilis (B. subtilis) |

|

4.6. |

Saccharomyces cerevisiae (S. cerevisiae) |

|

4.7. |

Yarrowia lipolytica (Y. lipolytica) |

|

4.8. |

Microorganisms used in different biomanufacturing processes |

|

4.9. |

Non-model organisms for white biotechnology |

|

5. |

TECHNOLOGY DEVELOPMENTS |

|

5.1. |

Synthetic Biology |

|

5.1.1. |

Synthetic biology: the design and engineering of biological systems |

|

5.1.2. |

Synthetic biology: manipulating the central dogma |

|

5.1.3. |

The vast scope of synthetic biology |

|

5.1.4. |

The Process of Synthetic Biology: Design, Build and Test |

|

5.1.5. |

Synthetic biology: why now? |

|

5.1.6. |

Synthetic biology: from pharmaceuticals to consumer products |

|

5.1.7. |

Synthetic biology: disrupting existing supply chains |

|

5.1.8. |

Synthetic biology: drivers and barriers for adoption |

|

5.1.9. |

Synthetic biology as applied to white biotechnology |

|

5.2. |

Tools and Techniques of Synthetic Biology |

|

5.2.1. |

Tools and techniques of synthetic biology: overview |

|

5.2.2. |

DNA Synthesis |

|

5.2.3. |

Introduction to CRISPR-Cas9 |

|

5.2.4. |

CRISPR-Cas9: a bacterial immune system |

|

5.2.5. |

CRISPR-Cas9's importance to synthetic biology |

|

5.2.6. |

Protein/Enzyme Engineering |

|

5.2.7. |

Computer-Aided Design |

|

5.2.8. |

Commercial examples of engineered proteins in industrial applications |

|

5.2.9. |

Strain construction and optimization |

|

5.2.10. |

Synergy between synthetic biology and metabolic engineering |

|

5.2.11. |

Framework for developing industrial microbial strains |

|

5.2.12. |

The problem with scale |

|

5.2.13. |

Introduction to cell-free systems |

|

5.2.14. |

Cell-free versus cell-based systems |

|

5.2.15. |

Cell-free systems in the context of white biotechnology |

|

5.2.16. |

Cell-free systems for white biotechnology |

|

5.2.17. |

Commercial implementation of cell-free systems: Solugen |

|

5.2.18. |

Startups pursuing cell-free systems for white biotechnology |

|

5.2.19. |

Robotics: enabling hands-free and high throughput science |

|

5.2.20. |

Robotic cloud laboratories |

|

5.2.21. |

Automating organism design and closing the loop |

|

5.2.22. |

Artificial intelligence and machine learning |

|

5.3. |

Improvement of Biomanufacturing Processes |

|

5.3.1. |

Continuous vs batch biomanufacturing |

|

5.3.2. |

Benefits and challenges of continuous biomanufacturing |

|

5.3.3. |

Continuous vs batch biomanufacturing: key fermentation parameter comparison |

|

5.3.4. |

Machine learning to improve biomanufacturing processes |

|

5.4. |

White Biotechnology for Sustainability |

|

5.4.1. |

White biotechnology as a sustainable technology |

|

5.4.2. |

Routes for carbon capture in white biotechnology |

|

5.4.3. |

Autotrophic bacteria for carbon capture through biomanufacturing |

|

5.5. |

Alternative Feedstocks for Biomanufacturing |

|

5.5.1. |

Why use alternative feedstocks for white biotechnology? |

|

ページTOPに戻る

本レポートと同じKEY WORD()の最新刊レポート

- 本レポートと同じKEY WORDの最新刊レポートはありません。

よくあるご質問

IDTechEx社はどのような調査会社ですか?

IDTechExはセンサ技術や3D印刷、電気自動車などの先端技術・材料市場を対象に広範かつ詳細な調査を行っています。データリソースはIDTechExの調査レポートおよび委託調査(個別調査)を取り扱う日... もっと見る

調査レポートの納品までの日数はどの程度ですか?

在庫のあるものは速納となりますが、平均的には 3-4日と見て下さい。

但し、一部の調査レポートでは、発注を受けた段階で内容更新をして納品をする場合もあります。

発注をする前のお問合せをお願いします。

注文の手続きはどのようになっていますか?

1)お客様からの御問い合わせをいただきます。

2)見積書やサンプルの提示をいたします。

3)お客様指定、もしくは弊社の発注書をメール添付にて発送してください。

4)データリソース社からレポート発行元の調査会社へ納品手配します。

5) 調査会社からお客様へ納品されます。最近は、pdfにてのメール納品が大半です。

お支払方法の方法はどのようになっていますか?

納品と同時にデータリソース社よりお客様へ請求書(必要に応じて納品書も)を発送いたします。

お客様よりデータリソース社へ(通常は円払い)の御振り込みをお願いします。

請求書は、納品日の日付で発行しますので、翌月最終営業日までの当社指定口座への振込みをお願いします。振込み手数料は御社負担にてお願いします。

お客様の御支払い条件が60日以上の場合は御相談ください。

尚、初めてのお取引先や個人の場合、前払いをお願いすることもあります。ご了承のほど、お願いします。

データリソース社はどのような会社ですか?

当社は、世界各国の主要調査会社・レポート出版社と提携し、世界各国の市場調査レポートや技術動向レポートなどを日本国内の企業・公官庁及び教育研究機関に提供しております。

世界各国の「市場・技術・法規制などの」実情を調査・収集される時には、データリソース社にご相談ください。

お客様の御要望にあったデータや情報を抽出する為のレポート紹介や調査のアドバイスも致します。

|

|